Francis Bacon Triptych 1976

If only they could have a decent conversation.

• All Eyes On Trump-Putin Dynamics As They Meet For First Time At G20 (R.)

U.S. President Donald Trump and Russian President Vladimir Putin are set to size each other up in person for the first time on Friday in what promises to be the most highly anticipated meeting on the sidelines of the G20 summit. Trump has said he wants to find ways to work with Putin, a goal made more difficult by sharp differences over Russia’s actions in Syria and Ukraine, and allegations Moscow meddled in the 2016 U.S. presidential election. That means every facial expression and physical gesture will be analyzed as much as any words the two leaders utter as the world tries to read how well Trump, a real estate magnate and former reality television star, gets along with Putin, a former spy. The fear is that the Republican president, a political novice whose team is still developing its Russia policy, will be less prepared than Putin, who has dealt with the past two U.S. presidents and scores of other world leaders.

“There’s nothing … the Kremlin would like to see more than a (U.S.) president who will settle for a grip and a grin and walk away saying that he had this fabulous meeting with the Kremlin autocrat,” Representative Adam Schiff, the top Democrat on the House of Representatives’ Intelligence Committee, said in an interview on MSNBC. As investigations at home continue into whether there was any collusion between Trump’s presidential campaign and Russia the U.S. president has come under pressure to take a hard line against the Kremlin. Moscow has denied any interference and Trump says his campaign did not collude with Russia. On Thursday, Trump won praise from at least one Republican hawk in the U.S. Congress after his speech in Warsaw in which he urged Russia to stop its “destabilizing activities” and end its support for Syria and Iran.

“This is a great start to an important week of American foreign policy,” said Republican Senator Lindsey Graham, who has often been critical of Trump on security issues. But earlier in the day, Trump declined to say definitively whether he believed U.S. intelligence officials who have said that Russia interfered in the 2016 election. “I think it was Russia but I think it was probably other people and/or countries, and I see nothing wrong with that statement. Nobody really knows. Nobody really knows for sure,” Trump said at a news conference, before slamming Democratic former President Barack Obama for not doing more to stop hacking.

So much for that decent conversation. James Clapper, who not long ago stated there is no proof of Russian election hacking, now claims that there is no proof of anyone BUT the Russians being involved.

• Deep State Begins Anti-Russia Media Blitz Ahead Of Trump-Putin Meeting

It’s been relatively quiet in the last few weeks on the “the Russians did it, and Trump’s Putin’s best-buddy” propaganda-fest, but it appears the Deep State had three stories tonight – just hours ahead of Trump’s face-to-face with Putin – claim Russian hackers are targeting US nuclear facilities, the Russians are nonchalantly stepping up their spying, and that Russia alone interfered with the US election. With all eyes on the ‘handshake’ as Putin and Trump come face-to-face for the first time as world leaders, it seems the Deep State is desperately fearful of some rapprochement, crushing the need for NATO, and destroying the excuses for massive, unprecedented military-industrial complex spending.

And so, three stories (2 anonymously sourced and one with no facts behind it) in The New York Times (who recently retracted their “17 intelligence agencies” lie) and CNN (where do we start with these guys? let’s just go with full retraction of an anonymously sourced lie about Scaramucci and Kushner and the Russians) should stir up enough angst to ensure the meeting is at best awkward and at worst a lose-lose for Trump (at least in the eyes of the media). First off we have the ‘news’ that hackers have reportedly been breaking into computer networks of companies operating United States nuclear power stations, energy facilities and manufacturing plants, according to a new report by The New York Times.

“The origins of the hackers are not known. But the report indicated that an “advanced persistent threat” actor was responsible, which is the language security specialists often use to describe hackers backed by governments. The two people familiar with the investigation say that, while it is still in its early stages, the hackers’ techniques mimicked those of the organization known to cybersecurity specialists as “Energetic Bear,” the Russian hacking group that researchers have tied to attacks on the energy sector since at least 2012.” And Bloomberg piled on…”The chief suspect is Russia, according to three people familiar with the continuing effort to eject the hackers from the computer networks.” So that’s that 5 people – who know something – suspect it was the Russians that are hacking US nuclear facilities (but there’s no proof).

Next we move to CNN who claim a ‘current and former U.S. intelligence officials’ told them that Russian spies have been stepping up their intelligence gathering efforts in the U.S. since the election, feeling emboldened by the lack of significant U.S. response to Russian election meddling. “Russians have maintained an aggressive collection posture in the US, and their success in election meddling has not deterred them,” said a former senior intelligence official familiar with Trump administration efforts. “The concerning point with Russia is the volume of people that are coming to the US. They have a lot more intelligence officers in the US” compared to what they have in other countries, one of the former intelligence officials says.”

Holding it in Hamburg is a conscious decision intended to show muscle, and the necessity to show that muscle. Do it in the middle of the Pacific and you can’t show off your new high tech water cannon.

• Anti-G20 Protesters Clash With Hamburg Police ‘Like Never Before’ (RT)

An anti-G20 rally in Hamburg has erupted into a violent confrontation between police and protesters. Dozens of officers have been injured by rioters as sporadic clashes on the streets of the German city continued into the night. “There have been offenses committed by smaller groups [but] we now have the situation under control… I was there myself, I’ve seen nothing like that before,” Hamburg police spokesman Timo Zill told German broadcaster ZDF. The ‘Welcome to Hell’ anti-globalist rally started off relatively peacefully as activists marched through the streets chanting slogans and holding banners. Clashes begun in the early evening after roughly 1,000 anti-globalism activists, wearing face masks, reportedly refused to reveal their identity to the authorities.

According to an official police statement, the trouble started when officers tried to separate aggressive black-bloc rioters from peaceful protesters at the St. Pauli Fish Market but were met with bottles, poles and iron bars, prompting them to use justifiable force. Police used pepper-spray on rioting protesters. Water cannons were also deployed by authorities and several people seemed to be injured as a number of people were seen on the ground or with bloody faces being led away by police. Footage from the scene also showed columns of green and orange smoke rising above the crowds. At least 76 police officers were injured in the riots, most, though, suffered light injuries, Bild reports. Five of them were admitted to hospital, a police officer told AFP. One policeman suffered an eye injury after fireworks exploded in front of his face. The number of injured demonstrators has not yet been released by authorities, DW German notes.

As a result of the violence, organizers declared the protest over Thursday evening, but pockets of activists remained on the streets throughout the night. Police confirmed persistent sporadic attacks on security forces in the districts of St. Pauli and Altona. Damage to property has also been reported throughout the city. According to RT’s correspondent on the scene, Peter Oliver, one of the protesters’ grievances was that they received no clear directives from the police as to where they were allowed to march and found themselves kettled by officers in riot gear once they set off. “They are macing everyone,” one witness at the scene told RT. “As far as I could tell, they were attacking the demonstration with no reason.” “I’m from Hamburg, [and] I’ve never seen anything like this. We’ve had fights about squatted houses and all that, [but] I’ve never seen anything like that. The aggression, as far as I could tell, the purposelessness… my face hurts, I’ve got mace and everything, this is unbelievable.”

Central bankers trying to deflect the blame.

• The Party Is Over: Central Banks Pull The Plug On Bond Market Rally (CNBC)

Central banks are shutting down the music and turning on the lights after a near decade-long bond market party that resulted in ultra-low yields and low volatility. In the past two weeks, interest rates have been rising, at the prodding of the world’s central banks. Some bond strategists now see the possibility of a shift to a more fundamental-driven market, which could result in higher, more normal interest rate levels that will affect everything from home mortgages to commercial loans. That doesn’t mean the wake-up call will be a jolt, with rates snapping back violently or markets spinning out of control—though it could if rates begin to move too quickly. For now, market pros expect the rising interest rates of the past several weeks to be part of an orderly adjustment to a world in which central banks are preparing to end excessive easy policies.

The Federal Reserve is about to take the unprecedented step of reducing the balance sheet it built up to save the economy from the financial crisis. Since June 26, the U.S. 10- year yield has risen from 2.12% to Thursday’s high of 2.38%. The move has been global, after ECB President Mario Draghi last week pointed to a less risky outlook for the European economy, and Fed officials made consistently hawkish remarks. Some of those officials said they were even concerned that their policies created a too easy financial environment, meaning interest rates should be higher. The stock market caught wind of the rate move Thursday, and equities around the world responded negatively to rising yields. Bond strategists say if higher yields trigger a bigger sell off in stocks it could slow down the upward movement in interest rates, as investors will seek safety in bonds. Bond prices move opposite yields.

Friday’s June jobs report could be a moment of truth for the bond market. Strategists are looking to the wage gains in the report, expected at 0.3%. If they are as expected, the move higher in yields could continue. But a surprise to the upside could mean a much bigger move since it would signal a return of inflation. The Fed has said it is looking past the recent decline in inflation, but the market would become more convinced of the Fed’s rate-hiking intentions if it starts to rise.

“..our responsibility now is to keep dancing but closer to the exit and with a sharp eye on the tea leaves..”

• Central Bank Easy Money ‘Era Is Ending’ – Ray Dalio (CNBC)

Ray Dalio has declared the era of easy money is ending. The founder and chief investment officer of the world’s biggest hedge fund said Thursday in a commentary posted to LinkedIn that central bankers have “clearly and understandably” signaled the end of the nine-year era of monetary easing is coming. They are shifting strategy and are now focused on raising interest rates at a pace that keeps growth and inflation in balance, risking the next downturn if they get it wrong. “Recognizing that, our responsibility now is to keep dancing but closer to the exit and with a sharp eye on the tea leaves,” Dalio wrote.

In May, Dalio posted a commentary that said he was worried about the future, concerned that the magnitude of the next downturn could produce “much greater social and political conflict than currently exists.” On Thursday, he said the aggressive easing policies brought about “beautiful deleveragings,” and it was time to pause and thank the central bankers for pursuing them. “They had to fight hard to do it and have been more maligned than appreciated.” Dalio ends by saying he doesn’t see a big debt bubble about to burst, largely because of the balance sheet deleveraging that came about in the last few years. But, he said, “we do see an increasingly intensifying ‘Big Squeeze.'”

“..the only reason the world is in its current abysmal socio-political and economic shape is due to the cumulative effect of their disastrous policies..”

• Ray Dalio’s ‘Beautiful’ Deleveraging Delusion (ZH)

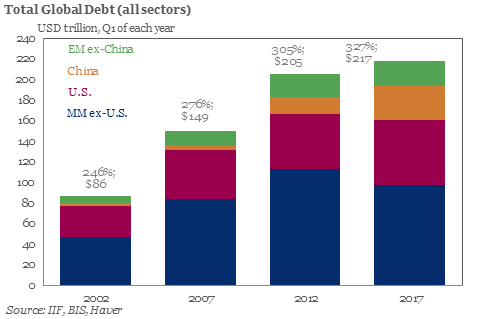

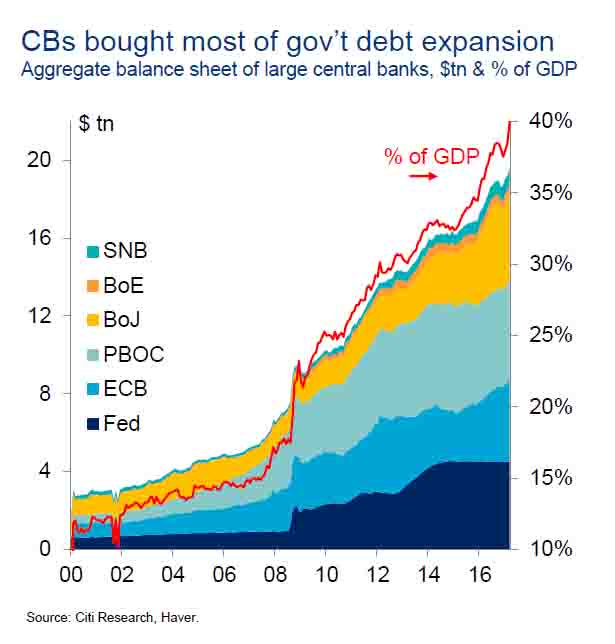

For some inexplicable reason, Ray Dalio still thinks the the world not only underwent a deleveraging, but that it was “beautiful.” Not only did McKinsey prove that to be completely false two years ago, but for good measure the IIF confirmed as much last week, when it revealed that global debt has hit a record $217 trillion, or 327% of GDP… while Citi’s Matt King showed that with no demand for credit in the private sector, central banks had no choice but to inject trillions to keep risk prices from collapsing.

And now, replacing one delusion with another, the Bridgewater head has penned an article in which he notes that as the “punch bowl” era is ending – an era which made Dalio’s hedge fund the biggest in the world, and richer beyond his wildest dreams – he would like to take the opportunity to “thanks the central bankers” who have ‘inexplicably’ been “more maligned than appreciated” even though their aggressive policies have, and here is delusion #1 again, “successfully brought about beautiful deleveragings.” “In my opinion, at this point of transition, we should savor this accomplishment and thank the policy makers who fought to bring about these policies. They had to fight hard to do it and have been more maligned than appreciated. Let’s thank them.” They fought hard to print $20 trillion in new money? Now that is truly news to us.

That said, we can see why Dalio would want to thank “them”: he wouldn’t be where he is, and his fund would certainly not exist today, if it weren’t for said central bankers who came to rescue the insolvent US financial system by sacrificing the middle class and burying generations under unrepayable debt. Still, some who may skip thanking the central bankers are hundreds of millions of elderly Americans and people worldwide also wouldn’t be forced to work one or more jobs well into their retirement years because monetary policies lowered the return on their savings to zero (or negative in Europe), as these same “underappreciated” central bankers created three consecutive bubbles, and the only reason the world is in its current abysmal socio-political and economic shape is due to the cumulative effect of their disastrous policies which meant creating ever greater asset and debt bubbles to mask the effects of the previous bubble, resulting in unprecedented wealth and income inequality, and which have culminated – most recently – with Brexit and Trump.

Amen.

• ‘It’s Too Late’: 7 Signs Australia Can’t Avoid Economic Apocalypse (News)

Australia has missed its chance to avoid a potential “economic apocalypse”, according to a former government guru who says that despite his warnings there are seven new signs we are too late to act. The former economics and policy adviser has identified seven ominous indicators that a possible global crash is approaching – including a surge in crypto-currencies such as Bitcoin – and the window for government action is now closed. John Adams, a former economics and policy adviser to Senator Arthur Sinodinos and management consultant to a big four accounting firm, told news.com.au in February he had identified seven signs of economic Armageddon. He had then urged the Reserve Bank to take pre-emptive action by raising interest rates to prevent Australia’s expanding household debt bubble from exploding and called on the government to rein in welfare payments and tax breaks such as negative gearing.

Adams says he has for years been publicly and privately urging his erstwhile colleagues in the Coalition to take action but that since nothing has been done, the window has now closed and Australia is completely at the mercy of international forces. “As early as 2012, I have been publicly and privately advocating that Australian policy makers take pre-emptive policy action to deal with the structural imbalances within the Australian economy, especially Australia’s household debt bubble which in proportional terms is larger than the household debt bubbles of the 1880s or 1920s, the periods which preceded the two depressions experienced in Australian history,” he told news.com.au this week. “Unfortunately, the window for taking pre-emptive action with an orderly unwinding of structural macroeconomic imbalances has now closed.”

Adams has now turned on his former party and says both its most recent prime ministers have led Australia into a potential “economic apocalypse” and Treasurer Scott Morrison is wrong that we are heading for a “soft landing”. “The policy approach by the Abbott and Turnbull Governments as well as the Reserve Bank of Australia and the Australian Prudential Regulation Authority, which has been to reduce systemic financial risk through new macro-prudential controls, has been wholly inadequate,” he says. “I do not share the Federal Treasurer’s assessment that the economy and the housing market are headed for a soft landing. Data released by the RBA this week shows that the structural imbalances in the economy are actually becoming worse with household debt as a proportion of disposable income hitting a new record of 190.4%.

“Because of the failure of Australia’s political elites and the policy establishment, the probability of a disorderly unwinding, particularly of Australia’s household and foreign debt bubbles, have dramatically increased over the past six months and will continue to increase as global economic and financial instability increases. “Millions of ordinary, financially unprepared, Australians are now at the mercy of the international markets and foreign policy makers. Australian history contains several examples of where similar pre conditions have resulted in an economic apocalypse, resulting in a significant proportion of the Australian people being left economically destitute.”

Sanctions don’t really work in this case.

• World-Beating Wealth Props Up Qatar Against Arab Sanctions (R.)

A month after Saudi Arabia, the United Arab Emirates, Bahrain and Egypt severed diplomatic, trade and transport ties with Qatar, accusing it of backing terrorism, it is suffering from isolation but is nowhere near an economic crisis. The alliance against it, meanwhile, may not have options to inflict further damage. As the world’s top liquefied natural gas exporter, Qatar is so rich – at $127,660, its gross domestic product per capita in purchasing power terms is the highest of any country, according to the IMF – it can deploy money to counter almost any type of sanction. In the past month it has arranged new shipping routes to offset the closure of its border with Saudi Arabia, deposited billions of dollars of state money in local banks to shore them up, and drawn the interest of some of the West’s biggest energy firms by announcing a plan to raise its LNG output 30%.

The success of these initiatives suggests Qatar could weather months or years of the current sanctions if it has the political will to do so – and that further sanctions being contemplated by the alliance may not prove decisive. On Wednesday, the alliance said Qatar, which denies any support for terrorism, had missed a deadline to comply with its demands. Further steps against Doha will be taken in line with international law “at the appropriate time”, Saudi Foreign Minister Adel al-Jubeir said. Saudi media reported this week that the new sanctions would include a pull-out of deposits and loans from Qatar by banks in alliance states, and a “secondary boycott” in which the alliance would refuse to do business with firms that traded with Qatar. Those steps would cause further pain for Qatar, but not to the point of destabilizing its financial system or breaking the peg of its riyal currency to the U.S. dollar, senior Qatari businessmen and foreign economists said.

“..a soft month for Toronto real estate market..”, “..a better supplied market and a moderating annual pace of price growth…”

• Home Sales In Greater Toronto Area Plunged 37.3% Last Month (CP)

The number of homes sold last month in the Greater Toronto Area plunged a whopping 37.3% compared to the same month a year ago, the city’s real estate board said Thursday, weeks after Ontario introduced measures aimed at cooling the housing market. The Toronto Real Estate Board said 7,974 homes changed hands in June while the number of new properties on the market climbed 15.9% year over year to 19,614. The average price for all properties was $793,915, up 6.3% from the same month last year. In April, the Ontario government implemented rules intended to dampen Toronto’s heated real estate market, where escalating prices have concerned policy-makers at the municipal, provincial and federal levels.

Ontario’s measures, retroactive to April 21, include a 15% tax on foreign buyers in the Greater Golden Horseshoe region, expanded rent controls and legislation allowing Toronto and other cities to tax vacant homes. “We are in a period of flux that often follows major government policy announcements pointed at the housing market,” TREB president Tim Syrianos said in a statement. “On one hand, consumer survey results tell us many households are very interested in purchasing a home in the near future, but some of these would-be buyers seem to be temporarily on the sidelines waiting to see the real impact of the Ontario Fair Housing Plan. On the other hand, we have existing homeowners who are listing their home because they feel price growth may have peaked. The end result has been a better supplied market and a moderating annual pace of price growth.”

60-odd years later, it’s still true: “As General Motors goes, so goes the nation.”

• The Fast Track to “Carmageddon” (David Stockman)

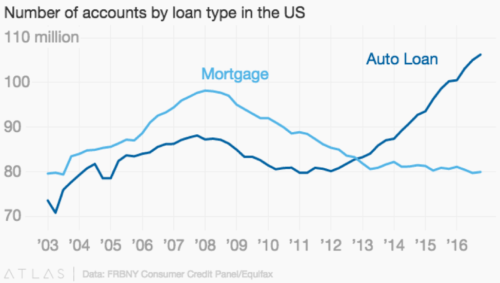

Back in the 1950s when GM had 50% of the auto market they always said that, “As General Motors goes, so goes the nation.” That was obviously a tribute to GM’s economic muscle and its role as the driver of growth and rising living standards in post-war America’s booming economy. Those days are long gone for both GM and the nation. GM’s drastically reduced 20% market share of U.S. light vehicle sales in June was still an economic harbinger, albeit of a different sort. GM offered a record $4,361 of cash incentives during June. That was up 7% from last year and represented 12% of its average selling price of $35,650 per vehicle, also a record. But what it had to show for this muscular marketing effort was a 5% decline in year-over-year sales and soaring inventories. The latter was up 46% from last June.

My purpose is not to lament GM’s ragged estate, but to note that it — along with the entire auto industry — has become a ward of the Fed’s debt-fueled false prosperity. The June auto sales reports make that absolutely clear. In a word, consumers spent the month “renting” new rides on more favorable terms than ever before. But that couldn’t stop the slide of vehicle “sales” from its 2016 peak. In fact, June represented the 6th straight month of year-over-year decline. And the fall-off was nearly universal — with FiatChrysler down 7.4%, Ford and GM off about 5% and Hyundai down by 19.3%. The evident rollover of U.S. auto sales is a very big deal because the exuberant auto rebound from the Great Recession lows during the last six years has been a major contributor to the weak recovery of overall GDP.

In fact, overall industrial production is actually no higher today than it was in the fall of 2007. That means there has been zero growth in the aggregate industrial economy for a full decade. Real production in most sectors of the U.S. economy has actually shrunk considerably, but has been partially offset by a 15% gain in auto production from the prior peak, and a 130% gain from the early 2010 bottom. By comparison, the index for consumer goods excluding autos is still 7% below its late 2007 level. So if the so-called “recovery” loses its automotive turbo-charger, where will the growth come from?

20th Anniversary, Asian Financial Crisis.

• Clinton, The IMF And Wall Street Journal Toppled Suharto (Hanke)

On August 14, 1997, shortly after the Thai baht collapsed on July 2nd, Indonesia floated the rupiah. This prompted Stanley Fischer, then the Deputy Managing Director of the IMF and presently Vice Chairman of the U.S. Federal Reserve, to proclaim that “the management of the IMF welcomes the timely decision of the Indonesian authorities. The floating of the rupiah, in combination with Indonesia’s strong fundamentals, supported by prudent fiscal and monetary policies, will allow its economy to continue its impressive economic performance of the last several years.” Contrary to the IMF’s expectations, the rupiah did not float on a sea of tranquility. It plunged from a value of 2,700 rupiahs per U.S. dollar to lows of nearly 16,000 rupiahs per U.S. dollar in 1998. Indonesia was caught up in the maelstrom of the Asian Financial Crisis.

By late January 1998, President Suharto realized that the IMF medicine was not working and sought a second opinion. In February, I was invited to offer that opinion and was appointed as Suharto’s Special Counselor. Although I did not have any opinions on the Suharto government, I did have definite ones on the matter at hand. After nightly discussions at the President’s private residence, I proposed an antidote: an orthodox currency board in which the rupiah would be fully convertible into and backed by the U.S. dollar at a fixed exchange rate. On the day that news hit the street, the rupiah soared by 28% against the U.S. dollar on both the spot and one year forward markets. These developments infuriated the U.S. government and the IMF. Ruthless attacks on the currency board idea and the Special Counselor ensued. Suharto was told in no uncertain terms – by both the President of the United States, Bill Clinton, and the Managing Director of the IMF, Michel Camdessus – that he would have to drop the currency board idea or forego $43 billion in foreign assistance.

Economists jumped on the bandwagon, trotting out every imaginable half-truth and non-truth against the currency board idea. In my opinion, those oft-repeated canards were outweighed by the full support for an Indonesian currency board by four Nobel Laureates in Economics: Gary Becker, Milton Friedman, Merton Miller, and Robert Mundell. Also, Sir Alan Walters, Prime Minister Thatcher’s economic guru, a key figure behind the establishment of Hong Kong’s currency board in 1983, and my colleague and close collaborator, endorsed the idea of a currency board for Indonesia. Why all the fuss over a currency board for Indonesia? Merton Miller understood the great game immediately. As he said when Mrs. Hanke and I were in residence at the Shangri-La Hotel in Jakarta, the Clinton administration’s objection to the currency board was “not that it wouldn’t work, but that it would, and if it worked, they would be stuck with Suharto.”

Much the same argument was articulated by Australia’s former Prime Minister Paul Keating: “The United States Treasury quite deliberately used the economic collapse as a means of bringing about the ouster of Suharto.” Former U.S. Secretary of State Lawrence Eagleburger weighed in with a similar diagnosis: “We were fairly clever in that we supported the IMF as it overthrew (Suharto). Whether that was a wise way to proceed is another question. I’m not saying Mr. Suharto should have stayed, but I kind of wish he had left on terms other than because the IMF pushed him out.” Even Michel Camdessus could not find fault with these assessments. On the occasion of his retirement, he proudly proclaimed: “We created the conditions that obliged President Suharto to leave his job.”

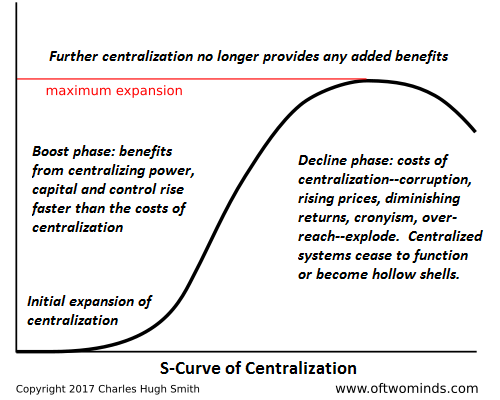

Hmm. Treating this is an American phenomenon is not useful. It’s global. And that has a lot to do with deteriorating economic conditions. Centralization is only accepted as long as it has tangible benefits for people.

• Our Political Parties Are Obsolete (CH Smith)

History informs us that once something is obsolete, it can disappear far faster than anyone expected. While we generally think of obsoleted technologies vanishing, social and political systems can become obsolete as well. Should a poor soul who entered a deep coma a year ago awaken today, we must forgive his/her astonishment at the political wreckage left by the 2016 election. The Democratic Party, a mere year ago an absurdly over-funded machine confident in an easy victory in the presidential race, is now a complete shambles: its leadership in free-fall, its Fat-Cat donors disgusted, and its demented intoxication with pinning collaboration with Russia on the Trump camp eroding whatever feeble legacy legitimacy it still holds. What the party stands for is a mystery, as its Elites are clearly beholden to insiders, special interests and Corporate donors while glorifying the worst excesses of globalism and the National Security State’s endless war on civil liberties.

The newly awakened citizen would also marvel at the chaotic war zone of the Republican Party, in which the Insider Warlords are battling insurgent Outsiders, while the same Elites that fund the Democratic machine are wondering what they’re buying with their millions of dollars in contributions, for it’s unclear what the Republican Party stands for: it’s for Small Government, except when it’s for Bigger Government, which is 95% of the time; it’s for more law enforcement and the militarization of local police, and more intrusion into the lives of the citizenry; it’s for stricter standards for welfare, except for Corporate Welfare; it’s for tax reform, except the thousands of pages of give-aways, loopholes and tax breaks for the wealthy and corporations all remain untouched, and so on: a smelly tangle of special interests masked by a few sprays of PR air freshener to the millions left behind by the globalization that has so enriched Corporate America and the class of financier-owners, bankers, insiders and technocrats–the same group that funds and controls both political parties.

Political parties arose to consolidate centralized control of the central state. We have now reached the perfection of this teleology: the political elites and the financial elites are now one class. In our pay-to-play “democracy,” only the votes of wealth and institutional power count. As I have often noted here, the returns on centralization are diminishing to less than zero. The initial returns on centralizing capital, production and social-political power were robust, but now the centralized cartel-state is eating its own tail, masking its financial bankruptcy by borrowing from the future, and cloaking its political bankruptcy behind the crumbling facades of the legacy parties. Now that technology has enabled decentralized currency, markets and governance, the centralized political parties are obsolete.

Erdogan was never going to withdraw his troops. That’s the whole story. Guterres just looks foolish.

• Cyprus Reunification Talks Collapse (R.)

Talks to reunify the divided island of Cyprus collapsed in the early hours of Friday, U.N. Secretary General Antonio Guterres said after a stormy final session. “I’m very sorry to tell you that despite the very strong commitment and engagement of all the delegations and different parties … the conference on Cyprus was closed without an agreement being reached,” he told a news conference. The collapse marked a dramatic culmination of more than two years of a process thought to be the most promising since the island was split more than 40 years ago. Guterres had flown in on Thursday to press Greek Cypriot President Nicos Anastasiades and Turkish Cypriot leader Mustafa Akinci to seal a deal reuniting the east Mediterranean island, while U.S. Vice President Mike Pence had phoned to urge them to “seize this historic opportunity”.

Diplomatic efforts to reunite Cyprus have failed since the island was riven in a 1974 Turkish army invasion triggered by a coup by Greek Cypriots seeking union with Greece. The week of talks in the Swiss Alps, hailed by the United Nations as “the best chance” for a deal, ground to a halt as the two sides failed to overcome final obstacles. Diplomats said Turkey had appeared to be offering little to Greek Cypriots wanting a full withdrawal of Turkish troops from the island, although the Greek Cypriots had indicated readiness to make concessions on Turkish Cypriot demands for a rotating presidency, the other key issue. Guterres finally called a halt at 2 a.m. after a session marred by yelling and drama, a source close to the negotiations said. “Unfortunately… an agreement was not possible, and the conference was closed without the possibility to bring a solution to this dramatic and long-lasting problem,” Guterres said.