DPC “Steamer loading grain from floating elevator, New Orleans 1906

“..the country with the bigger deficit would have the bigger problem. And conventional belief would expect this to be state-oriented France, rather than the free-enterprise-oriented USA. Guess again..”

• The USA – All Systems Go? (Steve Keen)

The contrast today between Europe—the subject of my first few posts on Forbes—and the USA could not be more extreme. The crisis, when it began in 2007/08, was seen initially as a purely American phenomenon—and by some, proof that the deregulated American (and more generally, the Anglo-Saxon) model of capitalism had failed, while Europe’s more collectivist version was still going strong. One of the most voluble putting that argument was then French President Nicolas Sarkozy, who asserted that the crisis proved that the American deregulated version of finance was kaput: “A page has been turned,” he said, on the “Anglo Saxon” financial model. “Even our Anglo-Saxon friends are now convinced that we must have reasonable rules.” Well that was then. Now, it’s the European system—and its very peculiar rules—that are looking decidedly poor, while the USA seems to be powering ahead.

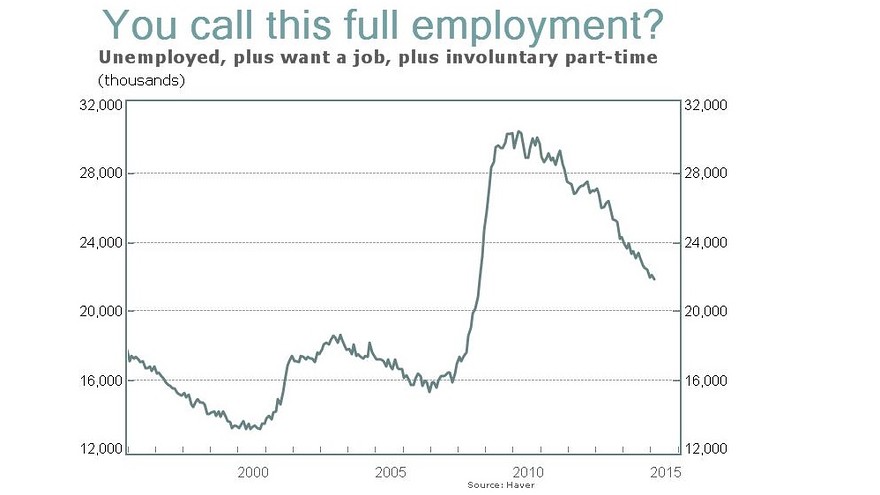

A simple comparison of unemployment rates tells that story well. The US unemployment rate, which briefly exceeded France’s at the depth of the crisis in 2009-2010, is now falling rapidly, while France’s rate has stagnated, and is in excess of the worst that the USA experienced during the crisis. So does the resurgence of the USA and Europe’s stagnation make the opposite point to the one Sarkozy reached in such haste? Is the deregulated US model really the superior one, in that while it succumbed to crisis, its recovery was that much more robust that rule-bound Europe? I am sure that many commentators will reach that conclusion in the next few years. But I think they will prove to be as misguided—or rather as wrongly focused—as was Sarkozy.

There’s a cliché in statistics that “correlation isn’t causation”. I’ve often seen this used to simply dismiss an argument that the interjector doesn’t like, but its spirit applies here: people often draw inferences from the correlation of two factors—American model, recovery; European model, stagnation—when there’s actually a third causal factor at work that is the real explanation. [..] part of the reason for the divergence is that the EU’s policy of austerity—which began in mid-2010—has made the crisis much worse. On that front, the conventional wisdom—as enshrined in the European “Growth and Stability Pact”—is that the country with the bigger deficit would have the bigger problem. And conventional belief would expect this to be state-oriented France, rather than the free-enterprise-oriented USA. Guess again.

Read more …

While the printing press is stuttering.

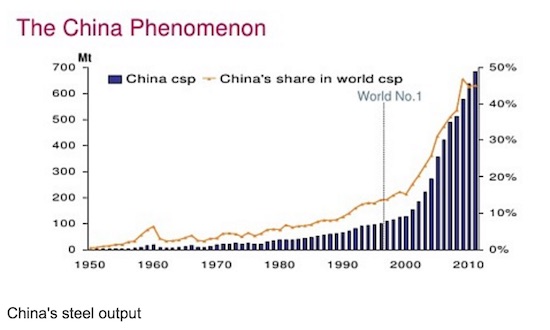

• ‘China Must Guarantee Minimum 6.5% Annual GDP Growth In 5 Year Plan’ (Reuters)

China needs to guarantee a “bottom line” of 6.5% annual economic growth for its 13th five-year-plan, a state newspaper quoted the director of the National Development and Reform Commission (NDRC) Department of Planning, Xu Lin as saying. That would mark the lowest annual growth rate since 1990. The comments by Xu, made on Feb. 14 at the “50 Forum Annual Meeting” – a gathering of Chinese economists – is also an acknowledgment that China is switching to a more sustainable pace of growth from the double-digit rates of the recent past. If this year’s GDP growth is 7%, then the “bottom line” for annual GDP growth in the 13th five-year-plan needs to be at least 6.5%, the China Securities Journal quoted Xu as saying.

China’s economy grew at 7.4% in 2014, its slowest pace in 24 years, dragged down by cooling property prices, slowing inflation and deteriorating domestic and foreign demand. Beijing is set to unveil China’s 13th five-year-plan after the National People’s Congress in March. The plan is an important document that outlines national priorities and sets targets for economic and social development. The International Monetary Fund said last year that China should set a less ambitious growth target of 6.5-7% in 2015 and refrain from stimulus measures unless the economy threatens to slow sharply from that level. China also needs to prioritize the systemic reform of property rights, taxation, banking, finance and rule of law, among other national priorities, Xu said.

Read more …

“There is something tragically irrational driving both of these crises. The genesis of each, at least nominally, is the question of whether markets serve society or it is the other way around.”

• Greece And Ukraine Are The Hot Spots Of A New War For Supremacy (Salon)

Europe’s confrontation with Greece, the West’s with Russia as the Ukraine crisis runs nearly out of control: Why is it more useful by the week to think of these together? They are both very large, moments of history. There is this. They both reach critical moments this week, as if in concert. The outcomes in each case will be consequential for all of us. As noted with alarm last week, most Americans have by now surrendered to a blitz of propaganda wherein Russia and its leadership are cast as Siberian beasts, accepting as truth tales the National Enquirer would be embarrassed to run. In Europe, Greeks and Spaniards show us up, indeed, as a supine, spiritless people incapable of response or any resistance to the onslaught. There is this, too.

At writing, Yanis Varoufakis, Greece’s imaginative new finance minister, has just made his first formal effort to present European counterparts with new ideas to get foreign debts of €240 billion off the books and the Greek economy back in motion. These ideas can work. Even creditor institutions acknowledge that Greece cannot pay its debts as they are now structured. But at a session in Brussels Wednesday, the European Union’s arms remained folded. Also at writing, the Poroshenko government in Ukraine appears to have recommitted to a cease-fire signed last September in Minsk and promptly broken. It is not surprising given Kiev’s very evident desperation on all fronts. But neither would it be if Poroshenko once again reneges. There is a sensible solution on the table now, but these are not people who have so far been given to one.

There is something tragically irrational driving both of these crises. The genesis of each, at least nominally, is the question of whether markets serve society or it is the other way around. Economic conflict, then, has been transformed into humanitarian disasters. This is what Greece and Ukraine have most fundamentally in common. It is in search of a logical explanation of the illogic at work in these two crises that something else, something larger, emerges to bring them into a coherent whole. Washington has so many wars going now, none declared, one can hardly keep the list current. But the most sustained and havoc-wreaking of them is unreported. This is the war for neoliberal supremacy across the planet. Greece and Ukraine are best viewed as two hot fronts in this war, a sort of World War III none of us ever imagined.

Read more …

“Upon close inspection, all of these rationales fall apart. None is satisfactory. The interventions are too widespread, too long-lasting and too unsuccessful at what they supposedly accomplish..”

• The Great War of the American Empire or Great War II (Michael S. Rozeff)

The Great War of the American Empire began 25 years ago. It began on August 2, 1990 with the Gulf War against Iraq and continues to the present. Earlier wars involving Israel and America sowed the seeds of this Great War. So did American involvements in Iran, the 1977-1979 Islamic Revolution in Iran, and the Iran-Iraq War (1980-1988). Even earlier American actions also set the stage, such as the recognition of Israel, the protection of Saudi Arabia as an oil supplier, the 1949 CIA involvement in the coup in Syria, and the American involvement in Lebanon in 1958. Poor (hostile) relations between the U.S. and Libya (1979-1986) also contributed to a major sub-war in what has turned out to be the Great War of the American Empire.

The inception of Great War II may, if one likes, be moved back to 1988 and 1989 without objection because those years also saw the American Empire coming into its own in the invasion of Panama to dislodge Noriega, operations in South America associated with the war on drugs, and an operation in the Philippines to protect the Aquino government. Turmoil in the Soviet Union was already being reflected in a more military-oriented foreign policy of the U.S. Following the Gulf War, the U.S. government engages America and Americans non-stop in one substantial military operation or war after another. In the 1990s, these include Iraq no-fly zones, Somalia, Bosnia, Macedonia, Haiti, Zaire, Sierra Leone, Central African Republic, Liberia, Albania, Afghanistan, Sudan, and Serbia.

In the 2000s, the Empire begins wars in Afghanistan, Iraq, and Libya, and gets into serious military engagements in Yemen, Pakistan, and Syria. It has numerous other smaller military missions in Uganda, Jordan, Turkey, Chad, Mali, and Somalia. Some of these sub-wars and situations of involvement wax and wane and wax again. The latest occasion of American Empire intervention is Ukraine where, among other things, the U.S. military is slated to be training Ukrainian soldiers. Terror and terrorism are invoked to rationalize some operations. Vague threats to national security are mentioned for others. Protection of Americans and American interests sometimes is made into a rationale. Terrorism and drugs are sometimes linked, and sometimes drug interdiction alone is used to justify an action that becomes part of the Great War of the American Empire.

On several occasions, war has been justified because of purported ethnic cleansing or supposed mass killings directed by or threatened by a government. Upon close inspection, all of these rationales fall apart. None is satisfactory. The interventions are too widespread, too long-lasting and too unsuccessful at what they supposedly accomplish to lend support to any of the common justifications. Is “good” being done when it involves endless killing, frequently of innocent bystanders, that elicits more and more anti-American sentiment from those on the receiving end who see Americans as invaders? Has the Great War II accomplished even one of its supposed objectives?

Read more …

“Any new bailout program might require several national parliamentary ratifications and could also bring Germany’s Constitutional Court into play.”

• Greece Sticks To No-Austerity Pledge (Reuters)

Greek government spokesman Gabriel Sakellaridis showed no sign that Greece was backing off on its core demand. “The Greek government is determined to stick to its commitment towards the public … and not continue a program that has the characteristics of the previous bailout agreement,” he told Greece’s Skai television. He later said: “The Greek people have made it clear that their dignity is non-negotiable. We are continuing the negotiations with the popular mandate in our hearts and in our minds.” Some of the problems facing the Eurogroup are semantic. The Greeks, for example, will not countenance anything that smacks of an “extension” to the old bailout, preferring something new called a “bridge” agreement.

This is political. Tsipras rode into power on a wave of anti-austerity and anti-bailout anger last month and would have a hard time explaining a row-back so soon. Thousands of Greeks massed outside parliament in Athens on Sunday to back his strategy. But even a cosmetic change of labels could have practical consequences. An “extension” may not require many national ratifications unless it involves additional financial commitments from euro zone governments. Any new bailout program, on the other hand, might require several national parliamentary ratifications and could also bring Germany’s Constitutional Court into play. Among those requiring a parliamentary vote on a new bailout are Germany, Slovakia, Estonia and Finland, all identified by one veteran of EU meetings as part of a hard core of opponents to Greece’s plan.

The Eurogroup’s main debate with Greece’s “no austerity” stance will revolve around the funding of a bridge program, Greece’s request to reduce the ‘primary’ budget surpluses, excluding interest payments, that it is required to reach, and privatizations and labor reform. Greece said on Saturday that it was reviewing a €1.2 billion deal for Germany’s Fraport to run 14 regional airports, one of the biggest privatization deals since Greece’s debt crisis began in 2009. It has also pulled the plug on the privatization of the ports of Piraeus and Thessaloniki. On the question of liberalizing labor markets, government spokesman Sakellaridis remained tough: “We will discuss it with workers and with pensioners. Whatever we do, we will do through dialogue. We will not legislate at the sole behest of outside factors.”

Read more …

” Europe’s been expanding up to the borders of Russia and there’s a country called Ukraine, and, essentially, that means that Europe is writing a put option, which Ukraine has now decided to cash in. Which is why, basically, Europe’s now on the hook for all the crap that is Ukraine. That’s a put option contract.”

• Austerity Is ‘Complete Horsesh*t’ (Alternet)

What is it about austerity that you take personally?

Part of it is because what I think the financial crisis is best seen as — and we’re still dealing with the aftermath of it, whether we like it or not — is that there’s a class-specific put option. Let me explain what I mean by this: A put option is a contract that’s very common in finance where essentially someone is selling insurance and the other person is taking the income for payments. At some point, they get to basically cash in the put. One way to think about this is, Europe’s been expanding up to the borders of Russia and there’s a country called Ukraine, and, essentially, that means that Europe is writing a put option, which Ukraine has now decided to cash in. Which is why, basically, Europe’s now on the hook for all the crap that is Ukraine. That’s a put option contract.

What has this got to do with the financial crisis and why do I feel passionately about it? Well, remember all those banks that got bailed [out]? In order to get bailed out you need to have assets, and my liabilities are the bank’s assets. The bank doesn’t give a damn about my condo because they’ve got an income stream coming from the mortgage. The assets and liabilities of the bank and the private sector sum up to zero, so when you bail that out, what you’re doing is you’re bailing out the private sector’s assets, which basically means the top 20% – if not about the top 10%, the top 1% – of the income distribution.

How do you pay for those bailouts? You pay for those bailouts with cuts. And who are the people that use government services? Well, it’s not the top 20% or above of the income distribution, it’s the bottom 70% and below. That’s what I mean by a class-specific put option. The people at the top get their assets bailed; the government says, Oh my God, look at all that spending! It’s out of control! We need to cut policemen and fire brigades and healthcare and various public services.

Read more …

Strategic considerations may expose EU’s bluff.

• Greek Postwar Alliances Show Europe Has More to Lose Than Money (Bloomberg)

As Prime Minister Alexis Tsipras focuses on the economic arguments for a new bailout deal for Greece, the country’s strategic importance to the European Union may do as much to persuade Germany to grant him concessions. With war in Syria to the east, the failure of the Libyan state to the south and a nascent cease-fire in Ukraine to the north adding to the perennial tensions between Israel and its neighbors, the value of Greece as a NATO member and its ports on the eastern Mediterranean is rising. “One would be justified to ask whether Europe, the U.S. and NATO could afford the creation of a security vacuum and a black hole in a critical region,” Thanos Dokos, director of the Hellenic Foundation for European and Foreign Policy said. “That may not be “an acceptable loss for an EU with any ambitions to play a meaningful global and regional role,” he said.

The diplomatic effort that persuaded Russia to halt the violence in Ukraine was punctuated by Tsipras’s own, far more amicable exchanges with President Vladimir Putin. It signaled to German Chancellor Angela Merkel that European powers have more than just 195 billion euros ($223 billion) of bailout funds at stake in its standoff with Greece. The country, among a handful that complies with the North Atlantic Treaty Organization’s defense spending recommendations, has more than 200 fighter jets and 1,000 tanks. NATO facilities include a military base in Crete that was used during the airstrikes on Libya in 2011. That role may be Tsipras’s strongest weapon in negotiations with the rest of the euro area, according to Dimitris Kourkoulas, a former deputy foreign minister. “This is probably the last bargaining card Tsipras has,” Kourkoulas said.

Western powers recognized Greece’s strategic importance during and after World War II. The country’s resistance to Italy under Benito Mussolini scored the first allied ground victories against the axis powers and is marked annually by a national holiday in Greece on Oct. 28. The U.S. and Britain then intervened in the civil war to help defeat the communists as the rest of eastern Europe fell under the influence of the Soviet Union. The Greeks joined NATO in 1952, three years before the Federal Republic of Germany and at the same time as Turkey. In 1981, Greece became the 10th member of the EU, joining before countries like Spain and Austria, and adopted the euro two decades later.

Read more …

An important signal going into the new talks.

• Greeks Show Support for Tsipras on Eve of Brussels Talks (Bloomberg)

Thousands of Greeks gathered in central Athens Sunday in support of Prime Minister Alexis Tsipras’s government, as officials prepared for a crunch meeting with creditors aimed at breaking an impasse over financing Europe’s most indebted state.

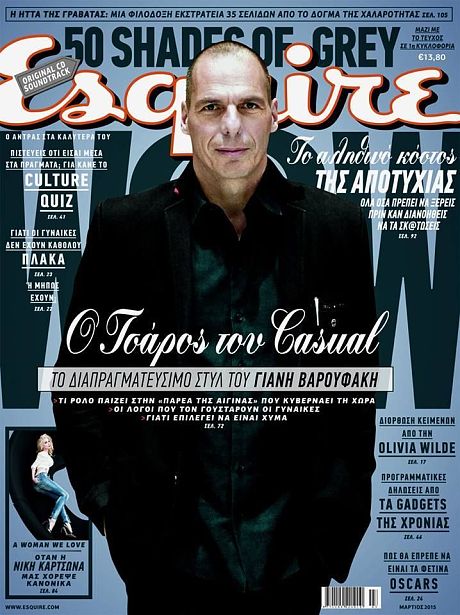

Police said more than 20,000 people assembled in front of the Greek Parliament as of about 8 p.m. in Athens, with more expected to join during the evening. The show of support was directed at a government delegation led by Finance Minister Yanis Varoufakis that will return to Brussels early Monday to try and negotiate a bridge agreement with euro-area peers that allows time and financing to discuss Greece’s post-bailout era. Greek stocks and bonds rose on Friday as officials on both sides signaled a willingness to compromise.

With Greece’s current bailout running out at the end of February, discussions continued at technical level into the weekend to prepare the ground for the Brussels meeting of finance chiefs. “We’re looking at difficult negotiations on Monday,” Tsipras was cited as saying in a weekend interview with Germany’s Stern magazine. “Nevertheless, I’m full of confidence.” Talks took place on Saturday between officials from Greece’s finance and foreign ministries and technical delegations from the Troika. The focus was on identifying common ground and those areas of divergence rather than on negotiating, according to Greek and EU officials. Varoufakis said that both sides have agreed on many issues already, according to an interview with Kathimerini newspaper published on Saturday.

It still isn’t certain that a final agreement will be reached Monday, the Greek official said. Tsipras’s Syriza party was elected Jan. 25 on a platform of ending austerity, a partial debt writedown and no more audits by the troika of the commission, the ECB and the IMF. It is seeking a bridge agreement for the next six months that will replace its current bailout, which it blames for the country’s economic hardship, and secure the country’s financing needs to give officials time to discuss “a new deal” with the euro area, Tsipras said last week. The government is “determined to abide by its commitment to the Greek people and its fresh mandate to end austerity,” government spokesman Gabriel Sakellaridis told Skai TV Sunday.

Read more …

“We need time rather than money to put into effect our reform plan,” [..] “I promise you, within six months Greece will then be a different country.”

• Greece, Creditors Extend Talks on Eve of Eurogroup Meeting (Bloomberg)

Greek officials and the country’s creditors extended discussions through the weekend, as they raced to make progress ahead of the meeting of euro-area finance ministers in Brussels on Monday. While negotiators sought an agreement, government leaders back home reiterated their markers. For Greece, that means no discussions to continue its current bailout program, government spokesman Gabriel Sakellaridis told Skai TV this morning. French Foreign Minister Laurent Fabius, meantime, said that even as officials hold talks over Greece’s debt load, they aren’t willing to write it off. The government is “determined to abide with its commitment to the Greek people and its fresh mandate” for ending austerity,’’ Sakellaridis said.

Meetings dragged on in Athens, where the government held preparative discussions, and Brussels, where officials from Greece’s Finance and Foreign Ministries held “technical” talks with the EU, IMF and ECB, with the goal of laying the groundwork for a successor program. Greek Prime Minister Alexis Tsipras said it’s too early to say if there’s a deal in the making. Since coming to power in an election last month, Tsipras has maintained his pledge to help Greeks by reversing the austerity imposed under the country’s bailout. That’s led to clashes with other European governments. Germany, the biggest country contributor to bailouts, has led calls for Greece to stick to its political promises regardless of any change in government, while France and Italy have been more sympathetic to Greece’s efforts to secure bridge financing while it works out a longer-term plan.

In the face of opposition, the Greek government has already watered down its position on the debt, ditching a pre-election pledge for a writedown in its nominal value. Greece has more than €320 billion euros in debt outstanding, about 175% of GDP, mostly in the form of bailout loans from the euro area and the IMF. Frustration over the insurmountable pile of debt – even after the world’s biggest-ever restructuring in 2012 – and the dismal economic state helped Tsipras and his anti-austerity Syriza party topple former PM Samaras’s New Democracy in last month’s elections. “We’re looking at difficult negotiations on Monday,” Tsipras told Germany’s Stern magazine. “Nevertheless, I’m full of confidence.” [..] “We need time rather than money to put into effect our reform plan,” Tspiras said after convening a meeting of his cabinet in Athens Friday night, Stern reported. “I promise you, within six months Greece will then be a different country.”

Read more …

“An exit from the eurozone would be “the most expensive solution both for Greece and for the euro area..”

• Greece May Win Compromise Offer From EU Bailout Fund (WSJ)

A Greek exit from the eurozone would be the worst of all options for everybody involved, the head of the European bailout fund said in a televised interview aired Sunday, signaling willingness to compromise over some conditions that have been linked to the country’s existing bailouts. The comments come a day before a crucial meeting of eurozone finance ministers in Brussels, where officials will aim to lay the foundation of a financing deal for struggling Greece, whose existing bailout expires at the end of February. An exit from the eurozone would be “the most expensive solution both for Greece and for the euro area,” said Klaus Regling, the head of the European Stability Mechanism, in a transcript of an interview with German broadcaster Phoenix. “That’s why we try to prevent precisely this.”

Greece’s new leftist government wants to end the austerity course and reduce the country’s debt burden, and is refusing to complete the existing bailout program. Instead of extending its current program, Athens wants a bridge arrangement to keep it afloat until September while it negotiates less onerous terms for long-term assistance. “That a newly elected government has different priorities than the previous government is understandable and nothing new,” said Mr. Regling. “We have for instance seen this too when the government in Ireland changed in the middle of the [bailout] program. It was also possible there to change individual measures but the main direction was kept in place.”

He stressed that countries must embrace reforms to help generate more economic growth in the medium term. “The European Central Bank’s monetary measures can of course be supportive and have an effect,” he said. “With its recent decisions, the ECB has done the maximum to buy time. Now it’s up to the governments.”

Read more …

“If our so-called partners insist, in any way, on extending the existing programme, that is to say the sinful memorandum because that is what they mean by the programme, there can be no agreement,”

• Syriza Leader Confident Ahead Of Eurozone Crunch Talks In Brussels (Guardian)

Greece’s new prime minister Alexis Tsipras is “full of confidence” his country can secure a deal to ditch strict austerity measures while still satisfying Athens’ international creditors, despite warning that crunch talks in Brussels today would be “difficult”. As a key deadline approaches for Greece to either agree to stick to its existing bailout programme or reach a compromise with its lenders, eurozone finance ministers meet again on Monday in an attempt to hammer out an agreement. The new leftist Greek government is arguing for an end to relentless cuts imposed as a condition of the country’s rescue funding and wants more time to prove that a more pro-growth approach will work better. But it faces opposition from other eurozone countries, most notably Germany, which have pushed for the strict terms of Greece’s €240bn bailout programme to stay in place.

Talks in Brussels last week made no headway in resolving the standoff. But Tsipras also faces growing criticism from hard-left militants in his own party for appearing to row back on some pre-election pledges to ditch austerity measures. Asked about the Brussels talks, the 40-year-old prime minister told German news magazine Stern: “I expect difficult negotiations on Monday. But I am full of confidence. “I am in favour of a solution where everyone wins. I want a win-win solution. I want to save Greece from tragedy and Europe from a split.” “I promise you: Greece will, in six months’ time, be a completely different country,” he said. His finance minister Yanis Varoufakis told Greek newspaper Kathimerini at the weekend that a deal between Athens and the eurozone will be found, even if that may well be at the last minute.

But Tsipras not only has to persuade Berlin that debt-stricken Athens will keep along the path of reform, but assure his own hard-left militants that red lines will not be crossed in any compromise. There was mounting disquiet at the weekend that Varoufakis had gone too far by saying the new government was willing to implement 70% of the hated memorandum outlining Greece’s bailout accords. Firing a warning shot over the government’s bows, the energy minister Panagiotis Lafazanis, who represents Syriza’s radical wing, said there could be no solution if foreign lenders insisted on Athens adopting the “sinful memorandum”. “If our so-called partners insist, in any way, on extending the existing programme, that is to say the sinful memorandum because that is what they mean by the programme, there can be no agreement,” he told the state news agency ANA-MPA on Sunday.

Read more …

“Should a nation build up liabilities and then leave the currency union, the remaining members may have to share the bill.”

• Greek Euro Exit Risk Signals Inadequate ECB QE Safeguards (Bloomberg)

Mario Draghi’s assurance that the European Central Bank has ring-fenced the risks of its bond-buying program has a caveat. While the ECB president says the euro area’s 19 national central banks will buy and hold their own country’s debt, the money they create – at least €1.1 trillion – can flow freely across borders through the region’s Target2 payment system. Should a nation build up liabilities and then leave the currency union, the remaining members may have to share the bill. The risks have been thrown more sharply into focus by the standoff between European governments and a newly elected Greek administration, which has prompted a deposit flight and put the country’s future in the euro in doubt.

As ECB officials join politicians gathering in Brussels on Monday to seek a solution to the crisis, Greece ultimately threatens to expose the weakness of measures to address legal constraints and public concern over central-bank stimulus. “There’s a political signal that comes out of the suspension of risk sharing: there’s no willingness in the ECB to build up fiscal risks via the back door if politicians aren’t,” said Nick Matthews at Nomura in London. “At the same time, asset purchases will create reserves that permeate through the Target2 system. The question of what happens if a country exits hasn’t been addressed.” Whatever happens in Brussels on Monday, Draghi and his Governing Council will meet in Frankfurt on Wednesday to nail down the details of quantitative easing.

Before buying starts in March, policy makers must sign off on the legal act and decide on key elements such as how assets will be bought and how to calculate self-imposed limits. ECB-style QE will be more complicated than programs by the Federal Reserve and Bank of England because it’ll happen in a currency union that isn’t backed by a fiscal union, with debt mutualization and central-bank financing of governments banned. That makes Target2, the Eurosystem’s financial plumbing, a potential indicator of where risks are building up.

When a lender in one country settles an obligation with a counterparty in another, the assets and liabilities are registered on the central-bank balance sheets. Those balances are aggregated each business day at the ECB, the Eurosystem’s hub, and reflected in Target2.

All five bailout countries are running negative Target2 balances, as are six others including Italy and France, according to data compiled by Germany’s Osnabrueck University. Greece had liabilities of 49 billion euros at the end of last year. The biggest creditor is Germany, which saw claims on the ECB jump to 515 billion euros at the end of January from 461 billion euros the previous month.

Read more …

“Is the euro zone just a branch office of the Federal Republic of Germany?”

• US And Greece Helping To Save The Euro (CNBC)

Greece’s pleas to stop the “fiscal waterboarding” of its devastated economy are substantively no different from President Obama’s repeated warnings to Germany to stop bleeding the euro area economy with excessive fiscal austerity. Sadly, the president’s reportedly more than a dozen phone calls to the German Chancellor Merkel in 2011 and 2012 urging supportive economic policies in the euro area fell on deaf ears. These calls were not just brushed aside; they were plainly ridiculed as Chancellor Merkel kept telling the media that “it made no sense to be adding new debt to old debt.” But – worrying about one-fifth of U.S. exports going to Europe – Washington kept trying.

The former U.S. Treasury Secretary Timothy F. Geithner went as far as visiting his German counterpart Wolfgang Schaeuble at his summer retreat on a North Sea island on July 30, 2012 to talk about relief to euro area economies. That’s where Geithner was in for a big shock. He writes in his book “Stress Test: Reflections on Financial Crises” that he was “frightened” by the German talk of Greece leaving (i.e., being pushed out of) the monetary union. President Obama, he says, was “deeply worried” about Berlin’s designs. In the end, Geithner had to settle for his host’s assurances that everything was going to plan, and that the heavily indebted euro area countries were making progress on their structural reforms.

Indeed they were: At the time of that meeting, the Greek economy was sinking at a rate of 6.9%, followed by economic downturns of 3.5% in Portugal, 2.4% in Italy, 1.6% in Spain and a continuing economic stagnation in France. These five countries represent 53.1% of the euro area economy, but Germany would not relent in its firm insistence on fiscal retrenchment. For the German Chancellor, these countries’ plight was just a case of self-inflicted wounds because “they did not respect the budget rules and failed to supervise their banks.” That message played well with domestic audience in the run-up to German elections in September 2013. Obviously, it was important to be seen as a stern guardian of German finances bent on protecting taxpayers from southern spendthrifts and fiscal miscreants.

That policy exasperated so much Jean-Claude Juncker to push him into an unheard of attack on German leadership. Currently serving as the president of the European Commission (EU’s executive body), Mr. Juncker was Luxembourg’s prime minister and the chairman of the Eurogroup (a forum of the euro area finance ministers) when he aired his concerns on July 29, 2012. Here is what he said: “… how can Germany have the luxury of playing domestic politics on the back of the euro? If all other 16 euro area countries did the same thing, what would remain of our common project? Is the euro zone just a branch office of the Federal Republic of Germany?”

Read more …

“In this case, the abuse consisted of BAC funded and enabled tax avoidance schemes with respect to stock dividends – arrangements which happen to be illegal in the US.”

• Shoot Bank Of America Now – The Case For Super Glass-Steagall (David Stockman)

The mainstream narrative about “recovery” from the financial crisis is a giant con job. And nowhere does the mendacity run deeper than in the “banks are fixed” meme—an insidious cover story that has been concocted by the crony capitalist cabals that thrive at the intersection of Wall Street and Washington. So this morning comes yet another expose in the Wall Street Journal about the depredations of Bank of America (BAC). Not surprisingly, at the center of this latest malefaction is still another set of schemes to grossly abuse the deposit insurance safety net and enlist the American taxpayer in the risky business of financing high-rolling London hedge funds. In this case, the abuse consisted of BAC funded and enabled tax avoidance schemes with respect to stock dividends – arrangements which happen to be illegal in the US.

No matter. BAC simply arranged for them to be executed for clients in London where they apparently are kosher, but with funds from BAC’s US insured banking entity called BANA, which most definitely was not kosher at all. As to the narrow offense involved – that is, the use of insured deposits to cheat the tax man – the one honest official to come out of Washington’s 2008-2009 bank bailout spree, former FDIC head Sheila Bair, had this to say: “I don’t think it’s an appropriate use.. Activities with a substantial reputational risk… should not be done inside a bank. You have explicit government backing inside a bank. There is taxpayer risk there.” She is right, and apparently in response to prodding by its regulator, BAC has now ended the practice, albeit after booking billions in what amounted to pure profits from these illicit trades.

But that doesn’t end the matter. This latest abuse by BAC’s London operation is, in fact, just the tip of the iceberg – the symptom of an unreformed banking regime that is rotten to the core and that remains a clear and present danger to financial stability and true economic recovery. And not by coincidence there stands at the very epicenter of that untoward regime a $2 trillion financial conglomerate that is a virtual cesspool of malfeasance, customer abuse, operational incompetence, legal and regulatory failure, downright criminality and complete and total lack of accountability at the Board and top executive level. In short, BAC’s six-year CEO, Brian Moynihan, is guilty of such chronic malfeasance and serial management failure that outside the cushy cocoon of TBTF he would have been fired long ago.

Read more …

“In 2012 one in five children lived in a home that was cold or damp; one in 10 lacked a necessary clothing item, such as a warm winter coat; and one in 20 households couldn’t afford to feed their kids properly.”

• Low-Pay Britain, Where Working Families Have To Rent A Fridge (Guardian)

There’s a minor domestic crisis in any family when the fridge-freezer breaks down. Wasted food; no fresh milk; pools of water on the kitchen floor. But for some households, the demise of the washing machine, the tumble dryer or the telly is more than a hiccup – it throws up a major financial challenge. That’s where firms like BrightHouse come in: pop into one of its 291 stores, and instead of having to find several hundred pounds up front, you can replace a busted appliance for a much more manageable £10-£15 a week. Except there’s a sting in the tail. When MPs on the all-party parliamentary group on debt and personal finance looked into these “rent-to-own” retailers, of which BrightHouse is the leader, they found that by the time delivery charges, insurance and servicing are loaded on, consumers who can ill afford it end up paying several times over.

One fridge-freezer with a five-year service plan, which sells for £644 at middle-class favourite John Lewis, ended up costing £1,716. They have now asked the regulator, the Financial Conduct Authority, to investigate. But, like disgraced payday lender Wonga, BrightHouse’s appeal is a sharp reminder of the precariousness of many families’ lives. Perhaps BrightHouse’s customers should have read the small print. But signing up to a usurious loan deal because of the temptingly low upfront payment is hardly a rare mistake in today’s credit-fuelled economy. Many rent-to-own customers – half of whom receive benefits, and who have on average £19 a week spare for one-off costs – have little or no alternative. According to Breadline Britain, a salutary new book from poverty researchers Stewart Lansley and Joanna Mack, a growing proportion of families are unable to afford the things – such as a working fridge – that most of us would define as essential.

In 2012, their large-scale research project found, one in five children lived in a home that was cold or damp; one in 10 lacked a necessary clothing item, such as a warm winter coat; and one in 20 households couldn’t afford to feed their kids properly. These children’s chances are hobbled long before they reach the school gates – and in many cases their parents are not in the dole queue, but juggling jobs. Many of the adults suffering this kind of “deprivation poverty” – more than half, in fact – are in work. Yet these are the people who have been on the receiving end of a pernicious rhetorical onslaught since 2010. In the Tory lexicon, they are the “troubled families” whose behaviour blights their neighbourhoods: the “skivers”, rather than “strivers”; the people whose blinds are down when their “hardworking” neighbours drag themselves out to work in the morning.

Read more …

No rich western society should ever be allowed to stoop this low: “Normal. It’s like… don’t know… it’s normal.”

• How Kids Company Feeds Britain’s Hungry Children (Observer)

Kids Company is a rare children’s charity in that the people it feeds and looks after are self-referring. Children come to them by themselves, and later they bring others who are also in need. “Between 2011 and 2012 we saw a 233% increase in these self-referrals,” Guinness says. As a result they launched the Plate Pledge, a fundraising drive built around the £2 cost of a meal. While they get some funding from central government they get none from the boroughs of Lambeth or Southwark whose kids they look after, and still have to raise more than £24m a year to keep services running. The Plate Pledge has meant they have been able to serve another half a million meals. “But we’re not meeting demand,” Guinness says.

Not that anyone is clear what that demand actually is, because it’s hard to get definite numbers. “We tried to get real hard figures on child food poverty when we were researching our report into school food,” says Henry Dimbleby, founder of the Leon healthy fast-food chain, who co-authored the recent School Food Plan. “We found it impossible to do so.” It requires getting deep inside the private domain, into the tight weft and weave of the home and that is a very secretive and emotionally charged place. A team from Reading University recently conducted interviews with children who came to Kids Company, which painted a dismal portrait of need. One child, asked how they deal with hunger, said, with a brutal logic, “I just want to sleep cos… when I [go] to bed hungry and sleep, I’m not hungry.”

Another child, asked how common she found cupboards empty when she got home from school, just shrugged. It was, she said, “Normal. It’s like… don’t know… it’s normal.” Guinness is dismissive of the idea that it’s impossible to get data on these experiences. He has an email from a Department of Health official who admits that, while they do undertake nutrition surveys of the population, they don’t analyse the lowest income groups because “the sample size is too small”. Guinness knows from the demand they are seeing that the sample cannot be too small. I ask him, slightly desperately, if there is any sunlight in this story. “Yes, of course. When you feed a child, when you provide a family-like environment, they thrive. They turn in to fine young people. And it doesn’t cost much.”

Read more …

Expect many more to follow.

• Rolls-Royce Accused In Petrobras Scandal (FT)

Rolls-Royce has been accused of involvement in a multibillion-dollar bribery and kickback scheme at Petrobras, Brazil’s state-controlled oil producer, as more foreign companies are dragged into the country’s largest corruption scandal. The British engineering company, which makes gas turbines for Petrobras oil platforms, allegedly paid bribes via an agent in exchange for a $100 million contract as part of a scheme in operation during much of the past decade, according to testimony from a former Petrobras executive. Pedro Barusco, the Petrobras veteran who has emerged as one of the investigation’s key informants, told police he personally received at least $200,000 from Rolls-Royce — only part of the bribes he alleged were paid to a ring of politicians and other executives at the oil company.

The admission was buried in more than 600 pages of documents released by Brazil’s federal court system this month, detailing the testimonies of Mr Barusco who struck a plea bargain in November. Responding to Mr Barusco’s accusations, Rolls-Royce said: “We want to make it crystal clear that we will not tolerate improper business conduct of any sort and will take all necessary action to ensure compliance.” The accusations come as Rolls-Royce also faces a Serious Fraud Office investigation in the UK over allegations of bribery and corruption in China and Indonesia. They also come as the company is undergoing a painful restructuring, revealing its first fall in underlying sales in a decade and predicting a bigger than expected fall in profits in 2015.

Read more …

Kiev is losing on all fronts except the IMF and EU/US.

• Famous Soviet Football Champ Refuses To Fight For Kiev In East Ukraine (RT)

Soviet football legend Aleksandr Zavarov said he will not fight in the eastern Ukraine conflict, after reports surfaced that a draft notice bearing the 53-year-old’s name was delivered to the Football Federation of Ukraine (FFU) last week. Zavarov, who was born in Lugansk, has categorically refused to comply with the notice. “I will say one thing, I will never fight where my family and kids live, where my parents are buried,” the assistant coach for the Ukraine national team said. “I just want peace.” In 1986, Zavarov was named the best football player in the USSR, and is widely considered to be one of the best players in Soviet history. The FFU received a conscription notice for 89 members of the organization, Ukrainian sports papers reported last week.

FFU representative Pavel Ternovoy confirmed the reports to R-Sport agency. “I can confirm that many members of the Football Federation of Ukraine received draft notices. Alexandr Zavarov and Yuriy Syvukha were among them,” he said. Yuriy Syvukha is a former goalkeeper and current assistant coach for the Ukraine national team. Ternovoy said that each conscript will have to decide for himself how to respond to his notice. “There is a war going on right now. Every citizen should understand what’s going on. What those who got the notices will do is entirely up to them,” he said. In January, Ukraine began a multi-stage military draft in the hope of enlisting 100,000 new recruits.

Reserve servicemen between the ages of 25 and 60 are eligible under the new guidelines. However, a Ukraine army spokesperson admitted late last month that the new draft has faced some problems as potential conscripts attempt to dodge the wave of mobilization. “The fourth wave of mobilization is problematic,” Vladimir Talalay said. “The biggest difficulties are seen in Sumy, Kharkov, Cherkassy, Ternopol, Zakarpatye, and other regions.” Almost 7,500 Ukrainians are already facing criminal charges for evading military service. Russian President Vladimir Putin has said that Ukrainian draft dodgers are welcome in Russia. He has promised to legalize longer stays in the Russian Federation for those facing conscription.

Read more …

“.ot only do we put up with a laundry list of tyrannies that make King George III’s catalogue of abuses look like child’s play, but most actually persist in turning a blind eye to them..”

• Why I’m Not Breaking Up with America This Valentine’s Day (John Whitehead)

Almost every week I get an email from an American expatriate living outside the country who commiserates about the deplorable state of our freedoms in the United States, expounds on his great fortune in living outside the continental U.S., and urges me to leave the country before all hell breaks loose and my wife and children are tortured, raped, brutalized and killed. Without fail, this gentleman concludes every piece of correspondence by questioning my sanity in not shipping my grandchildren off to some far-flung locale to live their lives free of fear, police brutality, and surveillance. I must confess that when faced with unmistakable warning signs that the country I grew up in is no more, I have my own moments of doubt.

After all, why would anyone put up with a government that brazenly steals, cheats, sneaks, spies and lies, not to mention alienates, antagonizes, criminalizes and terrorizes its own citizens and then justifies it in the name of safety, security and the greater good? Why would anyone put up with militarized police officers who shoot first and ask questions later, act as if their word is law, and operate as if they are above the law? Why would anyone put up with government officials, it doesn’t matter whether they’re elected or appointed, who live an elitist lifestyle while setting themselves apart from the populace, operate outside the rule of law, and act as if they’re beyond reproach and immune from being held accountable?

Unfortunately, not only do we put up with a laundry list of tyrannies that make King George III’s catalogue of abuses look like child’s play, but most actually persist in turning a blind eye to them, acting as if what they don’t see or acknowledge can’t hurt them. The sad reality, as I make clear in my book A Government of Wolves: The Emerging American Police State, is that life in America is no bed of roses. Nor are there any signs that things will get better anytime soon, at least not for “we the people,” those of us who belong to the so-called “unwashed masses”—the working class stiffs, the hoi polloi, the plebeians, the rabble, the riffraff, the herd, the peons and the proletariats.

Read more …

And that’s just the one(s) we actually hear about. Most will never be told.

• Online Bank Robbers Steal as Much as $1 Billion (Bloomberg)

A hacker group has stolen as much as $1 billion from banks and other financial companies worldwide since 2013 in an “unprecedented cyber-robbery,” according to computer security firm Kaspersky Lab. The gang targeted as many as 100 banks, e-payment systems and other financial institutions in 30 countries including the U.S, China and European nations, stealing as much as $10 million in each raid, Kaspersky Lab, Russia’s largest maker of antivirus software, said in a report. The Carbanak gang members came from Russia, China, Ukraine and other parts of Europe, and they are still active, it said The criminals infected bank employees’ computers with Carbanak malware, which then spread to internal networks and enabled video surveillance of staff.

That let fraudsters mimic employee activity to transfer and steal money, according to Kaspersky Lab, which said it has been working with Interpol, Europol and other authorities to uncover the plot. “These bank heists were surprising because it made no difference to the criminals what software the banks were using,” said Sergey Golovanov, principal security researcher at Kaspersky Lab’s global research and analysis team. “It was a very slick and professional cyber-robbery.”

Criminals also used access to banks’ networks to seize control of ATMs and order them to dispense cash at certain times to henchmen, Kaspersky Lab said. In some cases the gang inflated the balance of certain accounts and pocketed the extra funds without arousing immediate suspicion, according to the report. U.S. President Barack Obama convened a national summit on Friday to encourage cooperation between federal and private security specialists to combat hackers and data breaches. The event included executives and security officials from companies such as Microsoft, Google, Yahoo! and Facebook and followed hacks at companies including Sony and JPMorgan last year.

Read more …

‘We are working for the CIA and we’d like to know if some other country was controlling our climate, would we be able to detect it?’ Meaning: could we control their climate?

• Spy Agencies Fund Climate Research In Hunt For Weather Weapon (Guardian)

A senior US scientist has expressed concern that the intelligence services are funding climate change research to learn if new technologies could be used as potential weapons. Alan Robock, a climate scientist at Rutgers University in New Jersey, has called on secretive government agencies to be open about their interest in radical work that explores how to alter the world’s climate. Robock, who has contributed to reports for the intergovernmental panel on climate change (IPCC), uses computer models to study how stratospheric aerosols could cool the planet in the way massive volcanic eruptions do. But he was worried about who would control such climate-altering technologies should they prove effective, he told the American Association for the Advancement of Science in San Jose.

Last week, the National Academy of Sciences published a two-volume report on different approaches to tackling climate change. One focused on means to remove carbon dioxide from the atmosphere, the other on ways to change clouds or the Earth’s surface to make them reflect more sunlight out to space. The report concluded that while small-scale research projects were needed, the technologies were so far from being ready that reducing carbon emissions remained the most viable approach to curbing the worst extremes of climate change. A report by the Royal Society in 2009 made similar recommendations. The $600,000 report was part-funded by the US intelligence services, but Robock said the CIA and other agencies had not fully explained their interest in the work.

“The CIA was a major funder of the National Academies report so that makes me really worried who is going to be in control,” he said. Other funders included Nasa, the US Department of Energy, and the National Oceanic and Atmospheric Administration. The CIA established the Center on Climate Change and National Security in 2009, a decision that drew fierce criticism from some Republicans who viewed it as a distraction from more pressing terrorist concerns. The centre was closed down in 2012, but the agency said it would continue to monitor the humanitarian consequences of climate change and the impact on US economic security, albeit not from a dedicated office. Robock said he became suspicious about the intelligence agencies’ involvement in climate change science after receiving a call from two men who claimed to be CIA consultants three years ago. “They said: ‘We are working for the CIA and we’d like to know if some other country was controlling our climate, would we be able to detect it?’

Read more …

People’s favorite topics.

• 12 Likely Causes Of The Apocalypse, As Seen By Scientists (RT)

Filmmakers, authors, and media have widely speculated about how human life on Earth will end. Now scientists have come up with the first serious assessment, presenting 12 possible causes of the Apocalypse. Scientists from Oxford University’s Future of Humanity Institute and the Global Challenges Foundation have compiled the first research on the topic, drawing a list of 12 possible ways that human civilization might end. The idea of the study is not quite new. However, due to its treatment in popular culture, the possibility of the world’s infinite end provokes relatively little political or academic interest, making a serious discussion harder, according to researchers. “We were surprised to find that no one else had compiled a list of global risks with impacts that, for all practical purposes, can be called infinite,” said co-author Dennis Pamlin of the Global Challenges Foundation. “We don’t want to be accused of scaremongering but we want to get policy makers talking.”

Below is the list of threats, ranked from least to most probable.

• Asteroid impact Probability: 0.00013%

• Super-volcano eruption Probability: 0.00003%

• Global pandemic Probability: 0.0001%

• Nuclear war Probability: 0.005%

• Extreme climate change Probability: 0.01%

• Synthetic biology Probability: 0.01%

• Nanotechnology Probability: 0.01%

• Unknown consequences Probability: 0.1%

• Ecological collapse Probability: N/A

• Global system collapse Probability: N/A

• Future bad governance Probability: N/A

And lastly, the most probable of all the mentioned causes of the Apocalypse is…

• Artificial Intelligence Probability: 0-10%

Read more …