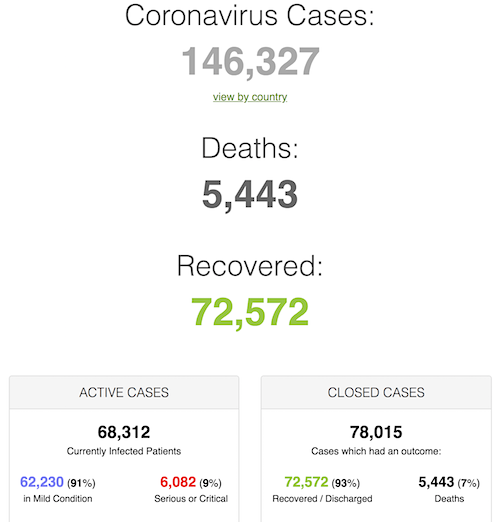

Yay! We’re setting records! Over 10,000 cases in one day, 2,547 of which in Italy, and 451 deaths, with 250 in Italy.

• Cases 146,327 (+ 10,518 from yesterday’s 135,809)

• Deaths 5,443 (+ 453 from yesterday’s 4,990)

Something went wrong with my usual snapshot from last night’s Worldometer numbers, so yesterday’s “gains” per country are lost. Apologies.

Trajectories are clear though. Spain is a country to watch, as are Denmark, Norway and Sweden. And Switzerland with 220 new cases today, and and and.

Other than that, economic policies are taking the spotlight, and especially the failures. The question arises: can the west do what it did in WWII, and confiscate production facilities?

Just as abhorrent to US “values”: Tulsi Gabbard and Bush economic adviser Greg Mankiw, separate from each other I think, want the US to give every citizen $1,000 a month to counter the corona fallout.

Can America as a nation unite, or is that ability forever lost? Because: if you give out that $1,000, will you allow your firms, say Big Pharma, to charge exorbitant prices for essentials?

In that same vein, Germany appears ready to abandon its long term fiscal prudence, and to drag Europe along for the ride.

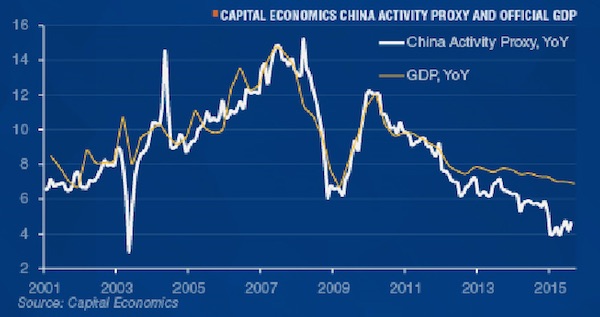

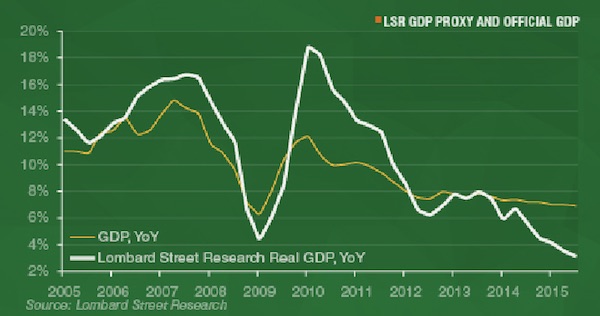

I changed the order of the graphs around a bit, SCMP is getting further behind all the time.

From Worldometer (NOTE: mortality rate is back up to 7%!)

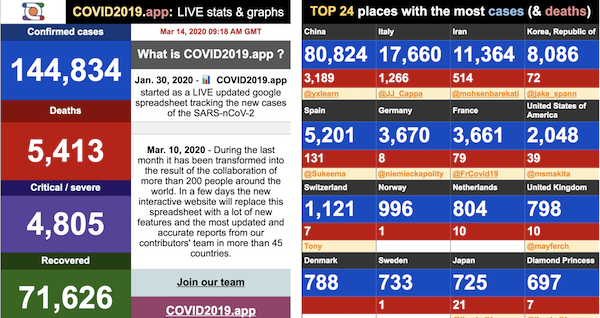

From COVID2019.app: (This site is playing with its formats while expanding, now over 200 global contributors)

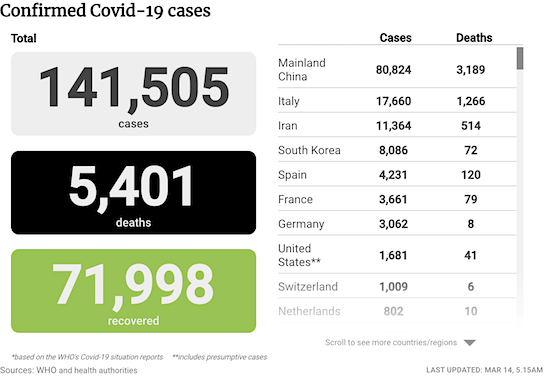

From SCMP: (Note: the SCMP graph was useful when China was the focal point; they are falling behind now)

Joshua Bach is a scary dude.

• “Flattening the Curve” Is A Deadly Delusion (Bach)

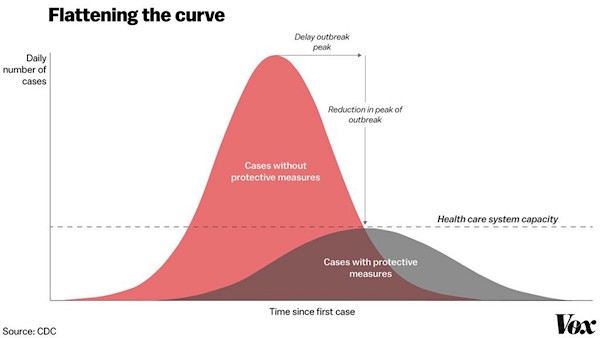

You have all seen a version of this curve of COVID-19 case loads by now:

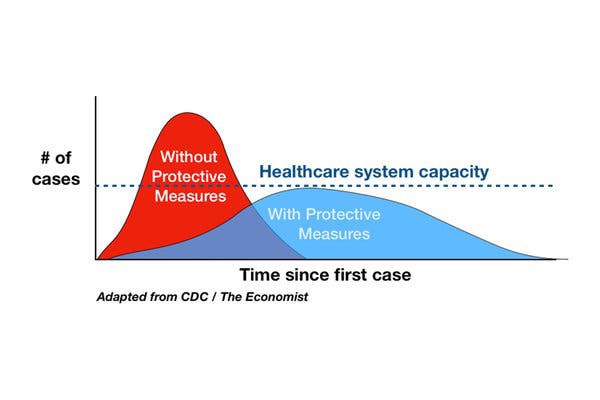

Or this one:

There are many more. What all these diagrams have in common: They have no numbers on the axes. They don’t give you an idea how many cases it takes to overwhelm the medical system, and over how many days the epidemic will play out. They suggest that currently, the medical system can deal with a large fraction (like maybe 2/3, 1/2 or 1/3) of the cases, but if we implement some mitigation measures, we can get the infections per day down to a level we can deal with. They mean to tell you that we can get away without severe lockdowns as we are currently observing them in China and Italy. Instead, we let the infection burn through the entire population, until we have herd immunity (at 40% to 70%), and just space out the infections over a longer timespan.

These suggestions are dangerously wrong, and if implemented, will lead to incredible suffering and hardship. Let’s try to understand this by putting some numbers on the axes. What is the capacity of the healthcare system? This is a difficult question and cannot be answered in a short post like this. The US has about 924,100 hospital beds (2.8 per 1000 people). California has only 1.8. Countries like Germany have 8. South Korea has 12. (Their hospital system got overloaded nonetheless.) Most of these beds are in use, but we can create more, using improvisation (for instance using hotels and school gyms) and strategic resources of the military, national guard and other organizations.

Based on Chinese data, we can estimate that about 20% of COVID-19 cases are severe and require hospitalization. However, many severe cases will survive if they can be adequately provided for at home (which may include oxygen, IVs and isolation). More important is the number of ICU beds, which by some estimates can be stretched to about a 100,000, and of which about 30,000 may be available. About 5% of all COVID-19 cases need intensive care, and without it, all of them will die. We can also increase the number of ICU beds somewhat, but the equipment that we need to deal with sepsis, kidney, liver and heart failure, severe pneumonia etc. cannot be stretched arbitrarily between them.

An important part of the equation are ventilators. Most of the critically ill COVID-19 cases die of an infection of the lungs that makes it impossible to breathe and even destroys so much tissue that the blood can no longer be sufficiently oxygenated. These patients need intubation and mechanical ventilation to give them a chance of survival, or even an ECMO machine, which oxygenates the blood directly. About 6% of all cases need a ventilator, and if hospitals put all existing ventilators to use, we have 160,000 of them. In addition, the CDC has a strategic stockpile of 8900 ventilators that can be deployed in hospitals that need them. If we take the number of ventilators as a proximate limit on the medical resources, it means we can take care of up to 170,000 critically ill patients at the same time.

How many people will get infected? Without containment, the virus becomes endemic, and leading epidemiologists like Marc Lipsitch (Harvard) and Christian Drosten (Charité Berlin) estimate that between 40% and 70% of the population get infected until we develop some degree of herd immunity. (Unfortunately, we do not know how long this immunity lasts. We already observe multiple strain of COVID-19, and will see many more, due to the large number of carriers.) In a population like the US (327 million), that means between 130 million and 230 million. Let’s assume that 55% of the US population (the middle ground) get infected between March and December, and we are looking at 180 million people.

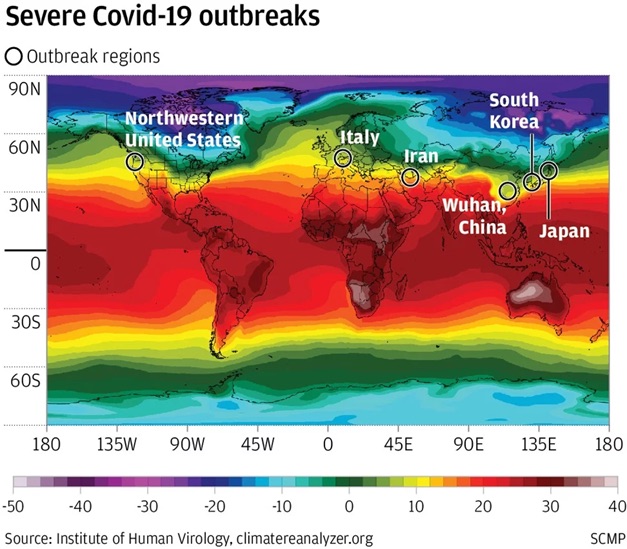

Saw that picture with the narrow yellow band before. But of course they still don’t agree on anything.

• Higher Temperatures Affect Survival Of New Coronavirus (Accu)

Research from a laboratory-grown copy of the coronavirus (SARS-CoV-2) that causes the COVID-19 illness shows that heat affects the virus and impacts its behavior, a top pathologist said new research has shown. But other infectious disease experts aren’t yet convinced. “In cold environments, there is longer virus survival than warm ones,” Hong Kong University pathology professor John Nicholls told AccuWeather exclusively. Nicholls and colleagues from a team at Sun Yat-sen University in Guangzhou, China, previously produced a study, which was published in February and has yet to be peer-reviewed, noting the effect of heat. Their research is based on one of the world’s first lab-grown copies of SARS-CoV-2.

“Temperature could significantly change COVID-19 transmission,” the authors note in the study. They also pointed out that the “virus is highly sensitive to high temperature.” On March 11, the World Health Organization officially declared the coronavirus outbreak a global pandemic. This is the first pandemic in 11 years, according to the Centers for Disease Control and Prevention (CDC). One recent research paper supported this assertion by pointing out the proximity of the major hotspots. The authors of the study, which was published last week, wrote that COVID-19 “has established significant community spread in cities and regions only along a narrow east-west distribution roughly along the 30-50 North latitude corridor at consistently similar weather patterns (5-11 degrees C [41 to 51 F] and 47-79 percent humidity).”

“Notably, during the same time, COVID-19 failed to spread significantly to countries immediately south of China,” the paper notes. “The number of patients and reported deaths in Southeast Asia is much less when compared to more temperate regions noted … The association between temperature in the cities affected with COVID-19 deserves special attention.” Some have suggested the possibility that weather factors might affect the virus – particularly the intensity and amount of hours of sunshine as well as heat and humidity. “Obviously, the virus is something we’ve never dealt with before, but if we look at other viruses … they all had their peak during the cold season,” said AccuWeather Founder and CEO Dr. Joel N. Myers.

“The statistics all show that they breed and survive longer when it’s cold and dry,” Myers said. “So, when it’s warmer and more humid and there’s a lot of sunshine, the statistics on all of the others show a virus is less lethal, it spreads less efficiently and less effectively among humans.” Dr. Joseph Fair, a virologist, epidemiologist and infectious disease specialist, suggested sunshine is a critical factor in subduing the virus. “It really doesn’t have anything to do with the warmth, but it has to do with the length of the day and the exposure to sunlight, which inactivates the virus through UV light,” Fair [said]. “We expect a dip in infections as we would see with the cold and flu in the spring and summer months.

But, he cautioned, “The science is still out. We can assume this will follow typical other coronavirus cases. We can expect a dip in the summer. But that doesn’t mean that we will be out of the woods … Everyone in the scientific and public health community expects it to be back in the fall and we expect to be in this for quite some time.”

Transmission electron microscope image shows SARS-CoV-2, the virus that causes COVID-19, isolated from a patient in the U.S. Virus particles are emerging from the surface of cells cultured in the lab. The spikes on the outer edge of the virus particles give coronaviruses their name, crown-like. (NIAID-RML)

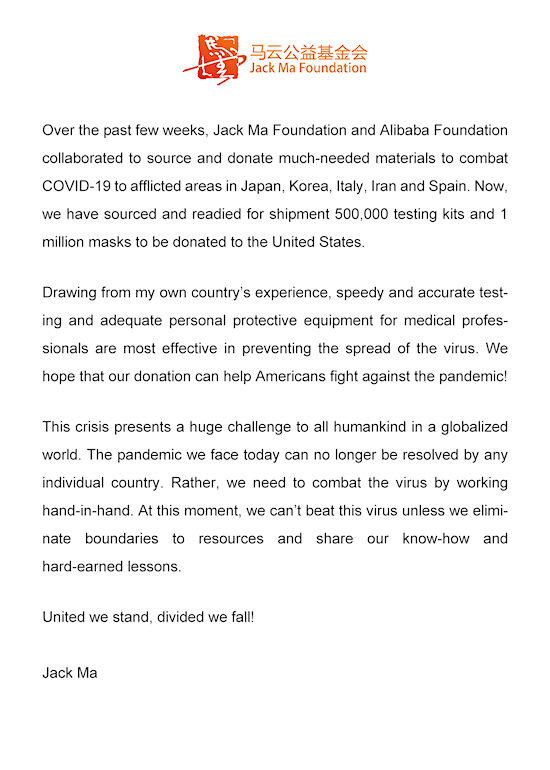

What a nation is capable of when it starts working together.

• South Korea’s Drive-Through Testing For Coronavirus Is Fast – And Free (NPR)

If you roll up to a drive-through COVID-19 testing center in South Korea, you might notice that safety procedures extend all the way to your car’s air conditioning. You will be advised to hit the recirculation button so that if you’re sick, you can keep your pathogens to yourself, in your car, and avoid infecting the medical personnel doing the testing. The test takes 10 minutes at most. Results are texted to you, usually the next day. And it’s free — paid for by the government. Drive-through centers have helped South Korea do some of the fastest, most-extensive testing of any country. And while nobody is claiming that South Korea has defeated the outbreak, experts credit the emphasis on testing with reducing case numbers and fatalities.

“I think our approach was right,” says professor Lee Hyukmin of the Yonsei University College of Medicine in Seoul. “We will continue to see sporadic infections,” he predicts. “But still, the situation in Daegu,” the epicenter of the outbreak, “is being stabilized.” South Korea has about 8,000 infections. Italy and Iran overtook it this week as the countries with the most cases outside of China. South Korea’s new cases have gradually declined since the end of last month. For the first time since Jan. 20, the number of patients released from treatment on Friday, March 13 — 510 — outnumbered the 110 new cases. A nation of 51 million, South Korea has tested about 250,000 people since its outbreak began on Jan. 20, with a daily capacity of 15,000. It has conducted 3,600 tests per million people compared to five per million in the U.S.

South Korea’s aggressive testing may make it unnecessary to impose the sort of lockdowns to which China and Italy have resorted, although health officials insist that all options remain on the table in dealing with the epidemic. “It’s much better to test and then quarantine a specific person than to do a citywide or provincewide lockdown, which in certain ways prevents the virus from leaving the province but actually doesn’t make the province any less likely to have high infection rates,” says Eric Feigl-Ding, a senior fellow at the Federation of American Scientists in Washington, D.C., and an epidemiologist at the Harvard Chan School of Public Health.

Just like Tulsi: “Greg Mankiw, a former top economic adviser to President George W. Bush, advocated sending $1,000 checks to everyone as soon as possible.”

• Nancy Pelosi, Trump Administration Reach Deal On Coronavirus Aid Package (NYP)

House Speaker Nancy Pelosi and the Trump administration reached a last-minute deal Friday on a sweeping coronavirus aid package that will provide free testing for all Americans. The “Families First Coronavirus Response Act” will guarantee free tests for all Americans, including the uninsured, and provide two weeks of paid sick leave for those affected by the health crisis, Pelosi said. It will also provide up to three months of paid family and medical leave and strengthened unemployment Insurance for those facing layoffs amid the health and economic crisis. The aid package will also strengthen food banks, seniors’ meals and the food stamps program, known as SNAP.

Pelosi and Treasury Secretary Steven Mnuchin had been locked in feverish negotiations as the crisis rapidly escalated — speaking up to seven times a day — and by Friday morning, senior Democrats were confident the package would pass the House by the end of the day. But the deal appeared to hit a snag when Trump on Friday declared a State of Emergency at the White House Rose Garden and announced he didn’t support the aid package. “We don’t think the Democrats are giving enough,” Trump told reporters. “We are negotiating. We thought we had something, but all of a sudden they didn’t agree to certain things that they agreed to,” he added, without specifying the sticking point.

The president has repeatedly demanded a payroll tax cut be included in the bill, something that has been met with tepid support from within his own administration. “We could have something but we don’t think they are giving enough. They are not doing what is right for the country,” he concluded. Pelosi was bullish about passing the bill on Friday, even though it now languishes until Monday when the Senate returns from a break, calling the health outbreak a “grave and accelerating challenge.” The new bill comes after Trump last week signed into law a separate $8.3 billion in emergency aid for states and local authorities to combat the spread of the virus.

https://twitter.com/i/status/1238516118391791617

Jim Bianco on Twitter:

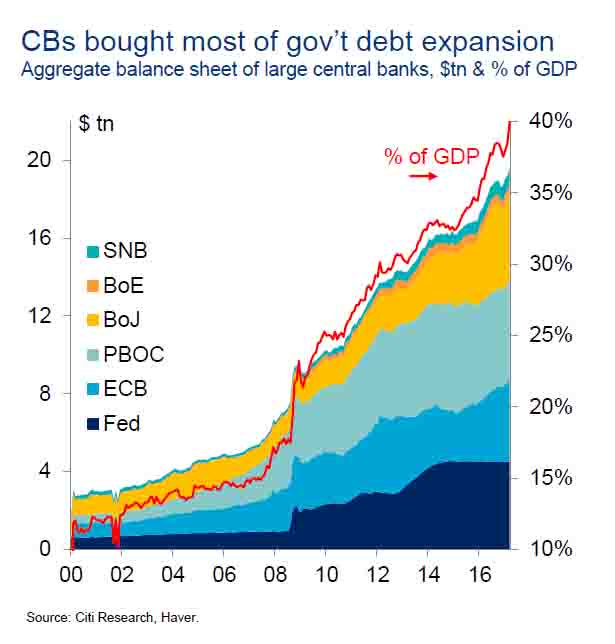

“German Gov’t will offer unlimited loans to all companies that want them. Will buy stakes in German Governments. Guaranteed every job in Germany. Said “no on will lose their job over a virus.” They are essentially asking all EU countries to do the same as Germany. Couple this with the Fed trillions, the ECB yesterday , the BOE wed and the BoJ overnight … Everyone is “all-in” to stop the decline. If this does not work, closing mkts might be all that is left.”

• EU Ready To Trigger Crisis Clause Allowing Fiscal Stimulus (BBG)

Denmark, Poland and Cyprus tightened their borders to limit the spread of the coronavirus even as European leaders called for more concerted action to contain the economic fallout. Germany, which borders two of those countries, pledged to spend whatever was necessary to protect its economy and the European Commission said it’s ready to green-light widespread spending after a market meltdown and a forecast that the euro zone was headed for recession. With Group of Seven policy makers struggling to forge a united front, the response from national capitals reflects the urgency to avoid the lockdown that hit Italy amid an epidemic that seemed to be spiraling out of control.

In Denmark, only Danes, Danish residents and green card holders will be let in. For everyone else, the country’s borders will be closed until April 14 and people arriving in Denmark will be sent back. “We’re painfully aware that this will have severe consequences,” Danish Prime Minister Mette Frederiksen said in Copenhagen on Friday, as she announced borders would close. “We can see how the situation in Italy developed in a catastrophic direction,” she said. “Everything we’re doing is to ensure that we get through this situation in a different way.” Likewise, Cyprus is closing its borders for 15 days to foreigners who don’t live or work on the Mediterranean island, President Nicos Anastasiades said in a televised address.

[..] The ability to travel without border checks has been a fact of life for more than two decades in most of Europe, with passport-free movement arguably the most successful feature of daily life for more than 400 million people in the EU. Officials in Brussels are accepting the new – if temporary – restrictions through gritted teeth. “General travel bans are not seen as being the most effective by the World Health Organization,” said Ursula von der Leyen, the president of the European Commission, the bloc’s executive arm. “Moreover, they have a strong social and economic impact. They disrupt people’s lives and business across the borders.”

Just hours earlier, German officials announced KfW, the state bank, can lend as much as €550 billion to companies to ensure they survive the pandemic and shield their workers from its impact. Switzerland pledged 10 billion francs ($10.5 billion) of aid for its companies. European stocks surged. “This is the bazooka,” Finance Minister Olaf Scholz. “We’re using it to do what is necessary. We’ll check later to see if we need additional smaller weapons.”

Suspect that unlike in WWII, US industry would be allowed to turn huge profits.

• Big Pharma Prepares To Profit From The Coronavirus (IC)

As the new coronavirus spreads illness, death, and catastrophe around the world, virtually no economic sector has been spared from harm. Yet amid the mayhem from the global pandemic, one industry is not only surviving, it is profiting handsomely. “Pharmaceutical companies view Covid-19 as a once-in-a-lifetime business opportunity,” said Gerald Posner, author of “Pharma: Greed, Lies, and the Poisoning of America.” The world needs pharmaceutical products, of course. For the new coronavirus outbreak, in particular, we need treatments and vaccines and, in the U.S., tests. Dozens of companies are now vying to make them.

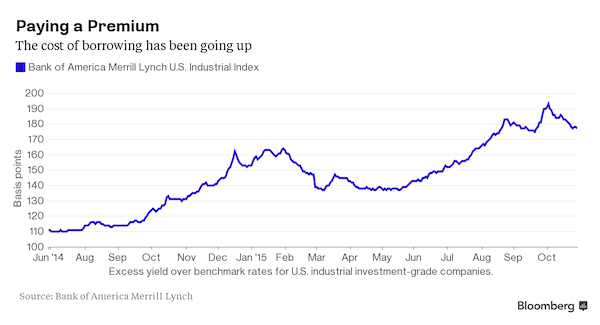

“They’re all in that race,” said Posner, who described the potential payoffs for winning the race as huge. The global crisis “will potentially be a blockbuster for the industry in terms of sales and profits,” he said, adding that “the worse the pandemic gets, the higher their eventual profit.” The ability to make money off of pharmaceuticals is already uniquely large in the U.S., which lacks the basic price controls other countries have, giving drug companies more freedom over setting prices for their products than anywhere else in the world. During the current crisis, pharmaceutical makers may have even more leeway than usual because of language industry lobbyists inserted into an $8.3 billion coronavirus spending package, passed last week, to maximize their profits from the pandemic.

[..] According to calculations by Axios, drug companies make 63 percent of total health care profits in the U.S. That’s in part because of the success of their lobbying efforts. In 2019, the pharmaceutical industry spent $295 million on lobbying, far more than any other sector in the U.S. That’s almost twice as much as the next biggest spender — the electronics, manufacturing, and equipment sector — and well more than double what oil and gas companies spent on lobbying. The industry also spends lavishly on campaign contributions to both Democratic and Republican lawmakers. Throughout the Democratic primary, Joe Biden has led the pack among recipients of contributions from the health care and pharmaceutical industries.

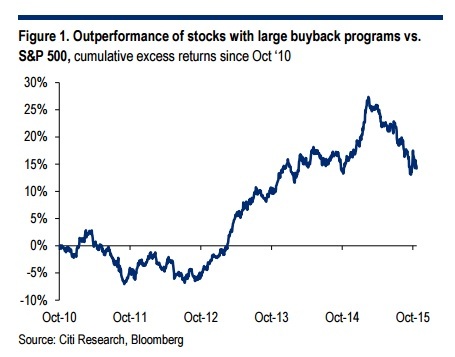

Big Pharma’s spending has positioned the industry well for the current pandemic. While stock markets have plummeted in reaction to the Trump administration’s bungling of the crisis, more than 20 companies working on a vaccine and other products related to the new SARS-CoV-2 virus have largely been spared. Stock prices for the biotech company Moderna, which began recruiting participants for a clinical trial of its new candidate for a coronavirus vaccine two weeks ago, have shot up during that time. On Thursday, a day of general carnage in the stock markets, Eli Lilly’s stock also enjoyed a boost after the company announced that it, too, is joining the effort to come up with a therapy for the new coronavirus. And Gilead Sciences, which is at work on a potential treatment as well, is also thriving.

1 day (or is it 2?) after re-opening all Chinese stores.

• Apple To Close All Stores Outside Of China (BI)

Apple will be temporarily shuttering all stores outside China until March 27, in response to mounting concern over the novel coronavirus, Apple CEO Tim Cook announced on Saturday. Cook also said in a tweet that the company will be committing $15 million to recovery efforts and matching employee donations two-to-one as the coronavirus, which causes the disease known as COVID-19, continues to grip the US. “What we’ve learned together has helped us all develop the best practices that are assisting enormously in our global response,” Cook wrote in a press release. “One of those lessons is that the most effective way to minimize risk of the virus’s transmission is to reduce density and maximize social distance.” “As rates of new infections continue to grow in other places, we’re taking additional steps to protect our team members and customers.” The retailer will continue to fulfill purchases made online or through the Apple phone apps.

Can you self-isolate in a car?

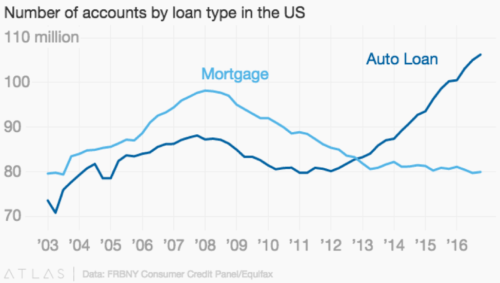

• Bad Coronavirus News Starts To Hit US Auto Dealers (R.)

A relentless barrage of bad news surrounding the coronavirus epidemic has begun to affect customer visits at some U.S. auto dealers and even those businesses that have thrived so far believe a big sales decline is imminent if China’s experience is any guide. Since the coronavirus outbreak began in China last year it has killed more than 5,000 people globally, including 41 so far in the United States, where President Donald Trump on Friday declared a national emergency. The outbreak has caused automakers to shutter plants in Asia and Europe, and the mounting responses in the United States – school closures, pro sports leagues suspending play and other big events canceled – are now being felt by some U.S. dealers. For a sign of what may be in store, analysts said look no further than China, where auto sales plunged 79% last month.

“Sales are definitely falling,” said John Luciano, managing partner with Street Volkswagen in Amarillo, Texas, and chairman of Volkswagen’s national dealer council. “We’re waking up in a different world a little bit more every day.” At Russ Shelton’s Buick GMC dealership in Rochester Hills, Michigan, so far this month customer visits are down 30% while the service department has seen a 40% drop in business due to the outbreak. “When schools close, mothers get worried – and this stops economic activity,” industry consultant and former GM executive Warren Browne said. Cox Automotive now sees negative U.S. economic growth in the second quarter and has withdrawn its forecast for 16.6 million new-vehicle sales in the United States this year.

“We’re definitely voting. They voted during the Civil War. We’re gonna vote..”

• Next Week’s Primaries To Proceed Despite Coronavirus, Louisiana Delay (R.)

Louisiana on Friday became the first U.S. state to postpone its presidential nominating contest because of the coronavirus pandemic, while four states holding their primaries next week said those elections would go forward as planned. The Southern state said it would reschedule voting in the run-up to the Nov. 3 election because of the outbreak. Officials there said they would postpone their scheduled April 4 primary to June 20 “to best protect the health and safety of Louisiana voters and voting officials,” Louisiana Secretary of State Kyle Ardoin said at a news conference. The four states holding their primaries on Tuesday – Arizona, Florida, Illinois and Ohio – said in a joint statement they would proceed with their contests while taking steps to ensure public safety.

“Americans have participated in elections during challenging times in the past, and, based on the best information we have from public health officials, we are confident that voters in our states can safely and securely cast their ballots in this election, and that otherwise healthy poll workers can and should carry out their patriotic duties on Tuesday,” election officials from the four states said. “We’re definitely voting. They voted during the Civil War. We’re gonna vote,” Florida Governor Ron DeSantis told reporters on Friday. Louisiana’s move poses a problem for the Democratic Party, which mandates all nominating contests must be held by early June or states risk losing delegates to the party convention in July.

[..] Biden’s attempt to connect with voters via a virtual town hall on Friday was plagued by early technical glitches that delayed its start and made most of his early remarks impossible to understand. The event provided the first glimpse into the challenges of running a virtual campaign. He used his opening remarks to discuss his plan for tackling the coronavirus crisis and pleading for citizens to listen to public health officials and wash their hands. He then turned to virtual attendees for questions and comments. The first person said, “Mr. Biden’s speech was garbled the entire time.”

People what the hell is happening.

pic.twitter.com/cdktiytvXX— Imraan Siddiqi (@imraansiddiqi) March 14, 2020

Let Washington handle it, make it free.

• Major US Internet Firms Agree Not To Cancel Service Over Next 60 Days (R.)

The Federal Communications Commission said Friday that major internet providers – including Comcast Corp, AT&T Inc and Verizon Communications Inc – agreed not to terminate service for subscribers for the next 60 days if they are unable to pay their bills due to disruptions caused by the coronavirus. FCC Chairman Ajit Pai said after calls with more than 50 companies that they also agreed to waive any late fees residential or small business customers incur because of their economic circumstances related to the coronavirus pandemic. They also agreed to open Wi-Fi hotspots to anyone who needs them, the FCC said.

Millions more Americans are expected to work from home as employers and states urge people to telework to reduce the potential to spread the coronavirus outbreak. Others agreeing to take part are Alphabet Inc’s Google Fiber, Charter Communications Inc, CenturyLink Inc, Cox Communications, Sprint Corp, T-Mobile US Inc. “As the coronavirus outbreak spreads and causes a series of disruptions to the economic, educational, medical and civic life of our country, it is imperative that Americans stay connected,” Pai said in a statement. “Broadband will enable them to communicate with their loved ones and doctors, telework, ensure their children can engage in remote learning.”

FCC Commissioner Jessica Rosenworcel, a Democrat, praised the companies adopting the pledge, but said the FCC should do more. She called on the commission to “provide hotspots for loan for students whose school doors have closed” and should “work with health care providers to ensure connectivity for telehealth services are available for hospitals, doctors, and nurses treating coronavirus patients and those who are quarantined.” Pai also said he had asked providers that offer low-income consumers lower-speed cheaper service to increase speeds and expand eligibility. Comcast said Thursday it was raising its speeds for all its low-income users, while AT&T said it was waiving data caps for consumers that have plans with usage caps.

John Solomon promises more. Will there be elections, though?

• FBI’s Russia Collusion Case Fell Apart In January 2017 (Solomon)

Flynn’s motion is confirmed by a 2018 letter obtained by Just the News between Special Counsel Robert Mueller’s office and defense lawyers. It shows the DOJ exoneration memo was written after Flynn had been interviewed by FBI agents in January 2017 and after the government learned the former Defense Intelligence Agency chief had kept his old agency briefed on his contacts with Russia, something that weighed heavily against the notion he was aiding Moscow.

“According to an internal DOJ memo dated January 30, 2017, after the Jan. 24 interview, the FBI advised that based on the interview the FBI did not believe Flynn was acting as an agent of Russia,” Mueller’s team wrote in the letter. U.S. District Judge Emmett Sullivan so far has concluded that the exoneration of Flynn on the Russia collusion charge wasn’t relevant to his conviction since he pled guilty to a different crime, making a false statement to the FBI. But for the American public, such a revelation is momentous. Less than two weeks into Trump’s presidency the FBI had concluded his national security adviser had not been working as an agent of Russia.

While that was the view of federal law enforcement, the false storyline of Flynn as a Russian stooge was broadcasted across the nation, with leaks of his conversations with a Russian ambassador and other tales, for many more months. In an interview with Just the News and its John Solomon Reports podcast, Powell confirmed she was provided by letter three sentences from the DOJ memo but has been unable to get the full document. “It’s just horrible,” Powell said. “They gave us a little three lines summary of it and the letter and told us it existed but have refused to give us the actual document, which I know means there’s a lot of other information in it that would be helpful to us.” Powell also confirmed that Mueller was fully aware of a letter sent in early January 2017 to Flynn from Britain’s national security adviser raising concerns about Steele’s credibility.

The British government “hand-delivered” a letter to Flynn’s team that “totally disavowed any credibility of Christopher Steele, and would have completely destroyed the Russia collusion narrative,” Powell said. Flynn himself has no memory of receiving the communique, but people around him at the time do and confirmed the existence of the document, Powell explained. Flynn was questioned about it during his debriefings by Mueller’s team, she added. “I was told that a copy of the document would have been given to [then-National Security Adviser] Susan Rice as well,” she added. “So the Obama administration knew full well that the entire Russia collusion mess was a farce.”

Evangelical humor.

• ‘Dead Sea Scrolls’ At DC Museum Of The Bible Are All Forgeries (NatGeo)

On the fourth floor of the Museum of the Bible, a sweeping permanent exhibit tells the story of how the ancient scripture became the world’s most popular book. A warmly lit sanctum at the exhibit’s heart reveals some of the museum’s most prized possessions: fragments of the Dead Sea Scrolls, ancient texts that include the oldest known surviving copies of the Hebrew Bible. But now, the Washington, D.C. museum has confirmed a bitter truth about the fragments’ authenticity. On Friday, independent researchers funded by the Museum of the Bible announced that all 16 of the museum’s Dead Sea Scroll fragments are modern forgeries that duped outside collectors, the museum’s founder, and some of the world’s leading biblical scholars. Officials unveiled the findings at an academic conference hosted by the museum. “The Museum of the Bible is trying to be as transparent as possible,” says CEO Harry Hargrave.

“We’re victims—we’re victims of misrepresentation, we’re victims of fraud.” In a report spanning more than 200 pages, a team of researchers led by art fraud investigator Colette Loll found that while the pieces are probably made of ancient leather, they were inked in modern times and modified to resemble real Dead Sea Scrolls. “These fragments were manipulated with the intent to deceive,” Loll says. The new findings don’t cast doubt on the 100,000 real Dead Sea Scroll fragments, most of which lie in the Shrine of the Book, part of the Israel Museum, Jerusalem. However, the report’s findings raise grave questions about the “post-2002” Dead Sea Scroll fragments, a group of some 70 snippets of biblical text that entered the antiquities market in the 2000s. Even before the new report, some scholars believed that most to all of the post-2002 fragments were modern fakes.

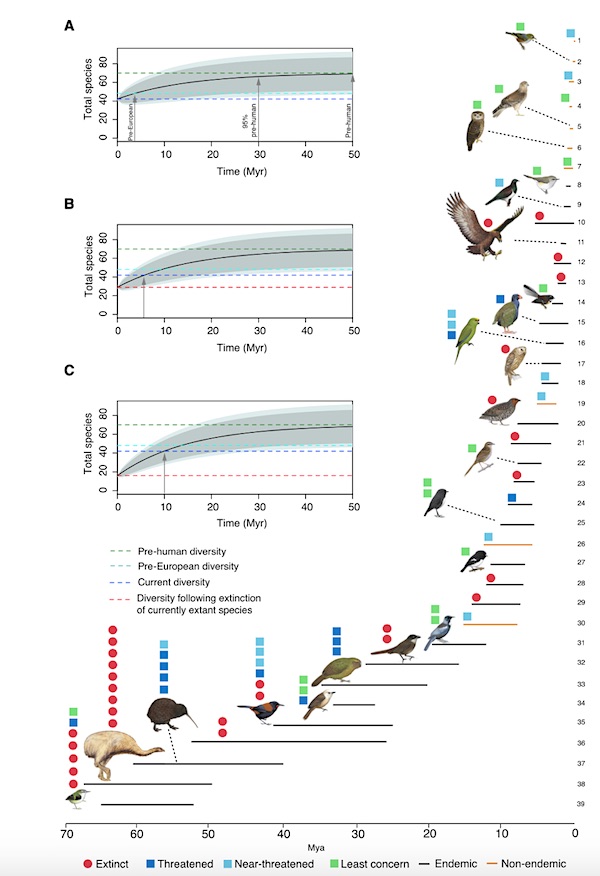

How long does it take to kill 50 million years?

• It Would Take 50 Million Years To Recover New Zealand’s Lost Bird Species (F.)

Long before people arrived in New Zealand, it was dominated by multitudes of unique birds. They were absolutely everywhere: big birds, little birds, colorful birds, flightless birds. In the absence of reptilian and mammalian predators, birds evolved to fill every available niche, from giant moas that stood 11 feet tall and weighed as much as 230 kilograms (510 pounds) that were the ecological equivalent of deer and antelopes, to the largest eagle that ever lived, which was New Zealand’s apex predator, functioning similarly to lions and tigers and other big cats. But after humans arrived 700 years ago, it took us only a few hundred years to drive more than half of New Zealand’s bird species into extinction, and more than 30% of the birds that survived our original onslaughts are threatened with extinction today. Nearly two-thirds could be under threat in the future.

Considering these dire circumstances, an international team of scientists wondered how long it might take for New Zealand to recover its full diversity of bird species lost to human actions. According to their recently published study, the researchers estimated this process would take approximately 50 million years (50Ma). Further, they found that, if bird species that are currently threatened are allowed to go extinct, it would take an additional 10Ma for New Zealand to achieve today’s (severely compromised) level of species diversity. “The conservation decisions we make today will have repercussions for millions of years to come”, said the lead author of the study, Luis Valente, a Research Associate at the Museum für Naturkunde in Berlin.

“Some people believe that if you leave nature alone it will quickly recuperate, but the reality is that, at least in New Zealand, nature would need several million years to recover from human actions — and perhaps will never really recover.” New Zealand is home to a collection of odd birds, including the wrybill, a small shorebird whose bill curves sideways; the iconic kiwis, whose feathers resemble fur and which are the only bird species in the world to have nostrils at the tip of their beak; the flightless kakapo, which resembles a large moss-colored owl and is the heaviest parrot alive today; and of course, the kea, which is the world’s only alpine parrot and who is pushing the boundaries of our understanding of how astonishingly clever parrots can be. Despite this modern surfeit of avian biodiversity, it is just a mere whisper of what once lived on New Zealand, which was the result of many millions of years of evolutionary history.

If you read us, please support us. Help the Automatic Earth survive.