Wassily Kandinsky Yellow-Red-Blue 1925

They can’t really sell Treasuries. MBS, though…

• Could China’s Next Target Be the US Housing Market? (Forsyth)

While so much attention is focused on foreign purchases of Treasuries, the big action has been in U.S. agencies, most of which consist of mortgage-backed securities from government-sponsored Ginnie Mae, Fannie Mae, and Freddie Mac. In April, overseas investors bought $20 billion of agencies, bringing their 12-month total to $186 billion, or over $100 billion more than Treasuries. Asia accounted for $160 billion of those purchases, including $24 billion from China. U.S. corporations also get key support for their borrowing habit from abroad. Foreign investors bought $128 billion of corporate bonds in the latest 12 months, although just $1.6 billion in April. As for equities, overseas investors bought $82 billion ($6 billion in the latest month).

The numbers show that, even more than Uncle Sam, U.S. home borrowers depend on the kindness of strangers. China could retreat from bolstering the American housing market merely not reinvesting the monthly MBS interest and principal payments, resulting in a stealth tightening of mortgage credit. The housing market is already in the doldrums, as May’s weaker-than-expected existing home sales at an annual rate of 5.43 million, 100,000 less than forecast and below April’s 5.45 million annual pace. That disappointing home sales pace comes with unemployment at just 3.8%. But with single-family home prices up 5.2% from a year ago, home sales are sluggish. A further push up in mortgage rates, already at seven-year highs, would further crimp this key sector of the U.S. economy.

Do we see nerves there?

• Next Central Bank Puts QE Unwind on the Calendar (WS)

Markets were surprised today when the Bank of England took a “hawkish” turn and announced that three out of nine members of its Monetary Policy Committee – including influential Chief Economist Andrew Haldane, who’d been considered dovish – voted to raise the Bank Rate to 0.75%, thus dissenting from the majority who kept it at 0.5%. This dissension, particularly by Haldane, communicated to the markets that a rate hike at the next meeting in August is likely. The beaten-down UK pound jumped. But less prominent was the announcement about the QE unwind. Like other central banks, the BoE heavily engaged in QE and maintains a balance sheet of £435 billion ($577 billion) of British government bonds and £10 billion ($13 billion) in UK corporate bonds that it had acquired during the Brexit kerfuffle.

Before it starts shedding assets on its balance sheet, however, the BoE wants to raise the Bank Rate enough to where it can cut it “materially” if needed, “reflecting the Committee’s preference to use Bank Rate as the primary instrument for monetary policy,” as it said. In this, it parallels the Fed. The Fed started its QE unwind in October 2017, after it had already raised its target range for the federal funds rate four times. The BoE’s previous guidance was that the QE unwind would start when the Bank Rate is “around 2%.” Back in the day when this guidance was given, NIRP had broken out all over Europe, and pundits assumed that the BoE would never be able to raise its rate to anywhere near 2%, and so the QE unwind could never happen.

Today the BoE moved down its guidance about the beginning of the QE unwind to a time when the Bank Rate is “around 1.5%.” The Fed’s target range is already between 1.75% and 2.0%. The Fed leads, other central banks follow. And by August 2, the BoE’s Bank Rate may be at 0.75%. From that point forward, the QE unwind may only be three rate hikes away.

Many headlines talk about debt relief. But that’s not what this is. It’s just another bunch of loan extensions and a €15 billion new loan. There will be many more years of austerity and creditor oversight. No, the bailout has not been completed.

• Eurogroup Deal For Greece Clinched After Marathon Session (K.)

After several hours of negotiations, Greek officials and representatives of the country’s international creditors reached an agreement on securing the sustainability of the country’s debt in the early hours of Friday. Greece is to receive a loan tranche of 15 billion euros (3.3 billion euros of which would be used to pay off part of the country’s debt to the ECB and IMF), European officials said. Greece will also get a 10-year extension for the repayment of its European Financial Stability Facility (EFSF) loans and an additional grace period of 10 years on interest payments. The extension of the repayment period of the EFSF loans and the size of the final bailout tranche had been a sticking points in the talks.

These two issues were the focus of several trilateral meetings between Greek Foreign Minister Euclid Tsakalotos and his French and German counterparts, Bruno Le Maire and Olaf Scholz. At a press conference announcing the details of the deal, European Economic and Financial Affairs Commissioner Pierre Moscovici spoke of a “historical moment for Greece” and said a new chapter was beginning for the country. He expressed “great satisfaction” in seeing Greece emerge from eight years of financial support.

“Tonight’s Eurogroup agreement achieves what we have been calling for, a credible, upfront set of measures, which will meaningfully lighten Greece’s debt burden, allow the country to stand on its own two feet, and reassure all partners and investors,” he said. Eurogroup President Mario Centeno struck a similar note. “This is it,” he said. “After eight long years, the Greek bailout has been completed.”

The IMF has caved on debt relief. Even though it knows it must be accorded.

• IMF Welcomes Greek Debt Deal But Has Reservations On Long-Term (R.)

The IMF welcomed on Friday a deal on debt relief for Greece reached by Athens’ euro zone creditors saying it will improve debt sustainability in the medium term, but maintained reservations on the long term. Euro zone finance ministers earlier on Friday offered Greece a 10-year deferral and maturities extension on a large part of past loans as well as 15 billion euros in new credit to ensure Athens can stand on its own feet after it exits its third bailout in August. “The additional debt relief measures announced today will mitigate Greece medium-term financing risks and improve medium term debt prospects,” the IMF managing director Christine Lagarde told a news conference.

But she added that the fund will not join the expiring 86-billion-euro bailout as the time “has run out”, and maintained “reservations” on the long term sustainability of the Greek debt, which runs until 2060. The fund will begin assessing the sustainability of the Greek debt “as early as next week”, Lagarde said, adding that the fund will remain engaged in Greece and will participate to the monitoring of the Greek economic performance and reforms after the end of the program.

“Contrary to all right-wing myths, Germany has benefited massively from the crisis in Greece..”

• Germany Has Made Over $3 Billion Profit From Greek Crisis (KTG)

Germany has earned around 2.9 billion euros in profit from interest rate since the first bailout for Greece in 2010. This is the official response of the Federal Government to a request submitted by the Green party in Berlin. The profit was transmitted to the central Bundesbank and from there to the federal budget. The revenues came mainly due to purchases of Greek government bonds under the so-called Securities Markets Program (SMP) of the European Central Bank (ECB). Previous agreements between the government in Athens and the eurozone states foresaw that other states will pay out the profits from this program to Greece if Athens would meet all the austerity and reform requirements.

However, according to Berlin’s response, only in 2013 and 2014 such funds have been transferred to the Greek State and the ESM. The money to the euro bailout landed on a seggregated account. As the Federal Government announced, the Bundesbank achieved by 2017 about 3.4 billion euros in interest gains from the SMP purchases. In 2013, approximately 527 million euros were transferred back to Greece and around 387 million to the ESM in 2014. Therefore, the overall profit is 2.5 billion euros. In addition, there are interest profits of 400 million euros from a loan from the state bank KfW.

“Contrary to all right-wing myths, Germany has benefited massively from the crisis in Greece,” said Greens household expert Sven Christian Kindler said and demanded a debt relief for Greece. “It can not be that the federal government with billions of revenues from the Greek interest the German budget recapitalize,” Kindler criticized. “Greece has saved hard and kept its commitments, now the Eurogroup must keep its promise,” he stressed.

And here’s why the Greek recovery story is simply falsehood.

• Greek GDP Is Low, But Food Prices Are High (K.)

Greeks may be among the poorest citizens in the European Union, but that does not mean low prices for basic products and services in this country. According to figures published on Wednesday by Eurostat, Greece was the 17th most expensive country among the 28 EU member-states last year, with the general price level standing at 84 percent of the EU average. However, in the most basic category – food – price levels in Greece stood above the bloc’s average, having a significant negative impact on living standards. Eurostat figures had shown on Tuesday that the per capita GDP in Greece in 2017 amounted to just 67 percent of the EU average, while real private consumption stood 23 percent below the EU mean rate.

A key role in food prices remaining at such high levels – in spite of the decade-long crisis – has been played by a succession of hikes in the value-added tax: From a 9 percent rate on food imposed in 2009, many food products now bear a VAT rate of 24 percent, making Greece the 13th most expensive country for food across the bloc. High indirect taxes also explain the particularly high prices in tobacco and alcoholic beverages in Greece, which make this country the 12th most expensive in the EU in this category.

A hard Brexit will be very unpretty. Airbus talked today about moving 14,000 jobs out of the UK. And they won’t be the last.

• EU Is Getting Ready For No-Deal Brexit – Juncker (G.)

The EU needs to be realistic about the dangerous state of the Brexit negotiations and is preparing to deploy its trillion-pound budget to cushion the bloc from the prospect of a no-deal scenario, the European commission president has warned. With the two sides still far apart on the “hardest issues”, just days from a crunch leaders’ summit in Brussels, Jean-Claude Juncker told the Irish parliament on Thursday he was stepping up preparations for a breakdown in talks, and even drafting plans aimed at keeping the peace in Northern Ireland. The problem of avoiding a hard border with the Republic – said by the Irish taoiseach, Leo Varadkar, to be akin to a “riddle wrapped in an enigma” – is threatening to thwart all attempts to make progress on a wider deal.

With Theresa May refusing to countenance what Juncker described as the bloc’s “bespoke and workable solution”, of the Northern Ireland effectively staying in the customs union and single market, it was crucial for the 27 EU member states to prepare for the worst outcome, the commission president said. Juncker told Irish MPs and senators in a joint session of parliament in Dublin: “With pragmatism comes realism. As the clock to Brexit ticks down, we must prepare for every eventuality, including no deal. This is neither a desired nor a likely outcome. But it is not an impossible one. And we are getting ready just in case.

“We will use all the tools at our disposal, which could have a cushioning impact. The new long-term budget for our union from 2021 onwards has an in-built flexibility that could allow us to redirect funds if the situation arose. “We will also earmark €120m (£105m) for a new peace programme which has done so much in breaking down barriers between communities in Northern Ireland and the border counties.”

More things coming to an end in Britain.

• Multi-Decade Outsourcing Boom Comes to Sticky End in the UK (DQ)

The United Kingdom, widely considered to be the birthplace of the modern incarnation of the public-private partnership (PPP), in which private firms are contracted to complete and manage public projects, could be one of the first countries to jettison the model. The collapse in January of 200-year old UK infrastructure group Carillion, whose outsized role in delivering public services earned it the moniker “the company that runs Britain,” has fueled concerns that other big outsourcing groups could soon follow in its doomed footsteps. Last week the CEO of Interserve, another large outsourcing group, revealed that the government has given the firm a red rating as a strategic supplier, meaning it has “significant material concerns” about the company’s finances.

Fears are growing that Carillion was not a one-off episode but rather the swan song of a deeply flawed and dying business model. Those fears were hardly assuaged by the release this week of a damning parliamentary report into the UK government’s practice of outsourcing public projects through so-called Private Finance Initiatives (PFIs). PFI deals were invented in 1992 by the Conservative government and then enthusiastically rolled out by the subsequent Labour government. The schemes usually involved large-scale public buildings such as new schools and hospitals which were previously funded by the UK Treasury. Under PFI they were put out to tender with bids invited from developers who put up the investment to build new schools, hospitals or other schemes and then leased them back.

[..] The Treasury’s incapacity to measure the actual benefits of PFI should be of grave concern to British taxpayers given that the interest rate of private-sector debt — these projects are debt financed — can be as much as 2 to 3.75 percentage points higher than the cost of government borrowing. Even if the government doesn’t enter into any new PFI-type deals, it will pay private companies £199 billion, including interest, between April 2017 until the 2040s for existing deals, in addition to some £110 billion already paid. That’s for 700 projects worth around £60 billion. British taxpayers could clearly “get a much better deal,” the report concludes.

John Lounsbury posted this talk by Steve from late 2016 again. And why not? Economics denies the role of energy…

• Energy Is The Primary Driver Of The Economy (EI)

Economic theory has failed to incorporate the role of energy in production for two centuries since the Physiocrats, according to Prof. Steve Keen. In this video he derives a production function that includes energy in an essential manner. It implies that economic growth has been driven by the increase in the energy throughput capabilities of machinery. Prof. Keen argues that all economic gain can be traced to the use of energy which we receive at no cost from the sun. Capital and labor participate in the economy only by use of this energy.

The Dutch play a strange role in this.

• Italy To Pick Up Migrants, Impound German Charity Ship (R.)

Italy appeared to relent on Thursday after at first refusing to accept 226 migrants on board a German charity rescue ship, saying later in the day it would take them in but would impound the vessel. Anti-immigrant interior minister Matteo Salvini initially said the Dutch-flagged ship Lifeline should take the people it plucked from the Mediterranean to the Netherlands and not Italy. But transport minister Danilo Toninelli, who oversees the coastguard, later said it was unsafe for the 32-metre vessel to travel such a great distance with so many people on board. “We will assume the humanitarian generosity and responsibility to save these people and take them onto Italian coastguard ships,” Toninelli said in a video posted on Facebook.

Earlier this month Salvini pledged to no longer let charity ships bring rescued migrants in Italy, leaving the Gibraltar-flagged Aquarius stranded at sea for days with more than 600 migrants until Spain offered them safe haven. The Dutch government denied responsibility for the vessel, something Toninelli said Italy would investigate. The Italian coastguard would escort Lifeline “to an Italian port to conduct the probe” and impound the ship, he said. Also on Thursday, the German charity Sea Eye which operates another Dutch-flagged ship, the Seefuchs, said in a statement it was ending its sea rescue mission after the Dutch government told them that it was no longer responsible for the vessel.

Please make sure it’s spent well.

• People Donate Millions To Help Separated Families (AP)

In an outpouring of concern prompted by images and audio of children crying for their parents, hundreds of thousands of people worldwide are donating to nonprofit organizations to help families being separated at the U.S.-Mexico border. Among those that have generated the most attention is a fundraiser on Facebook started by a Silicon Valley couple, who say they felt compelled to help after they saw a photograph of a Honduran toddler sobbing as her mother was searched by a U.S. border patrol agent. The fundraiser started by David and Charlotte Willner had collected nearly $14 million by Wednesday afternoon.

The Willners, who have a 2-year-old daughter, set up the “Reunite an immigrant parent with their child” fundraiser on Saturday hoping to collect $1,500 — enough for one detained immigrant parent to post bond — but money began pouring in and within days people had donated $5 million to help immigrant families separated under the Trump administration’s “zero-tolerance” policy that criminally prosecutes all adults caught crossing the border illegally. “What started out as a hope to help one person get reunited with their family has turned into a movement that will help countless people,” the couple said in a statement released by a spokeswoman Wednesday. The couple, who were early employees at Facebook, declined to be interviewed.

“Regardless of political party, so many of us are distraught over children being separated from their parents at the border.” The money collected from more than 300,000 people in the United States and around the world will be given to the Refugee and Immigrant Center for Education and Legal Services, or RAICES, a Texas nonprofit that that offers free and low-cost legal services to immigrants.

South Korean President Moon Jae-in doesn’t sit still.

• 2 Koreas Meet To Arrange Reunions Of War-Split Families (AP)

North and South Korean officials are meeting to arrange the first reunions in three years between families divided by the 1950-53 Korean War. Friday’s meeting at the North’s Diamond Mountain resort comes as the rivals take reconciliation steps amid a diplomatic push to resolve the North Korean nuclear crisis. Seoul’s Unification Ministry said the meeting will discuss ways to carry out an agreement on the reunions made at a summit between North Korean leader Kim Jong Un and South Korean President Moon Jae-in. The two summits between Kim and Moon have opened various channels of peace talks between the Koreas, including military talks for reducing tensions across their tense border and sports talks for fielding combined teams at the upcoming Asian Games in Indonesia.

Even if we don’t shoot them, we find other ways to kill them off.

• Tourism Preventing Kenya’s Cheetahs From Raising Young (G.)

High levels of tourism can lead to a dramatic reduction in the number of cheetahs able to raise their young to independence, new research has found. A study in Kenya’s Maasai Mara savannah found that in areas with a high density of tourist vehicles, the average number of cubs a mother cheetah raised to independence was just 0.2 cubs per litter – less than a tenth of the 2.3 cubs per litter expected in areas with low tourism. Dr Femke Broekhuis, a researcher at Oxford University and the author of the study, surveyed cheetahs in the reserve between 2013 and 2017 to assess how the frequency of tourist vehicles affected the number of cheetah cubs that survived to adulthood.

“During the study there was no hard evidence of direct mortality caused by tourists,” such as vehicles accidentally running over cubs, Broekhuis said. “It is therefore possible that tourists have an indirect effect on cub survival by changing a cheetah’s behaviour, increasing a cheetah’s stress levels or by minimising food consumption.” Broekhuis said she has seen as many as 30 vehicles around a single cheetah at the same time. “The most vehicles that we recorded at a cheetah sighting was 64 vehicles over a two-hour period,” she said.

Too many tourist vehicles can reduce a cheetah’s hunting success rate, the study suggests, and even if the hunt is successful, the disturbance from tourists could cause a female to abandon her kill, making her less likely to be able to provide for her young. Broekhuis said it was “crucial that strict wildlife viewing guidelines are implemented and adhered to,” and suggested limiting the number of vehicles around a cheetah to five and not allowing them to get any closer than 30 metres.

The shape of things to come.

• India Is Facing Its Worst-Ever Water Crisis (ZH)

India is facing its worst-ever water crisis, with some 600 million people facing acute water shortage, a government think-tank says. The Niti Aayog report, which draws on data from 24 of India’s 29 states, says the crisis is “only going to get worse” in the years ahead. Around 200,000 Indians die every year because they have no access to clean water, according to the report. And as The BBC reports, many end up relying on private water suppliers or tankers paid for the by the government. Winding queues of people waiting to collect water from tankers or public taps is a common sight in Indian slums. Indian cities and towns regularly run out water in the summer because they lack the infrastructure to deliver piped water to every home.

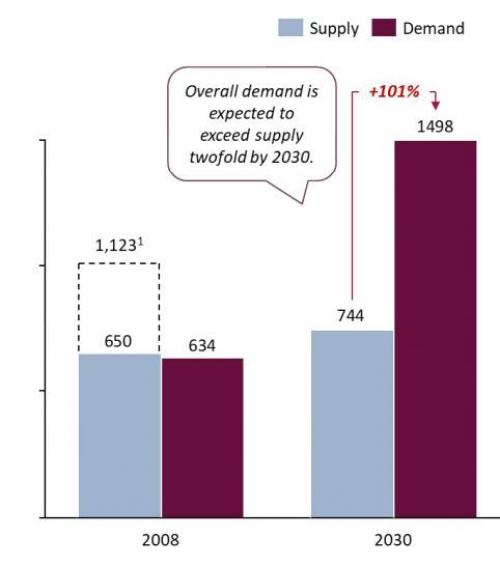

• 600 million people face high-to-extreme water stress. • 75% of households do not have drinking water on premise. 84% rural households do not have piped water access. • 70% of our water is contaminated; India is currently ranked 120 among 122 countries in the water quality index. India faces more than one problem – all compounding the nation’s crisis: Droughts are becoming more frequent, creating severe problems for India’s rain-dependent farmers (~53% of agriculture in India is rainfed17). When water is available, it is likely to be contaminated (up to 70% of our water supply), resulting in nearly 200,000 deaths each year.

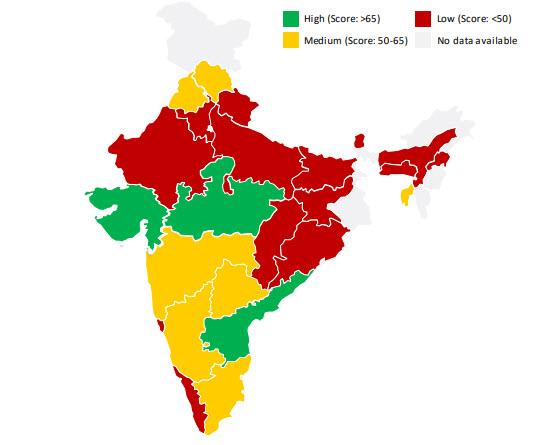

Interstate disagreements are on the rise, with seven major disputes currently raging, pointing to the fact that limited frameworks and institutions are in place for national water governance. And that means massive problems lie ahead… 40% of the Indian population will have no access to drinking water by 2030 with 21 cities running out of groundwater by 2020 – affecting 100 million people which will cut 6% from GDP by 2050. What remains alarming is that the states that are ranked the lowest – such as Uttar Pradesh and Haryana in the north or Bihar and Jharkhand in the east – are also home to nearly half of India’s population as well the bulk of its agricultural produce.