What Ben Bernanke Is Really Saying

Home › Forums › The Automatic Earth Forum › What Ben Bernanke Is Really Saying

- This topic is empty.

-

AuthorPosts

-

July 22, 2013 at 10:24 am #8369

Raúl Ilargi Meijer

KeymasterEver wonder what Bernanke is saying? Well, it boils down to this: at the same time that Jimmy Carter says the US doesn't have a functioning democr

[See the full post at: What Ben Bernanke Is Really Saying]July 22, 2013 at 7:23 pm #7993Ken Barrows

ParticipantThat’s going out on a limb saying that the end of QE leads to disaster. I think big banks realize that the Fed may pull the plug when it feels right. They also realize, though, the QE can come back if needed. The backstop is there, always. It’s only not there if inflation rears its ugly head. And that’s not happening. Now if the price of oil gets out of hand, then things will get interesting.

QE is a huge redistribution program, but I don’t think it’s really siphoning funds from the 99%. It’s overpaying for the collateral and giving the 1% a greater proportion of claims to wealth, which neither the Fed nor most of us creates.

July 23, 2013 at 12:00 am #7994p01

ParticipantWhat Bernanke is really saying 😆 :

July 23, 2013 at 1:15 am #7995Professorlocknload

ParticipantIlargi, excellent run down on the mess our great men have made. Thanks!

Seems Central Planners profess to know more than all the markets and market players.

First there was TARP. QE is the second phase. 200,000 tons of $100 notes, in 3 wire bales, falling from the sky, accompanied by a $25,000 tax rebate, is the last. (Or something as absurd…new currency, devaluing the old at 2 to 1?)

Humm, and I remember when I was called “off Balance” for suggesting the Fed would buy MBS trash?

In between, expect manipulation of public perception, extraordinaire. At all costs, these Machiavellian Princes must keep natural Human Action at bay.

First of all, the very numbers the “authorities” are using as targets are phony. Mandating 2.5 % “inflation” (CPI?) using an index that is concocted and tweaked in house, is nuts.

Not to mention the maniacal suggestion that inflation (devaluation of the currency) is what the economy “needs.”

Then, targeting unemployment, in an environment where there is rapid decline in workforce participation, coupled with underemployment, is deceitful at best. Hell, just instruct Social Security to issue Disability grants to all who are not working, and unemployment falls like a rock.

Imagine using GDP as a target, then simply start a war and voila, target bulls eye. Forget the Broken Window Fallacy, it’s the missile and tank production used to achieve such goals that count. Besides, all the broken windows will be “theirs” “over there.”

Goal Seekers, all!

Maybe they should take over engineering the outcome of each game in the NFL, if they’re really that good at micro-management 😛

July 23, 2013 at 1:28 am #7996toktomi

ParticipantI just had the same thoughts a day or so ago, what Bernanke is really saying.

I had about the same title but slightly different words to go with it.

What I hear Bernanke saying is this:

We don’t know what we are going to do in the near term regarding QE and, perhaps, to a lesser degree interest rates. There are a number of critical processes that are maturing and nearing completion. The exact schedules of these processes are impossible to predict at this point. If these projects do not progress as expeditiously as intended, then tapering will not be implemented as quickly as was intimated.

If, however, as very likely may be the case, certain projects are completed without additional delays, tapering will begin as previously described. It is expected that the markets will respond in a more orderly manner having been previously introduced to the the possibility. It would be disastrous to begin tapering QE without it having been previously introduced.

In other words, maybe the Fed will begin tapering and maybe it won’t. It depends of a number of very big factors. You’ve been notified.

As an aside, from my point of view, anyone that believes that the Fed is inept and has not been doing a Herculean job of maintaining the growthless, dying global economy by administering extraordinary financial life support has not been paying attention. What Ben is saying now is that the Fed may begin the withdrawal of that life support as early as “late this year”.

Well, there’s my WAG.

July 23, 2013 at 1:48 am #7997p01

ParticipantThis is what Bernanke is REALLY saying 😆

July 23, 2013 at 6:55 am #7998rapier

ParticipantIn 07 as some Mortgage Backed Securities started to blow up I imagined that every night Bernake would go home and curl up in a fetal position. I am sure he didn’t of course. Fully confidence in the Feds ability to instill confidence with liquidity, from which all good things economic growth wise would follow. Some are now suggesting he has lost faith but I am not so sure.

We can be sure his replacement will have the faith, otherwise they won’t take the job. Those possessing the requisite faith for the most part have to be considered dumb. The rest, Larry Summers, are so full of ego and hubris nothing will alter their faith.

July 23, 2013 at 9:49 am #7999toktomi

Participantp01 post=7730 wrote: This is what Bernanke is REALLY saying 😆

https://youtu.be/R-tgpzixe3M?t=56m6sWell, ya, that is the subject matter, I reckon, but the message is slightly different in that this time it will be an orchestrated event with lifeboats for the very privileged few, eh?

July 23, 2013 at 9:51 am #8000toktomi

Participantrapier post=7731 wrote:

We can be sure his replacement will have the faith,I am having difficulty in seeing that far down the road.

July 23, 2013 at 12:10 pm #8001davefairtex

ParticipantI’m in relatively complete agreement with everything Ilargi is saying. Bernanke would be happy to help main street if he could – but he works for the banks, and so that is who gets the love.

For a good chunk of the move up it has been about improving earnings driving equity market prices higher. However at this moment, with companies disappointing on earnings and top-line sales numbers dropping, it seems clear that QE and the promise of more to come is responsible for continued upward movement, and as Ilargi suggests sucking volatility out along the way. The VIX (the “volatility index”) is currently down around 12, values common during the period 2004-2006.

John Hussman thinks this equity market behavior is primarily a faith-based self fulfilling prophecy trade; his thesis being, people think QE causes stock prices to rise, therefore, they rise because people buy because QE is happening. Converse is also true; the absence of QE or these days, even TALK about QE slowing down is enough to cause the market to drop.

The day will come when the promise of the current level of QE is no longer able to encourage the faithful to bid up equity prices. Once this occurs, it is likely that the jig will be up, and we will see a brisk correction no matter what Bernanke says. I have no idea what will trigger this; perhaps its a economic shock that happens in spite of Fed bond buying, due to currency market moves or interest rate moves, etc. Perhaps the end of the current housing mini-bubble. There are lots of candidates.

As for when this happens, who can say? We can only watch market prices and let them tell us. Hussman also suggests that during conditions like this, which he calls overvalued, overbought and overbullish, topping can be a long multi-month process with each rally back up to the peak increasing the complacency for the longs (and frustration for the shorts).

John’s article here

July 23, 2013 at 1:28 pm #8003TonyPrep

ParticipantSorry about the off-topic but, from the podcast, I see that Nicole has finally gotten away from New Zealand. I’ve been waiting for her last talk in Auckland (just up the road) TBA but I see that won’t happen now. 🙂 Could you delete the details about the A/NZ tour? Thanks.

July 23, 2013 at 2:13 pm #8004TonyPrep

ParticipantNicole said, in the podcast, that oil prices are going to crash. Really? Natural gas prices crashed in the US, because of shale gas hype but I don’t think they crashed around the world. Oil is much more transportable than natural gas and there is a much narrower band for the price of similar grade oil around the world than there is for natural gas. We’ve had shale oil hype for long enough now, and with a real rise in US output, that we can see the effect it will have on oil prices. It may be that oil prices would have been higher without all the hype but I very much doubt a crash in prices now, purely because of shale oil hype.

July 23, 2013 at 5:34 pm #8005Golden Oxen

ParticipantIt would seem Ilargi that you have acknowledged the effect of QE on creating a stock market orgy and finally concede that it might continue for a while longer. May I suggest that much of the rally in Gold was related to such endeavors as well, and we shall witness another bull run in the precious yellow as a result of the recent blabberings from the Princeton scholar. Just a guess of course; reality could always appear at any moment.

By the way, any ideas on what buffoonery we might hear from a Janet Yellen, or Summers?

Sorry I even mentioned it, have to run out and acquire more Gold and silver at just the mention of those two.July 23, 2013 at 6:54 pm #8007FrankRichards

ParticipantI agree. I admit to being wrong. What I thought was a 2 year horizon from the fall of ’07 is now at 6 and counting.

I am still extremely concerned, and this fall looks to be another minefield for the financial system. However, my best guess is now for a slow motion trainwreck kind of collapse, kind of like the Roman Empire except in decades rather than centuries. This calls for a significantly different set of preps for my declining years.

TAE started out looking at a 2 to 5 year, 7 at the very most, denoument. And it hasn’t happened.

I strongly suggest that I&S would do themselves as well as their readers a great favor by sitting down, looking at what did and didn’t happen, and coming up with a revised guess at the next decade or so.

July 23, 2013 at 7:18 pm #8008ted

ParticipantI too thought the crash would be sooner somewhere in 2012 but I was wrong as well…still I am amazed if we will get through 13′ without any crash…Natural gas is climbing up oil is climbing up both lead to inflation…Also why is the dollar not any stronger against other currencies like the Euro, if it is the last horse in the glue factory….

July 23, 2013 at 7:24 pm #8009Raúl Ilargi Meijer

KeymasterWe have long since conceded that we underestimated the extent to which people would take abuse lying down, so why should we address that yet another time? I think we have made clear enough we’re not here to help people make money, but to prevent them from losing even more.

As for advice for the next decade – and beyond -, it hasn’t changed. The only sensible thing to do still is to try to get out of the way of the storm, and certainly not to think that you can now feel safe to play the game a bit longer.

What’s positive about the prolonged Wile E. moment (and it isn’t anything else) is that it allows a few more people a bit more time to get out of the way with grace. I say a few more people because the majority will not listen no matter what we say.

If you understand to what extent Bernanke et al. are driving your children into debt, how can you not do all you can to make sure they will be able to take care of themselves, that they will have access to basic necessities? You’re not going to do that with gold or silver or stocks, it’s going to take a whole different sort of investment.

July 23, 2013 at 8:50 pm #8010p01

ParticipantThe only ones taking abuse were those who did not take on any debt during this period. The rest, at least did have some fun. The fact that we artificially stayed at the top for this long all but guarantees that even those who did not take on any debt will not have a chance because the crash will be much too profound. Personally I’m not blaming anyone else, because I had the same frame of mind, but now I don’t see any good coming out of it, even for those without debt and with some cash/treasuries/gold/whatever stashed away from the system.

The road ahead starts looking like “The Road”, or like those guys from Easter Island cutting the last tree, because, well, it did not matter anymore.

Oh, well…it was the only thing to try and hope for, but I’m afraid it won’t help anymore.July 23, 2013 at 10:01 pm #8011Variable81

Participant“The Road”

Well, here’s to hoping you’re wrong p01…

That’s about as depressing as it gets.July 23, 2013 at 11:04 pm #8012jal

ParticipantWe do not need to believe the central bankers. We can access and verify almost all information.

There have always been controllers and manipulators/scammers of the financial systems.

When was the last time you used carbon paper?

Computers and the web are the modern version of carbon paper for dissimilating information.

Here are some basic info., from wiki., that anyone can access.

https://en.wikipedia.org/wiki/Asymmetric_information

Information asymmetry deals with the study of decisions in transactions where one party has more or better information than the other. In contrast to neo-classical economics which assumes perfect information, this is about “What We Don’t Know”.[1] This creates an imbalance of power in transactions which can sometimes cause the transactions to go awry, a kind of market failure in the worst case. Examples of this problem are adverse selection,[2] moral hazard, and information monopoly.[3] Most commonly, information asymmetries are studied in the context of principal–agent problems. Information asymmetry causes misinforming and is essential in every communication process.

Several Nobel Prizes in Economics have been awarded for analyses of market failures due to asymmetric information.https://en.wikipedia.org/wiki/Credit_(finance)

Consumer debt can be defined as ‘money, goods or services provided to an individual in lieu of payment.’ Common forms of consumer credit include credit cards, store cards, motor (auto) finance, personal loans (installment loans), consumer lines of credit, retail loans (retail installment loans) and mortgages.

https://en.wikipedia.org/wiki/Money

A failed monetary policy can have significant detrimental effects on an economy and the society that depends on it. These include hyperinflation, stagflation, recession, high unemployment, shortages of imported goods, inability to export goods, and even total monetary collapse and the adoption of a much less efficient barter economy.

The control of the amount of money in the economy is known as monetary policy. Monetary policy is the process by which a government, central bank, or monetary authority manages the money supply to achieve specific goals. Usually the goal of monetary policy is to accommodate economic growth in an environment of stable prices.

In the US, the Federal Reserve is responsible for controlling the money supply, while in the Euro area the respective institution is the European Central Bank. Other central banks with significant impact on global finances are the Bank of Japan, People’s Bank of China and the Bank of England.

Governments and central banks have taken both regulatory and free market approaches to monetary policy.

https://en.wikipedia.org/wiki/Federal_Reserve_System#Central_banking_in_the_United_States

When the shit hit the fan … the rules and guide lines were the first to go.

So here we are today. The system is still operating.

The road ahead starts looking like “The Road”, or like those guys from Easter Island cutting the last tree, because, well, it did not matter anymore. Oh, well…it was the only thing to try and hope for, but I’m afraid it won’t help anymore.

Here hope for you.

Find social structures that are operating without using the banking system.

(cough, cough … the poor in every country)July 23, 2013 at 11:26 pm #8013ted

ParticipantI don’t think Ben is doing this on purpose…I think he really does believe he is helping the system…his son has a huge college debt to repay and he does have family. To think all his actions a of a dubious nature gives him more credit and dis credit for that matter. If he really knew what he was doing I think he would have stopped a long time ago…but then again what choice did he have..? He thought he was saving the system not realizing that the system is morphing into something else..

July 24, 2013 at 12:10 am #8014backwardsevolution

MemberKen Barrows – “QE is a huge redistribution program, but I don’t think it’s really siphoning funds from the 99%.”

Did you even read the article? As Ilargi said, if interest rates were allowed to “float,” we’d have a whole different ball game, wouldn’t we? Bernanke IS siphoning funds from all those who have savings. That is a fact.

And how about the money the banks end up getting in the “fair” (ha!) trade for their MBS? It’s not all sitting in reserves. It’s being used to juice up the stock market, allowing all of the elite to get their money out at high prices.

The banks (Morgan Stanley, Goldman, J.P. Morgan) are also hoarding commodities (aluminum, copper) in huge warehouses, driving up prices and, yes, that is siphoning funds from the 99%. (And they’re doing the same thing with oil).

Bernanke has put a bottom under house prices (got to keep those assets up). The insolvent banks (which should have gone tits up) were able to, with the help of FASB, hold inventory off the market, skewing supply and demand.

So if it’s “going out on a limb saying that the end of QE leads to disaster,” how about we give it a try. What do you think they know that you don’t?

July 24, 2013 at 12:24 am #8015backwardsevolution

MemberTed – “If he really knew what he was doing I think he would have stopped a long time ago…but then again what choice did he have..? He thought he was saving the system not realizing that the system is morphing into something else.”

You assume he doesn’t know what he’s doing, using words such as “he thought”, “not realizing”. But what if he DOES know what he’s doing? What if this has all been done on purpose? Can you wrap your mind around that?

He works for the banks, Ted. If some of us happen to benefit from his policies, purely as a side effect, that’s all good with him, but that’s not his primary goal.

This is why he’s able to continue – because too many people give him the benefit of the doubt. And they’ll continue to do this until it’s too late.

July 24, 2013 at 2:09 am #8017Anonymous

InactiveI’ve followed TAE for a while now, but first post:

From the standpoint of almost total ignorance, I’m having trouble interpreting exactly what we’re being told by the Velocity of M2 / Monetary Base graph, although it looks very dramatic. The L.H vertical axis is marked ‘Ratio’ (range 1.5 – 2.2). Ratio of what to what?

I read that GDP = Money supply x Velocity, so can it be that ‘velocity’ of a particular category of money supply is estimated by measuring the ratio of GDP to the total amount in circulation? If so, I imagine that the rapid fall in the ‘Ratio’ trace towards the end has more to do with the rapidly expanding money supply number than a fall in GDP. But then I read that, out of the 3.5-fold increase in the monetary base from $800+ billion to $3 trillion in the last 5 years, only about 14% of that additional amount found its way into circulation, the rest presumably staying hidden away in deposits.

So is the ‘money supply’ figure used in these calculations based on the raw number (i.e. currently $3T), or is the relatively small ‘M2 in circulation’ number used? Any guidance on the subject gratefully received.

July 24, 2013 at 4:18 am #8018Ken Barrows

Participantbackwardsevolution,

I think we’re talking about the same thing here. I guess I differed with “siphoning off” because I think what the Fed does is a little different from government spending favoring certain groups. Deficit spending doesn’t create something from nothing: you got to sell the bonds to raise the cash. The Fed does create something from nothing.

But you’re right, it is not very different in the end. That’s why I mentioned QE as a “redistribution program,” as much money on the War on Poverty or for defense contractors. Indeed, we’ll eventually see what happens when QE ends. I suspect, though, that it is a “permanent” policy tool until society collapses.

July 24, 2013 at 9:26 am #8019ted

ParticipantBackwards evolution……did you read the article? It is already too late…the train has left the station…the question is not if the crash will occur it is when. But I don’t subscribe to the theory that the “government is out to get us all” ….I think you give them too much credit….they are not the brightest of the brightest out there, otherwise they would not want to be the captain of a sinking ship…people believe what they want to believe and they don’t want to hear that there is a huge problem coming….

July 24, 2013 at 12:03 pm #8020Raúl Ilargi Meijer

KeymasterOldE,

The money supply is not rapidly expanding (M1, or narrow money, is plunging, M2 rises somewhat). The monetary base is. They’re not the same. A useful table to tell M1 from M2, MZM etc. is available here at Wikipedia.

As I wrote in QE, The Velocity of Money And Dislocated Gold (see graphs there):

“The monetary base is the sum of currency circulating in the public and commercial banks’ reserves with the central bank. The money supply – money stock -, on the other hand, is the sum of currency circulating in the public and non-bank deposits with commercial banks”

In other words, the monetary base includes a lot of “money” that doesn’t count towards money supply, since it is not available for circulation.

The ratio used for the velocity of money is, simplefied, GDP/money supply. This is very crude, though, I would specifically include aggregrate transactions, for something like this:

V = ( P * Q ) / M

V = money velocity,

P = aggregate price level,

Q = aggregate quantity of goods and services,

M = money supplyOr you can say:

M * V = P * Q;

Note: P * Q equals nominal GDP.

That makes it much clearer that the aggregate quantity of goods and services (Q) is a determining factor.

July 24, 2013 at 3:51 pm #8021Raúl Ilargi Meijer

KeymasterDeclining velocity of money in action:

Richmond Fed Index Shows Mammoth Fall In Retail Sales

Retail sales contracted this month, leaving the index at −22, twenty-three points below last month’s reading. Sales of big-ticket items declined slightly, while shopper traffic dwindled. The index for big-ticket sales slipped to −5, a point lower than the June reading, while the index for shopper traffic tumbled twenty-two points to −16. Inventories declined more slowly than last month, with that index settling at −12 compared to −22. Retailers were doubtful about sales in the next six months; the expectations index dropped to −29 from June’s reading of 11.

July 24, 2013 at 4:07 pm #8022Anonymous

InactiveIlargi,

Thanks for your prompt response.

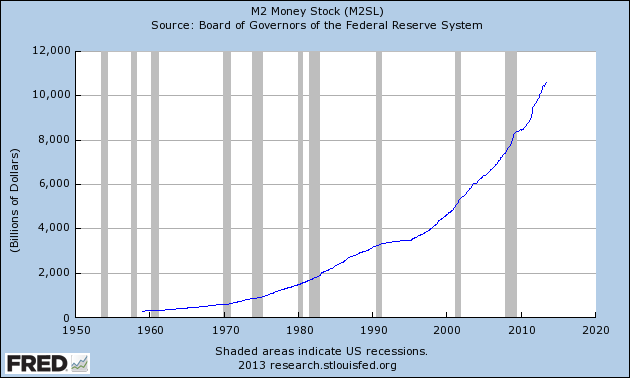

It sounds from what you say that the numerator and denominator used for the calculation of the M2V curve in the graph may not be as simple as nominal GDP and M2 values. But, as US GDP has increased by about 80% since the M2V peak around 1997/8, I take that to mean that some measure of M2 has increased by about 150% in the same period, much of that post-2008.

It will be interesting to see where the curve goes from here!

July 24, 2013 at 5:07 pm #8024SteveB

Participant“By aggregating the entire shaded orange area, SAVERS have missed out on a whopping 10.8 Trillion in earned interest usage.”

That’s not necessarily a bad thing, and is probably a good thing considering the environmental impacts of consumption. The “missed out” framing is specious when viewed in that context.

So (before we further distracted) what’s the real concern?

July 24, 2013 at 5:33 pm #8026Raúl Ilargi Meijer

KeymasterMaybe a bit more than 150%:

July 25, 2013 at 4:10 pm #8029

July 25, 2013 at 4:10 pm #8029Nassim

ParticipantOldEngineer,

I like to think of it as being a bit like the lake behind a dam. When this water does not go downhill through the turbines, it counts for little. The power released when it goes downhill is proportional to the volume per second multiplied by the height it drops.

Right now, the bankers are making sure that little of it goes through the turbines. One day, the water might find a path through the dam wall – and only then will we have hyperinflation.

July 25, 2013 at 10:44 pm #8032Professorlocknload

ParticipantWhat the Fed is really [strike]saying[/strike] doing.

At a controlled burn for now, until the wind comes up…https://www.zerohedge.com/news/2013-07-25/whats-inflation

Don’t need calculus to figure out less groceries go in the basket and less fuel in the tank on a c-note these days.

Political math wonkery and economist bafflry aside, all J6P understands is ever rising costs, but he is locked down by phony .gov CPI illusions (read manipulations), unless he is in gumnut or a protected sector of it.

Could be, a combo package of devaluation and jubilee are in the works. For sure, the former goes without saying. The latter will be a bone thrown for political purposes. Atlas (the conventional saver) is just odd man out.

Seems the catbird seat here might be leveraged to the max or all-in invisible assets, or both. Maybe equally, to make the “hypothetical” balance sheet read zero?

As the .gov’s of the world crack down on rational behavior, it’s going to get interesting.

August 1, 2013 at 2:07 am #8063Gravity

ParticipantSoylent green shoots are still made from people.

-

AuthorPosts

- You must be logged in to reply to this topic.

Sorry, the comment form is closed at this time.