Vincent van Gogh Field with Flowers near Arles 1888

Maher

https://twitter.com/i/status/1852565201515630859

In the bag

BAD NEWS: Harris – Obama privately smirking, 100% confident in victory. "Don't believe polls or what you read, election already in the bag."

Harris Transition Team 100% staffed with Obama staff.

Republic being overthrown. Our 1 chance = overwhelm rigged machines.

Retweet! pic.twitter.com/YoS1f5h0GQ

— Patrick Byrne (@PatrickByrne) November 1, 2024

Tucker

— Elon Musk (@elonmusk) October 27, 2024

Tucker Carlson: "It has flipped. The story the country tells itself about reality has flipped. None of the normal people are supporting the democratic machine. Tim Walz is supporting the democratic machine. A man you would never allow to babysit your own children."

"That's the… pic.twitter.com/cz0dpAcHOL

— Camus (@newstart_2024) November 2, 2024

Tucker Carlson: "That's why I'm here. I'm not here because he's gonna win. I'm here because I'm so thrilled by what I've watched over the past nine years. This is the end of a redemption arc. I've really never seen anybody treated like Donald Trump was treated. Ever. Anybody.… pic.twitter.com/WF0rYS8voF

— Camus (@newstart_2024) November 2, 2024

Fulton County

Fulton County hired 15 Republican poll workers and 789 Democrat poll workers.

Fulton County established four special ballot drop boxes to receive absentee ballots after the deadline.

Fulton County ordered staff to not allow observers into the buildings to monitor these drop… https://t.co/IkME1qCUdB pic.twitter.com/gpDjLJYEVq

— KanekoaTheGreat (@KanekoaTheGreat) November 2, 2024

RFK

Thanks @EricTrump. The only thing that will save our country is if we choose to love our kids more than we hate each other. Instead of vitriol and polarization, I will appeal to the values that unite us. pic.twitter.com/KjS1MMPC4p

— Robert F. Kennedy Jr (@RobertKennedyJr) November 1, 2024

Dec. 5?

https://twitter.com/i/status/1852539432395845815

Tulsi

https://twitter.com/i/status/1852686204921426042

Baris

KAMALA CANNOT LOSE ANY BLUE WALL STATE. Watch as @peoples_pundit gives a clear analysis of the current state of polling & the early voting real numbers. "The 2020 voter who mailed in their ballot and put Biden over is not showing up." @JackPosobiec pic.twitter.com/br7btRjbV6

— Real America's Voice (RAV) (@RealAmVoice) November 1, 2024

Jesse

Last week, election officials in three different Pennsylvania counties noticed stacks of fake registration forms piling up and now we know who’s behind it: a Democrat-aligned group from Arizona that works almost exclusively with anti-Trump outfits. Once the news broke, they wiped… pic.twitter.com/W5cj7q2lqN

— Jesse Watters (@JesseBWatters) November 2, 2024

Tucker Grand Finale With President Donald Trump in Glendale, AZ (start at 1.12?!, Trump at 1.38)

“Donald Trump recently did an interview with John Micklethwait, Bloomberg’s top editor and a former editor of The Economist. Micklethwait made the tired point that Trump’s tariffs would raise prices and be bad for Americans.”

• “The American System” Made America Great (Rickards)

Most of us have been taught that free trade is good and that tariffs are bad. And on the surface it certainly seems true. The theory of free trade based on comparative advantage was advocated by British economist David Ricardo in the early 19th century. Ricardo’s theory said that trading nations are endowed with attributes that give them a relative advantage in producing certain goods versus others. These attributes could consist of natural resources, climate, population, river systems, education, ports, financial capacity or any other factor of production. Nations should produce those goods as to which they have a natural advantage and trade with other nations for goods where the advantage was not so great. Countries should specialize in what they do best, and let others also specialize in what they do best. Then countries could simply trade the goods they make for the goods made by others.

All sides would be better off because prices would be lower as a result of specialization in those goods where you have a natural advantage. It’s a nice theory often summed up in the idea that Tom Brady shouldn’t mow his own lawn because it makes more sense to pay a landscaper while he practices football. For example, if the U.K. had an advantage in textile production and Portugal had an advantage in wine production, then the U.K. and Portugal should trade wool for wine. But if the theory of comparative advantage were true, Japan would still be exporting tuna fish instead of cars, computers, TVs, steel and much more. The same can be said of the globalists’ view that capital should flow freely across borders. That might be advantageous in theory but market manipulation by central banks and rogue actors like Goldman Sachs and big hedge funds make it a treacherous proposition.

The problem with this theory of comparative advantage is that the factors of production are not permanent and they are not immobile. If labor moves from the countryside to the city in China, then suddenly China has a comparative advantage in cheap labor. If finance capital moves from New York banks to direct foreign investment in Chinese factories, then China has the comparative advantage in capital also. Trump understands this, Micklethwait doesn’t. Trump didn’t just make polite conversation in the interview. He called out Micklethwait by saying, “It must be hard for you to spend 25 years talking about tariffs as being negative and then have somebody explain to you that you’re totally wrong.” Ouch! Micklethwait certainly isn’t alone. Listening to hysterical commentary from the mainstream media about Trump’s tariffs, one would think his policies were in violation of the U.S. Constitution.

Nothing could be further from the truth. By advocating tariffs, Trump actually wants to return to what made America great in the first place. In fact, tariffs are as American as apple pie. From 1790–1962, the United States pursued high tariff policies under a program known as the American System. It was created by George Washington’s secretary of the Treasury, Alexander Hamilton, who drafted a report to Congress called the Report on Manufactures presented in 1791. Hamilton proposed that in order to have a strong country, America needed a strong manufacturing base with jobs that taught skills and offered income security. To achieve this, Hamilton proposed subsidies to U.S. businesses so they could compete successfully against more established U.K. and European businesses. These subsidies might include grants of government land or rights of way, purchase orders from the government itself or outright payments. This was a mercantilist system that encouraged a trade surplus and the accumulation of gold reserves.

Hamilton’s plan was later proposed on a broader scale by Kentucky Sen. Henry Clay. This new plan began with the Tariff of 1816. Later on, Abraham Lincoln adopted the American System as his platform in the election of 1860, and it became a bedrock principle of the new Republican Party. It was affirmed by William McKinley at the end of the 19th century and by Dwight Eisenhower in the 1950s. The 19th and early 20th centuries were a heyday of the American System. This period was characterized by enormous economic growth and population expansion by the U.S. The American System was also accompanied mostly by low inflation or even deflation (which increases the purchasing power of everyday citizens) despite occasional financial panics and some inflation during the Civil War. The key takeaway is that America grew rich and powerful from 1787–1962, a period of 175 years, using tariffs, subsidies and other barriers to trade to nurture domestic industry and protect high-paying manufacturing jobs.

Ron Paul was made for this.

• Elon Musk Asks Ron Paul To Join Department Of Gov’t Efficiency (ZH)

With just two days left before the presidential election, Libertarians are waking up Saturday to a bunch of buzz on X about a potential “Ron Paul Revolution” in the White House—only possible if Donald Trump wins next week. On Friday evening, AFpost wrote on X, “Ron Paul says he wants to join Elon Musk to cut government waste in second Trump administration.” Musk chimed in on X: “It would be great to have Ron Paul as part of the Department of Government Efficiency!” Ron Paul responded: “I’d be happy to talk with you about it, Elon.” X users instantly went bananas on the prospect that Musk would give Ron Paul a role in the Department of Government Efficiency, or DOGE, only if Trump wins. For months, Musk and Trump have been discussing DOGE, which the billionaire would serve as “Secretary of Cost-Cutting” – a government agency that doesn’t exist yet…

Musk would basically take his skills as a successful manager – in which he slashed 80% of the Twitter workforce a few years ago to make the ‘free speech’ social media platform operate more efficiently. In August, Musk said the goal of DOGE was to cut wasteful spending by the federal government and roll back massive regulations that stifle the economy. Musk recently said DOGE could identify “at least $2 trillion in cuts” as part of a formal review of federal agencies. This would also mean tens of thousands of job cuts—if not more—across the federal government. Just imagine if Trump wins, Musk and Ron Paul would wind down unneeded federal agencies like a scene from Argentina’s Javier Milei.

Elon Musk + Ron Paul, January 2025 (colorized) pic.twitter.com/uJ7v2yYTCX

— Good Morning Liberty (@GoodAMLiberty) November 2, 2024

You hear that, Libertarian… Deal of a lifetime. And Libertarians, even Trump’s VP JD Vance, is coming around to Ron Paul’s argument on the Federal Reserve. Ron Paul had fun on X in the overnight hours. Delayed over the years … but now entirely possible. For decades, Ron Paul has proposed a smaller government by eliminating several wasteful federal agencies, ending foreign wars, eliminating taxes on capital gains and dividends, eliminating the estate tax, and—everyone’s favorite—abolishing the Federal Reserve. This has become true over the years. The only problem is when federal government spending accounts for 22.7% of the US GDP (in fiscal year 2023), reducing this spending could spark a recession. However, if Trump wins, DOGE could be messaged to the American people as a way to curb sky-high inflation sparked by disastrous ‘Bidenomics.’

“..Hispanics are no longer a Democrat bloc, that they have become free agent voters..”

• House Speaker ‘Really Bullish’ Washington Will Be All-GOP Town In January (JTN)

House Speaker Mike Johnson told Just the News on Thursday he is increasingly confident that Republicans will sweep control of Congress and the White House in next Tuesday’s election, saying Hispanics, Blacks, Jews, union workers and other Democrat-leaning constituencies are switching parties over frustration the country is moving in the wrong direction. “I feel really bullish,” Johnson said in a wide-ranging interview with the John Solomon Reports podcast when asked about the GOP’s chances for a clean sweep of Washington D.C. “….I believe we’re going to win unified government with Republicans back in the White House and controlling the Senate, and we grow the House majority.” Johnson said the election between Donald Trump and Kamala Harris presented a rare moment in U.S. history where voters could choose between two White House holders – a former president and a current vice president – based on their records and not just their promises.

“I genuinely believe we’re going to have an historic demographic shift in this election,” he said. “I think when all the analysis is done on the other side of this, they will see that we had a record number of Hispanic and Latino voters, for example, coming into the Republican Party, a record number of Black and African-American voters, Jewish voters, union workers. I mean, people who have not traditionally been in our camp are coming now. “And the reason is because they’re desperate for change, and they know the unique thing about this presidential contest is that both of these persons have had an administration. This isn’t theoretical…. They know what life is like under Harris and Biden, and they know what it was like under Trump, and I think that has a big effect across the board and all the way down the ballot,” he said.

Johnson’s comments follow several recent polls noting demographic shifts toward Trump by several Democratic constituencies even as Harris holds a commanding leading with female voters. The Speaker also reacted to comments the new CEO of the Spanish-language TV network Univision, Daniel Alegre, made on the John Solomon Reports podcast on Wednesday that Hispanics are no longer a Democrat bloc, that they have become free agent voters driven by issues and are shifting this election toward Trump and the GOP.

“Hispanic and Latino voters are just like everybody else, and they they’re so fed up and fired up about the cost of living and rising crime rates in all their communities.,” Johnson said, adding that border security has become another compelling concern for Latino voters. “And then also, on top of that, remember that Hispanic and Latino voters are very family oriented,” he added. “Many of them have deep religious traditions and beliefs, and they see the Democratic Party abandoning all of these sort of foundational principles. And they’ve had enough, and I think they have the same frustration everybody else does. I think that’s why they’re coming into our camp.”

” I just think there’s almost unlimited potential in front of us, and we’ve got to seize that moment..”

• House Speaker Plan: Moving Bureaucrats From DC To Reshape Government (JTN)

House Speaker Mike Johnson says Republicans have an ambitious plan to reshape and shrink federal government if they win the election. That vision includes a plan to deport tens of thousands of federal bureaucrats from Washington and relocate them to middle America. In a wide-ranging interview this week with Just the News, Johnson said he and other GOP leaders wants to move federal agency offices, personnel and assets from the nation’s capital to bring them closer to the people they serve and farther from the monied special interests that often hijack policy and spending. “There’s a lot of talk about uprooting, you know, these entrenched bureaucracies and putting them out elsewhere around the country,” Johnson told the John Solomon Reports podcast.

He explained such a re-invention of the monstrous federal bureaucracy with more than 2 million federal workers and contractors would integrate with former President Donald Trump’s plan to name billionaire entrepreneur Elon Musk to lead a government efficiency office and also tie to fiscal conservatives’ vision to eliminate federal bureaucracies and send monies to the states in the form of block grants. The Louisiana Republican said the deportation of Washington bureaucrats would also create a natural shrinkage in the size and cost of government, “That accomplishes a lot of important goals but the first would be that you don’t have all these career civil service law protected bureaucrats,” he said. “Some of them have been camped out of these agencies for decades. They’re nameless, faceless. We don’t know who to hold accountable,” he said.

Johnson continued, saying “The idea is, if you move the agency to, you know, northern Kansas or southwest New Mexico, or wherever it is around the country, then some of the swamp dwellers they will not desire to follow the job to the new, less desirable location,” he added. “They love the swamp. You know they want to stay. They’ll turn them into lobbyist or something to stay in D.C.” The mass transfer and departure of bureaucrats then leads to a “business reorganization proposition” for federal government, he said. “You’ve got agencies that you can scale down because you have empty cubicles and … almost all the agencies are bloated and inefficient,” he said. “So you can scale that down. And then in the cubicles that you do need to fill, we’ve had America First Policy Institute and some of our other think tanks that have been working to develop a notebook full of highly qualified, previously vetted, limited government conservatives who have expertise in these areas.”

Johnson’s comments were the most sweeping he’s made about a congressional vision for shrinking the budget and reshaping the budget. He said the process would take a “blowtorch” to the regulatory state and align government agencies in the aftermath of a historic Supreme Court ruling this summer that reversed a decades old “Chevron doctrine.” Under the new ruling, federal bureaucrats can’t make up or interpret their own regulations and simply must enforce those authorized by Congress. “We have a once in a lifetime, yeah, once in a lifetime opportunity to really claw back article one authority to the legislative branch under the Constitution and have an administration that is in tune with that whole agenda. So look, I just think there’s almost unlimited potential in front of us, and we’ve got to seize that moment,” Johnson said.

“We’ve done something that’s unprecedented, and we’ve had fun, but now we have to get, hopefully, to work.”

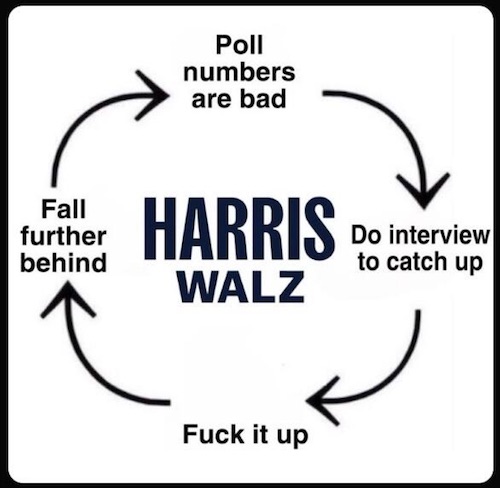

• Candidates’ Final Tours: A Flustered Harris, And A Joyful Trump (Whedon)

With the election just days away, both former President Donald Trump and Vice President Kamala Harris are in the final stretch of their campaign tours, but the tones of each couldn’t contrast more, with Trump on offense and on message and Harris playing defense against the political far-left at her own rallies. Though Harris initially attempted to portray her campaign as one of “joy”, Trump has taken on an almost jovial tone as polling and betting odds increasingly paint him as the favorite. His recent Madison Square Garden rally, moreover, was an offensive play in the heart of Democratic territory and saw tens of thousands of people gather in the Big Apple for what he later deemed a “love fest.” Polling data shows a tight contest, with Trump holding a 0.3% lead in the RealClearPolitics average. That outlet currently projects Trump to win 287 electoral votes to Harris’s 251. Polymarket betting odds also favor Trump to win with a 61.1% chance to Harris’s 39.0%.

Though the race remains in tossup territory, the Trump campaign is quite optimistic. Campaign pollster Tony Fabrizio, this week, released a memo highlighting the difference in polling between this election and 2020. The key point was that, in every swing state, Trump is polling better than in 2020 by a significant margin. “I point this out NOT to stoke overconfidence or complacency, but to illustrate just how close this election is and that victory is within our reach,” he wrote. “It is crucial we do not get distracted by the media noise and remain focused on our closing message, persuading the few remaining undecided voters and turning out our base.” The Trump campaign appears to have taken his words to heart. Kicking off the week with his blowout rally at Madison Square Garden, Trump proceeded to hold event after event all across all the key battlegrounds, often doing two rallies per day.

Election weekend will see him go beyond that and hold three rallies each on Saturday and Sunday, with four more scheduled for Monday. While two are set for North Carolina, Trump plans to appear in Salem, Va., as the Old Dominion appears competitive. His Saturday events come off of Friday rallies in Michigan and Wisconsin. His Sunday will feature rallies in Pennsylvania, North Carolina, and Georgia while his Monday will see him hold four more, two in Pennsylvania and one each in North Carolina and Michigan. Trump opened his Michigan rally, by applauding the crowd sizes and positive energy of his events, including stunts such as driving a garbage truck after President Biden called his supporters “garbage.” “They’ll never be anything like what we’ve done,” he said of Democratic rallies. “We’ve done something that’s unprecedented, and we’ve had fun, but now we have to get, hopefully, to work.”

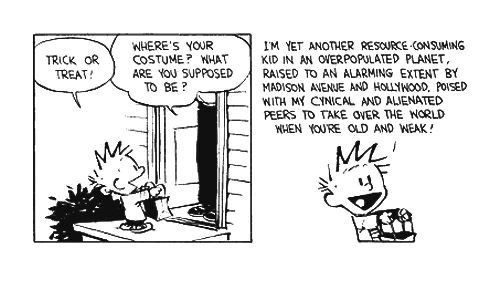

“It’s the people who define us by votes who are garbage, not the other way around.”

• People Aren’t Garbage. Partisan Politics Is (Matt Taibbi)

The cycle was the usual nonsense. At a Donald Trump rally in Manhattan a comic called Puerto Rico a “floating island of garbage.” Joe Biden emerged from his crypt to croak, “The only garbage I see floating out there is his supporters.” The Internet exploded. Reporters were dispatched around the country to gauge how much more pissed off everyone was now. ABC’s take interviewing Harris supporters in Pennsylvania was, “Voters view one another across partisan divide with increasing animosity.” They quoted humans-in-the-street, who all felt strongly. “I would say that some of them are garbage,” said Samantha Leister, 32, while Shawn Vanderheyden, 44, opined, “I just think they are uneducated, and they believe all the lies.” ABC summed up the cultural divide: “Interviews with voters in battleground states reveal that it’s only growing deeper and more insurmountable.”

Surely people know it, but this is all a trick. First, campaign writers only talk to people at campaign events, so the pool of quotes is automatically pared to holders of Very Strong Political Opinions. Second, the odd “Who cares?” answer is instinctively culled by campaign writers as commercially/politically unhelpful. Non-voters or even just people who care more about other things than Harris/Trump — UFOs, knitting, the girl in biology class — ruin the suspension of disbelief. You end up reading copy that hugely over-represents that strange subset of people who define themselves by their votes. When I was first sent to cover campaigns in 2004, a year in which 40% of eligible voters didn’t bother, I was troubled by the absence of non-voters in coverage.

A Rolling Stone editor with whom I rarely worked rolled eyes and said, “We don’t cover them because they’re not part of the fucking story,” which I instantly knew wasn’t true, but I was new and to my shame I didn’t say anything. The numbers of non-voters exposed how inconsequential presidential politics was for most people. It measured the number of people left behind or out, and leaving the non-enthused out of the shot was journalism’s way of covering the holes in the charade. Two years later I was embedded with a group of Oklahoma reservists sent to work as MPs in Iraq. Sgt. Stephen Wilkerson was the team commander. He wore a tattoo on his foot with an arrow pointing to his big toe that read, TAG GOES HERE. His nickname was “Stretch-Nuts” because it was said he could balance a Heineken bottle on his ball-skin. On my first day he asked what I do. I cover presidential elections, I said. He made a jerk-off gesture. That was the last mention of politics on the trip.

In the roughly twenty years since the act of not voting, or even just not really really caring about presidential politics, has been villainized. Now the emotionally healthy person, the one who has a life and isn’t consumed with fears about the Next Hitler, is assumed to harbor secret sympathies, as bad as the worst MAGAT. This is different from the old scam. Now the person who shrugs and says “Who cares?” is called a liar. Everyone must care the way they do, and if you don’t care in that right way — every waking minute, with chewed nails and a carefully weeded social circle to match the correct vote and attitude set — you’re garbage. Many of us have seen in recent years what this hounding has done even to friends or relatives, turning them to Flatland characters, two-dimensional nerve cases scanning everyone for signs of unsuitability. Whatever happens next week, I don’t ever want to be that. It’s the people who define us by votes who are garbage, not the other way around.

“In 2014, one wind project was canceled. Since then, the total number has grown to 464 wind projects shot down, as well as 281 solar projects.”

• Trump, Vance Take Aim At Renewable Energy, Many Communities Already Did (JTN)

While it’s been difficult for voters to determine exactly where Democratic presidential candidate Kamala Harris truly stands on energy, former President Donald Trump and his running mate, Sen. JD Vance, R-Ohio, each discussed their views at length on “The Joe Rogan Experience” podcast. Vance, who appeared on the podcast Thursday, spent several minutes discussing energy with host Joe Rogan. Vance said he and his wife took a road trip through Iowa, Nebraska and Kansas and for miles all they could see were wind farms. “This is beautiful American countryside that used to be green rolling hills, and now you have these disgusting, dystopian wind turbines. I’m sorry. They are ugly. I will die on this hill. They’re ugly. I don’t want them in American society,” Vance said. The wind energy industry is running up against more and more opposition. Much of it comes from grassroots efforts at the local level.

Energy watchdog Robert Bryce maintains a database of renewable energy projects that have been scrapped, most often because of community opposition. In 2014, one wind project was canceled. Since then, the total number has grown to 464 wind projects shot down, as well as 281 solar projects. The wind industry doesn’t appear to believe these community concerns are valid. The Associated Press reported on comments wind energy lobbyists made at a conference in Atlantic City, New Jersey Tuesday, claiming that concerns about wind projects are driven by “misinformation.” The industry is vowing to fight against it. Paulina O’Connor, executive director of the New Jersey Offshore Wind Alliance, told the Associated Press that she has trouble predicting “what crazy thing they’re [wind energy opponents] going to come next.” Bryce told Just the News that, while lobbyists the Associated Press quoted are dismissive of communities’ concerns, developers are going to find it harder and harder to get a welcoming response.

“The public acceptance of wind energy is exhausted. People don’t want to live near these massive turbines, and they are expressing that in many [places] across the country, from Maine to Hawaii,” Bryce said. Among the concerns that wind lobbyists described as “misinformation” was the claims that offshore wind is killing whales. During his appearance on the Rogan podcast, Trump commented on these concerns. “I wanna be a whale psychiatrist. It drives the whales fricking crazy. And something happens with them, but for whatever reason, they’re getting washed up onshore and you know, they’re ignored by these environmentalists. But they don’t talk about it.” Trump said. The Associated Press, which has received millions of dollars from political advocacy groups that promote the wind and solar industry, reported that these claims are “unsubstantiated” based on the fact that federal agencies tasked with carrying out the Biden-Harris goal of building 30 gigawatts of offshore wind have denied any connections between offshore wind and whale deaths.

While it’s true that wind turbines aren’t directly killing whales, whale advocates argue that the noise of the construction causes harm that results in the animals swimming into vessel traffic. Robert Rand, founder of the acoustics consultancy company Rand Acoustics, has surveyed noise levels from pile driving and sonar survey vessels. Both studies found that the incidental harassment authorizations — permits that offshore wind developers are required to obtain to conduct activities that may adversely affect marine animals — don’t impose sufficient mitigation requirements to protect marine animals. Rutgers professor Apostolos Gerasoulis performed a statistical analysis and found a strong correlation between where whales are dying and offshore wind development.

Besides growing opposition to offshore wind, especially after a blade broke off a wind turbine near Nantucket and scattered debris across multiple beaches, the offshore wind industry is struggling financially. An offshore lease sale in the Gulf of Maine netted only 4 bidders on 439,096 acres that were offered, and the bids came in at $50 per acre. A 2022 auction for a lease area off the coast of New York and New Jersey sold 6 leases on 488,000 acres for $8,955 per acre. The sale may be the last for at least a year, as a provision in the Inflation Reduction Act prohibits offshore wind lease sales without offering up oil and gas lease sales. The Department of Interior’s five-year offshore oil and gas lease shale program offers the fewest leases in the program’s history.

“..leftist major media outlets are setting America up for post-election social unrest by perpetuating a fiction that the race is a close one.”

Be that as it may, there have been some major shifts at Polymarket. Overnight, Trump has fallen from 67% to 55%. Wisconsin and Michigan are now Harris. The House has gone Democrat.

• Polymarket’s Trump-Bullish Whale: “Absolutely No Political Agenda” (ZH)

While still guarding his anonymity, the mysterious man who’s bet more than $30 million on a Trump election victory via the Polymarket prediction marketplace has come forward to assert that his wagers aren’t intended to sway the election, but simply to profit from an outcome he’s highly confident in. “My intent is just making money,” said the man who describes himself as a Frenchman and former US resident who was a trader for American banks. In an exclusive interview with the Wall Street Journal via Zoom, he used the pseudonym “Théo,” saying he wanted to remain anonymous out of a desire to conceal the extent of his assets from his children and friends. The Journal said he was “sport[ing] a short, neatly trimmed beard” and spoke English with a small accent. Here’s how the Journal described the precipitation of the interview, and the paper’s process to ensure it wasn’t talking to an imposter:

“Théo emailed the Journal after the publication of an Oct. 18 article about his wagers. To prove that he was behind the Polymarket wagers, the Journal asked him to place a bet on whether Taylor Swift would announce that she is pregnant in 2024—one of the many small, nonpolitical wagers available on the platform. Minutes later, Polymarket’s website showed that one of the four accounts, Theo4, had placed a small bet on Swift’s pregnancy. ” In that original Oct. 18 article, the Journal gave some credit to the idea that the concentrated bets may represent some form of intentional narrative-control scheme meant to benefit Trump. Théo emailed the Journal to refute that theory, writing, “I have absolutely no political agenda.” In his subsequent interview, Théo told the Journal he’s a veteran trader with a history of risking tens of millions of dollars when he discovers a high-confidence trade — and said that’s what he sees in the chance to wager on a Trump victory.

When news broke of the whale’s huge wagers on Trump, Polymarket engaged outside experts to scrutinize transactions in presidential election betting, an unnamed source told the Journal at the time. Last week, Polymarket said it had contacted the whale and confirmed it was a French citizen with an extensive financial services and trading background. “Based on the investigation, we understand that this individual is taking a directional position based on personal views of the election,” the firm said. Théo said his conviction on a Trump victory rests on pollsters’ failure to capture the full extent of Trump’s support in both the 2016 and 2020 elections, and his belief that the “shy Trump voter effect” still endures in 2024. “I know a lot of Americans who would vote for Trump without telling you that,” he said, while also scoffing at the possibility that pollsters have improved their methodologies this time around. Having been previously accused of trying to shape the election, Théo dished out an accusation of his own, saying leftist major media outlets are setting America up for post-election social unrest by perpetuating a fiction that the race is a close one.

Théo thinks Trump is poised to rout Harris, which is why he has more than $30 million on Trump reaching 270 electoral votes, with the potential to receive $80 million if he’s right. He says his $30 million on Trump represents most of his liquid assets. Théo also has bets on a Trump popular-vote victory, along with bets on various swing-state wins. He also gave some insights into how he’s been trading: He started quietly in August by betting several million dollars on Trump, using an account with the username Fredi9999. At the time, Trump and Harris had roughly even chances on Polymarket. Théo spread out his wagers over multiple days and weeks to avoid causing a price spike. Still, as his bets grew, Théo noticed other traders were backing away from quoting prices when Fredi9999 was buying. That made it harder for Théo to get attractive prices. He created the other three accounts in September and October to obscure his purchasing, Théo said.

Single-handedly accounting for 25% of the contracts on a Trump electoral college win and 40% of the bids on a popular vote victory, Théo would have a hard time pulling money off the table without pushing the value of his contracts down. Speaking of which, the electoral college version of a Trump win peaked on Wednesday at 76 cents (with a dollar payoff if Trump wins). However they’ve taken a big dive since — plunging to 57.5 cents as this is written in the wee hours of Saturday morning. [..] If you’re itching to buy the dip, note that Americans are officially barred from Polymarket. You can thank your all-powerful, all-knowing, Constitution-violating federal government for protecting you from yourself: The Commodity Futures Trading Commission fined the platform in 2022 for allegedly providing illegal trading services, prompting Polymarket to bar Americans going forward.

“JD Vance as dictator for life? Conservatives banning contraception? Elon Musk as an immortal techno god who spies on the masses using X and AI?”

• Leftists Predict Hysterical Dystopian Future (ZH)

The secret to understanding the average progressive mind is to first realize that everything they do revolves around a deeply ingrained fantasy world in which they are rebels; righteous underdogs fighting against “the system” or “the patriarchy.” Leftists cannot function within their collectivist ideology without first creating a fascist bogeyman to revolt against. If they were to ever realize that they are, in fact, the establishment and the authoritarians, their entire world view would collapse. This is why you will continue to see content like the election propaganda video below, no matter how ridiculous the premise might be. Leftist activists create these narratives, not because they are necessarily convincing to most people, but because they need to convince themselves that they are still the good guys.

This Democrat fearmongering ad is amazing. It depicts JD Vance as President for life and Elon Musk opens up concentration camps for illegal aliens and homeless people before uploading his consciousness into a super AI to become immortal. So based. pic.twitter.com/fHE4o16uX6

— Ian Miles Cheong (@stillgray) November 1, 2024

JD Vance as dictator for life? Conservatives banning contraception? Elon Musk as an immortal techno god who spies on the masses using X and AI? Global warming destroying the planet and creating a Mad Max future in which the homeless are forced into concentration camps? The only thing missing is the forced birthing ceremonies from The Handmaid’s Tale. The video credits cite a handful of progressive NGOs as references for donations (including Vote.org) but little on who specifically made it. The relevant issue is the insight this gives into the insanity of left activists. They cling to so many assumptions they have been proven wrong about time after time (global warming), and they also imagine a world in which conservatives are the elites searching for immortality. They seem to be projecting the habits and hobbies of the very globalists that fund leftist groups today.

One could argue that perhaps this is gaslighting – They’re accusing conservatives of scheming to rule the world when they are the people that actually want control. That could be, but the conspiracy theories surrounding “Project 2025” suggest a Q-Anon level of delusion going on that feeds directly into bizarre narratives like those in the video. Leftists have to believe they’re fighting the good fight, even though they’re actually useful idiots for the establishment. This desperate need to take on the role of “freedom fighter” doesn’t mesh very well with reality. Keep in mind, for nearly two decades progressives have enjoyed expanding political and social power, with nearly every western government, every major NGO, every corporation, every legacy media outlet and every Big Tech platform dominated by woke ideology. From ESG to DEI to LGBTQ+ and beyond, Americans and much of the west have been endlessly bombarded from every angle by leftist propaganda.

Their war on conservative principles and individual freedom nearly came to a crescendo during the covid pandemic when they claimed the power to take away people’s access to the economy if they refused to accept an experimental vaccine and follow the mandates to the letter. Surveys showed a disturbing number of Democrats supported the outright destruction of constitutional freedoms in the name of forcing people to adhere to medical mandates based entirely on lies. Leftists also supported the widespread censorship of conservative voices on everything from the covid vaccine, to the lockdowns, to climate change, to Hunter Biden’s laptop. This censorship was spearheaded by the Biden Administration acting in violation of the constitution as they worked closely with Big Tech companies to shut down dissent. They aren’t fighting “the man”, they are the man. Ridiculous AI generated political videos like the one above are not going to change that.

“There is optimism in Zelensky’s office that he could forge a personal bond with Trump..”

• Kiev Officials ‘Ready’ For Potential Trump Presidency – WaPo (RT)

Officials in Kiev reject the notion that an election victory for Donald Trump would spell disaster for Ukraine, despite his criticisms of US aid to Kiev and pledges to quickly end the conflict with Moscow, the Washington Post reported on Friday. Two unnamed members of Ukrainian leader Vladimir Zelensky’s team told the paper that the Republican presidential candidate’s “negative” messaging on Ukraine was “just campaign rhetoric” that will not necessarily correlate with his actions if he wins the election on November 5. There is a belief in the Kiev government that Trump would not want to look weak on the global stage by turning his back on Ukraine and, as a result, might make more decisive moves to support Kiev, WaPo said.

“With Russia advancing on the battlefield for the past year,” the Ukrainian officials believe that the status quo, which is likely to be maintained if Democratic presidential candidate Kamala Harris prevails in the race for the White House, is “not working,” the report read. Because of this, they suggested that “a drastic change” in US policy towards Ukraine could actually “be good” for Kiev. There is optimism in Zelensky’s office that he could forge a personal bond with Trump and eventually turn him into a supporter of Kiev, WaPo said. However, some Ukrainian officials, who talked to the paper, acknowledged that there is a “higher potential for a downside” if Trump wins a second term, and expressed concern that he would pressure Ukraine to make territorial concessions to Russia in exchange for peace.

Last month, Trump said on the PBD Podcast that the conflict between Russia and Ukraine was “a loser” and that Zelensky “should never have let that war start.” He described the Ukrainian leader as “one of the greatest salesmen I have ever seen,” referring to his ability to persuade the Biden administration to provide him with more military aid every time he comes to Washington. The Republican presidential candidate also reiterated his claim that he “will settle the Russia-Ukraine [conflict], while I am president-elect,” but did not reveal how he might achieve this. Back in June, Kremlin spokesman Dmitry Peskov commented on media reports of that Trump’s team was developing a roadmap for settling the Ukraine conflict, and stressed that “the value of any plan lies in the details and whether it takes into account the situation on the battlefield.” Peskov reiterated that Moscow remains ready for negotiations, but only if Ukraine recognises the realities on the ground.

“.. the rules-based order is actually what that the West believes “is right”, adding that “once you are out of this order, you’re a perpetrator.”

• West’s Rules-Based Order To Collapse Soon – Medvedev

The so-called rules-based order imposed by the US and its allies on the global scene is an unstable structure, which is about to fall apart, former Russian President Dmitry Medvedev has said in an exclusive interview with RT. Creating crises such as the conflict between Russia and Ukraine in various places is how the US is trying to rule the world, Medvedev, who now serves as the deputy chairman of Russia’s Security Council, told the broadcaster on Saturday. “So, the more crises they create, the better, they think, the situation is for America… It makes money from weapons, supplies, and by allocating money to its defense industry,” he said. “The Americans are getting what they want at the price of more blood and casualties. This is why the Americans are engaging in feeding the war. But that system is coming to an end,” the former president warned.

The authorities in Washington “feel the world is falling out from under their feet and they are resisting it in every way possible,” he said.This is why the Americans see BRICS and other unions currently being created around the globe, in which the US has no say, as “hostile,” Medvedev explained. Washington and its allies accuse the members of those groups of “violating the rules-based order,” but, at same time, cannot explain what this order is,” he said. “I have carefully picked through the legal text and studied it: it is incomprehensible. It is not clear what the order is and who approved it. It is really just an idea of the US and its allies, while mostly in NATO, of how best to do business in the world,” the former president stressed. According to Medvedev, the rules-based order is actually what that the West believes “is right”, adding that “once you are out of this order, you’re a perpetrator.”

“Western media reported that “Western pollsters” claimed that there were voting irregularities. What were Western pollsters doing in Georgia in the first place?”

• West Sees Red Over Failed Second Color Revolution In Georgia (SCF)

The United States and European Union are threatening consequences for Georgia after its citizens voted “the wrong way” – for peaceful relations with Russia and traditional moral values. Farcically, this is while the U.S. heads into presidential elections that are mired in chaos and recriminations over vote rigging and buying of votes by oligarchs and big businesses. Welcome to Western-style democracy where if you vote the way the powers-that-be want, it’s a fair election. If you vote the wrong way, it’s a rigged, flawed result that should be ignored or, worse, overturned. Such was the heated reaction from Western states to the electoral victory of the ruling Georgian Dream (GD) party last weekend in the South Caucasus nation. The party campaigned on a strong, clear platform for pursuing peaceful neighborly relations with Russia.

GD also declared support for traditional social and moral values, rejecting the Western pseudo-liberal agenda of promoting gender-bender LGBTQ+ identities, which was espoused by the Western-backed Georgian opposition parties. At the end of the day, Georgian Dream won a stunning victory, taking nearly 54 percent of the vote, translating into obtaining 90 out of a total of 150 parliamentary seats. Four opposition parties, which touted closer integration ties with NATO and the EU and acclaiming LGBTQ+ rights, won less than 38 percent of the vote. The Georgian people are to be commended for asserting their democratic rights in the face of massive Western interference in the election. Western money and NGOs amplified the opposition parties. If they had won, the new pro-Western administration would have turned Georgia into a second war front against Russia in conjunction with the NATO-backed Ukrainian regime.

Georgian and Ukraine have been at the center of the Western policy of expanding NATO around Russia’s borders. Both countries were declared future members of the military bloc as far back as 2008, although NATO membership is a red line for Russia. Fortunately, Georgian voters were aware of the geopolitical stakes and rallied to the cause of prioritizing peaceful regional relations and rejecting the notional security privileges of NATO. Western recriminations were fast and furious after the result. Western media reported that “Western pollsters” claimed that there were voting irregularities. What were Western pollsters doing in Georgia in the first place? Such entities sound more like a plant to stir post-election trouble.

As it turns out, there were indeed incidents of vote buying, ballot stuffing, and intimidation at polling stations. But videos showed that the incidents were agitprops organized by the Western-sponsored opposition parties. However, thankfully, such malfeasance was relatively minor and did not invalidate the overall final result. Georgia’s Central Election Committee declared the process to be free and fair. The authorized election invigilating body has given its verdict, and that should be the end of it.

“As a result of having communicated with Yulia Skripal I was interviewed by the police and my statement recorded.”

• Novichok: UK Government Sedated The Skripals To Stop Them Talking (Helmer)

The British Government was exposed in the Dawn Sturgess Inquiry this week as keeping Sergei and Yulia Skripal unconscious to silence them. That was six years ago, when they were in Salisbury District Hospital in March 2018. Now, prevented from testifying in public at the public inquiry under way in London, they are still incommunicado, either in prison or dead. The evidence revealed in the published witness statements and transcript of testimony in four days of hearings at the Sturgess Inquiry October 28-31 shows that British Government officials have lied in public and lied on oath in the courts to conceal what they have been doing to accuse Russia of Novichok poisonings in the Salisbury area in 2018. The Inquiry records show that the chairman and judge, Anthony Hughes (titled Lord Hughes of Ombersley), and the lawyers working for him are actively working to protect the lies and prevent contradicting evidence from becoming public. .

Surprise testimony by Dr Stephen Cockroft, the doctor who cared for Sergei and Yulia Skripal on their admission to Salisbury District Hospital (SDH) on March 4, 2018, has revealed that the British Government kept them heavily sedated in order to tell the courts and media that they were unconscious and unresponsive when they had revived. Government officials ordered the hospital to punish Cockroft from talking directly to Yulia Skripal when she came out of her coma on March 8, 2018. Cockroft’s evidence of March 8, 2018, directly contradicts the evidence given on oath in the High Court in London on March 20-22, 2018, by state officials and an SDH “treating consultant” – the name was kept secret in the published court report — that “Mr Skripal is heavily sedated following injury by a nerve agent. Ms Skripal is heavily sedated following injury by a nerve agent. Mr Skripal is unable to communicate in any way. Ms Skripal is unable to communicate in any meaningful way.”

Cockroft’s disclosures also contradict the script which Yulia Skripal read out at a MI6-supervised and Reuters-filmed appearance for two minutes at a US bomber base in the UK in May of 2018. Skripal claimed then “after 20 days in a coma I woke to the news that we had both been poisoned.” In fact, Yulia woke from her coma after four (4) days. On July 18, 2024, Cockroft told the Inquiry which questioned him for a second witness statement: “An untoward event took place on Thursday 8 March 2018. A colleague (Dr James Haslam) had ordered all sedation to be discontinued temporarily to Yulia Skripal. This is quite a common practice on Intensive Care Units (ICU) and we refer to it as a ‘sedation hold’ and would normally be planned and discussed with the team. Unfortunately, having ordered the sedation hold, Dr Haslam left the ICU without advising me. I was present on the ICU treating another patient. As a consequence, Yulia Skripal regained consciousness very quickly and was confused, frightened, trying to get out of bed and was pulling at her various vascular access lines and breathing tube.

Cockroft then revealed that because the sedation had been stopped and Yulia was no longer comatose, Cockroft was punished by Blanshard, the hospital’s chief doctor. “I tried to feedback my concerns to Dr Haslam, but he was of the opinion that nothing untoward had occurred, but when these events were reported back to the Medical Director (Christine Blanshard) she had a very different opinion and I was summoned to a meeting with her on Monday 12 March to discuss my management of the incident. There is no formal record of that meeting [sic], however I was suspended from working on the ICU with immediate effect until Yulia and Sergei had either been discharged or died. Apparently by having had a conversation with Yulia Skripal I had been unprofessional and should have left such a conversation to the security services. I was warned by Dr Blanshard that I should not discuss any aspect of the poisonings with colleagues or other individuals and advised that any such discussion would be treated as serious misconduct. As a result of having communicated with Yulia Skripal I was interviewed by the police and my statement recorded.”

The Salisbury hospital official who collaborated with government officials and police to conceal the condition of the Skripals in hospital; to threaten and sanction the medical staff; and to intervene in the treatment of the Skripals, was the SDH medical director, Dr Christine Blanshard. By enforcing sedation on the two patients for the government’s political purpose, without their consent when they were conscious, out of coma, and capable of communicating, Blanshard violated her Hippocratic Oath.

“..the strongest military alliance in human history had just launched its first war in North Africa since France was defeated in Algeria in 1962..”

• Brutally Murdered 13 Years Ago, Gaddafi Is Only Growing More Beloved (Fetouri)

October marked 13 years since Colonel Muammar Gaddafi was brutally murdered by a NATO-supported mob of rebels in circumstances still buried under a barrage of deliberate disinformation. Yet 13 years on, Gaddafi is probably the most popular figure in the North African country. Is it just nostalgia that makes the general public yearn for a man who has long been dead, or is there something else that goes beyond mere nostalgia as a human emotion? On September 23, 2009, in his first and only speech before the United Nations General Assembly, Muammar Gaddafi described the UN Security Council as council of “horror.” He explained that the council, by the UN charter, is responsible for peace in the world but has only brought “more wars and sanctions.” What he did not know at the time was that the same UN organ would, less than two years later, authorize his removal and ultimately his murder by adopting resolution 1973, which gave the green light to all UN member states to interfere in Libya as long they notified the UN Secretary General of their intention to do so.

Resolution 1973, adopted on March 17, 2011, was the UNSC response to public demonstrations that engulfed parts of Libya in the previous month, in which people demanded better living conditions, housing, and jobs. By the time the issue was deliberated at the UN, what had been peaceful and legitimate public demonstrations had turned into an armed revolt led by various stakeholders, including Islamists and former terrorists, against the legitimate government. The wave of public discontent in Libya was part of wider public awakenings that began in neighboring Tunisia before moving to Egypt. In both countries, the West attempted to save President Ben Ali in Tunisia and later his Egyptian counterpart, Hosni Mubarak, but failed. There were no calls for military intervention to “protect” civilians in either country. With Libya, it was a completely different matter.

Faced with armed groups seeking to destabilize the country, the Gaddafi government responded, just like any other respected government would do, by using force against the armed rebellion. Under Gaddafi, Libya had seen similar events in the previous four decades, where Western-supported attempts were made not only to kill Gaddafi but also to bring about regime change by force. The government used force to contain the demonstration, but specifically targeting the armed groups that had sprung up among the peaceful demonstrators. In this chaos, many innocent people were killed and wounded, but nowhere near the inflated figures reported in Western media and publically talked about by Western politicians in their quest to widen the rift between the Libyan authorities and its citizens and to sow discord among the Libyans who were divided between supporters of Gaddafi and supporters of what became known as the February 17 Revolution.

William Hague, the UK’s foreign minister at the time, for example, told the world’s media that Gaddafi had already fled the country and was on his way to Venezuela, when in fact Gaddafi never left Tripoli – so Hague misled public opinion, which further inflamed the situation. Under pressure from veto-wielding permanent superpower members, the UNSC passed resolution 1973 under the pretext of the ‘Right to Protect’ (R2P) doctrine that, controversially, allows the UN to use military force to protect civilians when their government fails to do so. Paragraph 4 of the resolution called on all world countries to “take all necessary measures” to protect civilians in Libya, impose a no fly zone, and urged all UN member states to tighten the embargo already imposed on the country by UNSC resolution 1970, passed on February 26, 2011, referring the situation in Libya to the International Criminal Court (ICC), to investigate the alleged war crimes and crimes against humanity allegedly being committed on a large scale in Libya on the orders of Gaddafi himself, who was one of three officials indicated by the court.

Resolution 1970 was not passed based on concrete independent investigative reports of facts but, mainly, based on biased media reports. Neither the UN nor any of its relevant institutions investigated events on the ground to be able to lay blame, and the first official UN mission arrived in Libya in March and reported to the UNSC in April 2011. This means the UNSC adopted its two resolutions, 1970 and 1973, based on unverified media reports, unreliable witness statements and biased civil organizations accounts. By the time the UNSC adopted resolution 1973, Libya was already in a full-swing civil war between the armed rebels and government forces that, in being dehumanized by biased Western media, were called “Gaddafi brigades.” The rebels were actually a mix of terror organizations and locals who chose to fight the government.

They included groups such as Al-Qaeda, Ansar Al-Sharia, Al-Qa’ida in the Lands of the Islamic Maghreb, Libyan Islamic Fighting Group, and remnants of other groups and Afghan war veterans who infiltrated the country. By mid-March 2011, Libya was consumed by internal violent strife, its government boycotted by most countries, its voice drowned under the barrage of media lies and fake news, its officials banned from travel, and its leader being hunted day and night. The rebels fighting the government were being supplied, financed, armed, trained, and directed by the West and several Arab countries such as Qatar, Jordan, and United Arab Emirates. The stage was set for NATO to take over the military intervention. In fact, France, the US, and UK had already started bombing Libya by launching the first wave of missile strikes on Libyan air defense sites and radars in order to prepare the ground for imposing a no-fly zone. Even civil security forces, manning checkpoints around Tripoli, were bombed.

By the end of March 2011, Libya has become a “theatre of operations” and NATO launched “Operation Unified Protector” with an around-the-clock bombardment. That meant that the strongest military alliance in human history had just launched its first war in North Africa since France was defeated in Algeria in 1962. By the end of its operation, NATO had killed hundreds of Libyan women and children, destroyed private properties and infrastructure, all in the name of reinforcing international law and protecting civilian while the real agenda was far more sinister. The scenes of chaos, destruction, displacements, and killings continued from March to October, in which the Libyan army managed to hold back the rebels on the ground while facing NATO air bombardments. On October 20, 2011, Gaddafi was murdered in gruesome scenes and his body, alongside the bodies of his son and his defense minister, displayed for the horrified public to see.

Rogan Fetterman

“you can see how you import 10 million people over the course of four years – illegally – and then move a significant number of them over the swing states… and then give them a path to citizenship, you can essentially rig those states” –@joerogan

“Undeniably- immigration is… pic.twitter.com/gEweS8fFc3

— Viva Frei (@thevivafrei) November 3, 2024

Eva

https://twitter.com/i/status/1852419256232636518

Dog fight

“It's not the size of the dog in the fight, it's the size of the fight in the dog.”

— Mark Twain

pic.twitter.com/HulirrXPhb— Dr. Eli David (@DrEliDavid) November 2, 2024

Dog kitten

https://twitter.com/i/status/1852392683748372979

Awesome

This is awesome

— Science girl (@gunsnrosesgirl3) November 2, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.