Martha McMillan Roberts Three sisters at Cherry Blossom Festival, Washington, DC” May 1941

“It’s not a stock market, it’s a casino.” But that’s not just true for China.

• Global Stocks Decline; Shanghai Slides 5% (CNBC)

A continued fall in the price of oil and a rout in Chinese stocks weighed on investor sentiment on Tuesday, with global equities seeing heavy losses during the session. The German DAX, French CAC 40 and U.K.’s FTSE 100 all slipped over 1% at the open, with the pan-European Euro Stoxx 600 index down 1.24% in early trading. Meanwhile, Greek stocks slid 6%, with continued political jitters in the country adding to the declines. U.S. stock futures were also pointing lower, indicating triple-digit losses for the Dow Jones at around 8:00 a.m. GMT, before trimming losses as the European session gathered pace.

China was the main focus for investors as the country’s Shanghai Composite benchmark tumbled in the final hour of trade. It finished the session down 5.3% after rallying to a three-and-half-year high of 3,091 points earlier in the day. It marked its biggest one-day fall inpercentage terms since August 2009 “It’s not a stock market, it’s a casino,” Peter Elston, a global investment strategist at Seneca Investment Managers, told CNBC about the Chinese benchmark. “It’s always been the case – it’s an incredibly volatile market… it is all going to end in tears and it looks like that is starting to happen now.”

Did Ambrose cause that Shanghai crash with this article last night?

• China’s Stock Mania Decouples From Economic Reality (AEP)

China’s stock market boom has reached outright mania, with equities galloping higher at a parabolic rate, despite threats of a crackdown by regulators and the continued slowdown of the national economy. The Shanghai Composite Index has risen 32pc in the past six weeks, blowing through 3,000 to a three-and-a-half-year high even though corporate earnings are declining steeply. The China Securities Regulatory Commission said late last week that it would “increase market supervision, resolutely crack down and earnestly safeguard normal market order”. It warned that stock manipulators had been “raising their head” and would be dealt with. The cautionary words have been ignored by retail investors as they throng brokerage offices, lured by momentum trades. The government itself is partly responsible for letting the genie out by talking up “cheap stocks” in the official media two months ago, but now appears alarmed by what it has done.

Many families are taking out brokerage loans to buy stocks, increasing leverage and risk. Margin debt has risen to more than $130bn from nothing three years ago. This is now 1.2pc of GDP. “Turnover, leverage and account openings have all soared and there is a sense of mania taking hold,” said Mark Williams, from Capital Economics. The latest surge follows a shift by the Chinese authorities towards “targeted easing” in October, intended to stop the housing market crumbling after five months of falling prices. This was followed by a surprise cut in interest rates last month. But aspects of the equity surge are bizarre. Financial stocks have jumped most, yet the rate cut was negative for banks since it reduced their margins. Deflationary pressures are eroding wafer-thin profit margins. Chen Long, from Gavekal in Hong Kong, said the momentum on the Shanghai bourse has become unstoppable but is losing touch with economic fundamentals. “When the tide recedes, the backwash is likely to be vicious,” he said.

China is as stimulus crazy and dependent as the rest.

• Yuan Headed For Biggest Single-Day Loss Since 2008 (CNBC)

The Chinese yuan fell sharply against the U.S. dollar on Tuesday as tight onshore liquidity conditions fueled rising expectations of further monetary easing, according to analysts. The currency, which is still tightly controlled by the Chinese central bank, declined 0.5% to 6.203, putting it on track for its biggest single-day decline since 2008. “Despite the recent interest rate cut, domestic liquidity has tightened,” Nizam Idris, head of strategy, fixed income and currencies at Macquarie told CNBC, noting that short-term interest rates in China have risen sharply in recent days. The People’s Bank of China rate cut the 12-month benchmark lending rate by 0.40 percentage points to 5.6% on November 21.

This effectively reduced the cost of funds without increasing quantity of funds available, he said. As a result, the market is pricing in further monetary easing in the form of a reserve requirement ratio (RRR) cut, which could happen sometime this week, Idris said. The catalyst for the RRR reduction could be the consumer price inflation (CPI) data due out Wednesday. “If CPI again shows there are disinflationary pressures in the economy, this could strengthen the argument for easing,” Idris said. The consumer price index (CPI) rose 1.6% in October from the year-ago period, remaining at its slowest rate in five years. Idris says the yuan has declined at a much quicker pace than he initially anticipated. He expects the downtrend to continue, noting dollar-yuan could reach 6.25 over the next three months.

Make that 4%. But that of course cannot be said out loud.

• China Likely To Lower Growth Target To 7% For 2015 (MarketWatch)

As China’s top leadership convened Tuesday for the annual Central Economic Work Conference in Beijing, state media reported the government might cut 2015’s economic growth target to as low as 7%, down from the 2014 goal of “about 7.5%.” Lowering next year’s target is a “a high probability event,” and the most likely case is “to set a 7% target and realize a growth slightly higher than the target,” the state-run China News Service quoted Guan Qingyou, head of research at Minsheng Securities, as saying Tuesday. China’s economy is at a “gear-down” stage, and 7% growth is enough to create 10,000 new jobs, ensuring sufficient employment for the economy, the report quoted Niu Li, head of macroeconomic research at the government’s State Information Center policy think tank, as saying. Niu added that cutting the growth target can reduce the stress on local governments, allowing them to push ahead with reforms. China’s official growth target numbers usually aren’t publically announced until the national legislature convenes in the spring.

What a world to live in.

• A Universe Beneath Our Feet: 1 Million People Live Underground In Beijing (NPR)

In Beijing, even the tiniest apartment can cost a fortune — after all, with more than 21 million residents, space is limited and demand is high. But it is possible to find more affordable housing. You’ll just have to join an estimated 1 million of the city’s residents and look underground. Below the city’s bustling streets, bomb shelters and storage basements are turned into illegal — but affordable — apartments. Annette Kim, a professor at the University of Southern California who researches urbanization, spent last year in China’s capital city studying the underground housing market. “Part of why there’s so much underground space is because it’s the official building code to continue to build bomb shelters and basements,” Kim says. “That’s a lot of new, underground space that’s increasing in supply all the time. They’re everywhere.” She says apartments go one to three stories below ground. Residents have communal bathrooms and shared kitchens. The tiny, windowless rooms have just enough space to fit a bed.

“It’s tight,” Kim says. “But I also lived in Beijing for a year, and the city, in general, is tight.” With an average rent of $70 per month, she says, this is an affordable option for city-dwellers. But living underground is illegal, Kim says, since housing laws changed in 2010. And, in addition, there’s a stigma to living in basements and bomb shelters, as Kim found when she interviewed residents above ground about their neighbors directly below. “They weren’t sure who was down there,” Kim says. “There is actually very little contact between above ground and below ground, and so there’s this fear of security.” In reality, she says, the underground residents are mostly young migrants who moved from the countryside looking for work in Beijing. “They’re all the service people in the city,” she says. “They’re your waitresses, store clerks, interior designers, tech workers, who just can’t afford a place in the city.”

“If you want to move product, you discount it ..”

• Oil Drops as Deeper OPEC Discounts Signal Fight for Market Share (Bloomberg)

Brent and West Texas Intermediate fell to a five-year low as Iraq followed Saudi Arabia in cutting prices for crude sales to Asia, adding to signs that OPEC’s biggest members are defending market share. Futures dropped as much as 1.4% in London to the weakest intraday price since September 2009. Iraq, the second-largest producer in the Organization of Petroleum Exporting Countries, reduced its Basrah Light crude to the lowest in at least 11 years, a price list for January showed. Oil will remain at about $65 a barrel for half a year until OPEC’s output changes or demand expands, according to Kuwait Petroleum Corp. Crude is trading in a bear market as the highest U.S. production in three decades exacerbates a global glut. Saudi Arabia, which led OPEC’s decision to maintain rather than cut output at a Nov. 27 meeting, last week offered supplies to its Asian customers at the deepest discount in at least 14 years.

“If you want to move product, you discount it,” David Lennox, a resource analyst at Fat Prophets in Sydney, said by phone today. “That is going to continue. Until there are cuts to production, there could be more pain to come.” Brent for January settlement declined as much as 90 cents to $65.29 a barrel on the London-based ICE Futures Europe exchange and was at $65.74 at 4:12 p.m. Singapore time. It slid $2.88 to $66.19 yesterday, the lowest close since September 2009. The European benchmark crude traded at a premium of $2.89 to WTI. Prices are down 41% this year. WTI for January delivery decreased as much as 80 cents, or 1.3%, to $62.25 a barrel in electronic trading on the New York Mercantile Exchange. The contract lost $2.79 to $63.05 yesterday, the lowest since July 2009. Total volume was about 29% above the 100-day average.

Iraq’s Oil Marketing will sell Basrah Light to Asia at $4 a barrel below the average of Middle East benchmark Oman and Dubai grades, the steepest discount since August 2003 when Bloomberg started compiling the data. The company reduced prices to U.S. buyers by 30 cents and marked up shipments to Europe by 10 cents, the list obtained by Bloomberg News showed. Middle East producers including Iraq, Iran and Kuwait typically follow Saudi Arabia’s lead when setting crude export prices. The kingdom is the biggest member of OPEC, which supplies about 40% of the world’s crude.

Gotta doubt that. Wishful thinking.

• Oil To Stay At About $65 For Six Months, Kuwait Petroleum Says (Bloomberg)

Oil prices will stay at about $65 a barrel for at least half a year until OPEC changes its collective production or world economic growth revives, said the head of state-run Kuwait Petroleum Corp. Oil is trading in a bear market as the U.S. pumps at the fastest rate in more than three decades and demand expands more slowly. OPEC decided on Nov. 27 to maintain its output target, prompting a drop in European benchmark Brent crude to less than $70 a barrel for the first time since May 2010. “I think oil prices will stay around the current level of $65 for six or seven months until OPEC changes its production policy, or recovery in world economic growth become more clear, or a geopolitical tension arises,” Nizar Al-Adsani, KPC’s chief executive officer, said yesterday in Kuwait City.

Crude prices have declined about 40% from a June peak amid overproduction and sluggish growth in consumption. Saudi Arabia led OPEC’s decision to maintain rather than cut output last month in Vienna, citing the threat U.S. shale presents to the group’s market share, Iranian Oil Minister Bijan Namdar Zanganeh said on Nov. 28. Brent was 4 cents higher at $66.23 a barrel at 9:25 a.m. in London. Fellow OPEC member Iraq deepened the discount for its Basrah Light crude next month to customers in Asia to the greatest in at least 11 years, following Saudi Arabia’s lead as Middle Eastern producers seek to defend market share. Iraq set the discount at $4 a barrel below the average of Middle East benchmark Oman and Dubai grades, according to a statement yesterday from the country’s Oil Marketing Co.

Everything in the world is grossly overvalued due to QE.

• Cheap Oil Also Means Cheap Copper, Corn And Sugar (Bloomberg)

Lower fuel prices are compounding the longest commodity slump in a generation. Because energy accounts for as much as half the cost to produce food and metals, all sorts of commodities will keep dropping, according to SocGen and Citigroup. With inventories ample and slowing economies eroding demand, cheaper oil lowers the price floor for mining companies and farmers to remain profitable. Corn may drop another 3%, cotton 6.5% and gold as much as 5%, SocGen estimates. Costs are falling as surpluses emerge in copper and sugar and as the economy slows in China, the top consumer of energy, metals, pork and soybeans. The Bloomberg Commodity Index of 22 items is heading for a fourth straight annual drop, the longest slump since its inception in 1991. Brent crude, gasoline and heating oil are the biggest losers as an increase in U.S. drilling led to a price war with producers in OPEC.

“There’s been a structural change in oil, and there’s more to come,” said Michael Haigh, the head of commodities research at SocGen. “This will also ripple through other commodity markets, in some cases directly, and others indirectly.” Brent crude, the international benchmark, has tumbled 42% since the end of June to $65.51 a barrel as U.S. output jumped to a three-decade high. The price today touched $65.33, the lowest since September 2009. The Bloomberg Commodity Index fell 12% this year. The MSCI All-Country World Index of equities gained 3.1%, while the Bloomberg Dollar Spot Index climbed 9.8%. Falling oil prices will be a boon to consumers who can expect to pay less for food, Citigroup’s Aakash Doshi said in Dec. 3 report. About 45% of the operating expenses of growing and harvesting rice comes from inputs such as fuels, lubricants, electricity and fertilizer, according to a U.S. Energy Information Administration analysis of U.S. Department of Agriculture data. Energy accounts for about 54% of costs of corn and wheat.

“Fragile governments will face a lot more stress.”

• Here Are 5 Global Problems Cheaper Oil May Fuel (MarketWatch)

The abrupt slide in oil prices being celebrated by American consumers is a two-edged sword that could complicate U.S. geopolitical relations everywhere from Baghdad to Caracas, industry analysts say. The price slide gained speed last month as OPEC, led by Saudi Arabia, decided not to cut production. Check out our global map of oil production. MarketWatch spoke with researchers and experts across the country to get a sense of how cheaper oil will play out in a variety of locations. Here are five themes that emerged:

1. Fragile governments will face a lot more stress: Large portions of Iraq and Syria are now under the control of the militant Islamic group alternately known as the Islamic State, or the Islamic State of Iraq and Syria (ISIS). Before the U.S. bombing campaign began, the group was making as much as $1 million a day smuggling oil to users in Syria and Turkey, according to Treasury Department estimates in late October. However the ability of the U.S. to cut off all the oil is limited because it won’t bomb the actual oil wells, and the refining of the oil is done in simple backyard facilities, according to Joshua Landis, Director of the Center for Middle East studies at the University of Oklahoma. [..]

Nice map.

• A Global Map Of Oil Production Says A Lot About Oil’s Plunge (MarketWatch)

Global oil production is concentrated among a handful of giant producer countries and about a dozen more which produce more than 1 million barrels a day, according to the U.S. Energy Information Administration. For 2013, the U.S. averaged 7.45 million barrels per day of crude oil production, third behind Russia and Saudi Arabia. However, U.S. production has been surging thanks to fracking technologies that free up oil trapped in shale formations. Total U.S. crude oil production averaged 8.9 million barrels per day in October, according to the EIA and is expected to top 9 million barrels a day in December. For 2015, the EIA expects U.S. crude oil production to average 9.4 million barrels a day. That would be the highest annual average crude oil production since before the first OPEC oil embargo in 1973.

Strange question. Who was first?

• Will This Country Be The Next Oil Domino? (CNBC)

Nigeria started 2014 as a darling of investors seeking opportunities in ever more far-flung frontiers, but now the African economy could take a body blow from the oil price decline. “In a country plagued by deep regional and religious divisions, oil revenue is literally the glue that binds the fractious elites together,” RBC Capital said in a note last week, adding that Nigeria is likely the OPEC country with the most immediate risk for civil unrest amid oil price declines. “Nigeria has experienced coups in previous low price environments due in part to drying up patronage funds.” It’s a major shift from earlier this year when many major European and U.S. multinational companies said they were putting the country at the top of their list of frontier markets where they were considering investments.

Nigeria overtook South Africa as Africa’s largest economy this year, and investors were eyeing its robust long-term growth prospects, underpinned by the combination of natural resources, an impending demographic dividend and an underpenetrated consumer market. The country’s stock market surged more than 55% from the beginning of 2013 through its July peak, but shares have fallen around 23% since then as oil prices began a precipitous multi-month slide. Since this summer, Brent has fallen from above $115 per barrel to around $66.05 in Asian trade Tuesday, with many oil analysts predicting prices will continue to slide. “Nigeria’s overreliance on oil for fiscal and foreign-exchange earnings has left the economy very vulnerable following the sharp decline in oil prices,” Barclays said in a note last week. Despite Nigeria’s economy being considered one of sub-Saharan Africa’s most diversified, oil and gas contributed around 95% of export revenue and around 70% of fiscal revenue, Barclays noted.

That’s what I think.

• Someday, Draghi Will Thank Weidmann For Blocking QE (MarketWatch)

As Oscar Wilde might have written had he been a follower of the European Central Bank, for Mario Draghi, the ECB president, to lose one board member’s support over quantitative easing may be regarded as a misfortune; to lose two looks like carelessness; to lose three might be downright embarrassing. On the key question of whether the ECB will embark on hefty government-bond purchases, Draghi and the financial markets have been blowing smoke signals at each other for several months, playing with words, intentions, expectations, and political and economic sensitivities. If Weidmann and his allies, through a mixture of threats, blandishments, subterfuge and propaganda, can hold off the proponents of full-scale QE until next spring, the game may be over.

Without taking any decisions, Draghi has deftly achieved quite a number of his tactical objectives. He has brought down the value of the euro , lowered further the spreads between German and peripheral government bonds, and prevented a massive downturn on equity markets. The phrase ‘”thought leadership” is overused, but Draghi has given it a new meaning: achieving results just by thinking about them. Jens Weidmann, the Bundesbank president, is much denigrated, both in the conservative professorial hinterland of Germany where he is widely mocked for being too soft, and in other parts of Europe for being an obdurately retrograde hawk determined to drive Europe into the deflationary dust.

In fact he seems to be doing a good job of blocking (alongside others, including members of the ECB’s six-strong executive board) a further string of unconventional measures that would probably do little good and might well reverberate badly on the ECB and its reputation. In coming years, Draghi might have cause to thank Weidmann for protecting him from embarking on a path that would have badly dented his image as a policy maker who gets his way with cleverly spun words rather than risky actions that might backfire. Of course, Draghi has failed so far in his goal of restoring inflation to the ECB’s medium-term target of close-to-though-below 2%. And the euro area, as has long been evident, is mired in stagnation. But arguably both of these shortcomings have little to do with the direction and conduct of monetary policy.

Absolutely. Europe needs more debt, channelled through Brussels. Great idea!

• EU Draws Up $1.6 Trillion Wish List To Revive Economy (Reuters)

The European Union has drawn up a wish list of almost 2,000 projects worth €1.3 trillion ($1.59 trillion) for possible inclusion in an investment plan to revive growth and jobs without adding to countries’ debts. Investment has been a casualty of the financial crisis in Europe, tumbling around 20% in the euro zone since 2008, according to the European Central Bank. Following a call by European Commission President Jean-Claude Juncker, EU governments have submitted projects ranging from a new airport terminal in Helsinki to flood defenses in Britain, according to a document seen by Reuters. “Almost 2,000 projects were identified with a total investment cost of 1,300 billion euros of which 500 billion are to be realized within the next three years,” said the document, to be discussed by EU finance ministers on Tuesday.

Projects on the list, which officials stress is not definitive, also include housing regeneration in the Netherlands, a new port in Ireland and a €4.5 billion fast rail connection between Estonia, Latvia, Lithuania and Poland. Other job-creating schemes involve refueling stations for hydrogen fuel cell vehicles in Germany, expanding high-speed broadband networks in Spain and making France public buildings use less energy. Almost a third of the projects are energy related, another third are focused on transport and the remainder on innovation, the environment and housing. The EU’s executive Commission aims to have the first projects chosen and ready to attract private money in June. Many on the list have been frustrated by lack of financing or political problems affecting cross-broader projects.

Yup. It’s going to kill emerging markets, for one thing.

• Strong Dollar May Have ‘Profound Impact’ On World Economy (MarketWatch)

With the dollar marching closer to an eight-year high, the impact of a solid greenback has started to worry traders and economists. The Bank for International Settlements, referred to as the central bankers’ bank, warned in its quarterly review that the strengthening dollar could “have a profound impact on the global economy,” and particularly on emerging markets. “Should the U.S. dollar — the dominant international currency — continue its ascent, this could expose currency and funding mismatches, by raising debt burdens. The corresponding tightening of financial conditions could only worsen once interest rates in the United States normalize,” Claudio Borio, head of the monetary and economic department at BIS, said in a briefing about the quarterly review, which was published on Sunday.

The comments come at a time when investors are speculating when the Federal Reserve will introduce its first rate hike and lift the benchmark interest rates from its record low of close to 0%. A stellar U.S. jobs report on Friday furthered the expectation that the first tightening will come earlier than the mid-2015, helping the ICE Dollar Index log its largest weekly gain in five weeks. On Monday, the index continued to climb and was flirting with levels not seen since 2006. While the appreciating dollar might be attractive for Americans traveling overseas, it seriously affects other parts of the world economy, and in particular countries and companies that have taken out loans in dollars. In this regard, emerging markets could be facing a major setback, as they pay back and service the debt they’ve taken out in the U.S. currency.

BIS estimated that since the financial crisis, international banks have continued to increase their cross-border loans to emerging-market countries, amounting to $3.1 trillion. Most of this debt is in U.S. dollars. That means if the local currency continues to weaken against the dollar it “could reduce the creditworthiness of many firms, potentially inducing a tightening of financial conditions,” BIS said in the quarterly report. Outstanding loans to China alone have more than doubled to $1.1 trillion since 2012, making the country the seventh largest borrower world-wide and sensitive to large swings in foreign currencies. Additionally, Chinese individuals have borrowed more than $360 billion through international debt securities, according to BIS. “Any vulnerabilities in China could have significant effects abroad, also through purely financial channels,” Borio said in his remarks.

“Market pricing and bullish perceptions have diverged profoundly both from underlying risk (i.e. Credit, liquidity, market pricing, policymaking, etc.) and diminishing Real Economy prospects.”

• World in a Box (John Rubino)

Of all the problems with fiat currency, the most basic is that it empowers the dark side of human nature. We’re potentially good but infinitely corruptible, and giving an unlimited monetary printing press to a government or group of banks is guaranteed to produce a dystopia of ever-greater debt and more centralized control, until the only remaining choice is between deflationary collapse or runaway inflation. The people in charge at that point are in a box with no painless exit. Prudent Bear’s Doug Noland describes the shape of today’s box in his latest Credit Bubble Bulletin:

Right here we can identify a key systemic weak link: Market pricing and bullish perceptions have diverged profoundly both from underlying risk (i.e. Credit, liquidity, market pricing, policymaking, etc.) and diminishing Real Economy prospects. And now, with a full-fledged securities market mania inflating the Financial Sphere, it has become impossible for central banks to narrow the gap between the financial Bubbles and (disinflationary) real economies. More stimulus measures only feed the Bubble and prolong parabolic (“Terminal Phase”) increases in systemic risk. In short, central bankers these days are trapped in policies that primarily inflate risk. The old reflation game no longer works.

In other words, most real economies (jobs, production of physical goods, government budgets) around the world are back in (or have never left) recession, for which the traditional response is monetary and fiscal stimulus — that is, lower interest rates and bigger government deficits. Meanwhile, the financial markets are roaring, which normally calls for tighter money and reduced deficits to keep the bubbles from becoming destabilizing. Both problems are emerging simultaneously and the traditional response to one will make the other much, much worse.

Painful. Think about this when you hear the word ‘recovery’.

• The Incredible Shrinking Incomes of Young Americans (Atlantic)

American families are grappling with stagnant wage growth, as the costs of health care, education, and housing continue to climb. But for many of America’s younger workers, “stagnant” wages shouldn’t sound so bad. In fact, they might sound like a massive raise. Since the Great Recession struck in 2007, the median wage for people between the ages of 25 and 34, adjusted for inflation, has fallen in every major industry except for health care.

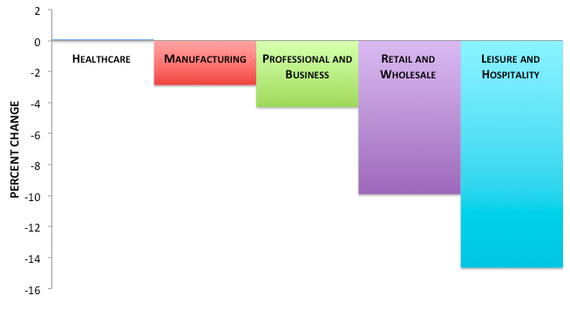

Young People’s Wages Have Fallen Across Industries Between 2007 and 2013

These numbers come from an analysis of the Census Current Population Survey by Konrad Mugglestone, an economist with Young Invincibles. In retail, wholesale, leisure, and hospitality—which together employ more than one quarter of this age group—real wages have fallen more than 10% since 2007. To be clear, this doesn’t mean that most of this cohort are seeing their pay slashed, year after year. Instead it suggests that wage growth is failing to keep up with inflation, and that, as twentysomethings pass into their thirties, they are earning less than their older peers did before the recession. The picture isn’t much better for the youngest group of workers between 18 and 24. Besides health care, the industries employing the vast majority of part-time students and recent graduates are also watching wages fall behind inflation. (40% of this group is enrolled in college.)

Why are real wages falling across so many fields for young workers? The Great Recession devastated demand for hotels, amusement parks, and many restaurants, which explains the collapse in pay across those industries. As the ranks of young unemployed and underemployed Millennials pile up, companies around the country know they can attract applicants without raising starter wages. But there’s something deeper, too. The familiar bash brothers of globalization and technology (particularly information technology) have conspired to gut middle-class jobs by sending work abroad or replacing it with automation and software. A 2013 study by David Autor, David Dorn, and Gordon Hanson found that although the computerization of certain tasks hasn’t reduced employment, it has reduced the number of decent-paying, routine-heavy jobs. Cheaper jobs have replaced them, and overall pay has declined.)

“When the wind turns and the selling begins, we urge everyone to short these names first.”

• Q3 Buybacks Surge: See The Top 20 Repurchasers Of Their Own Stock (Zero Hedge)

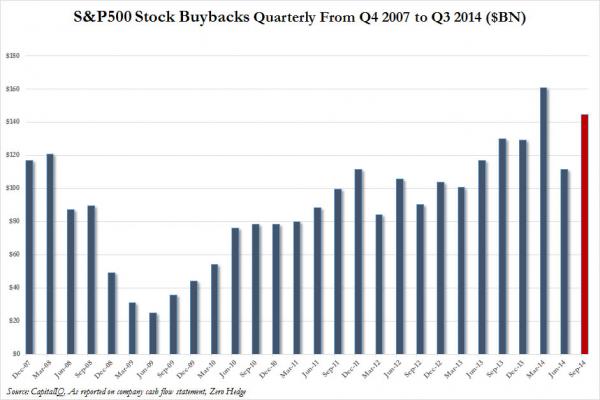

Back in September, when we looked at the total amount of stock buybacks by S&P 500 companies, we observed that the “Buyback Party Is Over: Stock Repurchases Tumble In The Second Quarter” – according to CapIQ data, after soaring to a record $160 billion in Q1, the amount of repurchased stock dropped 20% to “only” $110 billion, which perhaps also explains why the market went absolutely nowhere in the spring and early summer. Our conclusion was that, if indeed this was the end of the buyback party, then “the Fed will have no choice but to step in again, and the central-planning game can restart again from square 1, until finally the Fed’s already tenuous credibility is lost, the abuse of the USD’s reserve status will no longer be a possibility, and the final repricing of assets to their true levels can begin.”

As it turns out our conclusion that it’s all over was premature (with the Fed getting some breathing room thanks to desperate corner offices eager to pump up their CEO’s equity-linked compensation), and as the just concluded Q3 earnings seasons confirms, what went down, promptly soared right back up, with stock repurchases in Q3 surging by 30% following the 30% drop in Q2, and nearly offsetting all the lost “corporate wealth creation” in the second quarter, with the total amount of stock repurchases by S&P 500 companies jumping from $112 billion to $145 billion, just shy of the Q1 record, and the second highest single quarter repurhcase tally going back to 2007, and before.

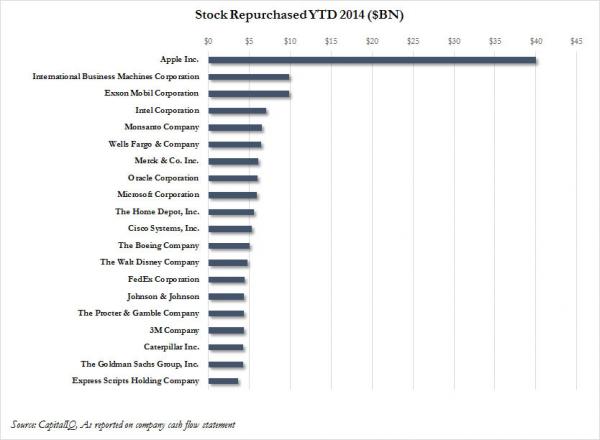

So who are the most glaring offenders of engaging in what James Montier calls the “World’s Dumbest Idea”, i.e., maximizing shareholder value almost entirely through buybacks? Here are the 20 S&P corporations who repurchased the most stock in 2014 through the end of Q3. (Incidentally these are also some of the best big name “performers” this year. When the wind turns and the selling begins, we urge everyone to short these names first.)

And you thought Iceland’s troubles were over ..

• Iceland Tests Hedge Funds as Showdown With Creditors Arrives (Bloomberg)

Iceland will this week tell hedge funds and other creditors in its failed banks how their claims can be settled. The government has designed a model to protect the krona from any jolts that might result from a capital outflow as currency controls are relaxed to enable repayment. The next step is to find out whether the creditors will accept the deal. “Creditors that are unfairly treated internationally do not just walk away,” Timothy Coleman, senior managing director of Blackstone Group, which is advising bondholders in Kaupthing Bank hf, said in an interview. “They will use every part of every legal system available to them to ensure that they are treated appropriately and fairly.” As Iceland starts to scale back currency restrictions in place since 2008, the central bank has suggested the process may involve an exit tax.

While Coleman emphasized that creditors have no interest in a deal that undermines Iceland’s financial stability, he made clear there are some pills bondholders won’t swallow. “I don’t think they are assuming an exit tax,” he said. Creditors in Kaupthing, once Iceland’s biggest bank, say they are owed $23 billion, according to the bank’s first-half report. That’s more than three times as much as the bank has in reported assets. “The debt against Kaupthing is trading below 30 cents on the dollar, so” creditors “understand there will be some negotiated cost,” Coleman said. Bondholders have three demands, he said: “The creditors want to secure a solution that respects the people of Iceland and their capital controls. That would be number one,” he said. “Number two would be to be paid back the money that they lent to the Icelandic banks. And, number three, the creditors have an expectation that they will be treated in accordance with international banking standards.”

How can you not love Farrell?

• ‘Madness Gene’ In All Of Us Wrecks The Economy, Destroys The Earth (Farrell)

Oklahoma GOP Sen. James Inhofe’s book, “The Greatest Hoax: How the Global Warming Conspiracy Threatens Your Future,” reveals everything you need to know about the Republican Party’s position on climate change. Bad news. Climate science is hogwash. Inhofe trusts divine guidance: “God’s still up there. The arrogance of people to think that we, human beings, would be able to change what He is doing in the climate is to me outrageous.” Inhofe’s scheduled to regain his old position as Chairman of the Senate Environment and Public Works Committee in January, So start praying to God folks. Because once ol’ Jim’s back in power, America will burn in climate hell. He’s vowed to block all regulations aimed at cutting carbon emissions. Game-on. Forget lame duck. The Wall Street Journal sure got it right, “Obama Puts Climate on the 2016 Ballot” … and it’s Obama vs. Inhofe rumbling till the presidential elections … this means war … the Democrats verus every GOP science denier kowtowing to Big Oil’s cash.

So for the next two years Inhofe’s “hoax” rhetoric is going to look a lot like a rerun of the original “Godzilla” movie. And the GOP will be looking down the barrel of Obama’s mega USA-China Climate Accord … while Inhofe makes Americans look like scientific and technological Luddites at the UN Climate Conferences in Peru. America still has a great opportunity to take the lead next year at the big one, the UN Climate Conference in Paris. But if Inhofe, the GOP, their Big Oil backers and army of science-denial Luddites keep playing their “global warming is a hoax” card … well then, the whole world will see proof why the IMF just announced that with it’s $17.6 trillion GDP, China is now the world’s new No. 1 economy, replacing the U.S. for the first time in 142 years. Yes, the GOP’s “global warming is a hoax” gambit has actually helped China overtake America. We’re our own worst enemy. Unfortunately the takeover started when we started the unnecessary Iraq War, unwittingly surrendering our credit to China.

Weird story from Pam Martens.

• Slain MassMutual Executive Held Wall Street “Trade Secrets” (Martens)

On Thursday, November 20, 2014, the body of 54-year old Melissa Millan, a divorced mother of two school-age children, was found at approximately 8 p.m. along a jogging path running parallel to Iron Horse Boulevard in Simsbury, Connecticut. A motorist had spotted the body and called the police. According to the coroner’s report, it was determined that Millan’s death was attributable to a stab wound to the chest with an “edged weapon.” Police ruled the death a homicide, a rarity for this town where residents feel safe enough to routinely jog by themselves on the same path used by Millan. Information has now emerged that Millan had access to highly sensitive data on bank profits resulting from the collection of life insurance proceeds from her insurance company employer on the death of bank workers – data that a Federal regulator of banks has characterized as “trade secrets.”

Millan was a Senior Vice President with Massachusetts Mutual Life Insurance Company (MassMutual) headquartered in Springfield, Massachusetts and a member of its 39-member Senior Management team according to the company’s 2013 annual report. Millan had been with the company since 2001. According to Millan’s LinkedIn profile, her work involved the “General management of BOLI” and Executive Group Life, as well as disability insurance businesses and “expansion into worksite and voluntary benefits market.” BOLI is shorthand for Bank-Owned Life Insurance, a controversial practice where banks purchase bulk life insurance on the lives of their workers. The death benefit pays to the bank instead of to the family of the deceased. According to industry publications, MassMutual is considered one of the top ten sellers of BOLI in the United States. Its annual reports in recent years have indicated that growth in this area was a significant contributor to its revenue growth.

Ebols hasn’t gone, even if the western press largely neglect it.

• Sierra Leone Baffled As 3 Ebola Doctors Die In 3 Days (VoA)

Sierra Leone’s chief medical officer has said he is baffled by the deaths of three doctors from Ebola over a three-day period. Dr. Brima Kargbo said a survey conducted jointly with the U.S. Centers for Disease Control (CDC) found that 70 percent of infections did not come from either the country’s Ebola holding centers or treatment facilities. Kargbo said Dr. Aiah Solomon Konoyeima died Saturday, becoming the 10th Sierra Leonean physician to die of the virus. He said Konoyeima was the third doctor to die from Ebola since Friday. “We have Dr. Tom Rogers and Dr. [Dauda] Koroma, who were buried yesterday, and also Dr. Konoyeima,” Dr. Kargbo said. Rogers was a surgeon at the Connaught Hospital, the main referral unit in the capital, Freetown. He was reportedly being treated at the British-run Kerry Town Ebola treatment center. He was said to be responding well to treatment when his condition deteriorated dramatically on Friday.

Koroma died at the Hastings Treatment Center, which is run entirely by local Sierra Leone medics. Kargbo said it’s difficult for him to understand where the doctors got the disease. “It interesting to note that a survey was conducted together with the CDC and it came up very clear that more 70 percent of our infections did not come from either our holding or treatment facilities,” he said. He said it is possible doctors became infected from patients they had been treating. “Most definitely because, at the end of the day, if you follow the trend of the disease, the most affected persons are the health care workers and the caregivers or those who are taking care of persons with the virus,” Kargbo said.