Daniel Garber Lambertville holiday 1941

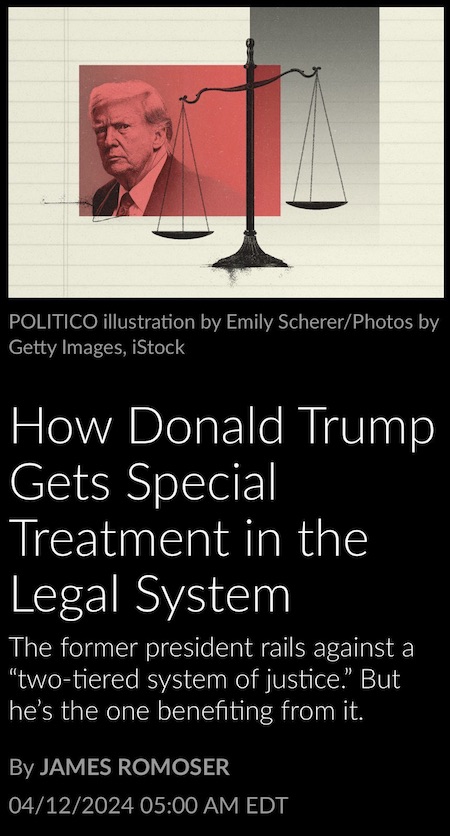

Watch this: Chasing Trump

WATCH: Chasing Trump is the very first documentary produced by American Greatness. We do a deep dive into the backgrounds of the four leftwing prosecutors targeting President Trump.

You can watch the whole documentary right here for free! pic.twitter.com/97UUpGdlP2

— American Greatness (@theamgreatness) April 15, 2024

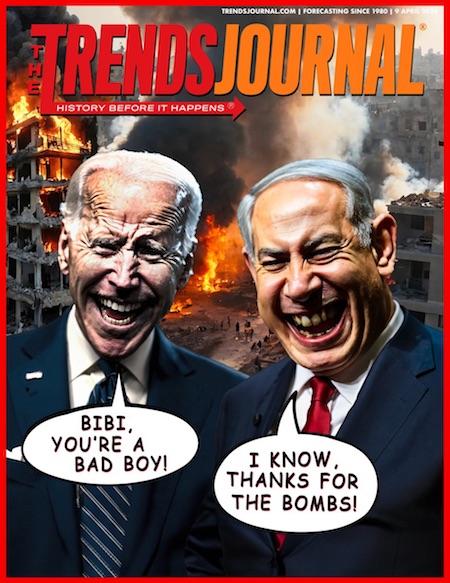

Kim Gaza

First the US Govt sent bombs causing destruction and suffering in Gaza and now the US Govt sends food because Genocide Joe is struggling in the polls, especially with young voters. Look at this post-apocalyptic scene and what Joe Biden did in your name. pic.twitter.com/IuJsjOZRj4

— Kim Dotcom (@KimDotcom) April 16, 2024

Florida 1982

https://twitter.com/i/status/1780229477265485883

Those hundreds of drones and missiles have fully exposed Israel’s defenses, including those provided by third countries.. At a low cost, and without starting a war. Pretty smart. Plus, Biden has refused US involvement in potential counter attacks.

• Iran’s Strike On Israel Was Much More Successful Than It Seems (Juma)

On the night of April 14, Iran and its proxy forces launched a series of cruise missile and kamikaze drone strikes on Israeli territory. The attacks did not come as a surprise. Tehran had warned that it would respond to the Israeli airstrike on Iran’s consulate in Damascus, Syria, on April 1, which killed several high-ranking officers of the Islamic Revolutionary Guard Corps (IRGC), including two generals. The retaliatory strike was called Operation True Promise. There is still much debate on whether Iran’s retaliatory strike was successful. Most military experts agree that there was nothing unusual about Tehran’s actions, except that this was Iran’s first direct attack on Israel. From a technical point of view, the strategy was simple and correct: Iran first suppressed the enemy’s air defense systems with drones and then launched hypersonic missiles which the Israelis and Americans were not able to intercept. Incidentally, in light of this, Ukraine’s statements about shooting down Russian Kinzhal hypersonic missiles sound ridiculous.

Many experts were skeptical about Iran’s strike and hastened to say that the retaliation did not live up to expectations. Given the clip thinking of most commentators, this reaction is hardly surprising. Their reasoning resembles a Hollywood blockbuster stuffed with special effects, where the end of the world and its miraculous salvation fit into 90-120 minutes, with a love scene in the middle. In real life, things are different. As Sun Tzu wrote in ancient times, to fight 100 battles and win 100 battles is not the height of skill. The best way to win is not to fight at all. This is Iran’s strategy. Its strike against Israel was not so much a military response as a grandmaster’s move in a big chess game. And the game is not over yet. After the attack on the Iranian consulate in Syria’s capital, Tehran found itself in a tough situation. It had to respond in a way that would look convincing and would achieve specific military goals, but would not start World War III.

To achieve the first point, Iran had to carry out a direct strike without resorting exclusively to proxy forces – and that is indeed how it acted. Regarding the second point, even though most of the missiles and drones were indeed shot down, some managed to penetrate Israeli air space and hit military targets. The Chief of Staff of the Iranian Armed Forces, Mohammad Bagheri, said that the information center on the Israeli-Syrian border and Israel’s Nevatim air base were hit. And finally, as to the third point – war didn’t happen. This resembled the situation in 2020, when the Iranians hit US bases in Iraq in response to the assassination of General Soleimani. However, it is still too early to speculate as to whether Iran’s attack was a success or not. The big question now is how Israel will respond. It’s important to emphasize that Iran’s operation carried more political than military weight. In this sense, it was carried out subtly and was a success. Obviously, the Iranians did not want to start a war which would involve the US, even though that is what Netanyahu wanted. In other words, Israel didn’t manage to provoke Iran.

It is also obvious that the Islamic Republic possesses more powerful drones and missiles than those used in the attack on April 14. However, even the less advanced drones and missiles were able to penetrate Israeli air space and inflict economic damage, since Israel spent much more money on shooting down the missiles and drones than Iran spent on launching them. Tehran has once again demonstrated that Israel is not invulnerable, and it is possible to attack it. As for the degree of inflicted damage, which some commentators were unsatisfied with, it largely depends on the type of missiles and drones used in the attack – and Iran has a lot of military equipment.

Ritter Galloway: Stand Down

https://twitter.com/i/status/1780203527265976596

“This was not a failure on Iran’s part. This was an action that has changed the game entirely..”

• Iran’s Retaliatory Attack Revealed Israel’s Military Weaknesses (Manley)

An article published in Mondoweiss on Sunday suggested that Iran’s retaliatory attack against Israel was not a failure, after Israeli military spokesperson Daniel Hagari said that 99% of the launched missiles and drones were intercepted by Israeli air defense systems. The article notes that Iran declared its intentions to attack a week in advance and promised the US that its attack would be “under control” and conducted in a way that “avoids escalation”. On Tuesday, Sputnik’s The Critical Hour was joined by Dr. Jim Kavanagh, an independent journalist, to discuss Iran’s recent response to Israel’s attack over the weekend. “This was not a failure on Iran’s part. This was an action that has changed the game entirely,” said Kavanagh. “This is a new game now because what Iran demonstrated was that the Israelis were defended by the US. The US, Great Britain, France and Jordan – all of them acted in their defense and shot down [Iran’s] missiles.

They had a 72-hour notice. The Iranians did constrain themselves in the sense that they were targeting specific military installations. They didn’t pick a broad target against any civilian targets or urban targets,” he continued. “What Iran demonstrated was that it would act against Israel, it could do so effectively and intelligently,” he continued. “That was the best defended territory in the world, the best radar, the best air defense systems. Iran used seven missiles to target that and hit with five. So five or seven missiles struck the best defended and the best air defense territory in the world.” “What Iran demonstrated was that Israel is not safe,” said Kavanagh. Sputnik’s Garland Nixon suggested that Iran’s recent attack showed how Israel’s military is extremely dependent on its Western allies.

“Isn’t it strange that the US, Great Britain and France joined in a military attack? A military action with Israel. Where’s the justification for that?” Kavanagh responded. “But they’re not going to get 72 hours notice [again]. They’re not going to get time for the Americans and British and France if there’s a real attack. If it’s all-out warfare, Israel is not going to have time. They’re going to be hurt very badly. And, this is something they cannot stand.” “Israel knows all this. They know how weak they are,” he added. “Israel has an ace in the hole that they will use if there’s a general war with Iran, and that is nuclear weapons. And that’s what they have them for, and that’s what they will use to restore the intimidation over the world, over their regional adversaries at least.”

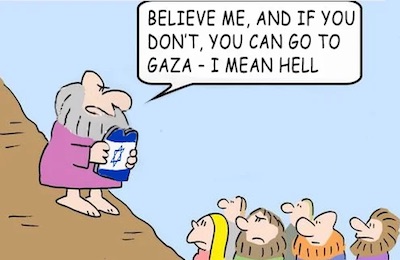

Israel 1948

"Netanyahu is influenced by his political partners to go into an escalation so he can hold onto power and accelerate the coming of the messiah."

Former Israeli Prime Minister Ehud Barak.

These are the Jewish Supremacist religious fundamentalists with nukes he's talking about: pic.twitter.com/VlVy1dhQBD

— Double Down News (@DoubleDownNews) April 16, 2024

“..the best surveillance radar in the world, working in concert with the most sophisticated anti-missile defences in the world, were impotent in the face of the Iranian attack..”

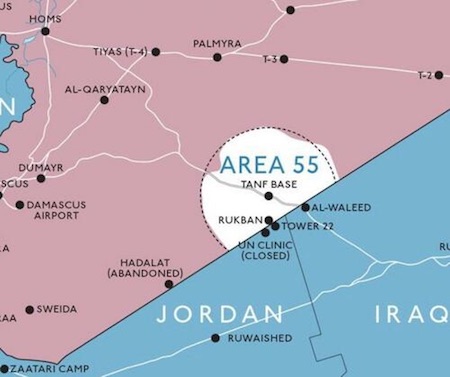

• Loose Lips Don’t Sink Ships, Or Israel (Helmer)

No Russian military source will publicly express the line that Iran’s attack on Israel of April 14 was a strategic success, despite the tactical shortcomings. This is first of all because Iran is a strategic ally of Russia in its war against the US and NATO in the Ukraine, in Syria, and in Yemen. It is also because of what may happen next. If Israel escalates by attacking Iran and striking at the country’s infrastructure, then Iran’s counter will be to take a page out of Russia’s book and commence the one line of attack which Israel, the US and their allies cannot withstand any better than Ukraine – that’s Electric War.

For the seven months which have elapsed since Hamas began its operation against Israel on October 7, and Israel commenced its genocide against the Palestinians, there has been no targeting by Hamas, Hezbollah, the Houthis, or the Syrian and Iraqi groups of Israel’s highly vulnerable maritime gas platforms, gas pipelines, coal and oil-fired electricity generating plants, the coal and oil storages nearby, solar and wind power units, or the electricity grids keeping the country alight. The Arab inhibitions and calculations are understandable. Iran’s will disappear if Israel triggers a new round of attacks. If and when that happens, the Palestinian failure in the US and in Europe to counterattack and stop Israel financing its war through the $60 billion genocide bond issue won’t matter. Bond holders don’t invest in blackouts. On the published Israeli counts to date, Iran launched between 180 and 185 drones, 30 to 36 cruise missiles, and 110 to 120 ballistic missiles[..]

The outcome counted by Israel’s enemies is that Israel, the US, British, French and Jordanian forces intercepted almost all of the drones and other decoys fired from Iran. Nine missiles beat the Iron Dome, Arrow, and other ground–to-air defences, five of them hit Nevatim air base and four of them hit the Ramon base. Iranian officials confirm those target strikes. In a briefing on April 16, the Iranian ground force commander, Brigadier General Kioumars Haydari, added that “the attack targeted the most strategic base and surveillance site of the Israeli military at the Jabal al-Sheikh Heights on the border between the occupied Palestinian territories and Syria.” Haydari did not mention Ramon or a Mossad facility as targeted or hit.

The case is being made by a group of retired colonels, majors, and lieutenants publishing in the US alt-media that the 6% rate of penetration – that’s 9 divided by 140 or by 156 – make a tactical victory over the US radar and missile combinations protecting Nevatim and Ramon, and therefore a strategic success for Iran. The US protection is Site 512 in the Negev region of southern Israel. According to one American interpretation, “the best surveillance radar in the world, working in concert with the most sophisticated anti-missile defences in the world, were impotent in the face of the Iranian attack…Who has deterrence supremacy? It ain’t Israel.”

Another American assessment goes further strategically without going as far tactically. The point of the penetrations at Nevatim and Ramon, this argument runs, was not to destroy the bases but to prove that, having beaten the US-Israeli defences this time round, the next time will be much more destructive; also, that the Israeli-American combination cannot afford the cost attrition of $1 billion spent per night to defend against larger and cheaper Iranian swarms. A third American interpretation is that even as slight as the 6% penetration rate appears to be, the Iranians have demonstrated the military and technological expertise to defeat the US technology on which Israeli defences are based.

A Russian military source acknowledges that “yes, several people have made this point that at least some projectiles got through at the airstrips; that the Iranians have learned from the defences and might have spotted weaknesses to exploit.” He dismisses this strategic victory as wishful thinking. “In a class room, these calculations of the pundits make sense. But up to the 10th Grade.” A NATO veteran and expert in applying electrical engineering to war comments: “Honestly, I don’t believe the Iranian strikes were all that effective in terms of damage done. This being said, again, they weren’t meant to be. They mostly used drones and older missiles with a few of the newer models thrown in to test, and send a message.”

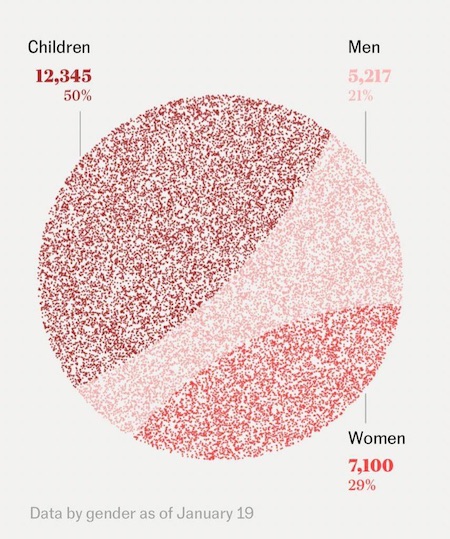

“..the ideal is to kill the population passively, to minimize visible bombing. And the line of least resistance is to starve the population. That has been Israeli policy since 2008.”

• The Gaza Genocide As Explicit Policy – Michael Hudson (Pepe Escobar)

In what can be considered the most crucial podcast of 2024 so far, Professor Michael Hudson – the author of seminal works such as Super-Imperialism and the recent The Collapse of Antiquity , among others – clinically lays down the essential background to understand the unthinkable: a 21st century genocide broadcast live 24/7 to the whole planet. [..] In an email exchange, Prof. Hudson detailed he’s now essentially “spilling the beans” about how, “50 years ago when I worked at the Hudson Institute with Herman Kahn [the model for Stanley Kubrick’s Dr. Strangelove], Israeli Mossad members were being trained, including Uzi Arad. In our email exchange, Prof. Hudson remarked “this is basically what I said” in reference to the podcast with Ania K, drawing on his notes. Fasten your seat belts: unvarnished truth is more lethal than a hypersonic missile hit.

[..] On the Zionist military strategy in Gaza: “My background in the 1970s at Hudson Institute with Uzi Arad and other Mossad trainees. My field was BoP, but I sat in on many meetings discussing military strategy, and I flew to Asia twice with Uzi and got to know him. The U.S./Israeli strategy in Gaza is based in many ways on Herman Kahn’s plan that was carried out in Vietnam in the 1960s. Herman’s focus was systems analysis. Start by defining the overall aim and then, how do we achieve it? First, isolate them in Strategic Hamlets. Gaza has been carved up into districts, requiring electronic passes for entry from one sector to another, or into Jewish Israel to work. First thing: kill them. Ideally by bombing, because that minimizes domestic casualties for your army. The genocide that we are seeing today is the explicit policy of Israel’s founders: the idea of “a land without a people” means a land without non-Jewish people.

They were to be driven out – starting even before the official founding of Israel, in the first Nakba, the Arab holocaust. Two Israeli Prime Ministers were members of the Stern Gang of terrorists. They escaped from their British jail and joined to found Israel. What we are seeing today is the Final Solution to this plan. It also dovetails into U.S. desires to control the Middle East and its oil reserves. For U.S. diplomacy, the Middle East IS (in caps) oil. And ISIS is part of America’s foreign legion since it was first organized in Afghanistan to fight the Russians. That is why Israeli policy has been coordinated with the U.S.. Israel is the main U.S. client oligarchy in the Middle East. Mossad does most handling of ISIS in Syria and Iraq, and wherever else the U.S. may send ISIS terrorists.

Terrorism and even the present genocide is central to U.S. geopolitics. But as the U.S. learned in the Vietnam War, populations protest and vote against the President who supervises this war. Lyndon Johnson couldn’t make a public appearance without crowds chanting. He had to sneak out the side entrance of hotels where he was speaking. To prevent an embarrassment such as Seymour Hersh describing the My Lai massacre, you block journalists from the battlefield. If they are there, you kill them. The Biden-Netanyahu team has targeted journalists in particular. So the ideal is to kill the population passively, to minimize visible bombing. And the line of least resistance is to starve the population. That has been Israeli policy since 2008.”

Prof. Hudson makes a direct reference to a Sara Roy piece in The New York Review of Books, citing a cable from the U.S. Embassy in Tel Aviv to the Secretary of State on November 3rd, 2008. The cable reads, “As part of their overall embargo plan against Gaza, Israeli officials have confirmed to [embassy officials] on multiple occasions that they intend to keep the Gazan economy on the brink of collapse without quite pushing it over the edge.” That has led, according to Prof. Hudson, to Israel “destroying fishing boats and greenhouses of Gaza to deprive it from feeding itself. Next, it has joined with the United States to block United Nations food aid and that of other countries. The U.S. quickly withdrew from the UN relief agency as soon as hostilities began, doing so immediately after the ICJ finding of plausible genocide. It was the major funder of this agency. The hope was that this would set back its activities.

Israel simply stopped letting food aid in. It set up long, long lines of inspections, that is, an excuse to slow the trucks to just 20% of their pre-Oct. 7 rate – from a normal rate of 500 a day to just 112. In addition to blocking trucks, Israel has targeted aid workers – about one a day.

“..the Kiev regime started out this conflict with a very formidable integrated Soviet legacy air defense network that took Russia about a year and a half to take apart..”

• Zelensky Green With Envy as West Comes to Aid of Israel (Miles)

The United States rushed to the defense of Israel this weekend to help shoot down a volley of drones and missiles launched by Iran in a retaliatory strike for an attack on Tehran’s Syrian consulate earlier this month. The US was joined in their effort by the UK, flying out of their airbase in nearby Cyprus, and the Western-aligned regime in Jordan. Israeli media alleged that Saudi Arabia came to the aid of the country as well, although observers have questioned the veracity of those reports. The Gulf monarchy has walked a fine line in recent months, attempting to keep hopes of rapprochement with Tel Aviv alive while also acknowledging the pro-Palestinian sentiment of the country’s population. The dramatic (and reportedly highly expensive) show of force apparently led to some envy from another US ally, according to security analyst Mark Sleboda.

The international relations expert joined Sputnik’s Fault Lines program Tuesday to break down the Israel-Gaza conflict’s ramifications for the US’ relationship with Ukrainian President Volodymyr Zelensky. “I think that Zelensky has finally come to the realization as the new mistress that the United States is never going to leave its wife, despite all the promises that Joe Biden has given, all of the late-night dinners and the hotel rooms,” Sleboda mused. “It’s all gone wrong… there’s a bit of envy.” “There was even an… interview with a Ukrainian academic, quote-unquote, saying how Ukraine is being two-timed by the United States with Israel and the rock on Israel’s finger is much bigger or something like that, that they are souring on the United States. I mean if you didn’t realize you were a proxy for US geopolitical motives, that’s entirely your problem,” the analyst stressed.

Sleboda broke down some of the reasons he believes the United States was able to come to the aid of its Middle Eastern ally in a way it hasn’t for Ukraine, noting that Israel is a much smaller country with an extensive air defense system in the Iron Dome. The analyst called the network “probably the second best air defense system in the world after Russia’s, and very tailored to task.” “Ukraine is an enormous country with very far-flung assets and Russia is a nuclear power with very large conventional and air forces, and it makes a world of difference,” Sleboda added. “It has to be said that the Kiev regime started out this conflict with a very formidable integrated Soviet legacy air defense network that took Russia about a year and a half to take apart, which is why only now are you starting to see the fruits of real Russian air superiority.”

“Russian forces are apparently able to use SU-25 aircraft in an essentially close air support role because the Kiev regime has no air defense, certainly not on the front line, left,” he concluded. “Ultimately the envy is at the moment primarily over air defense… [Zelensky] realizes he’s going to get no more air defense, which is simply going to make the end of this conflict come faster than it would have otherwise.”

“..the US “is not going to be involved in [the Ukraine conflict] in a combat role.”

• Ukrainians ‘Beginning To Dislike’ US – Odessa University Boss (RT)

There is growing disenchantment with the US among Ukrainians over its perceived lack of commitment to their defense, the Wall Street Journal has reported, citing the director of the Center for International Studies at the Odessa National University. Vladimir Dubovyk told the newspaper in an article on Monday that the swift action from the US and its NATO allies to fend off a massive Iranian missile and drone strike on Israel at the weekend stands in stark contrast to their apparent reluctance to beef up Ukraine’s air defenses amid its conflict with Russia. Ukrainians are “beginning to sour on the US,” Dubovyk was quoted as saying. The scholar noted that Washington played a key role “in the first two years of the war [with Russia], but now of course there’s a huge slowdown,” apparently referring to President Joe Biden’s latest aid package, which has been deadlocked by Republicans in Congress for several months.

“Rather than helping Ukraine create the kind of air-defense network Israel has, the West has provided [Kiev] with a patchwork of equipment,” the WSJ noted, adding that these stockpiles have become significantly depleted as Moscow escalates its campaign of air bombardments. The situation in Ukraine was contrasted with that of Israel, after Iran launched several hundred missiles and kamikaze drones at the Jewish state late on Saturday. US, British, French and Jordanian fighter jets scrambled to intercept the projectiles, and the Israel Defense Forces (IDF) later reported that the vast majority of Iranian rockets and UAVs had been shot down before they reached Israeli airspace. Tehran said the attack came in response to an Israeli airstrike on the Iranian consulate in Syria on April 1, and claimed that it had struck several Israeli military installations.

In a post on X (formerly Twitter) on Monday, Ukrainian President Vladimir Zelensky noted that Israel is not a NATO member, meaning Western powers were not legally obliged to come to its defense. The Ukrainian leader added that the involvement of the US, the UK, and France did not result in a war breaking out in the region. “European skies could have received the same level of protection long ago if Ukraine had received similar full support from its partners,” Zelensky concluded. During a press conference on Monday, US National Security Council spokesperson John Kirby made it clear that the situations in Israel and Ukraine cannot be compared, describing them as “different conflicts, different airspace, [and] different threat picture.” He also emphasized that the US “is not going to be involved in [the Ukraine conflict] in a combat role.”

Ukraine cannot be trusted.

• Ukraine Suddenly Walked Away From Black Sea Deal – Reuters (RT)

Russia and Ukraine had almost reached a new Black Sea shipping deal in March after two months of negotiations, only for Kiev to abruptly walk away, Reuters reported on Monday, citing anonymous sources familiar with the matter. The official agreement governing the freight route lapsed in July 2023, when Moscow declined to renew the original Türkiye- and UN-mediated Black Sea Grain Initiative. Russia said that the US and EU had not kept their part of the deal, blocking exports of Russian food and fertilizer. The most recent talks were brokered by Türkiye at the prompting of the United Nations, and a tentative agreement “to ensure the safety of merchant shipping in the Black Sea” was reached last month, according to Reuters’ sources.

They added that while Kiev did not formally sign, it agreed that President Recep Tayyip Erdogan could announce the deal a day before Turkiye’s March 31 local elections, with the pact to take effect immediately upon being made public. “At the very last minute, Ukraine suddenly pulled out and the deal was scuttled.” According to the draft seen by Reuters, Ankara had mediated agreements between Moscow and Kiev “on ensuring free and safe navigation of merchant vessels in the Black Sea,” in compliance with maritime conventions. The guarantees would not apply to “warships, civilian vessels carrying military goods,” except when agreed upon by all parties, the copy of the document stated. Both Russia and Ukraine were to offer security guarantees to commercial vessels in the Black Sea, undertaking not to strike, seize or search them, provided they were unladen or had declared a non-military cargo, according to the draft agreement.

The reasons for Kiev pulling out are unclear, but President Vladimir Zelensky accused Russia of targeting grain export infrastructure during the original deal, thereby putting vulnerable countries at risk. Speaking to reporters earlier this year, Russian Foreign Minister Sergey Lavrov denied that Moscow ever attacked Ukrainian ships in the Black Sea during the grain deal. One of the reasons Moscow did not return to the Black Sea Grain Initiative was Kiev’s misuse of the shipping passage during the agreement, he said. “The Ukrainians used these free secure passages to launch their weapons in the form of naval drones,” damaging Russian ships and ports, Lavrov stated. He added under the old agreement, only 3% of the shipped Ukrainian grain went to countries on the UN World Food Programme’s list of states in greatest need. Since then, Moscow has donated 200,000 tons of grain to six African nations, with the last shipments arriving in January of this year.

At least Xi didn’t refuse to talk to him.

• Xi Jinping Proposes Four Principles For Resolving Ukrainian Crisis (TASS)

Chinese President Xi Jinping has proposed four principles to restore peace in Ukraine as soon as possible and prevent the crisis from spiraling out of control. According to the Xinhua news agency, the Chinese leader had an in-depth exchange of views on the Ukrainian crisis with German Chancellor Olaf Scholz, who is on an official visit to Beijing. “First, we should give priority to maintaining peace and stability and refrain from seeking selfish gains. Second, we should cool down the situation instead of adding fuel to the fire. Third, we should create conditions for restoring peace and refrain from further escalating tensions. Fourth, we should reduce the negative impact on the global economy and refrain from undermining the stability of global industrial and supply chains,” the agency quoted the Chinese leader as saying.

Scholz is on an official visit to Beijing since April 12. This is his second trip to China as Chancellor of the Federal Republic of Germany. Scholz is accompanied by three ministers of environment, agriculture and transport. The delegation includes representatives of leading German companies, in particular Siemens, BMW and Mercedes-Benz. The visit focuses on bilateral trade and economic relations.

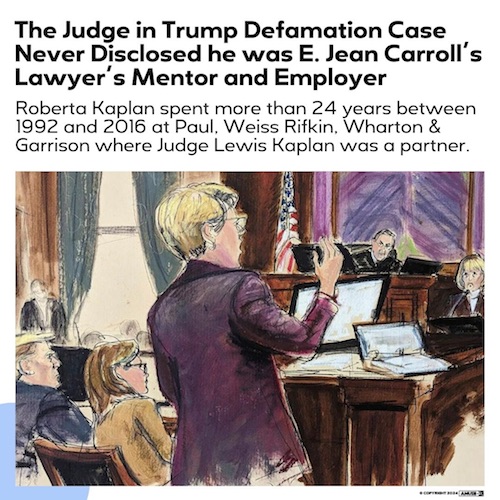

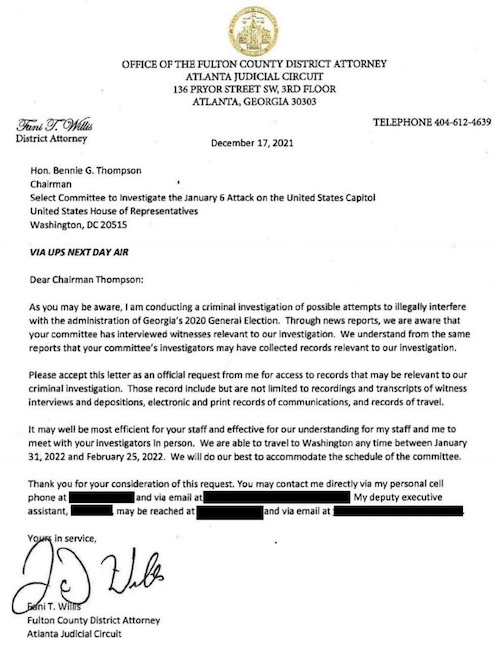

Why not subpoena him?

• Biden Refuses to Testify in GOP Impeachment Inquiry (ET)

President Joe Biden will not be testifying to U.S. House of Representatives members who are engaged in an impeachment inquiry against him, the White House said on April 15. Richard Sauber, special counsel to the president, told House Oversight Chairman James Comer (R-Ky.) that the president would not testify in the “partisan charade.” “Your committee’s purported ‘impeachment inquiry’ has succeeded only in turning up abundant evidence that, in fact, the president has done nothing wrong,” Mr. Sauber said in a letter to Mr. Comer. “Your insistence on peddling these false and unsupported allegations despite ample evidence to the contrary makes one thing about your investigation abundantly clear: The facts do not matter to you,” he added. Republicans in their investigation have found that millions of dollars flowed from businesses and individuals, including foreigners, to members of the Biden family while President Biden was vice president.

They’ve also identified payments from Hunter Biden’s business to the president, and from the president’s brother to him, as well as emails between President Biden and an associate of Hunter Biden. Several witnesses, meanwhile, testified that President Biden would get on the phone with Hunter Biden’s associates and that he attended multiple meals with them. President Biden and the White House have maintained that he was not involved with the business undertaken by his son and brother. Mr. Comer wrote to the president in March, saying the evidence “wholly contradicts your position.” “In light of the yawning gap between your public statements and the evidence assembled by the committee, as well as the White House’s obstruction, it is in the best interest of the American people for you to answer questions from members of Congress directly, and I hereby invite you to do so,” Mr. Comer wrote at the time.

“The apple doesn’t fall far from the tree in the Biden family. Like his son, Hunter Biden, President Biden is refusing to testify in public about the Bidens’ corrupt influence peddling,” Mr. Comer said Monday. “This comes as no surprise since President Biden continues to lie about his relationships with his son’s business partners, even denying they exist when his son said under oath during a deposition that they did,” he said. “It is unfortunate President Biden is unwilling to answer questions before the American people and refuses to answer the very simple, straightforward questions we included in the invitation. Why is it so difficult for the White House to answer those questions? The American people deserve transparency from President Biden, not more lies.” It’s not clear whether lawmakers are considering subpoenaing the president, and the White House did not respond when asked whether the president would comply with a subpoena.

Mr. Comer and other members have said they want answers to questions, including those about the source of the money for the payment from his brother. They’re also wondering whether President Biden ever interacted with Hunter Biden’s associates, such as Chinese businessmen Jonathan Li, Ye Jianming, and Henry Zhao. Lawmakers also want more details about the work done by Eric Schwerin, one of the associates, for President Biden. Mr. Schwerin told lawmakers that he often met with President Biden and provided him with free services, including tax preparation. Lawmakers have yet to outline the next steps in the inquiry. The November election is looming and, if President Biden loses his re-election bid, he would exit the presidency regardless in January 2025. Mr. Sauber, the special adviser to the president, is leaving the White House early next month. He was brought on in 2022 to oversee the White House’s response to congressional investigations as Democrats braced to lose their majorities on Capitol Hill that year.

“..Trump’s co-campaign manager Chris LaCivita quickly fired back, denying Kennedy’s claim and calling him a “leftie loonie” to boot…”

• RFK Jr Won’t Seek Libertarian Nomination, Says Team Trump Asked Him As VP (ZH)

After seriously considering the possibility, 2024 presidential hopeful Robert F. Kennedy, Jr has declared he will not seek the Libertarian Party nomination, saying he’s confident he’ll achieve ballot access across the country on his own. Meanwhile, in a social media skirmish with Team Trump, Kennedy said Trump associates asked him to consider becoming the former president’s running mate. In a political system with formidable ballot-access barriers that protect the Democrat-Republican duopoly, outsider presidential candidates are frequently attracted to the idea of running as a Libertarian — if only to access the party’s hard-earned, 50-state ballot qualification. “We’re not gonna have any problems getting on the ballot ourselves so we won’t be running Libertarian,” Kennedy tells ABC News. That declaration came as his team was celebrating their exploitation of a quirk in Iowa ballot-access law:

Rather than gathering 3,500 signatures, the Kennedy team held a convention in West Des Moines. Consistent with state requirements, it included at least 500 voters who represented at least 25 of the Hawkeye State’s 99 counties. Kennedy assured ABC that he’s “100% confident” he’ll manage the arduous process — which includes fending off Democrats’ lawfare — in all 50 states, saying “we’re going to add probably two to three states a week.” While Kennedy framed his decision solely in ballot-access terms, it was far from certain that he could have actually won the Libertarian nod. The nominee isn’t selected by party leadership, but by delegates at the group’s convention — all of whom show up fully free to vote for the candidate of their choice. [..] Kennedy has plenty of overlaps with libertarians, some of his stances could be seen as disqualifying:

His staunchly pro-Israel statements before and during the Gaza war devastated his standing with non-interventionist libertarians (and progressive leftists to boot). The damage hasn’t caused him to temper his remarks: On Saturday, he oddly referred to Israel as “our oldest ally” and said “the U.S. ought to be bending over backwards to protect Israel.” While he’s expressed skepticism about the effectiveness of gun control, he said he would sign an “assault weapon ban” if Congress sent him one. He’s also called for a $15 national minimum wage, more free childcare, and abolishing interest on all federal student loans. Meanwhile, responding to a series of Truth Social posts by Trump, in which the former president called Kennedy “the most radical liberal” in the race, Kennedy said Trump’s “emissaries” asked him to become his running mate. Trump’s co-campaign manager Chris LaCivita quickly fired back, denying Kennedy’s claim and calling him a “leftie loonie” to boot…

Politico reports that Trump had casually floated the idea in conversations, adding that “Trump is known to workshop ideas to a variety of aides and allies, even if they never come to fruition. As he does with many political rivals, Trump has directed a mixture of flattery and abuse at Kennedy — as he did last week: “He’s got some nice things about him. I happen to like him. Unfortunately he is about the ‘Green New Scam’ because he believes in that and a lot of people don’t. I guess that would mean that RFK Jr.’s going to be taking away votes from Crooked Joe Biden, and he should because he’s actually better than Biden. He’s much better than Biden. If I were a Democrat, I’d vote for RFK Jr. every single time over Biden.”

“..a number of attorneys general, including me, are facing similar attacks from their political adversaries. just for doing their jobs.”

• Coalition of AG’s File Amicus Brief Defending Ken Paxton and His Top Deputy (ET)

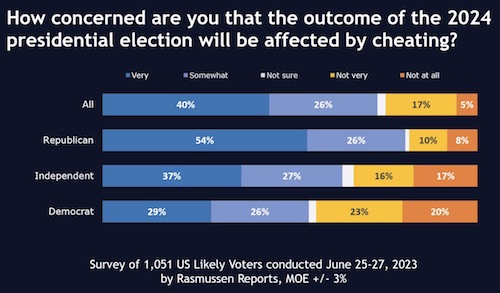

A national coalition of 18 state attorneys general filed an amicus brief to defend Texas Attorney General Ken Paxton’s First Assistant Attorney General Brent Webster in a lawsuit initiated by the State Bar of Texas. “The State Bar of Texas’s Commission for Lawyer Discipline attempted to censure Attorney General Paxton and First Assistant Attorney General Webster for taking action over genuine concerns of unconstitutional conduct by states during the 2020 election,” Mr. Paxton’s office wrote in a press release on Monday. The brief was filed on Friday in response to complaints against the state’s top attorney and his top deputy for their decision to file the “landmark” case known as Texas v. Pennsylvania. Mr. Webster authored the petition contesting the 2020 presidential election results to the U.S. Supreme Court. “Neither the State Bar nor this Court is an appropriate forum for what is ultimately a political fight,” the group of attorneys general wrote in the brief.

“And while it is, of course, true that the Attorney General is subject to general rules of professional conduct, those rules cannot be used to limit discretionary authority conferred by a State Constitution. Nor can they be weaponized to undermine the will of the voters who elected the Attorney General in the first place.” Montana AG Austin Knudsen, who led the coalition, said the commission’s complaint threatens the constitutional authority of elected officials. “The weaponization of the bar complaint process undermines the constitutional authority of elected officials and the will of the voters,” Mr. Knudsen told the Daily Caller. “I’m glad I could support Attorney General Ken Paxton in this instance as a number of attorneys general, including me, are facing similar attacks from their political adversaries. just for doing their jobs.” The coalition argues that the issue is not about the alleged misconduct but whether the court will allow state bars to take action against those with whom they disagree politically.

“The real question in this case is not whether the alleged misrepresentations amount to violation of the rules of professional conduct,” the court document reads. “Instead, it is whether courts will permit the politicization of the State Bars and weaponization of disciplinary rules against elected executive officers discharging their constitutional duties. “The Supreme Court of Texas will likely be the first to consider that question. It should be a resounding ‘No.’” The attorneys general argue that allowing the case to move forward will encourage further bar complaints made for the purpose of “obstructing the ability of attorneys general and their staff to carry out their constitutional responsibilities.” They are asking the Texas Supreme Court to reverse the decision of the appeals court. “The Court should grant the petition, reverse the court of appeals’ decision, and render judgment on behalf of the First Assistant,” the document states.

1512(c)(2)

• Supreme Court Takes Up Obstruction Case Affecting J6 Defendants (Turley)

Today, the U.S. Supreme Court will take up Fischer v. United States, a case that could fundamentally change many cases of January 6th defendants, including the prosecution of former president Donald Trump. The case involves the interpretation of a federal statute prohibiting obstruction of congressional inquiries and investigations. The case concerns 18 U.S.C. § 1512(c)(2), which provides: “Whoever corruptly—(1) alters, destroys, mutilates, or conceals a record, document, or other object, or attempts to do so, with the intent to impair the object’s integrity or availability for use in an official proceeding; or (2) otherwise obstructs, influences, or impedes any official proceeding, or attempts to do so, shall be fined under this title or imprisoned not more than 20 years, or both.” Joseph Fischer was charged with various offenses, but U.S. District Judge Carl J. Nichols of the District of Columbia dismissed the 1512(c)2 charges. Judge Nichols found that the statute is exclusively directed to crimes related to documents, records, or other objects.

The D.C. Circuit reversed and held that Section 1512(c)(2) is a “catch all” provision that encompasses all forms of obstructive conduct. Circuit Judge Florence Pan ruled that the “natural, broad reading of the statute is consistent with prior interpretations of the words it uses and the structure it employs.” However, Judge Gregory Katsas dissented and rejected “the government’s all-encompassing reading.” The Court will now consider the question of whether the U.S. Court of Appeals for the District of Columbia Circuit erred in construing 18 U.S.C. § 1512(c), which prohibits obstruction of congressional inquiries and investigations, to include acts unrelated to investigations and evidence. The law itself was not designed for this purpose. It was part of the Sarbanes-Oxley Act of 2002 and has been described as “prompted by the exposure of Enron’s massive accounting fraud and revelations that the company’s outside auditor, Arthur Andersen LLP, had systematically destroyed potentially incriminating documents.”

“..Members of parliament are being forced into court but would rather pay the fines imposed by the courts than release the information..”

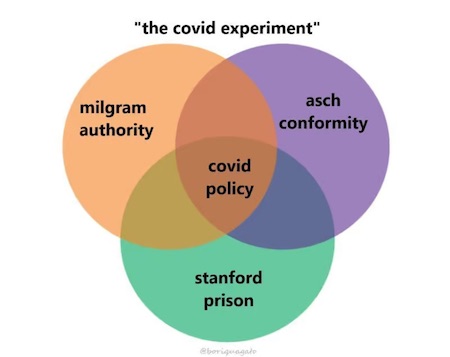

• Dutch Gov’t Data Hack Reveals Startling Amount Of Covid Adverse Reactions (X)

Exclusive Breaking: Dutch Government Data hacked and startling amount of Covid adverse reactions obtained. Astounding amount of data obtained. Millions of records now seen. There is a massive attempted coverup not only by the Government in Holland but in every nation that has been infiltrated by Globalists. Excess Deaths are exploding but there is a wall of silence from our respective Governments. I’m joined from Holland by Dutch Freedom Fighters and Truth Seekers, former Dutch Parliamentarian and business entrepreneur Wybren van Haga, Businessman and Data expert Wouter Aukema and Anne Merel Kloosterman who is representing many vaccine injured. The Dutch Minister of health has lied and needs to be brought to task. Members of parliament are being forced into court but would rather pay the fines imposed by the courts than release the information!!! Just what are they hiding?

A Great Awakening is taking place all around the world as people wake up and realise what has been done to them. Justice must be done and if any Government refuses to obey their own laws and constitution then they become illegitimate and those who form it and those who support them essentially become the enemy of the people they are supposed to be governing. The first order of any Government is to protect its own people. Not only have they failed to do this but they are attempting to hide their failings and perhaps more disturbingly hide a dark de-population agenda that they are involved in. They have essentially broken their contract with the people. Its time to get on board and join the quest for freedom and justice. Join us http://freedomtraininternational.org.

Exclusive Breaking: Dutch Government Data hacked and startling amount of Covid adverse reactions obtained.

Astounding amount of data obtained. Millions of records now seen.

There is a massive attempted coverup not only by the Government in Holland but in every nation that has… pic.twitter.com/o2ZRd6pZks

— Jim Ferguson (@JimFergusonUK) April 16, 2024

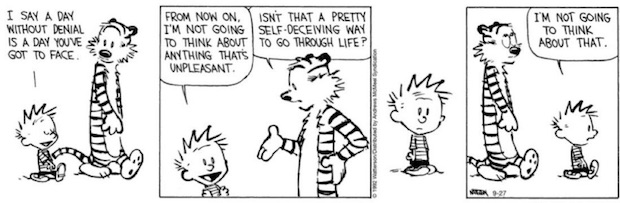

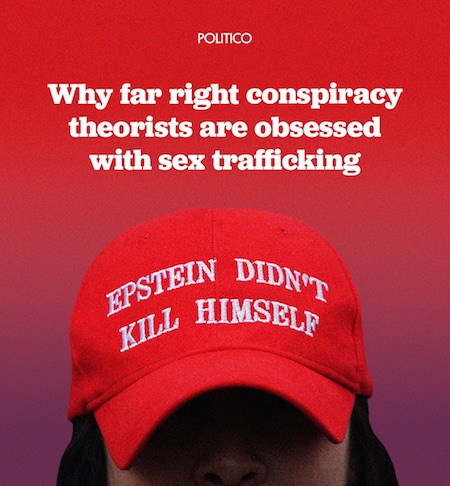

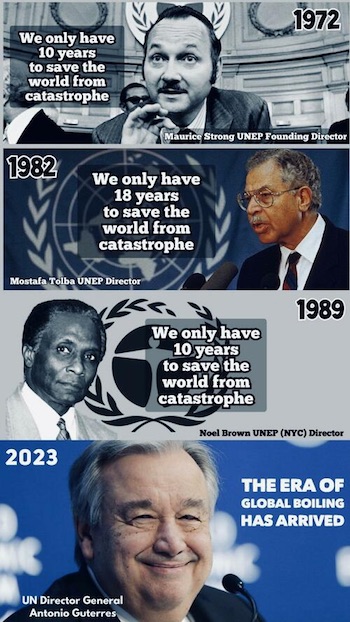

“..people with “woke” beliefs have higher rates of depression..”

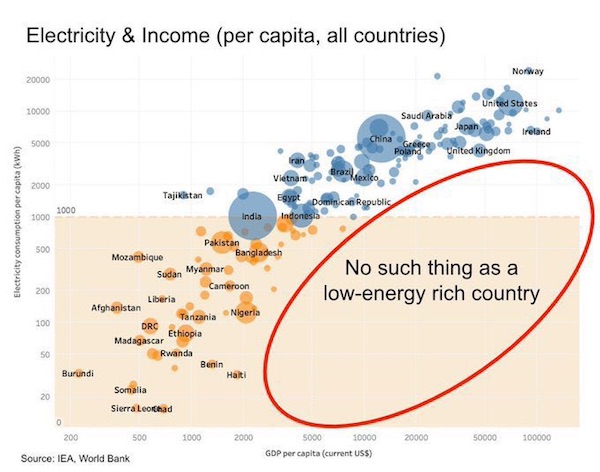

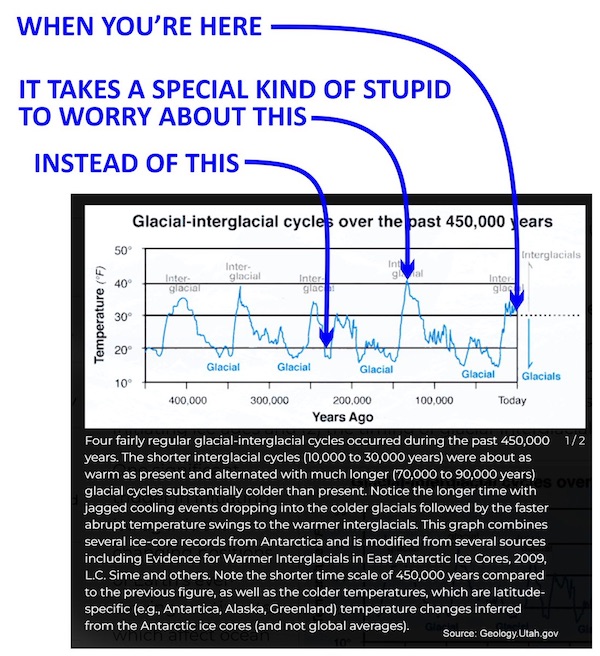

• A Generation Lost to Climate Anxiety (Zaruk)

In a far-reaching new essay in The New Atlantis, the environmental researcher Ted Nordhaus makes a damning and authoritative case that while the basic science of CO2 and climate is solid, it has been abused by the activist class in service of a wildly irresponsible and unscientific climate catastrophism. This reckless alarmism, saturated across the mainstream media and endlessly amplified by it, has had profound societal consequences. It has both distorted public understanding of the massive benefits the carbon economy makes possible and grossly exaggerated the risks of extreme events it allegedly makes more likely. As a result it has rendered reasonable debate on climate policy impossible, even as it has given cynical politicians an easy scapegoat for every social ill, drawing attention away from regulatory and institutional failures and laying blame instead at the feet of fossil fuel companies and other evil “emitters.”

Perhaps most perniciously, as Nordhaus details, the doomsday prophesying of climate extremists has created hardened skeptics on one side who are increasingly suspicious of all public “expertise”, while at the same time infecting true believers on the other side with a crippling, pathological fatalism that has come to be referred to as “climate anxiety.” If there’s any flaw in Nordhaus’ damning and comprehensive analysis it’s that he undersells just how much damage the advent of “climate anxiety” has done already—and how much more it’s likely to do in years to come. Yes, there’s the obvious cases of obnoxious and lawbreaking behavior, from climate iconoclasts defacing priceless works of art, to interrupting Broadway shows and sporting events, to gluing themselves to buses and holding up traffic on major thoroughfares. But it runs much deeper than that.

Consider recent headlines: From Vox: “What to do when you’re completely overwhelmed by climate anxiety.” From The Guardian: “Climate anxiety adds to teenagers’ fears.” And the New York Times: “How Climate Change is Changing Therapy.” And perhaps most depressing of all, from the BBC: “Climate anxiety: ‘I don’t want to burden the world with my child.” The trend is so wide now that they have given it a name: birth strike. And the data backs up the headlines—like the recent Finnish study of 6,000 subjects that showed people with “woke” beliefs have higher rates of depression. Developed countries are already facing real increases in mental health issues, many of them human-made and bound up in everything from the opioid crisis to the COVID pandemic. The manufacture of climate anxiety as an issue allegedly on par with those others is a dangerous distraction that draws resources away from solving these other mental health challenges.

Dore Kory

Pfizer batch

Pfizer employees were given a *special batch*… different from what was forced into the general population pic.twitter.com/2jmWRAjpKB

— healthbot (@thehealthb0t) April 16, 2024

Elephants

A family of elephants see a lion and form a circle to protect their children pic.twitter.com/DxYlHuXnft

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 15, 2024

Gibbon

Gibbons like to live dangerously pic.twitter.com/lPTpCF8vS6

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 16, 2024

Family

https://twitter.com/i/status/1780266693895266366

Slaps

How many slaps did you count? pic.twitter.com/9usOgx5lxk

— Why you should have a cat (@ShouldHaveCat) April 15, 2024

Clipnosis

How to deactivate a cat with "clipnosis".pic.twitter.com/lx7jpxLnL3

— Massimo (@Rainmaker1973) April 16, 2024

Sunscreen

https://twitter.com/i/status/1779962954617688422

Toll road

The elephant toll road

pic.twitter.com/L4ABhSjOcL— Science girl (@gunsnrosesgirl3) April 16, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.