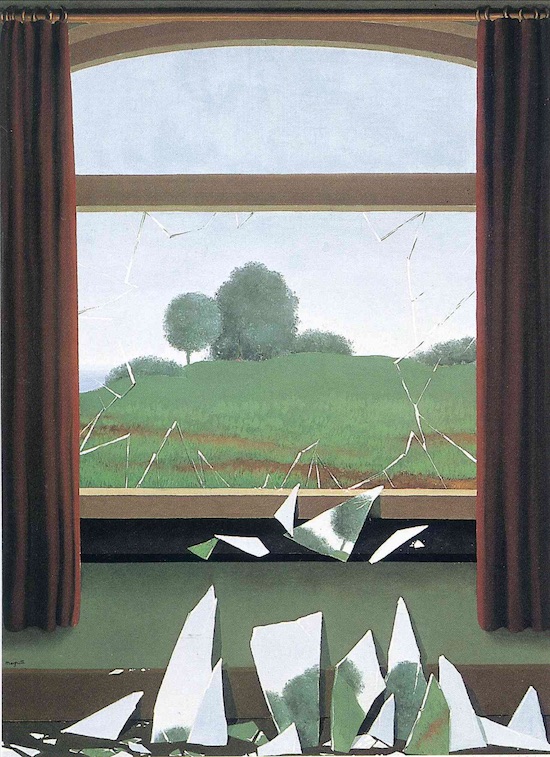

René Magritte The key to the fields 1936

1987

Trump has been the exact same person for 40 years.

On David Letterman 1987. pic.twitter.com/CqwLqnlMas

— Mila Joy (@MilaLovesJoe) December 29, 2024

1992

President Trump has always embodied American Greatness

pic.twitter.com/sQFGnsLO95— JohnRocker (@itsJohnRocker) December 28, 2024

Andreessen

Marc Andreessen on Whether We Will See a Twitter Files for the Federal Government

“I don't want to in any way speak for the new Administration, but I would not be remotely surprised if that's exactly what happens. And of course being the government, it will be spectacular.”… pic.twitter.com/KMOpTO43hV

— Chief Nerd (@TheChiefNerd) December 29, 2024

https://twitter.com/i/status/1873099800801099847

Dore

Here is Trump completely contradicting what Vivek & Elon are currently saying about the need for foreign high-tech workers. Trump was right when he said this.

2 Billionaires are pushing a false narrative that America doesn’t produce enough high tech…

— Jimmy Dore (@jimmy_dore) December 29, 2024

X

https://twitter.com/i/status/1873410603941048825

Munro

"Elon Musk is the greatest person on the planet right now."

一 Sandy Munro

— DogeDesigner (@cb_doge) December 29, 2024

200

https://twitter.com/i/status/1873449375092916283

A full life. The presidency was not his brightest moment.

• How Trump Reacted to Jimmy Carter’s Passing (TH)

Jimmy Carter passed away on Sunday at the age of 100. It was the longest post-presidencies in American history. Carter was also the oldest former president to ever live in American history. A few lived into their 90s; Carter’s predecessor, Gerald R. Ford, died at 93 in 2006. While not a successful presidency, Carter’s philanthropic activities and other forms of civil engagement is his real legacy. He lived a remarkable life (via NYT): “Jimmy Carter, who rose from Georgia farmland to become the 39th president of the United States on a promise of national healing after the wounds of Watergate and Vietnam, then lost the White House in a cauldron of economic turmoil at home and crisis in Iran, died on Sunday at his home in Plains, Ga. He was 100. The Carter Center in Atlanta announced his death, which came nearly three months after Mr. Carter, already the longest-living president in American history, became the first former commander in chief to reach the century mark. Mr. Carter went into hospice care 22 months ago, but held on longer than even his family expected.

Tributes poured in from presidents, world leaders and many everyday people from around the world who admired not only Mr. Carter’s service during four years in the White House but his four decades of efforts since leaving office to fight disease, broker peace and provide for the poor. President Biden ordered a state funeral to be held and was expected to deliver a eulogy. “To all of the young people in this nation and for anyone in search of what it means to live a life of purpose and meaning — the good life — study Jimmy Carter, a man of principle, faith and humility,” Mr. Biden, the first Democratic senator to endorse Mr. Carter’s long-shot 1976 bid for the presidency, said in a statement. “He showed that we are great nation because we are a good people.”

Trump issued two statements on Mr. Carter’s passing: “I just heard of the news about the passing of President Jimmy Carter. Those of us who have been fortunate to have served as President understand this is a very exclusive club, and only we can relate to the enormous responsibility of leading the Greatest Nation in History. The challenges Jimmy faced as President came at a pivotal time for our country and he did everything in his power to improve the lives of all Americans. For that, we all owe him a debt of gratitude. Melania and I are thinking warmly of the Carter Family and their loved ones during this difficult time. We urge everyone to keep them in their hearts and prayers.” And the second:

=y®fi BREAKING: Trump puts out a SECOND statement on Jimmy Carter s passing pic.twitter.com/4PZItI761c

— johnny maga (@_johnnymaga) December 29, 2024

Big fight.

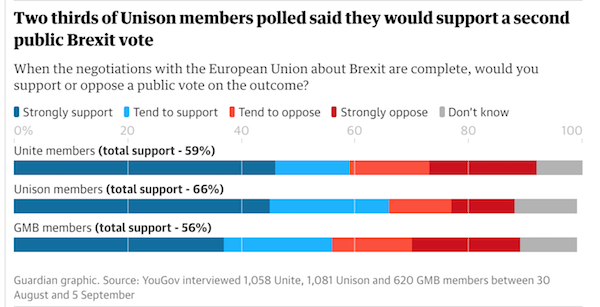

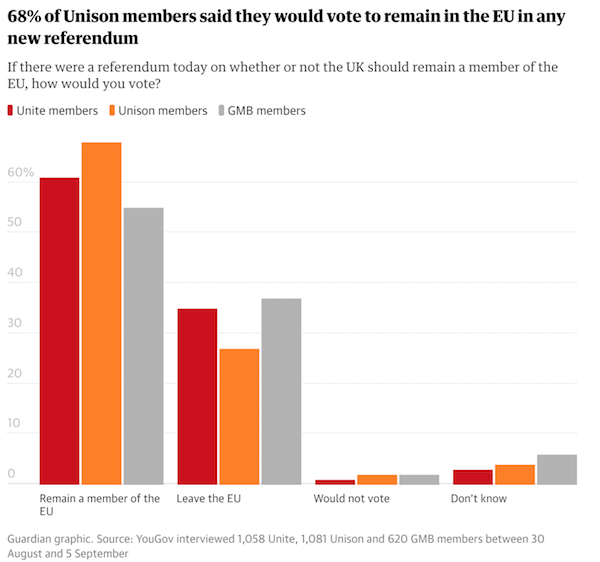

• Trump To Battle Federal Employee Unions As He Seeks To Shrink Government (JTN)

President-elect Donald Trump has pledged to drastically cut government and clean out inefficiencies, but he faces an entrenched power in Washington, D.C. that may throw a wrench in his plans: federal government public employee unions. “For president-elect Trump to succeed at making the federal bureaucracy more efficient and accountable to the American people, he’ll have to once again do battle with federal unions,” Max Nelsen, a labor policy expert at the Freedom Foundation, told The Center Square. Trump has tapped top businessmen Elon Musk and Vivek Ramaswamy to lead the new Department of Government Efficiency effort. Musk has claimed he can cut $2 trillion in federal spending. In a November joint editorial in the Wall Street Journal, Musk and Ramaswamy pledged “mass head-count reductions” in the federal government.

Firing federal workers is notoriously rare and difficult, but Ramaswamy has publicly said that mass, indiscriminate firings may allow for circumventing the usual bureaucratic holdups for firing a federal employee. Trump himself recently pledged to cut “hundreds of billions” in federal spending. “Government unions are hands down the single most significant defenders of the administrative state,” Nelsen said. “Their interests are always served by bigger, more expensive, less accountable government, and their partisan allegiance to the radical Left leads them to both overtly and covertly undermine conservative policy changes across the federal government…” The first battle with unions in the DOGE war may be federal work from home policies, where unions have already threatened legal action to protect their pre-arranged deals with the Biden administration.

Trump threatened to fire federal employees who are not willing to report to the office, a clear shot at federal work-from-home policies, something Musk has also blasted in recent weeks. “If people don’t come back to work, come back into the office, they’re going to be dismissed,” Trump told reporters during a news conference at Mar-a-Lago. The largest federal employee union quickly shot back after Trump made the comments and threatened legal action. Trump’s comments are likely at least in part reacting to a Biden administration official negotiating a deal with a union that extends until 2029, after Trump is scheduled to leave office. As The Center Square previously reported, Social Security Administrator Martin O’Malley negotiated a deal with union leaders to codify work-from-home policies, keeping telework in place for his 42,000 employees until 2029.

Everett Kelley, national president of the American Federation of Government Employees, the largest federal employee union, pointed out that these contracts are legally binding. “Collective bargaining agreements entered into by the federal government are binding and enforceable under the law,” Kelley said. “We trust the incoming administration will abide by their obligations to honor lawful union contracts. If they fail to do so, we will be prepared to enforce our rights.” Trump’s backers may have an ace in the hole, though, in the form of new Supreme Court precedent. The U.S. Supreme Court ruled earlier this year in a landmark case to overturn Chevron deference, the longstanding legal practice of giving federal agencies broad power to interpret and practically change and expand federal laws as they deemed fit, citing their expertise.

Now, Musk and Ramaswamy will likely have more leeway in cutting rules from the books and workers from the payroll. Nelsen said Trump should limit the amount of federal dollars that go toward unions, and that he should increase union transparency. “Additionally, President Trump will need a cadre of energetic appointees at the Office of Personnel Management, the Federal Labor Relations Authority, and in labor relations departments government wide to aggressively implement his directives,” Nelsen said. “Finally, to truly have a long-term impact, President Trump will need a successor in four years committed to continuing the fight.”

Make a deal.

• Trump’s Tariff Threats Cast Shadow Over European Auto Industry (RFGE/RL)

As Donald Trump prepares to take office on January 20, Europe’s already battered car industry is bracing for additional headwinds amid the threat of new tariffs from the incoming U.S. president. Trump has pledged to impose steep new tariffs on goods coming from China, Canada, and Mexico in one of his first acts in office, a promise that could ignite trade wars. That is bad news for European automakers who have already seen sales and manufacturing decline in top markets like the United States and China. The potential tariffs would be felt hard not only by leading European car brands like Volkswagen, Volvo, and Stellantis — the conglomerate that produces Fiat, Chrysler, and Citroen — but also for the Central and Eastern European countries whose economies rely heavily on making them.

Toma Savic, a former director at Zastava, a Serbian international car manufacturer that was shuttered in 2008, said the tariffs would be a particularly hard blow for operations in the Balkan country. “This inevitably would lead to the shrinking of production in Europe and mass layoffs,” he said. Zastava later became Fiat Chrysler Automobiles Serbia, which is owned by Stellantis. Based in Kragujevac in central Serbia, Fiat Chrysler Automobiles Serbia has already been struggling to recuperate its foothold in the European auto industry prior to the breakup of Yugoslavia in the early 1990s when it assembled 200,000 cars annually and exported them to 26 countries. Germany’s auto industry is also likely to be highly vulnerable to Trump’s promised tariffs, especially given that Europe’s biggest economy is by far the region’s largest exporter of passenger cars to the United States.

European and American carmakers could lose up to 17 percent of their combined annual core profits if the United States imposes import tariffs on Europe, Mexico, and Canada, according to some estimates. While Europe was not specifically mentioned in Trump’s first tariff announcement in late November, he took aim at the European Union while on the campaign trail earlier this year and accused European partners of unfair trade practices and stealing American manufacturing jobs. “They don’t take our cars, they don’t take our farm products, don’t take anything,” Trump said on the campaign trail in October. “They are going to have to pay a big price.” The U.S. market is the main destination for European passenger cars. Exports amounted to 42.5 billion dollars in 2023, according to Statista, a German online platform that specializes in data gathering and visualization.

In comparison, the value of U.S. vehicles imported to the EU was around 7.8 billion dollars during the same period. Trump said on the campaign trail in September that he wants German automakers to become “American car companies” and “build their plants here.” He added that he was prepared to offer low taxes and energy costs to draw more companies to set up manufacturing inside the United States. In 2016, German carmakers avoided 35 percent tariffs floated by Trump by investing in more production in the United States. But Trump’s new proposed tariffs could make it more costly for European automakers to set up U.S.-based factories. The threat of new tariffs will add to already growing pressures facing the European auto industry as it looks to compete for the future electric vehicle (EV) market that is dominated by Chinese manufacturers.

Earlier this year, the EU imposed duties of up to 35 percent for EVs from China saying that the “unfairly subsidized” cars have given them a market foothold. Added to this, car sales for EVs across the EU have dipped downward and some governments have repealed subsidies meant to incentivize consumers to buy the cars. The rise of Chinese companies, such as EV-leader BYD, has also seen Western car brands lose market share inside China at a steady rate, with Volkswagen in particular grappling with declining sales. Between tougher competition from China, declining sales at home, and new pressure from Trump, many European automakers are facing a bleak outlook.

You lost. Go away.

• Lefty Legal Experts Call on Congress to Disqualify Trump (Heine)

Two Democrat legal experts are calling on Congress to take immediate action to prevent President-elect Donald Trump from taking office, citing Section 3 of the 14th Amendment. Evan A. Davis, the former editor in chief of the Columbia Law Review and David M. Schulte, the former editor in chief of the Yale Law Journal, called for Trump’s disqualification in an opinion piece for The Hill, citing Section 3 of the 14th Amendment. Davis is a New York City attorney and a former president of the New York City Bar Association. He worked on the U.S. House Judiciary Committee impeachment inquiry staff during the impeachment process against Richard Nixon. Schulte is an investment banker and good friend of Barack Obama. He owns the oceanfront Martha’s Vineyard home where the Obama and his family used to vacation when he was in office.

Section 3 of the 14th Amendment bars individuals who have engaged in insurrection or rebellion against the United States, or given aid or comfort to its enemies from holding “any office, civil or military.” In a unanimous decision last March, the Supreme Court tossed out a Colorado court decision that barred Donald Trump from appearing on the state’s Republican presidential primary ballot. The lower court had based its decision on 14th Amendment provision. In their 9-0 ruling, the Supremes concluded that “states have no power under the Constitution to enforce Section 3 with respect to federal offices, especially the Presidency.” But Davis and Schulte argue that evidence of Donald Trump engaging in “insurrection” is “overwhelming” and that Congress has the authority to block Trump from being inaugurated under the Constitution and the Electoral Count Act of 2022.

The act, which was intended to prevent another January 6 scenario, added certain procedures for the counting of electoral votes following a presidential election. In January 2021, the then-Democrat controlled House of Representatives impeached Trump for “incitement of insurrection” following the January 6 Capitol riot, but the Senate acquitted him, falling short of the two-thirds majority needed for conviction. The Democrat lawyers argue that the majority (57-43) vote in the Senate supports their case for disqualification under the 14th Amendment. They say that any votes cast for Trump should be deemed “not regularly given” due to his alleged disqualification.

“Democrats need to take a stand against Electoral College votes for a person disqualified by the Constitution from holding office unless and until this disability is removed,” the Davis and Schulte wrote. “No less is required by their oath to support and defend the Constitution.” Most legal experts however agree that the notion of Republican lawmakers supporting a move that could elevate Kamala Harris to the presidency is highly improbable and at the moment, Democrats just don’t have the stomach for such a fight. “Republicans and Democrats seem to agree they’ll give Trump the smooth, drama-free transfer of power he denied Democrats in 2020,” Politico reported Thursday, adding “top Democrats say they have no plans to stand in the way of Trump’s victory — and they’re not even sure their rank-and-file colleagues will make the token objections they’ve lodged in years past.”

None of it sounds terribly smart.

• Musk Appears to Soften Pro-Foreign Worker, H-1B Visa Stance (ET)

Tesla billionaire and X owner Elon Musk appeared to soften his stance on H-1B visas on Saturday night after saying he’d “go to war” for the visas, amid an ongoing online spat over immigration and the tech industry. Tensions erupted between wealthy members of the tech world, including Musk and fellow entrepreneur Vivek Ramaswamy and their call for what they describe as highly skilled workers in their industry by using H-1B visas, and Trump supporters who have long championed more stringent immigration policies to give priority to American workers. On Saturday night, Musk responded to a mega-thread on social media platform X that criticized how H-1B visas are being used. “Easily fixed by raising the minimum salary significantly and adding a yearly cost for maintaining the H-1B, making it materially more expensive to hire from overseas than domestically,” he wrote.

“I’ve been very clear that the program is broken and needs major reform.” Musk was responding to a remark from investor Robert Sterling, who said that: “America needs to be a destination for the world’s most elite talent. But the H-1B program isn’t the way to do that.” The H-1B visa program allows up to 65,000 highly skilled foreign workers annually, plus 20,000 foreigners who obtained an advanced degree from a U.S. institution, to fill specialized roles in the U.S. workforce. Separately, Musk has been accused of censorship from conservatives after multiple prominent accounts that criticized his views on immigration and H-1B visas lost access to premium features. Laura Loomer, a conservative activist and independent journalist who has long backed President-elect Donald Trump, wrote on X in multiple posts over the weekend that the social platform demonetized her account of more than 1.4 million followers.

Her account appears to now lack a verified blue check mark. Loomer said that it was because she posted comments that were critical of Musk and his allies’ views on immigration as well as H-1B visas. “Why are X users who pay for @premium having their posts listed as ‘probable spam’ on my posts @elonmusk?” she wrote late on Saturday. “This is censorship. I understand you don’t like me, but this is nothing but retaliatory censorship?” Last Tuesday, Loomer criticized tech billionaires for descending “upon Palm Beach” as Trump works on his transition team at Mar-a-Lago. Two days later, Musk responded by saying: “Loomer is trolling for attention. Ignore.” Later that week, she said that her account lost access to premium features.

Others who also said their accounts lost premium access include InfoWars host and Jan. 6 defendant Owen Shroyer, New York Young Republican Club president Gavin Wax, and the ConservativePAC, which all have hundreds of thousands of followers apiece. “My verification badge is now under review. Weird! Didn’t change anything,” wrote Wax, who also spoke out against H-1B visas. As of Sunday, however, Wax appears to have had his verification badge restored. “All of our influencers have now lost verification status, as well as our own page,” the Trump-supporting ConservativePAC wrote. “Our brand did nothing. We spoke out against HB1 visas and it appears that @elonmusk intentionally shut us down? Is this the new status quo from America’s ‘most free’ social media platform?” So far, Musk has not publicly responded to the recent accusations of censorship on X. The Epoch Times contacted the platform for comment but received no response as of Sunday.

Musk and Ramaswamy, who were tapped to head the Trump-backed Department of Government Efficiency (DOGE), engaged in X infighting over whether immigrants who come to work at U.S. tech companies on H-1B visas or Americans would be better tech workers. Ramaswamy, in particular, drew ire for a lengthy post the day after Christmas that appeared to criticize a caricature of American culture. “A culture that celebrates the prom queen over the math olympiad champ, or the jock over the valedictorian, will not produce the best engineers,” Ramaswamy wrote. “A culture that venerates Cory from ‘Boy Meets World,’ or Zach & Slater over Screech in ‘Saved by the Bell,’ or ‘Stefan’ over Steve Urkel in ‘Family Matters,’ will not produce the best engineers.”

Musk appeared to echo his sentiments, writing in a post that the “number of people who are super talented engineers AND super motivated in the USA is far too low.” A number of pro-Trump accounts took umbrage with Musk’s and Ramaswamy’s comments. On Saturday, meanwhile, Trump weighed in on the controversy and appeared to back Musk and Ramaswamy, telling the New York Post that he supports the H-1B program. “I have many H-1B visas on my properties. I’ve been a believer in H-1B. I have used it many times. It’s a great program,” said Trump, although the president-elect had restricted access to such visas during his first term in office.

“..the odds of a return to centrist predictability appear slimmer by the day.”

• Musk’s Big Bet: Could Germans Kick Out Their Liberal Elites? (Romanenko)

Donald Trump will soon return to the White House, and Elon Musk – the tech billionaire and serial disruptor – regularly weighs in on European politics from across the Atlantic. Meanwhile, in Germany, public dissatisfaction with the political establishment has reached fever pitch. As Europe’s largest economy grapples with inflation, high energy costs, and a general sense that “liberal elites” have grown out of touch, more radical parties on both the right and left are seizing the moment. The Alternative for Germany (AfD) is gaining ground almost daily, wooing voters who feel abandoned by the mainstream, while Sahra Wagenknecht, a controversial leftist, is forming a new party that could siphon off working-class support from traditional parties. With these developments, Germany – once the epitome of stability – now stands on the verge of a political earthquake whose tremors may be felt throughout the European Union.

A major factor behind this upheaval is Germany’s stuttering economy. After decades of relying on relatively cheap Russian gas to fuel its industries and heat its homes, the sudden cut-off has left the country scrambling. Energy bills have skyrocketed, hitting vulnerable households the hardest, and making everyday life more expensive for everyone. Inflation, partially exacerbated by global trends, has eroded purchasing power and confidence in the traditional parties that were expected to safeguard economic prosperity. As factory orders dip and small businesses struggle to stay afloat, voters are growing frustrated – and the AfD has proven adept at channeling that frustration into votes.

But the AfD is not the only beneficiary of this climate of discontent. Wagenknecht, who made her name in the Left Party (Die Linke) before breaking away, is set on pulling disillusioned voters from across the political spectrum. Fiercely critical of deregulated markets and neoliberal orthodoxies, she accuses Germany’s mainstream leaders of abandoning true social justice in favor of what she sees as global corporate interests. For some on the left, who feel the Social Democrats and the Greens have lost touch with working-class realities, her new party offers a tantalizing alternative. By merging left-populist rhetoric with sharp critiques of rising living costs, Wagenknecht might peel away the very voters that kept the center-left afloat for years.

Friedrich Merz, who leads the center-right Christian Democratic Union (CDU) and is often seen as Chancellor Olaf Scholz’s principal rival, faces headwinds from unexpected quarters. Musk’s criticism of Merz has drawn attention to a rift between conventional conservatism and the disruptive style championed by a new generation of influential voices. Worse for Merz, Trump’s return to the presidency in the United States signals that a more populist brand of politics may gain transatlantic support. During his first term, Trump’s ambassador to Germany, Richard Grenell, made headlines by engaging openly with right-leaning German politicians, including members of the AfD. Now, with a second Trump administration, Washington could well encourage a similar or even more robust alignment with populist forces in Berlin.

This newfound enthusiasm for anti-establishment politics also points to a broader pattern across Europe, where trust in traditional parties has been waning. For years, Germany seemed immune to the populist waves that buffeted Italy, France, and other EU states. No longer. Should the AfD continue its ascent – and if Wagenknecht’s party gains real traction – a once-placid two- or three-party system might fracture, making future coalitions messy at best. Already, local and regional elections have hinted at the extent of voter dissatisfaction. On the national stage, that frustration could crystalize into a governing challenge the likes of which Berlin hasn’t seen in decades.

Nor can any of this be separated from Germany’s broader role in Europe. As the bloc’s central economic engine, Germany largely sets the tone for EU policy. A dramatic rightward shift, or even a strong left-populist surge, would ripple through Brussels. Questions of migration, defense policy, and EU fiscal rules might be renegotiated under a less europhile coalition. Countries that share more conservative or nationalist leanings could feel emboldened, while those favoring greater integration or progressive reforms might be sidelined.

In short, Germany’s political shift is a wake-up call to all of Europe: ignoring the grievances of voters on both ends of the spectrum comes at a price. If mainstream elites continue to champion broad liberal agendas without addressing concrete problems – such as ballooning energy bills and the loss of stable employment—more radical alternatives will claim their slice of the political pie. Whether that slice comes from the right, the left, or a combination of both, the result is likely to be a more fragmented, unpredictable Germany. And with Trump soon to be in the White House again and Musk’s disruptive influence seeping into every corner of public discourse, the odds of a return to centrist predictability appear slimmer by the day.

“The Last Spark Of Hope” For Germany..

“The portrayal of the AfD as rightwing extremist is clearly false, considering that Alice Weidel, the party’s leader, has a same-sex partner from Sri Lanka! Does that sound like Hitler to you?”

• Musk Pens Pro-AfD Op-Ed In Major German Paper; Editor Resigns (ZH)

Amid ongoing efforts by the establishment to ban the Alternative for Germany (AfD) party from the upcoming German elections (in the name of democracy?), Billionaire Elon Musk has waded deeper into the politics of this declining nation, in an effort to protect his “significant investments”. A week after he stated on X that “only the AfD can save Germany”, he has penned a supportive op-ed for the country’s Welt am Sonntag newspaper… prompting the resignation of the paper’s editor. The initial six word post on X was enough to prompt much wailing and gnashing of teeth among Europe’s cognoscenti, but this op-ed appears to have ratcheted up the panic to ’11’. First things first, this is not a direct op-ed as one might comprehend it as it’s title clearly highlights: “Why Elon Musk is betting on the AfD – and why he is wrong”.

Welt editor-in-chief Jan Philipp Burgard is careful to remind readers (multiple times) that: “The AfD is in parts xenophobic and anti-Semitic. That is why it is a danger to Germany.” Musk makes short work of the farcical “far-right extremist” accusation: “The portrayal of the AfD as rightwing extremist is clearly false, considering that Alice Weidel, the party’s leader, has a same-sex partner from Sri Lanka! Does that sound like Hitler to you? Please!” AfD co-leader Alice Weidel SLAMS Angela Merkel and the CDU party, says she destroyed Germany in powerful 13-minute speech. The Tesla CEO is undeterred as he covers a variety of topics that Germany needs to address as it near an “economic and cultural collapse,” adding that he has the “right” to address the country’s political climate as he has “made significant investments” in Germany’s technological and industrial sectors.

In the op-ed, Musk argued that Germany’s economy is handicapped by regulatory overreach and bureaucracy. “The AfD has understood that economic freedom is not just desirable, but necessary. Its approach of reducing government over-regulation, cutting taxes and deregulating the market reflects the principles that made Tesla and SpaceX successful,” Musk wrote, according to a rough translation. “If Germany wants to regain its industrial strength, it needs a party that doesn’t just talk about growth, but also takes policy action to create an environment where companies can thrive without heavy government intervention,” he added. While the globalist elites panic over Musk’s six word X statement (and now the op-ed), he points out this is not some marginalized political party:

“The AfD, even though it is described as far-right, represents a political realism that resonates with many Germans who feel that their concerns are ignored by the establishment. It addresses the problems of the moment – without the political correctness that often obscures the truth,” the tech billionaire continued. Musk also said the AfD was “committed to a controlled immigration policy that gives priority to integration and the preservation of German culture and security. This is not about xenophobia, but about ensuring that Germany does not lose its identity in the pursuit of globalization.” Musk concluded that AfD was the “last spark of hope” for the country.

Following the op-ed’s publication, the paper’s opinion section editor, Eva Marie Kogel, announced her resignation on X. “I always enjoyed heading the opinion section of WELT and WAMS. Today an article by Elon Musk appeared in Welt am Sonntag. I handed in my resignation yesterday after it went to print.” Elections in Germany are set for Feb. 23 following the collapse of Chancellor Olaf Scholz’s government. The AfD is now running second in opinion polls with around 19% support, behind the conservative CDU/CSU alliance with more than 30%. However, Germany’s mainstream parties have all ruled out working with AfD at the national level….all of which rings a very loud bell from what we just witnessed in Paris.

“..everybody’s prices are going up. Health insurance is going to become unaffordable for most people.”

• Sugar Juice & Fraud Propped Up Failing Biden Economy – Ed Dowd (USAW)

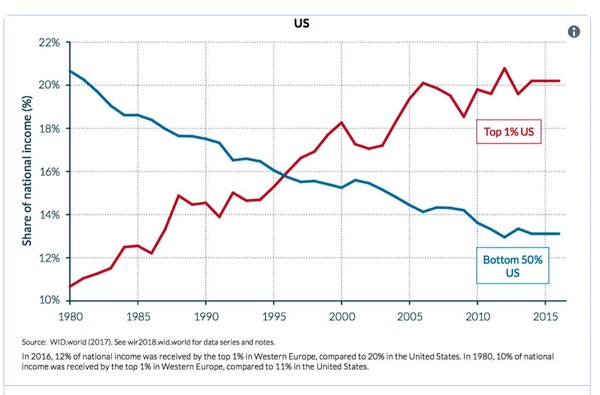

Former Wall Street money manager and financial analyst Ed Dowd of phinancetechnologies.com is back with more data on how the Biden Administration propped up a failing economy during the 2024 election year. Dowd contends “crisis level spending” was being administered, along with some bigtime “fraud.” Dowd says, “We had 10% deficit to GDP during the Great Financial Crisis (2008 – 2009) when we actually had a crisis. We had 8% deficit to GDP during this election year. You have to ask yourself, what was the crisis?” “The crisis was to get the Biden Administration (and Kamala) re-elected. So, they went on binge spending. They borrowed from the future to try to ensure they won. They did it two ways: They hired massive amounts of government personnel to float the economy, and they also did illegal immigration.

We are thinking it was 10 million to 15 million illegal immigrants that came in the last four years. The majority of the illegal immigrants came in the last two years. That stimulated the economy and raised the velocity of money as those people were given money. All the NGO’s that facilitated the illegal immigration also got money, and that stimulated the economy. This deficit added $2 trillion, and that was unproductive assets. So, we borrowed from the future to create more government jobs and imported unprecedented amounts of illegal immigrants that don’t add to the economy. That’s what we have, and President Trump’s policies are going to reverse all that sugar juice. There are going to be mass deportations and reduced government spending. That short term juice is going away, and it was not sustainable anyway. The bond markets are revolting, and that could not have gone on much longer.”

But it was not just massive money printing and debt creation that hid how bad the real economy was, it was very crooked data. Dowd says, “We also had bureaucratic incompetence or fraud or whatever you want to call it. They were padding the non-farm payroll numbers to the tune of 1.25 million jobs… If you look at the chart, which we don’t have here, it’s insane. It’s one of the biggest misses between reality and estimates we have ever seen. It’s a seven-sigma event. It’s 1.25 million jobs. It’s already started downward revisions… The 3rd quarter GDP of 3% will be revised down, and when we get . . . the data in February, there will be more GDP economic revisions down. . . . The capital markets made bad decisions on this data. The Fed made bad decisions on this data, and corporations made bad decisions on this data. The price tag is coming due in 2025. Not only that, but we have a slowing economy across the globe…

The amount of foreign assets in our stock market has never been higher, and this is all going to reverse. The price will be paid in 2025. . . .What’s coming is coming. It’s how low do we go, and when do the animal spirits kick in? So, there is pain coming, and it’s up to the Trump Administration to get all their policies enacted. Then we have a hope and a prayer coming out the other side that we will be way better off. The bottom line is there is pain coming regardless. The question is how fast can we restart with Trump’s policies?” Dowd likes gold as part of a portfolio, and he is suggesting people get some cash in hand. Dowd says the war in Syria is going to intensify, and you will be hearing much more negative news from that area in 2025.

Dowd, who wrote the popular book “Cause Unknown: The Epidemic of Sudden Deaths in 2021, 2022 and 2023,” says the epidemic caused by the CV19 injections will be with us for the rest of our lives. Dowd released new data that added 800,000 people to the 4 million disabled we already had since the CV19 mRNA vax began. Dowd says, “The other thing that is going on is the increase in cancers. Science is following up . . . There is cancer causing agents in the mRNA vaccines, and we are seeing cancers on the rise. . . . There are new (medical insurance) claims among young workers, especially cancer claims. . . . Insurance rates are going up across the board. The answer to what is going on is to raise prices. They are not differentiating between the vaxed and unvaxed. So, everybody’s prices are going up. Health insurance is going to become unaffordable for most people.”

Paul Craig Roberts

“The disassembly of our civilization has left a barbaric people who would not be able to understand Shakespeare if they were to read him.”

• No Longer Sustained by Education, Western Humanity Is in Death Throes (PCR)

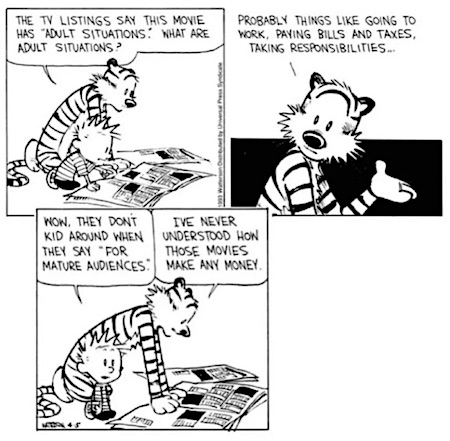

Universities no longer produce educated people, and educated people are ceasing to exist. It is an interesting question, not to be discussed here, whether the disappearance of educated people is cause or result of the rise in barbarity that is engulfing the world. Wherever one looks one sees degeneration. From Bach, Mozart, Beethoven to four-letter rap. Literature has ceased to be written as well as read. Art has become scribbles attesting to meaningless. Both the inclination and ability to read are declining. Fewer people can use their language. University students’ essays are written by insentient AI. People no longer understand the metaphors and allusions used in language, because they have been denied literature. Great literature explores the human condition and prepares people for an aware life. It protects against naïveté. It teaches the richness and usefulness of language, enhances communication skills, essential skills lost to today’s technical training and “customer service” AI.

Communication today is nonverbal, shorthand text messages. The digital revolution, artificial intelligence, and transhumanism are eliminating human communication. Increasingly humans are forced by “customer service” to communicate with an unthinking programmed voice that cannot recognize any question, an answer for which it has not been programmed. Just think how difficult it is to deal with a service provider. What once was a matter of a three minute telephone call answered by the third ring, can now be a multi-hour and even multi-day enterprise. The lack of Internet security means that even if a human is reached, no decision or solution can be made. It has to go up a level as fewer and fewer employees are trusted to make a judgment. The digital revolution has brought an explosion in crime and scams. Florida, for example, has so many that they don’t want you to report another one.

The digital revolution was sold to businesses as a way to drop cost by replacing customer service representatives with AI. But AI is not sentient and cannot deal with anything for which it is not programmed. The main purpose of AI “customer relations” is to make it too expensive in time to correct an incorrect bill. It is cheaper just to pay the overstated one. There are fewer and fewer service companies where you can contact a human with the ability to correct a problem without an investment of hours of time. My favorite is when the Internet is down and you call the service supplier and are told to contact their chat on their website.

Years ago Shakespeare was accused by the Israel Lobby of being anti-semitic. Shakespeare lived during 1564 and 1616. The term anti-semite did not exist and there was no Israel Lobby. This did not prevent Shakespeare from being labeled an anti-semite in the 20th century and removed from high school and university literature courses. Consequently, the most remarkable use of the English language has been denied to students who have been deprived of understanding portions of their own language because of Jewish objections to Shakespeare. Shakespeare’s literature, of course, is not a literature of anti-semitism. But here and there he says a few things about Jews that everyone then believed and many today still do. In literature the same thing happens to every ethnicity, but it is only Jews who complain.

The World Economic Forum, an evil institution to which Western politicians and corporate executives long to belong, has a transhumanist operative who says that AI has made human life unnecessary and inconvenient. The need to dispose of superfluous humans has led to discussions of a legislated lifetime. I predicted many years ago that abortion would lead to enforced euthanasia. Ask yourself whose hand is driving geeks to make humans superfluous. Why is it more important to have AI answer a phone than a human? If humans are to be disposed of, who is to purchase the products of robots? Don’t you think it is extraordinary that the AI advocates have never asked themselves this question? How does it advance humanity to forever find new ways to transfer the human function to a robot? How did it come to be that the main agenda of science is to make humans irrelevant?

Over the course of my life I have watched a dark age gradually engulf the world. Trump says he is going to make America great again, but how is he going to do that when the building materials no longer exist? What is Trump’s definition of great? The disassembly of our civilization has left a barbaric people who would not be able to understand Shakespeare if they were to read him.

“One wonders what people in the West who have either supported Israel’s genocide or remained silent tell themselves to justify their behavior and sleep at night. History will not treat them kindly.“

• The Moral Bankruptcy of the West (John Mearsheimer)

On 19 December 2024, Human Rights Watch issued a 179-page report detailing Israel’s genocide in Gaza. On 5 December 2024, Amnesty International issued a 296-page report detailing Israel’s genocide in Gaza. On 21 November 2024, the International Criminal Court issued arrest warrants for Israeli Prime Minister Benjamin Netanyahu and former Israeli Defense Minister Yoav Gallant for crimes against humanity and war crimes. On 26 January 2024, the International Court of Justice found that a plausible case can be made that Israel is committing genocide in Gaza. Given the West’s presumed commitment to human rights and especially to preventing genocide, one would have expected countries like the United States, Britain, and Germany, to have stopped the Israeli genocide in its tracks.

Instead, the governments in those three countries, especially the United States, have supported Israel’s unimaginable behavior in Gaza at every turn. Indeed, those three countries are complicit in this genocide. Moreover, almost all of the many human rights advocates in those countries, and in the West more generally, have stayed silent while Israel executed its genocide. The mainstream media has made hardly any effort to expose and challenge what Israel is doing to the Palestinians. Indeed some key outlets have staunchly supported Israel’s actions. One wonders what people in the West who have either supported Israel’s genocide or remained silent tell themselves to justify their behavior and sleep at night. History will not treat them kindly.

“Mike Johnson, Speaker of the House, is doing an extraordinary job. I tell everybody, I was a pretty effective Speaker. I could never do his job. He has no margins. Any two or three members can rebel at any moment..”

• Most, But Not All, Republicans Lining Up To Support Speaker Of The House (JTN)

Weekend talk shows have featured considerable discussion about the vote in the House on Friday, January 3, for speaker, a position currently held by Rep. Mike Johnson of Louisiana. The potential for chaos is very real. As Republicans face an uncertain and precarious series of critical deadlines, party members are weighing in on what they believe should happen. The key dates in January are the 3rd, the 6th and the 20th. January 3rd is the day Congress reconvenes, at noon ET. At a little after 1 p.m. ET is when the vote to elect the Speaker of the House commences, according to Fox News. No other business can occur until that happens, and the number in the Republican conference is what has Republicans nervous. January 6 is supposed to be the counting of the electoral votes for president. January 20 is supposed to be President-elect Donald Trump’s Inauguration Day.

Neither of those can happen, at least theoretically, until the House chooses a speaker. This is the breakdown when the new Congress starts: 219 Republicans to 215 Democrats. While the number is usually 435, this time it is 434, as Matt Gaetz resigned after winning reelection in November, then being nominated for Attorney General, from which he later withdrew. He then resigned from Congress thinking that would end the House Ethics Committee’s plans to release their report on him, which it didn’t. Two other recently reelected Republicans have been nominated or named by Trump for key posts in his administration, but they remain in the House for now. Those two are Rep. Michael Waltz of Florida, picked as Trump’s national security adviser, and Rep. Elise Stefanik of New York, nominated as U.S. ambassador to the United Nations.

To become speaker, the candidate “must win an outright majority of all members casting ballots for someone by name.” Needing 218 votes, there is little room for losing members. So far there is only one member who has said he will not be voting for Speaker Johnson, and that is Rep. Thomas Massie of Kentucky. At least four others have refused to commit to vote for Johnson. If he loses one more, he does not get to the necessary 218 votes. Former Speaker of the House Newt Gingrich spoke out, praising Johnson for the job he has done in his role as top Republican in the House. “Mike Johnson, Speaker of the House, is doing an extraordinary job. I tell everybody, I was a pretty effective Speaker. I could never do his job. He has no margins. Any two or three members can rebel at any moment,” Gingrich told John Catsimatidis on his show “Cats Roundtable” on WABC 770 AM, according to The Hill.

Rep. James Comer, R-Ky., was on “Sunday Morning Futures” on Fox News. He called on President-elect Trump to call all of the members who have not yet committed to support Johnson and urge them to do so. The party and country could be moving into uncharted water if the vote for speaker drags on. Last time, two years ago, it took 15 rounds of votes over five days to get there, when then-Speaker Kevin McCarthy failed to get a majority. Rep. Mike Lawler, R-N.Y., was on ABC’s “This Week.” When asked by host Jonathan Karl whether Johnson would and should be reelected as Speaker, “Yes, and yes,” he replied. “The fact is that Mike Johnson inherited a disaster.”

The old guard is still there, the people who gave you Biden and Kamala. This will take a long time.

• New Strategy For DNC: Younger Candidates Launching Bids To Run Party (JTN)

Following the Democrats’ 2024 sweeping election loss, younger candidates are stepping up to run for Democratic National Convention leadership positions as the midterm elections approach. Some of the candidates that have thrown their hat in the ring include gun control activist David Hogg, 24, who is running for DNC vice chairman and New York State Sen. James Skoufis, 37, who is running for chairman. “Moving forward, we must have a renewed focus on our youth outreach in all states and territories to rebuild our coalition after the massive shift to the right among young voters this election,” Hogg said in a statement, according to NBC News. Skoufis said last month that the Democratic Party needs to have a “fresh” perspective for the future and getting new voters. “I think I bring a healthy mix of a track record of knowing how to win over the past 12 years but also being that younger, fresher perspective,” he said.

The Democratic National Committee is scheduled to hold its election for chairperson on Feb. 1, 2025. Current DNC Chairman Jamie Harrison, who has had the position since 2021, announced he wouldn’t run again after his party this past election cycle lost the White House and Senate. “The DNC is committed to running a transparent, equitable, and impartial election for the next generation of leadership to guide the party forward,” he said. Others running for DNC chairman include former Maryland Governor Martin O’Malley, DNC vice chair Ken Martin, Ambassador to Japan and former mayor of Chicago, Rahm Emanuel, and Wisconsin Democratic Party Chair Ben Wikler, according to The Hill. New Age author and former presidential candidate Marianne Williamson announced Thursday she’s running to lead the Democratic National Committee, according to CNN.

“This year, the party faces a more critical problem than we have ever faced before,” Williamson wrote on her Substack. “The MAGA phenomenon now challenges the very way that politics are done in America, and the traditional tool kit of party organizing will not be enough to meet the moment.” During the 2024 election, both Vice President Kamala Harris and President-elect Donald Trump made efforts to get younger voters through influencers and podcasts. During the campaign, Trump went on “The Joe Rogan Experience,” comedian Theo Von’s podcast and popular podcaster and scientist Lex Fridman’s podcast, each of which have male-dominated audiences. Rogan’s podcast has 14.5 million listeners and is the most popular podcast in the world.

Harris went on a popular podcast called “Call Her Daddy,” had celebrity endorsements of Beyonce and Oprah Winfrey and had singer Gracie Abrams sing at one of her campaign rallies. The Harris campaign paid Winfrey’s production company more than $1 million to stage the endorsement event, and paid Beyoncé’s production company $165,000 for her appearance. However, with the Democrats’ most recent loss, the party is looking to re-strategize with how to win over voters in the 2026 midterm elections and the 2028 presidential election. Hogg, a who gained fame as a survivor of the Parkland school shooting in Florida, had come out prior to the election and said the Democratic Party had to do a better job about reaching the male demographic.

According to The Trace, he co-founded Leaders We Deserve, a political action committee formed in 2023 that has raised nearly $8.5 million in the past year to elect Gen Z and millennial progressives to state and national office. “I hope I’m wrong but if we lose in November I think the main reason why will be the number of young men of all races that are no longer Democrats,” Hogg wrote on X in a September post. “There’s been a taboo about talking about this because we understandably are hesitant to make men a main point of conversation (given we have been for thousands of years) but we have a real problem to deal with.” “Long-term, we have a lot of work to do to provide positive examples of what actual masculinity looks like that is not defined by putting down women or other people, but by lifting others up and being a true leader,” his post concluded. The Democrats have two years to come up with a winning strategy for 2026 with the midterm elections and less than two months to elect leadership to execute their plan.

“The envoy infamously branded Chancellor Olaf Scholz an “offended liver sausage” over his unwillingness to travel to Kiev personally.”

• Ukraine Could Agree To Non-NATO Security Guarantees – Envoy (RT)

Kiev’s main goal at present is to obtain meaningful security guarantees, which are not necessarily tied to the country’s NATO membership, Ukraine’s newly-appointed ambassador to the UN Andrey Melnik has said. The diplomat made the remarks in an interview published by Germany’s Berliner Morgenpost on Friday. Since the escalation of the Ukraine conflict in February 2022, the leadership in Kiev has consistently named accession to the US-led military bloc as one of its top priorities. Russia has, in turn, singled out the threat of NATO military infrastructure appearing on its Western border as one of the reasons it initiated its special operation against the neighboring nation. “NATO membership remains on the table for Ukraine,” Melnik said. He went on to clarify that “nevertheless, the question of security guarantees as an interim solution is central to us.”

The diplomat stressed that any such arrangements must go beyond mere political pledges akin to the ones given to Kiev under the 1994 Budapest Memorandum. Under the accord, Ukraine gave up its nuclear arsenal in exchange for security guarantees provided by the US, the UK and Russia. The Ukrainian ambassador noted that “our partners must meticulously write down what military assistance they would rush to the rescue to defend Ukraine, should it be attacked by Russia again.” Melnik told the newspaper that both bilateral and multilateral agreements could be considered, as long as they are binding under international law. “These could also be part of a potential large peace treaty with Russia,” the Ukrainian diplomat added.

He also brushed aside predictions that US President-elect Donald Trump could drastically reduce or terminate Washington’s aid to Kiev altogether. Melnik concurred with the Republican, however, that European NATO member states should come to the fore in terms of their own defense and military assistance to Ukraine. The ambassador expressed hope that the leader of Germany’s Christian Democratic Union party, Friedrich Merz, billed by many observers as the future chancellor, would heed Trump’s advice. The Ukrainian diplomat insisted that European NATO member states are affluent enough, and can afford to spend a lot more on defense.

Speaking of Germany, where he served as Ukraine’s ambassador between 2014 and 2022, Melnik expressed indignation at the fact that funds allocated for defense aid to Kiev in the budget of the Federal Republic for next year had been slashed from eight to four billion euros. He also reiterated his country’s demands for German long-range Taurus missiles and expressed hope that Berlin’s new coalition government would “put military aid to Ukraine on a stable basis.” German President Frank-Walter Steinmeier ordered the dissolution of the federal parliament on Friday, following the collapse of the country’s ruling coalition, with a snap election scheduled for February 23. During his time as Ukrainian ambassador to Germany, Melnik repeatedly used undiplomatic language when speaking about the country’s leadership. The envoy infamously branded Chancellor Olaf Scholz an “offended liver sausage” over his unwillingness to travel to Kiev personally.

Speaking of Germany, where he served as Ukraine’s ambassador between 2014 and 2022, Melnik expressed indignation at the fact that funds allocated for defense aid to Kiev in the budget of the Federal Republic for next year had been slashed from eight to four billion euros. He also reiterated his country’s demands for German long-range Taurus missiles and expressed hope that Berlin’s new coalition government would “put military aid to Ukraine on a stable basis.” German President Frank-Walter Steinmeier ordered the dissolution of the federal parliament on Friday, following the collapse of the country’s ruling coalition, with a snap election scheduled for February 23. During his time as Ukrainian ambassador to Germany, Melnik repeatedly used undiplomatic language when speaking about the country’s leadership. The envoy infamously branded Chancellor Olaf Scholz an “offended liver sausage” over his unwillingness to travel to Kiev personally.

“But who cares about Slovakia, right, Mr. Zelenskyy? But when you need something to keep you from freezing in the winter, you scream in frustration..”

• Zelensky Charges Slovakia’s Fico With Opening “Second Energy Front” (ZH)

Slovakia has threatened to cut off electricity to Ukraine if the Russian gas transit route halts at the end of the year, as we detailed earlier. Slovakia is greatly dependent on Russian gas, and Ukraine is not expected to renew a major energy transit contract with Russian state suppliers. With just a few days away from the start of the new year, Slovak Prime Minister Robert Fico escalated the standoff by saying he can leverage electricity supplies to Ukraine. “After Jan. 1, we will consider the situation and the possibility of reciprocal measures against Ukraine,” Fico said in a video released Friday. “If it is unavoidable, we will stop the supply of electricity, which Ukraine urgently needs in the event of grid failures,” he said. The war of words and threats is ratcheting by the day. Given that Fico just controversially met with Putin in Moscow, the electricity threat is going to add insult to injury at a moment Russian aerial forces have been pummeling Ukraine’s power grid this past week.

Fico lashed out in the most charged statement directed at Kiev to date: “But who cares about Slovakia, right, Mr. Zelenskyy? But when you need something to keep you from freezing in the winter, you scream in frustration,” Fico said. Zelensky responded Saturday by accusing Slovakia, which is a NATO and EU member state, of opening a “second energy front” against Ukraine on orders from Moscow. “It appears that Putin gave Fico the order to open the second energy front against Ukraine at the expense of the Slovak people’s interests,” Zelensky wrote on X. “Fico’s threats to cut off Ukraine’s emergency power supply this winter while Russia attacks our power plants and energy grid can only be explained by this,” he emphasized. He charged that Putin is “dragging Slovakia into Russia’s attempts to cause more suffering for Ukrainians.”

As Russia’s aerial assaults on Ukraine’s energy grid have grown worse, Ukraine has relied more and more on electricity imports from neighboring and outside countries to survive. Zelensky has indicated the Slovakia accounts for 19% of Ukraine’s power imports, which is a significant portion, and outsized given Slovakia’s small geographic size. Clearly, Fico does have serious leverage at his disposal. “Slovakia is part of the single European energy market and Fico must respect common European rules,” the Ukrainian leader further said Saturday. Fico has long been target of vitriol from Kiev officials, given he has consistently and loudly opposed Ukraine’s entry into NATO, in common with Hungary’s Viktor Orban. “As long as I am the prime minister of the Slovak Republic, as long as I lead the deputies, whom I, as the party chairman, have under political control, I will never agree to Ukraine’s membership in NATO,” Fico declared this past October.

Sure, cut off the gas in the middle of winter…

• EU States Seek To Protect Russian Gas Flow Despite Ukrainian Threat (RT)

Countries in central and southern Europe are exploring solutions to ensure the continued flow of Russian natural gas, as a key transit agreement between Russia and Ukraine is set to expire on December 31, Bloomberg has reported, citing sources. Kiev has refused to extend the agreement, citing ongoing tensions and unresolved disputes with Moscow. Slovakia, Hungary, Austria and Italy are reportedly pursuing alternative strategies to avoid disruptions to their gas supplies. Among the options considered is a commercial agreement that bypasses the need for a renewed intergovernmental deal between Kiev and Moscow, Bloomberg wrote in a report on Saturday. This could involve Slovakia and other Central European countries striking direct contracts with Russian energy giant Gazprom, ensuring uninterrupted gas flows despite Ukraine’s objections.

Slovakia’s state gas utility, SPP, is also in discussions with Azerbaijan’s state-owned oil company SOCAR. According to reports, one potential solution could involve a gas swap between SOCAR and Gazprom, where the Azeri company would purchase equivalent volumes of Russian gas to supply European buyers. Azerbaijan’s gas exports already reach several EU countries through the Southern Gas Corridor, an infrastructure project designed to reduce dependence on Russian gas. The strategy was adopted by the EU following the escalation of the Ukraine conflict in 2022.

Hungarian Prime Minister Viktor Orban has also proposed moving the location of Russian gas sales to the physical border between Russia and Ukraine, which would transfer gas ownership to European buyers and oblige Kiev to ensure transit under its free-trade agreement with the EU, Bloomberg wrote, citing persons familiar with the matter. Last week, Russian President Vladimir Putin acknowledged that various proposals have been discussed, involving Hungary, Slovakia, Türkiye, or Azerbaijan. He noted, however, that any such arrangement would be difficult to enact because of Gazprom’s long-term contracts. Ukraine is punishing Europe by banning the transit of Russian gas, which will become more expensive, the Russian leader argued. Moscow has also insisted that it’s ready to continue supplying natural gas to the EU.

Although only about 5% of the EU’s total gas supply now transits through Ukraine, the route remains vital for landlocked countries in Central and Eastern Europe. Since the start of the Ukraine conflict in 2022, the EU has sought to reduce its reliance on Russian gas, shifting toward alternatives such as liquefied natural gas (LNG) and increased imports from Azerbaijan via the Southern Gas Corridor. Before February 2022, Russia was the bloc’s top gas supplier, accounting for more than 40% of its imports. Last year, Russian gas made up around 8% of EU imports.

EU loses big.

• Georgia’s New President ‘Hardline Critic of the West’ (Sp.)

Mikheil Kavelashvili took his oath on the Bible and the Georgian constitution, swearing to serve the country’s national interests amid a political standoff. On December 29, Mikheil Kavelashvili was sworn in as Georgia’s new president in an inauguration at parliament that was attended by members of the ruling Georgian Dream party and its founder Bidzina Ivanishvili. Who is Georgia’s new president and how does the US meddle in internal affairs of the former Soviet republic? A former Dinamo Tbilisi and Manchester City football player, Kavelashvili was appointed president by the parliament during the December 14 elections, in which 224 out of 225 members of Georgia’s electoral college voted for the only candidate on the ballot.

The 53-year-old is a founder of the People’s Power party, allied with the Georgian Dream and known for being the main voice for anti-Western sentiments in Georgia. The Guardian recently called him “a pro-Russia, hardline critic of the West.” Kavelashvili has repeatedly said that Western intelligence agencies are seeking to drive Georgia into war with Russia. He accused opposition parties of acting as a “fifth column” directed from abroad, slamming outgoing President Salome Zourabichvili as a “chief agent”. The new president accused her of violating the constitution and declared that he would “restore the presidency to its constitutional framework.” The footballer-turned-politician insisted that Georgian society is divided,” and that “radicalization and polarization” in the country are being fueled from abroad. He pledged to do his best to unite the society “around the idea of Georgia’s identity and independence.”

Earlier this week, the US did not think twice before sanctioning Georgian Dream party’s founder Bidzina Ivanishvili for allegedly “undermining the democratic and Euro-Atlantic future of Georgia for the benefit of the Russian Federation,” according to Secretary of State Antony Blinken. In September, the US cited the aforementioned allegations as it slapped sanctions on Zviad Kharazishvili, head of the Department for Special Assignments of the Ministry of Internal Affairs and his deputy Mileri Lagazauri. Georgian Dream spokesman Givi Mikanadze denounced the sanctions as “interference in the pre-election processes and an attempt to influence the will of voters.”

The Russian Foreign Intelligence Service (SVR), in turn, said in a statement in July that Moscow has data that indicates Washington’s determination to seek a change of power in Georgia following the results of the parliamentary elections in the small Caucasian nation on October 26, which was finally won by the Georgian Dream. According to the SVR, the US instructors have already given the command to the opposition forces in Georgia to start planning protests in the country timed to coincide with the elections. The October 26 elections saw Georgian Dream obtain 54.2% of the votes, with the four opposition parties together gaining 37.33%. The remaining political forces failed to overcome the 5% ceiling needed to make it to the parliament.

Back at it

— Doglover (@puppiesDoglover) December 29, 2024

Husky

This kills me every winter. This husky is looking over like “finally some NORMAL weather. please shut that door, man. you’re bringing the warm air out here” pic.twitter.com/viK12ByWkJ

— Roy Drones Jr (@chiweethedog) December 29, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.