Edward Hopper Sailing 1911

Victor Orban

We never tested them

Dr. Drew and Dr. Kelly Victory: "this issue is now so large" that the government is not going to come out and say they were not safe and didn't work after people have lost their jobs, school opportunities; some have lost their lives" after taking the mass mandated products. pic.twitter.com/NXMiAZoAqr

— Peter McCullough, MD MPH (@P_McCulloughMD) July 31, 2022

Check the date

Body bags

Lol pic.twitter.com/CMUH2nmAhx

— Dirk (@Dirk_L471100) July 20, 2022

“..the three aims of the Allied Special Operation in the Ukraine [..] have had to be extended..”

The more weapons are poured in, the bigger the territory becomes.

• The End of Castle Europe and the First Day of Freedom (Batiushka)

It has now been officially admitted that the three aims of the Allied Special Operation in the Ukraine, the liberation of the Donbass, and the demilitarisation and denazification of the Ukraine, have had to be extended. This is firstly because of the resistance of the Neo-Nazi regime in Kiev to the liberation of the peoples of the Ukraine and secondly because of the support given to that regime by pro-Nazi regimes. Those regimes, known as ‘The Collective West’, are the regimes, representing only 13% of the world population, which have extended the war, both in time and in space.

This change was implicitly confirmed on 28 July by Dmitry Peskov, Press Secretary to President Putin, who declared that ‘the whole of the Ukraine needs to be denazified’. This means that most, or even all, of the Ukraine is going to be liberated, not just the Crimea, the two provinces of the Donbass and the surrounding four provinces of Kharkov, Dnipropetrovsk, Kherson and Zaporozhie. These fully- or partly-liberated provinces are being attacked from further away: clearly their liberation will not be complete until those attacks from further away have been stopped, even if that means proceeding right to the Ukrainian border with Poland. (And if NATO countries dared attack the liberated Ukraine from within their borders, then…).

As for the second aim of demilitarisation, which is ongoing in the Ukraine and has reached a high level as a result of the Russian destruction of military hardware and those willing to use it, it too has had to be extended. The extension is necessary because of the military hardware being sent to the Ukraine from the rest of the Collective West, that is, from Non-Russian Europe (just over 50% of European territory) and from the USA. Both have begun sending the Ukraine their weapons for destruction by Russia. However, the third aim, of denazification, both in the Ukraine and, as we explain below, even more in the rest of Non-Russian Europe, is far more complex. Let us explain this through what may at first seem to be rather academic historical considerations concerning English and Western history. Please be patient. There is a point to this.

You make that sound like it’s a bad thing…

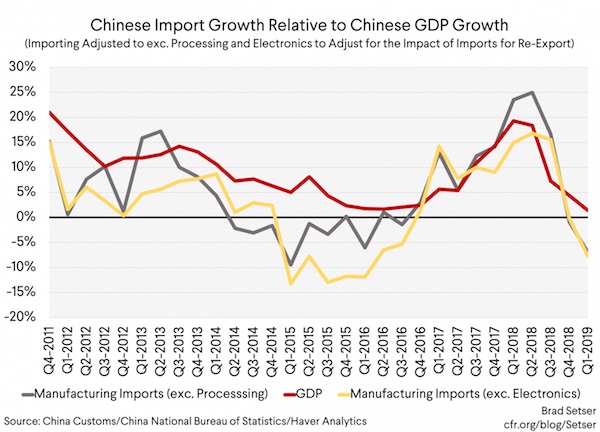

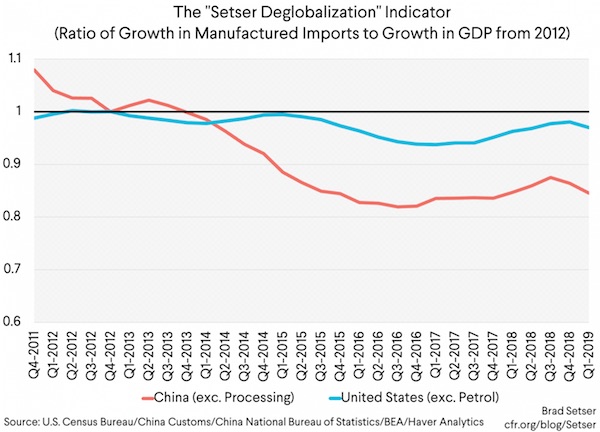

• World Economy At Risk Of Deglobalization – IMF (RT)

Russia’s military operation in Ukraine and the subsequent Western sanctions on Moscow might push the global economy into geopolitical fragmentation, the IMF warned in a report published on July 26. “A serious risk to the medium-term outlook is that the war in Ukraine will contribute to fragmentation of the world economy into geopolitical blocs with distinct technology standards, cross-border payment systems, and reserve currencies,” the report states. According to the IMF, such a split would prevent the global community from jointly addressing global problems. “Fragmentation may also diminish the effectiveness of multilateral cooperation to address climate change, with the further risk that the current food crisis could become the norm,” the authors of the report warn.

The report notes that traditional economic and financial risks have been exacerbated by the conflict in Ukraine and its repercussions. Such risks currently include the effect of tighter monetary policy, slowing economic growth in China and rising energy prices. However, according to the report, there is “limited evidence of reshoring,” or trade deglobalization, at the moment, and overall, global trade “has been more resilient than expected since the start of the [Covid-19] pandemic,” which can be taken as a positive sign. Still, the IMF predicts that increasingly tight sanctions on Russia will eventually result in a drop in Russia’s oil exports to the global market and a “decline to zero” of Russian gas exports to Europe, which in turn would make “inflation expectations more persistently elevated” across the globe and tighten financial conditions as governments attempt to deal with rising prices.

“In this scenario, the shock would have a widespread impact, as higher global commodity prices and tighter monetary and financial conditions would affect almost all countries, albeit to different extents. Europe would be particularly affected in this scenario, with 2023… near-zero regional growth,” the IMF states. Still, according to analysts, “taming inflation should be the first priority for policymakers”despite the costs of tighter monetary policy, as “delay will only exacerbate [the costs].”

Pelosi just released a doc stating which places she will visit. Taiwan is not on it.

• Tweaking The Dragon’s Tail To Ignite A Terrible Fire With China (Larry Johnson)

The next two weeks could be two of the most dangerous in the history of the United States because it appears Joe Biden and his clueless national security team are bumbling their way towards a showdown with China that is fraught with the peril of war. The Chinese Government now rejects the One China Policy that has been the foundation of U.S./Chinese relations for 43 years. CSIS boils it down nicely: When the United States moved to recognize the People’s Republic of China (PRC) and de-recognize the Republic of China (ROC) in 1979, the United States stated that the government of the People’s Republic of China was “the sole legal Government of China.” Sole, meaning the PRC was and is the only China, with no consideration of the ROC as a separate sovereign entity.

The United States did not, however, give in to Chinese demands that it recognize Chinese sovereignty over Taiwan (which is the name preferred by the United States since it opted to de-recognize the ROC). Instead, Washington acknowledged the Chinese position that Taiwan was part of China. For geopolitical reasons, both the United States and the PRC were willing to go forward with diplomatic recognition despite their differences on this matter. The Chinese are now unyielding on their claim of sovereignty over Taiwan. It does not matter any more that Washington threatens action if China takes any steps to impose its “sovereignty”, China is going to demonstrate its sovereignty. One way it may do this is to deny Nancy Pelosi and any other dignitary from Washington, DC from flying to Taiwan and setting foot on “Chinese territory” without the permission of Beijing.

The United States does not have an embassy in Taiwan. It has a consulate, which is subordinate to the U.S. Embassy in Beijing. In other words, any official visit by a U.S. official must have country clearance from China. Got it? What makes the current situation so dangerous is that the Commander of US Forces in the Indo-Pacific region (aka INDOPACCOM) has ordered the Ronald Reagan Carrier Strike Group to the South China Sea as a “show of force.” This is a deliberate act to demonstrate to the Chinese that they have no sovereignty over this territory. The Chinese reaction to this provocation is alarming:

“The Chinese Army urged citizens to “prepare for war” in a social media post Friday that garnered thousands of likes, according to the state-sponsored Global Times. Chinese officials have issued stark warnings of possible conflict should House Speaker Nancy Pelosi follow through with her promise to visit Taiwan in August, pledging a “forceful” response. The Chinese People’s Liberation Army (PLA) 80th Group Army’s post received over 300,000 thumbs-up on China’s social media platform Weibo within 12 hours “amid high morale among Chinese soldiers,” the Global Times said. “We must bear in mind the fundamental responsibility of preparing for war and charge on the journey of a strong army,” the 80th Group Army posted in a comment that received 8,000 likes”, according to Global Times.

“..the aid “aims to improve local network infrastructure, especially in those areas hit hard during the Syrian crisis since 2011.”

• New Chinese Aid For Syria Sets Off Alarms In Israel (BD)

A recent announcement of Chinese aid for Syria is setting off alarm bells in Israeli security circles. During a July 20 ceremony held in Damascus, an announcement was made that Syria will receive advanced communications equipment from China. According to the official announcement, the aid “aims to improve local network infrastructure, especially in those areas hit hard during the Syrian crisis since 2011.” Signed by Chinese Ambassador to Syria Feng Biao and Chairman of Syria’s Planning and International Cooperation Authority Fadi Salti Al-Khalil, the deal specifies that the equipment will be “delivered in two batches” to the Syrian Communications and Technology Ministry.

Relations between Israel and China are cordial, if somewhat strained in recent years by US pressure on Jerusalem to limit ties with Beijing. So on the face, having China in Syria is not in and of itself a major concern for Israel. But the economic or military improvements China could bring to Syria’s military is a reason for concern. Israeli defense sources told Breaking Defense that the exact type of the communication systems to be supplied to Syria is not clear, but it is expected to be of a type that will fill current gaps in Syria’s military communications network. And, the sources worry, this could be only the tip of the iceberg of Chinese assistance for Syria’s effort to rebuild its armed forces.

“We have indications that Chinese experts visited in recent months some Syrian military installations that were damaged heavily during the civil war,” one source said. “We believe that many [facilities] of the Syrian army will be rebuilt by the Chinese, who have the capability of bringing in thousands of workers to complete the work in the shortest time.” That source also warned that the Chinese may try to sell the Syrians some of their defense systems, which could complicate Israeli operations in Syria. “The Russian-made systems used by the Syrians are almost useless dealing with advanced weapon systems like those used by Israel,” the source noted.

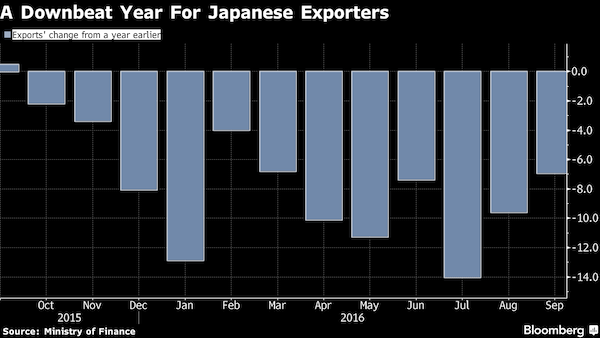

“..just 5% of Japanese companies that had operations in Russia have left [..] This contrasts with 46% for the UK, 33% for Canada, and 27% for the US.”

• Japanese Firms In No Rush To Leave Russia (RT)

Japanese companies are no in a hurry to quit the Russian market, amid fears of being unable to return and having to find new suppliers, the Japan Times reported this week, citing a survey from the statistics center Teikoku Databank. According to the report, within the past month no Japanese companies have announced a suspension or cessation of operations in Russia. Since Russia became subject to numerous sanctions due to its military operation in Ukraine, 74, or about 40%, of the 168 listed Japanese companies working in Russia announced intentions to leave the country. Of these, however, most said they would only halt some form of operation, while a mere five companies said they would withdraw from the Russian market completely.

According to the survey, Japanese companies attributed their reluctance to withdraw from Russia to fears of losing their niche in what they consider an important emerging market and potential difficulties in finding alternative suppliers. Earlier this year, reports emerged that the Japanese government had urged the conglomerates Mitsui and Mitsubishi to retain their stakes in the Russian liquefied natural gas (LNG) project Sakhalin-2, which now operates under a new Russian operator, in order to ensure continued LNG flows. Also, a number of Japan’s major automakers, including Toyota, have suspended their activities in Russia over the past several months but have not yet closed their businesses in the country.Western sanctions against Moscow have forced many international companies to quit the Russian market. However, according to a Yale University survey, just 5% of Japanese companies that had operations in Russia have left, which is tied with Italy for the lowest shares in the G7. This contrasts with 46% for the UK, 33% for Canada, and 27% for the US.

Gonzalo Lira @GonzaloLira1968

Azov Battalion POWs were killed with HIMARS rockets.

HIMARS are targeted by the Americans only.

Americans are providing targeting intelligence.

Americans deliberately targeted Azov Battalion POWs for assassination.

Not their first rodeo. The US did the same in Syria.

• Kiev Knew Prison It Shelled Held Ukrainian POWs – DPR (RT)

Kiev knew exactly where Ukrainian prisoners of war were being held when it ordered a strike on the detention facility in Donbass, Eduard Basurin, the spokesman for the army of the Donetsk People’s Republic (DPR), claimed. The attack on the prison near the village of Yelenovka on Friday morning claimed the lives of 53 people, with 75 more injured, according to the DPR. The Russian Defense Ministry confirmed that the facility had held members of Ukraine’s Azov Battalion, whose fighters surrendered to Russian and Donbass forces during the siege of the Azovstal steel factory in Mariupol. The battalion is notorious for having fighters with nationalist and neo-Nazi views. “I would like to note that Ukraine itself determined the place of detention of prisoners of war, so they knew exactly where they were kept and in what place,” Basurin told journalists without elaborating.

The DPR’s ombudswoman, Darya Morozova, explained that Ukrainian authorities had previously insisted Yelenovka’s facility be a detention center for Ukrainian prisoners of war. “It was discussed, it was their proposal. That is, they knew perfectly well where the prisoners were being held, at their own request. That’s how cynically they took the lives of 50 of their own officers and soldiers,” she told Izvestia newspaper. In Basurin’s opinion, the prison was targeted “after the Ukrainian prisoners of war began to talk about the crimes that they had committed on the orders of their commanders.” As the orders to conduct those crimes, according to Basurin, had been issued by Kiev, the Ukrainian “political leadership” ordered the strike on the detention center using US-made HIMARS multiple rocket launchers “to hide those crimes about which Ukrainian prisoners of war began to speak.”

“I would like to note that even the lack of ammunition did not stop them from shutting the mouths of those Ukrainian prisoners of war who began to tell how they killed, where they killed and why they killed the civilian population,”Basurin said. He echoed the earlier remarks by DPR head Denis Pushilin, who claimed that the Ukrainians “deliberately” targeted the detention center in order to kill Azov members who had been providing accounts of possible war crimes committed by their commanders. Kiev has categorically denied these allegations and accused “the Russian occupants” of carrying out the strike. According to a statement by the General Staff of the Ukrainian Armed Forces on Facebook, Russia’s aim was to accuse Ukraine of committing ‘war crimes’.

“..after the Ukrainian prisoners of war began to talk about the crimes that they had committed on the orders of their commanders.”

• Zelensky and US To Blame For ‘Bloodbath’ In Donbass – Russia (RT)

Ukrainian President Vladimir Zelensky is personally responsible, along with the United States, for the fatal shelling of a detention facility in the Donetsk People’s Republic (DPR), Russia’s Defense Ministry claimed on Saturday. According to the ministry’s statement, a missile strike using US-made HIMARS multiple rocket launchers on a prison near the village of Yelenovka killed 50 POWs, while 73 were hospitalized with severe injuries. The ministry added that the remains of 48 Ukrainian prisoners of war were found and extracted from underneath the rubble, while two inmates succumbed to their wounds on the way to a medical facility. “All political, criminal and moral responsibility for the bloodbath against Ukrainians is borne personally by Zelensky, his criminal regime and Washington, which supports them,” the statement reads.

Earlier this week, Eduard Basurin, the spokesman for the DPR’s army, said that Kiev knew exactly where the POWs were being held, because Kiev “itself determined the place of detention.” The DPR official also noted that the prison could have been targeted by Kiev in order to hide atrocities “after the Ukrainian prisoners of war began to talk about the crimes that they had committed on the orders of their commanders.” The Russian Defense Ministry confirmed that the facility had held members of Ukraine’s Azov Battalion, whose fighters surrendered to Russian and Donbass forces during the siege of the Azovstal steel factory in Mariupol. Kiev has categorically denied these allegations and claims Russia is responsible for the strike, saying that Moscow sought to blame Ukraine for committing ‘war crimes’. Russia and allied forces have repeatedly accused Ukraine of shelling civilian infrastructure with various heavy weaponry, including HIMARS.

There’s still money to be made…

• British Boats Assist In Transporting Russian Oil (RT)

British-crewed ships have participated in transporting Russian crude oil to Asia, The Independent revealed on Friday, claiming that the “small part” they play in the chain indicates “huge holes” in the Western sanctions on Moscow. A joint investigation of The Independent and the website Global Witness found that at least twice in May, British-crewed vessels based in the Suffolk town of Southwold “sped out from nearby harbours to help transfer Russian oil between vast tankers.” One boat was sent by a British company called STS Marine Transfers to move 14,000 tonnes of Russian fuel oil from one foreign tanker to another, while another, a catamaran called Endeavor that belongs to a company known as Wood Marine, delivered supplies and took the tankers’ crews ashore. The oil transfers took place outside UK territorial waters.

“After refuelling, the two tankers carried 165,000 tonnes of Russian fuel oil – worth more than £165m – onwards to the Persian Gulf and Singapore,” The Independent said. According to the outlet, the transfers “are one link in an international chain” that has helped Russia to quickly shift oil sales to Asia, as European buyers cut back. When approached by the journalists, one of the operators of the British ships said their boats just provide “a taxi service at sea,” and therefore there is no obligation to check where the oil comes from. Another company said it was complying with all international laws and regulations, and had not renewed its contract with cargoes originating from Russia.

“The exact number of transfers of Russian oil that have taken place off Britain’s coast is not known. They are not illegal, and there is nothing stopping British companies from taking part, but they are an indication of huge holes in Western sanctions,” the investigators claim. They added that, as “global shipping is among the most opaque and least accountable industries in the world,” and many things are happening “beyond the reach of individual nation states,” the industry significantly undermines Western countries’ ability to put pressure on Russia. The G7 has said it is aware of the problem and plans to introduce a price cap which would allow Western nations to curb Moscow’s oil revenue. The bloc has also been trying to lure China and India, major buyers of Russian crude, into joining the deal.

“..High-level Chinese Communist Party (CCP) members within the U.N. system helped create the SDGs..”

• UN, World Economic Forum Behind Global ‘War on Farmers’ (ET)

The escalating regulatory attack on agricultural producers from Holland and the United States to Sri Lanka and beyond is closely tied to the United Nations’ “Agenda 2030” Sustainable Development Goals and the U.N.’s partners at the World Economic Forum (WEF), numerous experts told The Epoch Times. Indeed, several of the U.N.’s 17 Sustainable Development Goals (SDGs) are directly implicated in policies that are squeezing farmers, ranchers, and food supplies around the world. High-level Chinese Communist Party (CCP) members within the U.N. system helped create the SDGs and are currently helping lead the organization’s implementation of the global plan, The Epoch Times has previously documented.

If left unchecked, multiple experts said, the U.N.-backed sustainability policies on agriculture and food production would lead to economic devastation, shortages of critical goods, widespread famine, and a dramatic loss of individual freedoms. Already, millions of people worldwide are facing dangerous food shortages, and officials around the world say those are set to get worse as the year goes on. There is an agenda behind it all, experts told The Epoch Times. Even private land ownership is in the crosshairs, as global food production and the world economy are transformed to meet the global sustainability goals, U.N. documents reviewed by The Epoch Times show.

As explained by the U.N. on its SDG website, the goals adopted in 2015 “build on decades of work by countries and the U.N.” One of the earliest meetings defining the “sustainability” agenda was the U.N. Conference on Human Settlements known as Habitat I, which adopted the Vancouver Declaration. The agreement stated that “land cannot be treated as an ordinary asset controlled by individuals” and that private land ownership is “a principal instrument of accumulation and concentration of wealth, therefore contributes to social injustice.” “Public control of land use is therefore indispensable,” the U.N. declaration said, a prelude to the World Economic Forum’s now infamous “prediction” that by 2030, “you’ll own nothing.”

He’s on a photoshoot.

• Zelensky’s ‘Elite Kraken neo-Nazi Battalion’ Destroyed – Russia (RT)

Russia’s armed forces destroyed the Ukrainian president’s ‘elite assault battalion’ and dozens of fighters from the notorious Kraken neo-Nazi formation, Defense Ministry spokesman Major General Igor Konashenkov said on Saturday. Providing an update on the progress of Moscow’s military operation in Ukraine, Konashenkov said that on July 28, at the Krasnoarmeysk railway station in the Donetsk People’s Republic (DPR), the Russian military conducted a direct strike “with a high-precision air-based weapon” on a train transporting “an elite assault battalion of the 1st Separate Brigade of the President of Ukraine.” “More than 140 nationalists were killed on the spot. About 250 more militants received injuries of varying severity. All military equipment that was in the echelon was disabled,” Konashenkov stated.

The next day, in the area of Bogodukhov in Kharkov Region, Iskander missiles hit the hangars of a meat processing plant where the Kraken nationalist formation had set up a temporary base, according to the military spokesman. “More than 30 Nazis and 10 units of military equipment were destroyed.” Kraken calls itself a special reconnaissance and sabotage unit under the Ministry of Defense, operating separately from the Armed Forces of Ukraine. Moscow has accused the battalion of committing several war crimes since the beginning of the conflict. Also on July 29, Russian forces destroyed 30 Ukrainian servicemen, a warehouse with rockets for Grad combat vehicles, and military equipment in the settlement of Yasnobrodovka in the DPR.

In the area of Artemovsk, according to Konashenkov, Ukrainian losses amounted to 50 servicemen and eight units of military equipment. “In total, since the beginning of the special military operation, the following have been destroyed: 261 aircraft, 145 helicopters, 1,644 unmanned aerial vehicles, 361 anti-aircraft missile systems, 4,190 tanks and other armored combat vehicles, 772 combat vehicles of multiple launch rocket systems, 3,217 field artillery guns and mortars, as well as 4,573 units of special military vehicles,” the general said.

“..The levy should be accompanied by a relief package for lower-income households, otherwise the new charge could lead to a “social catastrophe..”

• Gas Levy Could Triple Household Heating Bills In Germany (ZH)

Germany plans to introduce a levy for all its gas consumers beginning in October as the government looks to avoid a wave of collapsing gas-importing and gas-trading companies amid record-high natural gas prices, a new bill seen by Reuters showed on Thursday. Russia is further reducing flows via Nord Stream this week, to just 20% of the pipeline’s capacity, days after restarting the link at 40% capacity after regular maintenance. The German government has already intervened to rescue energy group Uniper, Russia’s single largest gas buyer in Germany. Uniper—and many other German gas traders and suppliers—have been reeling from reduced Russian supply and soaring prices of non-Russian gas.

Germany and Uniper agreed last week on a $15 billion bailout package, including the German government taking a 30-percent stake in the company and making more liquidity and credit lines available to the group. Under the plans of the government, all consumers of gas, including households, will have to pay an additional levy, which will go to support Germany’s gas importing companies, which struggle with a lack of Russian gas and sky-high prices of non-Russian alternatives. The details of the bill are set to be announced next month. Households and industrial consumers are expected to pay the levy through September 2024, according to the draft Reuters has seen.

“One doesn’t know exactly how much (gas) will cost in November, but the bitter news is that it’s definitely a few hundred euros per household,” German Economy Minister Robert Habeck was quoted by Reuters as saying on Thursday. Marcel Fratzscher, president of DIW, the German Institute for Economic Research, told Düsseldorf’s Rheinischen Post newspaper that German households should prepare for at least tripled costs of heating on gas. The levy should be accompanied by a relief package for lower-income households, otherwise the new charge could lead to a “social catastrophe,” Fratzscher added.

Karine Jean-Pierre is ridiculous.

• Biden Admin Quietly Builds More Border Wall Amid Migration Surge (JTN)

The Biden administration is quietly funding the completion of a segment of Trump’s border wall in Arizona amid an unprecedented influx of migrants crossing the nation’s border with Mexico. Department of Homeland Security Secretary Alejandro Mayorkas authorized Customs and Border Protection to fill gaps in existing barriers near the Morelos Dam outside of Yuma, Ariz., the New York Post reported.The department cited health and hazard concerns should migrants attempt to enter the U.S. via that route, saying the area “presents safety and life hazard risks for migrants attempting to cross into the United States where there is a risk of drownings and injuries from falls. This area also poses a life and safety risk to first responders and agents responding to incidents in this area.”

Some Republicans supported the decision to complete the portion of the border wall. “This may very well be the first time Biden has made a decision based on the actual facts, and the fact is an open border is a dangerous border,” Georgia Republican Rep. Austin Scott told Just the News. In a Thursday press conference, White House press secretary Karine Jean-Pierre denied the administration was completing Trump’s border wall. “We’re not finishing the wall,” she said, per the Post. “We are cleaning up the mess the prior administration left behind in their failed attempt to build a wall.” Record numbers of migrants continue to surge across the southern border as the administration struggles to process the influx.

https://twitter.com/i/status/1553150314206957568

“..Paxlovid can cause this issue by suppressing patients’ immune systems too early..” Say that again?!

• Covid Reinfection Rate With Paxlovid Is More Than 40%, Not 2% As Marketed (DM)

Joe Biden has been re-infected with COVID after taking an anti-viral drug that leaves patients running a 40 per cent risk of flare-up of the virus shortly afterwards. Taking Paxlovid leaves COVID sufferers in danger of testing positive for the virus again very quickly after clearing their initial infection. When Paxlovid came to market in December 2021, studies from Pfizer indicated that only 1-2 percent of patients who took the drug tested positive for Covid again shortly after finishing their dosage. But other experts say the rapid reinfection rate is closer to 40 per cent, and that Paxlovid can cause this issue by suppressing patients’ immune systems too early, meaning their own bodies are unable to get a handle on COVID.

Dr. Jonathan Reiner, a prominent cardiologist and professor of medicine and surgery at George Washington University Hospital tweeted: ‘I think this was predictable.’ He continued: ‘The prior data suggesting ‘rebound’ Paxlovid positivity in the low single digits is outdates and with BA.5 is likely 20-40% or even higher.’ In a memo released by the White House, Dr. Kevin O’Connor said that the president will continue to isolate, just like he did when he first tested positive on July 21. Dr. O’Connor also said that the president would not be prescribed Paxlovid again.

“Know what proteins are present in the vaccine..” Google translation.

• Italian Court Orders Analysis Of mRNA Vaccines (Muac)

An Italian court seized by an individual opposed to anti-Covid vaccination has ordered the laboratory analysis of messenger RNA (mRNA) vaccines, we learned this Saturday from the plaintiff’s lawyer. The court in Pesaro, near San Marino (east), has commissioned an expert to identify the contents of the Moderna and Pfizer/BioNTech messenger RNA anti-Covid vaccines . These analyzes will be carried out in September, said lawyer Nicoletta Morante. According to her, this is “a first in Italy, and perhaps in Europe”. The complainant, who has already contracted the disease in the past, is a fifty-year-old working in particular in education, and whose activity in Italy is subject to the vaccination obligation. Refractory, he is under administrative sanctions, according to Me Nicoletta Morante.

In addition to “he asks to establish whether vaccinating people cured of Covid satisfies the good administration of medicine”, he wants to know what proteins are present in these vaccines and whether they contain “excipients for non-human or dangerous use. for health,” according to a summary of the complaint. The messenger RNA treatment allows the cells to reproduce proteins present in the virus – the “antigens” – in order to accustom the immune system to recognize and neutralize it. In support of the civil complaint presented to Pesaro, the lawyer produced the opinion of a medical researcher, presented as an independent virologist, who believes that mRNA vaccines do not fulfill the protective function for which they are injected. . These vaccines, he writes in the complaint, “do not have the declared functional conformation” and the immune response they engender “is ineffective”.

Nanowires

Dr. Robert Young outlines what he has been seeing from jabbed autopsies – and what is happening to jabbed pilots pic.twitter.com/EwXTtbuBco

— Laura Lynn Tyler Thompson (@LauraLynnTT) July 29, 2022

WEF Ardern

New Zealand taxes farmers for methane released by sheep and cows

Source: Global News pic.twitter.com/Ut5vBvmpaj— Wittgenstein (@backtolife_2023) July 30, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.