Pablo Picasso The rescue 1936

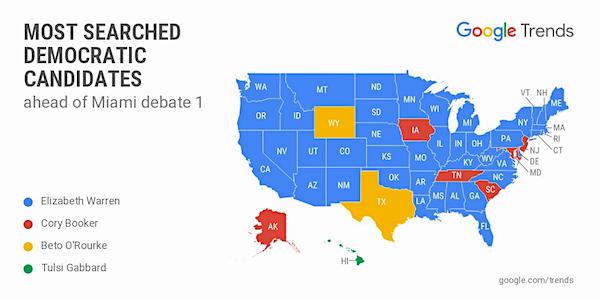

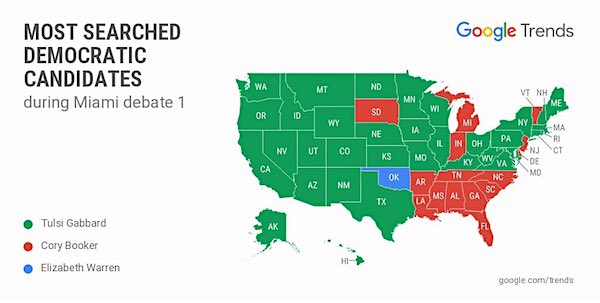

I’m not going to watch a ‘debate’ led by Rachel Maddow (hence no credibility) filled with also-rans, not even to join Matt Taibbi’s drinking games. Liz Warren will go through, but I understand the clear winner was Tulsi Gabbard (as the graphs show), the only anti-war Democrat, though MSNBC et al do what they can to deny that. The whole circus is exclusively goal-seeked. The DNC wants to control the entire process. Yes, just like they did in 2015-16. Big success.

China dominates payment technology. A big threat to western banks, and Visa, Paypal.

• Facebook May Pose a Greater Danger Than Wall Street (TD)

Payments can happen cheaply and easily without banks or credit card companies, as has already been demonstrated—not in the United States but in China. Unlike in the U.S., where numerous firms feast on fees from handling and processing payments, in China most money flows through mobile phones nearly for free. In 2018 these cashless payments totaled a whopping $41.5 trillion; and 90% were through Alipay and WeChat Pay, a pair of digital ecosystems that blend social media, commerce and banking. According to a 2018 article in Bloomberg titled “Why China’s Payment Apps Give U.S. Bankers Nightmares”:

The nightmare for the U.S. financial industry is that a technology company—whether from China or a homegrown juggernaut such as Amazon.com Inc. or Facebook Inc.—replicates the success of Alipay and WeChat in America. The stakes are enormous, potentially carving away billions of dollars in annual revenue from major banks and other firms. That threat may now be materializing. On June 18, Facebook unveiled a white paper outlining ambitious plans to create a new global cryptocurrency called Libra, to be launched in 2020. Facebook reportedly has high hopes that Libra will become the foundation for a new financial system free of control by Wall Street power brokers and central banks.

But apparently Libra will not be competing with Visa or Mastercard. In fact, the Libra Association lists those two giants among its 28 soon-to-be founding members. Others include Paypal, Stripe, Uber, Lyft and eBay. Facebook has reportedly courted dozens of financial institutions and other tech companies to join the Libra Association, an independent foundation that will contribute capital and help govern the digital currency. Entry barriers are high, with each founding member paying a minimum of $10 million to join. This gives them one vote (or 1% of the total vote, whichever is larger) in the Libra Association council. Members are also entitled to a share proportionate to their investment of the dividends earned from interest on the Libra reserve p- the money that users will pay to acquire the Libra currency.

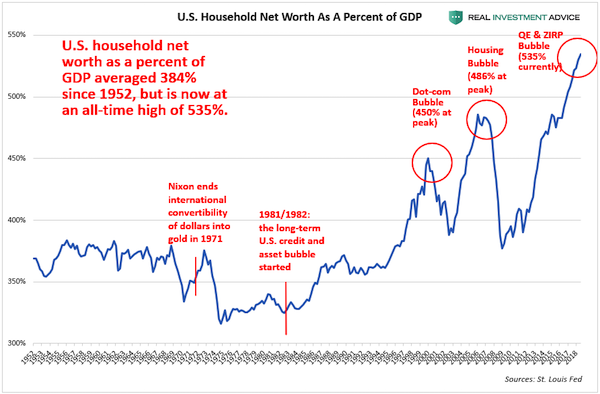

“..since 1952, household wealth has averaged 384% of the GDP, so the current bubble’s 535% figure is in rarefied territory.”

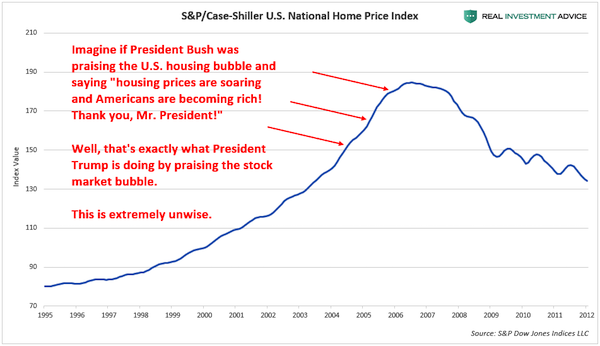

• Trump Praising Stock Market Is Like Bush Praising Housing In 2006 (Colombo)

Imagine, theoretically, if President George W. Bush was praising the U.S. housing bubble as it inflated in the mid-2000s while saying extremely arrogant and cocky things like “I’m making you all rich!” and “Thank you, Mr. President!“ Then, the housing bubble bursts and causes the most severe recession since the Great Depression. Well, that’s basically what President Trump is doing when he praises the soaring stock market.

Trump himself even called the stock market a “big, fat, ugly bubble” when he was on the campaign trail in 2016. He changed his tune immediately after he won the election. The Fed’s aggressive inflation of the U.S. financial markets has created a massive bubble in household wealth. U.S. household wealth is extremely inflated relative to the GDP: since 1952, household wealth has averaged 384% of the GDP, so the current bubble’s 535% figure is in rarefied territory. The dot-com bubble peaked with household wealth hitting 450% of GDP, while household wealth reached 486% of GDP during the housing bubble. Unfortunately, the coming household wealth crash will be proportional to the run-up.

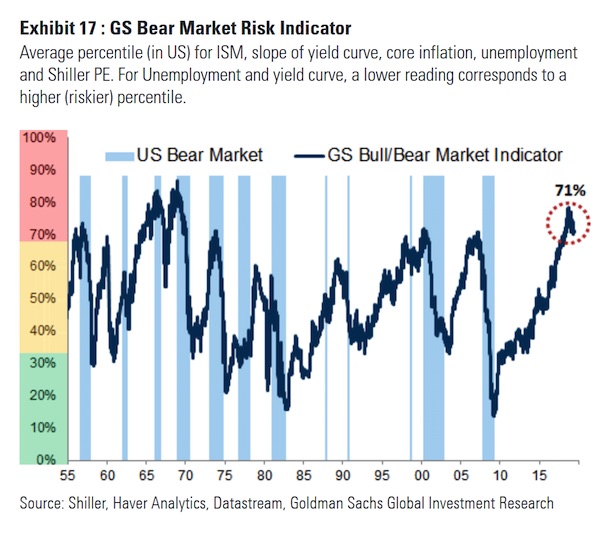

To make matters worse, Goldman Sachs’ very accurate Bear Market Risk Indicator has been at its highest level since the early-1970s:

How much of this is due to a -feared- lack of USD?

• President Xi, Still the Deglobalizer in Chief… (Setser)

Chad Bown of the Peterson Institute has argued that China is getting a leg up by, well, cutting tariffs for the world even as it raises tariffs on the United States. That’s certainly true, even if the tariff cuts are modest relative to the increase in tariffs on the United States. But, in my view, it is also only part of the story. China naturally imports commodities, and it recently has tilted its commodity imports away from the United States (beans, oil, lobster, and so on). But diverting your commodity imports away from a commercial rival is pretty much standard trade strategy: to my personal chagrin the United States always retaliates against French wine and cheese in trade disputes with Europe.

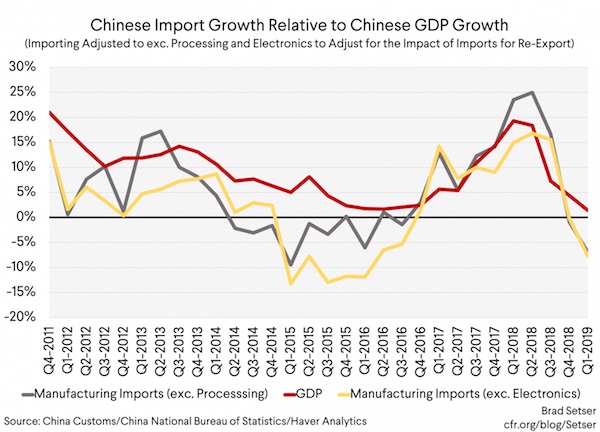

The real issue, I think, is whether or not China is prepared to open up—for real—to non-American manufactured goods in order to squeeze the United States out of a big and growing potential market for U.S. made goods. And there, I just don’t see the evidence. When it comes to manufactures, China is actually importing less from everyone right now—even with the (quite modest) tariff cuts. Best I can tell that isn’t just a function of the fact that China is also exporting less, or a result of the global fall in semiconductor prices. As the chart shows, it is true if you take out electronics imports, and it is true if you take out “processing” imports (imports for re-export).

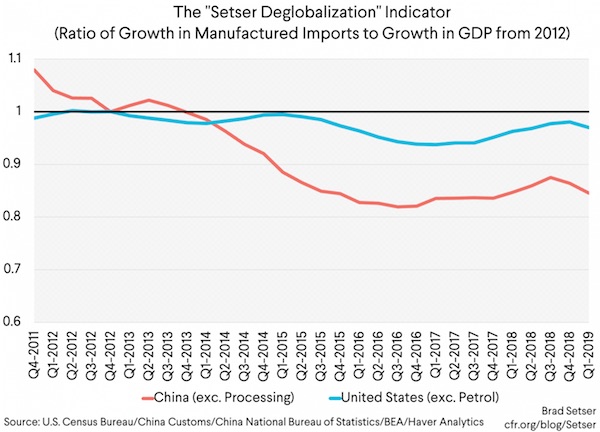

And it isn’t a new story either. I would argue that China under Xi has deglobalized more than the United States under Trump. Imports, broadly speaking, should normally grow with a country’s GDP. During the globalization or hyper globalization era, they grew more rapidly than GDP. After the crisis, they have basically grown with GDP in most countries. But import growth, in dollars, has lagged dollar GDP growth in China over the last eight years. Even when import growth was surprisingly strong in 2017 and 2018, it only matched dollar GDP growth.

The fall in imports vs. GDP is deglobalization in my view. And with China you can adjust for imports that are (mostly) for re-export by netting out processing imports to try to get a measure of what’s happening to imports that are directed primarily at meeting China’s own demand. To make a good-looking graph, I took the ratio of growth in (non-processing) manufacturing imports to the growth in China’s nominal GDP from the end of 2012. And for the United States, I looked at manufactured imports after taking out imports of refined petroleum (the U.S. is clearly “deglobalizing” when it comes to imports of petrol).

Yeah, let’s battle China and India at the same time. That’s almost ten times the US population.

• Trump Demands Withdrawal Of India’s ‘Unacceptable’ Tariff Hike (R.)

U.S. President Donald Trump on Thursday demanded India withdraw retaliatory tariffs imposed by New Delhi this month, calling the duties “unacceptable” in a stern message that signals trade ties between the two countries are fast deteriorating. India slapped higher duties on 28 U.S. products after the United States withdrew tariff-free entry for certain Indian goods. Washington is also upset with New Delhi’s plans to restrict cross-border data flows and impose stricter rules on e-commerce that hurt U.S. firms operating in India. “I look forward to speaking with Prime Minister Modi about the fact that India, for years having put very high tariffs against the United States, just recently increased the tariffs even further,” Trump said on Twitter.

“This is unacceptable and the tariffs must be withdrawn!” said Trump, who will meet Modi at this week’s G20 summit in Japan. Government sources rejected Trump’s argument, saying Indian tariffs were not that high compared to other developing countries and U.S. tariffs on some items were much higher. India’s trade ministry did not immediately respond to a Reuters email seeking comment. Trump’s tweet came hours after U.S. Secretary of State Mike Pompeo left New Delhi after meeting Modi. Pompeo had said the nations were “friends who can help each other all around the world” and the current differences were expressed “in the spirit of friendship”.

Time for a very big reset. Or Ralph Nader may get his wish and the 737MAX will never fly again.

• New 737 MAX Software Glitch Results In “Uncontrollable Nosedives” (ZH)

Maybe Boeing will finally think twice before cutting corners and slashing costs on planes it hopes will become the standard in commercial air travel. Then again, maybe not. With Boeing’s fleet of 737 MAX planes indefinitely grounded after unexpected problems with the MCAS system costs hundreds of people their lives in two fatal crashes, tests on the grounded planes revealed a new, and unrelated safety risk in the computer system for the Boeing 737 Max that could push the plane downward the FAA announced; the discovery could lead to further lengthy delays before the aircraft is allowed return to service.

A series of simulator flights to test new software developed by Boeing revealed the flaw, a source told CNN. In simulator tests, government pilots discovered that a microprocessor failure could push the nose of the plane toward the ground. It is not known whether the microprocessor played a role in either crash. While the original crashes remain under investigation, preliminary reports showed that “a new stabilization system pushed both planes into steep nosedives from which the pilots could not recover.” The issue is known in aviation circles as runaway stabilizer trim.

“The FAA recently found a potential risk that Boeing must mitigate,” the agency said in an emailed statement on Wednesday, without providing any specifics. While the latest glitch is separate from, and did not involve the Maneuvering Characteristics Augmentation System linked to the two fatal accidents since October that killed 346 people, it could produce an uncommanded dive similar to what occurred in the crashes, Bloomberg confirmed, also citing an unnamed source..

Regulators are scared. They have every right to.

• Airlines, Regulators Meet To Discuss Boeing 737 MAX Un-Grounding Efforts (R.)

Airlines and regulators are gathering at a closed-door summit in Montreal on Wednesday to exchange views on steps needed for a safe and coordinated return of Boeing Co’s grounded 737 MAX jets to the skies following two deadly crashes. The meeting, organized by industry trade group the International Air Transport Association (IATA), comes as airlines grapple with the financial impact of a global grounding of nearly 400 737 MAX jets that has lasted three months. Boeing, the world’s largest planemaker, has yet to formally submit proposed 737 MAX software and training updates to the U.S. Federal Aviation Administration (FAA), which will kick-start a re-certification process that could take weeks.

IATA Director General Alexandre de Juniac has said “shoring up trust among regulators and improving coordination” within an industry that grounded the MAX planes on different dates in March would be priorities at Wednesday’s summit. It is the second such meeting organized by IATA. China was first to ground the MAX after a March 10 crash in Ethiopia within five months of a similar crash off Indonesia, killing a combined 346 people, while the United States and Canada were the last. Regulators including Transport Canada, the Civil Aviation Authority of Singapore and the FAA will join airlines at the meeting, representatives from the authorities told Reuters. Once regulators approve the MAX for flight, airlines must remove the jets from storage and implement new pilot training, a process that will differ for each airline but that U.S. carriers have said will take at least one month.

Sept. 3 of what year?

• United Airlines Extends 737 MAX Cancellations Until Sept. 3 (G.)

United Airlines has become the latest carrier to extend its ban on using the Boeing 737 Max after the US aviation regulator said it had identified a new potential risk with the plane. As the Federal Aviation Administration said on Wednesday that Boeing must address the new issue before the jet can return to service, United joined American and Southwest in continuing to ground the plane through August. United said it would not use the plane until 3 September, forcing the cancellation of 1,900 scheduled flights with the planes which have been grounded due to two deadly crashes within five months.

The risk was discovered during a simulator test last week but it was not yet clear if the issue can be addressed with a software upgrade or will require a more complex hardware fix, sources told Reuters. The FAA did not elaborate on the latest setback for Boeing, which has been working to get its best-selling airplane back in the air following crashes in Indonesia and Ethiopia. The new issue means Boeing will not conduct a certification test flight until 8 July at the earliest, the sources said, and the FAA will spend at least two to three weeks reviewing the results before deciding whether to return the plane to service.

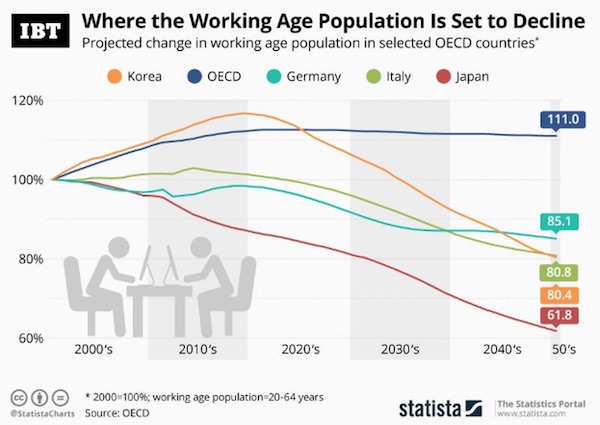

A big problem well before 2050. How are they going to organize pensions for people now 35-40 years old?

• Germany, Italy, Korea, Japan Face Workforce Collapse By 2050 (ZH)

Forget the trade war, debt, deflation, automation, and artificial intelligence: one of the most significant threats to the global economy and the future of the world as we know it is demographics. A new OECD report, published by International Business Times, said Korea, Japan, Germany, and Italy could see their working-age populations decline to dangerously low levels by 2050. The report took each OECD country’s population between the ages of 20 and 64 in the year 2000 as a base and was able to project the 2050 population. What they discovered was the working class population by 2050 would be 80% of its base year in Korea and Italy.

In Japan, the workforce population would be much worse, approximately 60% of its original size. For the OECD as a whole, there are about 34 countries from around the world, the size of the working age population is expected to increase by 111% of its original size by 2050. Much of the growth will be driven by stable birth rates and growing populations, like Australia and Turkey. The OECD noted that Japan’s working-age population has been in collapse for nearly three decades. Korea’s working-age population was expanding until just recently but is expected to begin contracting this year.

Based on new talks, which the EU will not tolerate.

• Boris Johnson: Odds Of No-Deal Brexit Are ‘A Million-To-One Against’ (G.)

Boris Johnson has said the chances of a no-deal Brexit are a “million-to-one against”, despite promising to leave on 31 October whether or not he has managed to strike a new agreement with the European Union. Johnson, the frontrunner to be prime minister, told a hustings that the chances of a no-deal Brexit were vanishingly small, as he believed there was a mood in the EU and among MPs to pass a new Brexit deal. “It is absolutely vital that we prepare for a no-deal Brexit if we are going to get a deal,” he said. “But I don’t think that is where we are going to end up – I think it is a million-to-one against – but it is vital that we prepare.”

He said there was a new feeling of “common sense breaking out” among MPs in favour of passing a deal, despite many of his Eurosceptic backers believing he is readying himself for a no deal Brexit. It comes just a day after he promised in a TalkRadio interview to leave the EU on 31 October “come what may, do or die”, raising fears among moderate Tory MPs and opposition parties that he was intending to push through a no-deal Brexit. The EU has repeatedly said it will not revisit Theresa May’s withdrawal deal and experts are severely sceptical that a new prime minister can secure any changes to the controversial Northern Ireland backstop hated by Eurosceptics by the end of October.

Many of Johnson’s Eurosceptic backers are convinced that he will push through a no-deal Brexit by simply ignoring the will of parliament, where a cross-party group of MPs are planning to try everything possible to block this possibility. However, Johnson was supremely confident that he could secure a new deal with the EU that would satisfy parliament. He played down the idea that he would simply sideline parliament or prorogue it in order to secure a departure on 31 October, but did not entirely rule it out. “I’m not attracted to archaic devices like proroguing,” he said.

By Nils Melzer, UN Special Rapporteur on Torture: “This Op-Ed has been offered for publication to the Guardian, The Times, the Financial Times, the Sydney Morning Herald, the Australian, the Canberra Times, the Telegraph, the New York Times, the Washington Post, Thomson Reuters Foundation, and Newsweek. None responded positively.”

• Demasking the Torture of Julian Assange (Nils Melzer)

In the end it finally dawned on me that I had been blinded by propaganda, and that Assange had been systematically slandered to divert attention from the crimes he exposed. Once he had been dehumanized through isolation, ridicule and shame, just like the witches we used to burn at the stake, it was easy to deprive him of his most fundamental rights without provoking public outrage worldwide. And thus, a legal precedent is being set, through the backdoor of our own complacency, which in the future can and will be applied just as well to disclosures by The Guardian, the New York Times and ABC News.

Very well, you may say, but what does slander have to do with torture? Well, this is a slippery slope. What may look like mere «mudslinging» in public debate, quickly becomes “mobbing” when used against the defenseless, and even “persecution” once the State is involved. Now just add purposefulness and severe suffering, and what you get is full-fledged psychological torture. Yes, living in an Embassy with a cat and a skateboard may seem like a sweet deal when you believe the rest of the lies. But when no one remembers the reason for the hate you endure, when no one even wants to hear the truth, when neither the courts nor the media hold the powerful to account, then your refuge really is but a rubber boat in a shark-pool, and neither your cat nor your skateboard will save your life.

Even so, you may say, why spend so much breath on Assange, when countless others are tortured worldwide? Because this is not only about protecting Assange, but about preventing a precedent likely to seal the fate of Western democracy. For once telling the truth has become a crime, while the powerful enjoy impunity, it will be too late to correct the course. We will have surrendered our voice to censorship and our fate to unrestrained tyranny.