Ivan Aivazovsky The Ninth Wave 1849

And the scribes and Pharisees brought unto him a woman found unvaxxed; and when they had set her in the midst, they say unto him, Master, this woman was found unvaxxed, with no mask. Now Fauci in the law commanded us, that such should be stoned: but what sayest thou?

He lifted up himself, and said unto them, He that is without fault among you, let him first cast a stone at her. And they which heard it, being convinced of their own righteousness, stoned the woman to death, plus all bystanders within 100 feet, and Jesus too, out of an abundance of caution.

– TAE Summary

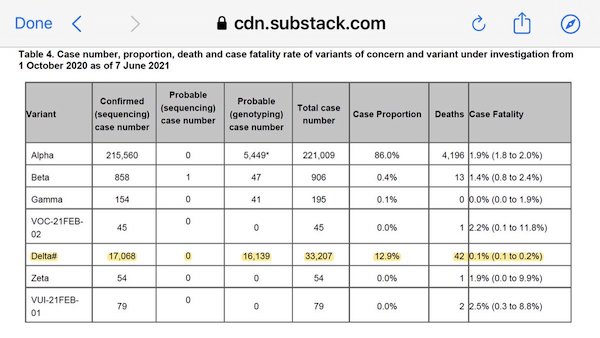

Delta doesn’t look very scary.

The #DeltaDeceit is exactly that

* UK went from low to >90% Delta (Indian) Scariant from April to June – practically no impact on ICU etc.

* Northern Ireland grew to 60% the other day – no-one in ICU, nothing happened

* same story all over the world, explained here:

2/6 pic.twitter.com/1JZpcOF6Wt— Ivor Cummins (@FatEmperor) June 29, 2021

PCR trap

A friendly reminder of the trap of PCRs. pic.twitter.com/e9z7MpsQWT

— Wake Up From COVID (@wakeupfromcovid) June 30, 2021

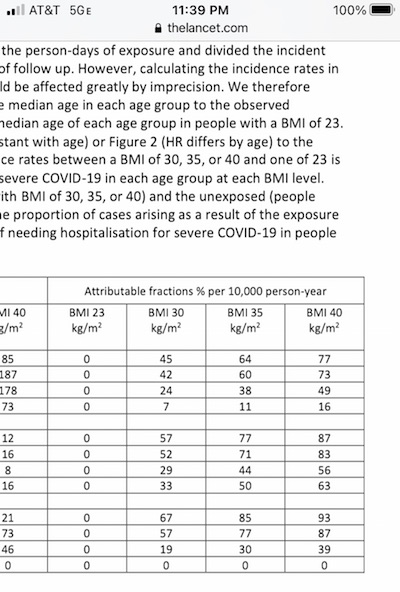

“They found that in the two younger groups – including adults up to age 60 – being obese was associated with nearly ALL the risk that Covid would lead to intensive care or death “

[..] the findings suggest that for people under 60, weight loss would be the single best way to reduce the risk of Covid – probably even more than a vaccine (and with no side effects).

Original paper: https://www.thelancet.com/journals/landia/article/PIIS2213-8587(21)00089-9/fulltext

• Why COVID is like AIDS (Berenson)

SARS-COV-2 isn’t even in the same time zone as HIV as a killer. But it is like HIV in one crucial way. It plays favorites. After a year, most of us know that the elderly are at much higher risk from coronavirus (though even well-informed people may not be aware HOW much higher the risk is). But what public health authorities have gone out of their way to obscure is how much obesity – especially severe obesity – drives the risk of the coronavirus in younger people. In April, British researchers published a definitive paper on the subject in The Lancet Diabetes & Endocrinology, a peer-reviewed journal. The researchers examined the medical records of almost 7 million people in England to look at the link between obesity and severe outcomes from Covid, including hospitalization and death.

The topline findings show only a moderate link between extra weight and Covid risk. But when the researchers looked more closely, they found that’s because in older people, being overweight does NOT drive excess risk. So the researchers divided the patients into four age ranges: 20-39, 40-59, 60-79, and over 80. They found that in the two younger groups – including adults up to age 60 – being obese was associated with nearly ALL the risk that Covid would lead to intensive care or death. The findings held even after they adjusted for many different potential confounding factors, like smoking, non-weight-related illnesses, and wealth. The excess risk was extremely high even for people who weren’t morbidly obese – defined as a body-mass index of 40 or more. A person between 40 and 60 with a BMI of 35 – someone who is 230 pounds and 5’8” – had about five times the risk of dying of Covid of a person of normal weight. For younger adults, the excess risk was even higher, and for morbidly obese people even higher still.

In contrast, people of normal weight under 40 are at essentially no risk of death from Covid. The researchers found their rate to be under 1 in 10,000 per year. Even in the 40 to 59 age range, normal-weight adults had an annual risk well under 1 in 1,000. The researchers did not include those stunning findings in the main body of the paper, only its appendix. Still, they were clear in their discussion about the overall results: “Our findings from this large population-based cohort emphasise that excess weight is associated with substantially increased risks of severe COVID-19 outcomes, and one of the most important modifiable risk factors identified to date.” In fact, the findings suggest that for people under 60, weight loss would be the single best way to reduce the risk of Covid – probably even more than a vaccine (and with no side effects).

Robert Malone: “The author apparently was unaware that Moderna was substantially funded by DARPA. and their jab engineered by NIH.”

• Covid’s Warped Vaccines (Weisser)

Samuel Langley, the inventor of a catastrophically incompetent ‘flying’ machine is a striking example of governments picking losers. When his 16-metre monster was catapulted into the air in 1903, it instantly plunged into the Potomac river like an obese Icarus. Langley was the beneficiary of the sort of government largesse and boosterism that has lately been lavished on Operation Warp Speed’s Covid vaccines but at least nobody died as a result of his incompetence. The same cannot be said of the Covid vaccines. In the US, the official database for adverse reactions to all the Covid vaccines has now registered almost 6,000 deaths, just in the first five months. Compare this to 2019, when there were only 605 deathreported in the whole year, for all vaccines combined.

That’s more than an order of magnitude increase. There were also almost 330,000 reports of vaccine injury including almost 2,200 heart attacks, more than 1500 reports of blood clots combined with low platelets and more than 15,000 reports of severe allergic reactions. Yes, correlation does not prove causation but adverse events on this scale have never before been seen, in the more than 200 years since the first vaccine was invented and need to be properly investigated and explained. In the UK, Dr Tess Lawrie, a world-class evidence-based medical researcher and consultant to the World Health Organization wrote to the British Medicines and Healthcare products Regulatory Agency saying, ‘The MHRA has more than enough evidence on the Yellow Card system to declare C19 vaccines unsafe for use in humans’.

In less than five months in the UK there were over 1,250 deaths and 888,000 adverse reactions including almost 14,000 bleeding, clotting and stroke events (856 fatal) occurring in almost every vein and artery and every organ — brain (152 fatalities), lungs (103 fatalities), heart (81 fatalities), spleen, kidneys, ovaries and liver. There were also almost 55,000 reports of infection and immune disorders, strongly suggesting vaccine-induced immune-compromise and re-activation of latent viruses resulting in shingles, Bell’s palsy and Guillain-Barré syndrome. And there were 4,771 reports of visual impairment including blindness. In the UN’s global database 6,500 deaths have been reported and over a million injuries, most among individuals aged 18 to 64 and 70 per cent women.

Malone censored on LinkedIn

Yes, I have been locked out of Linked In and my account has been shut down. #censorship in the time of COVID. I have had to submit copies of my driver’s license and Linked In will now make a determination about reactivating my account.

— Robert W Malone, MD (@RWMaloneMD) June 29, 2021

Lisbon courts have some clever judges. We’ve seen it before.

• Lisbon Court: Only 0.9% Of Verified Cases Died Of Covid; 152, Not 17,000 (AFD)

Following a citizen’s petition, a Lisbon court was forced to provide verified COVID-19 mortality data, reports AndreDias.net. According to the ruling, the number of verified COVID-19 deaths from January 2020 to April 2021 is only 152, not about 17,000 as claimed by government ministries. All the “others” died for various reasons, although their PCR test was positive. “We live in a fraud of unprecedented dimensions,” wrote Dias. “The data are from the Sistema de Informação dos Certificados de Óbito (Death Certificate Information System – SICO), the only such system in Portugal. The reference to 152 death certificated issued ‘under Justice Ministry supervision’ is spurious, as all death certificates are issued under Justice Ministry auspices, being the only institution that issues them.

“In response to a popular suit, a court order was required for the Ministry to respond, desperate not to denounce the fraud. “All those responsible for handling data from ‘cases’ and ‘deaths’ can, thereafter, only be tried for the crime if there is any dignity remaining in the rule of law,” he continued. “If these figures are of the same order of magnitude for other countries as well, and there is no reason to assume otherwise, then the plague is a deception of unprecedented proportions and crimes committed against humanity on a huge scale have been committed here.”

Ioannidis

IOANNIDIS STRIKES AGAIN

"We have solid evidence that 0.1% died 'with' or 'from' covid—probably mostly 'with' covid—and 50% of the population JUST GOT NUTS."

"It was a MASSACRE; I think it was a public health blunder of the top magnitude; probably the worst in the last century." pic.twitter.com/o42nbDoBXt

— Wake Up From COVID (@wakeupfromcovid) June 29, 2021

Not terribly impressed, but hey, she was censored too.

• The BIGGE$T Lie -Perhaps Ever (Kamen)

The BIGGE$T Lie is this: We do not yet have a medicine that can prevent and treat every phase of COVID-19 disease — from pre-exposure to the critical stage of illness. It’s the BIGGE$T Lie because of this: We we DO have such a pill. It’s ivermectin. A 50-year-old, highly safe, inexpensive, globally available Nobel prize-winning medicine that is dropping case counts and saving lives by the tens of thousands in the countries where it is being used. So why don’t we suggest the truer statement instead. It would read something like this: “We do not have an extremely high-priced, novel pill developed by Big Pharma using billions of taxpayer dollars that can prevent and treat every phase of COVID-19 disease — from pre-exposure to the critical stage of illness. We only have ivermectin, which actually does it all, safely and quickly, but which requires $0 to develop so there are no profits in it for us. So let’s hush it up, make up stuff about it and make it go away so we can rake in billion$. What do you say?”

[..] First, Big Pharma has a greedy hand in the BIGGE$T Lie. Huh? What? Drug companies? Aren’t they in the business of making drugs that save lives and enhance human health? Well, sure they are. And they do plenty of good throughout the world. That much is undeniably true. But the pandemic has blessed Big Pharma with a multi-billion dollar payday…predominantly remuneration for the development of desperately needed vaccines. OK. So what? I’ll tell you what. The reality is that there are people who are vaccine hesitant. Then there are those for whom vaccines are medically contraindicated. Others around the world have no access to the vaccine, and may not for years. What are they supposed to do? For them, finding a medicine — or combination of medicines — that will keep them safe from a killer virus is critical.

They need a bridge, if you will, to the vaccine; or a safety net to keep them well until either the virus recedes or herd immunity is established. Enter ivermectin. The little drug that could. And could. And could.

Pseudopandemic is the new book by Iain Davis.

Not too impressed by this either.

COVID 19 presented virtually no risk to those of working age and none at all to the young. There was no evidence that children were either at or presented any risk. The school closures were part of the pseudopandemic psy-op. They gave the misleading impression of an emergency and provided fraudulent justification for vaccinating children. The pseudopandemic was planned to lead to the complete transformation of our culture and society. It has irrevocably changed our relationship with governments, has caused catastrophic economic disruption, shutdown global trade and saw millions become reliant on government subsidies. The pseudopandemic was the opening salvo in a global coup d’état.

The new pseudopandemic biosecurity apparatus is designed to control our behaviour as we are forced through a global transformation. Those behind the pseudopandemic intend to change the International Monetary and Financial System (IMFS) and establish global governance in the shape of technocracy. Technocracy is a neofeudal, totalitarian system based upon communitarian principles. We will be offered the illusion of participatory democracy through our required participation and belief in “civil society.” Civil society will be a “stakeholder” in the Technocracy. However, civil society will only be allowed to pursue polices set at the global level.

Applied psychology was used throughout the pseudopandemic to fix our “choice environment.” We were conditioned to believe that following the rules was the responsible and moral choice. In reality our behaviour was being deliberately altered to ensure our compliance with the diktats of the biosecurity state, preparing society for the transition to technocracy. The new global IMFS is built upon carbon trading and a $120 trillion carbon bond market is currently under construction. Assets are being defined in terms of their Stakeholder Capitalism Metrics which rate investments depending upon their environmental, social and governance (ESG) score.

“This is about personal rights.”

• Ohio Lawmakers Ban Requiring Covid-19 Vaccine At Public Schools, Universities (CD)

Ohio’s public schools and universities couldn’t require students or employees to be vaccinated against COVID-19 under last-minute changes to a bill sent to Gov. Mike DeWine early Tuesday. Under the proposed changes, public schools and universities couldn’t require vaccines that haven’t received full U.S. Food and Drug Administration approval. That includes the three COVID-19 vaccines distributed in America, all of which have been approved via emergency use authorization, which is a rigorous process that includes clinical trials. “Parents, in consultation with their personal doctors, have the right to make decisions about their children especially for vaccinations that are not fully approved by the FDA,” said Sen. Andrew Brenner, R-Powell. “This is about personal rights.”

The bill wouldn’t apply to public hospitals, such as Ohio State University’s Wexner Medical Center, or private schools and universities. “There was a lot of feeling that you just don’t want to force kids to do it if their parents don’t want them to,” said Speaker Bob Cupp, R-Lima. Another amendment offered by Sen. Rob McColley, R-Napoleon, would ask individuals coming from countries designated as the highest risk by the U.S. Centers for Disease Control and Prevention to quarantine for no longer than 48 hours. While quarantined, their food, transportation and accommodations would be paid for by the Ohio Department of Health.

They will be a threat to you for the rest of your life. Take your pick.

• Pfizer, Moderna Vaccines May Stand Guard Against COVID for Years (HDN)

The Pfizer and Moderna vaccines trigger an immune system response that could fend off the coronavirus for years to come, new research reveals. The latest study bolsters growing evidence that most people immunized with the mRNA vaccines may not need booster shots, with one key caveat: That the virus and its variants don’t evolve too much beyond the virus’ original form. “It’s a good sign for how durable our immunity is from this vaccine,” Ali Ellebedy, an immunologist at Washington University in St. Louis, who led the study, told The New York Times. The study, published Monday in the journal Nature, did not look at the Johnson & Johnson vaccine, but Ellebedy said he expected the immune response for that vaccine to be less durable than that produced by mRNA vaccines.

Last month, Ellebedy and his colleagues reported that immune cells that recognize the virus lingered in bone marrow for at least eight months after COVID-19 infection. Another team found that memory B-cells continue to mature and strengthen for at least a year after infection, the Times reported. Those findings suggested that immunity might last years, possibly a lifetime, in people who were infected and later vaccinated. But whether vaccination alone might demonstrate the same power was unclear. After an infection or a vaccination, a specialized structure called the germinal center forms in lymph nodes, the researchers explained. This structure is where B-cells are trained. After infection with the coronavirus, the germinal center forms in the lungs. But after vaccination, the cells’ education takes place in lymph nodes in the armpits, within reach of researchers.

Ellebedy’s team found that 15 weeks after the first dose of vaccine, the germinal center was still highly active in all 14 study participants, and that the number of memory cells that recognized the coronavirus had not dropped. “The fact that the reactions continued for almost four months after vaccination — that’s a very, very good sign,” Ellebedy told the Times, because terminal centers typically peak one to two weeks after immunization, and then wane.

Dr. Richard Fleming

Dr. Richard Fleming – Frightening if true… pic.twitter.com/wGytu3GggA

— Husserl (@husserl79) June 30, 2021

(perception of) Reality has changed a lot lately. But people are not aware of that, so what’s the difference?

• The War on Reality (CJ Hopkins)

You could stage an apocalyptic global pandemic that only happened in certain countries, or in certain parts of certain countries, and that more or less mirrored natural mortality, and that didn’t drastically increase historical death rates, but was nonetheless totally apocalyptic. Perfectly healthy people could become “medical cases.” You could count anyone who died of anything as having died of your apocalyptic virus. You could tell people in no uncertain terms that medical-looking masks will not protect them from viruses, and then turn around and tell them that they will, and then, later, publicly admit you were lying in order to manipulate them, and then deny you ever said that, and tell them to wear masks.

You could experimentally “vaccinate” millions of people whose risk of becoming seriously ill or dying from your apocalyptic virus was minuscule or non-existent, and kill tens or hundreds of thousands in the process, and the people whose brains you had methodically broken would thank you for murdering their friends and neighbors, and then rush out to their local discount drugstore to experimentally “vaccinate” their own kids and post pictures of it on the Internet. At that point, you wouldn’t really have to worry about “populist uprisings,” or “terrorism,” or any other type of insurgent activity, because the vast majority of the global population would be scramble-headed automatons who were totally incapable of independent thought, and who had no idea what was real and what wasn’t, so just repeated whatever new script you fed them like customer-service representatives on Haldol.

How many of these over the past 5-6 years?

• NYC Mayor’s Race “Plunges Into Chaos” On 130,000 ‘Test-Run’ Votes (ZH)

With the New York City Mayoral race “plunged into chaos” (as the NYT puts it), journalist Bob Hardt now reports that the Board of Elections counted 130,000 ‘test-run’ votes, which would account for most of the ‘discrepancy’ reported earlier. Hardt added that the BoE will now head ‘back to the drawing board’ to produce corrected ranked-choice numbers tomorrow. Presumably by then the outcome of the election will have been decided and things can go smoother then…

* * *

Hours after the New York City’s Board of Elections released an updated ranked voting tally for the Democratic Primary which showed frontrunner Eric Adams’ lead shrinking considerably, BOE officials acknowledged a ‘discrepancy’ in the ballot count. At issue: on the day of the primary, the BOE reported just under 800,000 votes with 96.6% of scanners reporting. On Tuesday, however, the tally was 941,832 votes – nearly 20% higher, according to PIX11. The new figures narrows Adams’ lead over former sanitation commissioner Kathryn Garcia to just 51.9% (368,898) to 48.9% (352,990) – while there are still 100,000 absentee ballots which need to be processed, and could tip Garcia over the top.

In response, Adams’ campaign fired off a statement questioning the count, and demanding an explanation for the “irregularities.” “The vote total just released by the Board of Elections is 100,000-plus more than the total announced on election night, raising serious questions,” reads the statement. “We have asked the Board of Elections to explain such a massive increase and other irregularities before we comment on the Ranked Choice Voting projection.” Liberals, in response, accused Adams of going ‘full Trump’ and spreading ‘the big lie’ – that the election isn’t as secure as advertised.

People getting rid of people.

• Toxic Corporations are Destroying the Planet’s Soil (CP)

A newly published analysis in the journal Frontiers in Environmental Science argues that a toxic soup of insecticides, herbicides and fungicides is causing havoc beneath fields covered in corn, soybeans, wheat and other monoculture crops. The research is the most comprehensive review ever conducted on how pesticides affect soil health. The study is discussed by two of the report’s authors, Nathan Donley and Tari Gunstone, in a recent article appearing on the Scientific American website. The authors state that the findings should bring about immediate changes in how regulatory agencies like the Environmental Protection Agency (EPA) assess the risks posed by the nearly 850 pesticide ingredients approved for use in the USA.

Conducted by the Center for Biological Diversity, Friends of the Earth and the University of Maryland, the research looked at almost 400 published studies that together had carried out more than 2800 experiments on how pesticides affect soil organisms. The review encompassed 275 unique species or types of soil organisms and 284 different pesticides or pesticide mixtures. Pesticides were found to harm organisms that are critical to maintaining healthy soils in over 70 per cent of cases. But Donley and Gunstone say this type of harm is not considered in the EPA’s safety reviews, which ignore pesticide harm to earthworms, springtails, beetles and thousands of other subterranean species. The EPA uses a single test species to estimate risk to all soil organisms, the European honeybee, which spends its entire life above ground in artificial boxes. But 50-100 per cent of all pesticides end up in soil.

The researchers conclude that the ongoing escalation of pesticide-intensive agriculture and pollution are major driving factors in the decline of soil organisms. By carrying out wholly inadequate reviews, the regulatory system serves to protect the pesticide industry.The study comes in the wake of other recent findings that indicate high levels of the weedkiller chemical glyphosate and its toxic breakdown product AMPA have been found in topsoil samples from no-till fields in Brazil. Writing on the GMWatch website, Claire Robinson and Jonathan Matthews note that, despite this, the agrochemical companies seeking the renewal of the authorisation of glyphosate by the European Union in 2022 are saying that one of the greatest benefits of glyphosate is its ability to foster healthier soils by reducing the need for tillage (or ploughing).

This in itself is misleading because farmers are resorting to ploughing given increasing weed resistance to glyphosate and organic agriculture also incorporates no till methods. At the same time, proponents of glyphosate conveniently ignore or deny its toxicity to soils, water, humans and wildlife. With that in mind, it is noteworthy that GMWatch also refers to another recent study which says that glyphosate is responsible for a five per cent increase in infant mortality in Brazil.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Corbyn Assange

Julian #Assange is turning 50 this week. His birthday will be behind Belmarsh bars.

MPs now demand to see Julian who has been denied this basic right.I spoke to @jeremycorbyn who told me “Julian has stood up for truth and must not be extradited”

— Shadia Edwards-Dashti (@ShadiaED) June 29, 2021

Indiana Bones

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.