Marion Post Wolcott “Center of town. Woodstock, Vermont. Snowy night” 1940

The fixed game.

• Why A 0.25% Rate Hike Should Have Big Banks Nervous But Probably Won’t (Bern)

Current excess reserves at the Fed earn interest – The big banks hold a lot of excess reserves at the Federal Reserve [Fed]. The current interest rate paid by the Fed on both required and excess reserves is 0.25%, or 25 basis points. The rate is subject to change by the Fed Board. No surprise that this policy was set forth in the Federal Reserve Regulatory Relief Act of 2006 which was scheduled to go into effect October 1, 2011. Also, no surprise was the advanced effective date of October 1, 2008 when relief for banks was imperative.

The current profit stream that banks count on – According to the St. Louis Fed, depository institutions (banks) held over $2.5 trillion in excess reserves at the Fed in November. At a mere 25 basis points in interest that $2.5 trillion in excess reserves earns big banks about $6.25 billion a year in risk-free revenue. All of that amount may not go directly to the bottom line, though. How much depends upon what interest rate the Fed charges banks to borrow those funds (the fed funds rate). The effective fed funds rate has ranged between 7 basis points and 16 basis points over most of the last five years. The average borrowing rate of big banks since January 1, 2015 has been 12.27 basis points, or 0.1227%.

The banks have earned about $5.73 billion so far in 2015 on excess reserves. The cost to borrow those reserves has been approximately $3.07 billion. The net income earned from those borrowed reserves is $2.66 billion in 2015 thus far. That works out to an average of $725 million per quarter in extra earnings just for borrowing the money and leaving it parked at the Fed. Now, this may not seem like much to you, but I would not mind getting in on that action.

What happens when the fed funds rate rises by 25 basis points? – Let’s be honest about the rate hike, okay? The current fed funds rate is officially set at between zero and 25 basis points. So, if the Fed raises the official fed funds rate to 25 basis point, if that is the actual outcome, then it really will not be raising the rate by a full 25 basis points. The increase will be something more like about 13 basis points over the actual rate since the beginning of the year. Now, if the Fed raises the official rate to between 25 basis points and 50 basis points, then the difference could be closer to 25 basis points. But, it still depends on where within that range the actual fed funds rate lands. If it lands closer to the minimum of the range then the increase is more like 13 to 15 basis points. If it lands in the middle, then we have an actual increase in rates of about 25 basis points as advertised.

I do not really expect the actual rate to rise much, if any, above the 25 basis points threshold. So, my expectation is for a real rate increase of about 15 basis points. But that would mean that the earnings by the big banks could fall to zero. Somehow I do not expect the big banks to take this lying down. I could be wrong, but I also expect another, less publicized change in rate policy by the Fed. If the fed funds rate increases to 25 basis points or more, then the “profits” earned by banks on excess reserves will evaporate into thin air and potentially turn into an expense. Unless…

If the Fed decides to raise the fed funds rate by 25 basis points to the range between 25 and 50 basis points the banks would either decide to reduce reserves (to avoid paying the Fed interest on borrowed funds) or the Fed would need to change the rate paid to depository institutions upward to 50 basis points. Banks would need to put that money to work at a higher level of risk or just pay off the loans from the Fed used to fund reserves. Most likely some of the excess reserves would be withdrawn and banks would attempt to make up the lost earnings by adding more risk to balance sheets. More risk in the financial system is not something we need right now. I do not think the banks really want to take on more risk at the moment either. And since the banks own the Fed, guess which route I expect the Fed to take?

Psychology.

• “Coppock Guide” Signals A Bear Market Is At Hand (ZH)

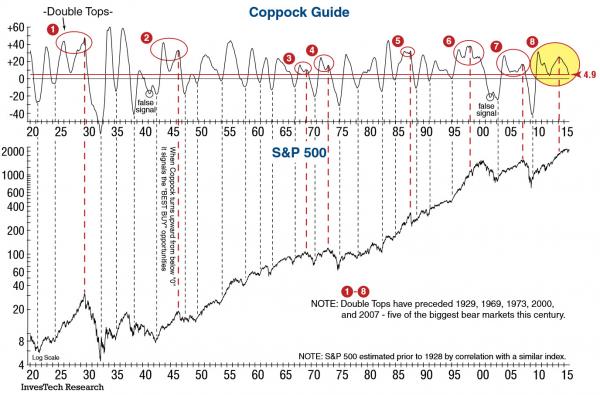

With Emerging Market currencies, bonds, and stocks collapsing, US corporate debt crashing, and carry trades unwinding everywhere (ahead of the $800 billion liquidity withdrawal that looms from next week’s 25bps hike from The Fed), it is no surprise that US equities are beginning to shudder (even the FANGs are not immune). But, as InvesTech Research notes, among its 6 compelling reasons to be cautious in 2016, the so-called Coppock Guide may be close to confirming that a bear market is at hand…:

In March 2015, the Coppock Guide was signaling that both primary and secondary momentum had peaked and this continues to be the case today. The Coppock Guide is a valuable tool to gauge the emotional state of a market index as it transitions from one psychological extreme to another. It was developed more than 50 years ago by Edwin S. Coppock and it measures momentum by taking a 10-month weighted moving total of a 14-month rate of change plus a 11-month rate of change of a market index. The Coppock Guide is typically most useful at market bottoms, when market indexes reverse sharply as psychology shifts. It signals a “Best Buy” opportunity when the index turns upward from below “0” (see black dashed lines). The last such buy signal came within 60 days after the March 2009 market bottom.

Early in a bull market, momentum runs high and often peaks early. For this reason, the Coppock Guide isn’t as effective in identifying market tops. In fact, the initial peak in the Coppock Guide was seen during the first 18 months of this lengthy bull market, with a secondary peak in March 2014. When a double-top occurs in an extended bull market without the Coppock falling below “0”, it signals that psychological excess could be at an extreme. And when that momentum finally peaks (see red dashed lines), it usually means a bear market isn’t far behind. This phenomenon was first observed by a market technician named Don Hahn in the late 1960s. Since 1929, there have been only eight instances of a double-top, and each one was followed by bear market losses of 30% or more.

It’ll be an interesting week.

• Junk-Bond Rout Deepens, Sends Shockwaves Through Stocks, Other Markets (WSJ)

U.S. junk bonds posted their steepest decline since 2011, intensifying fears that a six-year bull market in stocks and other risky assets is nearing an end. The largest high-yield exchange-traded fund, the $15 billion iShares iBoxx $ High Yield Corporate Bond ETF, dropped 2%, to close at $79.52, its lowest since July 2009. Friday’s trading volume of 53 million shares doubled a record set Tuesday. The retreat punctuated a day of heavy selling across markets, with the Dow Jones Industrial Average tumbling 310 points and U.S.-traded crude dropping 3.1%, to $35.62 a barrel. Oil’s 11% decline was its biggest weekly fall since March. Traders said much of Friday’s decline was triggered by the abrupt closure of a high-profile junk-bond mutual fund.

Investors in the Third Avenue Focused Credit Fund learned this week that they won’t get all their cash back for months or more, as Third Avenue liquidates the $789 million fund. The action crystallized long-standing fears about the vulnerability of the stock and bond markets to a broad shift in sentiment. The spreads between U.S. junk bonds and Treasury securities have widened sharply over the past week, underscoring investors’ sense that the risk of default by companies with high levels of debt is on the rise. The Federal Reserve is expected next week to raise interest rates for the first time since 2006, a development that traders said wasn’t a large part of Friday’s selloff but that has increased general market anxiety.

Some hedge funds are taking similar steps as Third Avenue. Hedge-fund firm Stone Lion Capital, a distressed-debt specialist, said it suspended redemptions in its credit hedge funds after many investors asked for their money back. Investors said it was a rare move in the hedge-fund industry since the financial crisis. This fall, Carlyle Group’s struggling Claren Road took a similar action. Some investors said that while they are concerned that falling commodity and junk-bond prices could point to economic turmoil ahead, U.S. consumer and jobs data have been mostly comforting. But even these investors said they are looking for ways to reconcile conflicting signs.

Never a ‘run’. Until now?!

• Junk-Bond Fund’s Demise Highlights SEC Mutual-Fund Worries (WSJ)

The demise of a Third Avenue junk-bond fund last week underscores financial regulators’ concerns about risks in mutual funds and highlights Washington’s urgency in trying to address those worries. Recently proposed rules are aimed at addressing the problems for investors exposed by the high-risk mutual fund’s struggles, but those regulations are unlikely to take effect until 2017 at the earliest. The Securities and Exchange Commission earlier this fall proposed new rules aimed at preventing the very types of problems that caused Third Avenue’s fund to essentially declare bankruptcy and bar investor withdrawals while it liquidates its high-yield Focused Credit Fund.

Those problems boiled down to the junk fund’s inability to raise sufficient cash to meet a sudden flood of investor redemptions without resorting to fire sales of its assets. The concern from regulators is that mutual funds and other asset managers fail to adequately foresee economic shocks, such as rising interest rates, which cause a fund to drop in value and prompt investors to bolt for the door. Widespread redemptions, in theory, could strain a fund’s ability to convert quickly assets into cash for redeeming shareholders, particularly during a crisis. “Nothing is more fundamental and important…than redeemability,” said SEC Commissioner Kara Stein in September. Ms. Stein’s remarks came as the SEC proposed, for the first time, to force fund managers to develop formal plans for their liquidity, or ability to easily buy and sell fund assets.

The measure also includes provisions aimed at dampening investor flight by allowing funds to charge fees to investors who bolt in periods of market stress. If those rules had been in place earlier, Third Avenue would have had to establish a “liquidity” plan and as part of it, set aside more assets that could be readily converted to cash. It may have faced charges for a poorly developed plan or for deviating from it. The fund industry has been quick to note that there hasn’t been a “run” on a long-term mutual fund in their 75 years of existence, through numerous interest-rate and market cycles. Large outflows from particular funds can occur, but never a “run” on the broader asset class.

“Exports climbed 22% to 102 million tons in the first 11 months [..]. That’s almost as much as Japan, the world’s second-biggest producer, made in the whole of last year..”

• China Steel Output Slumps to a One-Year Low as Prices Collapse (BBG)

Steelmakers in China reined in production last month as prices collapsed and the onset of winter in the largest producer curbed demand already hurt by a cooling economy. Crude steel output fell 1.6% to 63.32 million metric tons from a year earlier, according to data from the statistics bureau released Saturday. So far this year, production has dropped 2.2% to 738.38 million tons. China makes about half of the world’s steel. Demand in China is weakening as policy makers seek to steer Asia’s biggest economy away from investment-led growth to one driven by consumer demand and services. China’s steel sector contracted further last month, while an industry association said demand was shrinking at an unprecedented speed.

Determined to maintain output as growth cools, mills have flooded the world with exports, shipping more than 100 million tons this year. “The downtrend in steel output should continue as weak credit and demand conditions do not support expansion,” Huang Huiwen at Shanghai Cifco Futures said before the data was released. “Demand also goes into a seasonal lull, with some mills shutting for winter as construction slows.” As prices of some steel products slumped to records, mills in the country sought out overseas markets where their supplies may be sold at more competitive rates. Exports climbed 22% to 102 million tons in the first 11 months, according to customs data. That’s almost as much as Japan, the world’s second-biggest producer, made in the whole of last year, according to World Steel Association data.

One a week?!

• Chinese Billionaire Said to Be Assisting Authorities in an Investigation (WSJ)

Guo Guangchang became a billionaire by investing where China’s economy was going over the past two decades, pouring money into steel, property and finance while turning his gaze increasingly overseas. On Friday, Mr. Guo indicated authorities are holding him in connection with an investigation, a stark illustration of how Chinese business and finance is coming under intense scrutiny. After nearly two days of mystery over the whereabouts of the man who styles himself a Chinese Warren Buffett, a vague statement near midnight issued by his flagship investment conglomerate, Fosun International, said he is “assisting in certain investigations” by Chinese judicial authorities. The statement, which was signed by Mr. Guo, didn’t divulge his location, but said he is still able to participate in “major matters” before the company.

There was no indication of what the investigations were about or whether Mr. Guo could be implicated himself. Chinese investigators have broad powers to detain both suspects and potential witnesses even when they don’t face accusations of wrongdoing. A Chinese Foreign Ministry spokeswoman said Friday she had no information. Since a midyear stock-market crash exposed weaknesses in China’s financial system, authorities have detained senior stockbrokers, fund managers and bankers from a handful of the country’s top firms, saying little about the progress or findings of their investigations. About a dozen of the most senior people at the biggest brokerage, Citic Securities, have been held for questioning by authorities for months, and the firm says it is cooperating with investigations.

Jitters are particularly high in Shanghai, China’s largest city, where the biggest markets are based. In addition, the Communist Party’s antigraft agency put a vice mayor in Shanghai under official investigation last month, then named certain local brokerages, insurers, a private-equity firm and business schools as targets of its next inspections. With a proud mercantile tradition that has produced the largest regional economy in China, Shanghai has long celebrated business champions. And few stand taller than Mr. Guo, a 48-year-old with a steely focus on building asset values. A standard-bearer for private entrepreneurs, Mr. Guo’s personal fortune was estimated this year at $7.8 billion by Shanghai research firm Hurun Report, putting him at No. 17 on its list of China’s wealthiest people.

Perfect timing re: CON21.

• US Senators Close in on Oil-Export Deal Amid Tax-Break Talks (BBG)

Senate negotiators are nearing a deal to allow unfettered U.S. crude oil exports for the first time in 40 years, though differences remain on renewable-energy tax credits that Democrats are demanding in return, according to people close to the discussions. While any agreement could still collapse in the coming days – the deal faces opposition in the House – lawmakers are weighing the extension of solar and wind tax credits for as long as five years in exchange for lifting the crude-export restrictions, which were established to counter the energy shortages of the 1970s. Tax breaks are part of the discussion, though lawmakers are still negotiating the length of wind- and solar-energy tax extensions and whether they should be phased out, said a Senate Democratic leadership aide.

If agreed to and approved by Congress, repeal of the nation’s ban on most crude oil exports would mark the most significant shift in U.S. oil policy in more than a generation. Repeal, benefiting oil producers including ConocoPhillips, Hess Corp. and Continental Resources Inc., would come at a time when the industry is cutting jobs to deal with a global glut in crude oil and the lowest prices in seven years. Talks for a deal are under way as envoys from 195 nations reached an agreement to limit fossil-fuel pollution and curb the effects of climate change. Congress is considering lifting the export ban as part of either a package to extend expiring tax provisions or to finance the government through Sept. 30 before current funding authority expires Dec. 16.

Among the items being discussed are a 9% manufacturing tax credit for refiners and an extension of the U.S. Land Water Conservation Fund, according to at least three lobbyists close to the negotiations. Even if such a deal is struck by Republicans and Democrats in the Senate, House Democrats, who are vital to reaching an agreement, have suggested they won’t go along unless a provision for indexing the Child Tax Credit, which allows taxpayers to reduce federal income taxes for each qualifying child, is added to the mix. And it’s unclear whether House Republicans will support a deal if they assess that the price Democrats are seeking is too high.

The EU causes nationalism.

• EU Powerless to Stop Nationalist Ascendancy as Terror Fears Rise (BBG)

From Viktor Orban in the east to Marine Le Pen in the west, defiance of the European Union’s multilateral, multicultural, open-borders traditions is on the rise. But with issues like refugees and terrorism at the top of the agenda, there’s little the 28-nation EU can do about it. The popular clamor for security has strengthened the cult of the insular state that Orban champions in Hungary and Le Pen espouses in France. Europe’s multiple crises – first debt, then migration, now terrorism, all festering simultaneously – have put the established order on trial, from the former communist east to historically tolerant Sweden and EU-exit candidate Britain. The upshot is an existential threat that risks unpicking the union.

The collective blame lies with EU leaders for looking the other way, according to Sophie In ’t Veld, a Dutch member of the European Parliament, who says it is time to upgrade the bloc’s “very weak instruments” to enforce civil liberties and democratic due process. “People are beginning to lose faith in European integration,” In ’t Veld said in an interview on Thursday in Brussels. “We have all these wonderful values, and then it turns out that in practice they’re not being upheld.” The EU reached for literary heights to mark its eastern expansion on May 1, 2004, commissioning Nobel Prize-winning Irish poet Seamus Heaney to compose an ode to unity and inclusion: “On a day when newcomers appear, let it be a homecoming.”

That the newcomers didn’t feel at home became clear by 2010, when Orban returned as prime minister of Hungary and set out to build a more centralized state. Once a communist-era freedom fighter, Orban came to view democracy with its plurality of voices as a recipe for gridlock, for not getting things done. He championed the ideology of untrammeled majority rule – provided he had the majority – along with the rejection of multiculturalism in what he termed the “illiberal state.” Now Poland has elected a religiously tinged, anti-foreigner, anti-gay, family-values party, capturing the east’s discontent with the Europe it got after breaking free of Soviet domination. It has sought to pack Poland’s supreme court with party faithful, triggering a constitutional impasse.

Breakthroughs by anti-immigration parties across northwestern Europe – reaching an interim peak with the successes of Le Pen’s National Front in the first round of French regional primaries — showed that eastern Europe doesn’t have a patent on the more virulent strains of nationalism. The decisive runoff in France is on Sunday. The anti-European moment may pass, but for now, its originators are feeling vindicated. “The export of Western democracy has failed,” Orban said on Dec. 2, in remarks directed at the U.S. but applicable more broadly. “It’s time for realpolitik. The era based on the export of democracy and human rights is coming to an end.”

This election or the next one, she’ll get there. Thanks to the EU.

• French Vote for Regions as Main Parties Seek to Shut Out Le Pen (BBG)

French voters go to the polls Sunday to elect regional leaders in the last scheduled nationwide ballot before the next presidential contest in April 2017. President Francois Hollande, his predecessor Nicolas Sarkozy and the National Front’s Marine Le Pen are all jockeying for position in the race, which offers them the chance to establish regional bases and vaunt their credibility with an electorate battered by near-record unemployment and concerns over terrorism. Le Pen aims to build on the first-round result that showed her anti-euro, anti-immigrant party leading in the composite the national vote with prospects to win executive power in three of 13 regions for the first time. Sarkozy needs his party, The Republicans, to blunt her advance and show he has answers to France’s problems, while Hollande faces a judgment on his handling of the attacks that killed 130 in and around Paris one month ago.

“For many French voters, the stakes have changed,” said Jim Shields, a professor of politics at Aston University in Birmingham, England. “For years, elections have been fought on the question of who could best revitalize France’s ailing economy and bring down unemployment. Now, the paramount question is who can keep the French safe. That shift of priority plays to the advantage of the National Front.” Even so, as voters cast their ballots in the second-round runoff, Le Pen’s party is hobbled by its lack of allies from which it can draw fresh support. France’s two main parties are even working together in some districts to keep Le Pen out of power. Prime Minister Manuel Valls, a Socialist like Hollande, said on Friday that he was “convinced” his party’s supporters would engage in tactical voting to defeat Le Pen.

The latest polling suggests the National Front will fail to take either Nord-Pas de Calais-Picardie in the north or Provence-Alpes-Cote d’Azur in the south, both regions it looked set to take after the first round last Sunday. In the east, the party’s third target, the race is too close to call. Le Pen now looks to be losing her grip on the northern region that she is contesting personally. A BVA institute survey in Friday’s La Voix du Nord newspaper suggested she’ll lose out to the The Republic candidate, Xavier Bertrand, Sarkozy’s former labor minister. Marion Marechal Le Pen, the National Front leader’s niece, is also looking doubtful in the southern region.

They can’t frustrate their own laws forever.

• Julian Assange May Face Swedish Interrogation Within Days (Guardian)

The WikiLeaks founder, Julian Assange, may be questioned in London within days about alleged sexual offences after Ecuador indicated it had reached a bilateral deal with Sweden. Assange has been wanted for questioning by Swedish authorities since 2010, but was granted asylum by Ecuador and has been in the country’s London embassy for more than three years. In April, the activist said he consented to the Swedish prosecutor’s conditions for the interrogation procedure to take place in the Kensington embassy. The agreement refers specifically to Assange and Sweden’s intention to question him in London and will come into effect “in the coming days”, a statement from the Ecuadorian foreign ministry said.

Assange’s Swedish lawyer, Per Samuelson, told the Guardian that Sweden needed to formally approve the deal and he understood those discussions would take place on Thursday. Negotiations began in June this year between Ecuador’s acting foreign minister, Xavier Lasso, and the Swedish justice ministry’s international affairs chief, Anna-Carin Svensson. The Ecuadorian government statement said: “The agreement, without any doubt, is a tool that strengthens bilateral relations and facilitates, for example, the execution of such legal actions as the questioning of Mr Assange, isolated in the Ecuadorian embassy in London.”

The deal would ensure “the implementation and enforcement of national legislation and principles of international law, particularly those relating to human rights, to further the full exercise of national sovereignty in any event of legal assistance that may be required between Ecuador and Sweden”. The agreement would be the final step towards interviewing Assange in London, with a request to the UK for legal assistance having already been granted, according to previous statements from the Swedish prosecutor’s office. Assange sought refuge at the embassy in June 2012 after losing his final legal attempt to avoid extradition. Sweden’s director of public prosecutions, Marianne Ny, said in March this year that she would allow Assange to be interviewed in London if agreement could be reached with Ecuador.

Not sure about carbon pricing. The last attempt was a disgrace.

• James Hansen, Father Of Climate Change Awareness: Paris Talks ‘A Fraud’ (Guar.)

Mere mention of the Paris climate talks is enough to make James Hansen grumpy. The former Nasa scientist, considered the father of global awareness of climate change, is a soft-spoken, almost diffident Iowan. But when he talks about the gathering of nearly 200 nations, his demeanor changes. “It’s a fraud really, a fake,” he says, rubbing his head. “It’s just bullshit for them to say: ‘We’ll have a 2C warming target and then try to do a little better every five years.’ It’s just worthless words. There is no action, just promises. As long as fossil fuels appear to be the cheapest fuels out there, they will be continued to be burned.”

The talks, intended to reach a new global deal on cutting carbon emissions beyond 2020, have spent much time and energy on two major issues: whether the world should aim to contain the temperature rise to 1.5C or 2C above preindustrial levels, and how much funding should be doled out by wealthy countries to developing nations that risk being swamped by rising seas and bashed by escalating extreme weather events. But, according to Hansen, the international jamboree is pointless unless greenhouse gas emissions aren’t taxed across the board. He argues that only this will force down emissions quickly enough to avoid the worst ravages of climate change.

Hansen, 74, has just returned from Paris where he again called for a price to be placed on each tonne of carbon from major emitters (he’s suggested a “fee” – because “taxes scare people off” – of $15 a tonne that would rise $10 a year and bring in $600bn in the US alone). There aren’t many takers, even among “big green” as Hansen labels environment groups.

Refugees don’t make for the same kind of feel good fodder.

• No Mention In Paris Of Refugees: Global Issues Live In Separate Boxes (Betts)

While the United Nations climate change talks in Paris struggled to elicit credible commitments, notably missing from the debate was “environmental displacement” – people fleeing their homes on account of natural disaster. As temperatures and sea levels rise, and land-use patterns change, there will be significant consequences for human mobility within and across borders. However, public and media debate scarcely discussed the issue, and the only references in the Paris summit’s negotiated outcome document are vague to the point of meaninglessness. This absence is especially striking in a year in which refugees and migration have otherwise been so high on the political agenda. This political dissonance is of a piece with the compartmentalised way in which we approach many global issues.

During a frenzied summer, media coverage and political attention focused almost exclusively on refugees. Now, with saturation point reached, the circus has moved on. Climate change has, instead, become the de rigueur liberal issue of the day. Remarkably, the global focus on refugees was insufficient to influence the debate in Paris. When we shift our attention so dramatically, we risk missing important analytical connections and, with them, opportunities for meaningful solutions. To be clear, the so-called European refugee crisis was certainly not caused by climate change. But it is symptomatic of a global protection crisis, with climate change as one key component. That crisis is partly the result of numbers: there are more people displaced around the world than at any time since the second world war.

It is partly the result of political will: asylum is being undermined by governments around the world. However, it is above all a reflection of a growing gap between the contemporary nature of displacement and the institutions that govern forced migration. In the aftermath of the second world war, governments created the 1951 Convention relating to the Status of Refugees. It ensures that states have a reciprocal obligation towards people fleeing a well-founded fear of persecution. This framework was well adapted to the refugee movements of the 20th century. It continues to be relevant, but it leaves gaps.

Greece has many good souls.

• The Athens Lawyer Who Became A Guardian To Refugee Camp Children (Guardian)

Christina Dimakou is not yet 30, but she has four children, one of whom is 17. She shares neither a nationality nor a past with any of them. Two of them are from Syria: the 17-year-old girl fled Damascus after soldiers attempted to kidnap her and her brother, who escaped conscription; there’s a 10-year-old from Iran who longs to go to school for the first time; and a young girl from Afghanistan who has lost her family. For now Dimakou is their guardian. She cares for them within the confines of Moria, a makeshift hilltop camp for refugees on the Greek island of Lesbos. Her charges spend their days behind chain-linked fences where a discarded Minnie Mouse in a torn pink dress, caught in the razor wire, is the only indication that this is the children’s area.

More than 700,000 refugees have entered Europe through Greece this year, most of them wet and bedraggled arrivals on its eastern Aegean islands. Their coming has shaken Europe and changed the life of this determined lawyer. Instead of practising law in Athens, where she passed the bar exam, Dimakou has moved her life to an island now famous for the refugees who wash up on its shores. It’s a life with few of the trappings of the metropolitan middle class with whom she grew up. Her working outfit is an aid worker’s bib, her hair tied back. She shuttles between the crumbling neoclassical architecture of the port city of Mytilene and the crowded refugee reception centre at Moria in a battered Toyota loaded with translators and the dirt from a thousand strangers’ shoes.

She is one of only a dozen members of the guardianship network, a fledgeling programme run by the Athens-based charity Metadrasi, designed to help the countless lost children who have arrived alone. Some have been separated from their families while fleeing Syria, others have taken it upon themselves to strike out and find a new home for relatives who will follow later. Many of them have been told they carry their family’s only hope. To explain her decision Dimakou uses the allegory of the little boy and the starfish. Every day he would go to the beach and throw a few of the dying starfish he found back into the sea. When asked, in the face of the thousands of starfish that would wash up, whether he really made a difference, he would reply: “I make a difference to the ones I throw back.”

“I cannot save the world or make everything better,” Dimakou admits, “but I can affect the things around me. If everyone does this then the world becomes better. And we become better.” In legalese her starfish are known as “unaccompanied minors” and no one can be sure how many of them there are. It is the responsibility of officials from the Greek police and the European borders agency, Frontex, to ensure that all under-18s who arrive are taken into care if they are found to be without a parent or relative. The reality is that since the surge began earlier this year only a fraction of the true number of lost children have been caught in this shredded safety net.