G. G. Bain Navy dirigible, Long Island 1915

“In many states, offenders are expected to finance the justice system, including court costs, room and board while incarcerated, probation supervision and drug-treatment programs.”

• It’s A Crime To Be Poor In America (MarketWatch)

In America, you’re presumed innocent until proven guilty. Unless you’re poor, that is. Increasingly, it’s a crime to be poor, and the punishment is often further impoverishment. Fifty years ago, Chuck Berry sang about a brown-eyed handsome man who was “arrested for the crime of unemployment.” Little has changed since then. For poor people, even minor scrapes with the law can have major consequences, including prison time, probation, endless debt and permanent joblessness. For people of means, those same legal problems are a nuisance, but they aren’t life-changing events. More cities and states have realized that poverty can be a profit center.

Not for poor people, of course, but for government treasuries and for private companies hired to handle the influx into the criminal justice system of people whose only crime was the inability to pay a traffic ticket or a misdemeanor fine. Cash-strapped cities like Ferguson, Mo., count on fines and court-imposed fees to balance their budgets, and that reliance on the revenue from petty violations was cited by the Justice Department as a contributing factor in Ferguson’s high rates of traffic stops and arrests for minor crimes and misdemeanors. In many states, offenders are expected to finance the justice system, including court costs, room and board while incarcerated, probation supervision and drug-treatment programs.

For anyone living paycheck to paycheck, even a $100 fine can be a challenge, and paying off the debt to the court and to the privatized probation company can be impossible, especially if the arrest has led to the loss of a job or a driver’s license. Just being arrested can be devastating: Half a million people are languishing in jail awaiting trial because they can’t afford to pay the bail. People who are let out of prison are often said to have “paid their debt to society.” But in most cases, they haven’t paid their debt for the costs of their imprisonment and probation. More than 80% of people let out of prison leave owing money, according to an investigation by NPR and the Brennan Center for Justice. Those of us who live sheltered middle-class lives often wonder why anyone would run away from the police or resist arrest.

Running away can cost you your life, as what happened to Walter Scott. Why would he risk being shot in the back by a police officer? Perhaps he feared that an arrest for a minor traffic violation (the tail light on his car was out) would lead to a downward spiral of fines, jail time and permanent joblessness, as it has for others. According to relatives, Scott was behind on his child-support payments, and he may have feared that he’d be jailed for his failure to pay. Which, of course, would have cost him his job and any chance he and his family had of a future. So he ran, and he died.

Read more …

Hanging on by their fingernails.

• US States Are Not Prepared for the Next Fiscal Shock (Bloomberg)

U.S. states, still grappling with the lingering effects of the longest recession since the 1930s, are even more vulnerable to another fiscal shock. The governments have a little more than half the reserves they’d stashed away before the 18-month recession that ended in June 2009, according to a report last month by Pew Charitable Trusts. New Jersey, Pennsylvania, Illinois and Arkansas have saved the least. Skimpier rainy-day funds have implications for the national economy, which is in its sixth year of expansion. States would have to cut spending or raise revenue by a combined $21 billion in the event of a recession, exacerbating economic weakness, Moody’s found in a stress test of state finances. Reserves take on added importance for governments balancing obligatory pension and health-care costs with swings in tax collections, said Daniel White at Moody’s.

“What the Great Recession has shown is that things have fundamentally changed in terms of the way that state fiscal conditions are determined,” White said. “They need to be much more prepared for very volatile fiscal conditions than they had been in the past.” Investors are monitoring states’ fiscal balances after seeing how reserves helped some governments weather the recession, said John Donaldson at Haverford Trust. California won credit upgrades and saw borrowing costs shrink after voters in November agreed to bolster rainy-day funds. With Fitch Ratings lifting California to A+ in February, its fifth-highest level, the state has its highest marks from the three biggest rating companies since at least 2009.

Bond buyers demand about 0.3 percentage point of extra yield to own 10-year California munis instead of benchmark debt, close to the lowest spread since 2007, data compiled by Bloomberg show. “We’re looking for stability and credit quality,” said Richard Ciccarone at Merritt Research. “A rainy-day fund is a symbol of conservative financial management.” States were unprepared for the last recession. In 2009, budget gaps totaled $117 billion, about twice the level of reserves, according to Pew, a research group. With more of a cushion, they would’ve cut fewer jobs, White said. The governments employ about 5.1 million nonfarm workers, about 140,000 fewer than the 2008 peak, Bureau of Labor Statistics data show.

Read more …

Because the whole shebang is imploding.

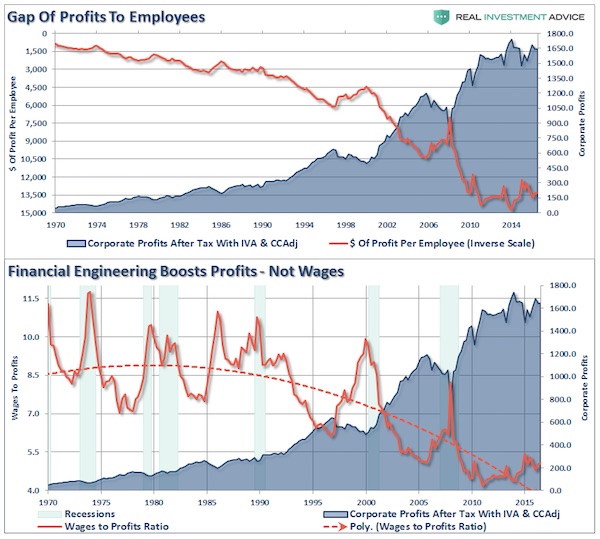

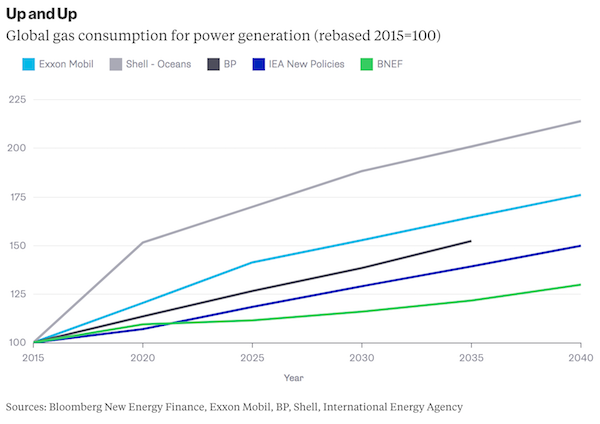

• Why Your Wages Could Be Depressed for a Lot Longer Than You Think (Bloomberg)

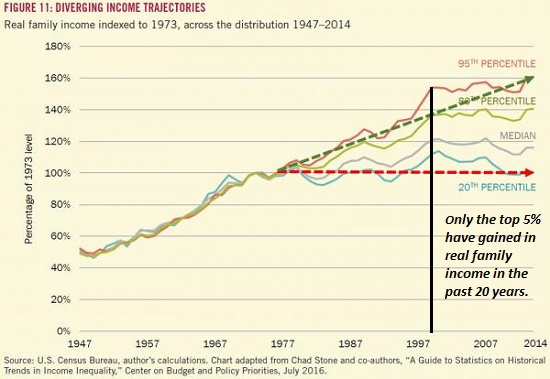

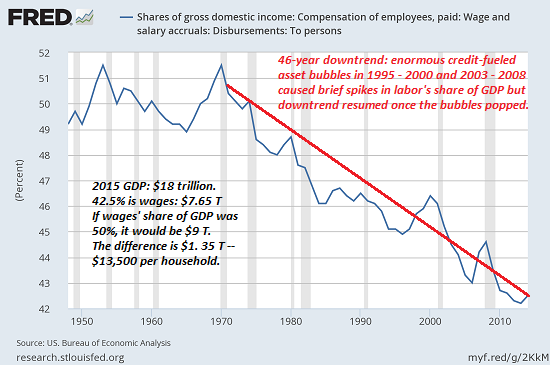

As if watching your paycheck stagnate for the last couple years hasn’t been bad enough, Federal Reserve researchers are out with more (potentially) bad news: Unless we get some big shifts in global economic forces, your wages could be weak for a while. Longer-term changes including soft productivity growth and labor’s declining share of income are at the heart of the problem, Filippo Occhino and Timothy Stehulak at the Cleveland Fed find. These two macroeconomic shifts, which result from broad themes such as globalization and technology, are felt all the way down to the U.S. worker. Productivity is important because it fosters faster economic growth without generating higher inflation. Companies can pay their workers more while still seeing their earnings increase.

Labor productivity — measured as the amount of goods or services produced by an employee in one hour — has averaged 1.5% growth in the 10 years ended 2014. That compares with 3.6% from the second quarter of 1997 to the end of 2003 — the salad days of American productivity. Gains in productivity have been slow to come by as companies hold off on investing in new capital equipment. Some economists such as Robert Gordon have argued that the U.S. is doomed to stagnant growth, with the low-hanging fruit of big technological innovations, such as the steam engine, all picked.

Another factor keeping wage growth depressed is labor’s declining share of income, the Fed authors note. While it’s been on the downtrend for years, “the evolution of the technology used to produce goods and services, increased globalization and trade openness, and developments in labor market institutions and policies” have exacerbated it since 2000, likely holding down wage growth, they wrote. The faster decrease since then has shaved 0.4 percentage point each year from average real wage growth, compared to the period before 2000.

Read more …

“..only savings from current production and income generate additional primary capital that can foster future wealth.”

• The Fed’s Calamitous Corruption Of Corporate Finance (David Stockman)

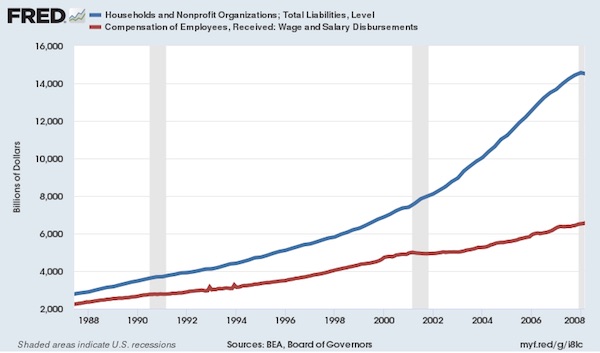

Central bank financial repression results in the systematic and severe mispricing of financial assets. And that has sweeping consequences far beyond the munificent windfalls it bestows on the thin slice of mankind that frequents the casinos of Wall Street, London, Tokyo and Shanghai. The fact is, the prices of money, debt, equity, traded commodities and all their derivatives comprise a vast and instantaneous signaling system that cascades through every nook and cranny of the real economy. When these signals are systematically falsified by a few dozen central bankers they cause hundreds of millions of ordinary businessmen, workers, investors and entrepreneurs to alter their economic calculus. And not in a good way. False signals lead to mistakes, excesses, losses and waste.

They ultimately reduce economic efficiency and productivity and lower the rate of economic growth and real wealth gains. Since the Greenspan age of financial repression incepted in the late 1980s, for example, the returns to savings have been obliterated while the rewards for speculation have soared. That’s important because only savings from current production and income generate additional primary capital that can foster future wealth. By contrast, leveraged speculation merely causes existing financial assets to be re-priced and a temporary redistribution of paper wealth from the cautious to the gamblers. In an honest free market, in fact, there is no excess return to leveraged speculation at all.

Natural market makers arbitrage out the spread between the costs of carry and the returns to carried assets such as long-dated futures contracts, term debt and various and sundry forms of equity and other risk assets. A relative handful of market makers can make a decent living arbing an honest market, but the mass of investors can not speculate their way to wealth. The latter can happen only when the central bank has its big fat thumb on the financial scales, pressing the cost of carry – that is, leveraged financial gambling – toward the zero bound.

Read more …

Dumbest piece so far this year? Then again, competition is fierce.

• U.S. Consumers Will Open Their Wallets Soon Enough (Bloomberg)

People are constantly exhorted to save, but as soon as they do, economists pop up to complain they aren’t spending enough to keep the economy growing. A new blogger named Ben Bernanke wrote on April 1 that there’s still a “global savings glut.” Two days later the Bureau of Labor Statistics announced the weakest job growth since 2013, which economists quickly attributed to soft consumer spending. The U.S. personal savings rate—5.8% in February—is the highest since 2012. “After years of spending as if there were no tomorrow, consumers are now saving like there is a tomorrow,” Richard Moody, chief economist at Regions Financial, wrote to clients in March. Saving too much really can be a problem when spending is weak.

There are only two things you can do with a dollar, after all: spend it or save it. If you spend it, great—that’s money in someone else’s pocket. If you save it, the financial system is supposed to recycle your dollar into productive investment with loans for new houses, factories, software, and research and development. But if no one’s in the mood to invest more and interest rates are already as low as they can go (as they are in much of the world), the compulsion to save can sap demand and throw people out of work. For the U.S. economy, the good news is that the jump in the personal savings rate is probably no more than a blip. Three economists from Deutsche Bank Securities in New York explained why in a March 25 report called U.S. Consumers: Still Shopping, Not Dropping.

While noting a “deceleration” in consumer spending, they wrote, “we think that concerns about the outlook for the consumer are overstated.” Their model of the U.S. economy predicts the savings rate will fall to 3% to 3.5% by 2017. Other economists have also concluded that the spending dropoff is temporary, which is why the slowdown in job growth, to just 126,000 in March, didn’t set off many alarm bells. “Consumer spending is starting to look more and more like a coiled spring,” says Guy Berger, U.S. economist at RBS Securities. One sign that consumers aren’t retrenching: On April 7 the Federal Reserve reported that consumer credit rose $15.5 billion in February, in line with the recent past.

Read more …

And yet, still persisting in that 7% growth prediction?

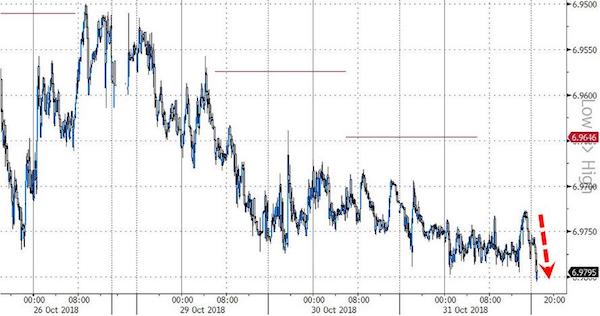

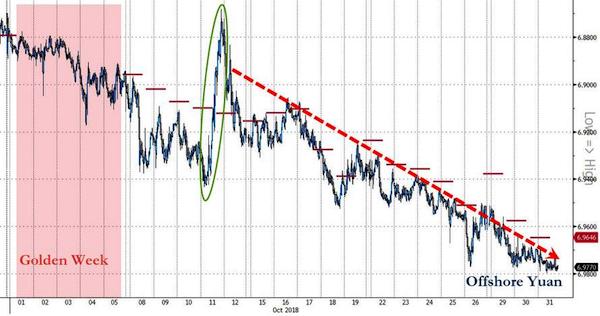

• We Traveled Across China and Returned Terrified for the Economy (Bloomberg)

China’s steel and metals markets, a barometer of the world’s second-biggest economy, are “a lot worse than you think,” according to a Bloomberg Intelligence analyst who just completed a tour of the country. What he saw: idle cranes, empty construction sites and half-finished, abandoned buildings in several cities. Conversations with executives reinforced the “gloomy” outlook. “China’s metals demand is plummeting,” wrote Kenneth Hoffman, the metals analyst who spent a week traveling across the country, meeting with executives, traders, industry groups and analysts. “Demand is rapidly deteriorating as the government slows its infrastructure building and transforms into a consumer economy.”

The China Steel Profitability Index compiled by Bloomberg Intelligence barely rose in March, a time after the annual Lunar New Year when demand would usually surge, and so far this month has resumed its decline. Steel use this year is down 3.4%, after slumping as much as 4% in 2014, according to BI. It had steadily risen for more than a decade. Prices for commodities from iron ore to coal are sinking as China’s leadership tries to steer the economy away from debt-fueled property investment and smokestack industries, embracing services and domestic-led consumption. At the same time, President Xi Jinping is stepping up efforts to combat pollution, further squeezing industry. Deteriorating economic data has led traders and analysts to speculate that China’s central bank will act to revive growth.

The bank has said it will keep an “appropriate balance between loosening and tightening” of interest rates. It has cut interest rates twice since November and lowered lenders’ reserve-requirement ratios once. Economists are forecasting 7% growth in China for this year, in line with government targets and down from 7.4% in 2014, according to the median of 59 estimates compiled by Bloomberg. That’s about half the last decade’s peak rate of 14.2% in 2007. The slowing steel and metals activity suggests the outlook could be grimmer. “There is a big fear this is going to get worse before it gets better,” Hoffman said in an interview. “It’s as bad as the data looks, if not worse.”

Read more …

She sounds like The Automatic Earth: “..liquidity can evaporate quickly if everyone rushes for the exit at the same time..”

• Lagarde Warns of ‘Bumpy Ride’ as Fed Prepares for Rates Liftoff (Bloomberg)

IMF Managing Director Christine Lagarde says the world could be in for a “bumpy ride” when the Federal Reserve starts raising interest rates, with overpriced markets and emerging economies likely to take the biggest hits. While risks to the global economy have decreased over the last six months, threats to the world’s financial system have actually risen, Lagarde said on Thursday ahead of next week’s spring meetings of the IMF and World Bank in Washington. A long period of low interest rates in the U.S. and other advanced economies has fostered a higher risk tolerance among investors, “which can lead to overpricing” and could pose “solvency challenges” for life insurers and defined-benefit pension fund, she said.

Lagarde, 59, warned that “liquidity can evaporate quickly if everyone rushes for the exit at the same time – which could, for example, make for a bumpy ride when the Federal Reserve begins to raise short-term rates,” she said the text of a speech at the Atlantic Council in Washington. The turbulence could be especially rough for commodity-exporting emerging economies, which may find themselves caught between falling prices for their goods and a stronger dollar, which increases the burden of dollar-dominated debt, she said. Lagarde’s warning comes as Fed policy makers led by Chair Janet Yellen consider when to raise their benchmark lending rate amid a strengthening labor market, which has pushed U.S. unemployment to the lowest level since May 2008.

The dollar has appreciated 19% over the last year as the U.S. economy has strengthened. The risk is that a surging greenback and higher interest rates will make it harder to service U.S.-denominated debt held outside the country by non-bank borrowers. This debt is estimated at $9 trillion by the Bank for International Settlements. Lagarde urged policy makers to take steps to ensure that markets have enough liquidity, improve prudential policies for non-banks, and follow through on regulatory reforms such as shielding “too-big-to-fail” institutions.

Read more …

This is repeated all across the nation, if not the entire world.

• Wall Street Fees Wipe Out $2.5 Billion in New York City Pension Gains (NY Times)

The Lenape tribe got a better deal on the sale of Manhattan island than New York City’s pension funds have been getting from Wall Street, according to a new analysis by the city comptroller’s office. The analysis concluded that, over the past 10 years, the five pension funds have paid more than $2 billion in fees to money managers and have received virtually nothing in return, Comptroller Scott M. Stringer said in an interview on Wednesday. “We asked a simple question: Are we getting value for the fees we’re paying to Wall Street?” Mr. Stringer said. “The answer, based on this 10-year analysis, is no.” Until now, Mr. Stringer said, the pension funds have reported the performance of many of their investments before taking the fees paid to money managers into account.

After factoring in those fees, his staff found that they had dragged the overall returns $2.5 billion below expectations over the last 10 years. “When you do the math on what we pay Wall Street to actively manage our funds, it’s shocking to realize that fees have not only wiped out any benefit to the funds, but have in fact cost taxpayers billions of dollars in lost returns,” Mr. Stringer said. Why the trustees of the funds — Mr. Stringer included — would not have performed those calculations in the past is not clear. Mr. Stringer, who was a trustee of one of the funds when he was Manhattan borough president before being elected comptroller, said the returns on investments in publicly traded assets, mostly stocks and bonds, have traditionally been reported without taking fees into account.

The fees have been disclosed only in footnotes to the funds’ quarterly statements, he said. The stakes in this arena are huge. The city’s pension system is the fourth largest in the country, with total assets of nearly $160 billion. It holds retirement funds for about 715,000 city employees, including teachers, police officers and firefighters. Most of the funds’ money – more than 80% – is invested in plain vanilla assets like domestic and foreign stocks and bonds. The managers of those “public asset classes” are usually paid based on the amount of money they manage, not the returns they achieve. Over the last 10 years, the return on those “public asset classes” has surpassed expectations by more than $2 billion, according to the comptroller’s analysis. But nearly all of that extra gain — about 97% — has been eaten up by management fees, leaving just $40 million for the retirees, it found.

Read more …

Solid read.

• China Seeks Dominance in Athens Harbor (Spiegel)

One could argue that China’s long path to Piraeus, Greece, began on April 27, 1961. It’s the day Mao Zedong founded the communist state’s first freight company, the China Ocean Shipping Company (COSCO). The Great Leap Forward, Mao’s plan for industrialization, had proven to be a disaster at the time, leaving millions dead or starving. With Cosco, China had its eyes on overseas markets. Almost 54 years later, the company is steering toward a major prize in Greece. After lengthy wavering, the Greek government – comprised of Prime Minister Alexis Tsipras, his far-left Syriza party and the right-wing populist Independent Greeks – has announced it will be selling the majority of its share in Athens’ Piraeus Port Authority. So far, Cosco is the most promising bidder.

Throughout, Fu Cheng Qui, or “Captain Fu,” as the chief executive of Cosco’s Piraeus subsidiary is called by those who know him, will be closely monitoring the bidding process. Fu has already been in Piraeus for a long time with the company, and he is determined to stay. He has placed the bid on behalf of his company and has little doubt it will be accepted. In his position, 65-year-old Fu is the guardian of China’s gateway to Europe. He may soon control the container piers, cruise-ship terminals and ferry quays of Greece’s biggest port. “The government has changed four times since I have been in Greece,” Fu says. “They all always talk a lot. But what counts? Actions count. Actions! Only actions!”

On the way to the cargo port, a small sign indicates a fork in the road – with one route leading to OLP and the other to PCT. Each to a different world. Pier I belongs to the primarily Greek state-owned OLP port authority. These days, though, most trucks take the other route, to PCT, to pier II and pier III, which is run by Piraeus Container Terminal, a subsidiary of Cosco. “Just look,” Fu says as he steps up to the window. Then the show begins. On Pier II, 11 container gantry cranes are in constant, powerful movement. All are new and made in China. Trucks move across the ground at an interval of only minutes.

Read more …

“.. we are prepared to make all sorts of compromises, we are not prepared to be compromised.”

• Varoufakis: The Three Critical Elements of a Good Deal for Greece (Bloomberg)

In an interview with Bloomberg TV at the Institute for New Economic Thinking earlier today, Greek Finance Minister Yanis Varoufakis said he is confident that an agreement will be reached later this month. He identified three pre-conditions for such a deal.

• “Prioritize deep reforms that will deal with the malignancy of the Greek social economy, of the Greek state.”

• “Deal with the ill effects of a five-year catastrophic recession.”

• “A resolution of long term, sustainable fiscal plan that involves three elements. One has to do with appropriate primary surpluses, so we need primary surplus. We never are going to fall back into primary deficits again, but at the same time this should not be excessive because it will crush the private sector. We need a sensible policy for crowding in private investment and that must involve a package of public investment..from some kind of European authority or institution that will help with the process of crowding in private investment..and a rationalization on the different slices of the Greek debt without any haircuts for anyone but in a way that maximizes the amount of value that our creditors will get back from the Greek state.”

He ended the interview by saying that compromises are to be expected, but he is not ready to be compromised. “We wouldn’t be fit for the purpose if we were not prepared to take the political costs which are necessary to stabilize Greece and lead it to growth, but let me be very precise on this, we are prepared to make all sorts of compromises, we are not prepared to be compromised.”

Read more …

“We should be very clear: our bailout fallout needs to be dealt with in the European family..”

• Varoufakis Says Greece Not Looking to Russia to Fix Debt Crisis (Bloomberg)

Greek Finance Minister Yanis Varoufakis said his country isn’t looking outside Europe to resolve its financial crisis, adding that he’s confident of reaching an agreement with European partners this month. Asked about a meeting between Prime Minster Alexis Tsipras and Russian President Vladimir Putin Wednesday, Varoufakis denied any links with talks Greece is holding with euro-area governments that are the country’s creditors. “We should be very clear: our bailout fallout needs to be dealt with in the European family,” Varoufakis said in an interview with Bloomberg Television in Paris. “This government is not seeking an extra-European solution to a European problem.”

Greece, Europe’s most-indebted state, is negotiating with euro-area countries and the IMF on the terms of its €240 billion rescue. The standoff, which has left Greece dependent upon ECB loans, risks leading to a default within weeks and the country’s potential exit from the euro area. The ECB approved a €1.2 billion increase in the emergency funds available to Greek lenders Thursday, a person familiar with the decision said. The Governing Council raised the cap on Emergency Liquidity Assistance provided by the Bank of Greece to €73.2 billion in a telephone conference, said the person who asked not to be named because the decision is confidential.

Greek officials said this week they are targeting an April 24 meeting of euro-area finance ministers as a deadline for approving new money. A looming cash crunch in the summer, when the ECB needs to be repaid, means a new bailout deal will be needed before then.

“I am very confident,” Varoufakis said, when asked about the talks. “The negotiations are proceeding quite well. It is in our mutual interest to strike a deal by the 24th and I’m sure we will.”

Read more …

With all the next payments coming up, it’s more interesting to wonder where the money WILL come from.

• Greece Met Its Latest Debt Payment, But Where Did The Money Come From? (Ind.)

Greece met a loan payment of €459 million to the IMF on Thursday, according to reports, as the EU discusses whether the country has reformed enough to merit a further cash injection. “The payment order has been given,” a finance ministry source told AFP. But no one is quite sure where the money came from – a consequence of the opaque Greek finance system. There are few trained accountants in the country and they do not adhere to international accounting standards, so records are thin and many citizens do not pay tax. Poor accounting standards are blamed by some for the uncertain numbers that have come out of Greece regarding the country’s debt.

Athens is aware of the tax problem. It promised to hire tourists and cleaners as part time tax inspectors in a recent round of reforms drawn up to meet EU criteria for further cash. The latest IMF payment was ordered at the same time as Greek Prime Minister Alex Tsipras met Putin in Moscow to discuss co-operation between the two orthodox Catholic nations. While both parties denied that Greece had financial aid had been requested, the two sides are said to have talked about extending a Turkish natural gas pipeline through Greece and relief from Russian sanctions on European food produce. Russian investment in key Greek infrastructure, including the port of Thessaloniki, is also in discussion.

Greek finance minister Yanis Varoufakis said during a visit to Washington this week that Greece would meet the April 9 payment and every other until the debts are cleared. He still has some way to go – next month, Athens owes a further €950 million to the IMF. Over €2 billion euros in six- and three-month treasury bills are also due to mature on April 14 and 17 – though they should roll on to the next maturity without incurring further cost. This week Athens raised another €1.14 billion in six-month Treasury bills and announced a further sale of €625 million next week. The country is dependent on such short terms bonds to raise cash, but the takers are mostly domestic investors because Greece is shut out of international debt markets.

Read more …

Bit dull perhaps, but potentially powerful.

• The Changes To Russia’s Business Environment That Flew Below The Radar (Forbes)

Companies doing business in Russia have been on a roller coaster ride for the last year. The combination of Western sanctions, a weakened currency and continued geopolitical uncertainty have threatened even the most robust of balance sheets. Yet amid these headline-grabbing harbingers of new challenges in Russia’s business environment, one seems to have gone largely overlooked: last September, Russian lawmakers passed unprecedented changes to their country’s corporate legislation. The aim was to update business legal frameworks and to extend additional protections to minority corporate stakeholders, but it remains uncertain whether the law will have the desired effect. The sweeping changes generally affect the rules for how companies and their stakeholders interact. They also overhaul the different classes of legal entities that are permitted to do business. Some highlights:

• All Russian legal entities are reclassified. Previously, entities were conceptually seen as either for-profit and “commercial” or “non-commercial,” today all organizations are split between the “unitary” and “corporate” categories. A “unitary” organization’s founder does not directly participate in the business’s affairs or ownership, while the founder of a “corporate” entity retains the right to remain a shareholder or manager.

• The rules for joint stock companies have changed. Companies were previously classified as open or closed, according to whether new shareholders could legally enter the company’s ownership structure. Now they are classified as public or non-public. The option to publicly trade their securities or shares distinguishes the former, who must accordingly include the word “public” in their name. All other corporation types, including the non-trading joint stock companies, are non-public by default and face no need to alter their names. Notably, the obsolescent open and closed joint stock companies do not have to reclassify themselves by the new guidelines until they have to alter their charter documents, but must comply with the new rules regardless.

Read more …

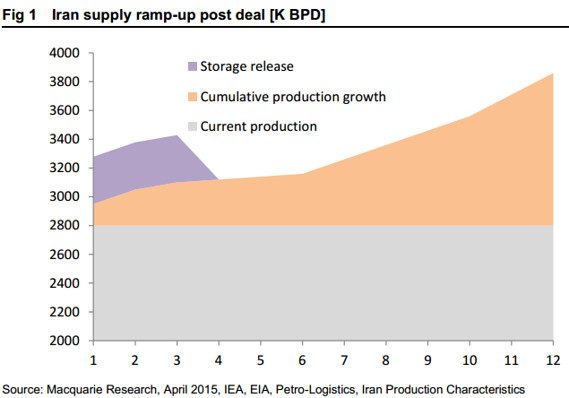

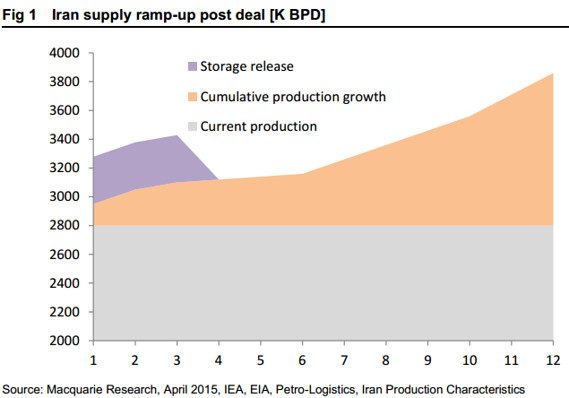

“.. Iran would be able to grow production and exports by 300,000 to 400,000 barrels a day within weeks of a final deal.”

• Here’s How Iran Could Prevent A Rebound In Oil Prices (MarketWatch)

Investors looking for a bottom in oil prices argue that a deal to curb Iran’s nuclear program and ease sanctions against the country won’t flood the market with more unwanted crude. But one analyst thinks Iran’s return to the market would continue to keep a lid on prices. Oil futures plunged Wednesday as U.S. crude inventories rose yet again. But oil had rallied earlier this week on ideas that fears Iran would soon be able to dump more supply on the market had been overdone. After all, a final deal isn’t due until June 30—and that deadline could easily slip. Moreover, Iran’s degraded infrastructure is likely to keep a lid on production even if a deal is struck, analysts said.

Of course, the likelihood of a deal remains up for debate. Iran’s supreme leader declared Thursday that there was no guarantee of a final agreement, saying world powers couldn’t be trusted to negotiate in good faith. Vikas Dwivedi, a Houston-based oil and gas strategist at Macquarie Capital, sounds far from convinced that a return to the market by Iran would be taken in stride. Making a pun on a 1982 New Wave hit, Dwivedi wrote a note this week entitled “Iran Not So Far Away, Dwivedi argues that Iran would be able to ramp up production significantly in the weeks after the final approval of a deal. But the real pressure, he says, might come from how Arab Gulf producers respond.

Dwivedi says Iran would be able to grow production and exports by 300,000 to 400,000 barrels a day within weeks of a final deal, but that the need for substantial capital upgrades to Iran’s reservoirs means it would take another six to nine months to ramp up production by the 1 million barrels a day needed to recapture the level of output seen before the sanctions.. Meanwhile, Arab Gulf members of OPEC would probably prove themselves unwilling to cede market share to accommodate rising Iranian output, Dwivedi writes. That means OPEC 2015 production could reach 32 million barrels a day or higher versus a previous call of 28.2 million, Dwivedi said. OPEC supply rose to 30.63 million barrels a day in March, according to a Reuters survey.

Read more …

“To make it pay, Shell really needs the oil price to move up to $90, and quickly.”

• Shell Shareholders Less Than Impressed With $70 Billion Bid For BG (Ind.)

The City is slathering with excitement at Shell’s £47bn bid for BG group. Its shareholders are less than impressed. The problem for them is that the price represents a 50 per cent premium to where BG shares languished prior to the deal’s announcement. To make it pay, Shell really needs the oil price to move up to $90, and quickly. The question its investors have to ask themselves is whether Shell could pick up something like BG’s portfolio, the opportunity it represents and the earnings stream it generates, with its existing assets and resources. Even if they think it can, and such an outcome won’t be quick, they still have to ask if they’d be happy for someone else to have BG, the profits of which will at least help to power the generous dividend Shell pays them. A dividend that represents a welter burden to their company.

What is certain is that this will not be the last mega-deal to be done in the energy sector, as its giants seek cheaper alternatives to risking cash they’re not earning on exploration. It likely won’t be the biggest either. BG’s most likely suitor was long rumoured to be Exxon, the American giant, which represents the most likely threat to this deal’s completion. But Exxon may have it’s eyes cast in the direction of an even bigger B in the form of BP. BG’s drift had become sufficiently aimless that its board felt the need to risk shareholders ire by offering an appalling £25m with nary a condition attached to lure Helge Lund from Norway’s Statoil. He’s now going to sail off into the sunset in a boat filled with cash.

BP’s board might wish it had only that to worry about. For the US lawyers ranged against it, the Deepwater Horizon disaster is the gift that keeps on giving. The company is more than half owned by Americans, it is run by one (Bob Dudley), and it has substantial operations in the country. But they still insist on referring to it as “British” Petroleum across the Atlantic. The logic of putting it formally into American hands via the mega-deal to end all mega-deals with Exxon is that it could take an awful lot of feet from off its neck.

Read more …

Let me guess: what’s that plan? Make the people pay?

• Ukraine Creditor Group Has Plan to Avoid Writedown in Debt Talks (Bloomberg)

Five creditors that own about $10 billion of Ukraine’s bonds are working on a debt-restructuring deal that won’t involve a reduction to their principal holdings as the government seeks to change the terms of its external debt. The committee is working on a plan that “provides Ukraine with the necessary financial liquidity support,” the group said in a statement released by Blackstone. Franklin Templeton, Ukraine’s biggest bondholder with about $7 billion of the nation’s debt, hired Blackstone to represent the creditor group in mid-March, according to Blackstone. Ukraine needs to reach an agreement with creditors by the end of May to save $15.3 billion over four years as a condition for receiving the next tranche of a $17.5 billion IMF loan.

“For sure, the creditors will try to achieve” a deal with no principal reduction, “but realistically it is not viable,” Michael Ganske at Rogge in London, said. “Ukraine’s debt-to-GDP is much too high and the economy is shrinking.” Public-sector debt is set to rise to 94% of gross domestic product this year, according to the IMF, after a yearlong conflict with pro-Russian separatists in the nation’s east crippled its economy. Output shrank 7 to 10% in the first quarter, Finance Minister Natalie Jaresko said on March 24. The country is seeking to restructure at least $21.7 billion, data compiled by Bloomberg News. A price of about 40 cents signals creditors will face writedowns to their principal holdings of about 20%, Bank of America said in March.

Read more …

Think I’ll keep my New Zealand theme going for a bit.

• Homeowners In Auckland’s Fringe Saving Up To $50,000 A Year (NZ Herald)

Buying a house on the city’s outskirts can save Aucklanders up to $50,000 each year in mortgage repayments, despite the added commuting costs, new figures reveal. The research, carried out by real estate firm Bayleys, factored in the cost of mortgage repayments as well as the cost of travel from the respective areas. Lower house prices in outlying suburbs – like Papakura, New Lynn, Sunnyvale and Manukau – meant even with transport costs homeowners were still paying significantly less than those in city-fringe suburbs. Bayleys calculated the first-year mortgage repayment costs for different suburbs based on median house prices from the Real Estate Institute of New Zealand (REINZ) and the ANZ variable rate of 6.74%.

It found the annual cost of servicing a mortgage for a median priced Orakei or Remuera home ($1.35 million) was $84,060 in the first year. In Pukekohe, where the median price of a home is $500,000, the annual mortgage repayment in the first year would be $31,128. Even factoring in the $4032 annual cost of commuting from Pukekohe to the CBD by train on the At Hop card system – as well as the $768 public transport cost from Orakei to the city – living in the southern suburb was about $50,000 cheaper. Bayleys Research manager Ian Little said even if a Pukekohe resident commuted by car and chose to park in the central city, it was still cheaper.

Read more …

Elected on a promise, and then back out with feeble excuses? Tar and feathers!

• New Zealand Unlikely to Deliver on 2015 Budget Surplus Promise (Bloomberg)

New Zealand’s government is unlikely to return its budget to surplus this year as it promised ahead of an election in 2014, Finance Minister Bill English said. “Lower inflation, while good for consumers, is making it less likely that the final accounts in October will show a surplus for the whole year,” English said in a statement Friday. The budget showed a NZ$269 million ($203 million) deficit in the eight months ended Feb. 28, the Treasury Department said earlier Friday. Prime Minister John Key won a third term last year, campaigning on his economic management and pledging to post the nation’s first budget surplus in seven years in the 12 months ending June 30, 2015.

In May last year, English projected a surplus of NZ$372 million for 2014-15. The Treasury in December said low inflation, which curbs nominal economic growth and tax revenue, suggested the budget would remain in deficit. English, who delivers his next annual budget May 21, previously said that the Treasury forecasts may be proved wrong by the time the full-year financial statements are prepared in October. Consumer prices rose 0.8% in the fourth quarter from a year earlier and were down 0.2% from the prior three-month period – the first quarterly decline in three years. The central bank last month forecast annual inflation would fall to zero in the first quarter.

Read more …

Only possible with more nukes.

• Japan To Pledge 20% CO2 Cut (Guardian)

Japan will promise to cut its greenhouse gas emissions by 20% from 2013 levels ahead of a global summit on climate change this year, a report said Thursday, despite uncertainty over post-Fukushima energy policy. The government will likely announce the new target at the G7 summit in June in Germany, the leading business daily Nikkei reported, citing unnamed government sources. In a separate report, Kyodo News said Tokyo will set a target of cutting gas emissions “by at least 20% by 2030, from 2005 levels.” Japan is one of the few leading polluters that has not yet declared a target on emission cuts, as the world works towards a new framework for combating climate change, to be finalised at December’s COP 21 gathering in Paris.

A total of 33 countries – including the no.2 emitter the United States, the no.3 emitter the European Union, and Russia, ranked fifth – submitted their reduction goals to the UN secretariat by the end of last month. The US has pledged to reduce greenhouse gas emissions by 26-28% over 2005 levels within the next decade, while the EU said it will cut its pollution by 40% by 2030 from 1990 levels. Russia said it could drive down emissions by up to 30% compared to 1990 levels, subject to conditions. In earlier rounds of climate talks, Tokyo pledged it would reduce its greenhouse gas output by 25% by 2020 from 1990 levels. But that target was slashed to a 3.8% cut from 2005 levels in the aftermath of the 2011 Fukushima nuclear disaster, which led to idling of the country’s entire nuclear stable.

Read more …

Finally US media are catching up to this story?

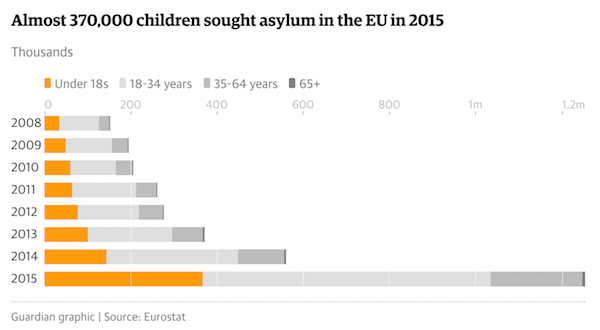

• Dying at Europe’s Doorstep (Bloomberg)

For people who court danger in foreign lands, Chris Catrambone is a good guy to know. Originally from Louisiana, he made his first $10 million before age 30 investigating insurance claims and lining up medical care for injured workers in some of the world’s most violent places, especially contractors of U.S.-owned companies operating in Iraq and Afghanistan. In 2008, at 27, he moved his two-year-old multinational company, the Tangiers Group, to Malta, the island nation in the central Mediterranean that’s been vital to various empires for more than two millennia, and where moorings are as common as parking spots. Tangiers Group’s portfolio includes travel insurance, up-to-date CIA World Factbook-type reports on emerging markets, and hospitalization and evacuations for expats.

In the summer of 2013, with his wife, Regina, and stepdaughter, Maria Luisa, Catrambone chartered a yacht for a trip to the coast of Tunisia with a stop on the Italian island of Lampedusa, a popular vacation spot. It’s also a landing point used by migrants trying to enter Europe illegally. As the Catrambones left the harbor, Regina spotted a parka floating on the waves. It struck her as incongruous—a winter coat being carried by the warm tide—and she asked their captain about it. He replied that it had almost certainly belonged to one of the thousands who’ve attempted a water crossing to Lampedusa from Libya in inflatable dinghies—one who didn’t make it. “Lampedusa has a beach called Rabbit Beach, and every year it’s rated as one of the top beaches in the world, so of course we wanted to visit it,” Chris says.

“But then we learned that there are bodies of refugees literally washing ashore on this most beautiful beach. So what, you’re going to have a nice swim in the same water where these people are dying? Is that right?” That afternoon, and well into the night, he and Regina discussed what Pope Francis, on his first visit outside the Vatican, had described as “the globalization of indifference” to the plight of refugees at sea. “Papa Francesco said that everyone that could help, should do it, [and] with his own skills,” says Regina, who speaks English as well as her native Italian. “So we start to think, what are our capabilities? We have a good background in helping people in trouble.”

Read more …