Pablo Picasso Family of Saltimbanques 1905

Biden condensed

Joe Biden's Afghanistan 'Press Conference,' Condensed pic.twitter.com/wcwkYojuW0

— JD Rucker (@JDRucker) August 16, 2021

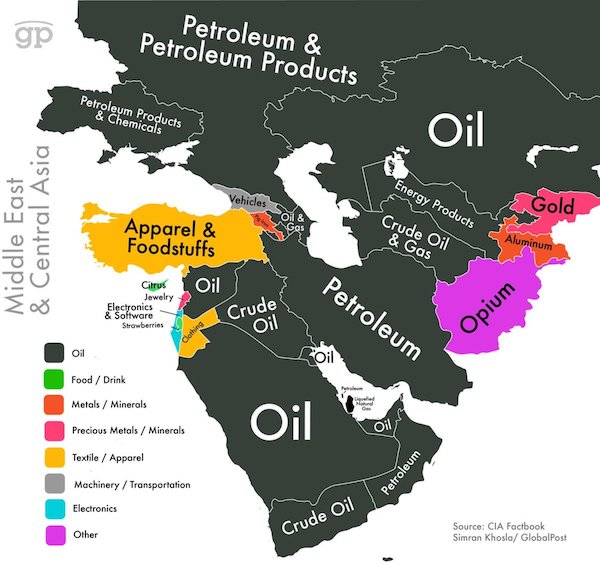

The CIA gets a large part of its off the books funding from poppies.

The Taliban banned poppy growing. The CIA moved its poppy farms to Colombia. Over the past years, much has been moved back.

Afghanistan GDP is $20 billion; the UNODC estimated the country’s overall illicit opiate economy in 2017 at $6.6 billion.

Will the CIA make a deal with the Taliban this time?

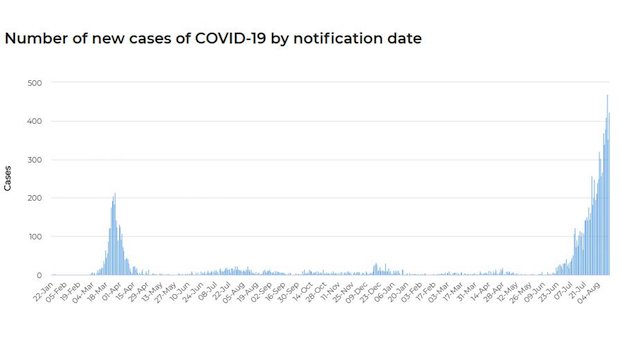

Shut you entire country down for one case, after 20 months, and people call you a success story.

• New Zealand To Enter Nationwide Lockdown After 1 Local Covid Case (Axios)

New Zealand will enter a snap nationwide lockdown at its highest level on Tuesday night after a 58-year-old man from Auckland tested positive for COVID-19, Prime Minister Jacinda Ardern announced. This is the first coronavirus case detected in NZ’s community for 170 days and officials are concerned the man may have the highly contagious Delta variant. New Zealand has only experienced a level 4 nationwide lockdown once before. This is only the second lockdown for communities outside Auckland, NZ’s most populous city, since the pandemic began. Ardern noted at a news conference Tuesday that although it was unknown what strain of the virus the man had, most of the infections in managed hotel quarantine had the Delta variant.

The level 4 national lockdown will last for three days, from 11:59 p.m. Tuesday. Auckland and the Coromandel Peninsula, which the recently man visited, will likely experience this for seven days. New Zealand has largely contained COVID-19 cases to managed hotel quarantine facilities. Under alert level 4 restrictions, schools move to remote classes and non-essential businesses close — including food delivery services. Only essential travel is permitted, and water activities like swimming are banned. People must remain at home unless they’re exercising outdoors and locally and within their household “bubbles.” The country has paused vaccinations for the duration of the lockdown.

This is the real success story.

• Uttar Pradesh Logs Lowest Ever Daily Covid Figure at 17 (N18)

Uttar Pradesh on Monday witnessed the steepest decline in the number of fresh cases as the state limited the infections to just 17, making it the lowest ever daily-case count. Uttar Pradesh has restricted the daily-case count below 100 for over 5 weeks now. The downward trajectory of the virus has continued for the consecutive 14th week. In another significant achievement, the state registered a drop in the daily Covid test positivity rate (TPR) — the number of positive cases against the total tests done — to 0.01 percent. This rate was at its highest at 16.84 percent on April 24 and now remains even lower than the lowest post the first wave of Covid-19. The active caseload in the most populous state now stands at 419, from its peak at 3,10,783 cases on April 30.

On the contrary, sparsely populated states like Kerala, Maharashtra and Tamil Nadu account for a heavy active caseload of 1,78,640, 64,219 and 20,458, respectively. In another major relief, none of the 75 districts reported fresh infections in double-digits, indicating signs that the pandemic is receding. Uttar Pradesh is rapidly moving towards being coronavirus-free as active and fresh cases in as many as 17 districts have declined to zero. In its bid to become self-reliant in terms of producing life-saving medication, as many as 317 of the 556 oxygen plants have already been established and are functional, while work on the remaining plants is going on in Uttar Pradesh.

From inside the jail.

• NSW Police Fine 600 People On First Day Of Covid Crackdown Blitz (AAP)

New South Wales police issued nearly 600 infringement notices to people flouting tough new health orders on the first day of a three-week crackdown designed to get the state’s escalating Covid crisis under control. The deputy commissioner, Mal Lanyon, said some people were still not complying even after a 5km travel rule came into effect for greater Sydney and the state reported a record 478 new local Covid-19 cases and eight deaths on Monday – the state’s worst day of the pandemic. “Yesterday we issued 579 infringement notices which is disappointing. It shows that people are still not complying. Thirty-four people received court attendant notices,” he told the Nine Network on Tuesday. Police also conducted 3,800 welfare checks to see if people were following stay-at-home orders.

Seven weeks of lockdown in Sydney (NSW)

One Covid-positive man from the hotspot of Fairfield in Sydney’s south-west wasn’t home when police arrived and was later unable to provide an excuse for his actions, Lanyon said. The entire state is now locked down and a 21-day police blitz came into effect on Monday to enforce new regulations, with almost 18,000 police officers supported by 800 members of the Australian defence force. Tougher noncompliance fines of up to $5,000 are in place with people in greater Sydney confined to within 5km of their homes. Police commissioner Mick Fuller warned that officers have been told to adopt “a no-nonsense approach” to people deliberately flouting laws.

OzStudents

Breaking: Australia will vaccinate 24,000+ students without parents present and they will not be allowed to be there. Parents are writing me completely outraged at what is happening to their children and what is happening to society and this entire planet! pic.twitter.com/27gPuOr4II

— Erin Elizabeth Health Nut News (@unhealthytruth) August 16, 2021

“All of us have been fully vaccinated (with two doses),” “All of us have been tested for COVID this week. And all of us have to take the second test tomorrow or the day after tomorrow,”

• Lockdowns Widen In China As Locals Doubt Official COVID-19 Data (ET)

A spokesperson for the Chinese National Health Commission Mi Feng said at a press conference on Friday: “As of now, the diagnosed local [COVID-19] cases have risen for 19 consecutive days, and involved 16 provinces.” On Saturday and Sunday, the regime announced more infections but many people interviewed by the Chinese-language Epoch Times said they didn’t believe the numbers because of the regime’s past underreporting on COVID-19. The regime has reported relatively small-scale local outbreaks this year until July 20, when Nanjing in eastern Jiangsu Province announced airport workers were diagnosed with COVID-19. Since then, the CCP (Chinese Communist Party) virus, commonly known as novel coronavirus, has spread to dozens of cities across the country.

In its counting of COVID-19 cases the Chinese regime doesn’t include infected people not showing obvious symptoms. The regime also claims that anyone found to have COVID-19 who travelled overseas in the past month must have contracted the CCP virus when they were out of China, and count them as imported cases. Local cases end up being those who haven’t visited other countries in the past months and have symptoms. In Zhengyang County in central Henan Province, the regime only announced one person diagnosed with COVID-19 in recent weeks, but have locked down residential compounds and villages. The regime even planned to test all residents in the county again on Friday, although it didn’t report any infections in a first round of tests carried out two days earlier.

As of around midday Monday local time, Zhengyang County government had only announced that it had found one case that tested positive on Aug. 9 and another that was counted as an individual showing symptoms on Thursday. However, the county has strictly controlled people’s movements. On Saturday, local residents in the county said lockdown measures meant they couldn’t leave home and many believed the real infection figure must be larger than what the authorities are admitting. “All of us have been fully vaccinated (with two doses),” Wang, a staff member of Zhengyang train station, said in a phone interview on Saturday. “All of us have been tested for COVID this week. And all of us have to take the second test tomorrow or the day after tomorrow,” Wang said. “The outbreak is very severe here.”

The Zhengyang City government announced that no private or business vehicles were allowed on roads from Saturday. Only ambulances, garbage trucks, and other emergency vehicles were allowed to use the roads. A Zhengyang farmer told the Chinese-language Epoch Times on Saturday that even farmers aren’t allowed to leave their homes or work their fields. “If there’s only one infection [in Zhengyang], the regime shouldn’t be so nervous, and shouldn’t ask us to test at night. They said we will be tested again,” the farmer said. “They [the regime] don’t allow us to farm our lands, don’t allow us to visit the city, don’t allow us to visit our friends and relatives. All schools and after-school classes were closed,” she said.

Berenson: “New @JAMA_current paper says @moderna_Tx caused 2.3x the number of “significant” symptoms compared to @pfizer in a sample of 950 people.

Moderna also produced more antibodies. Raising the question of what a third dose, which produces still MORE, will do.”

• Association of Vaccine Type and Prior SARS-CoV-2 Infection (JAMA)

In June 2020, HWs in the Johns Hopkins Health System provided oral informed consent to participate in a longitudinal study of S1 spike antibodies in which serum samples and survey responses were collected every 3 to 4 months. Ethical approval was obtained from the Johns Hopkins University Institutional Review Board. The HWs who participated for a study visit between March 10 and April 8, 2021, were included in this analysis if their serum sample was collected 14 or more days after receiving dose 2 of either mRNA vaccine. Using an enzyme-linked immunosorbent assay (Euroimmun), IgG antibody measurements were determined based on optical density ratios with an upper threshold of 11 based on assay saturation.

Prior SARS-CoV-2 infection was defined as having (1) a positive SARS-CoV-2 polymerase chain reaction test result prior to 14 days after dose 2 or (2) S1 spike IgG measurement greater than 1.23 prior to vaccination.5 Participants self-reported symptoms following vaccination as none, mild (injection site pain, mild fatigue, headache), or clinically significant (fatigue, fever, chills). Logistic regression models were used to explore the association of prior SARS-CoV-2 infection and vaccine type with symptoms following each dose, adjusting for sex and age. A linear regression model was used to explore the association between magnitude of antibody response (log-transformed) and age, sex, prior infection, vaccine type, symptoms, and time after 2 doses of vaccine. Analyses were performed in R, version 4.0.2 (R Foundation).

Results

A questionnaire and serum sample were collected 14 or more days following dose 2 for 954 HWs. Clinically significant symptoms were reported by 52 of the 954 (5%) after dose 1 and 407 (43%) after dose 2. After adjusting for prior SARS-CoV-2 infection, age, and sex, the odds of clinically significant symptoms following either dose were higher among participants who received the Moderna vs the Pfizer vaccine (dose 1: odds ratio [OR], 1.83; 95% CI, 0.96-3.50; dose 2: OR, 2.43; 95% CI, 1.73-3.40) (Table). Prior SARS-CoV-2 exposure was associated with increased odds of clinically significant symptoms following dose 1 (OR, 4.38; 95% CI, 2.25-8.55) but not dose 2 (OR, 0.60; 95% CI, 0.36-0.99), after controlling for vaccine type, age, and sex.Regardless of symptoms, the vast majority of participants (953 of 954, greater than 99.9%) developed spike IgG antibodies 14 or more days following dose 2; 1 participant who was taking immunosuppressant medication did not develop IgG antibodies. Reporting clinically significant symptoms, age younger than 60 years, female sex, receipt of Moderna vaccine, and prior SARS-CoV-2 exposure were independently associated with higher median IgG measurements, after adjusting for time after dose 2.

Kulldorff is next.

• Harvard Med Professor Censored For Contrarian Covid Posts (JTN)

Martin Kulldorff started relying on LinkedIn to share news and views on COVID-19 policy after Twitter suspended the Harvard Medical School professor for a month for questioning the protective power of masks. Now the Microsoft-owned professional social network is scrutinizing his posts, going so far as to remove two for violating its misinformation policy. It’s at least the second action LinkedIn has taken this summer against a vaccine scientist who questioned COVID-19 orthodoxy. It suspended Robert Malone, who credits himself as the inventor of mRNA vaccine technology, for alleging dangers from the “spike protein” in mRNA vaccines, citing heart-inflammation reports in some vaccinated young people and highlighting Big Tech censorship and conflicts of interest. A LinkedIn “senior executive” personally apologized to him for wrongful removal, Malone said.

Kulldorff made a similar cost-benefit argument against mandatory COVID vaccinations for young people in a June op-ed. He directed Twitter followers to find the op-ed on his LinkedIn page because “Twitter does not allow vaccine scientists to freely discuss vaccines.” Now he’s directing Linkedin followers to find him on Twitter, though the scientist confirmed to Just the News that he is concerned about further censorship there, “so I self-censor on Twitter.” One of Kulldorff’s Harvard Med colleagues spoke against LinkedIn for the censorship. “The point is not whether a minority viewpoint is right,” bioethics professor Jonathan Darrow, who cowrote a journal article with Kulldorff last year, wrote in an email. If such views are silenced, “public health options may be closed off prematurely, matters may be erroneously believed to be settled, and needed research may never be conducted.”

[..] COVID-19 orthodoxy has “unjustifiably tarnished” the reputations of scientists such as Stanford University’s John Ioannidis, “one of the most well-respected luminaries” in evidence-based medicine, Darrow said. Ioannidis lost that respect “because he publicly presented data about COVID’s infection fatality rate that were politically unpopular.” Censorship is also “communicable,” according to Darrow, “potentially tipping the scales of public judgment one way or the other and leading to a downward spiral of intolerance in which minority views are increasingly suppressed.”

When one insanity meets the other.

• Afghans Fleeing Taliban Need Negative PCR Test For Now-suspended Flights (RT)

The suspension of flights leaving Kabul has left countless civilians at the mercy of the Taliban. But even if flights resume, Afghans fleeing the country will still need to test negative for Covid, according to a baffling report. Soon after the Taliban seized the Afghan capital on Sunday, hundreds of civilians began to pour into Kabul’s international airport in hopes of being airlifted to safety. But by Monday morning, commercial airlines had halted operations in the Afghan capital due to gunfire around the air hub – caused at least in part by US soldiers firing warning shots at civilians gathering on the tarmac. But the suspension of regular outbound flights is just one of several hurdles facing Afghans seeking a one-way ticket out of the country: airlines operating in the Afghan capital ask for passengers to provide a negative coronavirus test.

The arguably ill-timed flight requirement was spotted at the end of an Atlantic article chronicling the frustrating story of an Afghan interpreter, Khan, and his family as they try to secure safe passage out of the country. “Today, Sunday, the Taliban are in Kabul… The neighborhood where Khan was renting a room has become dangerous, and he and his family have fled, walking six miles to another hiding place. He needs to find a facility that will administer the Covid-19 tests required by the airlines. He needs to get his family to the airport. He needs two more days,” reads the last paragraph of the article.

Bubbles.

• Tsitsipas Refuses To Take Vaccine Unless It Becomes Mandatory On Tour (R.)

World number three Stefanos Tsitsipas said he would only get the Covid-19 vaccine if it became mandatory to compete in tennis. While the men’s ATP Tour has publicly encouraged players to get vaccinated, the 23-year-old Greek is among those who still have reservations. “No one has told me anything. No one has made it a mandatory thing to be vaccinated,” he told reporters, when asked if he would seek a vaccine while competing in the US. “At some point I will have to, I’m pretty sure about it, but so far it hasn’t been mandatory to compete, so I haven’t done it, no,” added Tsitsipas, who received a first-round bye in the Masters 1000 tournament in Cincinnati.

He reached the French Open final in June but suffered a shock, first-round exit at Wimbledon, where he told reporters he found it challenging to live and compete in the Covid-19 “bubble.” The Covid-19 vaccine has divided opinion within tennis. World number one Novak Djokovic said in April he hoped the Covid-19 vaccine would not become mandatory for players to compete and has declined to answer questions regarding his own vaccination status. However, fellow 20-time Grand Slam winners Roger Federer and Rafa Nadal feel athletes need to play their part to get life back to some form of normality.

Federer said in May that he received the Pfizer-BioNTech vaccine, while Nadal said: “The only way out of this nightmare is vaccination. Our responsibility as human beings is to accept it. “I know there is a percentage of people who will suffer from side effects, but the effects of the virus are worse.” Spectators will not be allowed to attend qualifying rounds at this month’s U.S. Open due to the Covid-19 pandemic, the United States Tennis Association (USTA) said last week. The USTA previously said it would allow full fan capacity for the main part of the tournament.

China knows.

• Afghan Abandonment A Lesson For Taiwan (Global Times)

The geopolitical value of Afghanistan is no less than that of Taiwan island. Around Afghanistan, there are the US’ three biggest geopolitical rivals – China, Russia and Iran. In addition, Afghanistan is a bastion of anti-US ideology. The withdrawal of US troops from there is not because Afghanistan is unimportant. It’s because it has become too costly for Washington to have a presence in the country. Now the US wants to find a better way to use its resources to maintain its hegemony in the world. Taiwan is probably the US’ most cost-effective ally in East Asia. There is no US military presence on the island of Taiwan. The way the US maintains the alliance with Taiwan is simple: It sells arms to Taiwan while encouraging the DPP authorities to implement anti-mainland policies through political support and manipulation.

As a result, it has caused a certain degree of depletion between the two sides of the Taiwan Straits. And what Washington has to do is only to send warships and aircraft near the Straits from time to time. In general, the US does not have to spend a penny on Taiwan. Instead, it makes money through arms sales and forced pork and beef sales to the island. This is totally a profitable geopolitical deal for Washington. Once a cross-Straits war breaks out while the mainland seizes the island with forces, the US would have to have a much greater determination than it had for Afghanistan, Syria, and Vietnam if it wants to interfere. A military intervention of the US will be a move to change the status quo in the Taiwan Straits, and this will make Washington pay a huge price rather than earn profit.

Some people on the island of Taiwan hype that the island is different from Afghanistan, and that the US wouldn’t leave them alone. Indeed, the island is different from Afghanistan. But the difference is the deeper hopelessness of a US victory if it gets itself involved in a cross-Straits war. Such a war would mean unthinkable costs for the US, in front of which the so-called special importance of Taiwan is nothing but wishful thinking of the DPP authorities and secessionist forces on the island.

Afghans have no confidence in the US and US-supported regimes. I believe their distrust reflects the fact that the entire world has lost confidence in the US: Editor-in-Chief Hu Xijin #HuSays pic.twitter.com/yrcLPPxAwf

— Global Times (@globaltimesnews) August 16, 2021

“Unless there is a major purge of those who lied and misled, we can count on these disasters to continue until the last US dollar goes up in smoke.”

• Kabul Has Fallen – But Don’t Blame Joe Biden (Ron Paul)

This weekend the US experienced another “Saigon moment,” this time in Afghanistan. After a 20 year war that drained trillions from Americans’ pockets, the capital of Afghanistan fell without a fight. The corrupt Potemkin regime that the US had been propping up for two decades and the Afghan military that we had spent billions training just melted away. The rush is on now to find somebody to blame for the chaos in Afghanistan. Many of the “experts” doing the finger-pointing are the ones most to blame. Politicians and pundits who played cheerleader for this war for two decades are now rushing to blame President Biden for finally getting the US out. Where were they when succeeding presidents continued to add troops and expand the mission in Afghanistan?

The US war on Afghanistan was not lost yesterday in Kabul. It was lost the moment it shifted from a limited mission to apprehend those who planned the attack on 9/11 to an exercise in regime change and nation-building. Immediately after the 9/11 attacks I proposed that we issue letters of marque and reprisal to bring those responsible to justice. But such a limited and targeted response to the attack was ridiculed at the time. How could the US war machine and all its allied profiteers make their billions if we didn’t put on a massive war? So who is to blame for the scenes from Afghanistan this weekend? There is plenty to go around. Congress has kicked the can down the road for 20 years, continuing to fund the Afghan war long after even they understood that there was no point to the US occupation.

There were some efforts by some Members to end the war, but most, on a bipartisan basis, just went along to get along. The generals and other high-ranking military officers lied to their commander-in-chief and to the American people for years about progress in Afghanistan. The same is true for the US intelligence agencies. Unless there is a major purge of those who lied and misled, we can count on these disasters to continue until the last US dollar goes up in smoke. The military industrial complex spent 20 years on the gravy train with the Afghanistan war. They built missiles, they built tanks, they built aircraft and helicopters. They hired armies of lobbyists and think tank writers to continue the lie that was making them rich. They wrapped their graft up in the American flag, but they are the opposite of patriots.

[..] Political control in Afghanistan has returned to the people who fought against those they viewed as occupiers and for what they viewed as their homeland. That is the real lesson, but don’t expect it to be understood in Washington. War is too profitable and political leaders are too cowardly to go against the tide. But the lesson is clear for anyone wishing to see it: the US global military empire is a grave threat to the United States and its future.

Vet

This Afghanistan vet just blew up MSNBC’s entire Biden-simping Afghanistan narrative LIVE ON AIR.

What a glorious takedown. Watch this. pic.twitter.com/6mR2RlPN7I

— Benny (@bennyjohnson) August 17, 2021

Well, we have to make some money, c’mon!

• Afghanistan: We Never Learn (Taibbi)

Secretary of State Anthony Blinken, when asked months ago about the possibility that there might be a “significant deterioration” of the security picture in Afghanistan once the United States withdrew its forces, said, “I don’t think it’s going to be something that happens from a Friday to a Monday.” Blinken’s Nostradamus moment was somehow one-upped by that of his boss, Joe Biden, who on July 8th had the following exchange with press: “Q: Your own intelligence community has assessed that the Afghan government will likely collapse. BIDEN: That is not true, they did not reach that conclusion… There is going to be no circumstance where you see people lifted off the roof of an embassy… The likelihood that you’re going to see the Taliban overrunning everything and owning the whole country is highly unlikely.”

[..] The pattern is always the same. We go to places we’re not welcome, tell the public a confounding political problem can be solved militarily, and lie about our motives in occupying the country to boot. Then we pick a local civilian political authority to back that inevitably proves to be corrupt and repressive, increasing local antagonism toward the American presence. In response to those increasing levels of antagonism, we then ramp up our financial, political, and military commitment to the mission, which in turn heightens the level of resistance, leading to greater losses in lives and treasure. As the cycle worsens, the government systematically accelerates the lies to the public about our level of “progress.”

Throughout, we make false assurances of security that are believed by significant numbers of local civilians, guaranteeing they will later either become refugees or targets for retribution as collaborators. Meanwhile, financial incentives for contractors, along with political disincentives to admission of failure, prolong the mission. This all goes on for so long that the lies become institutionalized, believed not only by press contracted to deliver the propaganda (CBS’s David Martin this weekend saying with a straight face, “Everybody is surprised by the speed of this collapse” was typical), but even by the bureaucrats who concocted the deceptions in the first place.

The look of genuine shock on the face of Tony Blinken this weekend as he jousted with Jake Tapper about Biden’s comments from July should tell people around the world something important about the United States: in addition to all the other things about us that are dangerous, we lack self-knowledge. Even deep inside the machine of American power, where everyone paying even a modicum of attention over the last twenty years should have known Kabul would fall in a heartbeat, they still believe their own legends. Which means this will happen again, and probably sooner rather than later.

“..if you don’t see this US policy debacle increases the risks of ‘red-line’ incidents in the Asia/Indo-Pacific, perhaps you should look for a desk job at the CIA.”

• When The Penny Drops It’s You And Your Portfolio On That Kabul Tarmac (Every)

The US Beltway experts who six weeks ago said the Taliban could not establish an Islamic Emirate for at least a year, and then suddenly revised that down to six weeks, and then to 72 hours, still got it wrong: it happened on Sunday evening. The Afghan president has fled, along with his artificial $88bn “army”, but the actual weapons are now in the hands of the Taliban. Crowds of desperate Afghans are flooding the runway of Kabul airport –requisitioned by the US Army because it surrendered Bagram airbase without warning weeks ago, and the Taliban now control it– in scenes that look like Saigon in 1975. Or, tragically, like the Khmer Rouge entering Phnom Penh in ‘The Killing Fields’ (in Cambodia, a few years later); and there seems a very real risk the comparison won’t stop there.

Yes, markets will try to brush this geopolitical earthquake off: It’s just Afghanistan; It’s a long way away; We never wanted to go on holiday there anyway; They don’t even buy much cheese. There will probably be attempts to talk of a ‘New Taliban’, as we did with New Labour in the UK, brushing over the fact that the latter ‘New’ was vs. 1970’s socialism, and the former is vs. 7th century fundamentalism. Indeed, the Taliban seem to now realize which Western memes make it look more palatable, and are promising to be “inclusive”. They may only need to throw in “diverse”, “equity”, “green”, and “sustainability” for Wall Street to perk up and ask “Are you in favour of free trade and QE?”, and for EU foreign policy representatives to sit next to them.

But what to do? Michael Bloomberg has already penned an editorial that says “The US Can’t Walk Away From Afghanistan”, which is correct: the US *ran* away in the eyes of Afghans. He then Bloombergs that: “Words are easy. Solutions are hard,” and suggests the US continue to fund the Afghan government and army as long as viable (too late!), help people to flee (where?), and use airstrikes and special forces to keep terrorism at bay, which will involve “Cajoling neighbouring countries for intelligence support and basing rights.” (Neighbours like China; Turkmenistan; Tajikistan; Uzbekistan; Iran; and Pakistan.) Hey, words *are* easy! And solutions hard. Yet Bloomberg is right in that this geopolitical nightmare is almost certainly only just beginning.

As noted here on Friday, if you don’t see this US policy debacle increases the risks of ‘red-line’ incidents in the Asia/Indo-Pacific, perhaps you should look for a desk job at the CIA. The US now looks like it is flailing around like a social-media influencer discovering not just a micro-aggression, or that life contains people who don’t agree with you, but that there are people who aren’t even on Twitter that can punch you in the face and break your nose and teeth (and far, far worse). Geopolitically, opportunists of all stripes may now be considering if they may not be able to earn theirs, so to speak, by kicking the US while it is down. And yet the US is clearly swinging most of what is still the world’s most formidable military muscle squarely towards the Asia/Indo-Pacific region, and will almost certainly not want to be seen to ‘do a Kabul’ in that jurisdiction too. Or a Nord-Stream 2. Or an Iran.

“Floundering. Friendless. Broke. Broken!”

• Strange Days Ahead (Kunstler)

Well, we’ve become an ossified, administrative nomenklatura of Deep State flunkies as the Soviets were, and lately we’re just as lawless as they used to be, constitution-wise — e.g., the abolition of property rights via the CDC’s rent moratorium… the prolonged jailing in solitary confinement of January 6 political prisoners… the introduction of internal “passports.” The USA is running on fumes economically as the Soviets were. Our dominant party leadership has aged into an embarrassing gerontocracy. Is it our turn to collapse? Kind of looks like it. The days ahead are liable to be a rough ride. Surely China has taken the measure of our Woke military and is weighing the seizure of Taiwan in our moment of signal weakness.

No more computer chips for you, Uncle Sam! Do we come to Taiwan’s defense with guns blazing, or perhaps nukes? And what if that doesn’t work out so well? I’ll tell you what: a major geopolitical reordering of things, leaving us… where? Unable to enforce our will around the world as has been the case for eighty years. Floundering. Friendless. Broke. Broken! Of course, the domestic situation in our land has not been so fraught and overwrought since 1861. Everything is politicized, which is to say: used as a truncheon to beat-up adversaries and, let’s face it, mostly in the sense of Left against Right. This is especially true for the Covid-19 soap opera, which more and more pits the sanctimoniously vaccinated “progressives” against the recalcitrant conservative no-vax free-choicers — that is, coercive government trying to force supposedly free citizens to accept a pretty dubious experimental medical treatment.

Since when did the American Left become so pro-tyranny, and how’d that even happen? I have friends and relatives — I’m sure you do, too — who knocked themselves out in the 1960s protesting against the war, the government, the FBI, and the CIA… who fought in the streets for free speech and raged against official propaganda — and today they can’t get enough of coercing, punishing, brain-washing, and cancelling their fellow citizens. They’re going so far now as to engineer their vicious narrative to brand their opponents as “domestic terrorists.” Think that’s going to work?

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.