Egon Schiele Meadow, Church and Houses 1912

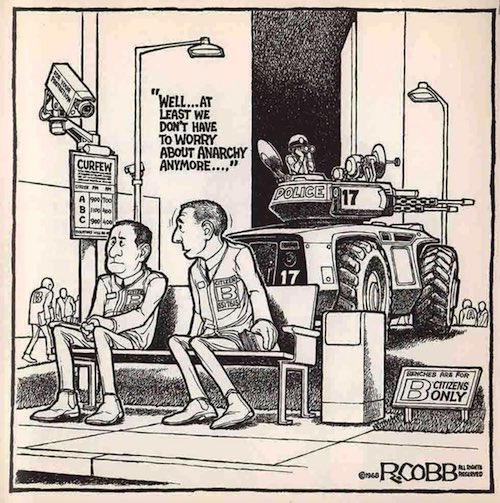

Awfully close to thought police. “Spreading lies about vaccines” here means “questioning vaccines”.

• Twitter To Remove Tweets That Spread Lies About COVID Vaccines (G.)

Twitter will remove tweets that spread harmful misinformation, starting with the Covid-19 vaccine, the company has announced – and from 2021 it will begin to label tweets that push conspiracy theories. The move sees the company follow Facebook and YouTube in tightening up policies around the coronavirus vaccination as the rollout of the jab begins across the world. “Starting next week, we will prioritise the removal of the most harmful misleading information,” the US company said in a blogpost. “And during the coming weeks, we will begin to label tweets that contain potentially misleading information about the vaccines.”

Examples of posts that may be removed include false claims “that suggest immunisations and vaccines are used to intentionally cause harm to or control populations”, and claims “that Covid-19 is not real or not serious, and therefore that vaccinations are unnecessary”. Tweets that do not reach the level of potential harm will not be removed, but may receive a label linking through to authoritative public health information, the company said. Examples of that sort of claim include unsubstantiated rumours, disputed claims, as well as incomplete or out-of-context information about vaccines. The labelling will have a similar visual appearance to the company’s notorious labels about the US election, regularly placed on tweets from Donald Trump in which he falsely claimed victory in the US election.

Twitter said it would enforce the policy “using a combination of technology and human review”. Confusingly, the company has no way for users to report Covid misinformation, or misinformation about vaccines, despite the content being banned on the site. Instead, Twitter says users who think a particular tweet breaks the company’s rules on the topic should report it for any other offence – such as “threatening harm” – and use the text box to add that it is banned misinformation. The move comes two weeks after Facebook tightened its own policy about Covid vaccines. The larger social network will remove claims that rise to the level of imminent physical harm, as well as claims that have been debunked by public health experts, even if they do not reach that level. Chinese network TikTok has also strengthened its policies on vaccine misinformation, announcing on Tuesday that it has policies in place that prohibit misinformation “that could cause harm to an individual’s health or broader public safety”.

Tucker Don’t question the Coronavirus vaccine.

Part 1/2: Don't question the Coronavirus vaccine. pic.twitter.com/haEGpLusth

— Tucker Carlson (@TuckerCarlson) December 18, 2020

“until I see that it’s actually safe for myself or my kids to take, I’m not going to take it.”

• “Who Wants To Be A Guinea Pig?”: Health Workers Balk At Vaccine (ZH)

As tens of thousands of doses of the new Pfizer COVID-19 vaccine make their way across the country, some health workers – first on the list to receive the two-stage jab – are leery of the emerging treatment which mainstream pundits warned would take a ‘miracle’ to produce before the end of the year. And while public concerns over the vaccine have eased compared to polling conducted before the November election, a not-insignificant number of health workers are unwilling to take the shot. Perhaps they’re concerned about taking the fastest vaccine developed in Western history, developed to treat a mysterious new virus which primarily kills the elderly (though can have lasting effects on people of all ages save for children).

As Bloomberg notes, the initial vaccines have few serious side effects (aside from a handful of serious allergic reactions), though nobody knows what long-term effects it has, if any. For example, nobody can possibly know what it does to a gestating fetus for nine months, or whether it affects fertility – yet, the American College of Obstetricians and Gynecologists recommend that pregnant women take the vaccine. “At one Chicago hospital where the city’s first COVID-19 vaccine was administered on Tuesday, 40% of the staff said in a survey earlier this month that they would not take it. Sherrie Burch, 56, a ward clerk at Loretto, is baffled by how quickly the Covid-19 vaccine was developed, given how long medical developments typically take. And that makes her nervous.

“It just happened too fast for me,” Burch said, adding that her children, grandchildren and 76-year-old mother aren’t planning to get it either. “It’s the fear of the unknown.” Burch wants more details about the vaccine’s research and longer-term side effects. She plans to wait at least a couple of months to see how co-workers respond to the shot. Until then, she’ll keep masking, distancing and hand washing. Some nurses, respiratory therapists and technicians at Loretto also are opting out, said Nikhila Juvvadi, the hospital’s chief clinical officer who was the first person to administer the vaccine in Chicago. At a staff town-hall meeting on Wednesday, she explained the science of how the mRNA Covid-19 vaccine works.” -Bloomberg

In Maine, 40% of staff and 30% of residents at the state’s larger nursing homes won’t take the jab, according to an “informal discussion” conducted by the Maine Health Care Association. “Without official polling, it’s hard to know how accurate a picture this paints, and we fully expect these percentages to increase with greater education and awareness,” said the organization’s director of communications, Nadine Grosso. “Ultimately, we know that vaccination is key to safely reopening our long term care facilities.” And if these are all the people who will admit to refusing the vaccine, how many lied and said they will?

Still, some remain unpersuaded. Jonathan Damato, 41, a New York City paramedic for 21 years, is not an anti-vaxxer. He gets an annual flu shot, and he trusts the life-saving potential of vaccines against measles, mumps, polio. His station does about 50 or 60 Covid ambulance runs a week — people presenting high fevers and shortness of breath. “I know the virus is real,” said Damato, who has a 4-year-old son with health issues. But “until I see that it’s actually safe for myself or my kids to take, I’m not going to take it.” -Bloomberg In short, nobody wants to be a guinea pig.

Tucker Don’t question the Coronavirus vaccine. Part 2

Part 2/2: Don't question the Coronavirus vaccine. pic.twitter.com/npng6H9JdF

— Tucker Carlson (@TuckerCarlson) December 18, 2020

More reports coming out on this theme. Good. Don’t know that missed education is the big thing here, though. Missed social life might be bigger.

• How Virtual Learning Has Traumatized Their Children (DC)

Data accumulated globally has shown that infections did not surge when schools reopened, and the nation’s leading infectious disease expert, Dr. Anthony Fauci, said as much in late November when he called on schools to reopen. While many private schools have reopened completely or partially, some of the nation’s largest school districts are still closed. In Washington, D.C., the city’s teachers union rejected an agreement with the public school system to reopen campuses in November. In Chicago, Philadelphia, Boston, Topeka, San Diego and multiple other cities, districts put off their plans to reopen in mid-November and gave no set date for reopening.

Eileen, a Latin teacher at a Christian Classical school in Maryland, has been able to teach in her regular classroom since Sept. 3, when her school reopened with health and sanitation protocols implemented to prevent COVID-19 spread. Eileen’s 15-year-old daughter, who is a sophomore at a public school, has been learning virtually for 14 weeks. She goes to school with her mother once a week just to “be part of normal life,” Eileen tells the Caller. In an essay Eileen’s daughter wrote about her virtual learning experience, she describes the despondency and defeat students and teachers feel. In some classes, students mute their audio feature to hide the fact that they’re playing video games instead of paying attention.

Teachers have difficulty holding students accountable, making flouting the rules easier. Eileen’s daughter, an aspiring writer and accomplished student, also faces her own waning motivation. “Every minute I sit at my desk I am being erased. It started with one of my dimensions. Then my voice was replaced by the chat, my face with a logo, and my life with progress checks,” Eileen’s daughter writes. “Virtual school is not real school. They are not giving us an education. They are teaching us how to not get caught using google translate. They are teaching us which websites will do your algebra homework for you. And if the Board of Education doesn’t take my education seriously, then why should I?”

“We have a vaccine now. We don’t need false positives anymore. Notionally, the system has produced its miracle cure.”

“all the PCR tests being done will be done “under the new WHO guidelines”, and running only 25-30 cycles instead of 35+. Lo and behold, the number of “positive cases” will plummet..”

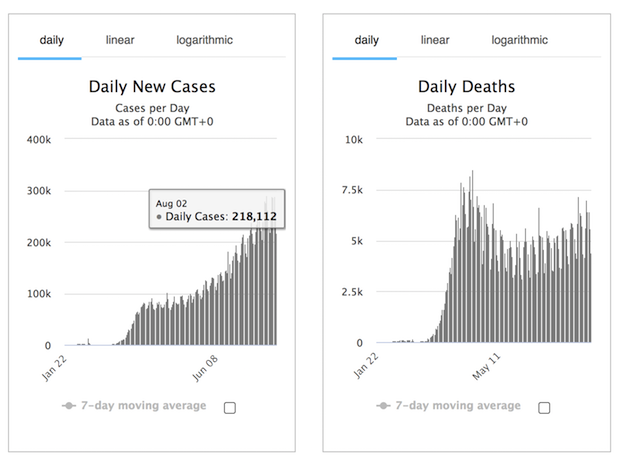

• WHO -Finally- Admits PCR Tests Create False Positives (OffG)

The World Health Organization released a guidance memo on December 14th, warning that high cycle thresholds on PCR tests will result in false positives. While this information is accurate, it has also been available for months, so we must ask: why are they reporting it now? Is it to make it appear the vaccine works? The “gold standard” Sars-Cov-2 tests are based on polymerase chain reaction (PCR). PCR works by taking nucleotides – tiny fragments of DNA or RNA – and replicating them until they become something large enough to identify. The replication is done in cycles, with each cycle doubling the amount of genetic material. The number of cycles it takes to produce something identifiable is known as the “cycle threshold” or “CT value”. The higher the CT value, the less likely you are to be detecting anything significant.

This new WHO memo states that using a high CT value to test for the presence of Sars-Cov-2 will result in false-positive results. To quote their own words [our emphasis]: “Users of RT-PCR reagents should read the IFU carefully to determine if manual adjustment of the PCR positivity threshold is necessary to account for any background noise which may lead to a specimen with a high cycle threshold (Ct) value result being interpreted as a positive result.” They go on to explain [again, our emphasis]: “The design principle of RT-PCR means that for patients with high levels of circulating virus (viral load), relatively few cycles will be needed to detect virus and so the Ct value will be low. Conversely, when specimens return a high Ct value, it means that many cycles were required to detect virus. In some circumstances, the distinction between background noise and actual presence of the target virus is difficult to ascertain.”

Of course, none of this is news to anyone who has been paying attention. That PCR tests were easily manipulated and potentially highly inaccurate has been one of the oft-repeated battle cries of those of us opposing the “pandemic” narrative, and the policies it’s being used to sell. Many articles have been written about it, by many experts in the field, medical journalists and other researchers. It’s been commonly available knowledge, for months now, that any test using a CT value over 35 is potentially meaningless. Dr Kary Mullis, who won the Nobel Prize for inventing the PCR process, was clear that it wasn’t meant as a diagnostic tool, saying: “..with PCR, if you do it well, you can find almost anything in anybody.” And, commenting on cycle thresholds, once said: “If you have to go more than 40 cycles to amplify a single-copy gene, there is something seriously wrong with your PCR.”

The MIQE guidelines for PCR use state: Cq values higher than 40 are suspect because of the implied low efficiency and generally should not be reported,” This has all been public knowledge since the beginning of the lockdown. The Australian government’s own website admitted the tests were flawed, and a court in Portugal ruled they were not fit for purpose. Even Dr Anthony Fauci has publicly admitted that a cycle threshold over 35 is going to be detecting “dead nucleotides”, not a living virus. Despite all this, it is known that many labs around the world have been using PCR tests with CT values over 35, even into the low 40s. So why has the WHO finally decided to say this is wrong? What reason could they have for finally choosing to recognise this simple reality?

The answer to that is potentially shockingly cynical: We have a vaccine now. We don’t need false positives anymore. Notionally, the system has produced its miracle cure. So, after everyone has been vaccinated, all the PCR tests being done will be done “under the new WHO guidelines”, and running only 25-30 cycles instead of 35+. Lo and behold, the number of “positive cases” will plummet, and we’ll have confirmation that our miracle vaccine works.

“Joe Biden defends his son — who is under federal investigation, was kicked out of the Navy for cocaine, and was sued by a stripper for paternity — as “the smartest man I know.”

“It’s used to get to me. I think it’s kind of foul play, but, look, it is what it is. And he’s a grown man. He is the smartest man I know. I mean, in a pure intellectual capacity.”

And boy, whatever happened to Stephen Colbert?

• Joe Biden Calls His Son Hunter ‘The Smartest Man I Know’ (DC)

President-elect Joe Biden says he is “not concerned” about a federal investigation into his son, Hunter, and accused his opponents of weaponizing the probe for political points. Biden said that Hunter, who has been involved in a string of high-profile personal and business controversies in recent years, as “the smartest man I know.” Hunter Biden announced last Wednesday that he is under investigation by the U.S. attorney’s office in Delaware over his “tax affairs.” A source familiar with the investigation told the Daily Caller News Foundation that the investigation began in 2018, before Joe Biden launched his presidential campaign.

The Associated Press reported that prosecutors subpoenaed Biden for his records with more than two dozen businesses, including companies in China and Ukraine. (RELATED: Joe Biden Says He Is ‘Confident’ His Son Did Nothing Wrong) Biden, who was interviewed by CBS’s Stephen Colbert, accused his political opponents of “foul play” by seizing on the investigation. “We have great confidence in our son. I am not concerned about any accusations made against him. It’s used to get to me,” Biden said in the interview, which he conducted with his wife Jill Biden at his side. “I think it’s kind of foul play,” said Biden, adding, “look, it is what it is.” “He’s a grown man. He is the smartest man I know. I mean, in a pure intellectual capacity. And as long as he’s good, we’re good.”

“The US Shadow State and its creatures are of the Soviet school of information: top-down tell, and censor the ‘show’ part.”

• They Won’t Take “No” For An Answer (Ward)

There are many issues facing us today both personally and globally. But they all boil down to one thing: those who have captured power through either electoral desperation or corporacratic subterfuge simply will not take no for an answer. We must look beyond the issue to the principle, and learn to say no in a forcefully peaceful and organised manner. It does seem eternally odd, does it not, that the US judicial system seems happy to throw out Republican affidavits giving evidence of electoral fraud, but at the same time the US has a media set that suffixes every report on what President Trump says about it with “although he has no evidence to support his claims”….and the world anglosphere falls lamely into line.

It is truly Pythonic, with just a dash of Catch22: “We’re not going to review these affidavits because they’re worthless,” said the Ostriches, “so will you stop saying you were cheated, because you haven’t got any evidence – we know this, because we don’t need to look at it”. My view is simple: it is entirely possible that Trump is lying his fat head off. But the common sense rejoinder to that pov is: 1) Why press ahead so vigorously with a case if (privately) you know it to be BS? And 2) If you the State know it to be BS, why not investigate every affidavit thoroughly and enumerate their lack of worth instance by instance? In short, we have a plaintiff behaving like a guy who’s done his homework, and the State dismissing everything out of hand for fear of finding magic bullets flying backwards, and Presidential Heads exploding in the wrong direction.

Show not tell: it’s an old adage, but still universally applicable. The ‘Tell’ approach: “Laugh at me because believe me, I’m funny….boy, am I funny”. The ‘Show’ approach: Tell a very funny joke with timing and élan. The US Shadow State and its creatures are of the Soviet school of information: top-down tell, and censor the ‘show’ part. When it doesn’t convince, smear the doubters as ill-educated, delusional and deviant.

“After the third and final recount, Biden won Georgia by 11,779 votes, or 0.2%.”

• Georgia Announces Signature Matching Review For Election Ballots (JTN)

After three recounts, Georgia certified the 2020 presidential election. But on Thursday, Georgia Secretary of State Brad Raffensperger announced a statewide move to match signatures to their absentee ballots in all 159 counties in the state. The announcement comes just weeks before two Georgia Senate runoff elections on Jan. 5 will determine which party controls the Senate. Raffensperger announced that the signature matching will be done in partnership with the University of Georgia. The study will review a random sample of signatures for mail-in ballots that were cast in the presidential election. “We are confident that elections in Georgia are secure, reliable and effective,” Raffensperger said.

“Despite endless lawsuits and wild allegations from Washington, D.C., pundits, we have seen no actual evidence of widespread voter fraud, though we are investigating all credible reports. Nonetheless, we look forward to working with the University of Georgia on this signature match review to further instill confidence in Georgia’s voting systems,” he also said. Earlier this week, Georgia officials announced an audit of signatures for mail-in ballots in Cobb County, a suburb of Atlanta. The Trump campaign claimed that Cobb County did not properly conduct signature match in June,” said Jordan Fuchs, Georgia’s deputy secretary of state. “After the countywide audit, we will look at the entire state. We will look at the entire election to make sure signature match was executed properly.” After the third and final recount, Biden won Georgia by 11,779 votes, or 0.2%.

The Durham probe comes to mind. Where is it?

• Where Bill Barr Failed the President (ET)

Barr’s most significant achievement during his tenure was perhaps his role in the final stages of the Mueller investigation, leading to his joint conclusion with Deputy AG Rod Rosenstein that evidence compiled by Robert Mueller failed to establish that the president had obstructed justice. But a series of curious missteps then followed. The investigation being conducted by U.S. Attorney John Huber disappeared entirely, although a portion of that investigation may have been folded into U.S. Attorney John Durham’s still ongoing investigation. Durham was appointed as special counsel by Barr, but reports indicate that Durham’s investigative scope has been narrowed, and the investigation’s long-promised results remain delayed.

Trump found himself impeached by the House in December 2019, despite evidence within the DOJ that might have prevented the politically driven result. Indeed, it now appears that Trump may have been impeached for making inquiries into the very crimes for which Hunter Biden, the son of Joe Biden, is now formally under investigation. Said differently, Trump may have effectively been impeached for being right about Biden. To date, only one person has been formally charged from the multi-year probe into the FBI’s handling of their investigation of the Trump campaign. Although two FISA warrants on Trump campaign adviser Carter Page were deemed as invalid—and thus illegal—there have been no prosecutions or convictions of high-level individuals involved in the surveillance conducted on members of the Trump campaign.

Barr remained concerned, perhaps rightly, about exhibiting any overt signs of interference in the 2020 presidential election. Unfortunately, while he studiously avoided disclosing any evidence regarding the Hunter Biden investigation, so did the mainstream media. The impact of the general public’s lack of knowledge on this matter may have been material to the election outcome. Barr also made what might generously be termed a material strategic error by speaking with The Associated Press in the weeks following the election. Barr’s comments that the DOJ had yet to uncover fraud on a level sufficient to affect the outcome of the election reverberated throughout the nation and caused material damage to the case being made by the president’s lawyers. Why Barr would choose to speak to the media, let alone the AP, at this critical juncture in post-election events remains unknown.

Barr, no political novice, has more than enough political acumen to comprehend the manner in which his comments would be interpreted and relayed to a nation in post-election turmoil. That he apparently held the belief there was no material evidence of election fraud strikes many who have been wading through court evidence for weeks as curious. Durham’s efforts may yet produce tangible results, but nearly four years of investigation has surely been long enough to bring forth something material. With each passing month, the lack of tangible results has allowed for unspoken discrediting of the president’s claims. And with the possibility of a politically motivated Biden administration, concerns over potential interference in Durham’s results—special counsel status notwithstanding—are valid.

In case you didn’t notice: the neocons won. So Russiagate is alive and kicking.

• Trump Takes Bipartisan Criticism For Silence On Massive Cyber Attack (F.)

President Donald Trump is taking heat from members of Congress in both parties in recent days for his continued silence on a massive cybersecurity breach linked to Russia, even as the president’s own officials say the U.S. is highly vulnerable to further attacks. Through a weakness in software from SolarWinds Orion, an IT firm that services numerous U.S. government agencies, hackers – that U.S. officials say are tied to Russia – were reportedly able to infiltrate the Department of Homeland Security, the Pentagon, the Treasury Department, the National Institutes of Health and various other departments. Democrats have been vocal about the breach and critical of the president’s actions, with Rep. Frank Pallone (D-N.J.) noting the president fired Cybersecurity and Infrastructure Security Agency (CISA) head Chris Krebs for debunking his election fraud conspiracy theories just one month before the attack occurred.

Rep. Ted Deutch (D-Fla.) called Trump’s silence “unacceptable,” adding, “For 4 years, Congress has been urging him to take Russian threats seriously,” while Rep. Bill Pascrell (D-N.J.) suggested the silence is because Trump has “cozied up to” Russian President Vladimir Putin. Sen. Mitt Romney (R-Utah), one of Trump’s most prolific Republican detractors, compared the breach to “Russian bombers… repeatedly flying over our entire country,” and slammed the “inexcusable silence and inaction from the White House.” Rep. Denver Riggleman (R-Va.) was critical of Trump’s silence as well, alleging a “leadership vacuum” in the administration and telling Forbes that Trump’s reticence to weigh in is because doing so “could highlight his firings” of cybersecurity, defense and intelligence officials in recent weeks.

Rep. Adam Kinzinger (R-Ill.) and outgoing Rep. Will Hurd (R-Texas) both took aim at Trump for his threat to veto a defense bill that includes cyber protections and would create a National Cyber Security Director, with Hurd adding, “We need to find the inaugural director ASAP because he/she is going to have a full plate on day one.” “No statement, no tweet, nothing from [Sen. Marco Rubio (R-Fla.)] on Russia hack of Federal agencies,” tweeted Rep. Debbie Mucarsel Powell (D-Fla.), echoing Democrats who have alleged not just Trump, but many Republicans in Congress have shied away from weighing in on the hack. “As Chair of Senate Intelligence his silence=complicity,” she added. “CISA has determined that this threat poses a grave risk to the Federal Government and state, local, tribal, and territorial governments as well as critical infrastructure entities and other private sector organizations,” the agency said in a statement on Thursday.

Is this even illegal?

• Google Secretly Gave Facebook Perks, Data In Ad Deal: US States (R.)

Facebook Inc and Alphabet’s Google, the two biggest players in online advertising, used a series of deals to consolidate their market power illegally, Texas and nine other states alleged in a lawsuit against Google on Wednesday. Google and Facebook compete heavily in internet ad sales, together capturing over half of the market globally. The two players agreed in a publicized deal in 2018 to start giving Facebook’s advertiser clients the option to place ads within Google’s network of publishing partners, the complaint alleged. Executives at the highest level of the companies signed off on the deal, according to the complaint. For example, a sneaker blog that uses software from Google to sell ads could end up generating revenue from a footwear retailer that bought ads on Facebook.

Google reached similar partnerships with other advertising companies as part of an effort to maintain market share that was internally codenamed Project Jedi, a source with direct knowledge of the matter said. But what Google did not announce publicly is that it gave Facebook preferential treatment, the complaint alleged. Facebook agreed to back down from supporting competing software, which publishers had developed to dent Google’s market power, the complaint said. “Facebook decided to dangle the threat of competition in Google’s face and then cut a deal to manipulate the auction,” it said, citing internal communications. In exchange, the states said, Facebook received various benefits, including access to Google data and policy exceptions that enabled its clients to unfairly get more ads placed than clients of other Google partners could.

[..] The complaint also alleged that Google and Facebook engaged in fixing prices of ads and have continued to cooperate, though the section was heavily redacted and left it unclear just how and when the companies allegedly used their “market allocation agreement.” However, it said that “given the scope and extensive nature of cooperation between the two companies, Google and Facebook were highly aware that their agreement could trigger antitrust violations. The two companies discussed, negotiated, and memorialized how they would cooperate with one another.”

The Pentagon needs enemies.

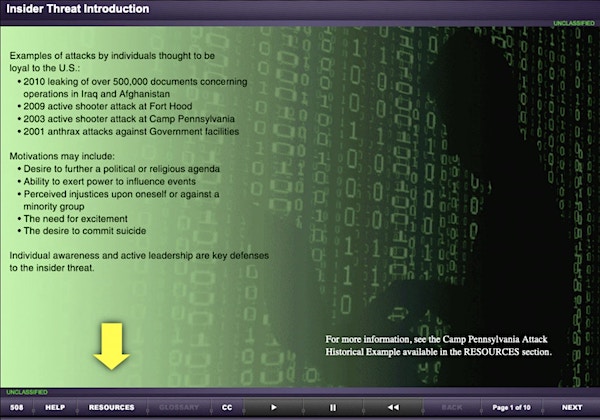

• Pentagon Training Equates Whistleblower Chelsea Manning With Terrorists (IC)

In the decade since her historic transfer of secret military and diplomatic materials to WikiLeaks, Chelsea Manning has consistently and across party lines been condemned as a traitor. Less common, and absent entirely from the government’s efforts to imprison her, are allegations that her leak was an act of terrorism. But anti-terrorism training materials obtained by The Intercept show that the Pentagon is teaching defense workers exactly that. Both civilian contractors and enlisted personnel are commonly required to complete JS-US007, a Pentagon course designed to “increase your awareness of terrorism and to improve your ability to apply personal protective measures,” according to Joint Knowledge Online, a Department of Defense education portal. JS-US007 covers a variety of grimly serious topics, from detecting roadside bombs to surviving active shooter scenarios and skyjackings.

The training also covers so-called insider threat attacks, acts of terroristic violence in which members of a group strike the group itself, like the 2009 Fort Hood, Texas, shooting in which Army Maj. Nidal Malik Hasan shot and killed 13 individuals on the base, wounding 30 more. The Department of Homeland Security defines insider threat terrorism as “an unlawful use of force and violence by employees or others closely associated with organizations, against those organizations to promote a political or social objective.” Other definitions may differ on technicalities, but like other acts of terrorism, the unifying theme is the violence of the acts.

But unclassified JS-US007 materials obtained by The Intercept show that the Pentagon’s anti-terrorism trainees are learning a far broader definition of terrorism, one that includes the entirely nonviolent acts of Manning. On a slide listing “Examples of attacks by individuals thought to be loyal to the US,” Manning’s “2010 leaking of over 500,000 documents concerning operations in Iraq and Afghanistan” is listed first, followed by three examples of murder: the “2009 active shooter attack at Fort Hood,” the “2003 active shooter attack at Camp Pennsylvania,” and the “2001 anthrax attacks against Government facilities” that closely followed the attacks of September 11. Another slide in the presentation lists Manning’s alleged “anti-American statements” as a “pre-attack indicator.”

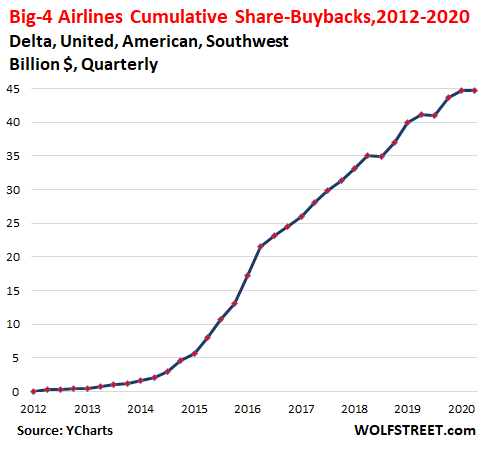

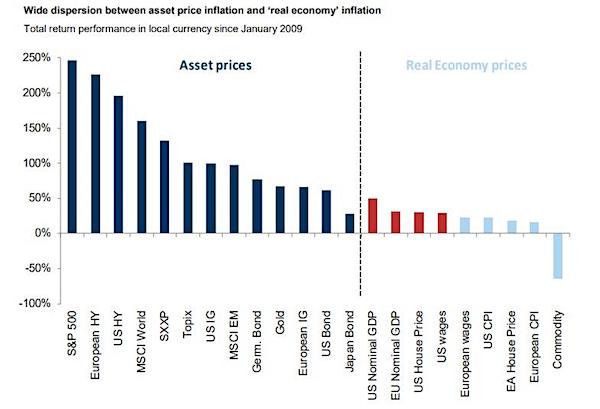

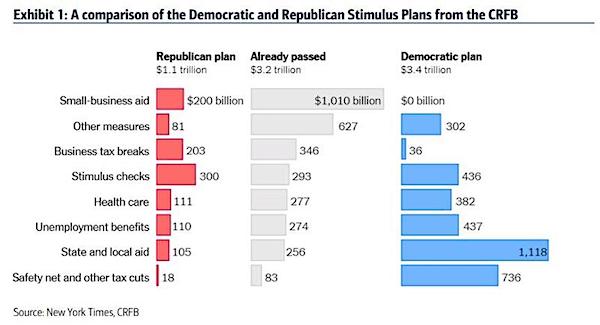

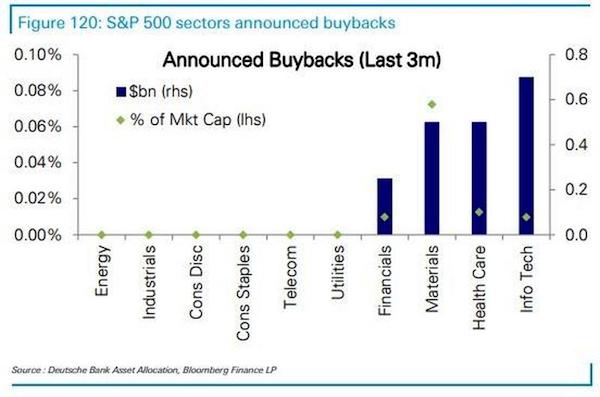

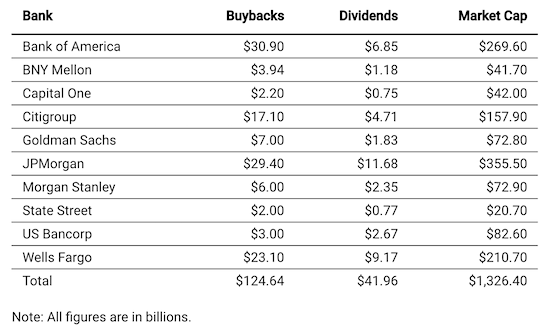

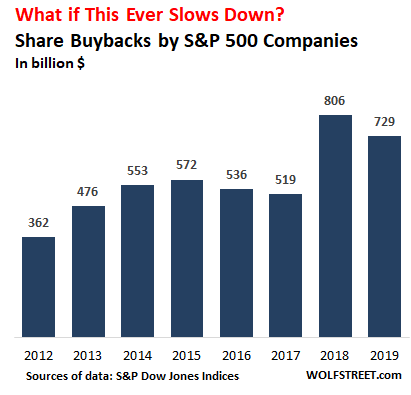

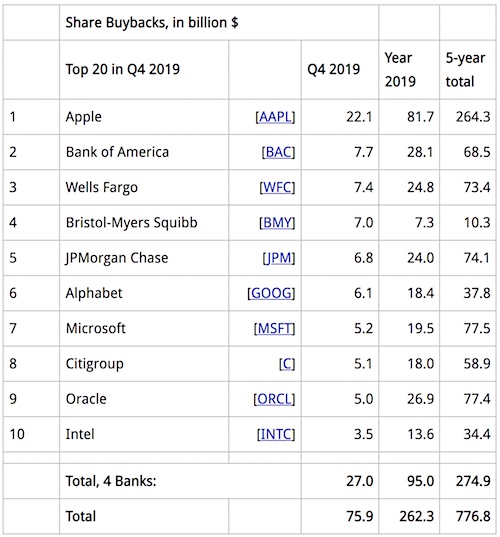

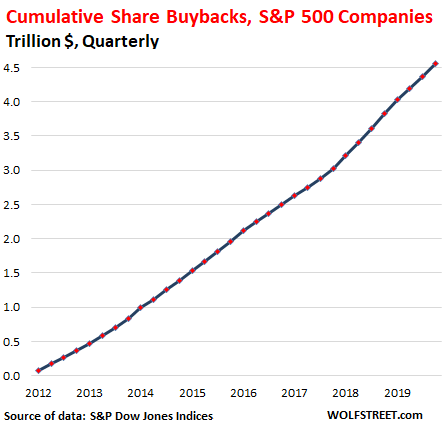

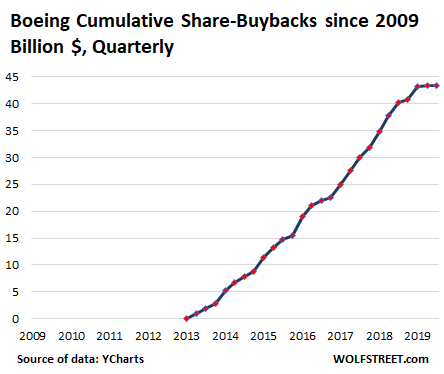

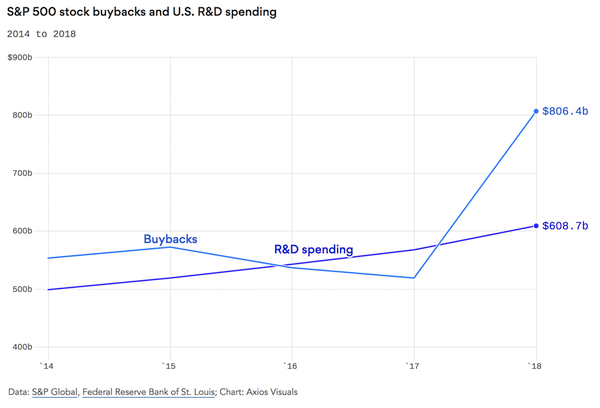

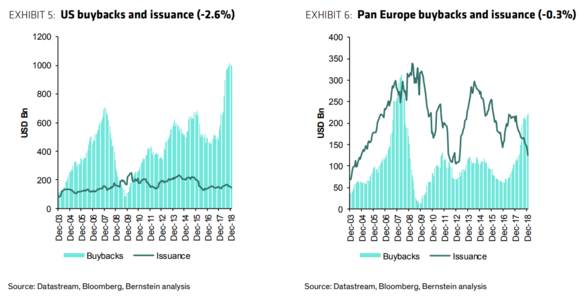

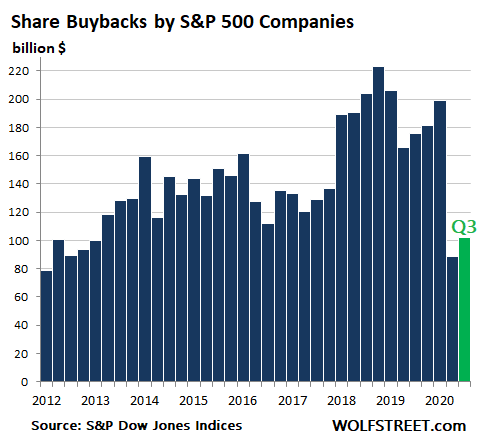

“..down 54% from peak share-buyback mania in Q4 2018..”

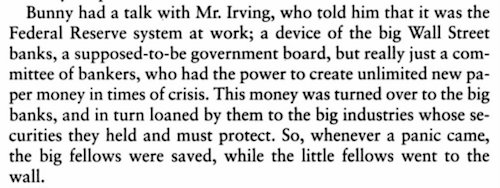

• Q3 Share Buybacks Plunged 42% YoY, Big Banks Are Gone (WS)

The big four banks are out. And other companies are out. But Big Tech is in, as big as ever, and Warren Buffett’s Berkshire Hathaway, after pooh-poohing share buybacks for years, is now the second largest share buyback queen. In the third quarter 2020, companies in the S&P 500 Index bought back $101.8 billion of their own shares, according to S&P Dow Jones Indices this morning. While this still sounds like a lot of share buybacks, it’s down 42% from Q3 last year, and down 54% from peak share-buyback mania in Q4 2018 following the corporate tax cuts:

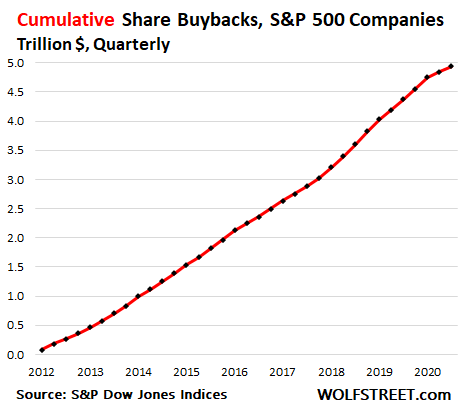

Since the beginning of 2012, the S&P 500 companies have bought back nearly $5 trillion of their own shares. How much is $5 trillion? It’s nearly one-quarter of US 12-month GDP in current dollars. It’s about equal to the amount by which the US government debt has exploded over the past 12 months. These $5 trillion could have been invested in expansion projects in the US, and in labor, and in training, or God forbid, in reducing the debt that Corporate America has loaded up on in a historic manner.

[..] Corporate debt levels have been showing up in the Fed’s Financial Stability Reports. The corporate “debt overhang,” as the Fed calls it, frazzled Fed researchers in 2019 and it is now again cropping up in Fed research papers, including by the New York Fed a few days ago. “We find that the economic costs of corporate debt booms rise when inefficient debt restructuring and liquidation impede the resolution of corporate financial distress and make it more likely that corporate zombies creep along,” summarize the researchers at the New York Fed. It was another research paper duly ignored by Fed Chair Powell.

Last year, the four big banks – Bank of America, Wells Fargo, JPMorgan Chase, and Citigroup – occupied the #2, #3, #4, and #7 spots on the Top 20 list of our share buyback queens. Now they’re gone from the list, having been told by regulators to stop share buybacks to preserve capital to absorb the coming losses from the Crisis. Big Tech and, ironically, Warren Buffett dominate the list. Apple retains its top spot with $17.6 billion in share buybacks in Q3, bringing the 12-month total to $76 billion.

I don’t normally include 4-month old articles in Debt Rattles, but this could just as well be from today.

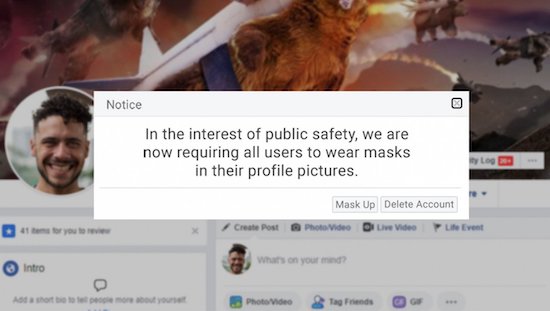

• Facebook To Require Masks In All Profile Pictures (BBee)

Facebook confirmed today that to prevent the spread of coronavirus and promote a safe space to virtue-signal, masks will be required on all profile pictures going forward. If you log in to Facebook you will be prompted to change your profile picture to one where you are wearing a mask. If you don’t have a mask, Facebook offers digital mask filters to give the appearance that you’re wearing one. Those who refuse the mask will be asked to delete their accounts.

“This is an issue of public safety,” said Mark Zuckerberg. “We were seeing people just commenting on things and posting memes and stuff while their face was clearly visible. The CDC currently says that masks are good, and therefore, you must wear a mask.” An assistant then whispered in Zuckerberg’s ear. “Oh, uh, this just in: the CDC now says that masks are bad. So we’ll take this all back.” But, before he could reverse the mask order, the CDC issued another update saying that masks were good again. “Anyway, yes, a mask for everyone. It’s a small thing to do to make everyone feel safe.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

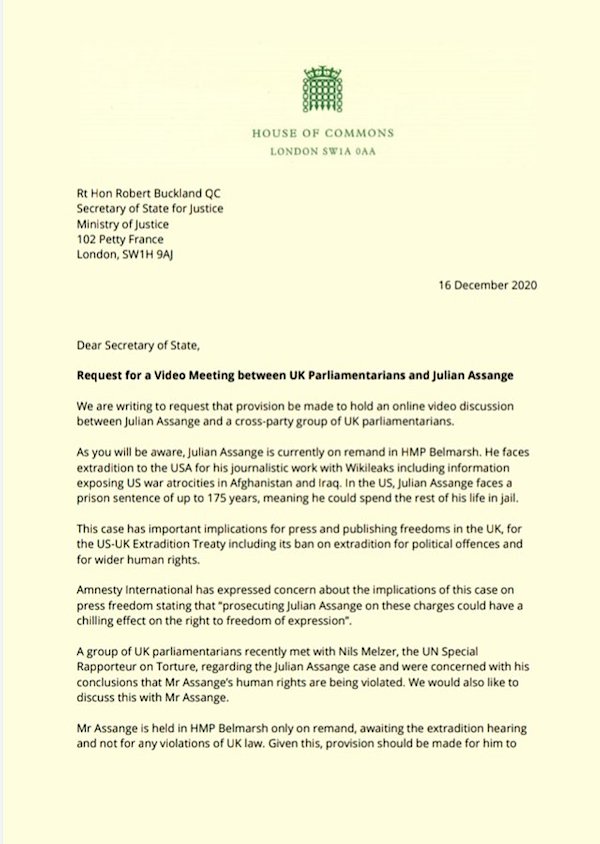

UK MPs ask for a meeting with Assange.

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.