Balthus Girl at the window 1955

Not much of a deal, but lots of talk, from what I understand. Still, 1.3 billion Chinese need food.

• US Delays China Tariff Increase As Trump Claims ‘Substantial’ Deal (G.)

Donald Trump announced a “very substantial phase one deal” to solve the long-running trade dispute with China. After a two-day meeting in Washington between US and Chinese officials on Friday Trump announced a delay on plans to raise tariffs on $250bn worth of goods to 30% on 15 October. A further 15% tariff on almost all remaining Chinese imports including laptops, smartphone, footwear and clothing is still set to be imposed on 15 December unless a deal can be reached with Beijing. Trump said progress had been made on allegations of currency manipulation, intellectual property theft and other issues.

China also agreed to increase its purchases of US agricultural goods and further open up its market to foreign financial services companies. The deal has not been written yet and may take weeks to finalize. Speaking in the White House Trump said: “I think we have a lot of good faith right now.” He said the agreement was bigger than a trade deal. “There was a lot of friction between the US and China and now it’s a lovefest,” said Trump. Earlier Trump had tweeted there were “warmer feelings” in US-China trade talks. The news helped boost stock prices with the Dow Jones Industrial Average closing up 319 points and the S&P 500 snapping a three-week losing streak.

Will Northern Ireland remain in the customs union forever?

• Boris Johnson’s Major U-Turn Sets Up 48 Hours To Clinch Brexit Deal (G.)

Boris Johnson has signalled that he will make a last-ditch U-turn on his plans for the Irish border, setting up 48 hours of intense negotiations that will make or break a Brexit deal. On a day of rapid movement in talks, EU sources said the prime minister had conceded that there could not be a customs border on the island of Ireland – a critical step away from his previous position. That came after European ambassadors prompted tentative hope of a deal by giving the green light for what some diplomats described as a “tunnel” discussion in which a small team of negotiators meet for intensive talks to find a break-through moment.

The Democratic Unionist party and European Research Group (ERG), a group of rightwing Conservatives, later issued statements promising flexibility, keeping hope alive that Johnson could find support for a new offer in the House of Commons. But amid ongoing scepticism that a deal could be forced through in the short time left and with Angela Merkel due to hold talks with Emmanuel Macron on Sunday night, the prime minister faces a frantic race to push through his fresh proposals with Brussels or at home. “The UK has accepted that there is not a deal that involves a border on the island of Ireland – that is a big break from what they were saying,” one EU source said. “Now the key is for them to lay out how their new position over the weekend.”

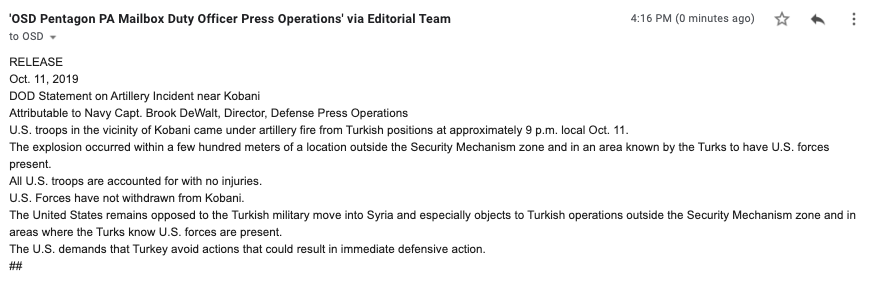

Tweet: “Coalition official tells me after Turkish bombing near US base Mashtenour hill: “They know we are there, we told them our position. There’s no other target in the area. They’re trying to drive us out. If Turkey can get us to leave so they can siege Kobane, it’s all over.”

• Turkey Attacks US Special Forces In Syria (NW)

A contingent of U.S. Special Forces was caught up in Turkish shelling against U.S.-backed Kurdish positions in northern Syria, days after President Donald Trump told his Turkish counterpart he would withdraw U.S. troops from certain positions in the area. A senior Pentagon official said shelling by the Turkish forces was so heavy that the U.S. personnel considered firing back in self-defense. Newsweek has learned through both an Iraqi Kurdish intelligence official and the senior Pentagon official that Special Forces operating on Mashtenour hill in the majority-Kurdish city of Kobani fell under artillery fire from Turkish forces conducting their so-called “Operation Peace Spring” against Kurdish fighters backed by the U.S. but considered terrorist organizations by Turkey. No injuries have been reported.

Instead of returning fire, the Special Forces withdrew once the shelling had ceased. Newsweek previously reported Wednesday that the current rules of engagement for U.S. forces continue to be centered around self-defense and that no order has been issued by the Pentagon for a complete withdrawal from Syria. The Pentagon official said that Turkish forces should be aware of U.S. positions “down to the grid.” The official could not specify the exact number of personnel present, but indicated they were “small numbers below company level,” so somewhere between 15 and 100 troops. Newsweek has reached out to the Pentagon for comment on the situation.

This will build.

• US Lawmakers Press Again For Stronger Trump Action On Turkey (R.)

U.S. lawmakers introduced more legislation on Friday seeking to slap stiff sanctions on Turkey over its offensive against Kurdish fighters in Syria, underscoring unhappiness from both Democrats and President Donald Trump’s fellow Republicans in Congress over his Syria policy. Representatives Eliot Engel, the Democratic chairman of the U.S. House of Representatives Foreign Affairs Committee, and Mike McCaul, the committee’s ranking Republican, introduced a bill that would sanction Turkish officials involved in the Syria operation and banks involved with Turkey’s defense sector until Turkey ends military operations in Syria. It also would stop arms from going to Turkish forces in Syria, and require the administration to impose existing sanctions on Turkey for its purchase of a Russian S-400 missile-defense system.

On Sunday, Trump abruptly shifted policy and said he was withdrawing U.S. forces from northeastern Syria, clearing the way for Turkey to launch an assault across the border. Turkey began the offensive quickly, pounding Kurdish militias, who had spent many months fighting alongside U.S. forces against Islamic State militants. Earlier, Engel and McCaul had introduced a resolution expressing strong support for Kurdish forces in Syria and recognizing their contribution to the fight against Islamic State. It also called on Turkey to immediately stop military action in northeast Syria and called on the United States to stand with Syrian Kurdish communities affected by violence.

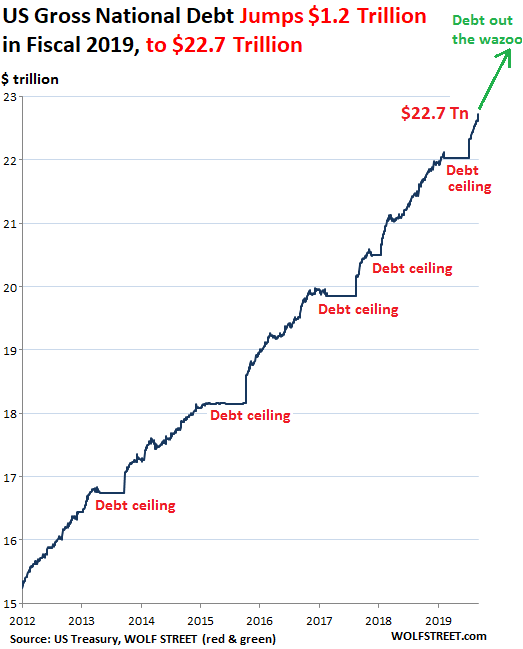

“The nation has been too preoccupied with political mud-wrestling to notice that the US debt has gone hockey-stick parabolic..”

• In Memoriam: Reality (Kunstler)

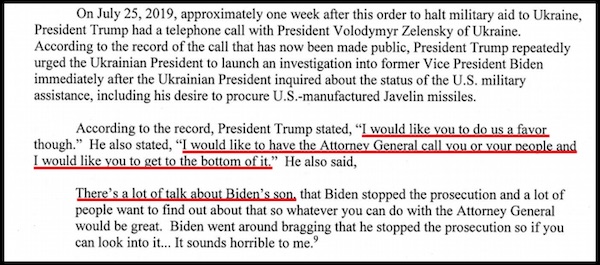

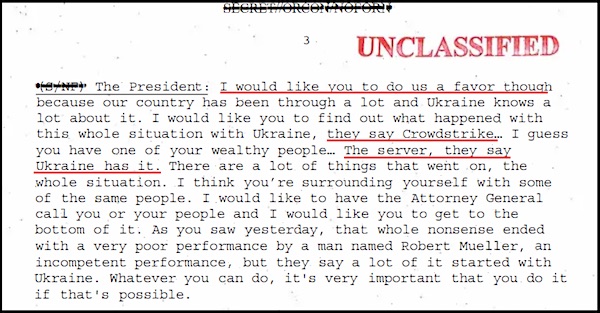

The Golden Golem of Greatness shifted into mad bull overdrive for last night’s Minneapolis fan rally, cussing and bellowing at the picadors of the Left who have been sticking lances in his neck for three years. Decorum is not Mr. Trump’s strong suit, but then the bull is not sent into the ring to negotiate politely for his life. The narrative of the bullring is certain death. The bull must do what he can within his nature to dispute it. It’s in Mr. Trump’s nature to act the part of a reality TV star, and, of course, it is the nature of reality TV shows to be unreal. That is perhaps the ruling paradox of life in the USA these days.

Saturated in unreality, the spectators (also called “voters”) flounder through a relentless barrage of narratives aimed at confounding them, with the unreal expectation that they can make sense of unreal things. In a place like Minneapolis of an October evening, you can go see the Joker movie or take in the President’s rally — and come away with the same sense of hyper-unreality. We’re no longer the nation we pretend to be and we don’t know it. Jokers are wild and the joke’s on us. So it goes in these dangerous autumn days of The Fourth Turning. Something’s got to give, and all indications are it will happen where few are looking at the moment: the sideshow of money and banking.

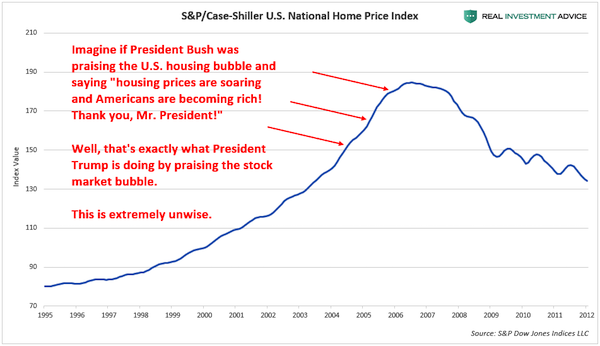

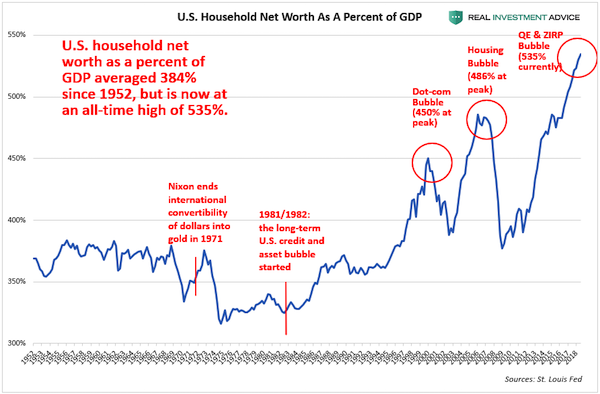

When things start slip-sliding away over in that alternative universe, Mr. Trump will be propelled into the role he was cast for in 2016: bag-holder for economic collapse. The global slowdown of productive activity and commerce is undermining a vast network of dubious financial obligations ruled by an overgrowth of loans that will never be paid back. Unlike New York real estate moguls, the whole world can’t just go into bankruptcy court and apply for a fresh start. The “workout” is brutal and produces epoch-defining trauma. The nation has been too preoccupied with political mud-wrestling to notice that the US debt has gone hockey-stick parabolic, racking up $814 billion just since August. Math majors may see that’s close to a trillion dollars, or 4 percent of the total $22,837 trillion, just in a few months.

“..to strengthen the company’s governance and safety management processes,” the company said.”

• Boeing Board Strips CEO Of Chairman Title Amid 737 MAX Crisis (R.)

Boeing Co’s board has stripped chief executive Dennis Muilenburg of his chairmanship title, in an unexpected strategy shift announced by the U.S. planemaker on Friday only hours after a global aviation panel criticized development of the troubled 737 MAX. Separating the roles, which will enable Muilenburg to have “maximum focus” on steering daily operations, was the latest step the board has taken in recent weeks to improve executive oversight of its engineering ranks and industrial operations. Lead Director David Calhoun, a senior managing director at Blackstone Group, will takeover as non-executive chairman, Boeing said in its announcement, which came late on Friday afternoon without warning.

It added that the board had “full confidence” in Muilenburg, who will retain the top job and remain on the board. The decision came as Boeing struggles to get its best-selling 737 MAX back into service following a worldwide safety ban in March triggered by two crashes that killed a total of 346 people in Ethiopia and Indonesia. It also comes some six months after Muilenburg survived a shareholder motion to split his chairman and CEO roles, part of the intense pressure he has faced during the worst crisis of his four years at the helm of the world’s largest planemaker. “This decision is the latest of several actions by the board of directors and Boeing senior leadership to strengthen the company’s governance and safety management processes,” the company said.

I said last week that Paypal wouldn’t be the only one.

• Facebook’s Libra Currency Abandoned By Major Financial Companies (R.)

Facebook Inc’s ambitious efforts to establish a global digital currency called Libra suffered severe setbacks on Friday, as major payment companies including Mastercard and Visa Inc quit the group behind the project. The two companies announced they would leave the association Friday afternoon, as did EBay Inc, Stripe Inc. and Latin American payments company Mercado Pago. They join PayPal Holdings Inc which exited the group a week ago, as global regulators continue to air concerns about the project. The latest exodus leaves the Libra Association without any remaining major payments companies as members, meaning it can no longer count on a global player to help consumers turn their currency into Libra and facilitate transactions.

The remaining association members, including Lyft and Vodafone, consist mainly of venture capital, telecommunications, blockchain and technology companies, as well as nonprofit groups. “Visa has decided not to join the Libra Association at this time,” the company said in a statement. “We will continue to evaluate and our ultimate decision will be determined by a number of factors, including the Association’s ability to fully satisfy all requisite regulatory expectations.” Facebook’s head of the project, former PayPal executive David Marcus, cautioned on Twitter against “reading the fate of Libra into this update,” although he acknowledged “it’s not great news in the short term.”

Libra, Grams, who’s next?

• US SEC Halts Telegram’s $1.7 Billion Digital Token Offering (R.)

U.S. authorities said on Friday they have halted a $1.7 billion unregistered digital token offering by the messaging service Telegram Group Inc and its TON Issuer subsidiary. The Securities and Exchange Commission said it had received a temporary restraining order against the two offshore entities, which the regulator said had failed to register to sell 2.9 billion digital tokens called “Grams” to initial investors globally, including 1 billion to U.S. buyers. The move marks the latest effort by the agency to crack down on the fledgling cryptocurrency industry.

The SEC has taken the position that initial coin offerings are securities offerings and therefore subject to SEC offering rules, which require firms to file registration and disclosure documents. “Our emergency action today is intended to prevent Telegram from flooding the U.S. markets with digital tokens that we allege were unlawfully sold,” Stephanie Avakian, co-director of the SEC’s Division of Enforcement, said in a statement.

You’re going to wish your cities weren’t designed to make cars a necessity.

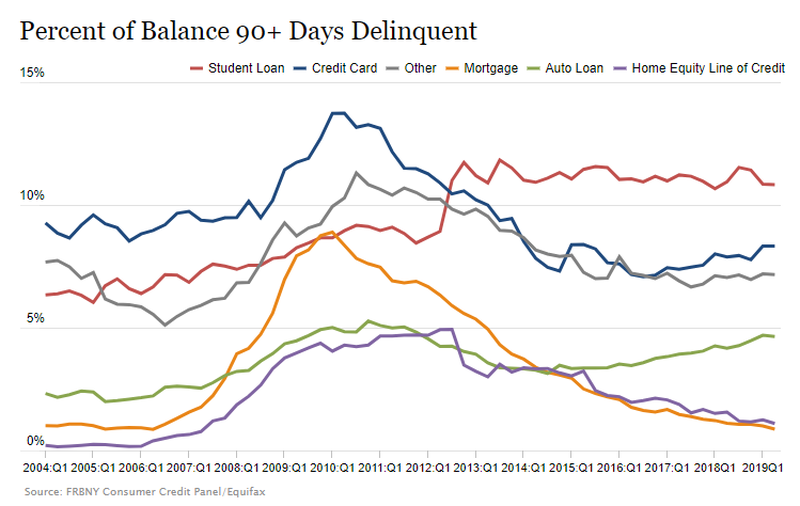

• Rising Used Car Prices Help Push Poor Americans Over The Edge (R.)

For America’s working poor, an often essential ingredient for getting and keeping a job – having a car – has rarely been more costly, and millions of people are finding it impossible to keep up with payments despite prolonged economic growth and low unemployment. More than 7 million Americans are already 90 or more days behind on their car loans, according to the New York Federal Reserve, and serious delinquency rates among borrowers with the lowest credit scores have by far seen the fastest acceleration. The seeds of the problem are buried deep in the financial crisis, when in the midst of the worst economic downturn since the Great Depression, automakers slashed production.

A decade later, that has made a relative rarity of used 10-year-old vehicles that are typically more affordable for low-wage earners. According to data provided to Reuters by industry consultant and car shopping website Edmunds, the average price of that vintage of vehicle is $8,657, still nearly 75% higher than in 2010 despite some softening in prices over the last year. The average new car, in contrast, has seen a price rise of 25% in that same time period. “This is pinching people at the worst point possible,” said Ivan Drury, Edmunds’ senior manager of industry analysis. “If you need basic A to B transportation, you have to get an older car that needs more repairs and has more wear-and-tear issues.”

War crimes.

• Saudi Naval Blockade Sparks Fresh Humanitarian Crisis in Yemen (MPN)

Recent political developments have offered a glimmer of hope to some that the end of the humanitarian crisis in Yemen may be near. But a new report by the United Nations Development Programme shows that a recent tightening of the Saudi-led Coalition’s blockade against the country, and the fuel shortages it has sparked, not only are exacerbating Yemen’s humanitarian crisis but also are slated to make Yemen the world’s poorest country by 2022. In the nursery at the Maternity and Childhood Hospital in Amran, doctors and families alike fear that fuel shortages will lead to power cuts, plunging the ward into darkness and rendering its life-saving machines inoperable.

One mother in the ward diligently watches a heater placed near her infant, knowing that it the electricity-powered medical device stops, her child will die. Dr. Hadi Al-Hamzi, the director-general of the hospital, said that 30 infants could die if their incubators stop for just two hours. He added, “We have a severe shortage of generator fuel, and we have no prospect of getting more in the coming days.” Mohammed Mujahed, the director of Amran Governorate’s Health Office, warned that intensive care for pregnant mothers and nurseries in the province could be stopped in a matter of hours if no generator fuel is secured.

The Saudi-led Coalition has stepped up its seizure and detention of ships carrying food and fuel into Yemen and the effects of those seizures are already being felt by ordinary people. Thousands of Yemenis already facing acute food shortages could die, as stocks of stored food dwindle and cannot be replenished. Sultana Begum, a representative of the Norwegian Refugee Council humanitarian organization, told Reuters that “fuel shortages in Yemen exacerbate the already dire humanitarian situation in the country and lead to unacceptable levels of suffering.”

“..nearly 4 million Yemenis are currently stranded abroad..”

• Human, Organ Trafficking Booming in Yemen as War Enters its Fifth Year (MPN)

In addition to poverty and the absence of law enforcement, there are other reasons why human trafficking flourishes in Yemen, perhaps the most prominent being the blockade levied against the country by the Saudi Coalition since 2015. Before the war, Yemenis would regularly leave the country to seek better health care, employment opportunities and safety abroad — including, somewhat ironically, in neighboring Saudi Arabia. Now — with seaports, airports, highways and especially the once-bustling Sana`a International Airport effectively shuttered by the Saudi Coalition — Yemenis are no longer able to flee the violence in their country or travel to neighboring wealthy Gulf countries for stints of work to earn some cash, leaving many with few options but to resort to selling their organs out of desperation to make ends meet.

The blockade has also left a large number of Yemenis stranded abroad, including some students and others who have managed to find a way out in hopes of receiving medical treatment. It is estimated, according to data provided by the Sana`a International Airport Media Center, that nearly 4 million Yemenis are currently stranded abroad. Many of the stranded are left in a state of legal limbo, unable to secure citizenship in neighboring countries and therefore unable to work, leaving them with no way to earn money short of begging on the street or agreeing to sell their organs. The Yemen Organisation for Combating Human Trafficking told MintPress that many Yemenis who fled when the war broke out are now stuck abroad and that the organization has recorded as many as 300 cases of Yemenis stranded abroad selling their kidneys out of desperation.

Emmy B on Twitter: “At Westminster Magistrates Court today we saw Julian #Assange via video link. We saw his further physical deterioration. He only said his name and DOB responding at the request of the Magistrate and remained speechless and motionless to the end. Hearing did not last more than 10’”

• Julian Assange To Remain Locked Up In UK Prison (RT)

WikiLeaks co-founder Julian Assange has been ordered to stay in a British prison ahead of a hearing on his possible extradition to the United States, despite reaching the end of his custody period. Assange was due to be released on September 22 after serving a sentence for breaching bail conditions by seeking refuge in the Ecuadorian Embassy in London in 2012. The 48-year-old was told at a court hearing last month that he would be kept in Belmarsh prison because of “substantial grounds” for believing he would abscond. At a brief hearing at Westminster Magistrates’ Court on Friday, deputy senior district judge Tan Ikram said that Assange would remain in custody “for the same reasons as before.”

Assange spoke only to confirm his name and age before he was remanded in prison. He is due to appear in court in person at his next hearing on October 21. “I very much hope we can make some progress on this case,” Judge Ikram told him at the end of the five-minute hearing, Reuters reports. In the US, Assange is charged with possession and dissemination of classified information. If found guilty, he could receive up to 175 years in prison. The activist has long feared that the US would attempt to extradite him after WikiLeaks published the leaked ‘Collateral Murder’ video, which shows the US military attacking journalists and civilians in Iraq in July 2007.

Autumn pedestrian crossing in Yekaterinburg, Russia.