William Eggleston Coupe de Ville, Los Angeles 1964

Vaccine job interview

This may be the best video of 2021. pic.twitter.com/9t6T4VJ1Cz

— Spencer Carter (@theflydoc) March 27, 2021

Full Moon.

• Cargo Ship Blocking The Suez Is Partially Floated – Suez Canal Authority (CNBC)

The giant container ship blocking the Suez Canal was partially refloated early Monday, days after the vessel got stuck and brought a vital global trade route to a standstill. A statement by the Suez Canal Authority said the ship, known as the Ever Given, “responded to the pulling and towing maneuvers.” It added that the ship’s course has been corrected by 80% and further maneuvers will resume when the water level rises later in the day. The statement followed an earlier tweet by maritime services company Inchcape, which said the Ever Given was refloated and being secured.

It remains unclear what the condition of the stranded ship is and when the canal would be open to traffic, with Inchcape saying that “more information will follow once they are known.” Efforts to free the mega vessel have lasted for nearly a week. The ship became stuck last Tuesday after running aground while entering the Suez Canal from the Red Sea. Ever Given is one of the largest container ships in the world. It is a 220,000-ton mega ship nearly a quarter-mile long with a 20,000 container capacity. The ship completely blocked the canal that’s home to as much as 12% of the world’s seaborne trade, and caused a traffic jam with hundreds of ships waiting to enter the Suez.

[..] Experts told CNBC that problems caused by the Suez blockage will not immediately ease when the Ever Given is freed. Tim Huxley, director of Mandarin Shipping, said it will take “some time” for traffic that has built up to cross the narrow canal. And when those ships and tankers arrive at their destinations, ports will likely face congestion that will also take time to clear, he added. “You normally have about 50 or so ships a day going through the canal, obviously at the moment it’s about 300 ships backed up … this is an enormous traffic jam, which is at both ends of the canal,” he told CNBC’s “Street Signs Asia” on Monday. “This will take quite awhile for the whole supply chain to get back to normal and that’s gonna have an impact on manufacturers, retailers right across the board,” said Huxley.

Ever Given

Greetings and appreciation to the Egyptian administration and the Suez Canal Authority for this work pic.twitter.com/dfS8AdDbmn

— مًحًـمًدٍ إبرآهّيَـمً Fathelbab (@IbrahemFthelbab) March 29, 2021

A fantasy.

• The Great Unvaxxed (TE Creus)

The vaccine was a resounding success. Yes, there had been a final death rate of 10% among the vaccinated, but this was mostly among the elderly or the already ill, so it was probably not the vaccine’s fault, and if it was, no one could prove it one way or another, and even if they could, well, the vaccine manufacturers were not liable to lawsuits due to the agreements they had made with the various governments. In any case, the pandemic had ended, that was for sure. Of course the masks and the lockdown mandates continued to be enforced; the reason was that while the pandemic had most certainly been defeated, the virus still existed in its natural form somewhere out there, and so it was vital to continue with the safety procedures to avoid any possible resurgence of the disease. So what? People got used to it, as they had gotten used to so many other things before that.

And was wearing a mask in the end much worse than wearing a helmet or a safety belt? Was being forced to stay at home for a few months every year much different than being forced to be at the office working for five days out of the seven in the week? Rules are rules, and those were not as bad as others that had been instituted in the past. But there was something that worried the authorities. While most people had predictably complied with the mandatory vaccination campaign, there were a few groups that had refused them, alleging religious or health reasons, and found refuge in rural communities living off the grid. They had abandoned the use of mobile and network technology and so could not be traced so easily, and, since non-digital cash had been abolished, they appeared to have returned to a form of commerce based in the exchange of physical goods.

At first, the authorities ignored them; most people saw them as a minority of loser hicks, “anti-vaxxers” as they had been called in earlier pre-scientific times, and since it was unlikely that too many among the masses would opt for such a harsh lifestyle away from the comforts of modern urban life, they were not seen as a menace. But what happened, in the end, was that rumours started to appear, even in the cities, about small communities where no one needed to wear masks, and people were dancing and smiling, and food was delicious and natural and people were even – gasp! – falling in love and procreating in natural ways.

Of course this was an obvious and mendacious falsity, but the authorities could not permit such fairy tales to gain acceptance among the people at large. So they started to persecute “the great unvaxxed”, as they called them, or the “free renegades” as they preferred to call themselves. Their communities were dispersed. Their leaders were arrested. Planting organic, unmodified seeds became illegal.

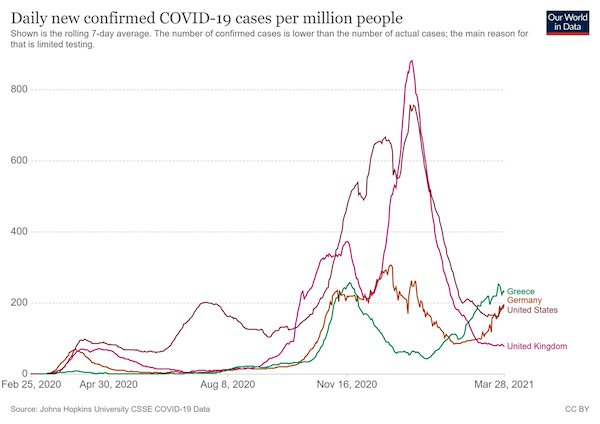

After a 6-month lockdown, Greece now has higher case numbers than ever.

• Pandemic Upsurge Hits Europe Recovery Hopes (Y!)

An upsurge in new coronavirus cases is forcing governments across Europe into new, damaging lockdowns that threaten to delay a much hoped-for return to growth, economists say. The plan was that mass vaccination programmes would turn the tide on the pandemic, allowing locked-down consumers free rein after months penned up at home. Instead the virus has embarked on a third wave which is proving more difficult to bring under control. French President Emmanuel Macron warned Thursday that the European Union would have to do more and beef up its already massive 750 billion euro ($885 billion) virus recovery fund as a result. The EU had made a major effort after the first wave last year, Macron said, but “following the second and third waves… we will no doubt have to add to our response”.

In September, as the economy picked up sharply after a rapid reverse in the first wave, expectations were high that by the middle of this year it would be solidly back on track, thanks especially to the vaccine rollout. Just a couple of weeks ago, European Central Bank head Christine Lagarde was even talking about a “firm rebound in activity in the second half of the year”. Now the EU’s strongest economies — Germany, France and Italy — have reimposed restrictions and the vaccine programme in Europe is mired in a blame game over supplies. Credit insurer Euler Hermes estimates that the EU is now seven weeks adrift of its target to have 70 percent of the population vaccinated by the end of the summer, compared with five weeks in February.

It estimates the delay will cost the bloc’s 27 member states some 123 billion euros this year. “If you compare us with the US, where the outlook is so much more positive, we are falling further behind on the recovery because of this third wave,” said Charlotte de Montpellier, economist with Dutch bank ING. ING now expects eurozone growth of 3.0 percent this year, down more than half a percentage point from its previous estimate. Most of the growth will also come from the third quarter, slightly later too, ING added. Andrew Kenningham, chief Europe economist at Capital Economics, said he does not expect the bloc to return to pre-pandemic activity levels before the second half of 2022, a year behind the US.

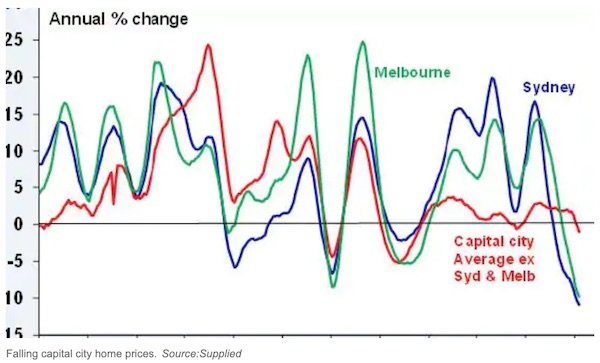

As of March 28, covid19 cases in Greece per million people are higher than Germany, the UK and US. Chart shows 7 day rolling average

“..what you want to do is reduce the total number of people who’ve been infected..”

Is that so? Isn’t it about the number of vulnerable people?

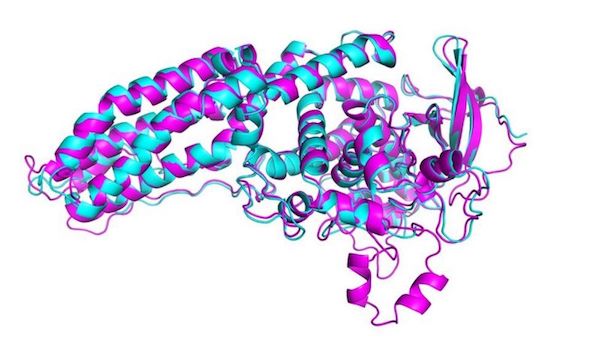

• First Covid Jab Cuts Infection Risk By 62% In England Care Home Residents (G.)

A government-funded study of care home residents in England has found that their risk of infection with Covid-19 – either symptomatic or asymptomatic – fell by 62% five weeks after they received their first Oxford/AstraZeneca or Pfizer/BioNTech vaccine dose. Those who were infected after having the vaccine may also be less likely to transmit Covid-19, initial findings showed. The study, funded by the Department of Health and Social Care, is key, given that most clinical trials and observational studies evaluated the impact of the vaccines on symptomatic infections, but whether the vaccines can reduce asymptomatic infections – which play a crucial role in the spread of the virus – is still unclear. “It’s helpful to look at people who don’t have symptoms because what you want to do is reduce the total number of people who’ve been infected,” noted UCL’s Dr Laura Shallcross, an author of the analysis.

Researchers tracked more than 10,400 care home residents in England (with an average age of 86) between December and March, comparing the number of infections occurring in vaccinated and unvaccinated groups – using data retrieved from routine monthly PCR testing. Both vaccines reduced the risk of infection by about 56% at 28-34 days after the first dose, and 62% at 35-48 days. The effect is maintained for at least seven weeks, the authors concluded in their analysis, which has not yet been peer-reviewed. This data is notable, given older adults with underlying illnesses have largely been excluded from vaccine trials. It also supports the UK’s decision to extend dose intervals beyond what was studied in clinical trials.

[..] In clinical trials, both vaccines were found to be very effective in reducing the risk of severe illness and death. But understanding whether these interventions can thwart the spread of the disease is imperative to public health policy, given vaccinating the world will take a long time, the risk of vaccine-resistant virus variants emerging and percolating, and that vaccines have not yet been proved safe and effective in children.

“to do that … will take about two or three years time with global collaboration.”

• Fauci and Chinese Counterpart Envision Lengthy Covid Restrictions (JTN)

Top U.S. infectious disease expert Anthony Fauci on a recent public health panel signaled common ground with a renowned Chinese doctor and public health administrator on the matter of ongoing COVID-19 restrictions, with both Fauci and his Chinese counterpart suggesting that those restrictions could continue for many months or even years. Fauci in early March appeared on the virtual panel, titled “The Future of Health,” hosted by the University of Edinburgh. Also present in the meeting was Chinese pulmonologist Zhong Nanshan, who has been at the forefront of China’s response to the pandemic and who has been referred to by national spokeswoman Hua Chunying as “China’s Fauci.”

Zhong has a long career in the Chinese Communist Party hierarchy, having served for years in delegatory positions in both the CCP’s National Congress and its National People’s Congress. He has also served on numerous state research initiatives and is the founder of the state-funded Guangzhou Institute of Respiratory Diseases. On the panel, Fauci and Zhong both expressed hopes that COVID-19 restrictions worldwide would continue well into the future. Zhong himself claimed that efforts to develop natural immunity to COVID-19 are inadvisable from a national policy standpoint. “It doesn’t work this way,” he said. “And it’s not realistic, and less scientific, and … inhumane.” Zhong argued that “mass vaccinations” are the “commonsense” approach to engendering herd immunity in the population, but “to do that … will take about two or three years time with global collaboration.”

“I have noticed in other countries,” the doctor said elsewhere, “that actions [are] not so strict enough. So that will be not enough to stop the spreading of [the virus].” Fauci himself echoed those concerns, warning against the danger of what he said was “jump[ing] the gun or do[ing] it too quickly” and seeming to imply that countries should keep COVID-19 measures in place even if they appear to have suppressed the virus within their borders. “It is important to realize,” Fauci claimed, “that variants arise, and if you suppress the virus in one country, but it is allowed to spread uninhibited in other areas of the world, sooner or later, the variants, the new lineages, the mutants, will come back and rekindle the outbreak, even in countries that seem to have it under control. So we still have a considerable amount of task in front of us.”

Still no mention whatsoever of prophylactics.

• Self-Isolation After Covid Contact Will Be Necessary For ‘Years’ (Ind.)

People will have to self-isolate after coming into contact with Covid-19 for many years as the UK learns how to “live with this virus”, a government adviser has warned. Mark Woolhouse, a professor of epidemiology, said the test-and-trace system is here to stay – as are some social distancing measures. He also admitted to being “nervous about a full relaxation in June”, calling the idea of emerging from the lockdown “in one great bound” wide of the mark. “I still suspect that looking forward – and I am talking now right through 2021 and into the years ahead – that we are still going to have to be alert to coronavirus,” Prof Woolhouse said. “There are still going to be situations where we might need to use personal protective equipment, we might well need to do some kind of social distancing, put some kind of biosecurity measures in place.”

It would also be necessary to “maintain our capacity to test and trace, and particularly to isolate people who are infected,” he told the BBC’s Andrew Marr Show. “That final thing is going to remain important for the entire future – that, when we get cases of novel coronavirus, that those people are then going to have to be asked to self-isolate and their contacts.” Prof Woolhouse, who sits on the SPI-M modelling group, which feeds advice into the main Sage body, also said vaccine certificates to enter nightclubs and other venues might be necessary. It’s certainly something we have to consider seriously as part of a wider package of measures that are designed to make our activities safe, he warned. And, on another lockdown, he said: We should regard that as a failure of public health policy if we have to go that route again.

“..visitors who can show either a vaccination certificate or proof they have recently recovered from the virus…”

Being healthy and strong and having natural immunity has been rendered fully meaningless.

• Madeira Lets In Tourists Who Can Show Covid ‘Vaccine Passport’ (G.)

Sara Pedro is sat at a beach-side restaurant with friends. It is her first time dining out in three months. She is in Madeira, an autonomous region of Portugal, having left her home city of Lisbon’s strict coronavirus restrictions to take advantage of the more relaxed atmosphere on the Atlantic island and its “green corridor” for visitors who can show either a vaccination certificate or proof they have recently recovered from the virus. “I came to Madeira because in continental Portugal we are under absolute lockdown, so there was a certain fatigue about it,” she says. Sara, who has recovered from Covid-19, entered Madeira without having to take a PCR test, as would typically be required. Instead, she presented a medical certificate proving she has been in contact with the virus.

The island has a 7pm curfew, but in its capital of Funchal the esplanades are full of people having coffee in the sun as customers go in and out of the shops. It’s in stark contrast with the empty streets and closed shopfronts across mainland Portugal, which is still under tough restrictions imposed on 15 January to tackle what was then the world’s worst coronavirus surge. “Obviously, border closures are necessary for extreme situations, but I think it’s time to bet on safe tourism. Why can’t this be done in other European countries?” Sara asks, as a waiter arrives with drinks.

Located off the coast of Morocco and more than 800km from mainland Portugal, Madeira is one of the few places in Europe accepting tourists – and since 18 February it has been operating a green corridor for tourists who have recovered from Covid-19 in the previous 90 days or who have been fully vaccinated against it, in a foretaste of what may be a future of vaccine passports for EU travel. Vaccinated travellers must present an immunisation certificate in English, validated in their home country, that includes their name, date of birth, type of vaccine, and the date (or dates) it was administered. Tourists must also respect the activation period set out in the vaccine’s summary of product characteristics.

Orwell.

• Congress Demands Tech CEOs Censor Internet Even More Aggressively (Greenwald)

Over the course of five-plus hours on Thursday, a House Committee along with two subcommittees badgered three tech CEOs, repeatedly demanding that they censor more political content from their platforms and vowing legislative retaliation if they fail to comply. The hearing — convened by the House Energy and Commerce Committee’s Chair Rep. Frank Pallone, Jr. (D-NJ), and the two Chairs of its Subcommittees, Mike Doyle (D-PA) and Jan Schakowsky (D-IL) — was one of the most stunning displays of the growing authoritarian effort in Congress to commandeer the control which these companies wield over political discourse for their own political interests and purposes.

As I noted when I reported last month on the scheduling of this hearing, this was “the third time in less than five months that the U.S. Congress has summoned the CEOs of social media companies to appear before them with the explicit intent to pressure and coerce them to censor more content from their platforms.” The bulk of Thursday’s lengthy hearing consisted of one Democratic member after the next complaining that Facebook CEO Mark Zuckerberg, Google/Alphabet CEO Sundar Pichai and Twitter CEO Jack Dorsey have failed in their duties to censor political voices and ideological content that these elected officials regard as adversarial or harmful, accompanied by threats that legislative punishment (including possible revocation of Section 230 immunity) is imminent in order to force compliance (Section 230 is the provision of the 1996 Communications Decency Act that shields internet companies from liability for content posted by their users).

Republican members largely confined their grievances to the opposite concern: that these social media giants were excessively silencing conservative voices in order to promote a liberal political agenda (that complaint is only partially true: a good amount of online censorship, like growing law enforcement domestic monitoring generally, focuses on all anti-establishment ideologies, not just the right-wing variant). This editorial censoring, many Republicans insisted, rendered the tech companies’ Section 230 immunity obsolete, since they are now acting as publishers rather than mere neutral transmitters of information. Some Republicans did join with Democrats in demanding greater censorship, though typically in the name of protecting children from mental health disorders and predators rather than ideological conformity.

“My understanding from people who are sort of in government surveillance is yes, they can understand, they can track it.”

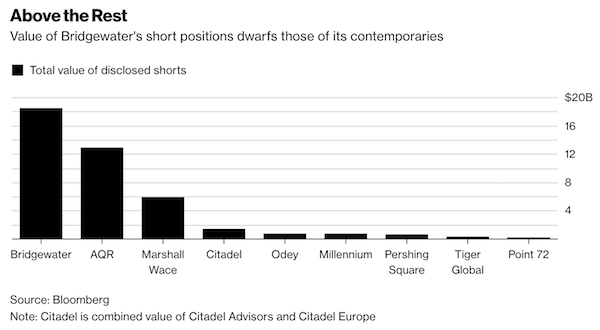

• Ray Dalio Warns Bitcoin Ban ‘Likely’ (F.)

Bitcoin has soared back after losing ground earlier this week, climbing toward its all-time high price of over $60,000. The bitcoin price hit an all-time high of around $62,000 per bitcoin earlier this month—more than double where it began the year—but has since fallen back, despite Elon Musk’s Tesla bombshell this week. Now, the billionaire founder of the world’s largest hedge fund and legendary investor Ray Dalio has warned he thinks there’s a “good probability” bitcoin will be banned by the U.S. government—comparing it to the 1930’s U.S. gold ban. “Every country treasures its monopoly on controlling the supply and demand,” Bridgewater Associates’s Dalio told Yahoo Finance this week.

“They don’t want other monies to be operating or competing, because things can get out of control. So I think that it would be very likely that you will have it under a certain set of circumstances outlawed the way gold was outlawed.” In the 1930s, President Franklin D. Roosevelt made gold ownership illegal in the U.S. in an attempt to shore up the Federal Reserve’s gold supplies so the Fed could justify printing more dollars. Dalio pointed to reports of a proposed bitcoin ban in India as potentially laying the groundwork for a more widespread crackdown on bitcoin. “[We] have to see what [reports of a proposed bitcoin ban in India] means,” Dalio said. “Now, can they do it? Yeah. Now we get into the particulars. My understanding from people who are sort of in government surveillance is yes, they can understand, they can track it. They can know who’s dealing with it … I would suspect it would be very hard to hold up against that kind of action.”

Clique.

• One Man Stands In The Way Of Cuomo Nursing Home Scandal Investigation (IC)

Over the past two months, two scandals have subsumed the administration of New York Gov. Andrew Cuomo: the state’s gross mishandling of the coronavirus pandemic, especially in the state’s nursing homes, and the governor’s reported harassment of several women around him. But the state attorney general has launched a formal investigation into only one of those scandals. In January, New Yorkers were shocked to learn that the actual Covid-19 death tolls in the state’s nursing homes were as much as 50 percent higher than what had previously been disclosed. The misreporting, which was revealed in a report released by New York Attorney General Tish James on January 28, meant that thousands of deaths may have gone uncounted. And many of these deaths occurred in the early days of the pandemic, as Cuomo told hospitals to send coronavirus-positive patients back to the facilities, leading to rapid spread of the virus.

That scandal gained legs in February when the top aide to the governor, Melissa DeRosa, said that the misreporting was deliberate; Cuomo’s office wanted to throw off an investigation into the state’s handling of nursing homes. “We were in a position where we weren’t sure if what we were going to give to the Department of Justice, or what we give to you guys, and what we start saying, was going to be used against us and we weren’t sure if there was going to be an investigation,” she said on a conference call with Democratic legislators. But the spotlight quickly turned to a second scandal, as eight women reported inappropriate behavior and sexual harassment by the governor. The sexual harassment allegations, which have attracted the bulk of media coverage, prompted an investigation into Cuomo by James, by referral from Cuomo himself.

And many of the top Democrats in the state have called for Cuomo’s resignation. James has not, however, begun an investigation into the Cuomo administration on its actions last spring, for a bureaucratic reason: She needs a referral from either Cuomo himself or Tom DiNapoli, the state’s low-profile comptroller, who has served since 2007. James has the statutory authority to investigate nursing homes, hence the January 28 report. She does not have the statutory authority to launch an investigation with subpoena power into the Cuomo administration without DiNapoli’s referral. (Theoretically, James could decline to investigate Cuomo’s handling of the nursing home crisis even if she received the referral from DiNapoli, though that seems very unlikely given her willingness to investigate the issue so far.)

A nursing home investigation has the potential to be explosive for a much broader range of actors than just Cuomo, and DiNapoli is himself considering a run for governor. While DiNapoli, a mainstream Democrat who nonetheless has occasionally clashed with Cuomo, is among the Democratic politicians calling for Cuomo’s resignation over sexual harassment claims, so far his office has declined to make a referral.

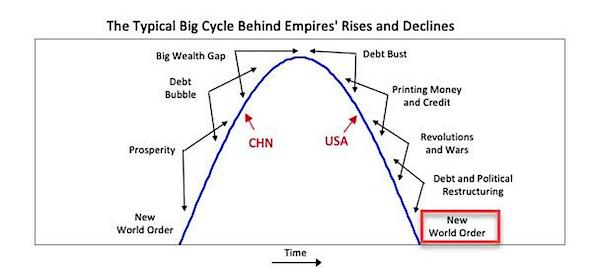

Professor Michael Hudson and Pepe Escobar discuss the emerging economic world order..

• In Quest Of A Multipolar Economic World Order (Saker)

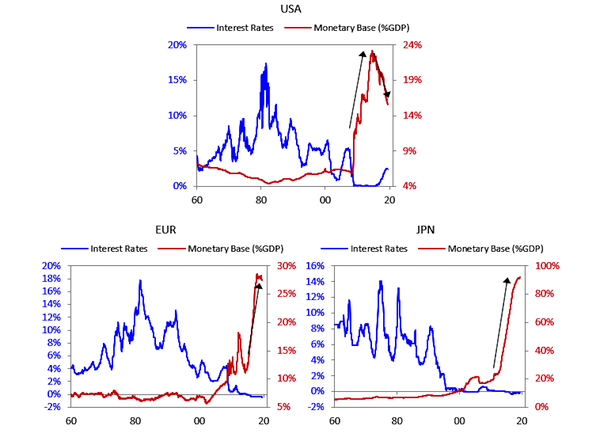

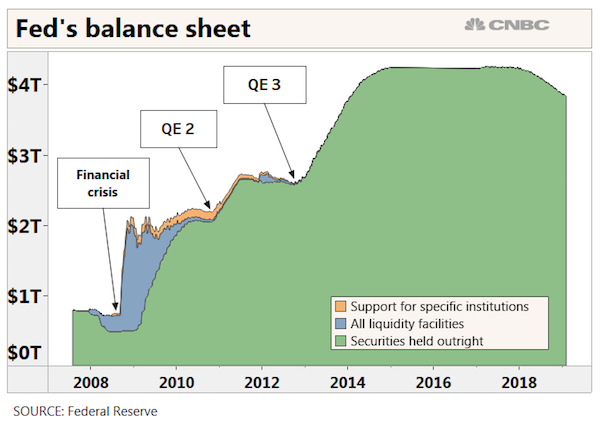

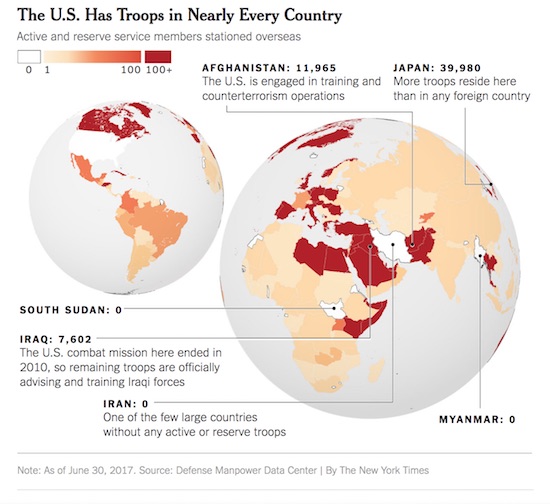

Hudson: 50 years ago, I wrote Super Imperialism about how America dominates the world financially, and gets a free ride. I wrote it, right after America went off gold in 1971, when the Vietnam war – which was responsible for the entire balance-of-payments deficit – forced the country to go off gold. And everybody at that time worried the dollar was going to go down. There’d be hyperinflation. But what happened was something entirely different. Once there was no gold to settle U.S. balance-of-payments deficits, America strong armed its allies to invest in US Treasury bonds, because central banks don’t buy companies. They don’t buy raw materials. All they could buy is other government bonds. So, all of a sudden, the only thing that other people could buy with all the dollars coming in were US Treasury securities.

The securities they bought essentially were to finance yet more war making and the balance-of-payments deficit from war and the 800 military bases America has around the world. The largest customer – I think we discussed this before – was the Defense Department and the CIA. They looked at it as a how-to-do-it book. That was 50 years ago. What I’ve done is not only re-edit the book and add more information that’s come out, but I’ve summarized how the last 50 years has transformed the world. It’s a new kind of imperialism. There was still a view, 50 years ago, that imperialism was purely economic, in the sense that there’s still a rivalry, for instance, between America and China, or America and Europe and other countries.

But I think the world has changed so much in the last 50 years that what we have now is not really so much a conflict between America and China, or America and Russia, but between a financialized economy, run by financial planners allocating resources and government spending and money creation, and an economy run by governments democratic or less democratic, but certainly a mixed economy. Everything that made industrial capitalism rich, everything that made America so strong on the 19th century, through its protective tariffs, through its public infrastructure investment all the way down through world war two and the aftermath, was that we had a mixed economy in America. Europe also had a mixed economy, and in fact, every economy since Babylon has had a mixed economy.

One small step from “Multipolar Economic World Order” to “Multipolar Global Political Economy”.

• Stoltenberg Comes Clean On China “Opportunity” For NATO (SCF)

Jens Stoltenberg and other European leaders have been swooning over the “new chapter” in transatlantic relations under the Biden administration. After four years of dealing with vulgar-mouth Donald Trump and his relentless hectoring over military budgets, some European leaders are sighing with relief at Biden’s seemingly dulcet assurances that “America is back”. Of course people like Stoltenberg, a former Norwegian prime minister who has been the civilian head of NATO since 2014, are reliant on pushing a stronger alliance for their comfy livelihoods and no doubt for future sinecures at corporate-funded think-tanks. Stoltenberg is constantly striving to find a new vision and mission for NATO, an organization founded over 70 years ago at the start of the Cold War, and which has been expanding ever since despite the official end of the Cold War three decades ago.

The buzz phrase he uses is to make the alliance “future-proof” – that is to find a permanent pretext for the U.S.-led military organization to continue its existence regardless of real-world security needs. In his interview with Deutsche Welle this week, Stoltenberg commented on the rise of China. He said, inferring something menacing: “China is coming closer to us, investing in our critical infrastructure.” Well maybe that’s because China is the world’s biggest trading partner with the European Union and a major foreign direct investor in European nations which have become bankrupt from decades of neoliberal capitalism and austerity. Stoltenberg went on: “There’s no way we can avoid addressing the security consequences for our regional alliance of the rise of China and the shift in the global balance of power.”

And then the usually cautious, wooden Stoltenberg let it slip: China, he said, provided “a unique opportunity to open a new chapter in the relationship between North America — the United States — and Europe.” Voila! So the real strategic value of China being presented as a “threat” or an “adversary” is to give a new purpose to the U.S.-led NATO bloc which subordinates Europe to Washington’s geopolitical objective of hegemony. The emphasis here is on China “being presented as a threat” and not what the real relationship actually is, that is, one of a vital economic partner. (Same for Russia and its vast energy partnership with Europe.)

The United States in pursuit of global dominance by its corporations and its capitalist order must, by definition, thwart a multipolar global political economy which the rise of China and Russia embody. The fiendish political problem, however, is that Washington and its European surrogates cannot justify such a stance based on the normal and natural relations that exist. For in doing that, they would be seen as obnoxious, unwarranted aggressors. It is imperative therefore to conflate China and Russia as “security threats” to the presumed Western “rules-based order”.

The Donziger story is almost as crazy as Julian Assange’s.

• The Lawyer Who Took On Chevron Marks His 600th Day Under House Arrest (G.)

Many of us will have felt the grip of claustrophobic isolation over the past year, but the lawyer Steven Donziger has experienced an extreme, very personal confinement as a pandemic arrived and then raged around him in New York City. On Sunday, Donziger reached his 600th day of an unprecedented house arrest that has resulted from a sprawling, Kafkaesque legal battle with the oil giant Chevron. Donziger spearheaded a lengthy crusade against the company on behalf of tens of thousands of Indigenous people in the Amazon rainforest whose homes and health were devastated by oil pollution, only to himself become, as he describes it, the victim of a “planned targeting by a corporation to destroy my life”.

Since August 2019, Donziger has been restricted to his elegant Manhattan apartment, a clunky court-mandated monitoring bracelet he calls “the black claw” continuously strapped to his left ankle. He cannot even venture into the hallway, or to pick up his mail. Exempted excursions for medical appointments or major school events for his 14-year-old son require permission days in advance. An indoor bike sits by the front door in lieu of alternative exercise options. “There’s no comparison to quarantine because I can’t even go outside for a walk. If my kid is sick I can’t go to the drug store to get a prescription,” Donziger said. “I never truly understood freedom until I was put in this situation.”

The nights are hardest for Donziger, when he has to struggle to get his jeans off over the boxy tag and lie in bed next to his wife “with the government still there on my ankle”. Each morning he wakes up in angst. A flag reading “SOS Free Steven” sometimes flutters defiantly from the window, but efforts to end the unusually long detention have yet to be granted. “It’s been brutally difficult for him,” said Paul Paz y Miño, associate director of Amazon Watch, a conservation group allied to Donziger. “It’s taken a huge toll on him and his family. Chevron wants the narrative to be that he’s a criminal. The implications of that for the entire environmental movement against oil companies is terrifying.”

[..] The dispute with Chevron centres upon a landmark 2011 decision by the Ecuador courts to order the company pay $9.5bn in damages to people blighted by decades of polluted air and water. Chevron has never paid up, claiming “shocking levels of misconduct” and fraud by Donziger and the Ecuadorian judiciary. But the subsequent web of events that has led to Donziger being detained and stripped of his law license is befuddling even to legal scholars. “Frankly, I scratch my head when I look at this case,” said Larry Catá Backer, a professor of international law at Penn State University. “It is this strange multi-front battle with one extraordinary explosive development after another. It has had this magical quality to enrage everyone involved in it.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.