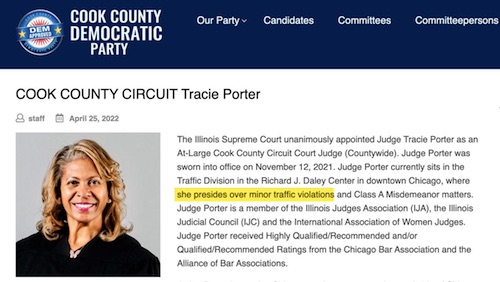

Giotto Lamentation 1306

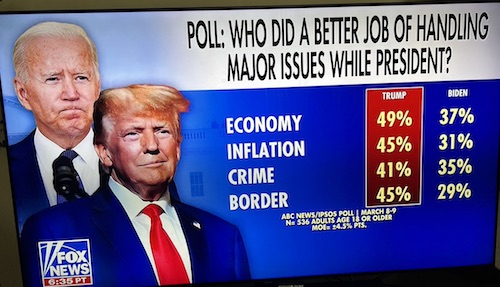

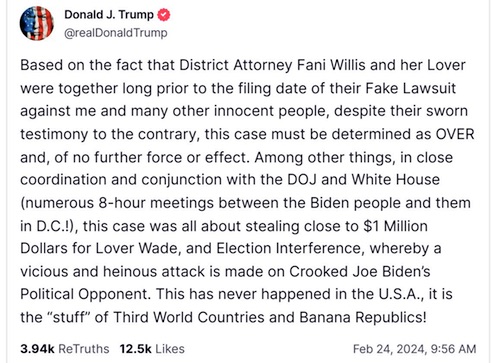

Trump ad

https://twitter.com/i/status/1772860260694261927

Dana Rogan

https://twitter.com/i/status/1772744228281688228

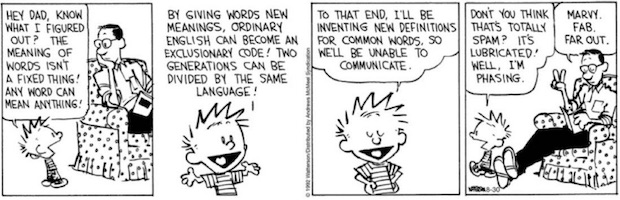

Rogan

Joe Rogan & Kurt Metzger Roast the New York Times' Latest Social Media Strategy

"The New York Times has just started doing this new thing on Instagram where they take the actual writers and they have the writers talk about the issues. This is exactly who we thought was writing… pic.twitter.com/XV1uFWgcXV

— Chief Nerd (@TheChiefNerd) March 26, 2024

https://twitter.com/i/status/1773013817187815900

KJP

Karine Jean Pierre MELTS DOWN and HANGS UP on North Carolina radio host after being asked questions about Biden.

That should win over some potential voters… pic.twitter.com/ALXe8JXBc7

— Sebastian Gorka DrG (@SebGorka) March 27, 2024

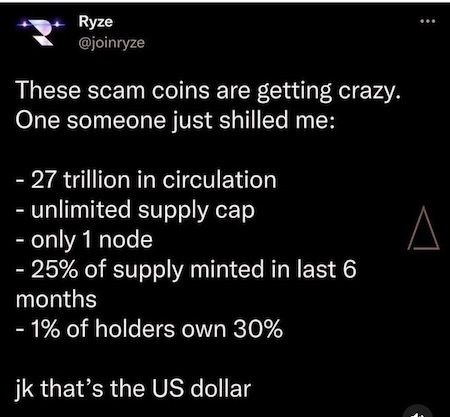

Dotcom

This is big: The US Govt has created a hardware backdoor in the CPUs of Apple devices. This cannot be patched with a software update. Every owner of an Apple device is affected. You have no security. US spy agencies will have done the same with other CPUs. https://t.co/FfuIbAOyWG

— Kim Dotcom (@KimDotcom) March 26, 2024

Laura Farage

"I cannot think of a more dangerous initiative than this."

Nigel Farage remarks on the recent call by unelected EU head, Ursula von der Leyen, for world leaders to roll out digital ID, CBDCs and a cashless society—globally—by 2030.

"If we're not careful, we head towards a… pic.twitter.com/QUi7hf1wWY

— Wide Awake Media (@wideawake_media) March 27, 2024

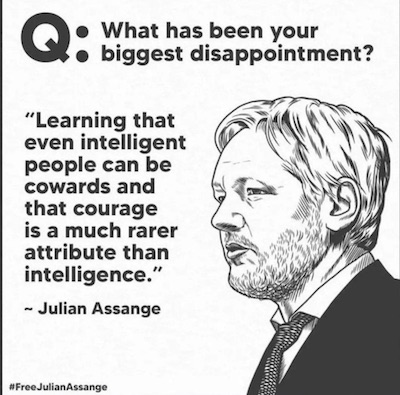

“The media organizations published the information, just as did Wikileaks, but they are not charged. Neither is Wikileaks charged. Only Julian Assange is charged..”

“Tyranny is what Julian Assange is experiencing, not a legitimate prosecution..”

“That so many dumbshit “patriots” support “getting Assange” indicates complete stupidity. “Getting Assange” means getting themselves, and they are too stupid to see it. This is how freedom is murdered.”

• The Most Astounding Feature of the Assange Case (Paul Craig Roberts)

The most extraordinary thing about Julian Assange is that he is being treated as if he were an American citizen. “Treason” was the original cry, now converted to “espionage.” There was no espionage. Wikileaks published, and made available to the New York Times, The Guardian, and other media organizations leaked information. The media organizations published the information, just as did Wikileaks, but they are not charged. Neither is Wikileaks charged. Only Julian Assange is charged. Nothing is any different from Ellsberg releasing the Pentagon Papers to the New York Times. The US government wanted to prosecute both, but was prevented by the First Amendment and long-accepted duty of media organizations to hold government accountable. The stark deterioration in the protective power of the First Amendment and journalistic freedom since 1971 demonstrates the rise in tyranny. Tyranny is what Julian Assange is experiencing, not a legitimate prosecution.

Let’s carefully examine the issue of “espionage.” Espionage is a function of every embassy everywhere in the world. The purpose of embassies is not simply to represent a country’s commercial and political interests. It is also to collect information, the more sensitive the better. When embassy personnel are caught engaging in espionage, the personnel are required to leave the country. They are not prosecuted. It is well known that US embassies contain CIA agents posing as diplomats. Under the protocol governing the Assange case, Russia, China, any number of countries could arrest members of US embassies and put them on trial. Indeed, many countries could do this to one another. What prevents it is not merely good judgment, but the fact that foreign citizens are not subject to the laws of other countries. Only the US, which imagines itself as some kind of international unipower, asserts the worldwide primacy of its laws. This is an absurd claim and has no legal basis.

The orchestrated, in fact legally incorrect, case against Assange is based on nothing but Washington’s demand for revenge. Here is what Assange is guilty of: He released leaked information that showed conclusively that the United States government is a liar, a deceiver of its allies, and a war criminal. The purpose of the case against Assange is to pay him back and to intimidate all journalists from ever again publishing information unfavorable to the US government. In other words, the purpose of the Assange case is to end forever the ability of media to hold government accountable. The Assange case is the fundamental foundation for tyranny. Once it is in place, tyranny is unleashed. That so many dumbshit “patriots” support “getting Assange” indicates complete stupidity. “Getting Assange” means getting themselves, and they are too stupid to see it. This is how freedom is murdered.

“..he spent his adult life speaking truth to power, challenging the status quo of his day, and pushing back against the abuses of the Roman Empire..”

• Rule by Criminals: When Dissidents Become Enemies of the State (Whitehead)

When exposing a crime is treated as committing a crime, you are being ruled by criminals. In the current governmental climate, obeying one’s conscience and speaking truth to the power of the police state can easily render you an “enemy of the state.” The government’s list of so-called “enemies of the state” is growing by the day. Wikileaks founder Julian Assange is merely one of the most visible victims of the police state’s war on dissidents and whistleblowers. Five years ago, on April 11, 2019, police arrested Assange for daring to access and disclose military documents that portray the U.S. government and its endless wars abroad as reckless, irresponsible, immoral and responsible for thousands of civilian deaths. Included among the leaked materials was gunsight video footage from two U.S. AH-64 Apache helicopters engaged in a series of air-to-ground attacks while American air crew laughed at some of the casualties.

Among the casualties were two Reuters correspondents who were gunned down after their cameras were mistaken for weapons and a driver who stopped to help one of the journalists. The driver’s two children, who happened to be in the van at the time it was fired upon by U.S. forces, suffered serious injuries. There is nothing defensible about crimes such as these perpetrated by the government. When any government becomes almost indistinguishable from the evil it claims to be fighting—whether that evil takes the form of war, terrorism, torture, drug trafficking, sex trafficking, murder, violence, theft, pornography, scientific experimentations or some other diabolical means of inflicting pain, suffering and servitude on humanity—that government has lost its claim to legitimacy.

These are hard words, but hard times require straight-talking. It is easy to remain silent in the face of evil. What is harder—what we lack today and so desperately need—are those with moral courage who will risk their freedoms and lives in order to speak out against evil in its many forms. Throughout history, individuals or groups of individuals have risen up to challenge the injustices of their age. Nazi Germany had its Dietrich Bonhoeffer. The gulags of the Soviet Union were challenged by Aleksandr Solzhenitsyn. America had its color-coded system of racial segregation and warmongering called out for what it was, blatant discrimination and profiteering, by Martin Luther King Jr.

And then there was Jesus Christ, an itinerant preacher and revolutionary activist, who not only died challenging the police state of his day—namely, the Roman Empire—but provided a blueprint for civil disobedience that would be followed by those, religious and otherwise, who came after him. Indeed, it is fitting that we remember that Jesus Christ—the religious figure worshipped by Christians for his death on the cross and subsequent resurrection—paid the ultimate price for speaking out against the police state of his day. A radical nonconformist who challenged authority at every turn, Jesus was a far cry from the watered-down, corporatized, simplified, gentrified, sissified vision of a meek creature holding a lamb that most modern churches peddle. In fact, he spent his adult life speaking truth to power, challenging the status quo of his day, and pushing back against the abuses of the Roman Empire.

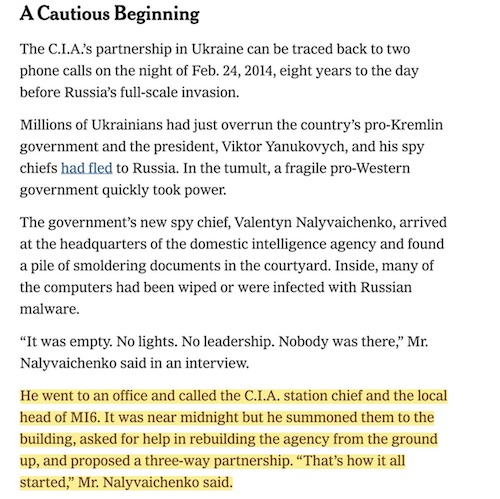

Greenwald Assange

Yesterday, instead of putting him on a plane to the US, the UK's High Court ruled that Julian Assange had valid concerns about the legality of the US govt's extradition request.

It is—at least—a partial victory against the gravest ongoing threat to press freedom in the West. pic.twitter.com/UkFtrzFBrE

— System Update (@SystemUpdate_) March 27, 2024

“Cohen’s appearance on the stand will only add to the lawfare claims given the recent view of a judge that he is a serial perjurer..”

• The Gag and the Goad: Trump Should Appeal Latest Gag Order (Turley)

New York Supreme Court Justice Juan Merchan this week became the latest court to impose a gag order on former president Donald Trump with a stinging order that found a history of Trump attacks that threatened the administration of justice. The order will bar public criticism of figures who are at the center of the public debate over this trial and the allegation of the weaponization of the legal system for political purposes, including former Trump counsel Michael Cohen, former stripper Stormy Daniels, and lead prosecutor Matthew Colangelo. Trump is still able to criticize Manhattan District Attorney Alvin Bragg and Merchan himself. What is most striking is the protection of Cohen who continues to goad Trump in public attacks. While many of us have criticized past attacks by the former president of judges and staff associated with cases, theses gag orders raise very serious free speech questions in my view.

Prosecutors like Special Counsel Jack Smith and Bragg have pushed for a trial before the election. (Recently, Smith even stated that he may force Trump into a trial running up to or even through the election). After these charges were delayed until just before an election, they have maintained that it is essential to try Trump before November. The timing of charges and proposed trial dates were the choice of these prosecutors. If judges are inclined to facilitate the effort for a pre-election trial, they should show some recognition of the unique context for such prosecution. Yet, judges like federal District Judge Tanya Chutkan have stated that she will not make any accommodation for the fact that Trump is the leading candidate for the presidency. I was previously highly critical of the efforts of Smith to gag Trump before the election. In my view, the order issued by Judge Chutkan was unconstitutional. I have opposed gag orders in many cases for decades as inimical to constitutional free speech rights.

The barring of Trump from criticizing jurors or court staff (or family members) is largely uncontroversial. However, Cohen and Daniels have long been part of the political campaigns going back to 2016. Indeed, I was highly critical of Cohen when he was still the thuggish lawyer for Trump. He is now one of the loudest critics of his former client and has made continual media appearances, including on his expected appearance in this case. Cohen’s appearance on the stand will only add to the lawfare claims given the recent view of a judge that he is a serial perjurer who appears to be continuing to game the legal system. Cohen ironically went public to criticize Trump and celebrate the gagging of him: “I want to thank Judge Merchan for imposing the gag order as I have been under relentless assault from Donald’s MAGA supporters. Nevertheless, knowing Donald as well as I do, he will seek to defy the gag order by employing others within his circle to do his bidding, regardless of consequence.”

Many Americans view the Bragg case as a raw political effort and many experts (including myself) view the case as legally flawed. Some polls show that a majority now believe the Trump prosecutions generally are “politically motivated.” This election could well turn on the allegation of lawfare. However, Merchan has now largely bagged the leading candidate (and alleged target of this weaponization) from being able to criticize key figures behind the effort. The inclusion of Colangelo in the order is equally problematic. Trump has campaigned on his involvement in a variety of cases targeting him in his federal and state systems. His movement between cases is viewed by many as evidence of a “get Trump” campaign of prosecutors. He is currently the most talked about figure that many, including Trump, view as showing coordination between these cases and investigations. My opposition to past gag orders was based on the constitutional right of defendants to criticize their prosecutions. Courts have gradually expanded both the scope and use of such orders.

It has gone from being relatively rare to commonplace. However, the use to gag the leading candidate for the presidency in the final months of the campaign only magnifies those concerns. There is a division on courts in dealing with such challenges involving politicians. For example, a court struggled with those issues in the corruption trial of Rep. Harold E. Ford Sr. (D–Tenn.). The district court barred Ford from making any “extrajudicial statement that a reasonable person would expect to be disseminated by means of public communication,” including criticism of the motives of the government or basis, merits, or evidence of the prosecution. The United States Court of Appeals for the Sixth Circuit rejected the gag order as overbroad and stressed that any such limits on free speech should be treated as “presumptively void and may be upheld only on the basis of a clear showing that an exercise of First Amendment rights will interfere with the rights of the parties to a fair trial.”

“The reconstruction was later found by a Ukrainian court to be a complete fabrication, a piece of “deliberate fraud and disinformation” that allowed Soros to interfere in Ukraine..”

• George Soros Overtaken by Trump in List of World’s Wealthiest (Sp.)

Billionaire financier George Soros has been overtaken by former US President Donald Trump on Bloomberg’s index of the world’s richest people, it was revealed Tuesday. The US news outlet’s updated rankings showed the prominent liberal donor at number 378 on the list with an estimated $7.16 billion net worth. Trump was ranked just above Soros at the 377th slot in the ranking. The former US president’s net worth more than doubled this year after his Trump Media & Technology Group merged with Digital World Acquisition Corp. Trump Media & Technology Group owns and operates the real estate mogul’s Truth Social online platform, where Trump took refuge after being banned from Twitter (now X). His increased wealth also places him above figures like Home Depot founder Bernie Marcus and Netflix cofounder Reed Hastings. Soros’ net worth has changed little in recent years as the 93-year-old former hedge fund manager devotes his attention to social causes.

He’s perhaps best known in Europe as “The Man Who Broke the Bank of England;” his short sale of the British pound sterling netted him $1 billion in profit during the UK’s 1992 Black Wednesday financial crisis. The wealthy financier’s political giving has made him a controversial figure. A 1991 article in the Washington Post dubbed Soros an “overt operative” of US-backed regime change operations in Europe. Alongside US government organizations like the National Endowment for Democracy (NED), Soros funnels his massive wealth towards pro-Western activists who help bring down Russian and socialist-aligned governments. Author William Blum describes a striking example of such tactics in his 1995 classic Killing Hope. When voters returned popular socialist parties to power in post-communist Albania and Bulgaria, the NED lavished opposition groups with millions of dollars to foment political unrest. Massive protests forced the collapse of both governments, which were replaced by neoliberal parties committed to economic reforms in the interest of Western capital.

After their economies were hollowed out, Eastern European countries were then integrated into Western institutions like the European Union and NATO, further surrendering their sovereignty to leaders in Washington and Brussels. The strategy was repeated again and again over the next several years, with donors like Soros pouring millions into ostensibly “pro-democracy” causes. Soros helped fund two such “color revolutions” on Russia’s border, once during Ukraine’s so-called “Orange Revolution” in 2004 and again during the 2014 Maidan coup. In both cases elected leaders aligned with Russia were overthrown in favor of pro-Western governments that dramatically shifted Ukraine’s political allegiances. Soros’ Open Society Foundations played a key role in Ukraine’s 2014 regime change by funding a 3-D model “reconstruction” pinning the blame for a massacre of protesters at Kiev’s Maidan Square on government forces.

The rendering was touted by The New York Times and other news outlets as “proof” that President Viktor Yanukovych’s government was using deadly force to repress demonstrators, a key narrative leading to his overthrow. The reconstruction was later found by a Ukrainian court to be a complete fabrication, a piece of “deliberate fraud and disinformation” that allowed Soros to interfere in Ukraine with deadly consequences. Soros has since poured his resources into influencing US politics, funding organizations that promote censorship on social media in the name of “combatting disinformation” and lobby for sanctions on Cuba and Venezuela. In 2022 Soros was the single largest donor to Democratic Party-aligned causes, just above disgraced cryptocurrency entrepreneur Sam Bankman-Fried. The influential billionaire’s defenders often claim criticism of Soros is antisemitic, but a cursory analysis of his outsized global influence demonstrates his conduct is ripe for critique.

Mar-a-Lago

Just seven years ago NBC called Mar-a-Lago the most valuable piece of real estate in Florida (the no. 3 was worth $300M at the time). Sadly according to a Democrat judge it is now only worth $18M. pic.twitter.com/CpZKSOmBPZ

— @amuse (@amuse) March 27, 2024

“..the United States military entered 2024 with its smallest active duty size since the Second World War..”

• Most Americans Think Biden ‘Weak’ Commander-in-Chief (Sp.)

Last week, a YouGov survey found that 61 percent of Americans think a new world war is either “very likely” or “somewhat likely” to break out over the next 5-10 years. The worrying survey results come amid continued efforts by Washington and its allies to set Eastern Europe, the Middle East, as well as East and Southeast Asia on fire. More than half of Americans believe President Joe Biden is a “weaker” commander-in-chief than his recent predecessors. According to new polling of 1,114 likely voters by Rasmussen Reports, 53 percent of likely voters think Biden is “weaker” in his capacity as chief of the military than past presidents. Some 24 percent believe he is a “stronger” C-in-C. Another 20 percent believe he’s “about the same.” The results mark a 10-point jump from polling by Rasmussen from May 2021, in which 43 percent of respondents said they thought Biden was “weaker” than other recent C-in-Cs, with 32 percent saying he was “stronger,” and 18 percent saying he was “about the same.”

More detailed polling by Rasmussen from October 2023 found that support for Biden as a military leader is particularly weak among Republicans and independents (just 15 and 20 percent of whom think he is stronger than his predecessors, respectively), with 51 percent of surveyed Democrats saying he is “stronger.” Despite plans to spend a record $886 billion on defense in the current fiscal year, the United States military entered 2024 with its smallest active duty size since the Second World War, with personnel numbers expected to drop from 1.39 million last year to 1.28 million service members now as recruiters face difficulties enticing skeptical young people to join, and existing servicemen retire amid the military’s increasingly “woke” culture, conflicts surrounding vax mandates, and falling morale following decades of illegal US wars abroad. Rasmussen’s polling comes in the wake of concerns voiced by Americans in a YouGov poll released last week that a new world war might be just around the corner.

In a survey of 1,000 US adult citizens taken between early February and early March, 22 percent of those polled by YouGov said a new global conflagration is “very likely,” with 39 percent saying it is “somewhat likely,” and just 17 and five percent saying it is “not very likely” or “not at all likely,” respectively. Some 77 percent believe that if a new world war broke out, the US would inevitably be involved, with only six percent saying the US would not be involved. Meanwhile, 72 percent said they expect Russia to also be involved, and 69 percent said that China would be involved. Americans believe their country could ally alongside the UK (67 percent), Ukraine (58 percent), and Israel (58 percent) in the hypothetical conflict. The poll also found that 45 percent of Americans believe their coalition would “win” in a conflict against both Russia and China. Only six percent of those polled said they would volunteer to fight, with nine percent saying they would fight if conscripted, 13 percent that they would refuse service, and 60 percent saying they don’t qualify. However, 16 percent said they would volunteer if the US itself was under threat of an imminent invasion.

[..] Former president and presumptive Republican presidential nominee Donald Trump has warned repeatedly in recent months that President Biden’s policies, particularly in Ukraine, have put the world “on the brink of World War III.” “The world is in tremendous danger. We’re in danger of possibly a World War III. And we have a man who’s absolutely the worst president in the history of our country – he can’t put two sentences together, he’s not going to be able to negotiate with Putin or Xi or Kim Jong Un of North Korea. Not going to be able to negotiate with anybody. All he knows how to do is drop bombs all over the place – meaningless bombs, except they kill a lot of people and cost a lot of money,” Trump said in February ahead of a Supreme Court ruling on his ability to appear on the ballot in Colorado for the 2024 presidential election.

Biden 1.7 trillion

Biden claims he "literally" cut the national debt by $7 billion, $1.4 trillion, $1.7 billion, $1.7 trillion, and "in half," depending on the day.

This is what happens when a compulsive, lifelong liar experiences cognitive decline.pic.twitter.com/qcRJ2hSlhs

— RNC Research (@RNCResearch) March 27, 2024

“..55 percent are of the opinion that a coalition made up of Moscow, Beijing and their allies would win..”

• Majority of Americans Would Not Serve in Event of Another World War (Bridge)

The majority of Americans say that another world war is at least somewhat likely to break out in the next 10 years, but most say they would not enlist to serve in combat or non-combatant roles if the United States were to be involved. A new YouGov poll revealed that 22% of Americans believe it’s ‘very likely’ that there will be another world war within the next five to 10 years; 39% say it’s ‘somewhat likely.’ Broken down politically, one-third of Republicans believe it’s ‘very likely’ that there will be another world war in the next decade; 20% of Independents and 16% of Democrats agree with that statement. Despite the United States and its NATO allies depleting their military supplies at a breakneck pace in a proxy war against Russia in Ukraine, and Moscow displaying fearsome offensive powers, Americans still remain optimistic over any hypothetical war against Russia and China.

If there were to be a world war in which the U.S. and their allies were fighting against Russia, China, or both, Americans are more likely to say that the NATO member states would win than to say they would lose. However, the patriotic optimism quickly fades in the hypothetical scenario that pits both China and Russia — and their allies — against Western nations and their allies in a world war. Just 45% of Americans say the Western nations would emerge victorious, while 55 percent are of the opinion that a coalition made up of Moscow, Beijing and their allies would win. In a similar YouGov survey conducted in the UK, just 21% of British adults believe that Western forces would lose to China, Russia, and their allies in the event of a world war.

Shockingly, if a global conflagration involving the United States were to break out, just 6% of Americans say they would enlist for military service, while 9% say they would not volunteer but would serve if called up, and 13% say they would not volunteer and would refuse to serve if called up. Meanwhile, a whopping 60% say the armed forces would not attempt to draft them due to age or disability. However, in the event that the U.S. finds itself under imminent threat of invasion, the percentage of people who would volunteer for military service increases to 16%. However, 47% say that even in such extreme circumstances, they don’t think the military would want them to serve due to age or disability.

“Americans are more open to the idea of serving in non-combat roles in the event of a world war,” says Jamie Ballard, a data journalist with YouGov. “19% say they would volunteer for this type of role; 12% would not volunteer but would serve if called up. If the U.S. were under imminent threat of invasion, 26% would volunteer for non-combat service. 42% of Americans say the government would not want them for non-combat roles for reasons related to age or disability; 38% say the government would not want them to serve for these reasons even if the U.S. were under imminent threat of invasion.”

“It’s not like he could say ‘Good job… thank you for the helping hand’. We understand what is going on there, in terms of internal politics..”

• Biden Calls Putin ‘A Butcher’ (RT)

US President Joe Biden has disparaged his Russian counterpart Vladimir Putin for the second time in two months, publicly calling him a “butcher” in connection with the Ukraine conflict. Biden made the jab while speaking at a campaign event in Raleigh, North Carolina, on Tuesday. He advocated raising the average federal tax for America’s wealthiest from 8.2% to 25%, arguing that this would allow Washington to raise $400 billion over the next ten years. “Imagine what we could do with that. We could fundamentally slash the federal deficit… We could do so many things – consequential – including finally making sure that we take care of Ukraine from that butcher Putin,” he said. Biden also lashed out at the Russian president in late February, calling him a “crazy S.O.B.”

He mentioned Putin while saying that the West must be wary of a nuclear conflict, but should pay even more attention to the danger posed by climate change. At the time, Kremlin spokesman Dmitry Peskov suggested that Americans should be ashamed of a leader who indulged in such comments. “If the president of that nation uses that kind of language, that is shameful,” he said, adding that Biden may have been trying to emulate a “Hollywood cowboy” to appeal to domestic audiences. Responding to the “S.O.B.” remarks, Putin stood by his previously expressed opinion that Moscow would be better off with Biden in the White House, adding that the US President’s words only prove his point. “

It’s not like he could say ‘Good job… thank you for the helping hand’. We understand what is going on there, in terms of internal politics,” he explained. This is not the first time that Biden has labeled Putin a “butcher.” The first instance dates back to March 2022, several weeks after the start of the Ukraine conflict. Peskov suggested that such offensive comments “narrow down the window for bilateral relations” at a time when Russia-US ties have sunk to a historic low. In 2021, Biden also called Putin “a killer.” The Russian president retorted, “It takes one to know one,” following that remark.

“The claims that we are going to attack Europe after Ukraine – it is utter nonsense and intimidation of their own population just to beat the money out of them.”

• Talk of Russia Attacking NATO is ‘Nonsense’ – Putin (RT)

Moscow is not seeking a confrontation with America’s vassals in Eastern Europe, Russian President Vladimir Putin said on Wednesday. Multiple Western officials have tried to drum up support for additional aid to Ukraine by claiming that Moscow will not stop if Kiev is defeated on the battlefield. Putin addressed these claims during a visit to Torzhok air base in Tver Region. “This is just nonsense,” the Russian president said, noting the disparity in Russian defense spending and the budgets of NATO militaries. “The claims that we are going to attack Europe after Ukraine – it is utter nonsense and intimidation of their own population just to beat the money out of them.” US “satellites” in Eastern Europe have no reason to be afraid, Putin added.

Talk of a potential Russian attack on Poland, the Czech Republic, or the Baltic states is just propaganda by governments that seek to scare their citizens “to extract additional expenses from people, to make them bear this burden on their shoulders.” NATO has been expanding towards the borders of Russia, not the other way around, the president noted, adding that Russia is merely ”protecting our people on our historical territories.” “They came right up to our borders… Did we go across the ocean to the borders of the United States? No, they are approaching us, and they have come very close,” he said. Torzhok is home to the 344th Training Center for Russian combat pilots, including personnel being trained to take part in the Ukraine conflict.

“The Americans came out after the meeting of the Security Council with something so absurd by the US ambassador saying, ‘well, this resolution is non-binding.’”

“When the United Nations Security Council is told by a permanent member, i.e., the US, that this binding resolution is non-binding, then we have a serious problem worldwide..”

• United States ‘Mocking’ International Law, Creating ‘World of the Jungle’ (Miles)

The Biden administration made waves on Monday when its delegation to the UN abstained during a Security Council vote calling for a ceasefire in the besieged Gaza Strip. The act was significant as the US has vetoed three previous resolutions with similar language. The passage of the statement raised hopes that violence could finally come to an end in the enclave as Israel’s nearly seven month-long operation has left over 32,000 Palestinians dead, most of them thought to be civilians. But the US immediately backpedaled in the hours since, insisting the Security Council resolution is “non-binding.” The Biden administration’s statements have caused analysts like Elijah Magnier to conclude the country is using the UN erely to manage its relationship with Israel, damaging the authority of international law and threatening world peace in the process. The journalist offered his thoughts during a discussion on Sputnik’s Fault Lines program Tuesday.

“First of all the resolution was [drafted] with the word ‘permanent’ ceasefire, and then the Americans rejected the word ‘permanent’ and changed it with a ‘lasting’ ceasefire,” explained Magnier. “And there’s a big difference between a ‘lasting’ ceasefire and a ‘permanent’ ceasefire. A lasting ceasefire implies a cessation of hostility that is intended to be stable and enduring, but not necessarily to be part of a comprehensive peace agreement that addresses all the issues that the Israelis and the Palestinians have been fighting about since 1948.” “It also requires a mechanism of verification of the ceasefire that has not been put in place,” he noted. “The Americans came out after the meeting of the Security Council with something so absurd by the US ambassador saying, ‘well, this resolution is non-binding.’” The statement was made by White House National Security Council spokesman John Kirby during a press conference after the vote.

The Biden administration has taken pains to insist the United States’ relationship with Israel hasn’t changed in light of the UN resolution. But Magnier said such statements do great damage to the power and legitimacy of international law. “If you look at Article 25 of the UN charter, all members of the United Nations agreed to… accept and carry out the decision,” said the journalist, noting that Security Council resolutions are intended to be binding and enforced by members. “Every single US official came out to say, ‘oh, this is a non-binding resolution,’ undermining international laws.” “If these laws are not implemented we live in the world of the jungle, we don’t live in an institution and we don’t live in international law.” The veteran war correspondent, who has reported from Iran, Lebanon, Syria, Iraq, Sudan, Afghanistan, and Yugoslavia, said the erosion in international cooperation seriously threatens the world’s ability to peacefully resolve global conflicts.

“At this point I think the whole world needs something to happen because the Second World War brought the United Nations,” Magnier said. “Do we need a third World War to change the world constitution and start putting a mechanism in place where all countries should abide by international laws? Because it seems the Americans are cherry picking who can implement international laws and who cannot.” “When the United Nations Security Council is told by a permanent member, i.e., the US, that this binding resolution is non-binding, then we have a serious problem worldwide,” he added.

“..It should be noted that Israeli Defense Minister Yoav Gallant lingered in Washington for talks with US Defense Secretary Lloyd Austin at the Pentagon..”

• US-Israel Rift Widens Amid Tense Back-and-Forth Over Gaza War (Sp.)

In a headline-grabbing shift from its three previous vetoes, the US abstained from a UN Security Council vote on a resolution calling for a ceasefire in Gaza on March 25. The move was seen as feeding into a growing chasm between US President Joe Biden and Israeli Prime Minister Benjamin Netanyahu. The Biden administration is continuing to fend off backlash after deviating from its previous course and abstaining from a vote on a United Nations Security Council (UNSC) resolution demanding an immediate ceasefire between Israel and the Palestinian group Hamas in Gaza. Even though many pundits believe the abstention was no more than a posturing PR stunt, blowback has nevertheless come from Israel as well as both parties in Congress.

While a furious Prime Minister Benjamin Netanyahu canceled a high-level delegation’s trip to Washington, incensed pro-Israel House lawmakers have slammed Biden for what they see as a US policy shift away from supporting Israel. A number of both Democrats and Republicans are up in arms over the abstention. Sen. John Fetterman (D-Pa.) went on social media to post that it was “appalling” the US allowed the passage of the resolution. Rep. Josh Gottheimer (D-NJ) was similarly “shocked.” Another Democrat, Rep. Tom Suozzi (D-NY) claimed the abstention had “emboldened” Hamas. House Republican Anthony D’Esposito (R-NY) on Tuesday introduced a resolution declaring that “any resolution of the Israeli-Hamas conflict should take place only with the full cooperation and approval of Israel at each step of the process.”

It also insisted that the US “should continue to support Israel and should not attempt to force Israel to take any course of action that is against its best interest.” The flurry of reactions from lawmakers followed a diplomatic snub as Israel called off the visit of a high-level delegation to Washington. The meeting had been called at Biden’s request and was purportedly set to discuss “alternatives” to a planned Israeli offensive into Gaza’s southern city of Rafah. It should be noted that Israeli Defense Minister Yoav Gallant lingered in Washington for talks with US Defense Secretary Lloyd Austin at the Pentagon. After the meeting, Gallant said Israel’s “goals are simple: We need to destroy Hamas as a military and governing organization in Gaza… It means that the military framework must be destroyed.”

Albanese

https://twitter.com/i/status/1772923297656947036

“..Should the US allow Israel to destroy the last remaining Palestinian holdout in Gaza, Biden will almost certainly lose the 2024 presidential election to Donald Trump.”

• Why The US Decided To Give Peace In Gaza A Chance (Blankenship)

In a historic move on Monday, the United Nations Security Council (UNSC) achieved a breakthrough by passing a binding resolution aimed at securing a “lasting, sustainable ceasefire” in Gaza and advocating the release of all hostages held by Hamas since the October attacks on Israel last year. This momentous step forward in international diplomacy signals a potential turning point in the protracted Israeli-Palestinian conflict, offering a glimmer of hope for peace in a region long plagued by violence and discord. The decision by the UNSC comes after several failed attempts to broker a ceasefire. It underscores the growing global consensus on the urgent need to address the root causes of the conflict and pave the way for a peaceful settlement. The resolution, which was passed with overwhelming support from the international community, reflects a shared commitment to upholding international law and promoting stability in the region.

The US, traditionally a staunch ally of Israel, notably abstained from vetoing the resolution this time, signaling a shift in its approach and a willingness to engage constructively in multilateral efforts to end the violence – though it has said that it does not represent a change in policy. This decision reflects a recognition of the need for a balanced approach that takes into account the legitimate concerns and aspirations of both Israelis and Palestinians. With the UNSC resolution now enshrined as international law, all UN member states are bound by its provisions, setting a clear mandate for concerted action to implement its objectives. This presents a unique opportunity for diplomatic initiatives and coordinated efforts to de-escalate tensions, rebuild trust, and create the conditions necessary for lasting peace and stability in the region. However, despite the optimism surrounding the UNSC resolution, significant challenges remain on the path to peace.

The Israeli government, led by Prime Minister Benjamin Netanyahu, has vowed to carry out operations in Rafah, a densely populated area where millions of displaced Palestinians now reside. This escalation threatens to further exacerbate tensions and undermine efforts to achieve a ceasefire and pave the way for meaningful negotiations. Moreover, Israel’s position as a key strategic ally of the United States poses a dilemma for Washington, which has long maintained unwavering support for Israel’s security and sovereignty. While the US remains committed to its alliance with Israel, the changing geopolitical landscape and evolving strategic priorities have complicated its stance on the conflict. The Biden administration faces pressure from both domestic and international stakeholders to balance its support for Israel with a commitment to upholding international law and promoting peace in the Middle East. Should the US allow Israel to destroy the last remaining Palestinian holdout in Gaza, Biden will almost certainly lose the 2024 presidential election to Donald Trump.

Additionally, relations with Muslim countries would be shattered beyond repair, as well as endangering US military personnel in the region. The prospect of a full-scale war looms large, with Israel’s military capabilities and the broader implications of its actions raising concerns about the potential for a regional conflict. The possibility of an invasion by neighboring Arab states adds another layer of complexity to an already volatile situation, highlighting the need for concerted diplomatic efforts to prevent further escalation and find a peaceful resolution to the crisis. Further, Israel’s nuclear ambiguity and so-called “Samson Option,” its rumored unofficial retaliatory policy, raise serious questions about whether spillover in the conflict, prompted by the state’s potential ground operation in Rafah, could trigger a international thermonuclear war.

The situation in the Middle East thus represents a major threat to international security, underscoring why major countries like Russia, China, and Brazil have been adamant about a ceasefire. Despite these challenges, there are reasons for cautious optimism. The UNSC resolution represents a significant step forward in international efforts to address the Israeli-Palestinian conflict and provides a framework for meaningful dialogue and engagement. By building on this momentum and redoubling efforts to promote reconciliation and mutual understanding, there is hope for a brighter future for the people of Gaza and the wider Middle East. While the road to peace remains long and arduous, the UNSC resolution offers a ray of hope in an otherwise bleak landscape. By seizing this opportunity and working together in good faith, the international community can help pave the way for a just and lasting peace in the region. Now is the time for bold leadership, unwavering commitment, and a shared vision of a future defined by cooperation, coexistence, and prosperity for all.

“It is misguided given that no wing of the conservative movement claims Ronna any longer!”

• Inmates Run NBC Asylum: Ex-RNC Chief McDaniel Fired After ‘Talent’ Mutiny (ZH)

Just four days after she was hired — and before she even started — former Republican National Committee chairwoman Ronna McDaniel was fired by NBC News on Tuesday as the network bent to the wishes of its on-air “talent” who protested her hiring during their programs. McDaniel was poised to become a talking head providing insights on politics heading into November’s general election. News of McDaniel’s hiring broke on Friday, immediately igniting a firestorm among leftists inside and outside of NBC’s walls. In the few days that followed, a parade of hosts — including Chuck Todd, Joe Scarborough and Joy Reid, dedicated portions of their shows to raking their bosses over the coals for hiring McDaniel. Rachel Maddow was among the most melodramatically warped, saying that having McDaniel on the payroll was “inexplicable” because she “hasn’t just attacked us as journalists, but…is part of an ongoing project to get rid of our system of government.”

On Tuesday, NBCUniversal News Group chairman Cesar Conde waved the surrender flag in a memo to staff: “No organization, particularly a newsroom, can succeed unless it is cohesive and aligned. Over the last few days, it has become clear that this appointment undermines that goal. After listening to the legitimate concerns of many of you, I have decided that Ronna McDaniel will not be an NBC News contributor. I want to personally apologize to our team members who felt we let them down.” McDaniel, who oversaw seven years of Republican electoral underperformance before resigning in February, was hired by NBC News editorial chief Rebecca Blumenstein. “They thought this would bring in more conservative viewers and give a conservative point of view,” a source at NBC tells the New York Post. “It is misguided given that no wing of the conservative movement claims Ronna any longer! Don’t understand how no one realized that.”

NBC’s fiasco was indeed multi-faceted. Aside from choosing a non-conservative to appeal to conservatives, the move precipitated a spectacle of hypocrisy, as Maddow and others who relentlessly promoted the Russiagate hoax and cheer on efforts to remove Trump from 2024 ballots assailed McDaniel for being dishonest and supposedly undermining democracy. On his nightly show System Update, Glenn Greenwald found the whole thing darkly amusing: As much as NBC would like to think this whole clusterf*** is behind them, McDaniel, who is Mitt Romney’s niece, is reportedly looking for an attorney, presumably to help her shake some money out of the peacock’s feathers.

“This is right in [Letitia James’] jurisdiction! I look forward to the grand jury indictment..”

• Jon Stewart Found To Have Overvalued His NYC Home By 829% (NYP)

Jon Stewart is facing online backlash after the comedian opined on air this week that Donald Trump’s civil real estate case for overvaluing his properties was “not victimless” — when it turns out the price of a previous home sale finds Stewart doing the exact same thing, The Post has learned. On Monday night, Stewart, 61, unpacked Trump’s $454 million appeal bond, calling out experts framing the former president’s New York civil case as not causing direct harm to any individual. “The Daily Show” host rolled a clip of CNN’s Laura Coates interviewing “Shark Tank” star Kevin O’Leary, who commented that the ruling didn’t “go over well” with the real estate industry that was now fretting over the possibility of becoming the next target. Jon Stewart slammed Kevin O’Leary for calling Trump’s Civil Case as “victimless.”

Coates responds to O’Leary by highlighting that Trump was found liable for falsifying business records in the second degree, issuing false financial statements, insurance fraud and conspiracy, all due to asset inflation. “Everything that you just listed off is done by every real estate developer everywhere on Earth in every city. This has never been prosecuted,” O’Leary replied. In response, Stewart asked: “How is he not this mad about overvaluations in the real world?” “Because they are not victimless crimes,” he said. To further his point, Stewart argued that “money isn’t infinite. A loan that goes to the liar doesn’t go to someone who’s giving a more honest evaluation. So the system becomes incentivized for corruption.”

Stewart also contended that failing to declare a higher market value on a property, while paying taxes based on a lower assessed value, constitutes fraudulent behavior. “The attorney general of New York knew that Trump’s property values were inflated because when it came time to pay taxes, Trump undervalued the very same properties,” Stewart added. “It was all part of a very specific real estate practice known as lying.” But it didn’t take long for internet sleuths to look into Stewart’s own property history, which shows an overvaluation of his New York City penthouse by a staggering 829%, records confirmed by The Post show. In 2014, Stewart sold his 6,280-square-foot Tribeca duplex to financier Parag Pande for $17.5 million. The property’s asking price at that time is not available in listing records.

But according to 2013-2014 assessor records obtained by The Post, the property had the estimated market-value at only $1.882 million. The actual assessor valuation was even lower, at $847,174. Records also show that Stewart paid significantly lower property taxes, which were calculated based on that assessor valuation price — precisely what he called Trump out for doing in his Monday monologue. Pande, who purchased the penthouse from Stewart, then resold the property at a nearly 26% loss, according to the Real Deal — at just over $13 million — in 2021. Timothy Pool, a political commentator known for more right-leaning views, alleged on X that Stewart was being a hypocrite. “Did @jonstewart commit fraud when he sold his penthouse for $17.5M? NY listed its market value at $1.8M an AV at around 800k… Who did he defraud?? I am SHOCKED,” he wrote. “This is right in [Letitia James’] jurisdiction! I look forward to the grand jury indictment,” a user quipped in response to the tweet.

For those who did not watch what Jon Stewart said, here it is. But keep in mind that it has now been found that he overvalued his NYC home by 829% after slamming Trump’s civil case as ‘not victimless.’ WATCH and then read his story here by @nypost: https://t.co/ebZz6E5weS pic.twitter.com/n5av29AZNW

— Simon Ateba (@simonateba) March 27, 2024

“..voters who cannot understand how the government can provide billions to Ukraine while planning spending cuts at home..”

• Macron Struggling To Justify Cash For Ukraine – Le Monde (RT)

It is “extremely unclear” how France can fulfill promises by President Emmanuel Macron to supply more military aid to Ukraine, as the government in Paris struggles with plans for spending cuts, Le Monde has reported. French authorities are looking to save €10 billion ($10.8 billion) this year amid a budget deficit of €144.5 billion ($156 billion) and a reduced growth forecast, according to which the economy will increase by just 1% in 2024. The French government said last month that the €10 billion cut could, among other things, be achieved by reducing the expenses of all its ministries and slicing public policies, including development aid and subsidies for building renovation.

In such circumstances, the pledge by Macron to provide €3 billion in support for Kiev this year to aid in the conflict with Russia – made when France and Ukraine signed a 10-year bilateral security pact in mid-February – has turned into a “budgetary and political headache” for his government, Le Monde reported on Tuesday. Lawmakers from Macron’s ruling Renaissance party say they regularly face questions from voters who cannot understand how the government can provide billions to Ukraine while planning spending cuts at home, the paper said. “People ask us why we’re giving €3 billion to Ukraine, it’s a lot of money,” Renaissance MP Mathieu Lefevre was quoted as saying. Le Monde suggested that in order to fulfill their promise to Kiev, the authorities in Paris would have to “play with the paperwork,” such as including France’s €900 million contribution to the European Peace Facility, an EU fund to aid Ukraine, in the €3 billion sum.

Another option might be to increase the value of the equipment donated to the Ukrainian government. The outlet added, however, that Macron’s cabinet would likely still be forced to make amendments to the finance bill (PLFR) in the summer, despite such a move being “politically inflammable.” It would require approval from the National Assembly, where opposition parties object to further funding for Kiev. Despite the issues outlined by Le Monde, French Defense Minister Sebastien Lecornu stated on Tuesday that Paris will soon be able to deliver 78 more Caesar howitzers to Kiev, while boosting the supply of shells to the country.

“The Port of Baltimore is the country’s busiest maritime terminal for exports of vehicles..”

• US Supply Chains Disrupted By Baltimore Bridge Collapse (RT)

The collapse of Baltimore’s Francis Scott Key Bridge, which has cut off ocean routes to the city’s major port, is expected to cause severe disruptions to local transport and logistics, producing ripple effects on global supply chains. The four-lane bridge collapsed on Tuesday after being hit by the Singapore-registered container ship Dali, operated by Danish shipping giant Maersk. As a result of the accident, a large section of the 1.6-mile (2.6km) bridge collapsed into the Patapsco River, with multiple vehicles falling nearly 55 meters into the water. Built in the 1970s, the Francis Scott Key Bridge spans the Patapsco River, and is the only passage connecting the US’ ninth-biggest foreign trading port to the ocean. The Port of Baltimore is the country’s busiest maritime terminal for exports of vehicles.

Very sharp turn

https://twitter.com/i/status/1772750115465269664

According to Maryland Governor Wes Moore, no other port in the country brings in more vehicles than Baltimore, with up to 850,000 cars and light trucks going in and out of its terminals annually. Parts used in vehicle assembly also pass through the port or across the bridge. The major hub for East Coast shipping also handles significant volumes of coal. During the second quarter of 2023, the port’s facilities had the second-highest coal export capacities, data tracked by S&P Global shows. Ten ships are reportedly stuck inside the port, unable to leave as the collapsed bridge spanned the only way in and out of the harbor. Another 30 small cargo vessels, tug boats, and other craft are also trapped in the port. Nearly 40 ships heading for Baltimore were forced to divert.

Commenting on the tragedy, US President Joe Biden said the bridge is vital to the economy, citing concerns about traffic and jobs connected to the port. He noted that the port supports around 15,000 jobs and that over 30,000 vehicles used the bridge each day. Officials closed the port to ship traffic following the incident. Rescue efforts are underway as the authorities search for six people who are still missing.

Peterson

https://twitter.com/i/status/1772718650652500293

Glutathione

https://twitter.com/i/status/1772964579091341340

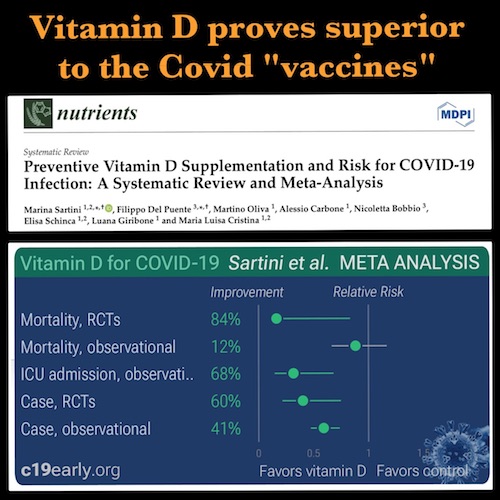

D3

https://twitter.com/i/status/1772990643842723868

Turbo

cat accidentally pressed the turbo button pic.twitter.com/S3vYCdanLl

— Why you should have a cat (@ShouldHaveCat) March 27, 2024

Lions

Oh nothing, just a lion and a lioness cuddling each other. pic.twitter.com/6YzFxl5Ys1

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 27, 2024

Baby rhino

Baby rhino playing with her mother. pic.twitter.com/MAoeyMqdT3

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 27, 2024

Tuffy

https://twitter.com/i/status/1772754349669716021

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.