Henri Matisse Odalisque couchée aux magnolias 1923

Bonds yield more than stocks.

• Making Money In The Stock Market Just Got A Lot More Difficult (MW)

For almost a decade, it’s been extremely difficult to lose money in the U.S. stock market. Over the next decade, it could be hard to do anything but, according to analysts at Morgan Stanley. The outlook for market returns has precipitously worsened in recent months, with analysts and investors growing increasingly confident that the lengthy bull market that began in the wake of the financial crisis could be, if not coming to a close, petering out. More market participants view the economy as being in the late stage of its cycle, and a recession is widely expected in the next few years. All of that could result in an equity-market environment that’s a mirror image of recent years, where gains were pretty much uninterrupted, and volatility was subdued.

“2018 is seeing multiple tailwinds of the last nine years abate,” Morgan Stanley analysts wrote in a report to clients that was entitled “The End of Easy,” in reference to the investing environment. “Decelerating growth, rising inflation and tightening policy leave us with below-consensus 12-month return forecasts for most risk assets. After nine years of markets outperforming the real economy, we think the opposite now applies as policy tightens.” As part of its call, Morgan Stanley reduced its view on global equities to equal weight, saying they were “in a range-trading regime with limited 12-month upside.” It raised its exposure to cash, following Goldman Sachs, which last week upgraded its view on the asset class on a short-term basis.

U.S. GDP grew at an annualized 2.3% in the first quarter, below the 3% average of the previous three quarters, as consumer spending hit its weakest level in five years. While slowing growth isn’t the same as a contraction, the data added to concerns that a period of synchronized global growth was coming to a close. According to a BofA Merrill Lynch Global survey of fund managers in April, just 5% of respondents expect faster global growth over the coming 12 months, compared with the roughly 40% that did at the start of the year.

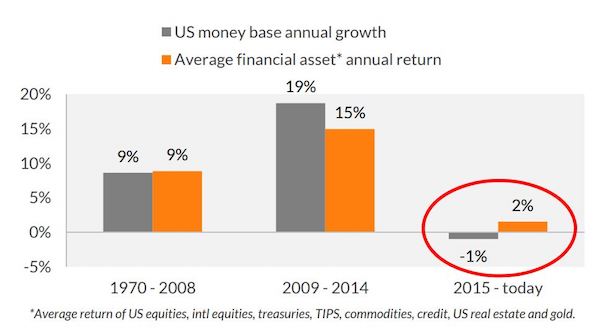

[..] Howard Wang, the co-founder of Convoy Investments, called the Fed’s ballooning balance sheet “the fundamental driver of asset prices over the last decade.” He provided the chart below, which compares the growth in the U.S. money supply against the long-term return of all assets, including global equities, bond categories, real estate, and gold. “I believe the trend of shrinking money supply in the system will continue for some time to come,” Wang wrote. “This adjustment is a painful but necessary process for healthier markets and economies.”

$52,000 per second.

• America’s Worst Long-Term Challenges: #1- Debt. (Black)

On October 22, 1981, the national debt in the United States crossed the $1 trillion threshold for the first time in history. It took nearly two centuries to reach that unfortunate milestone. And over that time the country had been through a revolution, civil war, two world wars, the Great Depression, the nuclear arms race… plus dozens of other wars, financial panics, and economic crises. Today, the national debt stands at more than $21 trillion– a milestone hit roughly two months ago. This means that the government added $20 trillion to the national debt in the 37 years between October 22, 1981 and March 15, 2018.

That’s an average of nearly $1.5 BILLION added to the national debt every single day… $62 million per hour… $1 million per minute… and more than $17,000 per SECOND. But the problem for the US government is that this trend has grown worse over the years. It took only 214 days for the government to go from $20 trillion in debt to $21 trillion in debt– less than eight months to add a trillion dollars to the national debt. That’s an average of almost $52,000 per second. Think about that: on average, the US national debt increases by more in a split second than the typical American worker earns in an entire year. And there is no end in sight.

At 105% of GDP, America’s national debt is already larger than the size of the entire US economy. (By comparison the national debt was just 31% of GDP in 1981.) Plus, the government’s own projections show a steep increase to the debt in the coming years and decades. The Treasury Department has already estimated that it will borrow $1 trillion this fiscal year, $1 trillion next year, and another trillion dollars the year after that. They’re also forecasting the national debt to exceed $30 trillion by 2025.

I’ll let Caitlin do the talking. The damage done to America yesterday will be felt for a long time.

• Fifteen Thoughts About Israel (Caitlin Johnstone)

1. I hate writing about Israel. The accusations of anti-semitism which necessarily go along with literally any criticism of that nation are gross enough, but even worse are the assholes who take my criticisms of the Israeli government as an invitation to actually be anti-semitic. They really do hate Jews, they really do think that every problem in the world is because of Jews and they post Jewish caricature memes and calls for genocide in the comments section on social media and it’s incredibly gross and I hate it. It feels exactly as intrusive, jarring and violating as receiving an unsolicited dick pic. But the Israeli government keeps committing war provocations and massacring Palestinians, so it’s something I’ve got to talk about.

2. Anti-semitism (or whatever word you prefer to use for the pernicious mind virus which makes people think it’s okay to promote hatred against Jewish people) is a very real thing that does exist, and I denounce it to the furthest possible extent. Anti-semitism is also a label that is used to bully the world into accepting war crimes, apartheid, oppression, and mass murder. Both of those things are true.

3. There were dozens of Palestinians killed and well above a thousand injured in the Gaza protests over the US moving its embassy to Jerusalem yesterday. I haven’t found any report of so much as a single Israeli injury. The only way to spin this as the fault of the Palestinians is to dehumanize them, to attribute behaviors and motives to them that we all know are contrary to human nature. To paint them as subhuman orc-like creatures who are so crazy and evil that they will keep throwing themselves at a hail of bullets risking life and limb just to have some extremely remote chance of harming a Jewish person for no reason. This is clearly absurd. A little clear thinking and empathy goes a long way.

6. Any position on Israel that is determined by words made up by dead men thousands of years ago is intrinsically invalid. Saying the Jewish people are more entitled to Israel than those who were living there seven decades ago because of some superstitious voodoo written in obsolete religious texts is not an argument. Religious freedom is important, and it’s important to be able to believe whatever you like, but your beliefs do not legitimize your actions upon other people. If you murder someone in the name of Allah, you have murdered someone. If you kill 58 people because you feel some ancient scripture entitles you to a particular section of dirt, you have killed 58 people. Your internal beliefs do not give you a free pass for your egregious actions upon others.

Betcha it’s true. Making people pay to be spied upon.

• Australia Probes Claim Google Harvests Data, Makes Consumers Pay For It (R.)

Google is under investigation in Australia following claims that it collects data from millions of Android smartphones users, who unwittingly pay their telecom service providers for gigabytes consumed during the harvesting, regulators said on Tuesday. Responding to the latest privacy concerns surrounding Google, a spokesman for the U.S. based search engine operator said the company has users’ permission to collect data. The Australian investigations stem from allegations made by Oracle Corp in a report provided as part of an Australian review into the impact that Google, owned by Alphabet Inc, and Facebook have on the advertising market. Both the Australian Competition and Consumer Commission (ACCC) and the country’s Privacy Commissioner said they were reviewing the report’s findings.

“The ACCC met with Oracle and is considering information it has provided about Google services,” said Geesche Jacobsen, a spokeswoman for the competition regulator. “We are exploring how much consumers know about the use of location data and are working closely with the Privacy Commissioner.” Oracle, according to The Australian newspaper, said Alphabet receives detailed information about people’s internet searches and user locations if they have a phone that carries Android – the mobile operating system developed by Google. Transferring that information to Google means using up gigabytes of data that consumers have paid for under data packages purchased from local telecom service providers, according to the Oracle report.

As I’ve said for a long time, this is the Belt and Road scheme.

• Warning Sounded Over China’s ‘Debtbook Diplomacy’ (G.)

China’s “debtbook diplomacy” uses strategic debts to gain political leverage with economically vulnerable countries across the Asia-Pacific region, the US state department has been warned in an independent report. The academic report, from graduate students of the Harvard Kennedy school of policy analysis, was independently prepared for the state department to view and assessed the impact of China’s strategy on the influence of the US in the region. The paper identifies 16 “targets” of China’s tactic of extending hundreds of billions of dollars in loans to countries that can’t afford to pay them, and then strategically leveraging the debt.

It said while Chinese infrastructure investment in developing countries wasn’t “inherently” against US or global interests, it became problematic when China’s use of its leverage ran counter to US interests, or if the US had strategic interests in a country which had its domestic stability undermined by unsustainable debt. The academics identified the most concerning countries, naming Pakistan and Sri Lanka as states where the process was “advanced”, with deepening debt and where the government had already ceded a key port or military base, as well places including Papua New Guinea and Thailand, where China had not yet used its amassed debt leverage.

Papua New Guinea, which “has historically been in Australia’s orbit”, was also accepting unaffordable Chinese loans. While this wasn’t a significant concern yet, the report said, the country offered a “strategic location” for China, as well as large resource deposits. While there was a lack of “individual diplomatic clout” in Cambodia, Laos and the Philippines, Chinese debt could give China a “proxy veto” in Asean, the academics said.

[..] China’s methods were “remarkably consistent”, the report said, beginning with infrastructure investments under its $1tn belt and road initiative, and offering longer term loans with extended grace periods, which was appealing to countries with weaker economies and governance. Construction projects, which the report said had a reputation for running over budget and yielding underwhelming returns, make debt repayments for the host nations more difficult. “The final phase is debt collection,” it said. “When countries prove unable to pay back their debts, China has already and is likely to continue to offer debt-forgiveness in exchange for both political influence and strategic equities.”

That’s been obvious for many years.

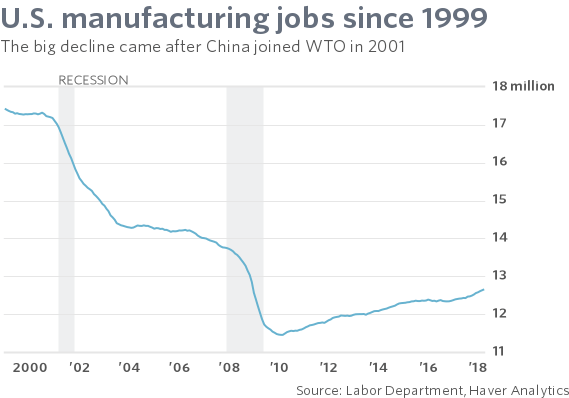

• China Really Is To Blame For Millions Of Lost US Manufacturing Jobs (MW)

Millions of Americans who lost manufacturing jobs during the 2000s have long ”known” China was to blame, not robots. And many helped elect Donald Trump as president because of his insistence that China was at fault. Evidently many academics who’ve studied the issue are finally drawing the same conclusion. For years economists have viewed the increased role of automation in the computer age as the chief culprit for some 6 million lost jobs from 1999 to 2010 — one-third of all U.S. manufacturing employment. Firms adopted new technologies to boost production, the thinking goes, and put workers out of the job in the process. Plants could make more stuff with fewer people.

In the past several years fresh thinking by economists such as David Autor of MIT has challenged that view. The latest research to poke holes in the theory of automation-is-to-blame is from Susan Houseman of the Upjohn Institute. Academic research tends to be dry and complicated, but Houseman’s findings boil down to this: The government for decades has vastly overestimated the growth of productivity in the American manufacturing sector. It’s been growing no faster, really, than the rest of the economy. What that means is, the adoption of technology is not the chief reason why millions of working-class Americans lost their jobs in a vast region stretching from the mouth of the Mississippi river to the shores of the Great Lakes. Nor was it inevitable.

Autor and now Houseman contend the introduction of China into the global trading system is root cause of the job losses. Put another way, President Bill Clinton and political leaders who succeeded him accepted the risk that the U.S. would suffer short-term economic harm from opening the U.S. to Chinese exports in hopes of long-run gains of a more stable China. No longer needing to worry about U.S. tariffs, the Chinese took full advantage. Low Chinese wages and a cheap Chinese currency — at a time when the dollar was strong — gave China several huge advantages. Companies shuttered operations in the U.S., moved to China and eventually set up research hubs overseas in another blow to the America’s economic leadership. The cost to the U.S. is still being tallied up.

Gee, what a surprise.

• No Progress Made On Any Key Area Of Brexit For Months – EU (Ind.)

EU27 ministers met on Monday with the bloc’s chief negotiator Michel Barnier in Brussels to discuss the state of talks so far. “Mr Barnier informed us that since 23 March no significant progress has been made on the three pillars that we work on: withdrawal, future framework, and Ireland,” Ekaterina Zakharieva, the Bulgarian foreign minister chairing the council, told journalists at an official press conference following the meeting. The renewed deadlock in Brussels comes as Theresa May’s cabinet repeatedly fails to agree with itself on what customs arrangement it wants with the EU after Brexit, despite publishing two options in August of last year. Both those options were dismissed as “magical thinking” by the EU at the time.

Speaking at a separate event in Brussels on Monday evening, Mr Barnier himself said that full talks on the future relationship had not even started in earnest despite getting the green light at a summit in March. “There is still a lot of uncertainty. Negotiations on the future with the UK have not started yet. We have had first exploratory discussions,” he said. Ms Zakharieva said the EU27 countries wanted more “intensive engagement by the UK government in the coming weeks”, warning that the October deadline was “only five months from now”. Ms May will next meet EU leaders in Brussels at the end of June for a meeting of the European Council.

If you can’t see the material used to accuse you, what rights do you have?

• Russian Company Charged In Mueller Probe Seeks Grand Jury Materials (R.)

A Russian company accused by Special Counsel Robert Mueller of funding a propaganda operation to interfere in the 2016 U.S. presidential election is asking a federal judge for access to secret information reviewed by a grand jury before it indicted the firm. In a court filing on Monday, lawyers for Concord Management and Consulting LLC said Mueller had wrongfully accused the company of a “make-believe crime,” in a political effort by the special counsel to “justify his own existence” by indicting “a Russian-any Russian.” They asked the judge for approval to review the instructions provided to the grand jury, saying they believed the case was deficient because Mueller lacked requisite evidence to show the company knowingly and “willfully” violated American laws.

Concord is one of three entities and 13 Russian individuals charged earlier this year by Mueller’s office, in an alleged criminal and espionage conspiracy to meddle in the U.S. race, boost then-presidential candidate Donald Trump and disparage his Democratic opponent Hillary Clinton. The indictment said Concord was controlled by Russian businessman Evgeny Prigozhin, who U.S. officials have said has extensive ties to Russia’s military and political establishment. Prigozhin, also personally charged by Mueller, has been dubbed “Putin’s cook” by Russian media because his catering business has organized banquets for Russian President Vladimir Putin and other senior political figures. He has been hit with sanctions by the U.S. government. Concord is facing charges of conspiring to defraud the United States, and is accused of controlling funding, recommending personnel and overseeing the activities of the propaganda campaign.

“..more than half a year ahead of schedule..” Try that at home.

• Bridge From Mainland Russia To Crimea Hours Away From Opening (RT)

The bridge across the Kerch Strait, which will connect the Crimean Peninsula and Krasnodar Region is set to open on Tuesday. Construction of the bridge, the longest in Russia with a span of 19 kilometers, has been carried out since February 2016, and it is opening for cars more than half a year ahead of schedule. The bridge capacity is 40,000 cars and 47 pairs of trains per day, 14 million passengers and 13 million tons of cargo per year. The railway section is scheduled to open in early 2019, the bridge will be opened for trucks starting from October of this year.

The link became vital after Crimea voted to rejoin Russia in 2014, as the peninsula’s only land border is with Ukraine. Before the opening, regular passenger and cargo deliveries were organized by direct flights and ferries from ports in southern Russia. Each pillar of the bridge needs about 400 tons of metal structures, which means that all pillars need as much iron as 32 Eiffel towers. The bridge’s piles are installed at least 90 meters under water.

It’s very easy to just ban the stuff. That your governments haven’t simply done that says a lot.

• Industrial Trans Fats Must Be Removed From Food Supply – WHO (G.)

Trans fats used in snack foods, baked foods and fried foods are responsible for half a million deaths worldwide each year and must be eliminated from the global food supply, the World Health Organization says today. Most of western Europe has already acted to reduce industrially made trans fats from factory-made foods. Denmark, like New York, which followed its lead, has an outright ban. Big food companies elsewhere have been under intense pressure to use substitutes. In the UK, the latest national diet and nutrition survey shows average intake of trans fats is well below the recommended upper limit of 2% of food energy, at 0.5-0.7%. Although companies manufacturing processed food in the UK do not use trans fats any more, the fats are in some cheap foods imported from other countries.

The WHO is calling on all governments to take action, including passing laws or regulations to rid their food supply of industrial trans fats. Director general Dr Tedros Adhanom Ghebreyesus said eliminating trans fats would “represent a major victory in the global fight against cardiovascular disease”. The WHO is targeting industrially made trans fats, but trans fats are also contained in milk, butter and cheese derived from ruminants, mainly cows and sheep. Dr Francesco Branca, director of the Department of Nutrition for Health and Development at the WHO, said the amounts we eat in dairy products are unlikely to breach the health guidelines. “We are saying that trans fats contained in those products have the same effect as industrial trans fats – we are not able to tell the difference,” he said. “But the amount contained in dairy products is much less.”

How about money NOT to build roads?

• Bank of England Should Print Money To Prevent Climate Change (Ind.)

The Bank of England should print money for the government to invest in the low-carbon economy to combat climate change, according to a new report. The BoE must also offload fossil fuel assets and use its existing powers more effectively to promote green projects, the campaign and research group Positive Money says. The report argues that the bank’s mandate to secure financial stability “looks incoherent over time unless it considers the long-term viability of the economy”. That viability will be undermined unless the threat of climate change is tackled soon, the researchers say. “The nature of climate change is such that either physical damage from weather or radical changes in technology and policy will occur in some combination, so action is needed now,” the report says.

It challenges the bank’s record on climate change and says its programme of, in effect, printing billions of pounds to prop up the economy has disproportionately helped carbon-intensive companies that are choking the planet. Under quantitative easing (QE), the bank has bought billions of pounds of debt from companies and the government. This is supposed to increase demand for debt, which in turn lowers interest rates. Cheaper borrowing means more borrowing which is supposed to be used to fund economic activity. But the researchers argue that QE has been actively harmful to efforts to combat climate change because the bank’s own criteria have been skewed towards buying debt from high-carbon sectors like manufacturing and utilities.

The only solution left.

• Wildlife Poachers In Kenya ‘To Face Death Penalty’ (Ind.)

Wildlife poachers in Kenya will face the death penalty, the country’s tourism and wildlife minister has reportedly announced. Najib Balala warned the tough new measure would be fast-tracked into law. Existing deterrents against killing wild animals in the east African nation are insufficient, Mr Balala said, according to China’s Xinhua news agency. So in an effort to conserve Kenya’s wildlife populations, poachers will reportedly face capital punishment once the new law is passed. Kenya is home to a wide variety of treasured species in national parks and reserves, including lions, black rhinos, ostriches, hippos, buffalos, giraffe and zebra.

Last year in the country 69 elephants – out of a population of 34,000 – and nine rhinos – from a population of under 1,000 – were killed. “We have in place the Wildlife Conservation Act that was enacted in 2013 and which fetches offenders a life sentence or a fine of US$200,000,” Mr Balala reportedly said. “However, this has not been deterrence enough to curb poaching, hence the proposed stiffer sentence.”