Jack Delano Atchison, Topeka and Santa Fe, Sibley, Missouri 1943

From junk bonds to junk loans.

• Bank Earnings Get Mauled by “Leveraged Loan” Time Bomb (WS)

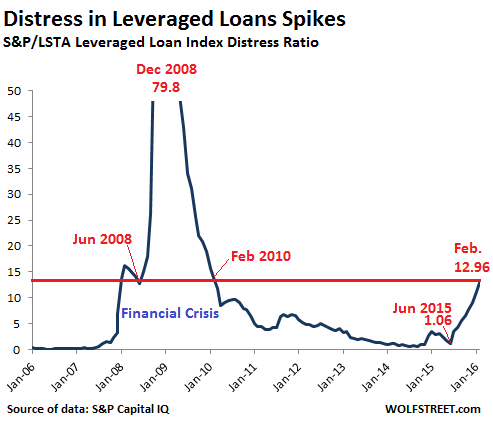

Banks have a few, let’s say, issues, among them: a source of big-fat investment banking fees is collapsing before their very eyes. S&P Capital IQ reported today that there was an improvement in the “distress ratio” of junk bonds, after nearly a year of brutal deterioration that had pushed it beyond where it had been right after Lehman’s bankruptcy. The recent surge in oil prices seems to have lifted all boats for a brief period. But not “leveraged loans.” Their distress ratio spiked to the highest levels since the Financial Crisis! Leveraged loans are the loan-equivalent to junk bonds. They’re issued by junk-rated companies to fund M&A, special dividends to the private equity firms that own the companies, or other “general corporate purposes.” They form an $800-billion market and trade like securities.

But the SEC, which regulates securities, considers them “loans” and doesn’t regulate them. No one regulates them. This gives banks a lot of leeway. But they’re too risky for banks to keep on their balance sheet. Instead, they sell them to loan mutual funds or ETFs, or they slice and dice them and repackage them into Collateralized Loan Obligations (CLO) to sell them to institutional investors, such as mutual-fund companies. Regulators have been exhorting banks to back off. Banks can get stuck with them when markets get woozy just when the loans blow up, as they did during the Financial Crisis – or as they’re doing right now…. The S&P/LSTA Leveraged Loan Index Distress Ratio for February spiked to 12.96 from 11.13 in January, from 9.07 in December, from 7.77 in November… from 1.06 just last June!

It was the highest level since February 2010, when distress was on the way down from the Financial Crisis. It’s where it had been in June 2008, when distress was blowing out as the Financial Crisis was cracking the slick veneer of the banks. Lehman went bankrupt in September 2008. By December, the distress ratio had reached a catastrophic 79.8. This chart, based on data from S&P Capital IQ, shows that before the Financial Crisis, as the bubble was reaching its final stages, the distress ratio was near zero! This happened again in 2014. Even in 2015, leveraged loans held up well, as junk bonds were already falling apart. The happy times lasted till July, when the distress ratio began to spike relentlessly:

Extend and pretend.

• Former Stock Darlings Japan, Europe Rebuked as Stimulus Gets Costly (BBG)

Japan and Europe, former darlings of stock investors, are now bottom of the heap. The Topix index lost 13% from the start of the year through last week and foreign investors have yanked $10.7 billion out of Japanese equities. The world’s worst-performing developed markets are found in Tokyo and across Europe, where a regional benchmark gauge lost 6.8% and strategists expect shares to tread water for the rest of 2016. For Tatsushi Maeno at Pinebridge Investments Japan, it’s no coincidence that those are the two regions where central banks have established negative interest rates. “The feeling is that we can’t ride our hopes on the monetary easing policies of the European Central Bank and the Bank of Japan any more,” Maeno said.

“They want to continue with negative interest rates, but there’s push back. They want additional easing, but we’re beginning to see the limits to that too.” As company profits decline and the yen and euro strengthen, investors are questioning the effectiveness of the stimulus that’s underpinned Japanese and European equities since 2012. In contrast, the easing is working elsewhere around the world, including emerging markets where equities are staging a 20% rally and as shares in the U.S. have erased losses for the year. The moves so far this year are a stark reversal of 2015’s investment trends, which saw shares in Japan and Europe rise 9.9% and 6.8%, respectively, while global equities fell 4.3% and emerging markets tumbled 17%. Bank of America’s monthly survey of fund managers consistently showed Europe and Japan as one of the most preferred markets throughout last year.

The latest example of diverging reactions to stimulus was on display this month, when the ECB’s decision to cut all three key rates and boost bond buying did little to spur a strong rebound. In Japan, Bank of Japan Governor Haruhiko Kuroda’s suggestion on Wednesday that he could cut interest rates to as low as 0.5% sent the nation’s banks and insurers tumbling, which weighed on the overall market. “Equities cannot really rally on monetary stimulus anymore,” Stephen Jen of SLJ Macro Partners and a former IMF economist, wrote in an e-mail. “As long as the earnings outlook continue to deteriorate, the basis for additional multiples expansion is not compelling.”

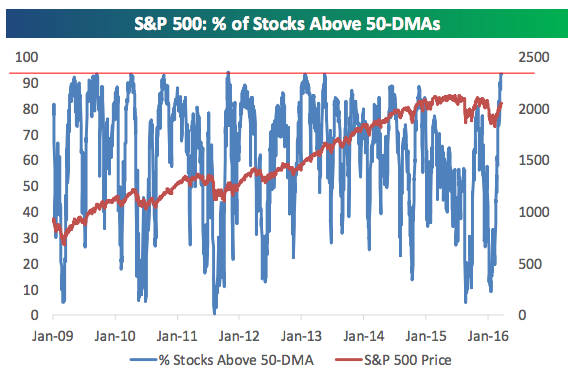

“..the S&P 500 has reached its most overbought position since 2009..”

• Technical Analysts Warn This Stock Rally Is Not Going to Last (BBG)

U.S. stocks are up a stunning 12% from their February depths, yet plenty of doubts persist about the strength of the recent rally. Some have attributed the recent increase to a need by investors to buy equities to cover so-called short positions. Others have warned that corporate buybacks have pushed the market to unsustainable price levels. Meanwhile, technical analysts who look at charts to divine the direction of stocks have joined the doubters; some are urging clients to proceed with caution when it comes to U.S. equities. Analysts at Bespoke Investment Group noted that while the latest rally has pushed more than 93% of stocks in the S&P 500-stock index above their 50-day moving averages—which smooths out price moves over the past 50 days—there may yet be cause for concern.

The strongest moving average reading since the start of the bull market in 2009 is not necessarily a bullish sign for markets, they warned, as it could indicate that stocks have surged past fair value. “In the coming weeks we expect this breadth measure to cool off a bit as the market works off extreme overbought measures. If you’ve been waiting to buy and haven’t yet, it’s best to wait for a pullback at this point,” Bespoke analysts wrote in a note. Still, Bespoke is far from bearish. The research firm points out that greater breadth is positive for the market’s strength over a longer-term time frame. “Strong breadth is a sign that all stocks are participating instead of just a few,” the team said. “This action is the complete opposite of the weak breadth we saw in the early part of last year when the S&P 500 was making new highs but fewer stocks were doing the same. Eventually, we saw a significant correction later in the year.”

Technical Analysts at UBS AG seem far less optimistic. “With the rally of the last few weeks and looking at our daily trend work, the S&P 500 has reached its most overbought position since 2009!!” wrote analysts Michael Riesner and Marc Muller, with added grammatical emphasis. “We see the market vulnerable for a significant reversal this week, which we would see as the beginning of a tactical top building process and subsequent correction into deeper [second quarter]. We reiterate … [that we] would not chase the market on current elevated levels.” They recommend that investors sell now, rather than await further price increases.

Be afraid.

• London House Prices Rose Almost £500 A Day In January (Guardian)

London house prices increased by almost £500 a day in January, according to government figures that provide fresh evidence of a “two-speed” property market. The latest data from the Office for National Statistics (ONS) reveals that while London and the south-east are powering ahead with double-digit annual growth rates, the property markets in Wales, Scotland and Northern Ireland appear to have stuttered to a halt. Overall, the average price of a UK home had just under £4,000 added to its value during January, lifting the typical figure to £291,504. This is almost £40,000 higher than the figure of £251,935 recorded two years earlier, in January 2014. The average London house price hit a record £551,000, said the ONS. This was £15,000 up on December’s figure of £536,000 and translates into an increase of £484 a day.

Annual house price growth in the south-east, London and the east of England is running at 11.7%, 10.8% and 9.8% respectively. By contrast, prices fell in Wales over the same period – by 0.3% – and notched up rises of just 0.1% in Scotland, 0.8% in Northern Ireland and 0.9% in north-east England. The strong price growth in the south-east may reflect the fact that growing numbers of homeowners in the capital are cashing in on London’s turbo-charged performance and buying properties in commuter belt towns and cities. Jonathan Hopper, the managing director of Garrington Property Finders, said that “seldom has the gulf between Britain’s two-speed property market been so stark”. However, he added that it was likely that the numbers were given a boost by a last-minute “stamp duty stampede”, as buy-to-let investors rushed to complete purchases before April’s 3% hike in stamp duty.

You can’t taper a Ponzi.

• Property Bubble Ghost Haunts Central Bankers Trying to Boost Prices (BBG)

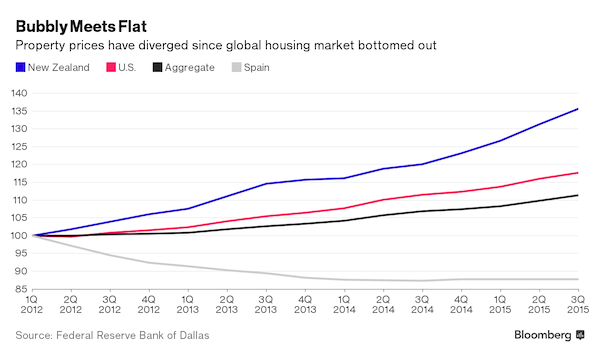

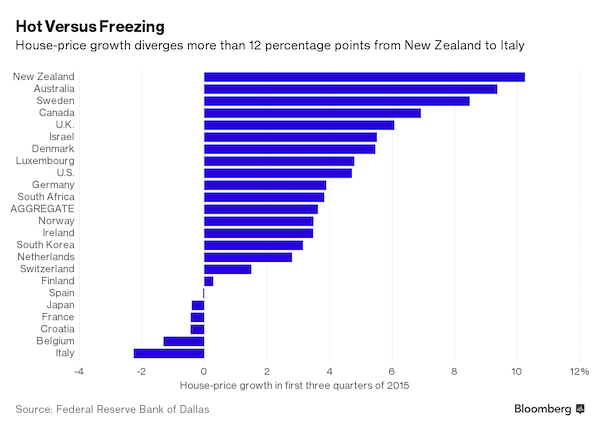

The property market is an animal almost every central banker is worried about and hardly anyone can control. As the Federal Reserve downshifts into go-slow mode while the ECB and other monetary authorities ease, expect to hear a lot of concern about property prices. Here’s the dilemma: How do you cut rates to goose too-low inflation and support growth without lighting a fuse under real estate? The U.S. is still feeling the consequences of a housing-market collapse that is widely blamed for triggering the Great Recession. The world’s largest economy stopped contracting in the second quarter of 2009, but house prices continued to fall over the next three years.

While property costs since then have risen at a faster annual pace than an aggregate of 23 countries tracked by the Dallas Fed, prices are still 3.8% below their peak. Since the global property market bottomed out at the start of 2012, house prices have risen most in New Zealand, Australia and South Africa. Increases of more than 30% in the three countries compare with an average gain of 11% in the sample. Prices are still declining in some of Europe’s largest economies. One exception is Germany, where property costs have surged more than 17% after prices slid for a decade and a half starting in the mid 1990s.

Central bankers want to see their low rates transmit into economic activity. Prices and transactions in real-estate markets can serve as indicators for buyers’ confidence in the economy, the strength of the labor market and spending prospects.

Too much froth in property markets can also be an obstacle to cutting rates further.

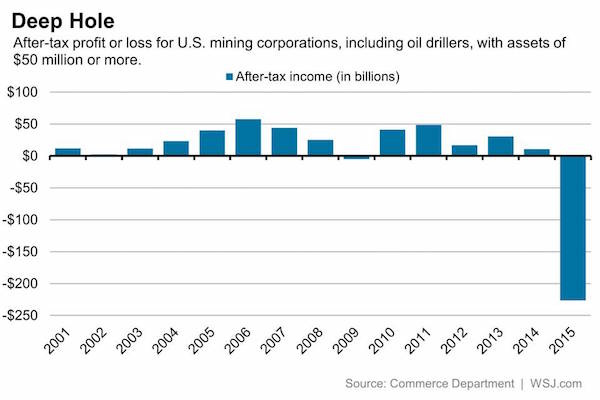

“..a collective $227 billion after-tax loss last year..”

• US Mining Losses Last Year Wipe Out Profits From Past Eight Years (WSJ)

The U.S. mining industry—a sector that includes oil drillers—lost more money last year than it made in the previous eight. Mining corporations with assets of $50 million or more recorded a collective $227 billion after-tax loss last year, according to Commerce Department data released Monday. That loss essentially wipes out all the profits the industry had made since 2007. A crash in oil prices last year caused significant losses for what had been an upstart domestic energy industry propelled by petroleum reserves accessed via fracking. Crude oil prices fell from above $100 a barrel in the middle of 2014 to less than $40 by the end of last year.

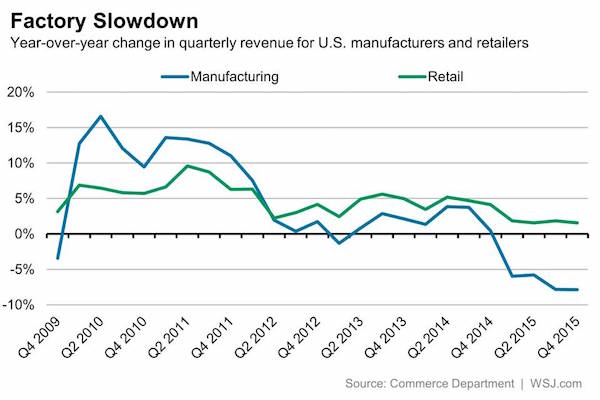

That meant many of those new wells were suddenly operating at a loss. What’s more, other types of mining operations were stung by falling commodity prices tied to weak demand from China and other parts of the globe. Mining revenues also fell sharply, down 38% in the fourth quarter from a year earlier. A faltering global economy also stung the manufacturing sector, though the industry remained profitable. The sector recorded a $510 billion annual profit, down from $609 billion in 2014. But manufacturing revenue declined 7.8% in the fourth quarter from a year earlier. Falling revenues suggest weaker global demand for U.S.-made goods. That’s likely a symptom of a stronger dollar making American products relatively more expensive overseas.

Not good. Too much debt to lay off workers. Or dispose of bad loans.

• Mounting Debts Derail China Plans To Cut Steel, Coal Glut (Reuters)

China’s campaign to slim down its bloated industries could be derailed by more than $1.5 trillion of debt in its steel, coal, cement and non-ferrous metal sectors, which threatens to overwhelm local banks. Tackling industrial overcapacity has become a priority for Beijing to make its slowing economy more efficient and address a supply glut that has hammered coal and steel prices. China is providing more than 100 billion yuan ($15 billion) in the next two years to handle layoffs from coal and steel, but that will only be made available once debts have been settled. Critics say there is no clear mechanism for tackling the debt burden, which will put huge strain on the weakest sections of the banking sector. The debt figures, revealed in papers submitted to China’s parliament this month, highlight the dilemma facing state firms grappling with surplus capacity and how difficult it will be to pull off this central plank of Beijing’s economic reform plans.

Costs for the estimated 1.3 million coal-sector layoffs alone are as much as 195 billion yuan, and coal industry delegates attending parliament urged government to provide more support to deal with the mounting debts of hundreds of stricken “zombie” firms. The four sectors targeted in the battle against overcapacity owe around 10.2 trillion yuan ($1.56 trillion), according to documents submitted to parliament by Wang Mingsheng, head of coal firm Huaibei Mining. China’s statistics bureau puts coal and steel debts alone at 8 trillion yuan, of which about a third is bank debt. If 20% of that were to go bad in 2016, which industry analysts say is not unrealistic, it would raise Chinese banks’ non-performing loans by nearly half. Bankers say city and regional banks set up by party or provincial government officials are most exposed, and that official NPLs, which already doubled last year, underestimate the scale of their problem lending.

“China needs to set up a new organization, a special bank just to take over these debts in order to avoid the local banks going bankrupt,” said steel industry consultant Xu Zhongbo. China’s banking regulator didn’t return a request for comment, though earlier in March sent notices to joint-stock banks and city commercial lenders to boost risk assessment and collateral valuations to control exposure to industries suffering overcapacity. A lawyer who handles steel industry non-performing loans for mid-sized Chinese banks said: “Banks’ fear is not without reason. The steel sector’s continued slump increases the difficulty of disposing of outstanding non-performing loans.”

It doesn’t matter what Beijing tries anymore, money will find a way to flow out.

• China May Adopt Tobin Tax on Short-Term Capital Flows (BBG)

China may impose a tax on currency trading to manage short-term cross-border capital flows as the U.S. Federal Reserve raises interest rates, the country’s foreign-exchange regulator said Tuesday. Interest rate hikes by the Fed will spur capital outflows and add pressure on yuan management, Wang Yungui, a director with the State Administration of Foreign Exchange’s General Affairs Department, told a news briefing in Beijing. A levy on trading is one of several tools under consideration to cope with the situation, Wang said. China’s central bank has drafted rules for a tax on foreign-exchange transactions that would help curb currency speculation, people with knowledge of the matter have said.

UBS has said a so-called Tobin tax would be a step back for China’s credibility on currency management, while Citi Private Bank said the proposal was “short-sighted” and would drive away foreign investors. Imposing a levy on foreign-exchange trading would be one of the most extreme steps yet by policy makers to prevent speculative bets against the Chinese currency, after state-run banks intervened repeatedly to prop up the yuan and the government intensified a crackdown on capital outflows. People’s Bank of China Deputy Governor Yi Gang said Saturday the tax is currently an academic subject. While SAFE last week said capital outflows have eased significantly, China is still grappling with economic data pointing to a deepening slowdown. Exports slumped 25% in February from a year earlier and the trade surplus almost halved from January’s level, making a case against yuan gains.

Ain’t that the truth: “..at some point, someone is going to decide to use the dollar-valued asset to get something of real, usable value. And where do you spend dollars? In the U.S.”

• Trade Deficits Come Due Someday (BBG)

In a recent interview on the EconTalk podcast, Massachusetts Institute of Technology economist David Autor said that a trade deficit represents a loan that has to be paid back. This is an important issue, since the U.S. has run a large trade deficit for several decades now. I was happy to hear someone talk about this fact, which is rarely acknowledged. But not everyone was pleased. When I repeated Autor’s statement, Dan Ikenson, director of the Herbert A. Steifel Center for Trade Policy Studies at the Cato Institute, said that I don’t understand how trade works, and that a trade deficit isn’t a loan. Ikenson is wrong, and this provides an important opportunity to explain how trade deficits work.

Suppose there are two countries, Germany and the U.S. And suppose that one fine day, Germany gives the U.S. a car. But Germany isn’t running a charity; it doesn’t just go around handing out cars – the U.S. has to give something in return. If the U.S. gets the car from Germany for free, it’s called aid, not trade. So what does the U.S. give Germany in exchange? It could send over a real, usable good or service – some bushels of corn, perhaps, or some copies of Windows 10. If the U.S. gives corn and software equal to the value of the car, that’s called balanced trade. Alternatively, if the U.S. doesn’t feel like growing any corn or writing any software today, it could write Germany an IOU. The U.S. could pay for the car not with corn or software, but with dollar bills.

The Germans might then use the dollar bills to buy some long-term American financial asset, such as a U.S. Treasury bond or some shares of Apple stock. In this case, we say that the U.S. ran a trade deficit with Germany, because it got something of real value from Germany (a car), while all Germany got in return was a slip of paper. But at some point, Germany is going to want to exchange its slip of paper for something of real value – something some German person can use and enjoy. Whoever in Germany is holding onto the American financial asset can’t use it within his or her own country – Germany uses euros, not dollars! He or she could sell the dollar-valued asset to another German for a euro-valued asset, but that just delays the issue – at some point, someone is going to decide to use the dollar-valued asset to get something of real, usable value. And where do you spend dollars? In the U.S.

“..finance and property ownership claims are not “factors of production.” They are external to the production process. But they extract income from the “real” economy.”

• Michael Hudson On Killing The Host (NC)

The financial sector today is decoupled from industrialization. Its main interface with industry is to provide credit to corporate raiders. Their objective isasset stripping, They use earnings to repay financial backers (usually junk-bond holders), not to increase production. The effect is to suck income from the company and from the economy to pay financial elites. These elites play the role today that landlords played under feudalism. They levy interest and financial fees that are like a tax, to support what the classical economists called “unproductive activity.” That is what I mean by “parasitic.” If loans are not used to finance production and increase the economic surplus, then interest has to be paid out of other income. It is what economists call a zero-sum activity.

Such interest is a “transfer payment,” because it that does not play a directly productive function. Credit may be a precondition for production to take place, but it is not a factor of production as such. The situation is most notorious in the international sphere, especially in loans to governments that already are running trade and balance-of-payments deficits. Power tends to pass into the hands of lenders, so they lose control – and become less democratic. To return to my use of the word parasite, any exploitation or “free lunch” implies a host. In this respect finance is a form of war, domestically as well as internationally. At least in nature, “smart” parasites may perform helpful functions, such as helping their host find food. But as the host weakens, the parasite lays eggs, which hatch and devour thehost, killing it.

That is what predatory finance is doing to today’s economies. It’s stripping assets, not permitting growth or even letting the economy replenish itself. The most important aspect of parasitism that I emphasize is the need of parasites to control the host’s brain. In nature, a parasite first dulls the host’s awareness that it is being attacked. Then, the free luncher produces enzymes that control the host’s brain and make it think that it should protect the parasite – that the outsider is part of its own body, even like a baby to be specially protected. The financial sector does something similar by pretending to be part of the industrial production-and-consumption economy.

The National Income and Product Accounts treat the interest, profits and other revenue that Wall Street extracts – along with that of the rentier sectors it backs (real estate landlordship, natural resource extraction and monopolies) – as if these activities add to GDP. The reality is that they are a subtrahend, a transfer payment from the “real” economy to the Finance, Insurance and Real Estate Sector. I therefore focus on this FIRE sector as the main form of economic overhead that financialized economies have to carry. What this means in the most general economic terms is that finance and property ownership claims are not “factors of production.” They are external to the production process. But they extract income from the “real” economy.

Any USD downturn is temporary.

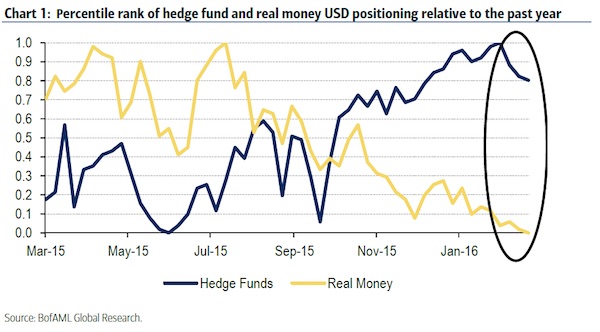

• What Happens When The US Dollar Is No Longer A Hedge Fund Hotel? (BBG)

In the wake of last week’s dovish decision from the Federal Reserve, investors have been throwing in the towel on the U.S. dollar. But Bank of America Merrill Lynch’s proprietary positioning data suggests there’s still another major shoe to drop for the greenback. In a note to clients, FX Strategists Myria Kyriacou and Athanasios Vamvakidis illustrate that hedge funds’ long position in the U.S. dollar remains substantial relative to the past 12 months and to other investors. “Real money is now short USD for the year, but hedge funds remain long, pointing to risks for a further squeeze USD lower,” they conclude. Real money, in this case, refers to pension funds, real estate investment trusts, smaller asset managers, and the like.

The strategists note that these parties often use foreign exchange positions to carry out trades in equities or debt, and therefore they may not be expressing a view on the currency itself. However, the positioning of this ‘real money’ does imply something about the appetite for assets denominated in U.S. dollars, an important factor for the currency. During an interview on Bloomberg TV, Vamvakidis said that any advances in the U.S. dollar going forward, both against other developed market currencies and their emerging market peers, would not be broad based. “We’re not going to see an overall strengthening trend of the dollar across the board,” he said. “We do expect the dollar to be stronger against the euro, not against the yen.”

Centralization is the biggest threat to the EU and the eurozone.

• French Central Banker Wants Eurozone Finance Minister With Sweeping Powers (FT)

France’s central bank governor has attacked the country’s government over its botched attempt to overhaul its labour markets, saying President François Hollande’s backtracking on vital measures has threatened growth. François Villeroy de Galhau, who succeeded Christian Noyer at the Banque de France last November, said officials across the eurozone needed to build trust by passing much-needed economic reforms. More trust between Germany and other member states would pave the way for the economic integration that he said was essential to improve the region’s longer-term economic prospects. Mr Villeroy de Galhau said the nascent recovery in the French economy, the second largest in the eurozone, was partly down to previous pro-business measures, such as €40bn in tax credits, introduced by Mr Hollande two years ago.

But a retreat by the French president, triggered by union opposition and student protests, had undermined businesses’ faith. “Confidence is a key issue for entrepreneurs,” Mr Villeroy de Galhau said in the palatial surroundings of the Banque de France’s headquarters in central Paris. “This question is very often raised: how can we better translate the favourable economic conditions created by the ECB’s monetary policy and low oil prices into a sustainable recovery? The key for that is investment, especially corporate investment, and the key for corporate investment is confidence. The method used for this labour market law didn’t help confidence.” Describing France’s labour market, he said: “The status quo is not an option.”

The reproach directed at Mr Hollande, who picked Mr Villeroy de Galhau for the Banque de France’s top job, comes as the president is battling unions and his own majority over a bill that hands companies more power to negotiate longer working hours with employees and facilitate lay-offs. Mr Villeroy de Galhau, a former banker at BNP Paribas, is more in line with Mr Hollande when it comes to eurozone integration. He is pushing for the creation of a eurozone finance ministry with sweeping powers to exert control on fiscal spending and “sanction” countries that refuse structural reforms.

Helicopter money will not be accepted in quite a few economies.

• It’s Not Going To End Well BUT Central Banks Have Plenty Of Ammo Left (Faber)

The magicians at central banks, they always come out with a new trick and these negative interest rates that we have today, this is for the first time in recorded human history from the times of Babylon up to today that we have negative interest rates, and it’s not going to end well. That, I can tell you. But the sequence of how it will not end well, I’m not so sure. But they still have a lot of ammunition. What they can do is helicopter money. In other words, they can send you and Mr. Bloomberg and me and everybody, say a check for $10,000, and that is like throwing gasoline into a fire…. will it help the economy? That is the question. It won’t help in the long run. You cannot grow an economy by just throwing money at people.

That’s crazy.

• Plant-Growing Season In UK Now A Month Longer Than In 1990 (Guardian)

The growing season for plants has become a month longer than it was a few decades ago, Met Office figures show. In the last 10 years, the growing season, measured according to the central England temperature daily record, which stretches back hundreds of years, has been on average 29 days longer than in the period 1961-1990, the data show. And while more of the year is warm enough for plants to grow, there has also been a decline in the number of frosty days in recent decades, the Met Office said. Between 2006 and 2015, the plant growing season, which begins and ends with periods of consecutive days where daily temperatures average more than 5C (41F) and is without any five-day spells of temperatures below 5C, averaged 280 days.

Figures also reveal that six of the 10 longest growing seasons have occurred in the last 30 years, with 2014 topping the list at 336 days, or about 11 months of the year, while 2015 was 10th, with 303 days – about 10 months. Only three of the 10 shortest growing seasons have taken place in the last century – in 1979, 1941 and 1922 – while the years with the shortest season were in 1782 and 1859, at just 181 days. Mark McCarthy, manager of the Met Office’s national climate information centre, said: “Between 1861 and 1890, the average growing season by this measure was 244 days, and measuring the same period a century later, the average growing season had extended by just over a week. For the most recent 10 years, between 2006 and 2015, the average growing season has been 29 days longer at 280 days, when compared with the period between 1961 and 1990.”

Nice try, but I think Europe has a lot more, and deeper problems. The deepest of all is that it has no heart and no soul.

• A Violent Coming-of-Age For Europe (Papachelas)

The most serious problem right now is that the West appears helpless in the face of major threats and challenges. Not that it is about to come tumbling down like a paper tower. The continent has been through too much for a hasty futurologist to discard it. But Europe does face two crucial issues: the flows of refugees and migrants and Islamic extremism. Large movements of populations are a recurring phenomenon throughout history. It’s hard to stop them. Europe is currently trying to do this through NATO and the closing of borders. NATO, however, is operating more along the lines of a think tank, as opposed to a military alliance. The alliance’s frigates may be state-of-the-art and look very threatening, but in reality they do not have the authority to halt a boat carrying refugees or migrants.

This is becoming evident to the rest of the world and paints a picture of weakness. The same is true of terrorism. Every time a terrorist attack occurs, the streets of Brussels are flooded by military vehicles and armed commandos. So what? They might offer a sense of security to passers-by or tourists visiting the city, but they are clearly not capable of deterring terrorists attacks. Watching footage of soldiers walking the streets, while we know that they merely give the impression of safety, is like watching a tragicomedy. Europe became very spoilt over the last decades. The Cold War brought the continent under the safety umbrella of the US. European governments, with very few exceptions, did not have to deal with security concerns.

They felt they could go on living the good life, which they became accustomed to after WWII, without spending energy, time and money on security issues. They are now realizing that the American umbrella no longer provides the continent with a shield and that, at the same time, the world has suddenly become far more dangerous and unpredictable. Europe has been coming of age in a violent way in the last few years. There’s another thing. Europe cannot handle both the refugee crisis and terrorism as it gradually enters a period of cold war conflict with Russia. This is a recipe for disaster for both Russian and European interests. Europe and Russia are natural allies in the war against terrorism and should work together to rebuild the broken puzzle in the Middle East.

You lock ’em up? Tsipras should have said no to this.

• NGOs Withdraw As Greece Refugee Camps Turn Into Detention Centers (Kath.)

Staff from non-governmental organizations were being withdrawn from the Idomeni refugee camp in northern Greece on Tuesday as the UN Refugee Agency (UNHCR) also said it would be taking a less active role in providing assistance on the Greek islands in the wake of the European Union’s agreement with Turkey. NGOs began withdrawing their personnel from Idomeni due to rising tension at the camp, where refugees had been protesting since the morning about not being able to continue their journey north. The aid organizations deemed that they would not be able to continue their work in the current circumstances. Their withdrawal came as the UNHCR also distanced itself from the deal to return refugees to Turkey, which has led to the agency scaling down its operations in places such as Lesvos. “Under the new provisions, these so-called hot spots have now become detention centers,” said UNHCR spokewoman Melissa Fleming.

“Accordingly, and in line with UNHCR policy of opposing mandatory detention, we have suspended some of our activities at all closed centers on the island.” Until Sunday, refugees arriving on Lesvos had been free to leave the Moria hot spot and continue their journeys but under the terms of the agreement with Turkey, Greek authorities now have to hold them there or at one of four other centers set up on the Aegean islands of Samos, Chios, Leros and Kos, pending the outcome of their asylum applications. The returns are due to begin on April 4. Part of the process involves Greece and Turkey exchanging police officials who will monitor the process. Six Turkish policemen have already arrived on Lesvos, while two Greek officers traveled to Cesme yesterday. Another four will follow. Also yesterday, Greece’s public broadcaster ERT began news bulletins in Arabic aimed at keeping refugees informed about developments.

Europe is busy creating an ever bigger mess.

• UN Slams Refugee ‘Detention Facilities’ In Greece (AFP)

The UN refugee agency on Tuesday harshly criticised an EU-Turkey deal on curbing the influx of migrants to Greece, saying reception centres had become “detention facilities”, and suspended some activities in the country. “Under the new provisions, these sites have now become detention facilities”, the UNHCR said in a statement. “Accordingly, and in line with our policy on opposing mandatory detention, we have suspended some of our activities at all closed centres on the islands,” it added. The EU and Ankara struck a deal on Friday aiming to cut off the sea crossing from Turkey to the Greek islands that enabled 850,000 people to pour into Europe last year, many of them fleeing the brutal war in Syria. The agreement, under which all migrants landing on the Greek islands face being sent back to Turkey, went into effect early on Sunday.

“UNHCR is not a party to the EU-Turkey deal, nor will we be involved in returns or detention,” the agency said Tuesday, adding though that it would “continue to assist the Greek authorities to develop an adequate reception capacity.” It pointed out that Greece currently “does not have sufficient capacity on the islands for assessing asylum claims, nor the proper conditions to accommodate people decently and safely pending an examination of their cases.” The UN agency said 934 refugees and migrants had landed on Lesbos alone since the accord took effect. “They are being held at a closed registration and temporary accommodation site in Moria on the east of the island,” it said, adding that the 880 others who arrived before Sunday were being hosted separately at the Kara Tepe centre, which is run by the local municipality and “remains an open facility”.