Vincent van Gogh Starry night 1889

At some point, these things start feeding upon themselves.

• Argentine Peso And Turkish Lira Crash, Put Pressure On Emerging Markets (CNBC)

Emerging markets were rattled again, with the Argentine peso, Turkish lira and Indonesian rupiah tumbling overnight. The negative sentiment is set to weigh on other Asian currencies, although they will remain fairly resilient to the impact, analysts say. The peso crashed nearly 12 percent, following a domestic crisis which saw its central bank hike rates to 60 percent in an attempt to shore up its currency. Extending its steep losses this year, the lira fell 2.94 percent to a fourth straight day of declines. In Asia, India’s rupee fell to a new record low against the dollar on Friday — a more than 11 percent fall since the start of the year, and the Indonesian rupiah hit a near three-year low.

“Emerging markets will remain pressured by the Argentine peso and Turkish lira crises,” DBS analysts said in a note Friday morning. The peso is down more than 45% against the greenback this year. “Argentina has hiked rates to a record 60% to address double-digit inflation, but this would exacerbate the recession, and coupled with budget/current account deficits of around 5% of GDP, have increased the risk of for the government to default on its debt,” they added.

Likely to be pushed hard ahead of mid terms.

• US, China To Regulate Big Tech Firms ‘Like National Security Companies’ (CNBC)

The U.S. and China may be at odds on trade, but both are lining up to crack down on big tech, according to an analyst. “I think this is actually wrapped up in the trade issue, which is around national security and tech companies,” Michael Hessel, political economy analyst at Absolute Strategy Research, told CNBC’s “Squawk Box Europe” on Thursday. “There’s a growing push both within China and the U.S. to regulate some of these companies increasingly like national security companies, which could have huge implications for their business model.” President Donald Trump on Tuesday made Google his latest target in a tirade against big tech, saying the firm’s search service is “rigged” against conservatives in favor of left-leaning media.

The president subsequently took another shot at the tech giant on Wednesday, claiming it snubbed twice his State of the Union speeches, while promoting Barack Obama’s during each year of the latter’s presidency. Google later responded to this claim, saying it did promote Trump’s State of the Union address this year, but not in 2017. [..] Absolute Strategy Research’s Hessel did not expand on how he expected either country to clamp down on their respective tech industries. He said that a lack of regulation in the U.S. on tech — while the media industry is more heavily regulated — meant it could be a long-term concern for lawmakers in Washington. “I think the regulation of the tech industry is going to be a huge issue on a three-to-five year view,” Hessel said.

2nd Special Counsel preparations.

• Trumps Legal Team Preparing Counter Report To Delegitimize Mueller (ZH)

President Trump’s lawyers are preparing a rebuttal to any negative report issued by special counsel Robert Mueller following the DOJ’s probe into Russian collusion with the Trump campaign, reports the Daily Beast following an interview with Trump attorney Rudy Giuliani. Part of the rebuttal, says Giuliani, would focus on whether the “initiation of the investigation was…legitimate or not.” “According to Giuliani, the bulk of the report will be divided into two sections. One section will seek to question the legitimacy of the Mueller probe generally by alleging “possible conflicts” of interest by federal law enforcement authorities. The other section will respond to more substantive allegations of Trump campaign collusion with Russian government agents to sway the 2016 election, and obstruction of justice allegations stemming from, among other things, the president’s firing of former FBI director James Comey.” -Daily Beast

The latter section of the rebuttal will focus on Deputy Director Rod Rosenstein’s mandate when he ordered the Mueller’s investigation – though Giuliani admits he has no idea what the final report will consist of. “Since we have to guess what it is, [our report so far] is quite voluminous,” Giuliani said, claiming that he would spend much of this weekend “paring it down” and that he was editing the document created by the “whole team.” “The first half of it is 58 pages, and second half isn’t done yet…It needs an executive summary if it goes over a hundred” -Daily Beast In other words, Mueller has fair warning that the Trump administration intends to fight this tooth and nail.

The Weekly Standard’s Eric Felton offered this last month: “Appellate and constitutional lawyers David B. Rivkin, Jr. and Elizabeth Price Foley recently made a compelling case that the political bias among the FBI agents working on “Crossfire Hurricane” renders illegitimate everything flowing from that investigation. If “Crossfire was politically motivated then its culmination, the appointment of a special counsel, inherited the taint,” Rivkin and Foley wrote in the Wall Street Journal. “All special-counsel activities—investigations, plea deals, subpoenas, reports, indictments and convictions—are fruit of a poisonous tree, byproducts of a violation of due process.” Rivkin and Foley add: “That Mr. Mueller and his staff had nothing to do with Crossfire’s origin offers no cure.” -Weekly Standard

Another fully crazy story. And yes, if such moles existed, nobody would tell the media.

• ‘Vital’ US Moles in the Kremlin Go Missing! (Stephen Cohen)

on August 25, the ever-eager New York Times published yet another front-page Russiagate story—one that if true would be sensational, though hardly anyone seemed to notice. According to the Times’ regular Intel leakers, US intelligence agencies, presumably the CIA, has had multiple “informants close to…Putin and in the Kremlin who provided crucial details” about Russiagate for two years. Now, however, “the vital Kremlin informants have largely gone silent.” The Times laces the story with misdeeds questionably attributed to Putin and equally untrustworthy commentators, as well as a mistranslated Putin statement that incorrectly has him saying all “traitors” should be killed. Standard US media fare these days when fact-checkers seem not to be required for Russia coverage. But the sensation of the article is that the US had moles in Putin’s office.

The real novelty of Russiagate is the allegation that a Kremlin leader, Putin, personally gave orders to affect the outcome of an American presidential election. In this regard, Russiagaters have produced even less evidence, only suppositions without facts or much logic. With the Russiagate narrative being frayed by time and fruitless investigations, the “mole in the Kremlin” may have seemed a ploy needed to keep the conspiracy theory moving forward, presumably toward Trump’s removal from office by whatever means. And hence the temptation to play the mole card again, now, as yet more investigations generate smoke but no smoking gun.

The pretext of the Times story is that Putin is preparing an attack on the upcoming November elections, but the once-“vital,” now-silent moles are not providing the “crucial details.” Even if the story is entirely bogus, consider the damage it is doing. Russiagate allegations have already delegitimized a presidential election, and a presidency, in the minds of many Americans. The Times’ updated, expanded version may do the same to congressional elections and the next Congress. If so, there is an “attack on American democracy”—not by Putin or Trump but by whoever godfathered and repeatedly inflated Russiagate.

Common practice, but in this case questionable.

• Trump Is Right About “Flipping” (FFF)

Suppose a federal criminal defendant contacts a prospective witness in a case and offers him $50,000 in return for his “cooperation” in his upcoming trial. The money will be paid as soon as the trial is over. The defendant makes it clear that he wants the witness to “tell the truth” but that his “cooperation” when he testifies at trial would be greatly appreciated. What would happen if federal officials learned about that communication and offer? They would go ballistic. They would immediately secure an indictment for bribery and witness tampering. What if the defendant says, “Oh, no, I wasn’t tampering with the witness. I specifically told him that I wanted him to tell the truth when he took the witness stand. I was just seeking his friendly ‘cooperation’ with my $50,000 offer to him.”?

It wouldn’t make a difference. Federal prosecutors would go after him with a vengeance on bribery and witness-tampering charges. And it is a virtual certainty that they would get a conviction. There is good reason for that. The law recognizes that the money could serve as an inducement for the witness to lie. Even though the defendant tells him to “tell the truth,” the witness knows that the fifty grand is being paid to him to help the defendant get acquitted, especially since it is payable after the trial is over. The temptation to lie, in return for the money, becomes strong, which is why the law prohibits criminal defendants from engaging in this type of practice.

Suppose a federal prosecutor says to a witness, “You are facing life in prison on the charges we have brought against you. But if you ‘cooperate’ with us to get John Doe, we will adjust the charges so that the most the judge can do is send you to jail for only 5 years at most. If you are really ‘cooperative,’ we will recommend that the judge give you the lowest possible sentence, perhaps even probation. Oh, one more thing, we want to make it clear that we do want you to tell the truth.” Do you see the problem? The temptation to please the prosecutor with “cooperation” becomes tremendous. If the witness can help secure a conviction of Doe, he stands to get a much lighter sentence for his successful “cooperation.” The inducement to commit perjury oftentimes takes over, notwithstanding the prosecutor’s admonition to the witness to “tell the truth.”

Are the UK going to use this to justify Brexit?

• France Says EU Needs Strategic Relationship With Russia On Defense (R.)

The European Union needs a strategic relationship with Turkey, including in defense matters, and should modernize its post-Cold War relations with Russia, French President Emmanuel Macron said on Thursday. Macron is a strong advocate for a Europe that is able to defend its strategic interests and financial independence and respond to new global economic and defense situation brought on by Donald Trump’s presidency in the United States. He has sought to improve relations with Russia’s President Vladimir Putin, although his efforts have been complicated by allegations of Russian meddling in elections from the United States to France and a nerve agent attack in Britain.

“It is in our interest for the EU to have a strategic relationship with Turkey as well as with Russia that brings stability, that will in the long term and bring more strength and coherency,” Macron said in a news conference in Helsinki alongside Finnish President Sauli Niinisto. He said the EU’s relations with Russia needed to be “brought up to date”, using the Italian word “aggiornamento”. “I think that on matters like cybersecurity, defense, strategic relationships, we could envisage the outlines of a new relationship between Russia and the EU which is coherent with the direction Europe is headed in,” Macron said.

Not enough, says Trump.

• EU Says It Is Willing To Scrap Car Tariffs In US Trade Deal (Pol.eu)

Brussels is willing to scrap tariffs on all industrial products, including cars, in its trade talks with the United States, EU trade chief Cecilia Malmström said Thursday. “We said that we are ready from the EU side to go to zero tariffs on all industrial goods, of course if the U.S. does the same, so it would be on a reciprocal basis,” Malmström told the European Parliament’s trade committee. “We are willing to bring down even our car tariffs down to zero … if the U.S. does the same,” she said, adding that “it would be good for us economically, and for them.”

Malmström’s comment went beyond what was agreed in July in the joint statement between European Commission President Jean-Claude Juncker and U.S. President Donald Trump, which only mentioned eliminating tariffs, non-tariff barriers and subsidies for “non-auto industrial goods.” [..] The EU’s car tariff of 10 percent is higher than the general U.S. auto tariff of 2.5 percent, but America imposes a 25 percent duty on light trucks and pick-ups. Malmström insisted that the discussions were not about “restarting TTIP” but aiming for “a more limited trade agreement.” “Agriculture would not be in the agreement, nor public procurement as it looks to today,” she said.

Same as Silk Road: loading countries up with debt. Then take their assets.

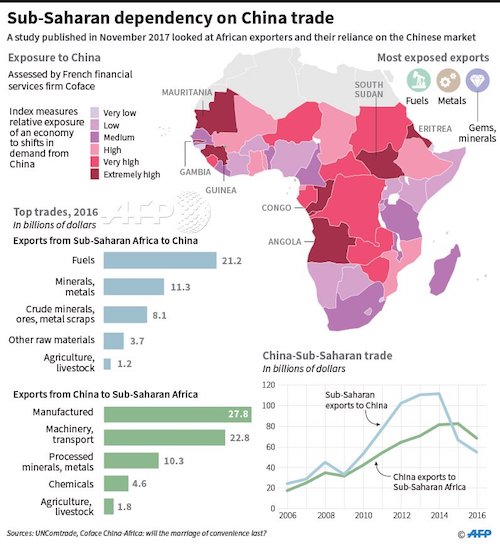

• China-Africa Summit To Target Investment Despite Debt Worries (AFP)

African leaders will gather in Beijing Monday for a summit focused on economic ties, granting China a feel-good photo opportunity as it comes under increasing fire for its debt-laden approach to aid in the developing world. President Xi Jinping will host leaders from across the continent for the two-day Forum on China-Africa Cooperation, which will include talks on his cherished “Belt and Road” infrastructure programme. The massive scheme, aimed at improving Chinese access to foreign markets and resources, and boosting its influence abroad, has already seen Beijing loan billions of dollars to countries in Asia and Africa for roads, railways, ports and other major building projects.

“The initiative will probably be expanded to include the whole of Africa,” said Cobus van Staden, senior researcher on Africa-China relations at the South African Institute of International Affairs. While some critics have branded the strategy a debt-trap, African leaders have long embraced Chinese investment, helping make Beijing the continent’s largest trading partner for the past decade. At the last three-yearly gathering in Johannesburg in 2015, Xi announced $60 billion of assistance and loans for Africa. This year, China will want to add more African countries to “its ever-expanding list of ‘friendly’ nations”, especially from the north and francophone west, said Adebusuyi Isaac Adeniran, an expert on the relationship at Nigeria’s Obafemi Awolowo University.

Starting to short all of Big Tech. Buffett calling iPhones underpriced may be seen in that light.

• As Tesla Shares Fall, Amazon Takes Over As Most Shorted US Stock (R.)

With Tesla’s shares briefly dipping below the $300 level on Thursday, the electric carmaker ceded its seat as the most shorted U.S. stock to Amazon.com, according to data from financial technology and analytics firm S3 Partners. Tesla short interest in dollars, calculated using the number of shares sold short and the share price, stood at $9.93 billion, on Thursday, just shy of $9.95 billion for Amazon, S3 Partners data showed. Analysts said investors were still shorting Tesla shares, or taking positions that amounted to bets the stock would keep declining. Short-sellers aim to profit by selling borrowed shares, hoping to buy them back later at a lower price.

“While there was some short covering the week after the tweet, there has still not been any significant net Tesla short covering on the Street,” said Ihor Dusaniwsky, head of research at S3 in New York. “Any traders who have closed down their positions to realize some profits have been replaced by new ones looking for continued price weakness,” he said. Tesla shares whipsawed this month after Chief Executive Elon Musk on Aug. 7 tweeted he planned to take the company private, only to abandon the idea by Aug. 24.

Sovereign nation.

• IMF Unwavering On Greek Pension Cuts (K.)

The government’s aim to suspend pension cuts due to come into effect in January is likely to fuel friction in the coming weeks, Kathimerini understands, as the IMF is adamant that the reductions should be made even if they are not required for Greece to meet budget targets. The IMF’s stance is at odds with that of European officials who are more flexible on the issue, as European Economic and Monetary Affairs Commissioner Pierre Moscovici has suggested in a series of recent comments. Indeed, according to sources, the EC’s envoy to Greece, Declan Costello, is working on a compromise that would be acceptable to the government.

The IMF has not publicly declared its position on the Greek pensions issue yet but sources say the Fund has not shifted from its stance in favor of pension cuts despite the more favorable than expected fiscal forecasts, due to fears about the Greek pension system, which remains unsustainable partially due to the country’s aging population. The IMF’s unofficial position, it seems, is that fiscal savings worth 1 percent of GDP – the value of the planned pension cuts – are not required for Greece to achieve a primary surplus of 3.5 percent of GDP but it is preferable that they be carried out and offset by countermeasures than not carried out.

US Republicans and German social democrats have the same agenda. But the latter have all but vanished.

• The Three Tribes of Austerity (Varoufakis)

The first, and best known, “austerian” tribe is motivated by the tendency to view the state as no different from a business or a household that must tighten its belt during bad times. Overlooking the crucial interdependence between a government’s expenditure and (tax) income (from which businesses and households are blissfully free), they make the erroneous intellectual leap from private parsimony to public austerity. Of course, this is no arbitrary error; it is powerfully motivated by an ideological commitment to small government, which in turn veils a more sinister class interest in redistributing risks and losses to the poor.

A second, less recognized, austerian tribe can be found within European social democracy. To take one towering example, when the 2008 crisis erupted, Germany’s finance ministry was in the hands of Peer Steinbrück, a leading member of the Social Democratic Party. Almost immediately, Steinbrück prescribed a dose of austerity as Germany’s optimal response to the Great Recession. Moreover, Steinbrück championed a constitutional amendment that would ban all future German governments from deviating from austerity, no matter how deep the economic downturn. [..] Against a background of failing banks and a mighty recession, he opined that fiscal deficits deny elected politicians “room for maneuver” and rob the electorate of meaningful choices.

The third austerian tribe is American and perhaps the most fascinating of the three. Whereas British Thatcherites and German social democrats practiced austerity in an ill-conceived attempt to eliminate the government’s budget deficit, US Republicans neither genuinely care to limit the federal government’s budget deficit nor believe that they will succeed in doing so. After winning office on a platform proclaiming their loathing of large government and pledging to “cut it down to size,” they proceed to boost the federal budget deficit by enacting large tax cuts for their rich donors. Even though they seem entirely free of the other two tribes’ deficit phobia, their aim – to “starve the beast” (the US social welfare system) – is quintessentially austerian.

Mindless and braindead.

• Trade Of Coastal Sand Is Damaging Wildlife, Coastlines Of Poorer Nations (G.)

The secretive trade of coastal sand to wealthy countries such as China is seriously damaging the wildlife of poorer nations whose resources are being plundered, according to a new study. Sand and gravel are the most extracted groups of materials worldwide after water, with sand used in the concrete and asphalt of global cities. China consumed more sand between 2011 and 2013 than the US did during the entire 20th century. India has more than tripled its annual use of construction sand since 2000. But coastal sand is also being used to make wealthy countries larger via land reclamation projects, and the cost to poorer nations is revealed in a presentation to the Royal Geographical Society’s annual conference.

Research by Melissa Marschke and Laura Schoenberger of the University of Ottawa highlights that the dredging of coastal sand from Cambodia is causing the loss of mangrove swamps, coastal erosion, and damaging local fishing. They also allege that the sheer scale of the multimillion dollar trade of sand must be illegal, given that the volumes permitted for import are being exceeded. Singapore is built on sand: its land area has grown by more than a fifth since its independence in 1965 from 581 sq km to 719 sq km in 2015, according to the researchers. Between 2007 and 2017, Singapore imported more sand from Cambodia than any other country. Sand worth US$752m was imported by Singapore from Cambodia between 2007 and 2016, according to UN data.

Cambodia is not the only place experiencing vast sand extraction. A study recently estimated that 236m cubic metres of sand were extracted from Poyang Lake in China, causing its water levels to drop dramatically. Sand miners have destroyed at least two dozen islands in Indonesia since 2005. The UK obtains about one fifth of its sand from the seabed.

But the minister who made it possible resigned last week. Watch out.

• France’s Ban On Bee-Killing Pesticides Begins Saturday (AFP)

A ban on five neonicotinoid pesticides enters into force in France on Saturday, placing the country at the forefront of a campaign against chemicals blamed for decimating critical populations of crop-pollinating bees. The move has been hailed by beekeepers and environmental activists, but lamented by cereal and sugar beet farmers who claim there are no effective alternatives for protecting their valuable crops against insects. With its ban, France has gone further than the European Union, which voted to outlaw the use of three neonicotinoids — clothianidin, imidacloprid and thiamethoxam — in crop fields. Heavily agriculture-reliant France banned these three neonicotinoids plus thiacloprid and acetamiprid, not only outdoors but in greenhouses too.

These are the only five neonicotinoid pesticides hitherto authorised for use in Europe. Introduced in the mid-1990s, lab-synthesised neonicotinoids are based on the chemical structure of nicotine, and attack the central nervous system of insects. They were meant to be a less harmful substitute to older pesticides, and are now the most widely-used to treat flowering crops, including fruit trees, beets, wheat, canola, and vineyards. In recent years, bees started dying off from “colony collapse disorder,” a mysterious scourge blamed partly on pesticides along with mites, viruses, and fungi, or some combination of these. Scientific studies have since shown that neonicotinoids harm bee reproduction and foraging by diminishing sperm quality and scrambling the insects’ memory and navigation functions.

Watching with great interest.

• The Ocean Cleanup Is Starting, Aims To Cut Garbage Patch By 90% By 2040 (F.)

A massive cleanup of plastic in the seas will begin in the Pacific Ocean, by way of Alameda, California. The Ocean Cleanup, an effort that’s been five years in the making, plans to launch its beta cleanup system, a 600-meter (almost 2,000-foot) long floater that can collect about five tons of ocean plastic per month. It’s a start. The launch date is September 8, and the Great Pacific Garbage Patch being targeted is more than 1,000 nautical miles from the launch point and on the move. The Ocean Cleanup plans to monitor the performance of the beta, called System 001, and have an improved fleet of 60 more units skimming the ocean for plastics in about a year a half. The ultimate goal of the project, founded by Dutch inventor Boyan Slat when he was 18, is to clean up 50% of the patch in five years, with a 90% reduction by 2040.

The organization will take time to learn lessons from System 001, but “we are in a big hurry,” said Lonneke Holierhoek, chief operating officer at The Ocean Cleanup. “We really see the urgency in starting the cleanup because there’s so much harm that could happen with this plastic that’s floating out there.” The total cost of System 001 is about 21 million euros ($24.6 million U.S.), according to a rep for startup. That includes design, development, production, assembly and monitoring during the first year of operation. The company will welcome corporations and philanthropists to sponsor their own cleanup system in coming years, the rep says. These systems will sport a sponsor logo and related app that follows the unit’s course through the gyre and shows how much plastic has been collected.