John Swope Trees in fog (Chile) 1939

Not learned a single thing in the past 10 years.

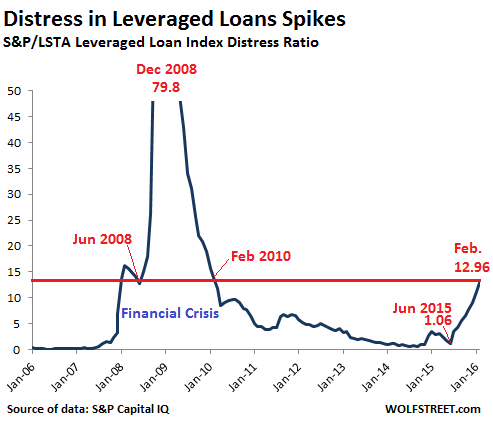

• Leveraged-Loan Risks Are Piling Up (WS)

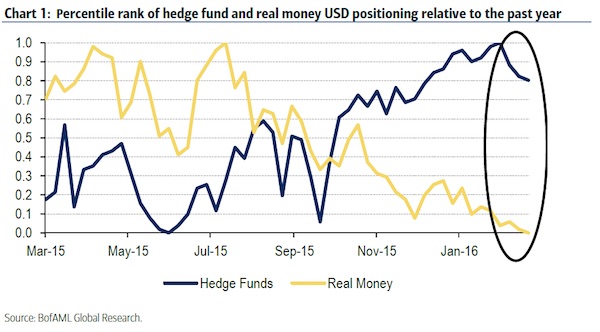

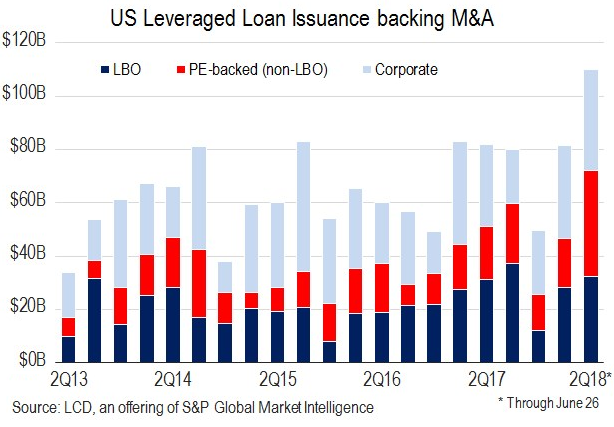

US junk-bond issuance in June plunged 31% from a year ago to just $14.5 billion, the lowest of any June in five years, according to LCD of S&P Global Market Intelligence. During the first half of the year, junk bond issuance dropped 23% from a year ago to $110.6 billion. Is investor appetite for risky debt drying up? Have investors given up chasing yield? On the contrary! They’re chasing harder than before, but they’re chasing elsewhere in the junk-rated credit spectrum: leveraged loans. Leveraged loans are another way by which junk-rated companies can raise money. These loans are arranged by banks and sold either as loans or as Collateralized Loan Obligation (CLOs) to other investors, such as pension funds or loan funds.

They’re a $1 trillion market and trade like securities. But the SEC, which regulates securities, considers them loans and doesn’t regulate them. No one regulates them. In the first half, companies issued $274 billion of non-amortizing leveraged loans, and $97 billion in revolving and amortizing leveraged loans, according to LCD, for a total of $371 billion, on par with the record set in the first half last year. This is well over triple the amount of junk bonds issued in same period ($110 billion). Many of these loans have floating interest rates, typically pegged to the dollar-Libor. And in an investment environment where the Fed has been trying to push up interest rates, Libor has surged, and floating-rate loans, whose interest payments increase as Libor ratchets higher, are very appealing to investors – despite the additional risks these higher interest payments pose for the companies that are already struggling with negative cash flows.

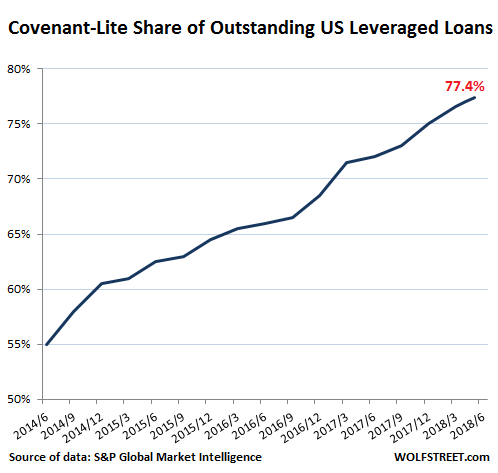

[..] Leveraged loans come with covenants that are supposed to protect investors during the term of the loan and in case of default. With strong covenants and good collateral, leveraged loans tend to be less risky than junk bonds issued by the same company. Alas, investors have the hots for this debt, and companies are taking advantage of it by weakening covenants, giving investors fewer protections and the company more leeway – such as paying interest with more debt rather than cash if it runs out of cash (payment-in-kind or PIK); normally, not being able to pay interest would constitute a default, but not with these “covenant lite” or “cov-lite” loans. The boom in cov-lite has started years ago and has surged to massive record proportions. When these loans default, investors are exposed to much greater losses.

Interesting idea. Decades too late though.

• UK House Prices Should Be Frozen For Five Years – Think Tank (Ind.)

UK house prices should be frozen for five years to help prevent another financial crisis, the think tank IPPR has said. The group has urged the Bank of England to freeze property prices under a separate new inflation target and said this could lead to house prices falling by around 10 per cent in real terms as other prices and wages continue to rise, making homes more affordable. Under the IPPR’s proposals, house prices would be allowed to increase “only after expectations of constantly rising house prices have been ‘reset’”. The think tank also said prices would be allowed to grow “no faster than the general consumer price inflation target of 2 per cent, meaning no further growth in the real value of people’s homes”.

The IPPR said its recommendations were part of a wider plan to “rebalance the UK economy away from finance” so as to avoid another financial crisis. According to the IPPR, the financial sector’s “dominance” since the 1980s has contributed to a strong pound, which has hurt exporters, and has attracted surplus money from other countries, which has been channelled into loans for speculative investors, including mortgage lending. This speculation over house prices, the think tank said, has helped drive up prices and at the same time made the economy more vulnerable to a crisis, because it has reduced funds available for more productive investment, created regional inequalities with disproportionate growth in London and the South East, and “concentrated market power into the hands of a small number of large banks”.

[..] Grace Blakeley, IPPR research fellow, said: “Since the 1980s, the UK’s business model has rested on attracting capital from the rest of the world, which it has channelled into debt for UK consumers. The 2008 crisis proved that this is unsustainable. “We need to move towards a more sustainable growth model, one built on production and investment rather than debt and speculation. To do this, we must break the cycle of ever-rising house prices driving property speculation, crowding out investment in the real economy.”

A confidence vote looks inevitable.

• 24 Hours of Brexit Mayhem (Ind.)

Theresa May is clinging on to power following the dramatic resignation of Boris Johnson and a bruising 24 hours of conflict with Tory Brexiteers. Mr Johnson became the third minister to quit in the space of a day, accusing Ms May of pursuing a Brexit that would lock Britain into “the status of colony”. In a scathing letter, he said her plans for negotiating with Europe decided at Chequers last week equated to going into battle with “white flags fluttering”. But despite the resignations and the looming threat of a “vote of no confidence”, Ms May survived the day and finished it with a swipe at Mr Johnson, in which she appeared to question his motives for quitting.

After David Davis left his job as Brexit secretary just before midnight on Sunday, speculation grew as to whether there would be a slew of resignations, bringing down the government. He had been followed by fellow Brexit minister Steve Baker, but it was not until 3pm on Monday, when it emerged that Mr Johnson was walking, that Ms May looked at her most precarious. It was claimed that Downing Street leaked news of his resignation before he could write his letter, which the prime minister’ aides guessed would be wounding. When it came it said: “Brexit should be about opportunity and hope. It should be a chance to do things differently, to be more nimble and dynamic, and to maximise the particular advantages of the UK as an open, outward looking global economy. “The dream is dying, suffocated by needles doubt.”

“Instead of the Star Trek vision of boldly going where no imperial nostalgic society had gone before, this Brexit would not have enough thrust to get the UK out of the gravitational pull of the European Union”

• Britain Has Gone To Huge Trouble To Humiliate Itself (Fintan O’Toole)

The best headline about British prime minister Theresa May’s short-lived triumph over the hard Brexiteers last Friday was undoubtedly the one on Pádraig Collins’s report in the Guardian: “Possum rescued after getting head stuck in Nutella jar”. Admittedly, Collins was actually reporting, not from Chequers, but from Brisbane, Australia. Yet the accompanying photograph was the perfect image of what May is trying to do. It showed the furry creature all curled up and immobilised with its head completely encased in a glass jar streaked with visible residues of sticky brown stuff. As a spokesman for the Australian RSPCA explained, the dumb animal “managed to get his head in the jar, but obviously couldn’t get it out”.

The rescuer put “towels around the possum so she could get him out of the jar without getting scratched by his claws”. The story saves me the trouble of thinking up a metaphor. The Brexiteers have their heads stuck in a jar of sticky brown stuff that seemed so sweet and enticing. May’s compromise deal and the White Paper she is still expected to publish this week are the towels wrapped round the Brexiteers’ claws so that their heads can be pulled out of the jar without her premiership getting scratched to death.

The only problem is that David Davis and Boris Johnson, having been successfully extracted, decided to bare their claws again. As any possum or two-year-old child will tell you, sticking your head inside a glass jar is quite a thrill. You get to see the world through a distorting lens that creates a comforting distance between you and reality. You can’t hear unwanted voices raising awkward questions. Brexit has so far been conducted through a glass darkly. It has been seen through glorious fantasies of imperial revival and layers of self-pity about imaginary oppression. What May has been attempting, very late in the day, is to force her more deluded colleagues to get their heads out of the jar and look directly at Brexit.

The story is the two have been exposed to high dose of novichok. That is not possible; they would have died in instants.

• Novichok In Wiltshire Death ‘Highly Likely’ From Batch Used On Skripals (G.)

Britain’s counter-terrorism chief has said it is highly likely the novichok that killed Dawn Sturgess in Wiltshire came from the same batch used four months earlier to attack a former Russian spy and his daughter at their Salisbury home. The Metropolitan police assistant commissioner Neil Basu also said the substance that led to Sturgess and her partner Charlie Rowley falling ill on Saturday was in a vessel or container when the couple came across it. Police have opened a murder investigation after Sturgess died in hospital on Sunday at 8.26pm. Basu said: “It is both shocking and utterly appalling that a British citizen has died having being exposed to a Novichok nerve agent.

“But make no mistake, we’re determined to find out how Dawn and her partner, Charlie Rowley, came into contact with such a deadly substance; and we will do everything we possibly can to bring those responsible to justice.” Basu said Sturgess and Rowley got a high dose of novichok after handling a container containing the nerve agent. It was most likely that the container police are hunting for was linked to the attack four months earlier on the Skripals. [..] “In the four months since the Skripals and Nick Bailey were poisoned, no other people besides Dawn and Charlie have presented with symptoms. Their reaction is so severe it resulted in Dawn’s death and Charlie being critically ill. This means they must have got a high dose. Our hypothesis is they must have handled the container we are now seeking.”

“The carmaker blamed staffing shortages for the scandal..”

• Nissan Says Emissions And Fuel Economy Tests Were Falsified (R.)

Nissan has said it has found evidence of misconduct relating to exhaust emissions and fuel economy measurements for 19 models sold in Japan. The Japanese carmaker said on Monday it had discovered the testing environments for emissions and fuel economy in final vehicle inspections at most of its factories in Japan were not in line with requirements, and inspection reports were based on altered measurements. “A full and comprehensive investigation of the facts … including the causes and background of the misconduct, is under way,” Nissan said. The problems were found during voluntary compliance checks following an improper vehicle inspection scandal last year.

In October, a recall of 1.2m vehicles was triggered after Nissan said uncertified inspectors had signed off on final checks for cars sold in Japan. The carmaker blamed staffing shortages for the scandal, which caused annual operating profit to slide. Nissan said the latest misconduct did not compromise the safety of the affected models, and mileage readings were in line with levels presented in product catalogues. It was in the process of compiling data for the GT-R sports car to confirm it satisfied safety standards. The carmaker said it would take appropriate action to prevent similar problems in future.

Time to keep promises.

• Trump Slams Pfizer After July 1 Drug Price Hikes (R.)

U.S. President Donald Trump on Monday took aim at Pfizer Inc and other U.S. drugmakers after they raised prices on some of their medicines on July 1, saying his administration would act in response. “Pfizer & others should be ashamed that they have raised drug prices for no reason.” Trump wrote in a post on Twitter on Monday. “We will respond!” Health and Human Services Secretary Alex Azar followed up with his own tweet saying that drugmakers who have raised prices have created a tipping point in U.S. drug pricing policy. “Change is coming to drug pricing, whether painful or not for pharmaceutical companies,” Azar wrote. Neither Trump nor Azar detailed what policy changes would be implemented to decrease prices.

Trump had said in May that some drug companies would soon announce “voluntary, massive” cuts in prices, but none have materialized yet. During his presidential campaign, he promised lower U.S. drug costs. Pfizer raised list prices on around 40 medicines earlier this month. Those include Viagra, cholesterol drug Lipitor and arthritis treatment Xeljanz, according to Wells Fargo. List prices do not include rebates and discounts drugmakers may offer. “The list price remains unchanged for the majority of our medicines. Our portfolio includes more than 400 medicines and vaccines. We are modifying prices for approximately 10 percent of these, including some instances where we’re decreasing the price,” Pfizer spokeswoman Sally Beatty told Reuters.

Enough of this already. Stop it.

• Judge Rejects Trump Request For Long-Term Detention Of Immigrant Children (R.)

A U.S. federal judge on Monday rejected the Trump administration’s request to allow long-term detention of illegal immigrant children, a legal setback for President Donald Trump’s push to detain immigrant families taken into custody at the U.S.-Mexico border. Los Angeles U.S. District Court Judge Dolly Gee dismissed as “dubious” and “unconvincing” the U.S. Justice Department’s proposal to modify a 1997 settlement known as the Flores Agreement, which says that children cannot be held in detention for long periods. The government made its request in June after public outcry over its policy of separating children from parents who entered the United States illegally.

A judge in a different case in San Diego ordered the government last month to reunite the families it had separated. The government asserted in its Flores filing that the San Diego ruling would necessitate longer-term detention of children, since that would be the only way to both reunite them with their parents and keep the parents incarcerated during their immigration proceedings. Gee rejected that argument. “Defendants advance a tortured interpretation of the Flores Agreement in an attempt to show that the … injunction permits them to suspend the Flores release and licensure provisions,” she wrote.

“The solution to the problem will be to resettle these refugees in their countries..” “This can only happen when the conflicts raging in these countries are settled.”

• Egypt Rejects Europe’s Intent To Set Up ‘Regional Disembarkation Centres’ (AW)

Egypt’s opposition to establishing camps for screening migrants heading to Europe has made the European Union’s “regional disembarkation centres” proposal seem even more implausible. Cairo’s stand has underscored the deep worries in the Egyptian administration about the country’s increasing refugee responsibilities, analysts said. “This is a burden Egypt shoulders alone, without any support from the international community,” said MP Ghada Agamy, a member of the Egyptian parliament’s Foreign Relations Committee.

Egypt said it would not be able to accommodate “regional disembarkation centres” for migrants trying to cross the Mediterranean to Europe just hours after European leaders reached a controversial migration deal that included refugee centres in North Africa and “controlled centres” in European countries. Egypt, Tunisia, Morocco and Algeria have rejected the idea of regional disembarkation centres. The Egyptian government said establishing refugee camps would violate the Egyptian constitution. Refugees, Egyptian parliament Speaker Ali Abdel A’al said, can live wherever they want in Egypt. “We do not establish camps here,” he said. Egyptian officials are concerned about Cairo’s ability to shoulder refugee-related burdens, analysts said, particularly at a time of economic transition.

[..] Instead of asking economically struggling countries to act as refugee hosts, European leaders need to solve the problems that cause these refugees to leave their countries in the first place, particularly the unrest that has engulfed many countries, Egyptian specialists said. “The solution to the problem will be to resettle these refugees in their countries,” said Youssef al-Metany, a refugee lawyer at local NGO Egyptian Network for International Law. “This can only happen when the conflicts raging in these countries are settled.”

Zoe Konstantopoulou is the former president of the Hellenic parliament.

• If You Love Greece, Help Us Get Rid Of Alexis Tsipras And His Zombie Party (G.)

Last week was the third anniversary of the 2015 referendum, in which the Greek people voted no to more austerity, and no to the violation of democracy by the creditors. The week before Alexis Tsipras, the prime minister who betrayed the brave no of the Greek people, visited London to present his capitulation to the troika of the European commission, the International Monetary Fund and the European Central Bank as an achievement.

Imagine how the British people would view a prime minister elected to end privatisation, and who instead privatised almost every piece of public property; who was elected to serve peace, and who instead facilitated military action against targets in Syria and agreed to sell weapons to countries accused of committing international crimes; who was elected to protect people’s homes, and who stood by while banks seized them, leaving people homeless; who was elected to serve democracy and the independence of his country, and who instead turned it over to the EU, the IMF and the ECB. This is what Tsipras did to the Greek people.

I was a Syriza MP and president of the Greek parliament during the seven months of the first Syriza government. When Tsipras signed the toxic third memorandum in 2015, I fought hard to protect our parliamentary procedures that he and the troika violated. In spite of continuous pressure, I refused to bend our democratic rules and accept more illegal debt for our people. Together with dozens of other Syriza MPs, I voted against the monstrous agreement. Tsipras then dissolved parliament prematurely to get rid of me and the dissenting MPs.

Three years on, his capitulation to the troika has proved the disaster many of us predicted. People’s lives have become unbearable. Youth unemployment has become the norm and an estimated 8% of the population has left in search of work. The minimum salary doesn’t pay the bills, and hundreds of thousands of families go without electricity for extended periods of time. This tragedy began in 2010, but Tsipras’s so-called left government has done everything to prove that it can implement austerity better than its predecessors. It even brags about exceeding the troika’s cruel targets in cuts and taxes.

“..the landscape as demolition derby..”

• When Collapse Goes Kinetic (Kunstler)

I suppose many who think about the prospect of economic collapse imagine something like a Death Star implosion that simply obliterates the normal doings of daily life overnight, leaving everybody in a short, nasty, brutish, Hobbesian free-for-all that dumps the survivors in a replay of the Stone Age — without the consolation of golden ages yet to come that we had the first time around. The collapse of our techno-industrial set-up has actually been going on for some time, insidiously and corrosively, without shattering the scaffolds of seeming normality, just stealthily undermining them. I’d date the onset of it to about 2005 when the world unknowingly crossed an invisible border into the terra incognito of peak oil, by which, of course, I mean oil that societies could no longer afford to pull out of the ground.

It’s one thing to have an abundance of really cheap energy, like oil was in 1955. But when the supply starts to get sketchy, and what’s left can only be obtained at an economic loss, the system goes quietly insane. In the event, popular beliefs and behavior have turned really strange. We do things that are patently self-destructive, rationalize them with doctrines and policies that don’t add up, and then garnish them with wishful fantasies that offer hypothetical happy endings to plot lines that do not really tend in a rosy direction. The techno-narcissistic nonsense reverberating through the echo-chambers of business, media, and government aims to furnish that nostrum called “hope” to a nation that simply won’t admit darker outcomes to the terrible limits facing humanity.

Thus, we have the Tesla saga of electric motoring to save the day for our vaunted way of life (i.e. the landscape as demolition derby), the absurd proposals to colonize distant, arid, frigid, and airless Mars as a cure for ruining this watery blue planet ideally suited for our life-form, and the inane “singularity” narratives that propose to replace grubby material human life with a crypto-gnostic data cloud of never-ending cosmic orgasm. The psychological desperation is obvious. Apparently, there are moments in history when flying up your own butt-hole is the most comforting available option.

But how do you prove it?

• As Trial Opens, Man Dying Of Cancer Blames Monsanto’s Roundup (AFP)

A lawyer for a California groundskeeper dying of cancer took aim at Monsanto Monday as a jury began hearing the lawsuit accusing the chemical giant of ignoring health risks of its top-selling weed killer Roundup. “For the past 40 years, Monsanto has known the primary ingredient in Roundup can produce tumors in lab animals,” attorney Brent Wisner told a California state court. A jury is hearing the case brought by Dewayne Johnson, a 46-year-old father of two. Diagnosed in 2014 with non-Hodgkin’s lymphoma, a cancer that affects white blood cells, Johnson used a Monsanto generic version of Roundup called “Ranger Pro” repeatedly in his job at a school in Benicia, California, after being promoted to groundskeeper in 2012.

In his opening statement, Wisner said Monsanto opted against warning consumers of the risks and that instead “they have fought science” by playing down the suspected link between the chemical herbicide and cancer. “Monsanto has gone out of its way to bully scientists and fight researchers,” he told the jury. The case in California Superior Court is the first trial in which Roundup is said to have caused cancer, a claim repeatedly denied by the chemical company. If Monsanto loses, the case could open the door to hundreds of additional lawsuits against the company recently acquired by German-based pharmaceutical and chemical group Bayer.

Johnson had little warning about the risks of Roundup, his lawyer said. “He was told you could drink it, it was completely non toxic,” Wisner said with his client sitting in the San Francisco courtroom. “You will hear testimony from him that he got drenched in it, repeatedly.” The lawyer said Johnson, who is between rounds of chemotherapy, “is actually on borrowed time, he is not supposed to be alive today.” A key to Johnson’s case will be convincing jurors that Monsanto’s pesticide — whose main ingredient is glyphosate — is responsible for the illness. Wisner contended glyphosate combined with an ingredient intended to help it spread over leaves in a cancer-causing “synergy.”