James Dean in a photobooth 1949

Wolf Richter explains what happened yesterday. They’re all either thieves or extremely stupid/negligent.

Merck, Rosneft, Ukraine government, Ukraine International Airport, Maersk, WPP (world’s largest advertising agency), Mondelez etc. They’ve all been found to either use bootleg software or not having patched their systems with a readily available Microsoft patch.

• All Companies Hit By Ransomware Attack Used Bootleg Or Unpatched Software (WS)

The Petya ransomware attack infected over 2,000 computer systems across the world as of midday today, according to Kaspersky Lab, cited by Reuters. Russia and Ukraine were most affected. Other victims were in Britain, France, Germany, Italy, Poland, and the US. When China starts up its computers, it will suffer the consequences for not staying in bed. The malware includes code known as “Eternal Blue,” which was also used in the WannaCry attack in May. Experts believe the code was purloined from NSA. The ransomware encrypts hard drives of infected machines and then demands $300 in bitcoin in order for the user to regain access. Petya takes advantage of the same vulnerability in Windows as WannaCry. But Microsoft released a patch to fix this vulnerability on March 14.

Patched computers were not affected by WannaCry, and are not affected today. The Windows Malicious Software Removal Tool detects and removes the malware automatically during the updating process. But that update isn’t available for bootleg copies of Windows – hence China’s disproportionate problems with the attack in May. And computers that are running legitimate versions of Windows but hadn’t been updated for whatever reason are vulnerable. Amazingly, when WannaCry hit, plenty of companies were mauled because some dude hadn’t updated their machines. Corporate and government networks were hit. You’d think after the hue and cry in May, all legit corporate systems would be updated, and bootleg copies of Windows would be replaced either by a legit copy of Windows or another operating system. But no. Rinse and repeat.

[..] These are big sophisticated companies, many of them with global operations, and therefore with global IT networks, not mom-and-pop operations. And yet the Windows machines in their networks hadn’t been updated and had remained vulnerable, or were using bootleg copies of Windows that couldn’t be updated, even after all the hoopla in May about this vulnerability. Just sitting here and shaking my head.

Read more …

Grandma goes nuts.

• Yellen: Banks Very Much Stronger; No Financial Crisis In Our Lifetime (CNBC)

Fed Chair Janet Yellen said Tuesday that banks are “very much stronger” and another financial crisis is unlikely anytime soon. Speaking during an exchange in London with British Academy President Lord Nicholas Stern, the central bank chief said the Fed has learned lessons from the financial crisis and has brought stability to the banking system. Banks last week passed the first round of the Fed’s stress tests to see how they would perform under adverse conditions like a 10% unemployment rate and turbulence in commercial real estate and corporate debt. “I think the public can see the capital positions of the major banks are very much stronger this year,” Yellen said. “All of the firms passed the quantitative parts of the stress tests.”

She also made a bold prediction: that another financial crisis the likes of the one that exploded in 2008 was not likely “in our lifetime.” The crisis, which erupted in September 2008 with the implosion of Lehman Brothers but had been stewing for years, would have been “worse than the Great Depression” without the Fed’s intervention, Yellen said. Yellen added that the Fed learned lessons from the financial crisis and is being more vigilant to find risks to the system. “I think the system is much safer and much sounder,” she said. “We are doing a lot more to try to look for financial stability risks that may not be immediately apparent but to look in corners of the financial system that are not subject to regulation, outside those areas in order to try to detect threats to financial stability that may be emerging.”

Read more …

Steve explains that Yellen knows Minsky, but prefers to ignore him.

• There Is No Excuse For Janet Yellen’s Complacency (Steve Keen)

Janet Yellen has been reported by Reuters as saying in London yesterday that “she does not believe that there will be a run on the banking system at least as long as she lives”: “Would I say there will never, ever be another financial crisis? You know probably that would be going too far but I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will be,” Yellen said at an event in London. The only word I can use to describe this belief is “delusional”. The only way in which her belief could be justified would be in financial crises were truly random events, caused by something outside the economy—or just by a very bad throw of the economic dice. This is indeed the perspective of mainstream “Neoclassical” economic theory, in which Yellen was trained, and because of which she was deemed eligible—and indeed eminently suitable—to Chair the Federal Reserve.

This is the theory that led the OECD to proclaim, two months before the crisis began in August 2007, that “the current economic situation is in many ways better than what we have experienced in years”, and that they expected that “sustained growth in OECD economies would be underpinned by strong job creation and falling unemployment.”. It is the theory that led her colleague David Stockton, then the Director of the Division of Research and Statistics at the Fed, to dismiss the possibility of a recession after the crisis had begun, in December 2007—the very month that the recession is now regarded as having commenced: “Overall, our forecast could admittedly be read as still painting a pretty benign picture: despite all the financial turmoil, the economy avoids recession and, even with steeply higher prices for food and energy and a lower exchange value of the dollar, we achieve some modest edging-off of inflation.” (FOMC, Dec 2007)

So what we are getting from her is not merely her own personal complacency, but the complacency of an approach to economics which has always been grounded in the beliefs that (a) capitalism is inherently stable, (b) that the financial sector can be ignored—yes that’s right, ignored—when doing macroeconomics, and (c) that the Great Depression was an anomaly that can also be ignored, because it can only have been caused either by an exogenous shock or bad government policy, both of which cannot be predicted in advance.

Read more …

It’s a really crazy thing to say. Does she expect to be fired soon?

• Yellen: “I Don’t Believe We Will See Another Crisis In Our Lifetime” (ZH)

If there was any confusion why the Fed intends to keep hiking rates, even in the face of negative economic data and disappearing inflation, it was put to rest over the past 2 days when not one, not two , not three, but four Fed speakers, including the three most important ones, made it clear that the Fed’s only intention at this point is to burst the asset bubble. First there was SF Fed president John Williams who said that “there seems to be a priced-to-perfection attitude out there” and that the stock market rally “still seems to be running very much on fumes.” Speaking to Australian TV, Williams added that “we are seeing some reach for yield, and some, maybe, excess risk-taking in the financial system with very low rates. As we move interest rates back to more-normal, I think that that will, people will pull back on that,

Then it was Fed vice chairman Stan Fischer’s turn, who while somewhat more diplomatic, delivered the same message: “the increase in prices of risky assets in most asset markets over the past six months points to a notable uptick in risk appetites…. Measures of earnings strength, such as the return on assets, continue to approach pre-crisis levels at most banks, although with interest rates being so low, the return on assets might be expected to have declined relative to their pre-crisis levels–and that fact is also a cause for concern.” Fischer then also said that the corporate sector is “notably leveraged”, that it would be foolish to think that all risks have been eliminated, and called for “close monitoring” of rising risk appetites.

All this followed the statement by Bill Dudley, who many perceive as the Fed’s shadow chairman, who yesterday warned that rates will keep rising as long as financial conditions remain loose: “when financial conditions tighten sharply, this may mean that monetary policy may need to be tightened by less or even loosened. On the other hand, when financial conditions ease—as has been the case recently—this can provide additional impetus for the decision to continue to remove monetary policy accommodation.” And finally, it was Yellen herself, who speaking in London acknowledged that some asset prices had become “somewhat rich” although like Fischer, she hedged that prices are fine… if only assumes record low rates in perpetuity:

“Asset valuations are somewhat rich if you use some traditional metrics like price earnings ratios, but I wouldn’t try to comment on appropriate valuations, and those ratios ought to depend on long-term interest rates,” she said. It was not all doom and gloom. Responding to a question on financial system stability, Yellen said post-crisis regulations (and $2.5 trillion in excess reserves which just happen to be fungible and give the banks the impression that they are safe) had made financial institutions much “safer and sounder.” “Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will.”

Read more …

There were smokescreeens a-plenty too.

• Trio of Fed Speakers Warn on Valuations With Eyes on Tightening (BBG)

When a trio of Federal Reserve officials delivered remarks on Tuesday, the state of U.S. financial markets came in for a little bit of criticism. When all was said and done, U.S. equities sank the most in six weeks, yields on 10-year Treasuries rose and the dollar weakened to the lowest level versus the euro in 10 months. Fed Chair Janet Yellen said that asset valuations, by some measures “look high, but there’s no certainty about that.” Earlier, San Francisco Fed President John Williams said the stock market “seems to be running very much on fumes” and that he was “somewhat concerned about the complacency in the market.” Fed Vice-Chair Stanley Fischer suggested that there had been a “notable uptick” in risk appetite that propelled valuation ratios to very elevated levels.

The Fed officials’ comments came amid a torrent of events that buffeted financial markets Tuesday, from an IMF cut to its U.S. growth forecast, Google suffering the biggest ever EU antitrust fine, a fresh blow to the Republican agenda in Washington and a global cyberattack. Still, selling in U.S shares accelerated around 1:30 p.m. as Yellen delivered her assessment of the market since the central bank raised interest rates June 14. “Asset valuations are somewhat rich if you use some traditional metrics like price earnings ratios, but I wouldn’t try to comment on appropriate valuations, and those ratios ought to depend on long-term interest rates,” Yellen said during a speech in London.

Investors are on guard for signs of a change in its economic outlook that could delay rate increases or when it will begin shrinking its $4.5 trillion balance sheet. Yellen said the Fed’s plans for the balance sheet were “well understood” by financial markets. Officials have said they intend to begin allowing the portfolio to roll off this year. In the end, Yellen made it pretty apparent that that her plans for continued monetary policy tightening haven’t shifted. “We’ve made very clear that we think it will be appropriate to the attainment of our goals to raise interest rates very gradually,” Yellen said.

Read more …

All the credit was the only thing that kept the country going.

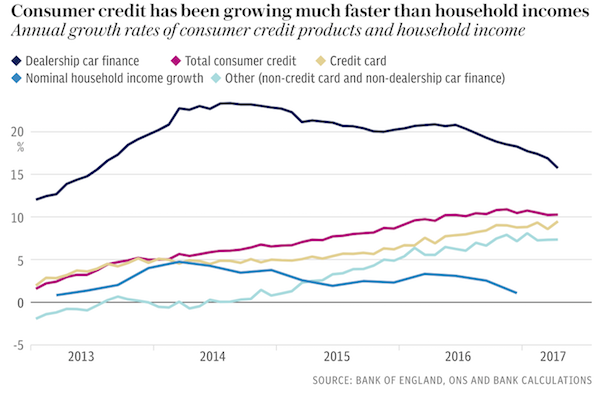

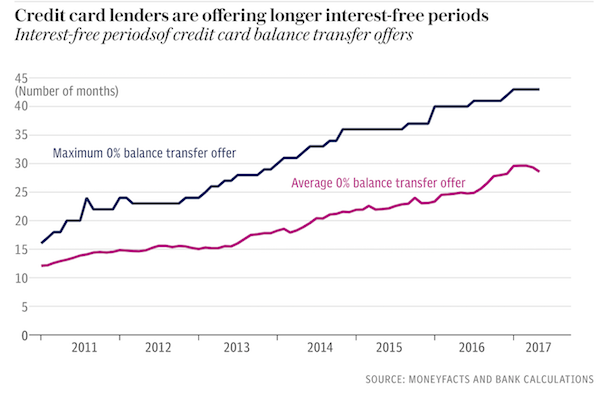

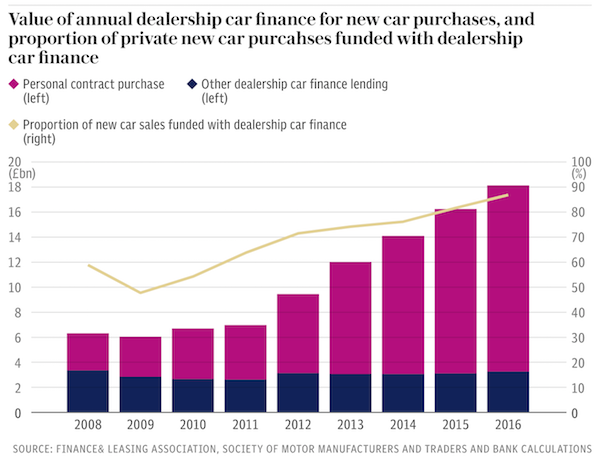

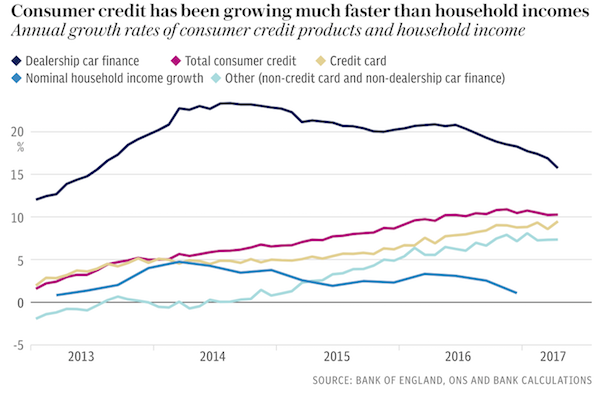

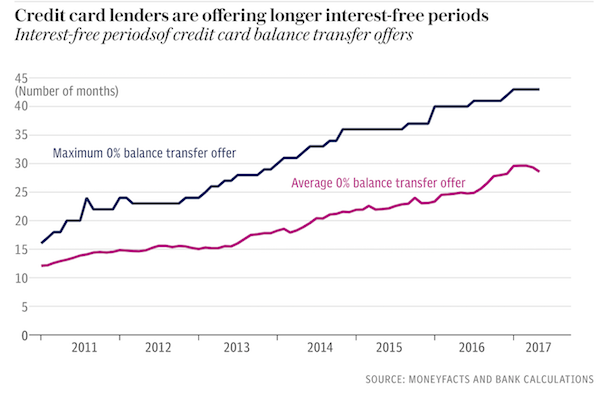

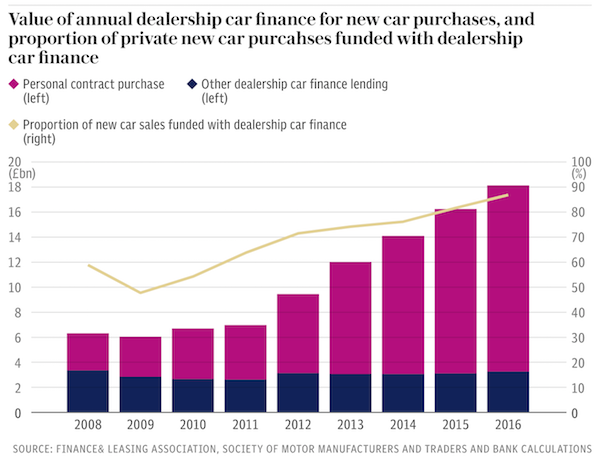

• Car Loans, Credit Card Debt Push UK Back Towards Another Credit Crisis (Tel.)

Banks are “forgetting the lessons” of the financial crisis, increasing the risk of reckless lending which could land them — and the wider economy — in trouble later, Mark Carney has warned. Credit card lending is booming and the Bank of England fears that banks are becoming complacent, assuming the relatively good economic times will continue indefinitely. As a result lenders are cutting down the amount of capital they put aside to keep them safe if those loans turn bad — something that could leave them in financial trouble if there is a recession and customers cannot pay back their debts. “I think it is forgetting some of the lessons of the past, or not fully learning the lessons of the past,” said Mr Carney, the Bank of England’s Governor. He said that the economy overall is performing well and total lending is not getting out of hand, but consumer credit is growing by more than 10pc per year, with credit cards and car loans growing particularly fast.

“Most financial stability indicators are neither particularly elevated nor subdued. Nevertheless, there are pockets of risk that warrant extra vigilance,” he said at the publication of the latest Financial Stability Report. “Consumer credit has increased rapidly. Lending conditions in the mortgage market are becoming easier. And lenders may be placing undue weight on the recent performance of loans in benign conditions.” As well as holding more capital against credit card debt and consumer loans, banks have also been warned that next month the Financial Conduct Authority and the Prudential Regulation Authority will also publish new affordability rules to make sure customers are likely to be able to repay their debts.

The situation is deemed relatively urgent — one part of an annual assessment of the losses which banks could make in a hypothetical recession has been brought forwards this year. Instead of publishing the results in November, the consumer credit part of the so-called stress tests will be revealed in September. That decision reflects the short-term nature of consumer loans. Short-term loans can also pose a threat to financial stability because households take them less seriously than mortgages. Consumer debts only amount to one-seventh of the total of mortgage debt, but they account for 10-times the amount of bad loans which banks write off.

That also has implications for the wider economy — a household in financial trouble will cut spending deeply to make sure it can still pay the mortgage, but is less worried about credit cards. Mortgage lending standards are also under the spotlight. The Financial Policy Committee told banks in 2014 that they should assess whether borrowers could still afford their mortgages if the Bank of England’s base rate went up by three%age points. Most banks calculated this by adding 3%age points to their standard variable rates, but some lenders said that in this scenario they might not pass the full cost onto customers. Officials reject this interpretation and have ordered banks to add the full 3 points to their rates when judging the affordability.

Read more …

First you lower rates, then you take measures against the fully predictable consequences.

• UK Banks Ordered To Hold More Capital As Consumer Debt Surges (G.)

The Bank of England is to force banks to strengthen their financial position in the face of a rapid growth in borrowing on credit cards, car finance and personal loans. The intervention by Threadneedle Street means banks will need to set aside as much as £11.4bn of extra capital in the next 18 months and is intended to protect the financial system from the 10% rise in consumer lending over the year. The Bank is also bringing forward the part of the annual stress tests on banks that scrutinises their exposure to consumer credit by two months to September. The Bank’s Prudential Regulation Authority and the City regulator, the Financial Conduct Authority, will also publish next month how they expect lenders to treat borrowers in the consumer credit market.

The Bank’s half-yearly assessment of risk to financial markets also set out measures to rein in the riskiest mortgage lending, highlighted the risks associated with the UK’s exit from the EU and said commercial property prices were “at the top end of sustainable valuations”. While the Bank found risks to financial stability were neither “particularly elevated nor subdued” it warned that there “pockets of risk that warrant vigilance”. “Consumer credit has increased rapidly. Lending conditions in the mortgage market are becoming easier. And lenders may be placing undue weight on the recent performance of loans in benign conditions,” said Mark Carney, governor of the Bank of England.

Carney said the decision to call on banks to hold more capital – which is largely a rejig of their current resources rather than raising new funds – was taken after domestic risks returned to “standard” levels. A year ago, after the Brexit vote, the Bank had relaxed regulatory requirements on banks – using new tools it was given after the financial crisis – and is now reversing that decision.

Read more …

“..if we adopt, as in the U.S., a broader concept of unemployment (which in the U.S. they call U6) then unemployment in the euro area is at 18% whereas it is at 9% in the case of the U.S..”

• ECB VP: Slack In European Economy Looks Worse Than We Thought (CNBC)

The difference between current and potential levels of output in the euro area economy could be greater than the ECB originally thought, its vice president, Vitor Constancio, warned on Tuesday. “What we see, what we observe is that domestic factors of inflation starting with wage and cost developments and then also price decisions are not responding the way we would expect in view of our more common estimates of this slack. So we have to ask ourselves – are these measures of the slack of the economy correct?,” explained Constancio, speaking to CNBC from the ECB Forum on central banking in Sintra. The board had therefore begun to ask themselves whether other variables should instead be considered to establish a more accurate view of the current economic situation.

“The unemployment rate now is 9.3% according to the normal international standard of measuring employment …. But if we adopt, as in the U.S., a broader concept of unemployment (which in the U.S. they call U6) then unemployment in the euro area is at 18% whereas it is at 9% in the case of the U.S. which would imply that the slack is then bigger than we could judge some time ago,” he noted. “That being the case it justifies fully what the president (Mario Draghi) said at the end of his speech (on Tuesday) that we need persistence. If we want to bring inflation to our target of below but close to 2% then we have to persist in the type of monetary policy that we been adopting,” he added.

Read more …

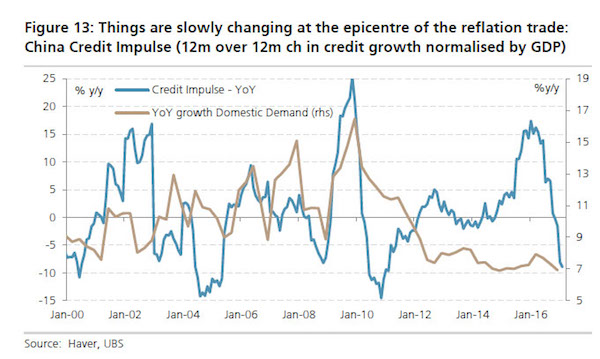

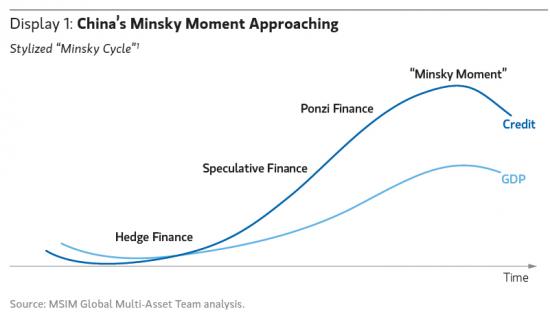

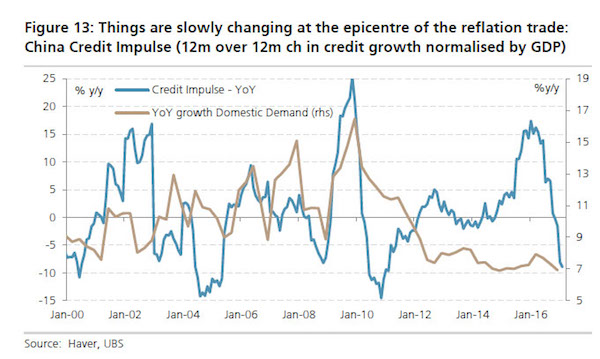

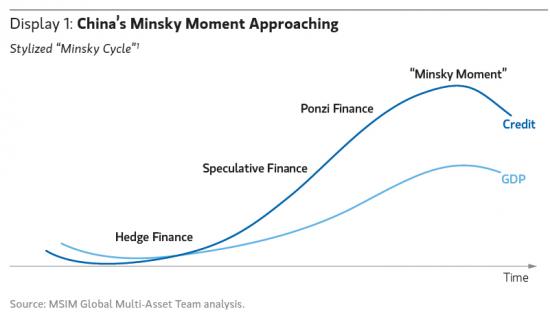

Earlier, we saw Yellen vs Minsky. Here’s China’s Minsky moment.

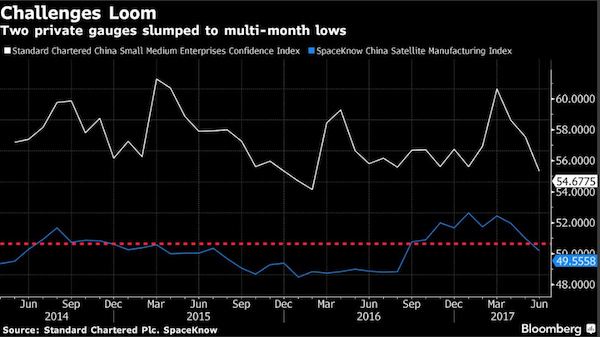

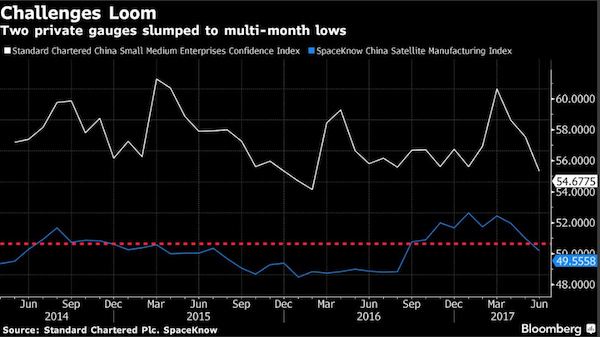

• Chinese Satellite Data Hint At Ominous Manufacturing Slowdown (ZH)

A reading published by San Francisco-based SpaceKnow Inc. which uses commercial satellite imagery to monitor activity across thousands of industrial sites signaled deterioration in the country’s manufacturing sector for the first time since August. The gauge, known as the China Satellite Manufacturing Index, fell to 49.6, below the 50 break-even level. The index incorporates satellite data from thousands of industrial sites across China. Satellite imagery has often proved eerily presceint in the recent past: In the US, satellite data analyzing activity in retailers’ parking lots pointed to significant activity weakness at core US retail locations, even as sentiment indicators were suggesting an uptick in sales following the election. Meanwhile, small- and medium-sized enterprises showed the lowest level of confidence in 16 months, and conditions in the steel business remained lackluster, according to Bloomberg.

Some other indicators have been slightly more sanguine: sales-manager sentiment stayed positive, and outlook of financial experts recovered. Still, data suggest that output in China’s economy slowed during the second quarter after a strong start to the year, with investment slowing, some credit becoming tighter and signs that curbs on the country’s property market are starting to have an impact. Should growth continue to slow, China’s leaders would find themselves in an awkward position, with the country’s twice-a-decade leadership transition expected to occur this fall when the 19th Party Congress convenes to appoint its new senior leadership. It’s widely believed that China’s President Xi Jinping will begin serving his second five-year term.

[..] [That] could be the spark that ignites China’s “Minsky moment” – the financial cataclysm that Kyle Bass and other perma-china-bears have been waiting for when China’s overleveraged market crumbles to dust – might finally be in the offing. Indeed, though China’s markets have been relatively calm recently, the PBOC’s attempts to tighten liquidity have sparked some instability in recent months. Back in March, the central bank had to engage in mini bailouts when a jump in interbank rates caused some small regional lenders to default on their interbank loans after money market rates shot higher. Meanwhile, China’s weakening credit impulse should give any China bulls pause.

Read more …

Completely nuts. Feels like they’re looking to get tossed out.

• UK Government Refuses To Pay For Fireproof Cladding (Ind.)

Councils face bills running to hundreds of millions of pounds to make tower blocks safe after the Government said it would not guarantee extra money to pay for vital work to prevent a repeat of the Grenfell disaster. Ninety-five high-rise buildings in 32 local authority areas have failed safety tests, the Department for Communities and Local Government (DCLG) said yesterday, with hundreds more blocks still to be tested. The findings prompted Theresa May to announce a “major national investigation” into the use of cladding on high-rise blocks, with every sample so far tested in the wake of the Grenfell found to be unsafe. But despite emergency fire safety checks being carried out nationwide under central government direction, councils will not be reimbursed for refurbishment work carried out.

A DCLG spokesperson said there was “no guarantee” of central government funding and that it would be “up to local authorities and housing associations to pay” for the work needed to ensure residents’ safety. The spokesperson said financial support would be considered on a “case by case” basis for those that could not afford to carry out the necessary work, but did not clarify what the criteria for that consideration would be. The announcement was met with severe criticism from some of the councils affected, with local authorities already having their budgets severely squeezed after years of austerity measures. Julie Dore, leader of Sheffield City Council, which is among the authorities to have discovered unsafe cladding, said “starved” councils would be forced to make cuts to other areas, including schooling, if central government did not help with costs.

“Local authorities have been starved of money over the past seven years. Our spending power has decreased,” she said. “There is no way we can afford to reclad our tower blocks. If we have to find that money, it will come from other projects, from investing in the fabric of our schools, capital investment in our infrastructure, the money has to come out of that. And it can’t really be done. “I say absolutely, categorically that the Government should pay. If they can find £1bn to send to Northern Ireland, that gets more spending per capita than anywhere else, to buy 10 votes, then these people, living in high-rise towers, deserve better.”

Read more …

There is no serious press left in the US to get to the bottom of this.

• Democrats The Only Thing Standing In The Way Of Single-Payer In California (CP)

Nothing better illustrates the political bankruptcy of the Democratic Party—for all progressive intents and purposes—than California State Assembly Speaker Anthony Rendon’s announcement on Friday afternoon that he was going to put a “hold” on the single-payer health care bill (SB 562) for the state, effectively killing its passage for at least the year. The Democratic Party finds itself in a bind in California. They hold the governorship and a supermajority in both houses of the legislature, so they can pass any bill they want. SB 562 had passed the Senate 23-14. There was enormous enthusiasm among California progressive activists, who [..] were working tirelessly, and hopeful of success. After all, Bernie’s people were taking over the California party from the bottom since the election.

I recall a night of drinking last year with an old friend who has been spearheading that effort, as he rebuffed my skepticism, and insisted that this time there would be a really progressive takeover of the California party, and single-payer would prove it. After all, once enough progressive pressure was been put on the legislators, the bill would be going to super-progressive Democratic Governor, Jerry Brown, who had made advocacy of single-payer a centerpiece of his run for President in 1992, saying: “We treat health care not as a commodity to be played with for profit but rather the right of every American citizen when they’re born.” Bernie foretold. Unfortunately, today that Governor is, according to Paul Song, co-chair of the CHC, “doing everything he can to make sure this never gets on his desk.”

And it won’t. Unfortunately, all the Democrats like Rendon, who “claims to be a personal supporter of single-payer,” will make sure that their most progressive governor is not put in the embarrassing position of having to reject what he’s been ostensibly arguing for for twenty-five years, of demonstrating so blatantly what a fraud his, and his party’s, progressive pretensions are. Thus unfolds the typical Democratic strategy: Make all kinds of progressive noises and cast all kinds of progressive votes, while carefully managing the process so that the legislation the putatively progressives putatively support never gets enacted. Usually, they blame Republican obstructionism, and there certainly is enough of that, and where there is, it provides a convenient way for Democrat legislator to “support” legislation they know will be blocked and wouldn’t really enact themselves if they could.

Read more …

Phones are as addictive as opioids.

• The Human Tragedy Of Drug Abuse And Car Crashes (BBG)

More than 130,000 Americans are killed annually by preventable causes, and the number has been climbing at a faster rate recently because of opioid abuse and car crashes involving drivers distracted by mobile devices. The death count jumped more than 7% in 2015 to about 146,600, according to a report by the National Safety Council Tuesday. The council said lawmakers often overlook simple solutions that could avoid deaths on the roads or in people’s homes, while public attention is focused on events that are relatively rare in the U.S., like terrorist attacks or plane crashes. Vehicle mishaps and poisonings, driven by opioid abuse, killed more than 80,000 people combined in 2015. Preventable accidents cost society about $850 billion a year, according to the group.

“Culturally, we’re numb to these things,” NSC President Deborah Hersman said in a phone interview. “Why are these deaths any less tragic or important? We should be talking about these things every day because they affect our families.” The toll from opioids is worsening, partly because so many patients become dependent on painkillers, often turning to street drugs like heroin. Almost one in four people on Medicaid, the U.S. health program for the poor, received powerful and addictive opioid pain medicines in 2015, Express Scripts Holding Co. said this month. The council said lawmakers should tighten oversight of the distribution of prescription medications and improve access to drugs that can reverse overdoses and treat addiction.

[..] “We need to make distracted driving socially unacceptable,” Tom Goeltz, whose daughter Megan was killed in a car crash last year, said at a news conference held by the NSC Tuesday. “This tragedy could have easily been prevented.” Goeltz, a Minnesotan who works to help industrial companies avoid accidents, said his daughter was pregnant when her car was struck by a distracted driver. “As a safety consultant with over 30 years of experience, I was powerless to save my daughter,” he said. “We all know people that have been killed on our roads. We all know somebody. How is this acceptable to us? We need to do more. You don’t want to be a part of this club.”

Read more …

“..Google has 90 days to come up with its own solution [..]. If it doesn’t do that, the EU will fine it up to 5% of the entire company’s daily global revenue.”

• Search Results Show Why Europe Is Mad at Google (BBG)

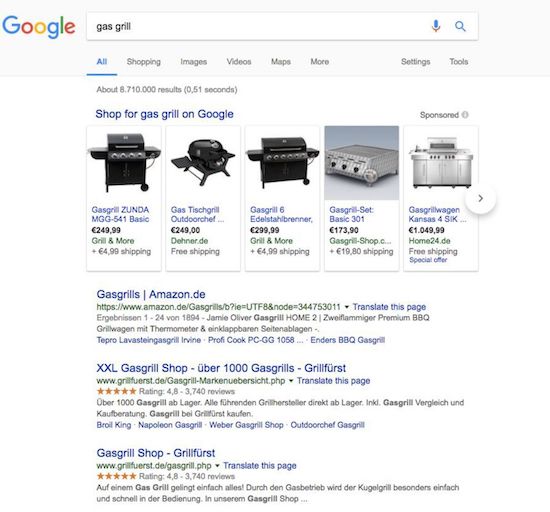

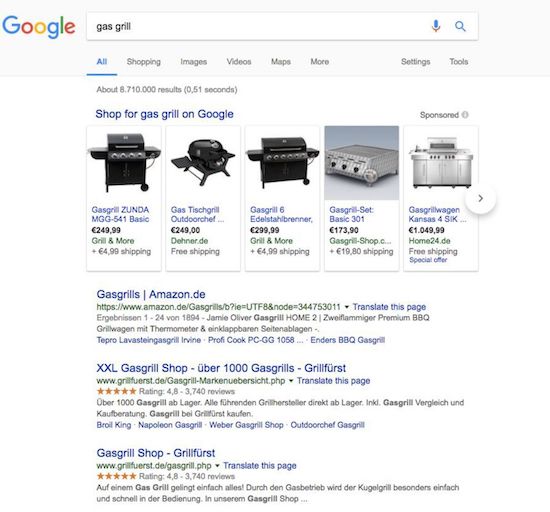

Europe hit Alphabet’ Google with a $2.7 billion fine on Tuesday, saying it broke antitrust laws by favoring one of its search services over rival websites. The case centers around Google Shopping ads, which place color pictures, prices and links to products that consumers have typed into its search engine. The EU’s Competition Chief Margrethe Vestager said Google’s search algorithms should treat its own Shopping service the same way as other price-comparison sites. What exactly does this look like in practice? Here’s a walk-through of what the EU is so upset about. This is for desktop computer searches. On phones, there’s less digital real estate, leaving even less space for competitors. Before we start, it’s important to note that Google argues customers aren’t that interested in clicking through to other price comparison sites and want to go directly to retailers’ sites from Google. It denies any wrongdoing and is considering an appeal.

Google Shopping Today: The screenshot below shows results for a search in Germany for “gas grill.” Five Google Shopping ads take up the most valuable part of the page at the top. No other comparison shopping websites show up in the first couple of links. Scrolling down, you see the first result for a competing price comparison service – Idealo – come in at number six. There’s another at number 11, Moebel24. But that link is listed as an ad, meaning Moebel24 had to pay for that placement, even though it’s near the bottom of the page. The EU says this is bad because consumers click far more often on results appearing higher up in Google’s search results. Even on a desktop computer, the top ten results on page 1 generally get about 95% of all clicks on generic search results (with the top result receiving about 35% of all clicks), the European Commission said on Tuesday.

2014 Proposal: The EU’s Google investigation has been going for years. Vestager’s predecessor tentatively struck a deal with Google in 2014 for a hybrid model that set aside space in those top Shopping search boxes for other price comparison websites. But the agreement fell apart when competitors realized they had to pay for that placement. [..] What could Google do to satisfy Europe’s demands this time? Vestager said Google has 90 days to come up with its own solution, as long as it gives equal treatment to competing price comparison sites. If it doesn’t do that, the EU will fine it up to 5% of the entire company’s daily global revenue. [..] Google would have to sacrifice space currently occupied by its own Shopping ads to make the latter idea work, cutting into a highly profitably and growing revenue stream.

Read more …

US anti-trust laws are strong enough to counter this. But you need politicians to apply them.

• ‘Google, Facebook Are Super Monopolies On The Scale Of Standard Oil’ (CNBC)

Google shareholders won’t be phased by the EU’s $2.7 billion fine against the company for competition abuses related to its shopping business, Elevation Partners co-founder Roger McNamee told CNBC on Tuesday. “As a shareholder of Google you’re looking at this and saying: ‘We won again,'” McNamee said. The venture capitalist spoke hours after EU regulators fined Google a record €2.4 billion ($2.7 billion), ruling that the search-engine giant violated antitrust rules for its online shopping practices. Google said it will consider appealing the decision to the highest court in Europe. “Google, Facebook, Amazon are increasingly just super-monopolies, especially Google and Facebook. The share of the markets they operate in is literally on the same scale that Standard Oil had … more than 100 years ago – with the big differences that their reach is now global, not just within a single country,” he said on “Squawk Alley.”

The fine is not large enough to change Google’s behavior, he added. “The only thing that will change it is regulations that actually say you can or can’t do something.” McNamee said Google’s business model isn’t structured in a way that allows for competition. “The way that Google’s product works makes its anti-competitive behavior much more obvious — but do not underestimate how powerful Facebook’s monopoly has been to boosting Instagram and WhatsApp,” he said. The competition issue with the big tech companies extends beyond the EU into the U.S., he said. “They do stifle innovation. They stifle entrepreneurship. … You can see this even in Silicon Valley it’s very hard for any of the unicorn generation of companies to actually reach successful critical mass because, you know, one of their competitors gets acquired by Google and Facebook and then the category is over,” said McNamee. “I think it’s a big policy question the world is going to have to deal with over the next few years,” he said.

Read more …

The problem is not even the duration, France and Belgium are worse. The problem is what Greeks are left with after taxes are paid, which is much less than the others.

• Greeks Work 203 Days Out Of The Year To Pay Taxes (K.)

Greeks will work an average of 203 days this year to pay taxes to the state and social insurance contributions, according to research conducted by the Dragoumis Center for Liberal Studies (KEFIM) to raise awareness about tax freedom day – the first day of the year in which a country has theoretically earned enough income to pay its taxes. In the case of Greece, this day will be on July 23, which means that Greeks will have worked 15 days more than last year, when tax freedom day arrived on July 7. The only two European Union countries in which tax freedom day will arrive after that in Greece are France and Belgium. Cyprus celebrated its tax freedom day on March 29, while Malta and Ireland did the same on April 18 and 30 respectively. Bulgaria was next on May 18 before Finland on June 22.

KEFIM, which conducted research into the topic for a third straight year, said citizens are working an increasing number of days each year to meet their tax obligations and, compared to 2006, Greeks now work two months more to this end. Referring to the results of the research, financial analyst and member of KEFIM’s scientific council Miranda Xafa said the “government managed to achieve a primary surplus by tax hikes and not through spending cuts.” Xafa also said that for every 100 euros a self-employed professional makes, 82 go toward tax and and other contributions. New Democracy vice president Adonis Georgiadis said that Greece had “lost another month because of overtaxation.” “Our aim when we become the government is to reverse the trend,” he said.

Read more …

Today is day 12 of the garbage strike. Weekend weather forecast up to 44ºC (111ºF). Some judge needs to declare a public health emergency, if Tsipras is too scared to do it.

• Greek Garbage Collectors Reject Compromise As Trash Piles Up (AP)

Greece’s municipal garbage collectors on Tuesday rejected a government compromise offer and decided to continue an 11-day protest that has left mounds of festering refuse piled up across Athens amid high temperatures during the key summer tourism season. Municipal workers union head Nikos Trikas said the protest will go on as planned until Thursday at least, after an inconclusive meeting with Prime Minister Alexis Tsipras. The union is pressing the left-led government to honor a pledge to provide permanent jobs for long-term contract workers, and rejected Tsipras’ proposals as a “slight” but unsatisfactory improvement on past offers. Greek authorities have warned that the uncollected trash poses a public health risk ahead of a heat wave forecast for later this week.

Tourism Minister Elena Kountoura urged the union to reconsider, arguing that the protest “endangers public health, and is bad for tourism as well as the country’s international image.” The Athens Trade Association has also called on the two sides to reach a compromise, warning that piles of garbage would discourage tourists from traveling to the Greek capital. Tourism is a vital source of revenue for Greeces battered economy. Although not technically on strike most of the time, municipal workers have been blockading garages where municipal trash collection trucks operate from, as well as landfill sites across the country. Trikas said that unions will review their position Thursday, when they have called a 24-hour strike. He also pledged to increase emergency crews that the union has on duty to ensure that the garbage mounds do not mushroom out of all control.

Read more …

Where are Merkel and Macron? Why are their voters not demanding they tackle the issue?

• At Least 24 Migrants Die Off Libya in 48 Hours, More Than 8,000 Rescued (R.)

Red Crescent volunteers recovered the bodies of 24 migrants on Tuesday that were washed up in an eastern suburb of the Libyan capital, Tripoli, as large-scale rescues were made in the Mediterranean. Residents in Tajoura district said the bodies had begun washing up at the end of last week. Several had been partially devoured by stray dogs, according to a local coast guard official. The toll was expected to increase as the flimsy boats used to carry migrants as far as international waters normally carry more than 100 people. Three migrants died in the Mediterranean on Monday night, a German aid group said, during Italian-led rescue operations in which thousands more were pulled to safety.

About 5,000 migrants were picked up off the Libyan coast by emergency services, Italy’s navy, aid groups and private boats on Monday, and rescues were continuing on Tuesday, according to an Italian coastguard spokesman. “Despite all efforts, three people died from a sinking rubber boat” and rescue boats in the area are struggling to cope, German humanitarian group Jugend Rettet said on Facebook. Jugend Rettet (Rescuing Youth) is one of about nine aid groups patrolling seas into which people traffickers have sent more than half a million refugees and migrants on highly dangerous voyages towards Europe over the past four years. “We reached the capacity limit of our ship, while our crew is seeing more boats on the horizon. Currently, all vessels are overloaded,” Jugend Rettet added.

About 72,000 migrants arrived in Italy on the perilous route from Libya between Jan. 1 and June 21, roughly 20% more than in 2016, and more than 2,000 died on the way, according to the International Organization for Migration.

Read more …