Piet Mondriaan Trafalgar Square 1939-43

There are still people calling for impeachment after Mueller’s horror show yesterday. Saw both AOC and Rob Reiner do just that. The somewhat more awake amongst us merely feel sorry for the old man, but that goes too far. He put himself in that position. He’s never delivered any proof of Russian meddling, but that doesn’t appear to bother many. He refused to talk to Assange just so that meddling narrative could be kept alive.

But the biggest takeaway from the hearing must be that Mueller didn’t write his own report, something that became glaringly obvious when he didn’t know what Fusion GPS was. Mueller has just been the face of an investigation that was conducted by others. He is the supposed hero who’s ideal as the front for such a thing. But the thing is hollow and empty.

There were far too many things Mueller said were not in his purview (he said that 16 times) of which at least some certainly were. Moreover, as several members of Congress pointed out, Mueller got far too close to ignoring the presumption of innocence. Trump does not have to prove he’s innocent, Mueller had to prove he’s guilty – and failed.

• Trump Cheers As Michael Moore Blasts ‘Frail’ Mueller (AFP)

In a rare meeting of minds Wednesday between two opposing American political voices, Michael Moore earned plaudits from President Donald Trump when the liberal filmmaker blasted former special counsel Robert Mueller’s “stumbling” congressional testimony. Moore, a frequent Trump critic who has also warned of the Democratic Party’s failure to resonate with working-class America, let loose on Mueller as he testified in often halting fashion before Congress about Russian election interference and possible connections to Trump and his 2016 campaign. “A frail old man, unable to remember things, stumbling, refusing to answer basic questions,” Moore said in a scathing tweet after Mueller appeared uncertain and asked for several questions to be repeated during some of the most closely watched congressional hearings of the year.

“I said it in 2017 and Mueller confirmed it today — All you pundits and moderates and lame Dems who told the public to put their faith in the esteemed Robert Mueller — just STFU from now on,” he added, using a crass acronym that includes an expletive. Trump seized on the famed documentarian and Academy Award winner’s fury, retweeting the post and adding his observation that “Even Michael Moore agrees that the Dems and Mueller blew it!” Mueller, 74, appeared reluctant to take the gloves off as he sat for hours in hearings before two House panels, often sounding dispassionate and unsteady.

At times lawyerly and assured, he was also dull and sluggish, declining to stray beyond the confines of his report or to push back aggressively on his Republican questioners and light the fireworks that several Democrats no doubt had been looking for. “Trump must be gloating in ecstasy,” tweeted Moore, director of films like “Bowling for Columbine” and “Roger & Me.” “Not because of the failure that is Robert Mueller — his Report is still a damning document of crimes by Trump — but because Trump understands the power of the visual, and he understands that the Dems aren’t street fighters and that’s why he’ll win.”

.@RepRatcliffe tears into Mueller: 'You managed to violate every principle and the most sacred of traditions about prosecutors'#Mueller #Muellerhearings pic.twitter.com/byXFsOuwCR

— BlazeTV (@BlazeTV) July 25, 2019

If the Dems wouldn’t waste so much time and credility with Russiagate, they could protest this. And sure, Pelosi tries, but they are not a believable anti-war party.

• Donald Trump Vetoes Bills Prohibiting Arms Sales To Saudi Arabia (AP)

Donald Trump has vetoed a trio of congressional resolutions aimed at blocking his administration from selling billions of dollars of weapons to Saudi Arabia and the United Arab Emirates. The secretary of state, Mike Pompeo, last month cited threats from Iran as a reason to approve the $8.1bn arms sale to the two US allies in the Gulf. Saudi Arabia is an enemy of Iran and tension has mounted between the UAE and Tehran over several issues, including the UAE’s coordination with US efforts to curb what it calls Iran’s malign activities in the region. But Trump’s decision in May to sell the weapons in a way that would have bypassed congressional review infuriated lawmakers. In a pushback to Trump’s foreign policy, Democrats and Republicans banded together to pass resolutions to block the weapons sale.

The White House had argued that stopping the sale would send a signal that the US did not stand by its partners and allies, particularly at a time when threats against them were increasing. The arms package included thousands of precision-guided munitions, other bombs and ammunition and aircraft maintenance support. Anger has been mounting in Congress over the Trump administration’s close ties to the Saudis, fuelled by the high civilian casualties in the Saudi-led war in Yemen – a military campaign the US is assisting – and the killing of the US-based columnist Jamal Khashoggi by Saudi agents. Trump’s decision in May to sell the weapons further inflamed the tensions. “The president’s shameful veto tramples over the will of the bipartisan, bicameral Congress and perpetuates his administration’s involvement in the horrific conflict in Yemen, which is a stain on the conscience of the world,” the House speaker, Nancy Pelosi, said in a statement.

Let’s start a casino and call it a market.

• Nothing Matters: It’s Like the Whole Market Has Gone Nuts (WS)

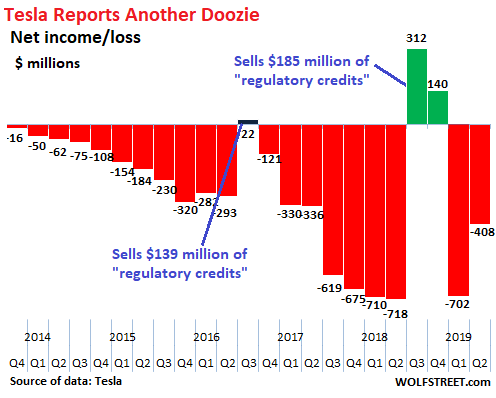

You see, Tesla is different. It just reported another doozie, a loss of $408 million in the second quarter, after its $702 million loss in the first quarter, for a total loss in the first half of $1.1 billion. In its 14-year history, it has never generated an annual profit. It has real and popular products and surging sales, but it subsidizes each of those sales with investor money. And here’s where it’s different this time: investors don’t care. They dig how the company has been consistently overpromising and underdelivering. They dig the chaos at the top. They dig everything that should scare them off.

Yeah, its shares plunged 11% afterhours today, but that takes those shares only down to where they’d been on May 1. Big deal. Shares are down 32% from the peak. But their peak should have been a small fraction of that. Even today, the company is still valued at over $40 billion. Tesla lacks a viable business model in the classic sense. Its business model is a new business model of just burning investor cash that it raises via debt and equity offerings on a near-annual basis because investors encourage it to do that, and love it for it, and eagerly hand it more money to burn, and they’re rewarding each other by keeping the share price high. It’s just a game, you see. And nothing else matters.

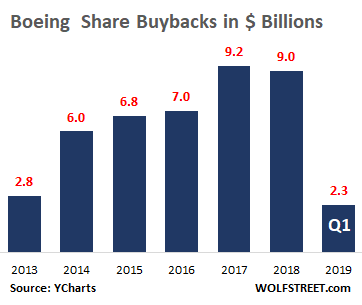

Then there is Boeing. It just reported the largest quarterly loss in its history of $2.9 billion due to a nearly $5-billion charge related to its newest bestselling all-important 737 Max, two of which crashed, killing 346 people, due to the way the plane is designed. The flight-control software that is supposed to mitigate this design issue is not working properly. And a software fix that is acceptable to regulators remains elusive. The plane has been grounded globally since March. No one, especially not the regulators, can afford a third crash. So today, Boeing announced that it may further cut production of the plane or suspend it altogether if the delays continue to drag out. This is big enough to start impacting US GDP.

[..] But here we go: From 2013 through Q1 2019, Boeing has blown a mind-boggling $43 billion on share buybacks (buyback data via YCharts): Blowing these $43 billion on share buybacks has caused Boeing to have a “total equity” of a negative $5 billion. In other words, it has $5 billion more in liabilities than in assets. This company is out of wriggle room. If it can’t borrow enough money to make payroll, it’s over.

Shouldn’t he wait for the DOJ investigation?

• Mnuchin Says Amazon ‘Destroyed’ US Retail Sector (R.)

U.S. Treasury Secretary Steven Mnuchin said on Wednesday that online giant Amazon.com Inc “destroyed the retail industry across the United States.” Mnuchin said he looked forward to hearing the results of a Justice Department probe, announced on Tuesday, into whether big U.S. technology firms engage in anticompetitive practices, the strongest sign yet that the Trump administration is stepping up its scrutiny of Big Tech. “If you look at Amazon, although they’re certain benefits to it, they’ve destroyed the retail industry across the United States,” Mnuchin told CNBC. “I don’t have an opinion other than I think it’s absolutely right the attorney general is looking into these issues and I look forward to listening to his recommendations to the president.”

Amazon defended itself, saying that 90% of all sales occur in brick-and-mortar stores. “Today, independent sellers make up more than 58% of physical gross merchandise sales on Amazon, and their sales have grown twice as fast as our own, totaling $160 billion in 2018,” a spokesman for Amazon said. A Justice Department spokesman declined to say on Tuesday which companies it would scrutinize under the antitrust probe, but said the review would consider concerns raised about “search, social media, and some retail services online” – an apparent reference to Google, Amazon, Facebook, and potentially Apple.

No more parking spaces left.

• Boeing Says It Could Halt Production Of 737 Max After Grounding (G.)

Boeing said it could halt production of the 737 Max jet on Wednesday as it reported the company’s largest ever quarterly loss following two fatal accidents involving the plane. The company lost $2.9bn in the three months to the end of June, compared to a profit of $2.2bn for the same period last year. Sales fell 35% to $15.8bn. Chief executive Dennis Muilenburg said production of the plane could be slowed or halted if regulators do not move to lift the ban on the plane. The 737 Max was Boeing’s best selling aircraft until the fleet was grounded worldwide in March following crashes in Indonesia and Ethiopia. In January Boeing’s executives said the Max was the fastest selling plane in its history and the company expected to deliver between 895 and 905 airplanes this year.

Now it has become the most costly plane in Boeing’s history. Boeing has predicted that the Max will be flying again by the end of the year, but this month the Wall Street Journal reported that government and industry officials believe a return date of January 2020 is more likely. On a call with analysts Muilenburg said the company may have to consider slowing or halting production if there are further delays in getting the plane back into the skies. Boeing is still producing 42 of its 737 jets a month and plans to boost that rate to 57 next year. But if there are further setbacks, Muilenberg said: “We might need to consider possible further rate reductions or other options including a temporary shutdown of the Max production.”

It got him out of jail…

• Jeffrey Epstein Found Injured In Jail Cell (R.)

Jeffrey Epstein, the financier facing charges of sex trafficking involving dozens of underage girls, was found unconscious in a Manhattan jail cell with injuries to his neck, media reported late on Wednesday, citing unidentified sources. Epstein was found by guards sprawled on the floor of cell at the Metropolitan Correctional Center on Wednesday, media reported. Some media reported that his face appeared blue. The billionaire financier was taken to hospital, the New York Post reported, but it was unclear where he was taken or what his condition was. It was not clear how he suffered his injuries. Epstein was recently denied bail, a move his lawyers plan to appeal according to a court notice made public on Tuesday.

Epstein was expected to ask the 2nd U.S. Circuit Court of Appeals to overturn the judge’s July 18 rejection of his request to remain under house arrest in his $77 million mansion on Manhattan’s Upper East Side. Epstein has pleaded not guilty to the charges and the appeal for bail was expected. His lawyer Reid Weingarten did not immediately respond to requests for comment. A spokesman for U.S. Attorney Geoffrey Berman in Manhattan declined to comment. The charges, concerning alleged misconduct from at least 2002 to 2005, were announced more than a decade after Epstein pleaded guilty to state prostitution charges in Florida. In denying him bail, U.S. District Judge Richard Berman in Manhattan said the government had shown by clear and convincing evidence that Epstein would pose a danger to the community if released pending trial.

Impressive.

• Embattled Governor Of Puerto Rico Resigns After Protests (AFP)

Puerto Rico’s embattled governor Ricardo Rossello announced his resignation late Wednesday following two weeks of massive protests triggered by the release of a chat exchange in which he and others mocked gays, women and hurricane victims. “I announce that I will be resigning from the governor’s post effective Friday, August 2 at 5 pm,” Rossello said, in a video statement posted on the government’s Facebook page. As soon as the video ended, a joyous commotion and cries of “ole ole ole” were heard from protesters who had rallied since the afternoon at the gates of the governor’s mansion.

“I trust that Puerto Rico will continue united and move forward as it always has,” Rossello said. “And I hope that this decision will serve as a call for citizen reconciliation.” Rossello said that Justice Secretary Wanda Vazquez would temporarily succeed him. Puerto Ricans had waited expectantly for the announcement throughout the day, as rumors of the governor’s forthcoming resignation swirled.

Christine Lagarde is stuck even before she takes the job. There is no way out of ultra-low rates.

• With Finger On Trigger, ECB Aims At More Stimulus (R.)

The European Central Bank is all but certain to ease policy further on Thursday, with the biggest question whether it staggers its moves over several months or opts for a big bang. With inflation stuck well below its target and the U.S. Federal Reserve already in easing mode, the ECB has flagged more stimulus, hoping to prop up confidence amid a steady flow of bad news that threatens to unravel years of unprecedented support. It could cut interest rates, perhaps while also helping banks offset the costs to them, restart a recently shuttered bond-buying program or raise the bar for any future tightening of monetary policy.

But with economic data relatively stable there is little urgency to deliver a comprehensive package this week, suggesting the ECB could take its time to prepare the measures and wait for the Fed to set its own course. This will be crucial for determining the euro’s exchange rate against the dollar, presently the single most-watched variable for ECB policymakers. Having stoked easing expectations already, ECB President Mario Draghi will have to deliver at least something on Thursday. If nothing else, he is likely to unveil revamped interest rate guidance that makes it clear a rate cut is coming and that rates will stay at record lows for much longer than the ECB had previously expected.

As I said: all they can do is to prolong the agony.

• Deutsche Bank Faces A -Much- Smaller, Poorer Future (Coppola)

Deutsche Bank has issued its results for the second quarter of 2019. They make grim reading. The bank reported a headline loss of €3.1bn ($3.44bn), which it said was due to “charges relating to strategic transformation” of €3.4bn ($3.78bn). But both net income of £231m ($256.67m) and underlying profits of €441m ($490m) were significantly down on the same quarter in 2018. The restructuring announced earlier this month has yet to impact fully. The “capital release unit” into which the bank plans to put €74bn ($82.22bn) of poorly-performing and non-strategic assets and business lines, including its entire equities trading division, is not yet up and running, and although headcount is about 4,500 lower than it was a year ago, the latest round of sackings doesn’t yet show up in the redundancy costs.

Restructuring costs themselves therefore only contribute €50m ($55.56m) to the headline loss. A further €350m ($388.89m) comes from junking software and service contracts that will no longer be needed because of the restructuring. But by far the largest part of the headline loss arises from impairment of goodwill to the tune of €1bn ($1.11bn) and a €2bn ($2.22bn) reduction in the value of the bank’s deferred tax asset. This may sound like accounting gobbledegook, but it sends a very important message. Deutsche Bank’s management has admitted the bank will never return to the profitability of the past. When the restructuring is complete, it will be a much smaller, poorer bank.

Let’s end with something positive.

• California Condor Comes Back From The Dead (NPR)

The California condor, North America’s largest bird, once ruled the American Southwest and California’s coastal mountains. The vulture-like bird was revered by Native Americans and was believed to contain spiritual powers. Hundreds of years later, its future seemed all but certain. Defying odds, conservation efforts brought the species back and prevented it from joining the dodo in extinction. Now, condor reintroduction celebrates a milestone: Chick No. 1,000 has hatched. In the 1980s, fewer than two dozen condors were left in the world. Conservationists rounded up the remaining condors and began breeding them in captivity.

According to the International Union for Conservation of Nature, the condor became critically endangered in the 20th century — one classification behind extinct in the wild. The decline came from poaching, habitat destruction and lead poisoning as condors scavenged for carrion containing lead shots. Today, more than 300 California condors exist in the wild. Including captivity breeding programs, there are more than 500 in the world, says Tim Hauck, the condor program manager at the Peregrine Fund.

The 1,000th successful birth signifies an optimistic future for the condor recovery mission. “We’re seeing more chicks born in the wild than we ever have before,” Hauck told NPR’s Scott Simon. “And that’s just a step towards success for the condor and achieving a sustainable population.” The hatchling is currently in Zion National Park — it emerged from its shell in May, but its survival was just confirmed in July. The chick, whose sex cannot be identified without a blood test, will be ready to fledge — or take flight — for the first time in November. If the chick successfully leaves the nest, it can expect to grow up to have a 10-foot wingspan. The bird’s average lifespan is 60 years, one of the world’s longest-living bird species.

Photo by National Park Service – AP