Pablo Picasso Rest (Marie-Thérèse Walter) 1932

Lutnick is impressive

https://twitter.com/MJTruthUltra/status/1899925243189170457

White House Automall

https://twitter.com/AutismCapital/status/1900027336676041126

Elon

If you hate Elon and Tesla, would you answer a few quick questions for me? pic.twitter.com/dcR8ayOQPf

— Kaizen D. Asiedu (@thatsKAIZEN) March 12, 2025

Fox Elon

https://twitter.com/MarioNawfal/status/1900061762788974949

Bondi Patel

https://twitter.com/1776Diva/status/1900069765340656088

Artemis

NASA’s Artemis mission isn't about returning to the moon. A 99-page playbook leaked to Blaze News & Glenn TV reveals it's really a $100 billion DEI PROPAGANDA operation, complete with heroes & villains, partnerships with Hollywood, Coca-Cola, & Nike, and even a theme park. pic.twitter.com/ibYHVWCLaG

— Glenn Beck (@glennbeck) March 13, 2025

Rogan DOGE

Joe Rogan explains the importance of hearing Elon Musk directly talk about USAID cuts instead of hearing it from the media

Every single thing being cut is FULLY transparent and available to view:

Joe Rogan “It’s fascinating because it's like the vampires all out themselves.… pic.twitter.com/a9WcirVZ53

— Wall Street Apes (@WallStreetApes) March 11, 2025

“They discussed NATO and being in NATO, and everybody knows what the answer to that is. They’ve known that answer for 40 years..”

• Trump ‘Would Like To Meet’ Putin (RT)

President Donald Trump has expressed his readiness to meet and speak with his Russian counterpart after President Vladimir Putin said Moscow was open to a US-proposed ceasefire in Ukraine but raised numerous questions about its practical implementation. The Russian president voiced support for a potential 30-day ceasefire in the Ukraine conflict on Thursday, but warned of loopholes and strategic disadvantages, outlining Moscow’s concerns over how such a truce could be enforced. “[Putin] put out a very promising statement, but it wasn’t complete. And, yeah, I’d love to meet with him or talk to him,” Trump told journalists during a bilateral press conference with NATO Secretary General Mark Rutte later in the day. Trump said the US has already discussed many details of a potential “final agreement” with Kiev and is now waiting to see “whether or not Russia is there.”

“We’ve been discussing land with Ukraine… pieces of land that would be kept and lost and all of the other elements of a final agreement. You know, we’ve been discussing concepts of land because you don’t want to waste time with a ceasefire if it’s not going to mean anything,” Trump said. “They discussed NATO and being in NATO, and everybody knows what the answer to that is. They’ve known that answer for 40 years, in all fairness.” Trump’s special envoy, Steve Witkoff, visited the Russian capital on Thursday to discuss the results of US-Ukraine talks in Saudi Arabia earlier this week and to relay Moscow’s position back to Washington. Witkoff was also expected to meet with the Russian president behind closed doors in the evening, but officials have yet to confirm whether the meeting took place or to provide details of his other interactions during the brief visit.

Earlier in the day, Putin stated that Russian troops were advancing along nearly 2,000 kilometers of the front line and warned that halting military actions would disrupt their momentum and give Ukrainian forces time to regroup. “These 30 days – how will they be used? To continue forced mobilization in Ukraine? To receive more arms supplies? To train newly mobilized units?” Putin asked. Enforcing a ceasefire over such a vast battlefield would be difficult, he added, and violations could easily lead to a blame game between both sides. Putin also mentioned that Ukrainian troops who invaded Russia’s Kursk Region in August 2024 are now cut off. “Are we supposed to let them out after they committed mass war crimes against civilians?” he said. The Russian leader suggested that further direct discussions with his American counterpart would be necessary to find a viable solution, but officials have yet to confirm any specific timeline for such talks.

R�u�s�s�i�a� �d�e�l�i�v�e�r�s� �m�a�i�n� �c�e�a�s�e�f�i�r�e� �d�e�m�a�n�d�s� �t�o� �U�S� �-� �R�e�u�t�e�r�s�

�

• N�o� �N�A�T�O� �m�e�m�b�e�r�s�h�i�p� �f�o�r� �U�k�r�a�i�n�e�

• N�o� �N�A�T�O� �”�p�e�a�c�e�k�e�e�p�e�r�s�”� �i�n� �U�k�r�a�i�n�e�

• U�k�r�a�i�n�e� �i�s� �d�e�n�a�z�i�f�i�e�d�/�d�e�m�i�l�i�t�a�r�i�s�e�d�

• T�h�e� �4� �D�o�n�b�a�s�s� �r�e�g�i�o�n�s� �a�r�e� �r�e�c�o�g�n�i�s�e�d� �a�s� �R�u�s�s�i�a�n� �t�e�r�r�i�t�o�r�i�e�s� �p�l�u�s� �C�r�i�m�e�a�

�

�I�n� �e�x�c�h�a�n�g�e�:�

• �C�e�a�s�e� �o�f� �a�l�l� �h�o�s�t�i�l�i�t�i�e�s� �

• �P�e�a�c�e� �a�n�d� �s�t�a�b�i�l�i�t�y� �f�o�r� �U�k�r�a�i�n�e�

• Putin Lists Guarantees Moscow Wants For 30-Day Ceasefire (RT)

Russian President Vladimir Putin has expressed support for a potential 30-day ceasefire in the Ukraine conflict but has raised concerns regarding how such a truce be implemented. Speaking on Thursday, Putin warned of potential loopholes and strategic disadvantages. “We also want guarantees that during the 30-day ceasefire, Ukraine will not conduct mobilization, will not train soldiers, and will not receive weapons,” Putin said during a press briefing with his Belarusian counterpart Alexander Lukashenko in Moscow. The president pointed out that Russian troops are advancing along nearly 2,000 kilometers of frontline, and halting military actions could disrupt ongoing operations. Ukrainian forces could use a ceasefire period to regroup, receive more weapons, and train fresh recruits, he warned.

“These 30 days — how will they be used? To continue forced mobilization in Ukraine? To receive more arms supplies? To train newly mobilized units? Or will none of this happen?” Putin asked. Enforcing a ceasefire over such a vast battlefield would be difficult, he added, violations could be easily disputed, leading to a blame game between both sides. Systems of “control and verification” to monitor a ceasefire are not in place but should be agreed. Putin also mentioned that Ukrainian troops who invaded Russia’s Kursk Region in August 2024 are now cut off. What is to be done with them in the event of a truce is unclear, he noted.

“Are we supposed to let them out, after they committed mass war crimes against civilians? Will the Ukrainian leadership tell them to lay down their arms, and just surrender?” Putin said. As of Wednesday evening, Moscow’s forces have regained control of 86% of the territory that was occupied by Ukrainian forces in August 2024, according to the head of the Russian General Staff, General Valery Gerasimov. Kiev’s remaining units in the area have been largely “encircled” and “isolated,” he claimed. Putin suggested that discussions with his American counterpart Donald Trump will be necessary to find a viable solution. “The idea of ending the conflict through peaceful means is something we support,” he stressed.

It’s simply not that simple..

“Who will give orders to stop hostilities? And what is the price of these orders? Can you imagine? Almost 2,000 kilometers. Who will determine where and who broke the potential ceasefire? Who will be blamed?”

• Putin’s Statement On Trump’s Ukraine Ceasefire Proposal (RT)

Russian President Vladimir Putin confirmed on Thursday that Russia is ready to discuss a ceasefire but that the terms of such an arrangement should be clarified. Putin has said as far back as July 2024 that Moscow is not interested in short-term pauses but is ready to engage on addressing the causes of the conflict. Washington and Kiev both endorsed a 30-day temporary truce following a meeting between their respective delegations in Saudi Arabia on Tuesday. Here’s a full transcript of the Russian president’s response:

“Before I assess how I view Ukraine’s readiness for a ceasefire, I would first like to begin by thanking the President of the United States, Mr. Trump, for paying so much attention to resolving the conflict in Ukraine. We all have enough issues to deal with. But many heads of state, the president of the People’s Republic of China, the Prime Minister of India, the presidents of Brazil and South African Republic are spending a lot of time dealing with this issue. We are thankful to all of them, because this is aimed at achieving a noble mission, a mission to stop hostilities and the loss of human lives. Secondly, we agree with the proposals to stop hostilities. But our position is that this ceasefire should lead to a long-term peace and eliminate the initial causes of this crisis. Now, about Ukraine’s readiness to cease hostilities. On the surface it may look like a decision made by Ukraine under US pressure.

In reality, I am absolutely convinced that the Ukrainian side should have insisted on this (ceasefire) from the Americans based on how the situation (on the front line) is unfolding, the realities on the ground. And how is it unfolding? I’m sure many of you know that yesterday I was in Kursk Region and listened to the reports of the head of the General Staff, the commander of the group of forces ‘North’ and his deputy about the situation at the border, specifically in the incursion area of Kursk Region. What is going on there? The situation there is completely under our control, and the group of forces that invaded our territory is completely isolated and under our complete fire control. Command over Ukrainian troops in this zone is lost. And if in the first stages, literally a week or two ago, Ukrainian servicemen tried to get out of there in large groups, now it is impossible.

They are trying to get out of there in very small groups, two or three people, because everything is under our full fire control. The equipment is completely abandoned. It is impossible to evacuate it. It will remain there. This is already guaranteed. And if in the coming days there will be a physical blockade, then no one will be able to leave at all. There will be only two ways. To surrender or die. And in these conditions, I think it would be very good for the Ukrainian side to achieve a truce for at least 30 days. And we are for it. But there are nuances. What are they? First, what are we going to do with this incursion force in Kursk Region? If we stop fighting for 30 days, what does it mean? That everyone who is there will leave without a fight? We should let them go after they committed mass crimes against civilians? Or will the Ukrainian leadership order them to lay down their arms. Simply surrender. How will this work? It is not clear.

How will other issues be resolved on all the lines of contact? This is almost 2,000 kilometers. As you know, Russian troops are advancing almost along the entire front. And there are ongoing military operations to surround rather large groups of enemy forces. These 30 days — how will they be used? To continue forced mobilization in Ukraine? To receive more arms supplies? To train newly mobilized units? Or will none of this happen? How will the issues of control and verification be resolved? How can we be guaranteed that nothing like this will happen? How will the control be organized? I hope that everyone understands this at the level of common sense. These are all serious issues.

Who will give orders to stop hostilities? And what is the price of these orders? Can you imagine? Almost 2,000 kilometers. Who will determine where and who broke the potential ceasefire? Who will be blamed? These are all questions that demand a thorough examination from both sides. Therefore, the idea itself is the right one, and we certainly support it. But there are questions that we have to discuss. I think we need to work with our American partners. Maybe I will speak to President Trump. But we support the idea of ending this conflict with peaceful means.

Kellogg is an ex-army guy, who comes in with pre-conceived ideas. “Not our kind of person, not of the caliber we are looking for.”

Witkoff is a business man.

• Moscow Banned Trump’s Ukraine Envoy From Peace Talks – NBC (RT)

Keith Kellogg, US President Donald Trump’s special envoy to Russia and Ukraine, has been barred from taking part in peace talks at Moscow’s request, NBC News reported on Thursday, citing sources. According to the report, Russian officials view Kellogg as too hawkish and “too close to Ukraine.” The retired US Army lieutenant general was absent from both last month’s Russia-US talks in Saudi Arabia and this week’s US-Ukraine talks in Jeddah. The White House also confirmed that Trump’s special envoy to the Middle East, Steve Witkoff, will attend the next round of negotiations with Russia instead of Kellogg. Witkoff arrived in Moscow late Thursday. “Kellogg is a former American general, too close to Ukraine,” an unnamed Russian official reportedly told NBC. “Not our kind of person, not of the caliber we are looking for.”

An official in the Trump administration reportedly confirmed that Moscow did not want Kellogg involved in the peace process. Another source claimed that Kellogg’s exclusion “stung” him. Neither Kellogg’s office nor Moscow have commented on the report. While Kellogg has supported Trump’s calls to end the Ukraine conflict, his views on achieving peace have not aligned with Moscow’s. He has backed continued US aid to Kiev, which Russia argues only prolongs the conflict, and advocated for freezing the conflict along the current front lines, which Moscow has rejected in favor of a lasting settlement. Kellogg has also pushed for using frozen Russian sovereign assets to rebuild and rearm Ukraine – an idea that Moscow has called theft.

In an interview with RT Russian on Wednesday, political analyst Malek Dudakov suggested that Kellogg could be permanently removed from negotiations following last month’s tense meeting between Trump and Vladimir Zelensky, which devolved into a shouting match after the Ukrainian leader pushed back against Trump’s demand for peace talks with Russia. This prompted Trump to accuse him of “gambling with World War III” before cutting the meeting short. The fallout reportedly delayed a key US-Ukraine rare-earth minerals deal and led to a temporary suspension of US military aid and intelligence-sharing with Kiev. “Basically, Kellogg was responsible for communication with the Ukrainian side, he instructed the Ukrainians, and we see that all this led to a grand failure. And now he will no longer participate in any new negotiations,” Dudakov told RT.

“The EU establishment has spent years positioning itself as the defender of Kiev, and to be excluded from decisive negotiations would be nothing short of humiliating. However, this is precisely what is happening.”

• Zelensky’s Last Stand? Trump’s Push For A Ukraine Settlement (Kortunov)

As high-stakes diplomacy unfolds between the United States and Ukraine, one thing is clear: President Donald Trump has little personal sympathy for his Ukrainian counterpart, Vladimir Zelensky. Their last meeting at the White House in February only reinforced this reality, with Trump once again treating Zelensky with thinly veiled disdain. There are rational reasons for Trump’s attitude. Zelensky bet too heavily on Joe Biden, tying Ukraine’s fate to the Democratic party. When Biden’s second term never materialized, and Kamala Harris crashed and burned, Kiev was left without a reliable sponsor in Washington. Trump’s instincts – both personal and political – place him in direct opposition to figures like Zelensky, who, despite also being an unconventional political outsider, represents a style of governance fundamentally at odds with the US president’s worldview.

What is particularly striking is Trump’s open criticism of Zelensky, a direct violation of established diplomatic norms. The White House has even floated the idea of his resignation – a notion recently reported by the German media outlet Bild. According to these reports, Trump no longer sees Zelensky as a viable ally and is exerting significant political pressure to force him out. The administration has not denied these claims. However, gaining Trump’s approval is no easy feat. Among today’s political heavyweights, very few leaders have managed to earn his genuine respect. The capricious and ego-driven 47th president of the United States has little patience for the leadership class of the European Union, nor for the leaders of America’s immediate neighbors, Mexico and Canada.

Trump appears far more at ease with strong, authoritative figures who project power – leaders like Hungarian Prime Minister Viktor Orban, Turkish President Recep Tayyip Erdogan, Israeli Prime Minister Benjamin Netanyahu, and, most notably, Russian President Vladimir Putin. Yet, in politics – as in business – one does not always get to choose one’s partners. Throughout his career in the highly competitive and often ruthless New York real estate market, Trump had to engage with individuals with questionable reputations. In that sense, his approach to international politics is no different from his business dealings: pragmatism trumps sentimentality. Trump’s interest in Ukraine is not about personal affinity; rather, he views the country as an asset in which the US has made a substantial investment. While he did not personally decide to back Kiev, he now finds himself responsible for managing America’s stake in the conflict, and like any businessman, he wants a return on investment.

This is why Trump’s approach is not one of immediate disengagement. He is looking for ways to extract value – whether through Ukraine’s rare earth minerals, transport and logistics infrastructure, fertile black soil, or other material assets. He does not want to simply write it off as a sunk cost, at least not before attempting to recoup some of America’s losses. Thus, his administration is attempting to force Kiev into a settlement on terms dictated by Washington. This effort culminated in Tuesday’s meeting in Riyadh, where Trump’s negotiators presented Zelensky’s team with a stark choice: accept the US conditions – including a ceasefire or partial cessation of hostilities – or risk complete abandonment.

Before this crucial meeting, Zelensky reportedly sent an apology letter to Trump, attempting to smooth over the tensions which followed their embarrassing White House encounter. According to US special envoy Steve Witkoff, this was an effort to salvage what remains of Ukraine’s negotiating position. Trump remains deeply skeptical of Zelensky’s ability to deliver on any agreement. The Ukrainian president’s credibility has been severely undermined, and his capacity to negotiate on behalf of his country’s political elite is far from certain. After all, Trump has learned from past experience that promises made by Kiev do not always translate into action. Following the Riyadh meeting, Trump’s attention turned to the far more consequential issue: negotiations with Moscow. Unlike Zelensky, Putin is negotiating from a position of strength, which makes any agreement far more complex. The days when the West could dictate terms to Russia are long over, and Trump likely understands that his leverage with Moscow is limited.

If Trump can reach an understanding with Putin, then the next stage of this process will involve forcing Western European nations to accept the new geopolitical reality. For Washington’s European allies, who have invested heavily in Ukraine, this will be a bitter pill to swallow. The EU establishment has spent years positioning itself as the defender of Kiev, and to be excluded from decisive negotiations would be nothing short of humiliating. However, this is precisely what is happening. The bloc’s leaders, including European Commission President Ursula von der Leyen, have been reduced to spectators, offering empty declarations of support for Ukraine while having no real influence over the outcome of events. For them, a settlement brokered by Trump without their participation would be the ultimate confirmation of their diminishing role in global affairs. Worse still, much of Western Europe’s investment in Ukraine – both financial and political – will likely be lost. While the Biden administration at least attempted to keep European allies involved in decision-making, Trump has no such inclination.

His goal is to conclude a deal that serves American interests, and he is unlikely to show concern for the reputational damage this will inflict on the EU’s political elite. The situation now presents Trump with one of the biggest diplomatic challenges of his presidency. Unlike in business, where deals can be walked away from, geopolitical agreements have long-lasting consequences. His ability to navigate this complex landscape – balancing pressure on Kiev, negotiating with Moscow, and sidelining Western Europe – will determine whether he can claim victory as a peacemaker. Ultimately, Ukraine’s fate is no longer in its own hands. The decisions made in Washington, Moscow, and – ironically – Riyadh will shape the country’s future. Whether Trump can strike a deal that satisfies all parties remains to be seen. But one thing is clear: Ukraine’s days as the central pillar of the West’s confrontation with Russia are coming to an end.

Any paper he signs comes (pre-)loaded with legality questions.

• Zelensky In Political ‘Final Act’ — FT (RT)

Vladimir Zelensky’s leadership is coming to an end, the Financial Times reported on Thursday, citing a senior Kiev’s official. The article comes amid growing concern in Washington over Zelensky’s legitimacy. Zelensky’s presidential term expired in May 2024. However, he has refused to hold a new election, referring to martial law imposed during the conflict with Russia. The current US administration has recently been trying to negotiate a path toward ending hostilities. US President Donald Trump briefly halted military assistance and intelligence sharing with Kiev, but resumed it following a bilateral meeting in Saudi Arabia earlier this week.

“We are in the final act [of Zelensky’s presidency],” a senior Ukrainian official told FT, confirming growing speculation in the country’s political circles over how long he will stay in office. The official also described the conflict with Russia as currently in a “hot phase.” According to Ukrainian soldiers, analysts, and officials cited by the newspaper, Kiev would be able to keep fighting for “at least six months” in case of a complete halt of military assistance from the US. They said, however, that it could be longer if the EU fills the gap and domestic arms production intensifies. Unnamed Western officials told FT that apart from a lack of weapons and ammunition, Zelensky’s leadership could be challenged by a shortage of men in the ranks, which remains Ukraine’s most pressing problem.

In November 2024, the administration of then US President Joe Biden urged Kiev to draft more troops and reduce the minimum conscription age from 25 to 18 to tackle a manpower shortage. The Ukrainian authorities rejected the proposal at the time, claiming that the main problem for the country’s forces was a lack of weapons. FT noted that Zelensky’s political opponents are currently “preparing for elections, forming alliances, and testing public messaging.” Several politicians have reportedly begun outreach to officials in the Trump administration.

Zelensky, whose presidential term expired in May 2024, has refused to hold new presidential and parliamentary elections, citing martial law due to the conflict with Moscow. Last month, US President Donald Trump questioned Zelensky’s legitimacy, branding him a “dictator without elections.” Russian President Vladimir Putin has cast doubt on Zelensky’s position as well. Shortly after his official term as the country’s head of state expired nearly a year ago, the Russian president called the Ukrainian parliament the only legitimate authority. Putin recently reiterated that the Ukrainian leader no longer has the right to sign official agreements.

“5 of Russia’s top foreign relations experts and actors react to US-Ukraine talks.”

• ‘A Ceasefire Only Benefits Those Who Are Retreating’ (RT)

Political analyst Sergey Markov: Reasons why Russia might refuse a ceasefire:

1. A ceasefire would be exploited by the West and Ukraine to halt the advance of the Russian army, strip it of its initiative, supply the Ukrainian army with more weapons, continue extensive mobilization in Ukraine, and strengthen the repressive and anti-Russian nature of the Ukrainian political regime

2. The experience of the Minsk 1 and Minsk 2 agreements clearly demonstrates this pattern

3. The consistent dishonesty of Western politicians and media regarding the conflict, as well as their refusal to acknowledge their own and Ukraine’s culpability, strongly suggests that history will repeat itself

4. Russian President Vladimir Putin and other Russian officials have repeatedly stated that what Russia needs is lasting peace, not just a temporary ceasefire

5. The West cannot really be trusted

6. Russia is advancing. A ceasefire always benefits those who are retreating.

“If Putin doesn’t agree to a cease fire, he risks offending Trump’s ego. Does Trump then become coercive because he is on the line with his promise to end the conflict?”

• Is Putin Being Boxed In by Trump and Zelensky? (Paul Craig Roberts)

Trump and Zelensky have agreed on a cease fire, a pause in the conflict. How does this benefit Russia? It doesn’t. The Ukrainian military is collapsing on all fronts. 86% of the Ukrainian incursion into Kursk has been retaken, and the remaining Ukrainian forces are surrounded. What remains of the Ukrainian military is retreating from the few kilometers of Russian territory still occupied in the Donetsk and Zaporozhye regions that have been reincorporated into Russia. A cease fire is the last thing Russia needs when Russia is on the verge of total victory. Russia should be imposing surrender terms on Zelensky, Trump, and Europe. Russia has won the conflict. Why agree to a negotiation? The victor dictates the surrender terms. If Russia’s surrender terms are not accepted, Russia should proceed with the conquest of the entirety of Ukraine and reincorporate Ukraine into Russia where it historically belongs.

It was Washington taking advantage of the Soviet collapse that cut out Ukraine from its historic multi-century home as part of Russia. Are Putin and Lavrov too besotted with good will toward the West, which has been trying to destroy Russia, to understand the basics? Does Putin understand that Trump should first have come to him, worked out the terms of surrender between them, and imposed them on Zelensky, who in fact is not a legitimate head of government as his term in office has expired? Putin is correct. There needs to be a Ukrainian election that installs a legal government to whom to dictate the terms of surrender. What is the worth of a document signed by an illegal occupant of office? If Putin agrees with the Trump-Zelenzky cease fire, will it obligate Putin to agree to a settlement that is less than victory?

A cease fire would halt the Russian advance, provide Ukraine with time to rebuild with the weapons now again supplied by Trump. Will negotiations be a repeat of Putin’s Minsk mistake which cost Russia so dearly? If Putin denies Russia a victory, could he be removed from office? Peace must be conclusive. Cease fires never are. If memory serves, the Korean War in the 1950s is still governed by a cease fire, and antagonisms still exist between North and South Korea with Washington still adding to the confrontation. From what I know of Russia’s Westernized intellectual class that influences Putin and Lavrov, they are Westernized to the point of treason. Putin needs a Russian government occupied and advised by Russian nationalists. Otherwise Russia will remain a target despite its unrivaled weapons systems. In my column on March 11, I asked, “What should Trump do about Ukraine?” I answered:

“To end the conflict Trump doesn’t need to be holding meetings and talking about meetings with Putin, Zelensky, EU or anyone. It is extremely simple for Trump to end the conflict as far as the US is concerned. All he has to do is to make the hold he has put on delivery of weapons permanent and withdraw all US operatives in the proxy conflict with Russia. Without the US supplying weapons, intelligence, targeting information and money to keep the conflict alive, the conflict will quickly end. This is what Trump needs to tell Putin: “I know Washington is responsible for this conflict. I am withdrawing Washington’s participation. The conflict would not have happened if the Democrats had not stolen the 2020 election. I am cancelling the sanctions. I will be accused by the Democrats and the presstitutes of selling out Ukraine to you. Your job is to be merciful to Ukraine. As the US is responsible for the conflict, the US will help you to rebuild a demilitarized Ukraine in which economic advancement takes precedent over war. You must not fail my good intentions, or the Cold War will resume.”

As I asked later in my column, can Trump’s ego permit him to allow the settlement on Putin’s terms? For three years Putin has been slowly fighting a conflict that a capable war leader would have ended in three weeks. Putin’s failure as a war leader is clear. Putin, being sufficiently Westernized, never realized that his never-ending war would result in negotiations in which he was the last participant included. As Trump and the illegitimate Zelensky have arrived at a cease fire, the pressure is on Putin to join in, or Russia will be reviled for blocking a settlement with intentions of proceeding from the conquest of Ukraine to the conquest of Europe. If Putin joins in the cease fire, he risks Russia’s victory being watered down by the terms of a negotiated settlement.

Russia has been in many ways an easy target for the West. Soviet Communism having bred distrust of Russian government, has left Russian intellectuals easy pickings for Western propaganda. Many Russian intellectuals represent the West, not Russia. This Russian vulnerability has been skillfully exploited by the West. The question remains: How serious are Putin’s mistakes in his dealings with Washington? By permitting a conflict to continue until the initiative for its end passed into Washington’s hands, Putin has lost the initiative. If Putin doesn’t agree to a cease fire, he risks offending Trump’s ego. Does Trump than become coercive because he is on the line with his promise to end the conflict? Does Putin submit to Trump’s coercion? The outlook for this conflict being resolved is not as good as it seemed.

Better call Elon.

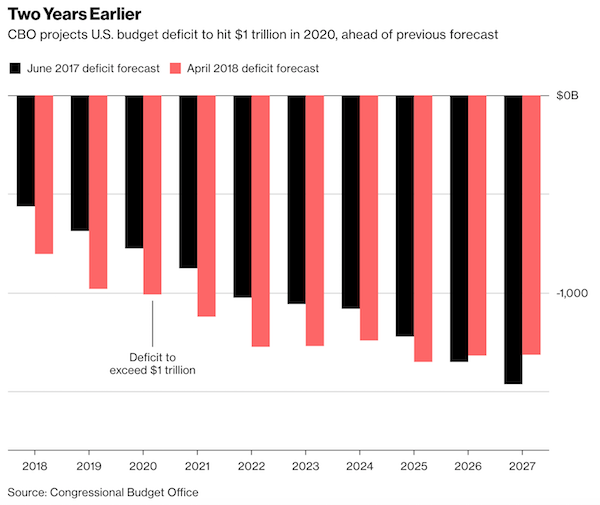

• US Deficit Sets Record With $1.1 Trillion In First 5 Months Of FY 2025 (jTN)

The United States’ deficit increased by a record-breaking $1.1 trillion during the first five months of the current fiscal year, new data from the Treasury Department showed. The new numbers, released Wednesday, showed the deficit between October 2024 and February 2025. The unadjusted increase saw a surge of $1.147 trillion, while the deficit for the same period in fiscal year 2024 was $828 billion. The deficit for February alone was $307 billion. The deficit is largely driven by spending on interest, military programs, public benefits and security, according to the financial news outlet Barron’s. The largest spending costs came from interest paid on the public debt and higher tax credits.

A Treasury department spokesperson told CNBC that there has been limited impact from Elon Musk’s Department of Government Efficiency, which is attempting to reduce wasteful government spending. But the department’s operations have only been active for one month. One exception has been the Education Department, per Barron’s, where expenditures were lower by $5.6 billion in February compared to the year before. President Donald Trump’s tariffs also did not appear to impact February’s deficit, but could impact March’s. The current fiscal year runs from October 2024 through September 2025.

“President Jose Raul Mulino stated that the canal is part of Panama’s “inalienable patrimony”..

But Americans built it..

• Trump Demands ‘Military Options’ To Control Panama Canal (RT)

The Panama Canal, a vital maritime route connecting the Atlantic and Pacific oceans, has been under Panamanian control since 1999 following the Torrijos-Carter Treaties, which stipulated that it would remain neutral and open to all nations. Trump has repeatedly threatened to take back control of the waterway, citing the “ridiculous fees” and concerns over China’s increasing presence in the region. Earlier this year, Trump refused to rule out the use of military force to take control of the canal, stating that all options are on the table to protect US economic and national security interests. In an Interim National Defense Strategic Guidance memo obtained by CNN on Thursday, the White House formally asked the Pentagon to “immediately” provide options to ensure unlimited US access to the canal.

“Provide credible military options to ensure fair and unfettered US military and commercial access to the Panama Canal,” one of the directives in the memo reportedly stated. US Southern Command is already developing potential plans, ranging from “partnering” closely with Panamanian security forces to a scenario in which US troops seize the canal by force, unnamed officials told NBC. Sources cited by Reuters also said the Pentagon had been ordered to explore military options to secure US access to the waterway.

Panamanian officials previously rejected Trump’s assertions and threats, while the Panama Canal Authority maintains that the canal is operated solely by Panamanians, with no evidence supporting claims of Chinese control. President Jose Raul Mulino stated that the canal is part of Panama’s “inalienable patrimony” and stressed that Panama maintains full control of its operations. However, after US Secretary of State Marco Rubio personally delivered Trump’s ultimatum to Panama in February, Mulino made a concession to Washington by refusing to renew the country’s 2017 agreements with China under Beijing’s Belt and Road Initiative.

Chuck is shrinking before our eyes….

• Schumer Throws Contrived Tantrum After Caving To GOP (ZH)

Update (2145ET): After bending the knee to the GOP and agreeing to vote ‘yes’ on the House-passed continuing resolution to fund the government through September, Senate Minority Leader Chuck Schumer (D-NY) offered a contrived outburst on MSNBC, calling Republicans ‘bastards’ before quickly correcting himself. “To have the conflict on the best ground we have, summed up in a sentence, that they’re making the middle class pay for tax cuts for billionaires?” said Schumer. “It’s much, much better not to be in the middle of a shutdown, which should divert people from the number one issue we have against these bastards, sorry, these people, which is not only all these cuts, but they’re ruining democracy.” How many times did he practice that in the mirror? Schumer also raged on X after bending the knee, writing that “a shutdown would be a gift,” and “the best distraction he could ask for from his awful agenda.”

Whatever you say Chuck…

* * *

Update (1800ET): And there it is… in a complete reversal following a closed-door lunch, Senate Minority Leader Chuck Schumer told fellow Democrats that he would vote for cloture tomorrow morning on the GOP stopgap, according to Punchbowl News’ Jake Sherman – who notes that 6 more Democrats will need to follow their leader after Sen. John Fetterman (D-PA) already said he would (see below). “I will vote to keep the government open and not shut it down,” Schumer announced on the Senate floor Thursday, adding that a shutdown “would give Donald Trump and Elon Musk carte blanche.” As we noted below, the most likely scenario looks to be the case; Dems will provide the necessary votes to pass the GOP bill, in exchange for Senate Republican leaders granting them a performative amendment vote on the Democrats’ separate CR proposal (which means absolutely nothing aside from putting their dissent on record).* * *

With tomorrow’s shutdown deadline looming (and the House gone on recess until March 24), Senate Democrats are scrambling to both kill the GOP bill that passed the house, and avoid the optics of a shutdown falling squarely on their shoulders after minority leader Chuck Schumer categorically rejected the bill on Wednesday, and instead floated a 30-day continuing resolution which would allow Democrats to stuff it full of their own pork to include in a revised package (that he doesn’t have the votes for)… As the Senate opened Thursday, Majority Leader John Thune (R-SD) – who filed cloture on the House-passed CR on Wednesday – said, “It’s time to fish or cut bait.”And as the Associated Press notes, debates over funding the federal government routinely erupt in deadline moments but this year it’s showing the political leverage of Republicans, newly in majority control of the White House and Congress, and the shortcomings of Democrats who are finding themselves unable to stop the Trump administration’s march across federal operations. Given that the Senate has 53 Republicans, one of whom is a definite ‘no’ (Rand Paul of Kentucky), at least eight Democrats need to cross party lines to avert a shutdown at midnight on Friday. According to the chaps at Punchbowl News, there’s really two ways this can play out at this point:

Option one: Democrats can fold and take the deal on the table – providing the votes needed to advance the House GOP’s stopgap spending bill in exchange for a symbolic amendment vote on their own 28-day funding extension. This would be pure theater, giving Democrats the chance to go on record opposing a shutdown while letting Republicans push through their own bill anyway. The government stays open, Schumer saves face with progressives, and Republicans get what they wanted all along. But make no mistake – this wouldn’t be a win for Schumer (a “fake BBQ’ing Palestinian”), who floated a 28-day CR that doesn’t have the votes to pass, even with a simple majority. Meanwhile, Republicans can sit back and let the clock force the issue. Time isn’t on the Democrats’ side, and at some point, they’ll have to face reality.

Option two: Schumer and Senate Democrats hold the line, block the House CR, and force a government shutdown. That means federal workers furloughed, services delayed, and chaos come Monday morning when the full effects hit. And here’s the kicker – Trump’s people at the Office of Management and Budget get to decide exactly how painful this shutdown will be. White House sources are already warning that the former president will make sure Democrats feel every bit of the pressure. But here’s where it gets ugly for Schumer: what’s the exit strategy? There isn’t one. The House is gone, meaning there’s no magic fix coming. And at some point, Democrats will have to explain why shutting down the government over a short-term CR that never had a shot at passing was somehow worth it.

So those are the choices: take the loss now and move on, or hold out, take the blame for the shutdown, and likely still take the loss later. Either way, Trump and Musk are watching from the sidelines, ready to make their next move while Washington does what it does best—trip over itself in broad daylight. According to the White House, “They’re totally screwed.”

You would hope the FBI is on it.

• MTG-Led DOGE House Panel Urges DOJ To Investigate Recent Attacks On Tesla (JTN)

The House’s Department of Government Efficiency panel, led by GOP Rep. Marjorie Taylor Greene, is asking the Justice Department to investigate Tesla vehicles being vandalized and destroyed since EV car company’s owner, Elon Musk, became a White House appointee. “These attacks, which seem to involve coordinated acts of vandalism, arson, and other acts of violence, seriously threaten public safety,” the DOGE subcommittee wrote in a letter Wednesday to Attorney General Pam Bondi and FBI Director Kash Patel.

Multiple Tesla cars, charging stations and dealerships have been vandalized since Musk began leading the Trump administration DOGE, according to ABC News. The letter listed examples such as Tesla charging stations being set on fire in Boston and Tesla cyber-trucks being set on fire in Seattle. Greene asked whether non-governmental organizations were involved in the attack. “If NGOs are linked to these attacks, has federal funding been provided to any of them?” the letter reads. “The American public deserves transparency and assurance that their tax dollars are not being used to fund domestic political terrorism.”

“The EPA will “reconsider” 31 major environmental actions ranging from emissions standards for automobiles to the legal theory underpinning climate change..”

• EPA to Begin the ‘Biggest Deregulatory Action in US History’ (Moran)

On Wednesday, Environmental Protection Agency (EPA) administrator Lee Zeldin outlined the most ambitious deregulation scheme in the history of the U.S. government. The EPA will “reconsider” 31 major environmental actions ranging from emissions standards for automobiles to the legal theory underpinning climate change. It’s truly breathtaking. However, announcing the reconsideration is only the first step. Now must come the long, drawn-out rulemaking process that will set guidelines on how the agency can proceed to repeal the regulations. That process alone will take many months, if not years, and green groups will challenge it every step of the way.

“These are all rules and regulations. They can’t just wish them away with a press release. You have to tear a regulation down the same way it was built up. They have to make a proposal for each one of these things and explain the reasoning and show evidence, and they have to have public comment and respond to public comment and then reach a final decision and defend it in court,” said David Doniger, the senior strategist and attorney for the Natural Resources Defense Council’s climate and energy department. “We’re going to fight them every step of the way.” Indeed, the work it will take to “reconsider” these regulations and repeal them makes me think this move by Zeldin has more to do with politics than government. Some of these rules have been upheld by the Supreme Court, including the climate change “endangerment finding” that undergirds the bulk of climate law.

Zeldin can’t just wave a magic wand and get rid of it. “This is crazy. This is insane,” said Jason Rylander, the legal director at the Center for Biological Diversity’s Climate Law Institute. “There have been attempts to limit the authority of EPA, but the scale and scope and speed with which this administration is attacking environmental safeguards is unprecedented.” It’s not “crazy” by any means. Remember that these environmental advocates think any word ever turned into regulation is holy writ and can’t be changed, or Gaia will strike us down. “Today is the greatest day of deregulation our nation has seen. We are driving a dagger straight into the heart of the climate change religion to drive down cost of living for American families, unleash American energy, bring auto jobs back to the U.S., and more,” said EPA Administrator Zeldin.

“Alongside President Trump, we are living up to our promises to unleash American energy, lower costs for Americans, revitalize the American auto industry, and work hand-in-hand with our state partners to advance our shared mission,” he added. As you might expect, some EPA staffers are approaching vapor lock. “Simply put, this is embarrassing,” one EPA worker said. “This is not the EPA we have dedicated our careers to. Instead of highlighting the importance of protecting human health and the environment, this administration is highlighting cutting cost in dollar figures while ignoring the human cost. The air we breathe and water we drink is a collective human right and more valuable than any dollar figure.”

No one is saying that air and water are not more valuable than dollars and cents. But neither are EPA regulations the word of god and can’t be changed. This particular employee actually believes that there’s no agenda attached to any of these regulations, an agenda that has little to do with protecting the environment. Even conservative judges are going to have a hard time with Trump’s EPA getting rid of most of these regulations. That’s why I suspect politics is the driving force in these actions by Zeldin and Trump, giving heart to the faithful and confusion to the enemy.

“..(NDFs), a financial derivative that allows investors to bet on a currency’s future value without actual exchange. By not involving physical Russian assets or individuals, they remain outside the scope of current sanctions.”

• Investors Betting On Russian Return To Western Markets – Bloomberg (RT)

Investors are quietly betting that US President Donald Trump’s recent initiatives to negotiate a peace deal in the Ukraine conflict could lead to Russia’s return to Western financial markets, Bloomberg reported on Thursday. The US and its allies have slapped numerous rounds of sanctions on Moscow since the escalation of the Ukraine conflict in 2022. Russia has been cut off from Western investments and its largest stock exchange has been sanctioned. In recent weeks, traders at a London brokerage have been seeking to buy Russian securities, an asset largely avoided over the past three years, Bloomberg reported. Their focus has been on buying dollar-denominated bonds issued by Russian energy giant Gazprom.

Investors are speculating that heavily discounted Russian securities could surge in value if Ukraine-related sanctions imposed on Moscow are lifted, the outlet stated. Investors “understand that as soon as there’s a thaw, these discounts will collapse,” Iskander Lutsko, Dubai-based head of research and portfolio management at Istar Capital, told Bloomberg. Money managers report that sales teams are assessing interest in staking on the ruble through non-deliverable forwards (NDFs), a financial derivative that allows investors to bet on a currency’s future value without actual exchange. By not involving physical Russian assets or individuals, they remain outside the scope of current sanctions.

Major US investment banks Goldman Sachs and JPMorgan Chase have reportedly been brokering ruble-linked derivative contracts to meet growing investor interest in Russian-related assets. “There’s an aggressive search for securities of Russian issuers around the world,” Evgeny Kogan, a Moscow-based investment banker, told Bloomberg. “Investors in general are asking how quickly they can enter the Russian market.” According to the report, Russia’s potential reintegration into the Western financial system could unlock hundreds of billions of dollars.

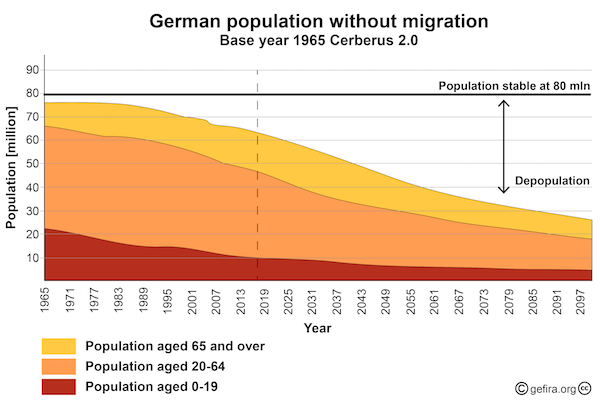

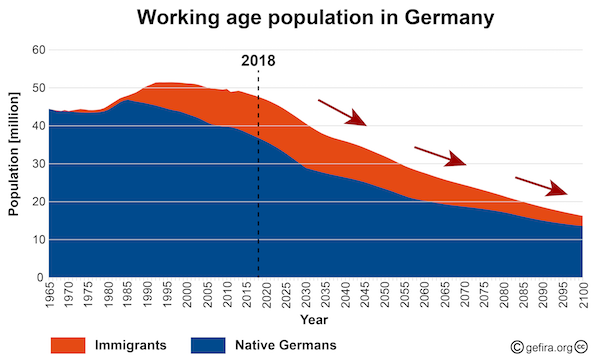

Uh-oh, there goes Mutti’s promised land..

• EU Seeks To Intensify Immigrant Deportations (RT)

The European Commission has formally proposed to harmonize deportation rules across the EU. The current regulations, which vary by state, allow those who have been denied the right to remain in the bloc lawfully to exploit the system, resulting in a 20% deportation rate. President Ursula von der Leyen has labeled the figure “by far, too low.” The proposed rules “will ensure that those who have no right to stay in the EU are actually returned” to their countries of origin, EU Commissioner for Internal Affairs and Migration, Magnus Brunner, has claimed.

The 87-page document unveiled on Tuesday will require immigrants to cooperate with authorities, permit the extended detention of asylum seekers, and introduce the mutual recognition of deportation orders among member states. The reforms aim to encourage voluntary returns and close loopholes currently exploited by illegal immigrants who evade forced repatriation by moving between EU countries.The plan will establish “return hubs” – deportation centers in third countries willing to accept expelled individuals from the EU. If approved by the European Parliament and the Council of Europe, the new system is set to take effect in mid-2027.

Illegal immigration has remained a hot-button issue in the EU since the 2015 crisis, which saw over a million people arrive in member states. The authorities’ decision to welcome this influx sparked a backlash from several Eastern European nations, citing threats to security and culture. Political guidelines issued by von der Leyen last July pledged to strengthen the EU’s borders and crack down on human trafficking, a significant driver of illegal immigration.

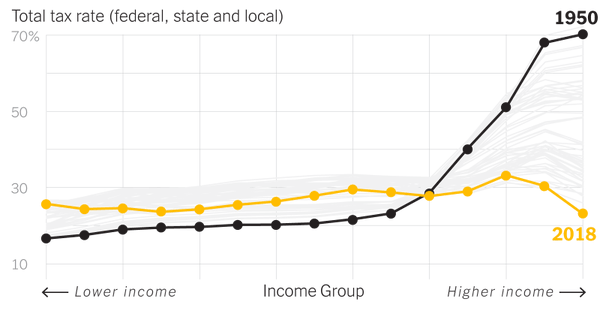

Interesting when compared to Paul Craig Roberts yesterday, who said:

“Trump has spoken of substituting tariffs for the income tax. This is a brilliant thought.

The income tax taxes labor and capital, factors of production. Thus income tax reduces GDP and living standards.”

• Tariffs are Theft (Ron Paul)

The US and China came closer to a full-fledged trade war last week when China imposed tariffs of up to 15 percent on key US agricultural exports. This was retaliation for President Trump’s increasing of tariffs on Chinese exports to the United States from 10 percent to 20 percent. China’s retaliatory tariffs show how export-dependent industries are harmed by protectionist policies. Even if other countries refrain from imposing retaliatory tariffs, exporters can still suffer from reduced demand for their products in countries targeted by US tariffs. Businesses that rely on imported materials to manufacture their products also suffer from increased production costs thanks to tariffs. President Trump acknowledged how tariffs harm US manufacturers when he granted US automakers’ request for a one-month delay in new tariffs on imports from Mexico and Canada.

Many American consumers who are struggling with high prices are concerned that President Trump’s tariff policy will further increase prices. They are right to be concerned. Contrary to popular belief, foreign businesses do not pay tariffs. Tariffs are paid by US businesses that wish to sell the imported goods. When tariffs are increased, the importing businesses try to recoup their increased costs by increasing their prices. Consumers then must choose whether to pay the higher price, find a cheaper alternative, or do without the product. Whatever they choose, consumers will be worse off because they cannot spend their money the way they prefer.Tariffs may provide a short-term benefit to the protected businesses. However, tariffs could keep businesses alive that should be allowed to fail so the business owners and workers can put their talents to use in other endeavors that would more greatly benefit and the whole economy.

Defenders of tariffs, including President Trump, claim the revenue from tariffs can be used to “offset” the revenue government loses from tax cuts. Some even claim that tariffs can generate enough revenue to allow the government to repeal the income tax. The problem with this is that a tariff brings in more revenue to “pay for” tax cuts only to the extent the tariff does not cause consumers to cease buying imported goods. Thus, the tariffs, to bring revenue to the government, must not be large enough to discourage Americans from buying foreign products. The more tariffs increase government revenue, the more they will tend to fail in bringing about another often promoted tariff goal — an increase in the purchase of domestic goods.

According to the Tax Foundation, if President Trump’s tariff plan for China, Mexico, and Canada were fully implemented, it would increase federal tax revenue by 142 billion dollars this year — an average tax increase of over one thousand dollars per household. The tariffs would also decrease economic output. This does not account for the decline in consumer satisfaction caused by consumers being forced to alter their consumption choices because of government-caused price increases. It also does not account for the new businesses, products, and jobs that could have been created had government not drained resources from the productive economy via tariffs. The economic effects are a good enough reason to oppose raising tariffs. However, the main reason to oppose tariffs is that tariffs, like all taxes (including the inflation tax), are theft.

Mr. policy-maker. He should move into the White House. ‘You can only fire people if i say so’..

• Clinton-Appointed Judge Slams Trump “Sham” (ZH)

San Francisco based… check. Clinton appointed… check. So how do you think the case against President Trump firing federal probationary staff went? Bingo… U.S. District Judge William Alsup described the mass firings as a “sham” strategy by the government’s central human resources office to sidestep legal requirements for reducing the federal workforce. Politico reports that Alsup, a San Francisco-based appointee of President Bill Clinton, ordered the Defense, Treasury, Energy, Interior, Agriculture and Veterans Affairs departments to “immediately” offer all fired probationary employees their jobs back. The Office of Personnel Management, the judge said, had made an “unlawful” decision to terminate them. The order is one of the most far-reaching rejections of the Trump administration’s effort to slash the bureaucracy and is almost certain to be appealed.

“You will not bring the people in here to be cross-examined. You’re afraid to do so because you know cross examination would reveal the truth,” the judge said to a DOJ attorney during a hearing Thursday. “I tend to doubt that you’re telling me the truth. … I’m tired of seeing you stonewall on trying to get at the truth.” The judge called the move “a gimmick.” Alsup also said the Office of Personnel Management couldn’t give guidance on who to terminate, according to ABC News. “It is sad, a sad day when our government would fire some good employee and say it was based on performance when they know good and well that’s a lie,” Alsup said. Do those sound like the findings of a non-partisan, legally-trained, judicially-independent member of the bench? And on it goes…

“Washington is increasingly making it clear that Western Europe must contribute more while receiving less in return.”

• America and the EU Are Drifting Apart – Moscow Is Watching (Bordachev)

The geopolitical unity of the West, often perceived as a monolithic front against Russia, is showing visible fractures. The question now is whether Moscow should actively encourage the widening rift between the United States and Western Europe – or simply sit back and let history take its course. For now, the EU states are desperate to avoid responsibility for the crisis in Ukraine. This was evident in Brussels’ immediate endorsement of the latest US-Ukraine talks, signaling relief that Washington is still managing the situation. European leaders had feared that the new American administration under Donald Trump might offload the burden onto them, forcing them to take direct responsibility for confronting Russia. That nightmare, at least for now, has been postponed. But the larger strategic question remains: How long can this uneasy balance last?

Is the US-Europe rift temporary or permanent? The unity of the collective West – a term used to describe the US and its European allies acting as a single political and military bloc – was never an absolute certainty. It was always dependent on American leadership, which is now undergoing major internal shifts. Trump’s return has signaled a profound shift in Washington’s strategic thinking. While the US remains the most militarized and economically powerful country in the Western alliance, it is now experiencing an identity crisis. The ruling elite in Washington knows it must redefine its role in a world where its global dominance is being challenged. This raises a critical question: Can the US and Western Europe continue as a united front, or is their strategic divergence inevitable? For Moscow, this is more than just a theoretical debate. If the West’s unity was merely a temporary phenomenon – a product of post-World War II security arrangements and Cold War politics – then it follows that Russia must consider whether and how to encourage this fragmentation.

The US political crisis and its impact on Europe The deepening internal crisis in the US is one of the main reasons the EU is being forced into an uncomfortable position. First, America’s economic model is under strain. For decades, Washington sustained its dominance by attracting cheap labor from Latin America while maintaining global economic hegemony. But the mass migration crisis has turned into a politically explosive issue, with growing resistance to uncontrolled immigration. Second, the old neoliberal model of globalization is breaking down. Many nations no longer accept a US-led order that imposes unequal economic relationships. This has led to an emergence of independent power centers – from China and India to Middle Eastern states – that refuse to play by Washington’s rules. Finally, the conflict in Ukraine has exposed the limits of American power. Russia’s ability to withstand three years of Western pressure – economically, militarily, and diplomatically – has forced Washington to reconsider its strategy. The US has never faced a direct geopolitical confrontation with China, and its approach toward Beijing remains one of cautious engagement. But with Russia, it has now met a determined adversary that refuses to bend.

Western Europe’s dilemma: dependence or independence? For the EU, any major shift in US policy is a cause for alarm. Since World War II, Western European elites have relied on American military protection while enjoying economic prosperity under the US-led global order. In exchange for this security umbrella, these states surrendered much of their foreign policy independence. Despite its economic weight, the EU has largely functioned as a political appendage of Washington. This has come at a cost: Western European leaders have little say in critical global decisions, and their fate remains tied to decisions made in the US. Now, with Washington signaling it wants to shift its focus – both in military and economic terms – the bloc finds itself in a precarious situation.

Western Europe lacks the demographic and financial resources to turn itself into a military superpower. The idea of building an independent EU defense structure is often discussed but remains unrealistic. Without U.S. support, these states cannot sustain a large-scale conflict with Russia. Also, Washington is increasingly making it clear that Western Europe must contribute more while receiving less in return. The US political class knows that economic resources are finite, and American taxpayers are questioning why they should continue subsidizing European security. The rise of populist and nationalist movements across Europe – many of which favor detente with Moscow – adds another layer of complexity. Washington’s support for non-mainstream European politicians, such as the Alternative for Germany (AfD) or Romania’s banned presidential candidate Calin Georgescu, signals an emerging divide.

How should Russia respond? Moscow must recognize that any long-term fracturing of the West works to its strategic advantage. History shows that Russia has been most successful in its geopolitical struggles when the West was divided. During the Northern War, Peter the Great’s Russia exploited divisions within Europe’s anti-Swedish coalition; in the Napoleonic Wars, Russia aligned with Britain – normally a rival – to defeat France. During World War II, the Soviet Union benefited from the split between the US and Nazi Germany’s former allies. Conversely, when the West has acted as a single entity, Russia has faced its most significant challenges – such as during the Cold War, which led to the eventual collapse of the Soviet Union. Given these historical lessons, it would be unwise for Moscow to ignore opportunities to accelerate the split between Washington and its European allies. Russia must continue engaging with Trump’s team while indirectly supporting voices in Europe who favor a more balanced approach to Russia. Moscow should deepen its bilateral economic ties with individual European countries, bypassing Brussels’ restrictive policies wherever possible. Any serious attempt by Western Europe to build an independent military bloc should be closely monitored – though in reality, such plans remain far-fetched.

The future of the West is uncertain While Trump’s arrival has disrupted the status quo, it remains unclear whether this is just a temporary setback for transatlantic unity or the beginning of a permanent shift. If Washington continues down the path of reducing its commitments to Europe, the EU will face an identity crisis – one that may ultimately lead to a loss of American influence over EU politics. For Russia, this presents an opportunity. By carefully navigating these developments, Moscow can ensure that any cracks in the Western alliance become permanent fractures – shaping a world where American and Western European interests no longer align as they once did. Russia does not need to rush or force the split – the US is doing that on its own. But Moscow can and should help accelerate the process where possible. After all, a divided West is a weaker West – and that is something Russia has always understood.

What an invitation! Now imagine Marco Rubio, or Macron, von der Leyen, reaching out to new media this way. Trump might…

• A Conversation with Foreign Minister Lavrov (Larry Johnson)

What an honor. I was invited, along with Judge Napolitano and Mario Nawfal, to interview Russian Foreign Minister Lavrov on Monday. Mr. Lavrov is smart, charming, funny and quite approachable. He ain’t a bullshitter. There was no pretense about him. After spending more than 90 minutes conversing with him, I came away with a new appreciation of his skill as the consummate diplomat. Although we each had prepared a couple of questions in advance, those went out the window once the conversation started. There were no constraints on what we could ask. There was an added treat before Mr. Lavrov arrived… we spent thirty minutes chatting with Maria Zakharova in a casual environment. She is equally charming and tough as a rhinoceros hide. I think of her as an iron fist wrapped in a luxurious velvet glove. A formidable diplomat in her own right.

Here is a summary of the key points Mr. Lavrov made during our discussion:

• I think what is going on in the United States is a return to normalcy. <…> The fact is that a normal administration without any, you know, unChristian ideas came to power and the reaction was such an explosion in the media, in the politics all over the world is very interesting and very telling.

• When we met in Riyadh with Marco Rubio, Mike Waltz and Steve Witkoff they suggested the meeting and they said, look, we want normal relations in the sense that the foundation of the American foreign policy under the Donald Trump administration is the national interest of the United States. But at the same time, we understand that other countries also have their national interest.

• It is very well understood that countries like the United States and Russia would never have their national interest the same. They would not coincide maybe even 50 or less percent. But when they do coincide this situation must be used to develop this simultaneous and similar interest. But when the interests do not coincide and contradict each other then the responsible countries must do everything not to allow this contradiction to degenerate into confrontation, especially military confrontation which would be disastrous for many other countries.

• The beginning of the special military operation was a decision because all other attempts, all other alternatives to bring things into some positive dimension failed for ten years after the illegal coup in Kiev, in violation of the deal signed the night before and guaranteed by the Germans, French and Poles.

• I don’t think the Americans would drop from NATO. At least President Trump never hinted that this might be the case. But what he did bluntly say was that if you want us to protect you, to give you security guarantees, you pay what is necessary.

• But President Trump doesn’t want to provide these security guarantees to Ukraine under Zelensky. He has his own view of the situation which he bluntly presents every now and then, that this war should never have started – that pulling Ukraine into NATO in violation of its constitution, in violation of the Declaration of Independence of 1991, on the basis of which we recognized Ukraine as a sovereign state. For several reasons including that this Declaration was saying no NATO, no blocs, neutral status. Another thing which this Declaration also confirmed and solidified – all rights of Russian and all other national minorities are to be respected.

• Europe and the UK, they certainly want this to continue. The way they received Zelensky in London after the scandal in Washington, it’s an indication that they want to raise the stakes and they are preparing something to pressure the Donald Trump administration back into some aggressive action against Russia.

• It’s not about the territories, it’s about the people who were deprived of their history by law. Territories are important only because people live on these territories. The people who live on the territories are descendants of those who for hundreds of years were building Odessa & other cities on those very lands who were building ports, roads, who were founding those lands and who associated with the history of this land.! The Americans know that we would not betray our commitments, legal commitments, the political commitments which we develop with China.

Mario Nawfal, the young man seated between the Judge and me, was a delight to be with. At the ripe old age of 30, he treated Judge Nap and me like two respected grandfathers. Being able to spend five days with Judge Napolitano — it was the first time we have been together physically in the entire time that I have known him — was a special treat. The Judge and I met for breakfast every morning in the room pictured above during our time in Moscow. While eating, we were serenaded by a talented harpist, which added a surreal quality to the experience. The staff at the Metropol are superb as well. I will provide a more detailed account of our time in Moscow in a forthcoming post.

Flu shot

https://twitter.com/VigilantFox/status/1899889092911129014

Happybird

https://twitter.com/buitengebieden/status/1900074009003188539

Table

Wood table with little dog sculpture

— Science girl (@gunsnrosesgirl3) March 13, 2025

Origami

https://twitter.com/gunsnrosesgirl3/status/1900239757554442694

AI Hepburn

https://twitter.com/gunsnrosesgirl3/status/1900059437622063208

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.