Pieter Bruegel the Elder The Fall of Icarus 1558

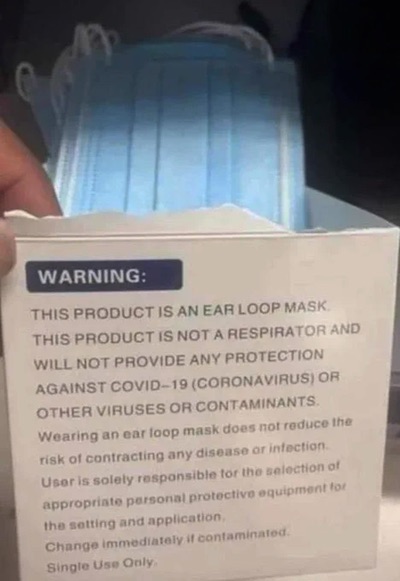

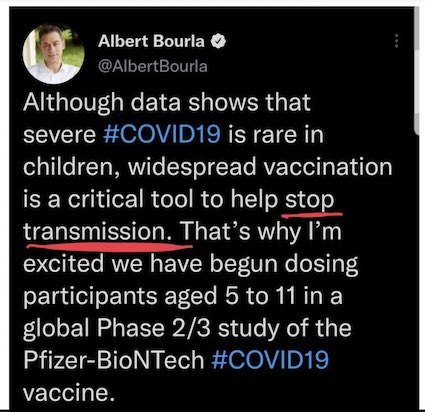

Japan vaccine

Prof. Fukushima at Press Conference. (No.1)

"This is not drug harm. To be clear, the vaccine is not a drug, but a bioweapon with all kinds of toxicity. So many people have died because of distribution of the bioweapon. It's a massacre. It's a Holocaust."Prof. Fukushima’s… https://t.co/TUIe0YLsp6 pic.twitter.com/1WbLapo2se

— You (@You3_JP) September 8, 2023

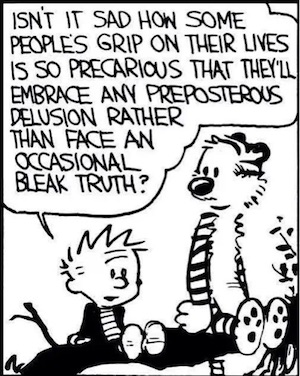

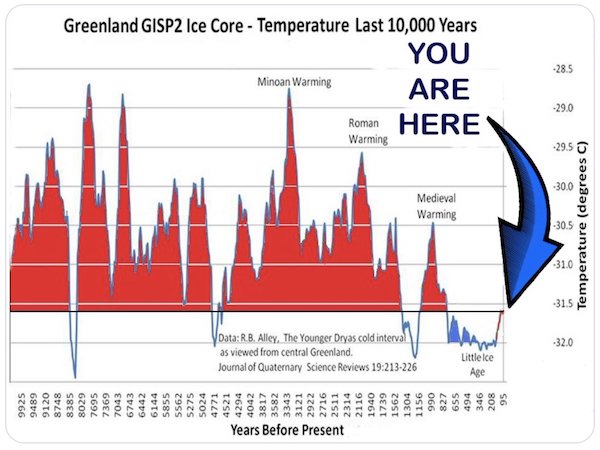

Hoax

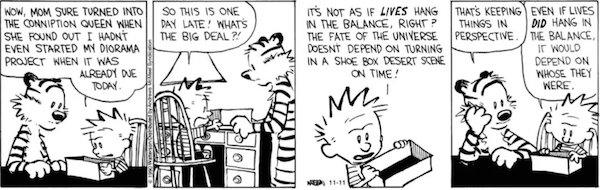

The human-induced climate change hoax is a trojan horse through which unelected globalist bodies such as the United Nations, are attempting to seize totalitarian control over every minute detail of our lives, under the pretext of "saving the planet".

From the documentary,… pic.twitter.com/W3ILz4XziB

— Wide Awake Media (@wideawake_media) September 9, 2023

Obama Minimize

https://twitter.com/i/status/1700313493428228549

DARPA McCullough

The U.S. Government, Not Pfizer or Moderna, First Envisioned mRNA Technology

Back in 2012, DARPA began investing in gene-encoded vaccines.

So, the military came up with the idea of messenger RNA vaccines, not Pfizer or Moderna – not operation warp speed pic.twitter.com/vMnSQz75eN

— illuminatibot (@iluminatibot) September 9, 2023

Macgregor

The people that control your financial markets, institutions and the people that control your main stream media, they now control your governments.

— Douglas Macgregor (@DougAMacgregor) September 10, 2023

Excellent conversation.

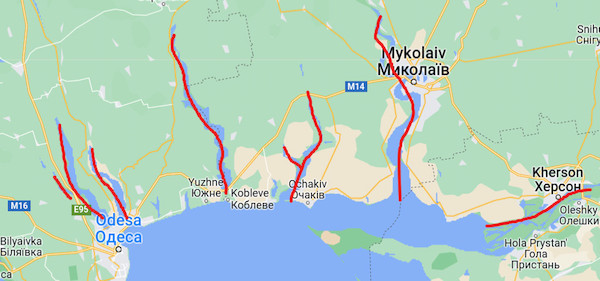

“Tony, look at a map,” and just look at the progress that “has not been made by Ukraine..”

• Wrongheaded US Leadership in Ukraine – Larry Johnson, Ray McGovern, Nap (Sp.)

The United States is blatantly lying about the botched Ukrainian counteroffensive, former CIA analyst Larry Johnson said in an interview with Judge Andrew Napolitano on his Judging Freedom podcast. “Tony, look at a map,” and just look at the progress that “has not been made by Ukraine,” said the retired CIA intelligence officer and State Department official, as he commented on recent remarks made by US Secretary of State Antony Blinken in Kiev. During his unannounced visit to the Ukrainian capital, Blinken, standing alongside Ukrainian President Volodymyr Zelensky, touted that the Ukrainian military had made “real progress” in its counteroffensive in the “last few weeks.” The Ukrainian president’s assessment of the battlefront developments “matches our own,” continued Blinken, who went over to Kiev to pledge a new aid package for Ukraine worth over $1 billion.

In fact, “Russia has been steadily pushing to the [west],” Johnson said, pointing out that the battle of Artemovsk was the “last big conflict” on the battlefront that Ukraine’s military was engaged in. “They [the US] don’t understand Russian defensive tactics,” Johnson emphasized. In May 2023, the Russian military liberated Artemovsk (also known as Bakhmut), a Donbass city reduced to ruins in over eight months of brutal house-to-house fighting. The Artemovsk operation destroyed tens of thousands of Ukrainian troops and foreign mercenaries, while Russia built up its reserves and prepared defenses in Donbass, Zaporozhye, and Kherson for Kiev’s much-heralded summer offensive

“Americans have been had,” added Ray McGovern, a former top US intel analyst, who also joined the Judging Freedom podcast. He pointed out that, “Billions of money had gone to Ukraine, with a lot of it syphoned off.” He told the host that America was “losing” in the proxy war against Russia in Ukraine. Nevertheless, senior-level members of the US intelligence community continue “to delude themselves, their colleagues, the press, and the public,” regarding the actual developments on the ground, specified Larry Johnson. These officials refused to wake up to the reality that Ukraine was experiencing “shortage of ammunition, shortage of manpower, trouble recruiting people,” etc.

“What distinguishes Umerov is that he was a key negotiator at the peace talks with Russia in Istanbul last year in March, which actually resulted in an agreed document … Again, he was instrumental in negotiating the Black Sea Grain Initiative..”

• Ice Cracking Sounds On Frozen Lake of US-Russia Relations (Bhadrakumar)

Meanwhile, on September 6, Blinken embarked on quite an untypical visit to Kiev. There was no fire in his belly. For once, he didn’t threaten Russia or ridicule Putin from Ukrainian soil. Nor did Blinken show much enthusiasm for Kiev’s counteroffensive. Rather, his focus was on the war’s horrific trail causing human suffering, Ukraine’s post-conflict recovery as a democracy and its economy’s reconstruction. Blinken said repeatedly that he was undertaking the visit on Biden’s instruction. In the presence of President Zelensky, Blinken stated:

“We are determined in the United States to continue to walk side by side with you. And President Biden asked me to come, to reaffirm strongly our support, to ensure that we are maximising the efforts that we’re making and other countries are making for the immediate challenge of the counteroffensive as well as the longer-term efforts to help Ukraine build a force for the future that can deter and defend against any future aggression, but also to work with you and support you as you engage in the critical work of strengthening your democracy, rebuilding your economy.”

Stirring words, but there was no boastful talk of liberating Crimea, carrying the fight into the Russian camp or forcing Russia to vacate the annexed territories and negotiating with Russia only from a position of strength. At Blinken’s joint press availability with Ukrainian Foreign Minister Dmytro Kuleba, the latter claimed that they had a “substantive” discussion on providing long-range rockets, ATACMS to Kiev. But Blinken sidestepped the topic. The most unusual thing about Blinken’s visit was that it spilled over to a second day. This must be the first time Blinken spent a night in Ukraine. Blinken had a rather tight schedule on the first day meeting Kuleba, Zelensky and Prime Minister Denis Shmigal, but the itinerary for the second day [September 7], was left open. Obviously, he came to Kiev for some serious discussions.

Conceivably, Biden could be interested in starting peace talks between Moscow and Kiev now that the Ukrainian counteroffensive has failed to meet its politico-military objectives, and there are worrisome signs of support waning in America and Europe for the proxy war, while a Russian offensive could deal a knockout punch on Ukraine’s military. Both Russian and western estimates are that close to 65-70,000 Ukrainian soldiers were killed in these past 3 months alone since Kiev’s “counteroffensive” began. Meanwhile, in an interesting coincidence, on September 6, Ukraine’s parliament Verkhovna Rada approved the appointment of Rustem Umerov as the new Defence Minister replacing Alexei Reznikov. A Crimean Tatar born in Uzbekistan (USSR), Umerov has no previous military background. But he is trusted by Zelensky and is acceptable to the Americans.

What distinguishes Umerov is that he was a key negotiator at the peace talks with Russia in Istanbul last year in March, which actually resulted in an agreed document (from which Zelensky subsequently retracted under Anglo-American pressure.) Again, he was instrumental in negotiating the Black Sea Grain Initiative (so-called grain deal between Ukraine and Russia) which became operational in July last year at Istanbul. These are straws in the wind that must be duly noted.

Even RT gets it upside down: “..secretly instructed engineers to turn off coverage..” No, he did not. There was never any coverage to be shut down. He declined to activate it.

• Musk Talked To Russian Ambassador Before Starlink Decision – WaPo (RT)

SpaceX CEO Elon Musk spoke to Russia’s ambassador to the US, Anatoly Antonov, before making the decision to switch off his Starlink satellite internet service in Crimea last September to thwart a Ukrainian attack on the peninsula, the Washington Post has reported. On Thursday, the paper published more details about Musk cutting Starlink coverage to prevent a Ukrainian seaborne drone strike on the Russian Black Sea Fleet base in Sevastopol. The events that occurred have been described in a biography of the tech billionaire by historian Walter Isaacson that is due to hit shelves next week. With Kiev’s forces poised to launch their attack, Musk spoke with Antonov, who told him that a strike on Crimea, which became part of Russia after a referendum in 2014, “could lead to a nuclear response” by Moscow, Isaacson said in his book.

“In later conversations with a few other people, he [Musk] seemed to imply that he had spoken directly to [Russian] President Vladimir Putin, but to me he said his communications had gone through the ambassador,” the historian wrote. According to Isaacson, Musk concluded that “allowing the use of Starlink for the attack… could be a disaster for the world.” He therefore took matters into his own hands and secretly instructed engineers to turn off coverage within 100km of the Crimean coast. As a result of the move, the six explosive-laden Ukrainian drones, which relied on Starlink for navigation, “lost connectivity and washed ashore harmlessly.” Musk started receiving “frantic” calls from Kiev as soon as the Ukrainians realized that the satellite service wasn’t working.

They tried to explain to the billionaire that the drones were “crucial to their fight for freedom,” but Musk still refused to switch Starlink back on. He argued that Ukraine was “going too far and inviting strategic defeat” by targeting Crimea, Isaacson wrote. The historian also claimed that Musk had discussed the situation with US National Security Adviser Jake Sullivan and Chairman of the Joint Chiefs of Staff General Mark Milley, explaining to them that he didn’t intend for Starlink to be used for offensive purposes. Musk provided a slightly different account of events in a series of posts on X (formerly Twitter), saying that Starlink was never active around Crimea and that he simply turned down Ukrainian calls to provide coverage in the area.

“If I had agreed to their request, then SpaceX would be explicitly complicit in a major act of war and conflict escalation,” he argued. Commenting on revelations from Isaacson’s book, Mikhail Podoliak, a senior aide to Ukrainian President Vladimir Zelensky, said that Musk’s decision was the result of “a cocktail of ignorance and big ego.” The billionaire “committed evil” by allowing the Russian fleet to continue striking Ukrainian targets with Kalibr missiles, he claimed. Former Russian President Dmitry Medvedev, who now serves as deputy head of the country’s Security Council, described Musk as “the last adequate mind in North America” for preventing a strike on Crimea.

It’s going to take many years.

• Musk: US Military Vulnerability Due to Slow Production Rate, Like Ukraine (Sp.)

US military vulnerability primarily “stems from the slow pace of production,” American entrepreneur and billionaire Elon Musk has pointed out. The tech guru took to his social media platform X (formerly Twitter), to comment on last year’s post by the company Anduril Industries. On its five-year anniversary, the military technology company had argued the need for a joint effort if it was expected to “transform US and allied military capabilities with advanced technology.” We need “a new group of defense technology companies to Reboot the Arsenal of Democracy,” the firm had stated. The entrepreneur also emphasized that making new prototypes is easy, but putting them into production is hard.

This comes as the third month of Ukraine’s botched counteroffensive has wrapped up, with the Kiev regime unable to boast any significant military gains, while US stockpiles of munitions are getting “dangerously low”. As of August 30, 2023, Ukraine has reportedly lost 466 airplanes, 247 helicopters, 6,234 unmanned aerial vehicles, 433 air defense missile systems, 11,570 tanks and other armored fighting vehicles, 1,146 fighting vehicles equipped with MLRS, 6,128 field artillery cannons and mortars, as well as 12,528 special military motor vehicles since the beginning of the special military operation.

Meanwhile, the US unveiled the latest military package for the Kiev regime, worth $250 million, late in August, including AIM-9M missiles for air defense, munitions for High Mobility Artillery Rocket Systems (HIMARS), 155mm and 105mm artillery ammunition, mine-clearing equipment, Javelin and other anti-armor systems and rockets, three million rounds of small arms ammunition, as well as other items. However, by continuing to funnel military aid to Kiev the US is reportedly fast-depleting its own military caches of various weapons. Thus, depletion of US stockpiles of 155mm artillery shells (for howitzer use) was recently cited in a US report, with the additional revelation that Washington was sending Kiev 155mm and 105mm shells for the simple reason that it no longer had adequate stockpiles of 155mm shells.

“..high-level radioactive waste contaminants can be found in uranium waste streams that then get made into depleted uranium.”

• NATO’s DU ‘Perfect Storm’ of Toxic Pollution in Breadbasket Ukraine (Tweedie)

NATO-supplied depleted uranium (DU) rounds will contaminate Ukraine’s ‘breadbasket’ grain-growing regions with radioactive waste, a nuclear watchdog has warned. This week the US followed the UK in announcing the supply of the controversial armor-piercing rounds for the M1 Abrams tanks it is supplying to the Kiev regime. British Challenger 2 tanks equipped with DU penetrators have already seen action in the Zaporozye region — with at least one meeting a fiery end. Depleted uranium is the left-over material from the enrichment process used to make fuel rods for nuclear power reactors and — at higher levels — elements of nuclear weapons. The concentration of fissile uranium-235 isotope in depleted uranium is about 0.3 percent, 40 percent of the level of element in its unenriched state, but it still emits around 60 percent as much atomic radiation as natural uranium.

Most of that is in the form of alpha particles from U-238 and U-234 — the most harmful form of radiation if ingested into the body — with beta particles given out by decay products that form within a few weeks. Watchdog Kevin Kamps told Sputnik that US national security spokesman John Kirby’s claim that DU penetrator rods were not radioactive or carcinogenic was simply not true. “Depleted uranium munitions are really intended to be armor piercing. They can bust tanks, they can penetrate through concrete,” Kamps explained. “It’s because they’re so dense. Uranium is the densest isotope an element on the periodic table.” The harmful nature of DU is well understood, the expert pointed out. “Uranium in nature is hazardous to begin with,” Kamps said. “It’s a toxic heavy metal. It is what they say as mildly radioactive, which is kind of a misnomer, radioactivity is hazardous even in mild form.”

He added that DU is often mixed with radioactive waste from nuclear power plants. “In both the United States, where this depleted uranium munitions is coming from, but also in other countries, there’s a mixing of uranium waste streams off of the enrichment process,” Kamps noted. “And what that can often mean is high-level radioactive waste contaminants can be found in uranium waste streams that then get made into depleted uranium.” What makes DU even more toxic is its pyrophoric properties — the material ignites on hitting its target, as well as pulverizing into microscopic dust from the near-hypersonic velocity impact. “It’s kind of the perfect storm of hazard. You’ve got toxic heavy metal, you’ve got radioactivity that can be contaminated with much higher level radioactivity from high-level radioactive waste,” Kamps stressed. “And then it turns into a fine dust that you can breathe in, that blows on the wind, that settles on the water and flows downstream and downwind and harms people and other living beings all along the way.”

I posted Justin Hart’s tweet yesterday, with a long list of officials affected by the decision. Will they stop?

WOW. 5th Circuit court JUST UPHELD Missouri v Biden and ruled that the following people CAN:

1) NO LONGER CENSOR YOU

2) NO LONGER FLAG YOUR POSTS

3) NO LONGER DICTATE SOCIAL MEDIA POLICIES

4) NO LONGER COMMUNICATE WITH THESE COMPANIES TO CENSOR YOU

5) NO LONGER WORK WITH…— Justin Hart (@justin_hart) September 8, 2023

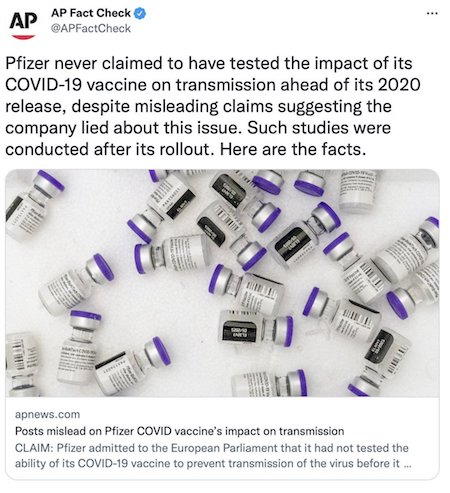

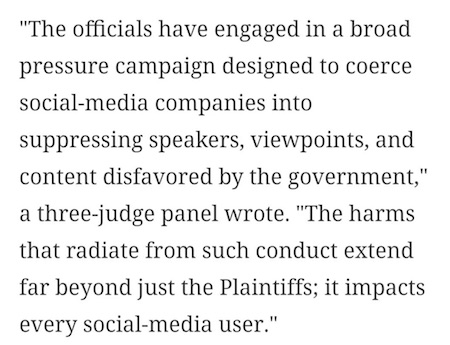

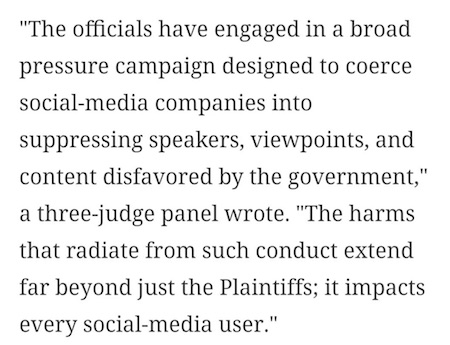

• Biden Admin Likely Violated 1st Amendment On Social Media: 5th Circuit (ZH)

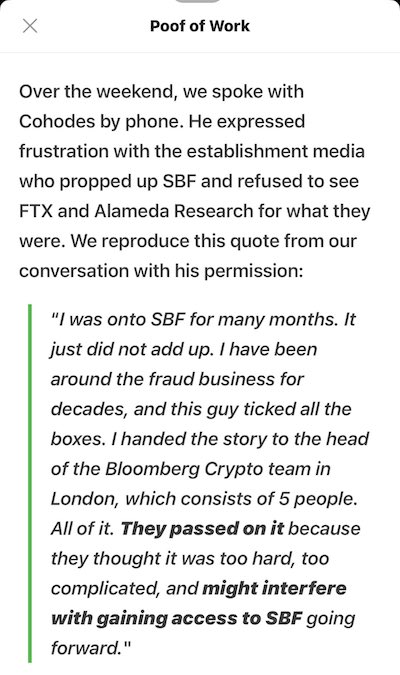

The 5th Circuit Court of Appeals ruled on Friday that several Biden administration officials had likely breached the First Amendment by pressuring social media companies to moderate or take down content they deemed problematic. And here is Exhibit A of that First Amendment-crushing coercion and collusion… which obviously began in the Trump-era under Anthony Fauci. ZeroHedge was banned from Twitter one day after this email. In an unsigned 75-page opinion, three 5th Circuit judges agreed with the plaintiffs that the administration “ran afoul of the First Amendment” by at times threatening social media platforms with antitrust action or changes to law protecting them from liability.

However, as The Epoch Times’ Aldgra Fredly reports, the three-judge panel of the New Orleans-based 5th U.S. Circuit Court of Appeals narrowed much of an injunction issued by a Louisiana judge that restricted Democratic President Joe Biden’s administration from communicating with social media companies. The court said that the White House, Surgeon General, Centers for Disease Control and Prevention (CDC), and the FBI “likely coerced or significantly encouraged social media platforms to moderate content” in violation of the First Amendment. “It is true that the officials have an interest in engaging with social media companies, including on issues such as misinformation and election interference,” the three-judge panel said in a 74-page ruling (pdf) on Sept. 8. “But the government is not permitted to advance these interests to the extent that it engages in viewpoint suppression,” they added.

The court found that the officials made “express threats” and “inflammatory accusations” by saying that the platforms were “poisoning the public” and “killing people.” The platforms were told they needed to take “greater responsibility and action.” “Then, they followed their statements with threats of ‘fundamental reforms’ like regulatory changes and increased enforcement actions that would ensure the platforms were ‘held accountable’. But, beyond express threats, there was always an unspoken ‘or else,'” it added. The court also said the officials encouraged social media platforms to moderate content by “exercising active, meaningful control over those decisions,” particularly concerning the platforms’ moderation policies.

According to the ruling, the FBI “regularly met with the platforms, shared ‘strategic information,’ frequently alerted the social media companies to misinformation spreading on their platforms, and monitored their content moderation policies.” “But, the FBI went beyond that—they urged the platforms to take down content. Turning to the Second Circuit’s four-factor test, we find that those requests were coercive,” it added. The judges emphasized that the government cannot supervise a platform’s content moderation decisions and cannot impose “legal, regulatory, or economic consequences” if they refuse to comply with a given request. “Social media platforms’ content-moderation decisions must be theirs and theirs alone,” the court asserted.

The attorneys general of Louisiana and Missouri, along with several social media users, had sued last year, saying Facebook, YouTube, and Twitter engaged in censorship as a result of repeated urging by government officials and threats of heightened regulatory enforcement. The lawsuit said the censored views included content questioning anti-COVID-19 measures such as masks and vaccine mandates and allegations of election fraud.

Watters 5th circuit

A bombshell ruling by the 5th circuit court today, finding the Biden White House, the FBI and the CDC violated the First Amendment rights of millions of Americans… pic.twitter.com/YYWuXs3HcQ

— Jesse Watters (@JesseBWatters) September 9, 2023

Not going to happen.

• Ukraine Will Be Ready To Join EU In Two Years – Kiev (RT)

Ukraine should be ready to become an EU member in the next two years, Deputy Prime Minister Olga Stefanishina told Voice of America on Friday. As Kiev’s official responsible for “European and Euro-Atlantic integration,” she says her nation is one of the “best prepared” for such a step. “I believe that two years would be enough for full preparedness,” Stefanishina said, when asked about Ukraine’s EU prospects. She also vowed to do “10 times more than we do now” to achieve the goal once the conflict with Moscow ends. However, the minister admitted that the timeline would ultimately be determined by the “course of war.”

According to Stefanishina, Ukraine remains one of the “best prepared [nations] for the EU accession” since it is “a big part of the European economy” even in the midst of armed conflict. The country is one of the EU’s “top 20” import partners and the Ukrainian domestic market is “the biggest” on the territory of Europe, she stated. At the same time, she admitted that Ukraine’s economic role in the EU would remain largely agricultural. “With all those agricultural lands… there can be no reality, in which Ukraine stops being an agrarian country,” she said. The bloc itself has been in no rush to accept Kiev into its ranks. EU officials have refused to set specific timelines for Ukraine’s accession, saying that it must first address issues such as rampant corruption and introduce comprehensive legal reforms. In 2022, France said that the process might eventually take years.

In early September, Austrian Foreign Minister Alexander Schallenberg warned that fast-tracking membership for Ukraine would spell “geostrategic disaster” since it would show that some nations are “more equal than others.” Former French President Nicolas Sarkozy also said on Friday that accepting the ex-Soviet republic into both the EU and NATO would increase Washington’s sway over the EU dramatically. Kiev might also join NATO even sooner than the EU, Stefanishina proposed, saying that the US-led military bloc would be happy to have a member with “one of the strongest armies” after, she said, it beats Moscow. The minister admitted, though, that Ukraine’s accession to the alliance is a “political decision,” while still maintaining that this decision was “taken in Vilnius,” which hosted the latest NATO summit.

Ukrainian President Vladimir Zelensky produced a scandal at the meeting in mid-July, when he condemned NATO for what he called “indecisiveness” over a lack of a clear roadmap for Kiev’s membership. He allegedly angered US officials to the extent that they briefly considered withdrawing Ukraine’s invitation to the bloc. Then British Defense Secretary Ben Wallace also criticized Kiev over its lack of gratitude for Western military aid, explaining that the US and its allies were “not Amazon.”

“I think that following Putin’s non-participation in this forum, our country’s exit from the organization is also possible. We must give preference to those platforms that can implement our projects and our ideas. BRICS can do this, the SCO can do this, but the G20 cannot ,” [Deputy Chairman of the Federation Council Committee Andrei] Klimov said.

• G20 Declaration On Ukraine A ‘Blow To Western Countries’ (Sp.)

The declaration of the G20 summit in India was a blow to the West, a British business newspaper reports, adding that this highlights the lack of global consensus in support of Kiev. The G20 leaders earlier in the day said in the New Delhi Summit Declaration that they had different views on and assessments of the Ukraine conflict during discussions of the issue, but all of them jointly call for respect for the UN Charter. “That statement, hammered out over weeks of negotiations between diplomats, is a blow to western countries that have spent the past year attempting to convince developing countries to condemn Moscow and support Ukraine,” the newspaper wrote. “The New Delhi summit declaration refers only to the ‘war in Ukraine’, a formulation that supporters of [Kiev] such as the US and NATO allies have previously rejected as it implies both sides are equally complicit,” the report added.

Russian G20 Sherpa Svetlana Lukash, meanwhile, emphasized that the declaration demonstrates the group’s balanced position on the Ukraine conflict and its intention to settle all conflicts around the world. “As for the Ukrainian case, I can say that the negotiations were very complex and, above all, the collective position of the BRICS countries and other partners has borne fruit … What we have been hearing all year, that the Ukrainian conflict is worsening the food security situation, is now reflected in a balanced way,” Lukash told journalists. Half of the group’s members refused to accept Western narratives, she said, adding that a “consensus language” had been used in the declaration. In addition, the G20 members have agreed to work jointly for peace, security, and conflict resolution around the world, Lukash said.

“At the beginning of 2022 it was hovering around 25%, now it is exceeding 80%.”

• Russia and China Have Effectively Ditched The Dollar – Moscow (RT)

The de-dollarization of Russia-China trade is practically complete, according to Georgy Zinoviev, the director of the Russian Foreign Ministry’s First Asian Department, as cited by RIA Novosti. The official said the share of the US dollar in mutual settlements between the neighboring nations has substantially shrunk over the past two years. “The share of national currencies in Russian-Chinese payments is growing at an extremely rapid pace,” Zinoviev told the news agency. “At the beginning of 2022 it was hovering around 25%, now it is exceeding 80%.” He added that the volume of trading in the ruble-yuan pair on the Moscow Exchange (MOEX) outpaced volumes in the dollar-ruble pair long ago. According to Zinoviev, Russian and Chinese businesses are “rapidly moving away from the ‘toxic’ Western currencies, opting for the ruble and yuan as more reliable and safe way of payment.”

The diplomat noted that Moscow and Beijing have developed vital tools to make it possible to “facilitate all necessary transactions as much as possible,” despite international political and economic instability that significantly affects financial institutions and their ability to efficiently operate. The changes reflect Russia’s move away from transactions in the currencies of ‘unfriendly countries’ against the backdrop of sanctions. Earlier this year, Finance Minister Anton Siluanov said the country no longer trusts the dollar, calling it “a completely unreliable instrument.” Zinoviev’s comments come ahead of the 8th Eastern Economic Forum, which kicks off on September 10 in Vladivostok, Russia. Most of the discussions at the annual event will focus on trade, business, and investment.

“..In the short term — i.e., between now and the presidential election—prices would need to fall back to pre-Biden levels. The average US gas price in January 2021 when Biden took office was $2.42 per gallon. Now it’s $3.95..”

• The Daunting Physics of ‘Bidenomics’ (Rall)

Democrats are confident enough about how things are going that “Bidenomics” is at the center of their case for another four years in the White House; however, this is a rosy picture few voters can see as Americans consistently give US President Joe Biden low marks for his handling of the economy. “I’ve never seen this big of a disconnect between how the economy is actually doing and key polling results about what people think is going on,” Heidi Shierholz, president of the Economic Policy Institute, a liberal think tank, told US media. What gives? Jason Furman, who served as chairman of the Council of Economic Advisers under the Obama White House, points to a yearslong trend that only ended recently: wages haven’t kept up with inflation, leaving the average worker $2,000 worse off than during the final year of the Trump presidency.

“The way to think about that is people were in an incredibly deep hole because of inflation and we’re still not all the way out of that hole,” Furman says. The problem for Biden is, what people would need to have happen in order to feel that inflation was truly behind them would be horrible for the economy – not to mention his prospects for reelection: deflation. During our lifetimes, ideal economic conditions in a healthy economy feature an annual official inflation rate in the single digits, a policy economists call inflation targeting. Prices rise, but if wages go up even faster employees are happy. Low inflation incentivizes consumers to buy sooner rather than later, when prices will be higher. But, as Furman points out, that hasn’t been the case lately. Airfares went up 28.5% in 2022. Butter rose 31.4%. Eggs a whopping 59.9%. So we’re displeased.

What will it take to convince voters that inflation is no longer a problem? In the short term — i.e., between now and the presidential election—prices would need to fall back to pre-Biden levels. The average US gas price in January 2021 when Biden took office was $2.42 per gallon. Now it’s $3.95. The Federal Reserve’s efforts to reduce inflation appear to be working. Prices are rising at a slower rate and that’s the problem for Democrats. Mechanical physics provides a helpful parallel. Many economists and political analysts seem to think of inflation rate as analogous to velocity. In their view, reducing the inflation rate from 8% to 3% is a victory for inflation-targeting fiscal policy. Indeed, if a 3% inflation rate (coupled with wages that rise faster than 3%) remains in effect indefinitely, people will eventually feel good (or less bad) about the economy. As the economist John Maynard Keynes observed a century ago, however, “in the long run, we will all be dead.” And the Democrats’ calendar is much shorter than that, a mere 14 months.

Before inflation-affected consumers can be persuaded to tap their feet to “Happy Days Are Here Again,” they’ll have to pass through several stages of recovery. First, they’ll feel less bad. Then comes meh. Penultimately, they’ll see themselves paying off credit card and other debts they ran up during the inflationary period. Only after those lingering financial hangovers are past will they be able to achieve what feels like the final stage, prosperity: earning enough to pay one’s bills while setting a surplus aside in the form of savings. With Americans’ credit card debt hitting the staggering benchmark of $1 trillion and rising, we are currently in the “less bad”/”meh” stage. But it’s hard to see what Biden or the Fed or anyone else can do in order to promote a sunnier view of the economy.

A lower inflation rate—even an ideal one in the low single digits—still means higher prices. We will probably not see $2.42 per gallon gas, the price in early 2021, any time soon, if ever. Gas prices will likely continue to increase to $4.00 and $4.05 and $4.10 and on and on and on, adding minor injury to gaping wound.

“..So 2024 can’t come soon enough for most of us.”

• World Is ‘Laughing At’ The US – Alaska Governor (RT)

The US government’s decision to cancel oil and gas drilling licenses and forbid further drilling will “hobble” the country’s economy and makes no sense except to advance the green agenda, Alaska Governor Mike Dunleavy has declared. President Joe Biden’s administration on Wednesday canceled seven ten-year oil and gas drilling licenses granted to the Alaska Industrial Development and Export Authority (AIDEA) by former President Donald Trump. Biden’s Department of the Interior followed up this decision by issuing a proposal to forbid future leases on more than 40% of the National Petroleum Reserve in Alaska.

Biden said that these two measures “will help preserve our Arctic lands and wildlife,” adding on Saturday that he would “continue to take bold action to meet the urgency of the climate crisis and to protect our lands and waters for generations to come.” Speaking to Fox News on Thursday, Dunleavy said that “this makes absolutely no sense from any perspective unless your goal is to drive up the cost of oil and gas so much that it makes certain renewables cheaper.” Dunleavy, a Republican, claimed that Russia, China, Saudi Arabia, and Iran are “laughing” at Biden’s energy policy. “They’re laughing together at the United States of America,” the governor said. “I can’t find anywhere in, really the history of nation-states or empires, where they worked at hobbling themselves to such a degree that’s happening currently with this administration. So 2024 can’t come soon enough for most of us.”

Gasoline prices have soared under Biden, reaching a record average high of just over $5 per gallon last June, up from around $2 when the president took office. Prices began to rise when Biden signed an executive order in January 2021 banning new oil and gas licenses on federal land, and spiked as the conflict in Ukraine rocked global energy markets. Ahead of last year’s midterm elections, Biden attempted to stabilize gasoline prices by draining the US’ strategic petroleum reserve, and by unsuccessfully lobbying the Saudi-led Organization of Petroleum Exporting States to cut production. The AIDEA argues that Biden has no legal right to rescind existing drilling licenses and told Fox News that it intends to challenge the decision in court.

“..Roughly 50% of price increases in the region resulted from local companies passing higher costs on to consumers..”

“..growth in corporate profits accounted for 45% of inflation in Europe last year..”

• ‘Greedflation’ Ravaging Western Europe – Nikkei (RT)

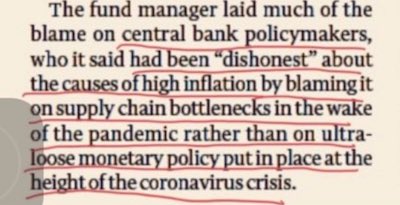

Inflation continues to rage in Western Europe, with monthly consumer prices soaring by over 14% in the UK and more than 10% in Germany, according to a Nikkei report. Some retailers have been hiking prices out of proportion with their underlying costs, it claimed. Roughly 50% of price increases in the region resulted from local companies passing higher costs on to consumers, the outlet estimated. Consumption has slumped across the region as price increases have outpaced wage growth. Nikkei cited an analysis of annual results from 70 European food retail and manufacturing companies by the management consultancy Oliver Wyman, which reportedly found that absolute EBITDA (earnings before interest, taxes, depreciation and amortization) rose by 11% at food retailers and 12% at manufacturers in 2022, compared to the previous year. That growth was mostly driven by increased revenues.

“Companies in the food sector viewed the inflation context as an opportunity to review their price management,” Rainer Muench, partner at Oliver Wyman, was quoted as saying.

According to the IMF data, cited by Nikkei, growth in corporate profits accounted for 45% of inflation in Europe last year, higher than the 40% attributed to the higher cost of imports. A survey of households by the European Commission reportedly found the perceived rate of inflation over the past year has risen to 26% among low-income families, the highest in 20 years. Earlier this year, Bank of England Governor Andrew Bailey accused domestic retailers of driving ‘greedflation,’ claiming that certain businesses were “overcharging customers” as millions of families struggle to make ends meet. The BoE has also warned that British households and businesses need to accept that they are worse off and should stop asking for wage increases and pushing prices higher.

“I’m running against a larger challenge because I am facing an entire infrastructure that is against me, from my own party and Big Tech and the pharmaceutical industry.“

• Robert F. Kennedy Jr. Wants His Party Back (ET)

On a steamy summer morning, Robert F. Kennedy Jr. strode into a hotel conference room in Columbia, South Carolina, amid a barnstorming town hall tour of a state where Joe Biden won close to 49 percent of the vote in the 2020 Democratic primary. Mr. Kennedy spoke about his 2024 presidential campaign. Democrat pundits say he is a fringe candidate who spreads conspiracy theories. Polls show him with the highest favorability rating of any presidential candidate. There is no path for Mr. Kennedy to defeat President Biden, critics claim, despite questions about President Joe Biden’s age and mental fitness, low approval ratings, and surveys showing that Americans are concerned about the economy. Earlier this year, the Democratic National Committee voted to give its full support to the president.

Mr. Kennedy agrees that unseating an incumbent president in the same party is a daunting challenge but disagrees with doubters who say he has no chance of securing the nomination. The 2024 presidential nominee will be announced during the Democratic National Convention in Chicago next summer. Until then, Mr. Kennedy intends to continue to press his case. “The DNC has around $2 billion, and they’re spending that money generously to try to marginalize me in many ways, but I think most Democrats care about one thing more than anything else, which is to beat Donald Trump,” Mr. Kennedy told The Epoch Times. “I think President Biden cannot do that. I can.” Mr. Kennedy is the nephew of President John F. Kennedy, who was assassinated in 1963; and the son of Robert F. Kennedy, who was shot and killed after a campaign speech while running for president in 1968.

During his town halls and meet-and-greets, Mr. Kennedy tells stories from time spent with his uncle and father and connects them to his presidential campaign. He wants to continue his father’s legacy of uniting Americans from all economic classes and ethnic backgrounds. “I think we do that by telling the truth to people. My dad did it that way. He talked about uncomfortable issues but talked about the truth. I think people are tired of being lied to by the government, by the media,” Mr. Kennedy said. “My dad ran against an incumbent president in his own party (Lyndon B. Johnson) during a divisive time. I’m running against a larger challenge because I am facing an entire infrastructure that is against me, from my own party and Big Tech and the pharmaceutical industry.”

RFK

Who are these “rich men north of Richmond” that Oliver Anthony @AintGottaDollar sings about, and how have they made it nearly impossible for the average American to afford a home? pic.twitter.com/gIGg4CBN89

— Robert F. Kennedy Jr (@RobertKennedyJr) September 9, 2023

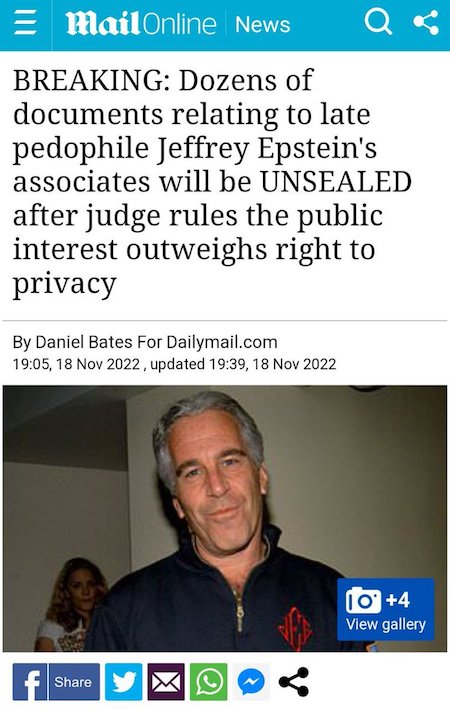

“..because I refused to lie about President Trump it cost me twenty-two years of my life.”

• Proud Boys Leader Enrique Tarrio Drops Bombshell (GP)

“They asked me to LIE about President Trump in order to indict him,” Enrique Tarrio exclusively told the Gateway Pundit. “I told them to pound sand, and because I refused to lie about President Trump it cost me twenty-two years of my life.” “The truth is, I could have been home,” said Tarrio. “I could have been home a long time ago. I could be in my warm ass bed right now, laughing at the world, without a problem…and all I had to do in order to do that WAS LIE ABOUT TRUMP. All I had to do was confirm a lie.” Tarrio opened up to the Gateway Pundit after he was sentenced to decades in prison by the Dishonorable Judge Kelly on Tuesday.

He told us that the prosecutors in the Department of Justice attempted to coerce him into signing a false statement that would implicate President Trump by swearing that “through several degrees of separation and connections, Tarrio had communicated with Trump regarding ‘plans’ for January 6th.” On Friday night The Gateway Pundit held a Twitter space with Enrique Tarrio as special guest. TGP reporters Cara Castronuova and Alicia Powe organized Friday night’s Twitter Space. During Friday night’s Twitter Space Enrique Tarrio repeated his accusations against the Biden regime. Later in the discussion Enrique disclosed two names of Biden officials who were in the meeting when he was pressured by federal agents to lie about President Trump.

Enrique Tarrio announced two DOJ officials who were in the room during this meeting: ** DOJ Lead Prosecutor Jocelyn Ballantine ** Assistant US Attorney Jason McCullough Jocelyn Ballantine was a DOJ attorney staffed on General Michael Flynn’s prosecution. The DOJ admitted to altering evidence in Flynn’s case and the government eventually dropped the case against General Flynn. Ballantine was caught lying during a DOJ investigation of Strzok and McCabe. She still holds a job as a top official in Merrick Garland’s DOJ.

https://twitter.com/i/status/1700542330682347608

No, not “climate change”. Tourism. In Athens, numbers of visitors to the Acropolis are being limited. New York City is severely cutting into AirBnB rentals.

• Japan’s Mount Fuji ‘In Real Crisis’ – Officials (RT)

Mount Fuji, one of Japan’s sacred mountains and a popular pilgrimage site, could become less attractive if the number of tourists is not brought under control, the local authorities warn. “Fuji is screaming in pain. We can’t just wait for improvement,” Masatake Izumi, a Yamanashi prefectural government official, told CNN during a tour for foreign media on Saturday, adding that “overtourism” needs to be tackled urgently. Izumi was quoted by Reuters as saying that “Fuji faces a real crisis” because of the “uncontrollable” flow of tourists. “We fear that Mount Fuji will soon become so unattractive, nobody would want to climb it,” he said.

According to government officials, the post-Covid tourism boom has brought thousands of hikers to the mountain, causing environmental damage and placing extra pressure on the first aid services. Despite the introduction of a campaign urging visitors not to litter, with volunteers removing tons of trash each year, both hikers and caretakers complain about overcrowding and the piles of litter left along the path. Mount Fuji ranger Miho Sakurai told reporters that there are “way too many people on Mount Fuji at the moment,” including many inexperienced “first timers,” often underdressed, poorly equipped, and prone to hypothermia or altitude sickness. As a result, rescue requests have increased by 50% from last year and one person died in April in a climbing accident.

An active volcano known for its picturesque snowcap and one of Japan’s national symbols, the mountain was recognized as a UNESCO World Cultural Heritage site in 2013. The number of visitors to Fuji more than doubled between 2012 and 2019 to 5.1 million, according to CNA news agency. This week, government officials met to discuss “overcrowding and breaches of etiquette” across high-traffic tourist spots, with Yamanashi Governor Kotaro Nagasaki proposing the construction of a light railway to control the number of people accessing the site. “We need a shift from quantity to quality when it comes to tourism on Mount Fuji,” Nagasaki said. A local ranger called the prospect of Mount Fuji losing its heritage status “devastating.”

Kids having fun

https://twitter.com/i/status/1700240513838760320

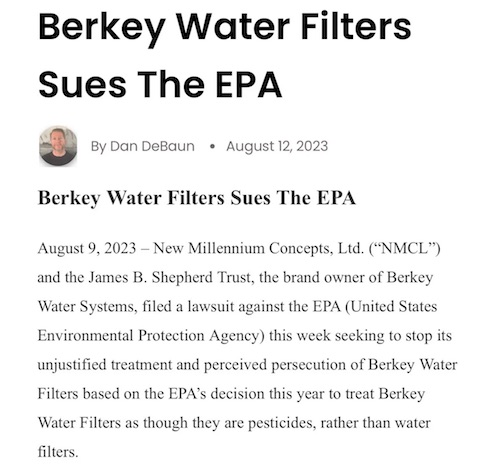

Water filters are now labeled “pesticides” (because they contain silver).

Elephants

https://twitter.com/i/status/1700575172858675668

Tuna

Tuna are strong, fast swimmers: some of them can swim at about 46 mph (74 km/h).

Watch this one: it doesn't even disturb the surface of the waterpic.twitter.com/VvtuMl77WT

— Massimo (@Rainmaker1973) September 9, 2023

CGI

Is this cgi or a real insect? pic.twitter.com/j2Fky3kunP

— The World Of Funny (@TheWorldOfFunny) September 9, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.

Pieter Bruegel the Elder The Fall of Icarus 1558

Japan vaccine

Prof. Fukushima at Press Conference. (No.1)

"This is not drug harm. To be clear, the vaccine is not a drug, but a bioweapon with all kinds of toxicity. So many people have died because of distribution of the bioweapon. It's a massacre. It's a Holocaust."Prof. Fukushima’s… https://t.co/TUIe0YLsp6 pic.twitter.com/1WbLapo2se

— You (@You3_JP) September 8, 2023

Hoax

The human-induced climate change hoax is a trojan horse through which unelected globalist bodies such as the United Nations, are attempting to seize totalitarian control over every minute detail of our lives, under the pretext of "saving the planet".

From the documentary,… pic.twitter.com/W3ILz4XziB

— Wide Awake Media (@wideawake_media) September 9, 2023

Obama Minimize

https://twitter.com/i/status/1700313493428228549

DARPA McCullough

The U.S. Government, Not Pfizer or Moderna, First Envisioned mRNA Technology

Back in 2012, DARPA began investing in gene-encoded vaccines.

So, the military came up with the idea of messenger RNA vaccines, not Pfizer or Moderna – not operation warp speed pic.twitter.com/vMnSQz75eN

— illuminatibot (@iluminatibot) September 9, 2023

Macgregor

The people that control your financial markets, institutions and the people that control your main stream media, they now control your governments.

— Douglas Macgregor (@DougAMacgregor) September 10, 2023

Excellent conversation.

“Tony, look at a map,” and just look at the progress that “has not been made by Ukraine..”

• Wrongheaded US Leadership in Ukraine – Larry Johnson, Ray McGovern, Nap (Sp.)

The United States is blatantly lying about the botched Ukrainian counteroffensive, former CIA analyst Larry Johnson said in an interview with Judge Andrew Napolitano on his Judging Freedom podcast. “Tony, look at a map,” and just look at the progress that “has not been made by Ukraine,” said the retired CIA intelligence officer and State Department official, as he commented on recent remarks made by US Secretary of State Antony Blinken in Kiev. During his unannounced visit to the Ukrainian capital, Blinken, standing alongside Ukrainian President Volodymyr Zelensky, touted that the Ukrainian military had made “real progress” in its counteroffensive in the “last few weeks.” The Ukrainian president’s assessment of the battlefront developments “matches our own,” continued Blinken, who went over to Kiev to pledge a new aid package for Ukraine worth over $1 billion.

In fact, “Russia has been steadily pushing to the [west],” Johnson said, pointing out that the battle of Artemovsk was the “last big conflict” on the battlefront that Ukraine’s military was engaged in. “They [the US] don’t understand Russian defensive tactics,” Johnson emphasized. In May 2023, the Russian military liberated Artemovsk (also known as Bakhmut), a Donbass city reduced to ruins in over eight months of brutal house-to-house fighting. The Artemovsk operation destroyed tens of thousands of Ukrainian troops and foreign mercenaries, while Russia built up its reserves and prepared defenses in Donbass, Zaporozhye, and Kherson for Kiev’s much-heralded summer offensive

“Americans have been had,” added Ray McGovern, a former top US intel analyst, who also joined the Judging Freedom podcast. He pointed out that, “Billions of money had gone to Ukraine, with a lot of it syphoned off.” He told the host that America was “losing” in the proxy war against Russia in Ukraine. Nevertheless, senior-level members of the US intelligence community continue “to delude themselves, their colleagues, the press, and the public,” regarding the actual developments on the ground, specified Larry Johnson. These officials refused to wake up to the reality that Ukraine was experiencing “shortage of ammunition, shortage of manpower, trouble recruiting people,” etc.

“What distinguishes Umerov is that he was a key negotiator at the peace talks with Russia in Istanbul last year in March, which actually resulted in an agreed document … Again, he was instrumental in negotiating the Black Sea Grain Initiative..”

• Ice Cracking Sounds On Frozen Lake of US-Russia Relations (Bhadrakumar)

Meanwhile, on September 6, Blinken embarked on quite an untypical visit to Kiev. There was no fire in his belly. For once, he didn’t threaten Russia or ridicule Putin from Ukrainian soil. Nor did Blinken show much enthusiasm for Kiev’s counteroffensive. Rather, his focus was on the war’s horrific trail causing human suffering, Ukraine’s post-conflict recovery as a democracy and its economy’s reconstruction. Blinken said repeatedly that he was undertaking the visit on Biden’s instruction. In the presence of President Zelensky, Blinken stated:

“We are determined in the United States to continue to walk side by side with you. And President Biden asked me to come, to reaffirm strongly our support, to ensure that we are maximising the efforts that we’re making and other countries are making for the immediate challenge of the counteroffensive as well as the longer-term efforts to help Ukraine build a force for the future that can deter and defend against any future aggression, but also to work with you and support you as you engage in the critical work of strengthening your democracy, rebuilding your economy.”

Stirring words, but there was no boastful talk of liberating Crimea, carrying the fight into the Russian camp or forcing Russia to vacate the annexed territories and negotiating with Russia only from a position of strength. At Blinken’s joint press availability with Ukrainian Foreign Minister Dmytro Kuleba, the latter claimed that they had a “substantive” discussion on providing long-range rockets, ATACMS to Kiev. But Blinken sidestepped the topic. The most unusual thing about Blinken’s visit was that it spilled over to a second day. This must be the first time Blinken spent a night in Ukraine. Blinken had a rather tight schedule on the first day meeting Kuleba, Zelensky and Prime Minister Denis Shmigal, but the itinerary for the second day [September 7], was left open. Obviously, he came to Kiev for some serious discussions.

Conceivably, Biden could be interested in starting peace talks between Moscow and Kiev now that the Ukrainian counteroffensive has failed to meet its politico-military objectives, and there are worrisome signs of support waning in America and Europe for the proxy war, while a Russian offensive could deal a knockout punch on Ukraine’s military. Both Russian and western estimates are that close to 65-70,000 Ukrainian soldiers were killed in these past 3 months alone since Kiev’s “counteroffensive” began. Meanwhile, in an interesting coincidence, on September 6, Ukraine’s parliament Verkhovna Rada approved the appointment of Rustem Umerov as the new Defence Minister replacing Alexei Reznikov. A Crimean Tatar born in Uzbekistan (USSR), Umerov has no previous military background. But he is trusted by Zelensky and is acceptable to the Americans.

What distinguishes Umerov is that he was a key negotiator at the peace talks with Russia in Istanbul last year in March, which actually resulted in an agreed document (from which Zelensky subsequently retracted under Anglo-American pressure.) Again, he was instrumental in negotiating the Black Sea Grain Initiative (so-called grain deal between Ukraine and Russia) which became operational in July last year at Istanbul. These are straws in the wind that must be duly noted.

Even RT gets it upside down: “..secretly instructed engineers to turn off coverage..” No, he did not. There was never any coverage to be shut down. He declined to activate it.

• Musk Talked To Russian Ambassador Before Starlink Decision – WaPo (RT)

SpaceX CEO Elon Musk spoke to Russia’s ambassador to the US, Anatoly Antonov, before making the decision to switch off his Starlink satellite internet service in Crimea last September to thwart a Ukrainian attack on the peninsula, the Washington Post has reported. On Thursday, the paper published more details about Musk cutting Starlink coverage to prevent a Ukrainian seaborne drone strike on the Russian Black Sea Fleet base in Sevastopol. The events that occurred have been described in a biography of the tech billionaire by historian Walter Isaacson that is due to hit shelves next week. With Kiev’s forces poised to launch their attack, Musk spoke with Antonov, who told him that a strike on Crimea, which became part of Russia after a referendum in 2014, “could lead to a nuclear response” by Moscow, Isaacson said in his book.

“In later conversations with a few other people, he [Musk] seemed to imply that he had spoken directly to [Russian] President Vladimir Putin, but to me he said his communications had gone through the ambassador,” the historian wrote. According to Isaacson, Musk concluded that “allowing the use of Starlink for the attack… could be a disaster for the world.” He therefore took matters into his own hands and secretly instructed engineers to turn off coverage within 100km of the Crimean coast. As a result of the move, the six explosive-laden Ukrainian drones, which relied on Starlink for navigation, “lost connectivity and washed ashore harmlessly.” Musk started receiving “frantic” calls from Kiev as soon as the Ukrainians realized that the satellite service wasn’t working.

They tried to explain to the billionaire that the drones were “crucial to their fight for freedom,” but Musk still refused to switch Starlink back on. He argued that Ukraine was “going too far and inviting strategic defeat” by targeting Crimea, Isaacson wrote. The historian also claimed that Musk had discussed the situation with US National Security Adviser Jake Sullivan and Chairman of the Joint Chiefs of Staff General Mark Milley, explaining to them that he didn’t intend for Starlink to be used for offensive purposes. Musk provided a slightly different account of events in a series of posts on X (formerly Twitter), saying that Starlink was never active around Crimea and that he simply turned down Ukrainian calls to provide coverage in the area.

“If I had agreed to their request, then SpaceX would be explicitly complicit in a major act of war and conflict escalation,” he argued. Commenting on revelations from Isaacson’s book, Mikhail Podoliak, a senior aide to Ukrainian President Vladimir Zelensky, said that Musk’s decision was the result of “a cocktail of ignorance and big ego.” The billionaire “committed evil” by allowing the Russian fleet to continue striking Ukrainian targets with Kalibr missiles, he claimed. Former Russian President Dmitry Medvedev, who now serves as deputy head of the country’s Security Council, described Musk as “the last adequate mind in North America” for preventing a strike on Crimea.

It’s going to take many years.

• Musk: US Military Vulnerability Due to Slow Production Rate, Like Ukraine (Sp.)

US military vulnerability primarily “stems from the slow pace of production,” American entrepreneur and billionaire Elon Musk has pointed out. The tech guru took to his social media platform X (formerly Twitter), to comment on last year’s post by the company Anduril Industries. On its five-year anniversary, the military technology company had argued the need for a joint effort if it was expected to “transform US and allied military capabilities with advanced technology.” We need “a new group of defense technology companies to Reboot the Arsenal of Democracy,” the firm had stated. The entrepreneur also emphasized that making new prototypes is easy, but putting them into production is hard.

This comes as the third month of Ukraine’s botched counteroffensive has wrapped up, with the Kiev regime unable to boast any significant military gains, while US stockpiles of munitions are getting “dangerously low”. As of August 30, 2023, Ukraine has reportedly lost 466 airplanes, 247 helicopters, 6,234 unmanned aerial vehicles, 433 air defense missile systems, 11,570 tanks and other armored fighting vehicles, 1,146 fighting vehicles equipped with MLRS, 6,128 field artillery cannons and mortars, as well as 12,528 special military motor vehicles since the beginning of the special military operation.

Meanwhile, the US unveiled the latest military package for the Kiev regime, worth $250 million, late in August, including AIM-9M missiles for air defense, munitions for High Mobility Artillery Rocket Systems (HIMARS), 155mm and 105mm artillery ammunition, mine-clearing equipment, Javelin and other anti-armor systems and rockets, three million rounds of small arms ammunition, as well as other items. However, by continuing to funnel military aid to Kiev the US is reportedly fast-depleting its own military caches of various weapons. Thus, depletion of US stockpiles of 155mm artillery shells (for howitzer use) was recently cited in a US report, with the additional revelation that Washington was sending Kiev 155mm and 105mm shells for the simple reason that it no longer had adequate stockpiles of 155mm shells.

“..high-level radioactive waste contaminants can be found in uranium waste streams that then get made into depleted uranium.”

• NATO’s DU ‘Perfect Storm’ of Toxic Pollution in Breadbasket Ukraine (Tweedie)

NATO-supplied depleted uranium (DU) rounds will contaminate Ukraine’s ‘breadbasket’ grain-growing regions with radioactive waste, a nuclear watchdog has warned. This week the US followed the UK in announcing the supply of the controversial armor-piercing rounds for the M1 Abrams tanks it is supplying to the Kiev regime. British Challenger 2 tanks equipped with DU penetrators have already seen action in the Zaporozye region — with at least one meeting a fiery end. Depleted uranium is the left-over material from the enrichment process used to make fuel rods for nuclear power reactors and — at higher levels — elements of nuclear weapons. The concentration of fissile uranium-235 isotope in depleted uranium is about 0.3 percent, 40 percent of the level of element in its unenriched state, but it still emits around 60 percent as much atomic radiation as natural uranium.

Most of that is in the form of alpha particles from U-238 and U-234 — the most harmful form of radiation if ingested into the body — with beta particles given out by decay products that form within a few weeks. Watchdog Kevin Kamps told Sputnik that US national security spokesman John Kirby’s claim that DU penetrator rods were not radioactive or carcinogenic was simply not true. “Depleted uranium munitions are really intended to be armor piercing. They can bust tanks, they can penetrate through concrete,” Kamps explained. “It’s because they’re so dense. Uranium is the densest isotope an element on the periodic table.” The harmful nature of DU is well understood, the expert pointed out. “Uranium in nature is hazardous to begin with,” Kamps said. “It’s a toxic heavy metal. It is what they say as mildly radioactive, which is kind of a misnomer, radioactivity is hazardous even in mild form.”

He added that DU is often mixed with radioactive waste from nuclear power plants. “In both the United States, where this depleted uranium munitions is coming from, but also in other countries, there’s a mixing of uranium waste streams off of the enrichment process,” Kamps noted. “And what that can often mean is high-level radioactive waste contaminants can be found in uranium waste streams that then get made into depleted uranium.” What makes DU even more toxic is its pyrophoric properties — the material ignites on hitting its target, as well as pulverizing into microscopic dust from the near-hypersonic velocity impact. “It’s kind of the perfect storm of hazard. You’ve got toxic heavy metal, you’ve got radioactivity that can be contaminated with much higher level radioactivity from high-level radioactive waste,” Kamps stressed. “And then it turns into a fine dust that you can breathe in, that blows on the wind, that settles on the water and flows downstream and downwind and harms people and other living beings all along the way.”

I posted Justin Hart’s tweet yesterday, with a long list of officials affected by the decision. Will they stop?

WOW. 5th Circuit court JUST UPHELD Missouri v Biden and ruled that the following people CAN:

1) NO LONGER CENSOR YOU

2) NO LONGER FLAG YOUR POSTS

3) NO LONGER DICTATE SOCIAL MEDIA POLICIES

4) NO LONGER COMMUNICATE WITH THESE COMPANIES TO CENSOR YOU

5) NO LONGER WORK WITH…— Justin Hart (@justin_hart) September 8, 2023

• Biden Admin Likely Violated 1st Amendment On Social Media: 5th Circuit (ZH)

The 5th Circuit Court of Appeals ruled on Friday that several Biden administration officials had likely breached the First Amendment by pressuring social media companies to moderate or take down content they deemed problematic. And here is Exhibit A of that First Amendment-crushing coercion and collusion… which obviously began in the Trump-era under Anthony Fauci. ZeroHedge was banned from Twitter one day after this email. In an unsigned 75-page opinion, three 5th Circuit judges agreed with the plaintiffs that the administration “ran afoul of the First Amendment” by at times threatening social media platforms with antitrust action or changes to law protecting them from liability.

However, as The Epoch Times’ Aldgra Fredly reports, the three-judge panel of the New Orleans-based 5th U.S. Circuit Court of Appeals narrowed much of an injunction issued by a Louisiana judge that restricted Democratic President Joe Biden’s administration from communicating with social media companies. The court said that the White House, Surgeon General, Centers for Disease Control and Prevention (CDC), and the FBI “likely coerced or significantly encouraged social media platforms to moderate content” in violation of the First Amendment. “It is true that the officials have an interest in engaging with social media companies, including on issues such as misinformation and election interference,” the three-judge panel said in a 74-page ruling (pdf) on Sept. 8. “But the government is not permitted to advance these interests to the extent that it engages in viewpoint suppression,” they added.

The court found that the officials made “express threats” and “inflammatory accusations” by saying that the platforms were “poisoning the public” and “killing people.” The platforms were told they needed to take “greater responsibility and action.” “Then, they followed their statements with threats of ‘fundamental reforms’ like regulatory changes and increased enforcement actions that would ensure the platforms were ‘held accountable’. But, beyond express threats, there was always an unspoken ‘or else,'” it added. The court also said the officials encouraged social media platforms to moderate content by “exercising active, meaningful control over those decisions,” particularly concerning the platforms’ moderation policies.

According to the ruling, the FBI “regularly met with the platforms, shared ‘strategic information,’ frequently alerted the social media companies to misinformation spreading on their platforms, and monitored their content moderation policies.” “But, the FBI went beyond that—they urged the platforms to take down content. Turning to the Second Circuit’s four-factor test, we find that those requests were coercive,” it added. The judges emphasized that the government cannot supervise a platform’s content moderation decisions and cannot impose “legal, regulatory, or economic consequences” if they refuse to comply with a given request. “Social media platforms’ content-moderation decisions must be theirs and theirs alone,” the court asserted.

The attorneys general of Louisiana and Missouri, along with several social media users, had sued last year, saying Facebook, YouTube, and Twitter engaged in censorship as a result of repeated urging by government officials and threats of heightened regulatory enforcement. The lawsuit said the censored views included content questioning anti-COVID-19 measures such as masks and vaccine mandates and allegations of election fraud.

Watters 5th circuit

A bombshell ruling by the 5th circuit court today, finding the Biden White House, the FBI and the CDC violated the First Amendment rights of millions of Americans… pic.twitter.com/YYWuXs3HcQ

— Jesse Watters (@JesseBWatters) September 9, 2023

Not going to happen.

• Ukraine Will Be Ready To Join EU In Two Years – Kiev (RT)

Ukraine should be ready to become an EU member in the next two years, Deputy Prime Minister Olga Stefanishina told Voice of America on Friday. As Kiev’s official responsible for “European and Euro-Atlantic integration,” she says her nation is one of the “best prepared” for such a step. “I believe that two years would be enough for full preparedness,” Stefanishina said, when asked about Ukraine’s EU prospects. She also vowed to do “10 times more than we do now” to achieve the goal once the conflict with Moscow ends. However, the minister admitted that the timeline would ultimately be determined by the “course of war.”

According to Stefanishina, Ukraine remains one of the “best prepared [nations] for the EU accession” since it is “a big part of the European economy” even in the midst of armed conflict. The country is one of the EU’s “top 20” import partners and the Ukrainian domestic market is “the biggest” on the territory of Europe, she stated. At the same time, she admitted that Ukraine’s economic role in the EU would remain largely agricultural. “With all those agricultural lands… there can be no reality, in which Ukraine stops being an agrarian country,” she said. The bloc itself has been in no rush to accept Kiev into its ranks. EU officials have refused to set specific timelines for Ukraine’s accession, saying that it must first address issues such as rampant corruption and introduce comprehensive legal reforms. In 2022, France said that the process might eventually take years.

In early September, Austrian Foreign Minister Alexander Schallenberg warned that fast-tracking membership for Ukraine would spell “geostrategic disaster” since it would show that some nations are “more equal than others.” Former French President Nicolas Sarkozy also said on Friday that accepting the ex-Soviet republic into both the EU and NATO would increase Washington’s sway over the EU dramatically. Kiev might also join NATO even sooner than the EU, Stefanishina proposed, saying that the US-led military bloc would be happy to have a member with “one of the strongest armies” after, she said, it beats Moscow. The minister admitted, though, that Ukraine’s accession to the alliance is a “political decision,” while still maintaining that this decision was “taken in Vilnius,” which hosted the latest NATO summit.

Ukrainian President Vladimir Zelensky produced a scandal at the meeting in mid-July, when he condemned NATO for what he called “indecisiveness” over a lack of a clear roadmap for Kiev’s membership. He allegedly angered US officials to the extent that they briefly considered withdrawing Ukraine’s invitation to the bloc. Then British Defense Secretary Ben Wallace also criticized Kiev over its lack of gratitude for Western military aid, explaining that the US and its allies were “not Amazon.”

“I think that following Putin’s non-participation in this forum, our country’s exit from the organization is also possible. We must give preference to those platforms that can implement our projects and our ideas. BRICS can do this, the SCO can do this, but the G20 cannot ,” [Deputy Chairman of the Federation Council Committee Andrei] Klimov said.

• G20 Declaration On Ukraine A ‘Blow To Western Countries’ (Sp.)

The declaration of the G20 summit in India was a blow to the West, a British business newspaper reports, adding that this highlights the lack of global consensus in support of Kiev. The G20 leaders earlier in the day said in the New Delhi Summit Declaration that they had different views on and assessments of the Ukraine conflict during discussions of the issue, but all of them jointly call for respect for the UN Charter. “That statement, hammered out over weeks of negotiations between diplomats, is a blow to western countries that have spent the past year attempting to convince developing countries to condemn Moscow and support Ukraine,” the newspaper wrote. “The New Delhi summit declaration refers only to the ‘war in Ukraine’, a formulation that supporters of [Kiev] such as the US and NATO allies have previously rejected as it implies both sides are equally complicit,” the report added.

Russian G20 Sherpa Svetlana Lukash, meanwhile, emphasized that the declaration demonstrates the group’s balanced position on the Ukraine conflict and its intention to settle all conflicts around the world. “As for the Ukrainian case, I can say that the negotiations were very complex and, above all, the collective position of the BRICS countries and other partners has borne fruit … What we have been hearing all year, that the Ukrainian conflict is worsening the food security situation, is now reflected in a balanced way,” Lukash told journalists. Half of the group’s members refused to accept Western narratives, she said, adding that a “consensus language” had been used in the declaration. In addition, the G20 members have agreed to work jointly for peace, security, and conflict resolution around the world, Lukash said.

“At the beginning of 2022 it was hovering around 25%, now it is exceeding 80%.”

• Russia and China Have Effectively Ditched The Dollar – Moscow (RT)

The de-dollarization of Russia-China trade is practically complete, according to Georgy Zinoviev, the director of the Russian Foreign Ministry’s First Asian Department, as cited by RIA Novosti. The official said the share of the US dollar in mutual settlements between the neighboring nations has substantially shrunk over the past two years. “The share of national currencies in Russian-Chinese payments is growing at an extremely rapid pace,” Zinoviev told the news agency. “At the beginning of 2022 it was hovering around 25%, now it is exceeding 80%.” He added that the volume of trading in the ruble-yuan pair on the Moscow Exchange (MOEX) outpaced volumes in the dollar-ruble pair long ago. According to Zinoviev, Russian and Chinese businesses are “rapidly moving away from the ‘toxic’ Western currencies, opting for the ruble and yuan as more reliable and safe way of payment.”

The diplomat noted that Moscow and Beijing have developed vital tools to make it possible to “facilitate all necessary transactions as much as possible,” despite international political and economic instability that significantly affects financial institutions and their ability to efficiently operate. The changes reflect Russia’s move away from transactions in the currencies of ‘unfriendly countries’ against the backdrop of sanctions. Earlier this year, Finance Minister Anton Siluanov said the country no longer trusts the dollar, calling it “a completely unreliable instrument.” Zinoviev’s comments come ahead of the 8th Eastern Economic Forum, which kicks off on September 10 in Vladivostok, Russia. Most of the discussions at the annual event will focus on trade, business, and investment.

“..In the short term — i.e., between now and the presidential election—prices would need to fall back to pre-Biden levels. The average US gas price in January 2021 when Biden took office was $2.42 per gallon. Now it’s $3.95..”

• The Daunting Physics of ‘Bidenomics’ (Rall)

Democrats are confident enough about how things are going that “Bidenomics” is at the center of their case for another four years in the White House; however, this is a rosy picture few voters can see as Americans consistently give US President Joe Biden low marks for his handling of the economy. “I’ve never seen this big of a disconnect between how the economy is actually doing and key polling results about what people think is going on,” Heidi Shierholz, president of the Economic Policy Institute, a liberal think tank, told US media. What gives? Jason Furman, who served as chairman of the Council of Economic Advisers under the Obama White House, points to a yearslong trend that only ended recently: wages haven’t kept up with inflation, leaving the average worker $2,000 worse off than during the final year of the Trump presidency.

“The way to think about that is people were in an incredibly deep hole because of inflation and we’re still not all the way out of that hole,” Furman says. The problem for Biden is, what people would need to have happen in order to feel that inflation was truly behind them would be horrible for the economy – not to mention his prospects for reelection: deflation. During our lifetimes, ideal economic conditions in a healthy economy feature an annual official inflation rate in the single digits, a policy economists call inflation targeting. Prices rise, but if wages go up even faster employees are happy. Low inflation incentivizes consumers to buy sooner rather than later, when prices will be higher. But, as Furman points out, that hasn’t been the case lately. Airfares went up 28.5% in 2022. Butter rose 31.4%. Eggs a whopping 59.9%. So we’re displeased.

What will it take to convince voters that inflation is no longer a problem? In the short term — i.e., between now and the presidential election—prices would need to fall back to pre-Biden levels. The average US gas price in January 2021 when Biden took office was $2.42 per gallon. Now it’s $3.95. The Federal Reserve’s efforts to reduce inflation appear to be working. Prices are rising at a slower rate and that’s the problem for Democrats. Mechanical physics provides a helpful parallel. Many economists and political analysts seem to think of inflation rate as analogous to velocity. In their view, reducing the inflation rate from 8% to 3% is a victory for inflation-targeting fiscal policy. Indeed, if a 3% inflation rate (coupled with wages that rise faster than 3%) remains in effect indefinitely, people will eventually feel good (or less bad) about the economy. As the economist John Maynard Keynes observed a century ago, however, “in the long run, we will all be dead.” And the Democrats’ calendar is much shorter than that, a mere 14 months.

Before inflation-affected consumers can be persuaded to tap their feet to “Happy Days Are Here Again,” they’ll have to pass through several stages of recovery. First, they’ll feel less bad. Then comes meh. Penultimately, they’ll see themselves paying off credit card and other debts they ran up during the inflationary period. Only after those lingering financial hangovers are past will they be able to achieve what feels like the final stage, prosperity: earning enough to pay one’s bills while setting a surplus aside in the form of savings. With Americans’ credit card debt hitting the staggering benchmark of $1 trillion and rising, we are currently in the “less bad”/”meh” stage. But it’s hard to see what Biden or the Fed or anyone else can do in order to promote a sunnier view of the economy.

A lower inflation rate—even an ideal one in the low single digits—still means higher prices. We will probably not see $2.42 per gallon gas, the price in early 2021, any time soon, if ever. Gas prices will likely continue to increase to $4.00 and $4.05 and $4.10 and on and on and on, adding minor injury to gaping wound.

“..So 2024 can’t come soon enough for most of us.”

• World Is ‘Laughing At’ The US – Alaska Governor (RT)

The US government’s decision to cancel oil and gas drilling licenses and forbid further drilling will “hobble” the country’s economy and makes no sense except to advance the green agenda, Alaska Governor Mike Dunleavy has declared. President Joe Biden’s administration on Wednesday canceled seven ten-year oil and gas drilling licenses granted to the Alaska Industrial Development and Export Authority (AIDEA) by former President Donald Trump. Biden’s Department of the Interior followed up this decision by issuing a proposal to forbid future leases on more than 40% of the National Petroleum Reserve in Alaska.

Biden said that these two measures “will help preserve our Arctic lands and wildlife,” adding on Saturday that he would “continue to take bold action to meet the urgency of the climate crisis and to protect our lands and waters for generations to come.” Speaking to Fox News on Thursday, Dunleavy said that “this makes absolutely no sense from any perspective unless your goal is to drive up the cost of oil and gas so much that it makes certain renewables cheaper.” Dunleavy, a Republican, claimed that Russia, China, Saudi Arabia, and Iran are “laughing” at Biden’s energy policy. “They’re laughing together at the United States of America,” the governor said. “I can’t find anywhere in, really the history of nation-states or empires, where they worked at hobbling themselves to such a degree that’s happening currently with this administration. So 2024 can’t come soon enough for most of us.”

Gasoline prices have soared under Biden, reaching a record average high of just over $5 per gallon last June, up from around $2 when the president took office. Prices began to rise when Biden signed an executive order in January 2021 banning new oil and gas licenses on federal land, and spiked as the conflict in Ukraine rocked global energy markets. Ahead of last year’s midterm elections, Biden attempted to stabilize gasoline prices by draining the US’ strategic petroleum reserve, and by unsuccessfully lobbying the Saudi-led Organization of Petroleum Exporting States to cut production. The AIDEA argues that Biden has no legal right to rescind existing drilling licenses and told Fox News that it intends to challenge the decision in court.

“..Roughly 50% of price increases in the region resulted from local companies passing higher costs on to consumers..”

“..growth in corporate profits accounted for 45% of inflation in Europe last year..”

• ‘Greedflation’ Ravaging Western Europe – Nikkei (RT)

Inflation continues to rage in Western Europe, with monthly consumer prices soaring by over 14% in the UK and more than 10% in Germany, according to a Nikkei report. Some retailers have been hiking prices out of proportion with their underlying costs, it claimed. Roughly 50% of price increases in the region resulted from local companies passing higher costs on to consumers, the outlet estimated. Consumption has slumped across the region as price increases have outpaced wage growth. Nikkei cited an analysis of annual results from 70 European food retail and manufacturing companies by the management consultancy Oliver Wyman, which reportedly found that absolute EBITDA (earnings before interest, taxes, depreciation and amortization) rose by 11% at food retailers and 12% at manufacturers in 2022, compared to the previous year. That growth was mostly driven by increased revenues.