Max Ernst The Angel of the home or the Triumph of Surrealism 1937

A friend of mine here in Athens, Greece, named Wayne Hall, who’s of Australian descent but moved here at about the time Napoleon headed for St. Petersburg, and works as a translator and language teacher, sent me a mail a few days ago that I thought was interesting.

In particular, Wayne referred to a video I didn’t know existed, of Julian Assange hosting a get-together in the Ecuadorian embassy in London on the night of the Brexit referendum, June 23, 2016, that includes a video (sound) link to Yanis Varoufakis who was in Rome at the time.

Julian was receiving visitors and broadcasting! How times have deteriorated, it’s heart-rendering, and it’s so painfully good to see him here in better days…. That video is below. The sound quality of Varoufakis speaking is really bad, and I don’t have the equipment here to work on that, but Wayne was kind enough to transcribe it. See also below.

What I found especially intriguing is the difference in view between the two: Varoufakis wanted (wants) the UK to stay in the EU, in order to reform it from within. And he thinks (thought) that his cross-European party, DiEM 25, can play a role in that. Even though it has no seats in the EU parliament, not then, and not now.

Assange, on the other hand, was pretty much pro-Brexit. He was quite clear about this (a few hours before the referendum results were in):

[..] if there is a Leave or even if the vote is very close, which it surely is, it is something that calls into question the political legitimacy of the European Union in the way it has been conducted so far. And really it’s quite incredible that it came to this.

That the European Union as a political structure was so unadaptable to the political calls upon it that it was not able to hand out the appropriate concessions to show that it had political legitimacy by doing what people wanted. And regardless of what that structure is, any structure which manages a nation state or collection of nation states has to be able to keep political legitimacy.

So I think that there is a very strong argument that the structure is a failure. Regardless of what side of politics you are on. A structure that cannot dynamically adapt to the political expediencies around it to regain political legitimacy when it is eroding is a failed structure.

Once again, testimony to Julian’s profound insight if not intelligence. And testimony to how much he is missed, withering away in solitary confinement in a prison for terrorists while he should be explaining our world to us.

Still, Varoufakis has some good points as well I find:

The British people are disenchanted. They’ve had a gutful of the policies that have come from Brussels, as well as the austerian authoritarianism from the British establishment, even those who are voting for Brexit, like Boris Johnson and the rest of the Tories. The only quarrel that they have with the practice is that they want to be able to rule over the British people without any impediments from Brussels.

Wayne has some more well-argued thoughts on the difference in thinking between Assange and Varoufakis. Here he is:

Wayne Hall: I am Wayne Hall and I’m speaking from Athens. I have a message for the Unity 4j network in defence of Julian Assange and first and foremost for the Greek group. Many if not most of Julian’s defenders in Europe are on the Left. In the US the situation is different but here we are talking about Europe. Some of Julian’s Leftist defenders even criticize him for not being Left himself. If he is not a Leftist what is he?

I think he would say that the question of truth and falsehood should take priority over political identity and that this is particularly urgent because at this moment the world is approaching a situation of near total domination of either falsehood in public discussion or else of censorship. At the moment a hot issue in Europe is Britain’s relations with the European Union. It is certainly more discussed than Julian Assange, Chelsea Manning or Wikileaks.

I have proposed the idea of opening a discussion under the title “From Wikileaks to Brexit” and I have been confronted with this question “what is the connection between Wikileaks and Brexit?” The first point I would like to make in response to this is to remind people, or inform people, because most probably they will not know, that on the day of the Brexit referendum (23rd June 2016) that has led to the current situation in relations between Britain and the EU, Julian Assange organized a comprehensive debate on Brexit with a wide range of activists, scholars and other citizens, and made it available through live streaming.

At that time Julian was still in the Ecuadorian Embassy and was able to receive visitors, have access to the internet and speak to the public. This was changed on 28th March 2018 and on 11th April 2019 Assange was expelled from the Embassy, tried and imprisoned. At the moment he is being held incommunicado and also prevented from preparing for the hearing on extradition to the United States, to be charged under the Espionage Act of 1917. The hearing in England is programmed for 25th February 2020.

The discussion on Brexit hosted by Julian Assange has characteristics that are not present in the Brexit debate as it is being conducted today. The Assange discussion strives for impartiality and a plurality of viewpoints, mostly sincere, unscripted viewpoints of a kind that seem today, unfortunately, to be disappearing from public discussion.

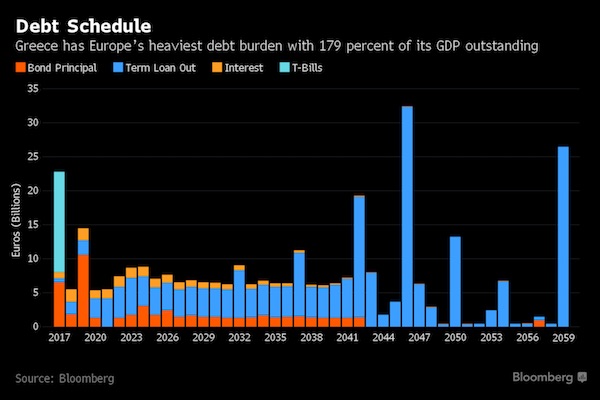

Hopefully this offers the beginning of an answer to the question “What is the connection between Wikileaks and Brexit”? The participant in the discussion that is featured in the following video is Yanis Varoufakis, former Finance Minister in the first six months of the 2015 to 2019 SYRIZA government headed by Alexis Tsipras. Varoufakis resigned from this government in protest at its surrendering to pressures from the Troika of the European Commission, the European Central Bank and the International Monetary Fund.

Assange’s and Varoufakis’ stance on the Brexit issues are not the same. Assange is more or less favourable to Brexit. Varoufakis and the citizens’ movement he founded, DiEM25, campaigned against it, saying that the issue was not that Britain should withdraw from the EU but that the EU should become an entity with which British people and people in other EU member countries would wish to be associated.

Assange asked Varoufakis an important question just before the result of the referendum became known. He said, if the Remains side wins, will there be any pressure at all for the kinds of changes in the EU that DiEM25 seeks to promote? Varoufakis replied that DiEM will see to it that the pressure continues. But is this what has happened, even though it is the Leave side, not the Remain side, that won the referendum? There has been a separation between the Assange question and the Brexit question.

A defence campaign for Julian Assange is under way but it faces a mainstream media blackout. A recent concert by Pink Floyd member Roger Waters was totally ignored by the channels that the majority of people watch. Was DiEM25 able to help get this concert into the mainstream media? And in any case, was Roger Waters’ message the same as what Julian’s message would have been if he had been able to speak for himself? Has the campaign against Brexit, against Trump and against Boris Johnson displaced the campaign for democracy? And is democracy favoured when a British Prime Minister is prevented from being able to call an election?

All because of a change in the electoral law voted on the initiative of the Liberal Democrat Nick Clegg in 2011 to make it more difficult for his coalition partner the Tory David Cameron to bring down the fragile Tory-Lib Dem coalition government that was in power at that time. How much is the media talking about this factor? How much is it being mentioned by DiEM25? Doubtless it would be mentioned by Julian Assange but he is no longer a participant in public discussion. If disinformation and censorship is becoming universalized and control over it almost total, the question of right wing versus left wing politics becomes a secondary issue.

Not to be ignored but not given priority over accuracy and availability of correct information. This is a basic component of Julian Assange’s world view. On 8th September 2019 Labour members of the House of Commons sang “The Red Flag” as they supported the moves against Prime Minister Boris Johnson’s efforts to call an election. Is the symbolism of this enough to open minds?

Transcript for the video

Introduction:

The Brexit referendum took place on 23rd June 2016 to ask if the United Kingdom should remain a member of, or leave the European Union. Julian Assange, at that time being given political asylum in the Ecuadorian Embassy but also free from the restrictions later imposed by the successor Ecuadorian government of Lenin Moreno, was still able to receive visitors, organize meetings and use the internet. He held a marathon videorecorded discussion of Brexit with a variety of activists, journalists, public figures and supportive citizens. The referendum resulted in 51.89% of votes being in favour of leaving the EU. One of the people Assange interviewed was Yanis Varoufakis.

Julian Assange: This is Brexit club, live streaming at Brexitclub.eu throughout the evening as we count the Brexit vote from here inside the Ecuadorian Embassy in London. I’m Julian Assange. This embassy, some of you probably know, has been under a police siege for the last four years, incredibly. Here at the centre of the siege we have Yanis Varoufakis calling in from Rome. He is the immediately former Finance Minister of Greece, who famously negotiated with Schaeuble and the European Central Bank in relation to the Greek bailout. Naomi Colvin, the London director of the Courage Foundation. She represents a number of people who are being extradited from the UK. Craig Murray,former ambassador to Usbekistan. A Scot, so he’ll have some social perspective. He’s come down…. Where in Scotland, Craig?

Craig Murray: Edinburgh.

Julian Assange: To join us. And Srecko Horvat, a Croatian philosopher, who perhaps can give us an Eastern European perspective. He’s also involved in something that Yanis Varoufakis founded, which is the DiEM25 movement, which is the movement from the Left, essentially, to create ideas and structure a unity for a new and better Europe, not the Europe we have now, which I think most people concede has an enormous democratic deficit.

Yanis, your thoughts from Rome, where you are now. (He’s not from Rome. He’s Greek).

Yanis Varoufakis: Well you know we’re all pigs after all, you know. Portugal, Italy, Ireland, Greece, even Spain. We’re all the swine of Europe. Well, Julian, you say that from where I’m standing it seems that the “remain” may have a small lead. It’s not clear yet. As we know DiEM25, the Democracy in Europe movement that you were so kind as to refer to a moment ago – and which of course you have signed the Manifesto of.

Julian Assange: That’s right, which I have signed the Manifesto of I must confess and which I helped, with some words……

Yanis Varoufakis: Unlike you, as a movement, we have campaigned vigorously in favour of a radical “in” vote, not the kind of “in” votes or “remains” that Cameron has been campaigning for, which together with Hillary Clinton, Francois Hollande, Wolfgang Schaueble, Tony Blair, Jean-Claude Juncker, Barack Obama and all the other contributors to the loss of the European Union legitimately, technically and so on. We’ve been campaigning for a radical “in” and “against” the European Union approach, to struggle within the European Union institutions in order to usurp them, in a sense.

A standard dialectical position about how to enter a particular set of institutions and try to change them from within through confrontation, not just mere reform. One way or the other, my view – and I think it’s where we differ is that the British people have clearly given the ambivalence that they are displaying on the runup to the referendum and I’m sure that that ambivalence will be demonstrated today….

And we’re saying that the establishment, both in London and in Brussels, has spectacularly failed with Brexit. The British people are disenchanted. They’ve had a gutful of the policies that have come from Brussels, as well as the austerian authoritarianism from the British establishment, even those who are voting for Brexit, like Boris Johnson and the rest of the Tories. The only quarrel that they have with the practice is that they want to be able to rule over the British people without any impediments from Brussels. And it is clear to us in DiEM25 that if “remain” wins, even though we campaigned for “remain”, we are not in any mood for celebration.

We rejected the logic of the European Union, the creation of the Brexit. But we also reject the logic of “business as usual”, which is the establishment view in Brussels and in London. And as of today, whatever the result might be we are going to promote, continue promoting a radical agenda for confronting the Establishment in London and Brussels and Paris everywhere and to put in practice the ideas that can be linked to. . Bring together European democrats in a fight to democratize Europe. And therefore we see 24th June as the beginning of a very long campaign. We certainly don’t see it as the beginning of “business as usual” or the end of some process.

Julian Assange: Do you think there are opportunities, Yanis, in the case of a “remain” result, of course, you know the Junckers of this world, the Camerons, respectively I suppose, European federalists and Transatlanticists will be celebrating, trying to suggest that it was a landslide, for example. I think that is highly unlikely. It seems like it is going to be a very close vote, whichever way it is. Do you think that there is an opportunity to take hold. Is there an opportunity at all if there is a “remain” outcome?

Yanis Varoufakis: Oh there is always an opportunity and we are going to make sure there is one. We will carve one out of the Establishment’s hopes for “business as usual”. We’re not going to allow them to celebrate. We’re going to make sure that the scare that they got from this referendum, and they did get a major scare, is going to be magnified. And we are going to try to utilize that fear that the popular will has instilled into their souls by coalescing around a democratic campaign from Ireland to Greece, from the Baltics all the way to Portugal. We’re not going to allow them to even imagine that they can continue doing what they have been doing all those years.

And in any case the European crisis, including immigration, even though it has a gigantic human cost in terms of actual lives that are being diminished as a result of this crisis, nevertheless this crisis is going to make sure that they cannot be allowed to celebrate. They know that they are clueless. They have no idea as to stabilize this undemocratic, antidemocratic, European Union, and it is the peoples of Europe that have an opportunity to seize upon the democratic process that culminates in this referendum in order to create the space we need for an integrating democracy in Europe and for making sure that they have sleepless night after sleepless night.

Julian Assange: Tomorrow, Yanis, when the result is known and I guess the work must start, tomorrow, across the weekend, on Monday, if it’s a leave, what is the call by DiEM to heed the lessons of a Leave vote?

Yanis Varoufakis: I’d like to speak personally for a moment and then on behalf of DiEM. I can do that too but I think it is more honest and straightforward to speak personally. I happen to be a politician who last year was crushed by Brussels, crushed by Berlin, crushed by Frankfurt, where the European Central Bank is domiciled. and vilified by the scandal press, throughout Europe, in Greece, the world over. And yet in this campaign I campaigned for remaining in the EU.

Not because of any love lost between me and the European Union but because of the particular judgements that we need an internationalist agenda, we need a narrative of binding people together, within the European Union against the European Union. I believe in being honest to people like Wolfgang Schaeuble, Jean-Claude Juncker, my own comrades who remain now in the European Union completely surrendered to its ways and means and the idea that there is no alternative logic, and I say to them: We radicals who opposed Brussels argue for Remain.

We went, I went, personally, to Birmingham, to Ireland, to Wales, to Ireland, to London, to Scotland, and campaigning for the British people to stay in. And the British people turned it down. And they turned it down not because they didn’t want to listen to me. They turned it down because you, the Establishment of the European Union has made such a deep mess of the European Union that it was impossible to convince them to continue to accept you as the established order of Europe. So we tried to save the European Union from you, and you who are supposed to be the custodians of the European Union have failed so badly.

Julian Assange: I mean, to my mind, if there is a successful Leave vote, and I mean we have some vote counts here, but they’re very early. 146,000 England-wide Leave votes 136,000 Remain votes. I don’t think you can say very much on that. Actually, here we have some slightly updated but still very early. Remain on 49.5%. Brexit on 50.5%. The vote counts are only 150,000 so it doesn’t really mean anything statistically. But, what was I saying? So yes, if there is a Leave or even if the vote is very close, which it surely is, it is something that calls into question the political legitimacy of the European Union in the way it has been conducted so far.

And really it’s quite incredible that it came to this. That the European Union as a political structure was so unadaptable to the political calls upon it that it was not able to hand out the appropriate concessions to show that it had political legitimacy by doing what people wanted.

And regardless of what that structure is, any structure which manages a nation state or collection of nation states has to be able to keep political legitimacy. So I think that there is a very strong argument that the structure is a failure. Regardless of what side of politics you are on. A structure that cannot dynamically adapt to the political expediencies around it to regain political legitimacy when it is eroding is a failed structure.

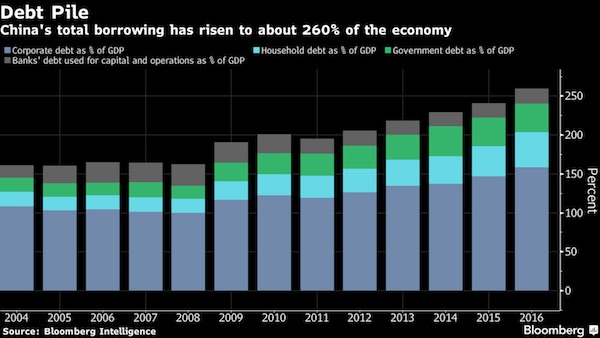

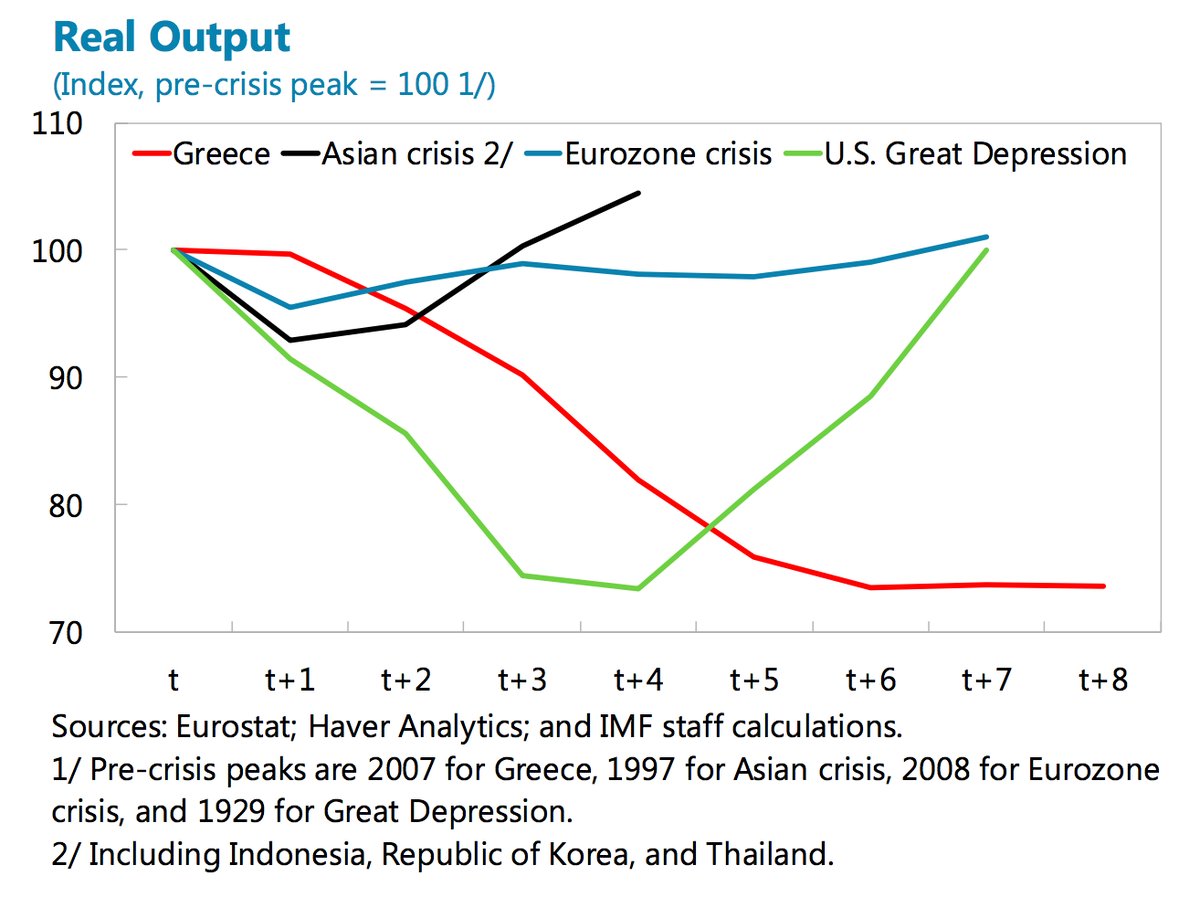

Yanis Varoufakis: It is very much so. Indeed I dedicated a whole book recently on precisely that. And I’ve described the European Union as a postwar cartel of heavy industry which was pretty adept at creating consensus around it throughout Europe. Think of the period of growth when it was distributing monopoly profits throughout Europe and in a way which was very unequal but nevertheless it created alliances between different social groups for instance there was a Greek monopoly that gave the profits to farmers through the Common Agricultural Policy.

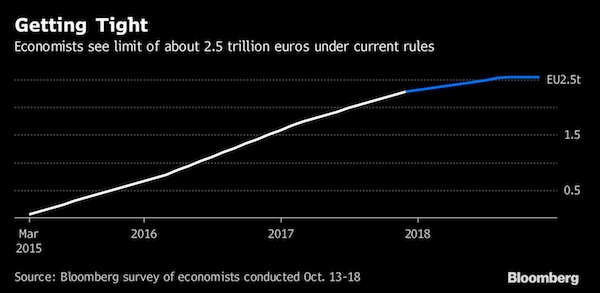

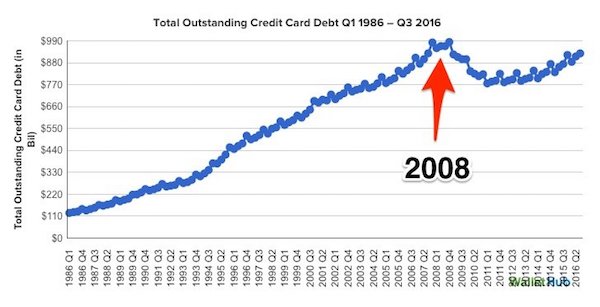

Cartels that could be good at distributing the goodies during the good times but they are pretty appalling and inefficient when it comes to distributing burdens in periods of crisis and particularly when it comes to arresting the crisis through macroeconomic adjustment policies which recycle surpluses and deficits in a way that is macroeconomically sustainable. And Europe has really failed in this task especially since 2008. And you don’t have to wait for today’s result, or tonight’s result to be given. Just look at the Eurobarometers. The Eurobarometer is an official European Union opinion poll which is controlling over time. …..

Julian Assange: And what is it? It’s a port for the EU.

Yanis Varoufakis: The vast majority of Europeans declared that they have confidence in the institutions of the European Union. Percentages above 65-70%. In some countries more than 80%. If you look at the same data today on the same questions. “Do you trust the institutions of the European Union?” in most countries you get below 50%. In some countries you get below 35%. So there is no doubt about it.

NOTE: the video continues after the conversation with Varoufakis, and I didn’t want to cut it off.