Pablo Picasso Swimming 1908

Biden speech

So, Joe Biden's speech went well. pic.twitter.com/1eZpxYMceV

— Bongino Report (@BonginoReport) October 7, 2021

“Boys between 16 and 19 years of age had the highest incidence of myocarditis after the second dose . . . The risk of heart problems in boys of that age was about nine times higher than in unvaccinated boys of the same age.”

• Why Is Pfizer Pushing An Untested Vaccine On Children? (TF)

The face of Pfizer – Pfizer board member (and former FDA commissioner) Scott Gottlieb, MD – was on CBS Face the Nation today estimating the upcoming availability of the Pfizer vaccine for kids aged 5-11. His key quote: “The FDA has said the review is going to be a matter of weeks, not months. . . that could give you a vaccine by Halloween.” Perhaps more concerning is the fact that Gottlieb is confident Pfizer will get FDA approval. This concern is based on the questionable safety and effectiveness of the Pfizer vaccine for kids aged 5-11, as well as questions over whether there is a need for an emergency use authorization for that segment of the American population.

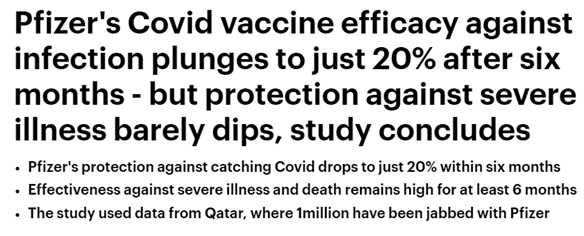

Pfizer tested the vaccine on a small sample of “2,268 participants 5 to <12 years of age.” Pfizer concluded that the results demonstrated “strong immune response in this cohort of children one month after the second dose.” Pay attention to that last part: “one month after the second dose.” Is that it – is Pfizer pushing this vaccine on children after just one month of efficacy data? (The benefit of the emergency use authorization – studies can be limited.) By now it’s clear this is Pfizer’s pattern: they say the vaccine’s “duration of protection” is “unknown” while data demonstrates its effectiveness wanes over time. Compare the Comirnaty Fact Sheet to the latest reporting on the Pfizer vaccine: One would rightfully assume that the effectiveness of the vaccine will wane in children as it has done in other populations.

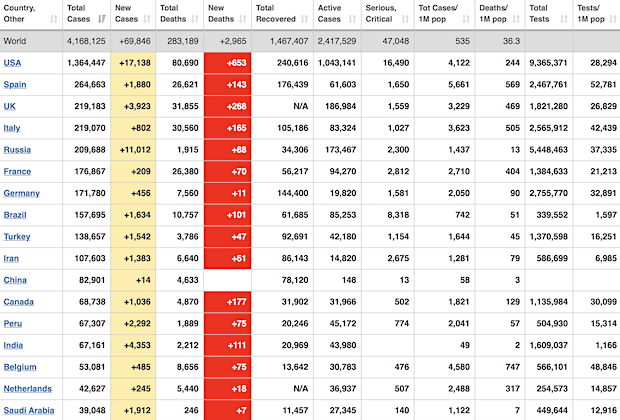

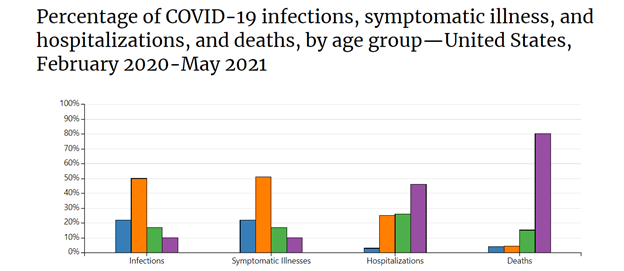

One would also be correct to assume this is the rationale for Pfizer to submit its current (one month) data to the FDA, hoping for approval from its friends in government before its study group shows the vaccine has diminishing returns. All that has to do with effectiveness. Now we get to the question of safety. This has always been a pandemic of the oldest among us. According to CDC data, children aged 5-14 years-old have accounted for only 161 COVID-19 deaths since the start of the pandemic. In comparison, this same group has experienced 194 pneumonia deaths. To put these numbers into perspective, the CDC cites over 530,000 COVID-19 deaths for the ages 65 years and up. As New York Magazine observed, “The Kids Were Safe from COVID the Whole Time.”

Those numbers are important when we start to look at the necessity of a vaccine for kids. As with all vaccines, there is a cost-benefit analysis that must be made: do the benefits of the vaccine outweigh the cost? (This is something the FDA and CDC have drilled to the American public – that the benefits of the vaccines outweigh the costs.) Looking at the data, a 17 year-old teenager might properly disregard the vaccine while a 75 year-old might seriously consider it. This is expected. Considerations of costs and benefits get us to the safety of the vaccine for kids aged 5-12. Pfizer proudly announces the vaccine’s side effects for 5-12 year olds is “generally comparable to those observed in participants 16 to 25 years of age.” That’s not good. If you’ve been paying attention, you know why those numbers (ages 16-25) matter. It’s because young people – especially young men – in that age range have an increased risk of developing heart problems after the second Pfizer dose. The younger they are, the greater the risk: “Boys between 16 and 19 years of age had the highest incidence of myocarditis after the second dose . . . The risk of heart problems in boys of that age was about nine times higher than in unvaccinated boys of the same age.”

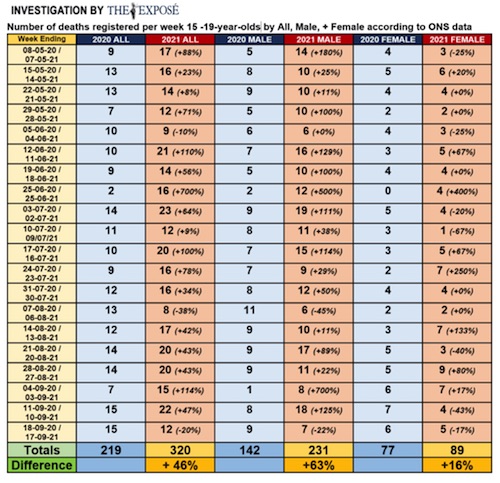

“..since teens over the age of 15 had been given the Covid-19 vaccine deaths among the age group had increased by 47%..”

• Judge Orders Gov’t To Provide Evidence To Justify Vaccinating Children (TE)

A Judge has ordered the UK Goverment to submit evidence that justifies Covid-19 vaccination of children, giving them a deadline of Monday 11th October. The order from The Hon. Mr Justice Jay is most welcome after we exclusively revealed Thursday 30th September that since teens over the age of 15 had been given the Covid-19 vaccine deaths among the age group had increased by 47% compared to the same period in 2020. We also then delved back into the Office for National Statistics data due to a suspicion we would find the majority of those deaths had been among teenage boys due to the risk of myocardtis, inflammation of the heart muscle, associated with the Pfizer vaccine and mainly occurring in younger males, as well as a correlation with a rise in emergency calls requesting an ambulance due to cardiac arrest, found in Public Health England data.

Unfortunately our fears were confirmed, as we exclusively revealed on Monday 4th October that deaths among teenage boys have increased by 63% in the UK since they started getting the Covid-19 vaccine. To add to that we then exclusively revealed on Tuesday 5th October that Chris Whitty’s decision to overrule the Joint Committee on Vaccination and Immunisation and advise the Government to offer the Covid-19 vaccine to all healthy secondary school children, has so far led to a 400% increase in deaths among male children compared to the same period in 2020. (See here) However, people have been fighting in court to overturn the decision of the Chief Medical Officer for England that children should be given an experimental Covid-19 injection, but unfortunately to no avail so far.

The ‘Covid-19 Assembly’ and lawyer Francis Hoar had an application for an urgent hearing to pause the Covid-19 roll-out to under 18’s denied for a second time on September 2nd. The Claimants had asked for just half a day for the Court to listen to oral argument to consider whether to pause the roll out of injections of experimental mRNA vaccine technology, producing increasing reports of clotting and other adverse effects including death, still under emergency authorisation and never before given to humans, to the whole of the healthy population of children aged 12-17. The Court’s view was that to delay consideration of the Claimants’ application for 14 days to allow the government to prepare its response was not in fact a refusal. However, that delay had the practical effect of denying the urgent relief sought and left the full resources and machinery of the state to be put into gear.

“..without the approval of its booster, which has caused great controversy even among the country’s top vaccine officials, Moderna faces a massive financial reckoning.”

• Moderna: A Company “In Need Of A Hail Mary” (Whitney Webb)

Not only did the COVID-19 crisis obliterate hurdles that had previously prevented Moderna from taking a single product to market, it also dramatically reversed the company’s fortunes. Indeed, from 2016 right up until the emergence of COVID-19, Moderna could barely hold it together, as it was shedding key executives, top talent, and major investors at an alarming rate. Essentially, Moderna’s promise of “revolutionizing” medicine and the remarkable salesmanship and fund-raising capabilities of the company’s top executive, Stéphane Bancel, were the main forces keeping it afloat. In the years leading up to the COVID-19 crisis, Moderna’s promises—despite Bancel’s efforts—rang increasingly hollow, as the company’s long-standing penchant for extreme secrecy meant that—despite nearly a decade in business—it had never been able to definitively prove that it could deliver the “revolution” it had continually assured investors was right around the corner.

This was compounded by major issues with patents held by a hostile competitor that threatened Moderna’s ability to turn a profit on anything it might manage to take to market, as well as major issues with its mRNA delivery system that led them to abandon any treatment that would require more than one dose because of toxicity concerns. The latter issue, though largely forgotten and/or ignored by media today, should be a major topic in the COVID-19 booster debate, given that there is still no evidence that Moderna ever resolved the toxicity issue that arose in multi-dose products.

In this first installment of a two-part series, the dire situation in which Moderna found itself immediately prior to the emergence of COVID-19 is discussed in detail, revealing that Moderna—very much like the now disgraced company Theranos—had long been a house of cards with sky-high valuations completely disconnected from reality. Part 2 will explore how that reality would have come crashing down sometime in 2020 or 2021 were it not for the advent of the COVID-19 crisis and Moderna’s subsequent partnership with the US government and the highly unusual processes involving its vaccine’s development and approval. Despite the emergence of real-world data challenging the claims that Moderna’s COVID-19 vaccine is safe and effective, Moderna’s booster is being rushed through by some governments, while others have recently banned the vaccine’s use in young adults and teens due to safety concerns.

As this two-part series will show, safety concerns about Moderna were known well before the COVID crisis, yet they have been ignored by health authorities and the media during the crisis itself. In addition, in order to stave off collapse, Moderna must keep selling its COVID-19 vaccine for years to come. In other words, without the approval of its booster, which has caused great controversy even among the country’s top vaccine officials, Moderna faces a massive financial reckoning. While the COVID-19 crisis threw the company a lifeboat, the administration of its COVID-19 vaccine, in which the US government has now invested nearly $6 billion, must continue into the foreseeable future for the bailout to be truly successful.

Yup, it’s a horse drug. Priceless.

Barron’s behind paywall:

Beware of the new Merck drug: Wall Street Cheered Merck’s Covid Pill. Some Scientists Are Highlighting Its Potential Dangers. Researchers say the drug could integrate itself into patients’ DNA, theoretically leading to cancer. Merck says its tests show that isn’t an issue.

• Molnupiravir Was Made Possible By Government-funded Innovation (STAT)

The story behind molnupiravir is intriguing and a testament to government-funded innovation. Molnupiravir, also known as EIDD-2801 or MK-4482, came out of Drug Innovation Ventures at Emory (DRIVE), a not-for-profit LLC owned by Emory University. It had previously demonstrated broad-spectrum activity against other viruses such as influenza, Ebola, and the Venezuelan equine encephalitis virus. The work goes back to 2004, when Emory researchers were studying a related compound known as EIDD-1931/NHC. Before it was tested for Covid-19, EIDD-2801 had accrued millions of dollars of federal funding. In 2019, the National Institute of Allergy and Infectious Diseases (NIAID) gave the Emory Institute for Drug Development a $16 million contract to test the drug for influenza.

It had previously garnered funding from several other NIAID grants, as well as funding from the Defense Threat Reduction Agency (DTRA), as disclosed by Emory. When attention turned to Covid-19, Emory received pledges of more than $30 million from NIAID and the Department of Defense to cover development of the drug. Jumping on an opportunity to develop a promising drug therapy for Covid-19, Ridgeback Biotherapeutics licensed the drug from DRIVE in March 2020. Ridgeback was founded by Wayne and Wendy Holman, both former investment managers. Within just three months, Ridgeback licensed worldwide rights for EIDD-2801 for Covid-19 to Merck, for which Ridgeback received an undisclosed upfront payment plus milestone payments and shared profits.

But before signing on with Merck, Ridgeback had tried to negotiate a deal with the Biomedical Advanced Research and Development Authority (BARDA), one that was specifically mentioned in the explosive whistleblower complaint by Rick Bright, the former director of BARDA. In his complaint, Bright wrote that George Painter, the CEO of the Emory Institute for Drug Development, and Ridgeback cofounder Wendy Holman sought a contract first from ASPR Next and then from BARDA to develop EIDD-2801 for $100 million, and they personally lobbied the authority to get more financial aid. BARDA denied the request due to a lack of adequate documentation for the request. Even before 2020, Bright had been reluctant to give BARDA funding to EIDD-2801, saying they already had $30 million of support from NIAID and the Department of Defense.

Merck eventually backed Ridgeback and took on development of the drug. Molnupiravir then received even more federal funding: In September 2021, BARDA procured 1.7 million courses of the five-day regimen for $1.2 billion, or $700 per treatment course.

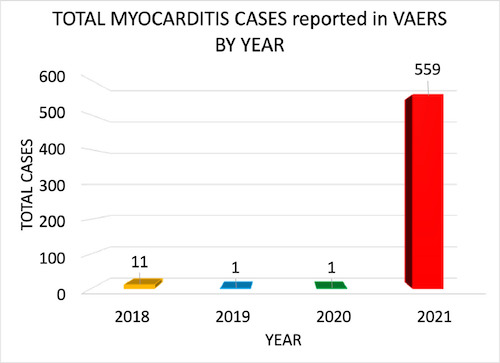

Exhaustive study by Jessica Rose and Peter McCullough.

• Myocarditis Adverse Events in VAERS (SD)

The fact that the VAERS reporting of myocarditis is 6X higher in 15-year-olds following dose 2 may be indicative of a cause-effect relationship. If we assume that following dose 1, a certain percentage of healthy young males who lack co-morbidities or co-factors experience cardiac-related AEs mild enough so as not to dissuade them from receiving dose 2 (ie: pallor, chest pain and shortness of breath, for example), then it is not difficult to imagine that they may have been experiencing symptoms of myocarditis. If a percentage of young males had experienced primary damage to the heart as a result of inflammation following dose 1, then dose 2 may have induced a much more noticeable clinical impact, or cardiac ‘insult’.

In other words, these young males may receive a definitive diagnosis of myocarditis only following dose 2. What this implies, based on these assumptions, is that if there is a causal relationship then it might manifest with overlooked/unreported AEs following dose 1 and a diagnosis of myocarditis following dose 2. It is noteworthy that ‘Vaccine-induced myocarditis’ was in fact used as the descriptor by medical professionals as the reason for the myocarditis in the VAERS database. During phase III clinical trials for the mRNA COVID-19 products, safety was assessed based on a maximum observation period of 6 months. This is not adequate to assess long-term safety outcomes as it is a requirement, even in an accelerated timeline setting, to spend up to 9 months in Phase III trials.

Karl’s take on that study.

VAERS is known to materially under-report adverse events. We do not know what the multiplication factor for these findings is as a consequence of that. Note that in the context of all prior years this basically never happens statistically. The average over the three previous years associated with any vaccination is four. Further, an extraordinary level of cardiac adverse events are associated with these jabs. This is not uncommon or “rare” as claimed; there are in fact, as of July 9th, nearly 130,000 such reports for Covid-19 jabs. If we accept the CDC’s numbers for the number of Americans jabbed this puts the rate of cardiac adverse events are right around one in a hundred! What’s nasty is that while the myocarditis incidence is skewed heavily toward males under 30 the cardiac incidence is not; it is centered in the 20-70 range, or roughly “right up the middle” for the people in the nation as a whole.

Indeed, given the known under-reporting in VAERS a 1-in-100 incidence for a category of serious adverse events is extraordinarily significant. There is every reason to believe we may be causing cardiac injury to as many as one in 25 people who get these shots! Whether those injuries spontaneously resolve without permanent compromise or worse, degenerate progression is completely unknown as nobody is following up these individual cases to measure blood levels (e.g. troponins, EKGs, etc.) in an attempt to determine whether these events are transient or result in permanent impairment or worse. “The only way to understand how common myocarditis is after COVID-19 vaccination, is to perform a prospective cohort study where all vaccinated individuals undergo clinical assessment, ECG, and troponin measurement at regular intervals post-administration.”

Which is not being done, on purpose. Incidentally the markers indicating potential trouble were present in the original studies. They were not followed up and the reason for not doing is obvious: It would have prevented issuance of the EUAs on the original desired schedule. As a result the firms involved and the FDA deliberately ignored that signal in the original studies and we have now jabbed somewhere around 200 million Americans — and may have screwed as many as several million of them with irreversible, or even worse degenerate cardiac damage. We do not know because we intentionally did not look. “COVID-19 injectable products are novel and have a genetic, pathogenic mechanism of action causing uncontrolled expression of SARS-CoV-2 spike protein within human cells. When you combine this fact with the temporal relationship of AE occurrence and reporting, biological plausibility of cause and effect, and the fact that these data are internally and externally consistent with emerging sources of clinical data, it supports a conclusion that the COVID-19 biological products are deterministic for the myocarditis cases observed after injection.”

Again, as we knew and as I have documented before these jabs were first released for widespread use — and again, deliberately ignored. While this paper describes a specific risk with regard to myocarditis in young people the larger issue of cardiac events must not be ignored. While it is certainly true that it in healthy young people the risk from Covid-19 infection itself is minuscule and thus appears on the data to be outweighed by the risks of the jab even without accounting for incomplete reporting in my opinion the 900lb Gorilla in the china shop does not simply lie there.

It’s a sales job. Always has been.

• The Cult of the Vaccine Neurotic (Taibbi)

Yesterday, I ran a story that had nothing to do with vaccines, about the seeming delay of the development of a drug called molnupiravir (see the above segment with the gracious hosts of The Hill: Rising for more). In the time it took to report and write that piece, conventional wisdom turned against the drug, which is now suspected of ivermectinism and other deviationist, anti-vax tendencies, in the latest iteration of our most recent collective national mania — the Cult of the Vaccine Neurotic. The speed of the change was incredible. Just a week ago, on October 1st, the pharmaceutical giant Merck issued a terse announcement that quickly became big news. Molnupiravir, an experimental antiviral drug, “reduced the risk of hospitalization or death” of Covid-19 patients by as much as 50%, according to a study.

The “first draft of history” stories that rushed out in the ensuing minutes and hours were almost uniformly positive. AP called the news a “potentially major advance in efforts to fight the pandemic,” while National Geographic quoted a Yale specialist saying, “Having a pill that would be easy for people to take at home would be terrific.” Another interesting early reaction came from Time: Vaccines will be the way out of the pandemic, but not everyone around the world is immunized yet, and the shots aren’t 100% effective in protecting people from getting infected with the COVID-19 virus. So antiviral drug treatments will be key to making sure that people who do get infected don’t get severely ill. This is what news looks like before propagandists get their hands on it. Time writer Alice Park’s lede was sensible and clear. If molnupiravir works — a big if, incidentally — it’s good news for everyone, since not everyone is immunized, and the vaccines aren’t 100% effective anyway. As even Vox put it initially, molnupiravir could “help compensate for persistent gaps in Covid-19 vaccination coverage.”

Within a day, though, the tone of coverage turned. Writers began stressing a Yeah, but approach, as in, “Any new treatment is of course good, but get your fucking shot.” A CNN lede read, “A pill that could potentially treat Covid-19 is a ‘game-changer,’ but experts are emphasizing that it’s not an alternative to vaccinations.” The New York Times went with, “Health officials said the drug could provide an effective way to treat Covid-19, but stressed that vaccines remained the best tool.” If you’re thinking it was only a matter of time before the mere fact of molnupiravir’s existence would be pitched in headlines as actual bad news, you’re not wrong: Marketwatch came out with “‘It’s not a magic pill’: What Merck’s antiviral pill could mean for vaccine hesitancy” the same day Merck issued its release. The piece came out before we knew much of anything concrete about the drug’s effectiveness, let alone whether it was “magic.”

Bloomberg’s morose “No, the Merck pill won’t end the pandemic” was released on October 2nd, i.e. one whole day after the first encouraging news of a possible auxiliary treatment whose most ardent supporters never claimed would end the pandemic. This article said the pill might be cause to celebrate, but warned its emergence “shouldn’t be cause for complacency when it comes to the most effective tool to end this pandemic: vaccines.” Bloomberg randomly went on to remind readers that the unrelated drug ivermectin is a “horse de-worming agent,” before adding that if molnupiravir ends up “being viewed as a solution for those who refuse to vaccinate,” the “Covid virus will continue to persist.”

“Your hospital is reluctant to change their well-established protocols. Most of your intubated patients are dying. What do you do?”

• The Problems With Censoring Doctors Over Their COVID-19 Stances (RCS)

Everyone has a right to their opinion. The question is: does everyone have a right to voice their opinion? Increasingly, in these strange times, it seems that we physicians have the right to voice only certain opinions, when it comes to discussing Covid-19. Wanting to hit the mute button on physicians who choose to challenge the public health narrative, especially in regard to vaccination for Covid-19, is understandably tempting. We carry a bit more authority than lawyers or statisticians when we share our thoughts about medical matters; and quite a few physicians seem to have little interest in toeing the party line. However, appealing as it might be to silence these voices, succumbing to the temptation of censorship might end up costing our society more than it gains.

Imagine this: you’re a physician in charge of opening an intensive care unit in New York City for Covid-19 patients in March 2020 as the disease is tearing through the city. You notice that the standard protocols your hospital follows for intubated patients seem to be failing, perhaps injuring, your patients with Covid-19. Rumblings from Chinese intensivists, and publications from Italian physician Luciano Gattitoni, imply that intubation and ventilator management should be reconsidered in this new disease. Your hospital is reluctant to change their well-established protocols. Most of your intubated patients are dying. What do you do? Dr Cameron Kyle-Sidell experienced this dilemma — and then posted a video on YouTube on March 31, 2020, watched nearly a million times, in which he described his experiences caring for Covid-19 patients in respiratory failure.

In the video, Kyle-Sidell shared that existing treatment protocols for patients with severe pneumonia did not seem to apply to Covid-19 patients with dangerously low oxygen levels — they could be intubated later, and their lungs were less stiff and required lower ventilation pressures, than typical severe pneumonia patients. His warning was part of an alarm that was raised by others, as well, which did indeed lead to a rapid shift in management of severely ill Covid-19 patients. He also ended up stepping down from his leadership of the ICU due to disagreement with hospital management; and some of those hundreds of thousands of viewers of his YouTube video concluded that his perhaps poorly-worded comparison of Covid-19 lung disease to high altitude sickness was cause to consider the pandemic a hoax.

Was Dr Kyle-Sidell a hero for sticking his neck out and challenging the prevailing dogma, in a sincere attempt to improve outcomes for severely ill Covid-19 patients? Or should his video have been censored, and perhaps his medical license threatened, for questioning the conventional narrative in ways that could be co-opted by conspiracy theorists?

“..without an actual policy or regulation visibly in place, state attorneys general cannot file a lawsuit or request an injunction..”

• Biden Keeps Pushing Nonexistent Worker Vaccine Mandate (CTH)

Joe Biden did it again today. A month after the first announcement, the White House occupant claimed again a Dept of Labor rule (via OSHA) is forthcoming, yet no such process appears to be taking place. This ploy now seems very purposeful, because without an actual policy or regulation visibly in place, state attorneys general cannot file a lawsuit or request an injunction. As long as Biden keeps threatening a DOL worker vaccination rule sometime in the future, many employers will take action to require worker vaccination. This seems to be the actual strategy; bolstered by White House Press Secretary Jen Psaki caught off-guard last week when asked about it. Psaki had no idea how to answer the question about any OSHA activity not taking place.

Obviously Psaki didn’t expect the question, but it was also obvious that no background conversation had ever taken place amid the White House communication team. Perhaps responding to an awakening on that issue, Joe Biden gave a speech today begging people to get vaccinated and again warning that a federal vaccine mandate for all workers was coming: TRANSCRIPT – […] The Labor Department is going to shortly issue an emergency rule — which I asked for several weeks ago, and they’re going through the process — to require all employees [employers] with more than 100 people, whether they work for the federal government or not — this is within a — in the purview of the Labor Department — to ensure their workers are fully vaccinated or face testing at least once a week. In total, this Labor Department vaccination requirement will cover 100 million Americans, about two thirds of all the people who work in America. These requirements work. […] And as the Business Roundtable and others told me when I announced the first requirement, that encouraged businesses to feel they could come in and demand the same thing of their employees.”

Biden then went on to praise companies who are doing it on their own. Others are starting to notice as this article in the Federalist notes: […] According to several sources, so far it appears no such mandate has been sent to the White House’s Office of Information and Regulatory Affairs yet for approval. The White House, the Occupational Safety and Health Administration (OSHA), and the Department of Labor haven’t released any official guidance for the alleged mandate. There is no executive order. There’s nothing but press statements. Despite what you may have been falsely led to believe by the media fantasy projection machine, press statements have exactly zero legal authority.

“The primacy of constitutional law over other sources of law results directly from the Constitution of the Republic of Poland..”

• Poland’s Top Court Rules Polish Law Takes Presedence Over The EU (ZH)

In a stinging rebuke to Europe’s unelected bureaucrats, and a major escalation in the rule of law crisis between Warsaw and Brussels, Poland’s constitutional court ruled on Thursday that Polish law can take precedence over EU law amid an ongoing dispute between the European bloc and the eastern European member state. The decision by the Constitutional Tribunal came after Polish Prime Minister Mateusz Morawiecki requested a review of a decision by the EU’s Court of Justice (ECJ) that gave the bloc’s law primacy. Two out of 14 judges on the panel dissented from the majority opinion. “The attempt by the European Court of Justice to involve itself with Polish legal mechanisms violates … the rules that give priority to the constitution and rules that respect sovereignty amid the process of European integration,” the ruling said, in an outcome that could have wide-reaching consequences for Europe when the next crisis hits.

Meanwhile, Brussels considers the Constitutional Tribunal illegitimate due to the political influence imposed upon Poland’s judiciary by the ruling Law and Justice party (PiS). As the FT’s Henry Foy notes, it is “Hard to overstate the importance of this ruling.” He goes on to note that “Poland is *the* EU success story of eastern enlargement, and the biggest recipient – by a long long way – of EU taxpayer money since 2004. And now it is saying that it refuses to recognize a fundamental part of the whole project.” As DW reports, the court had looked specifically at the compatibility of provisions from EU treaties, which are used by the European Commission to justify having a say in the rule of law in member states, with Poland’s constitution.

A ruling by the ECJ in March said that the EU can force member states to disregard certain provisions in national law, including constitutional law. The ECJ says that Poland’s recently implemented procedure for appointing members of its Supreme Court amounts to a violation of EU law. The ruling from the ECJ could potentially force Poland to repeal parts of the controversial judicial reform. Meanwhile, the EU is withholding billions of euros of aid for post-pandemic rebuilding in Poland over concerns that the rule of law is being degraded in the country. “The primacy of constitutional law over other sources of law results directly from the Constitution of the Republic of Poland,” PiS government spokesman Piotr Muller wrote on Twitter after the court’s decision. “Today (once again) this has been clearly confirmed by the Constitutional Tribunal.”

However, the EPP group, the center-right bloc in the European Parliament to which PiS belongs, come out strongly against the court’s ruling: “It’s hard to believe the Polish authorities and the PiS Party when they claim that they don’t want to put an end to Poland’s membership of the EU. Their actions go in the opposite direction. Enough is enough,” Jeroen Lenaers, MEP and spokesperson for the group, said. “The Polish Government has lost its credibility. This is an attack on the EU as a whole,” he added. Previously, the European Parliament called on Morawiecki to cancel the court case in a resolution passed last month. It stressed the “fundamental nature of primacy of EU law as a cornerstone principle of EU law”, which however now is put in doubt.

Scapegoat?

“Schulte, who had worked at an elite CIA hacking unit, said that whoever leaked the Vault 7 documents “deserved to be executed” and that “no traitors ever came from Texas”..”

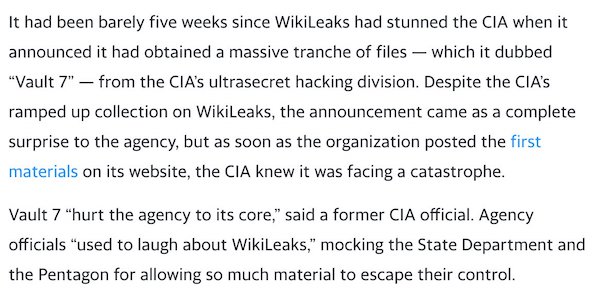

• Prosecution Of Alleged WikiLeaks Vault 7 Source Hits Multiple Roadblocks (Y!)

The prosecution of the former CIA operative accused of providing WikiLeaks with the biggest theft of agency documents in U.S. history continues to be mired in delays and legal issues, drawing out a painful chapter for the agency. WikiLeaks’ publication in 2017 of documents that included CIA hacking tools, which it called Vault 7, so enraged some senior officials, including then-CIA Director Mike Pompeo, that it sparked discussions within the agency and the Trump White House about kidnapping or even killing WikiLeaks founder Julian Assange, according to a Yahoo News investigation. The first trial of Joshua Schulte, the former CIA programmer accused of transmitting the documents to WikiLeaks, ended in a hung jury in March 2020. (Schulte was, however, convicted of related minor charges and remains jailed.)

It was a stinging defeat for federal prosecutors in New York’s Southern District, who vowed to retry the former agency operative. The retrial, which has already been repeatedly postponed, was last scheduled for late October. In September, Schulte, who is now representing himself in court, asked for another delay. The parties are now supposed to confer on a new trial date by Nov. 1, as Inner City Press first reported, but it is unclear precisely when the alleged WikiLeaks source will face another jury. WikiLeaks began publishing Vault 7 documents in March 2017. The leak was “instantly devastating,” said the prosecutor in the case, causing “critical intelligence gathering operations all over the world” to come to “a crashing halt.” Agency investigators later called the leak “the largest data loss in CIA history.”

Before WikiLeaks began publishing the Vault 7 materials, the CIA had no idea they had even been taken. The leak set off a furious search for the culprit. The CIA would soon determine that the files had been stolen in the spring of 2016 by Schulte, a disgruntled agency employee who quit his job within the CIA four months before WikiLeaks began releasing Vault 7 materials. FBI officials, who code-named Schulte “Kinetic Piranha” or “Kinetic Panda,” confronted him in March 2017 in the New York City office lobby of his new employer, Bloomberg LP. In subsequent interviews with bureau officials, Schulte, who had worked at an elite CIA hacking unit, said that whoever leaked the Vault 7 documents “deserved to be executed” and that “no traitors ever came from Texas” (he is a native of Lubbock, Texas).

Schulte has continued to deny any wrongdoing. Interviewing him at a restaurant across from Grand Central Terminal, FBI agents presented Schulte with a grand jury subpoena and a separate subpoena to seize his phone. Bureau personnel then also executed a search warrant of his apartment. Schulte was first arrested in August 2017 after investigators said they had found “approximately ten thousand images and videos of child pornography” while searching his electronic devices. In June 2018, prosecutors charged him with providing the materials to WikiLeaks.

Veritas Pfizer fetal tissue

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.