NPC Kidwell’s Market on Pennsylvania Avenue, Washington DC 1920

I think I’ll just give you a slew of quotes, and then you can figure out if you can figure out why I chose to call this the Yellen Massacre. Which consists, by the way, of two separate but linked parts, not quite the Siamese twin perhaps, but close. What links them is the upcoming Fed decision to raise interest rates, and the timing of the announcement of that decision. It will blow up both bond markets and a large swath of emerging markets. People keep saying ‘the Fed won’t do it’, or ask ‘why would they do it’, but arguably they’re already quite late. It must be half a year ago now that I wrote it would hike rates, and also told you why: Wall Street banks. First, here’s a fine little ditty published at Econmatters:

Six Days Until Bond Market Crash Begins

Early on Thursday morning, realizing this was going to be a robust selloff in equities, the ‘smart money’, i.e., the big banks, investments banks, hedge funds and the like, ran to the old staple of buying bonds hand over fist with little regard for the yield they are getting paid for stepping in front of the freight train of rate rises coming down the tracks.

Just six days away from the most important FOMC meeting in the last seven years, and another 300k employment report in the rear view mirror, this looks like an excellent place to hide for nervous investors who have far more money than they have grains of common sense. Newsflash for these investors, yes markets are over-valued, and you need to get out of Apple, and about 100 other high flying overpriced momentum stocks, but you can`t hide out in bonds this time.

That party is over, and next Wednesday`s FOMC meeting is going to make this point abundantly clear. There is no place to hide except cash. You should have thought about that before you gorged yourself on ZIRP to the point where you have pushed stocks and bonds to unsupportable price levels, and you keep begging for the Fed to stall just another six months, so you can continue to buy more stocks and bonds.

Well you have done an excellent job hoodwinking the Fed to wait until June, you should thank your lucky stars you have done such a good job manipulating the Federal Reserve; but just like the boy crying wolf, this strategy loses its effectiveness over time. Throwing another temper tantrum right before another important FOMC meeting hoping that Janet Yellen will be alarmed by these Pre-FOMC Selloffs to put off another six months the inevitable rate hike, this blackmail strategy has run its course.

The Fed is forced to finally start the Rate Hiking Cycle after 7 plus years of Recession era Fed policies by an overheating labor market. You knew this day was going to come, but most of you are still in denial. What the heck were you buying 10-year bonds with a 1.6% yield five months before a rate hike?? You only have yourself to blame for the 65 basis point backup in yields on that disaster of an “Investment”.

But really what were you thinking here?? That is the problem when the Fed has incentivized such poor investment decisions and poor allocation of capital to useful, growth oriented projects over the past 7 plus years of ZIRP that these ‘investors’ don`t think at all, they have become behaviorally trained ZIRP Crack Addicts!

They can cry over the strong dollar, have a couple of 300 point Dow Selloffs, scare monger over Europe or Emerging Market currencies, but the fact is that the due date has come on your stupidity. You bought all this crap, and now you have to sell it! Well too freaking bad, boo hoo, you shouldn’t have bought so many worthless stocks and bonds at unsustainable levels in the first place. [..]

The positioning for this inevitability is as poor as I have seen in any market. The carnage in the bond market is just going to be gruesome, the denial is so strong, the lack of historical perspective of what normal bond yields look like, and what a normalized economy represents where savers actually get paid to save money in a CD or checking account. The fact that the Fed has so de-sensitized investors to what a normalized rate economy and healthy functioning financial system looks like is probably one of the biggest drawbacks of ZIRP Methodology.

The Federal Reserve, and now the European Union have set the stage for the biggest collapse in bond markets that will make the sub-prime financial crisis look like a cakewalk.

One may question whether 6 days is carved in stone; maybe THE announcement will come the next meeting, not this one. But does it really matter? Yellen has created a narrative about the US economy, especially the (un)employment rate. About which yet another narrative has been created by the BLS, which refuses to count many millions of Americans as unemployed, for various reasons. And that leads to the article’s claim of ‘an overheating labor market’. The only way the US jobs market is overheating is that it seems to have created a huge oversupply of underpaid waiters, greeters and burger flippers.

But the narrative is now firmly in place, so Yellen and her stooges can claim they have no choice but to hike. Not just once, but three times this year, suggests Ambrose Evans-Pritchard in the following very bleak read and weep portrait of the world today. In which he also describes how all of this plays out in sync with the soaring dollar, which will have devastating consequences around the world, starting in the poorer parts of the world (what else is new?).

Global Finance Faces $9 Trillion Stress Test As Dollar Soars

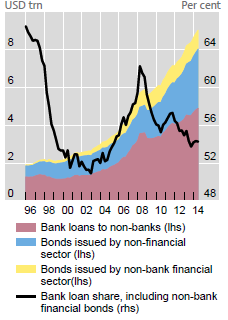

The report – “Global dollar credit: links to US monetary policy and leverage” – was first published by the Bank for International Settlements in January, but its biting relevance is growing by the day. It shows how the Fed’s zero rates and quantitative easing flooded the emerging world with dollar liquidity in the boom years, overwhelming all defences.[..]

Foreigners have borrowed $9 trillion in US currency outside American jurisdiction, and therefore without the protection of a lender-of-last-resort able to issue unlimited dollars in extremis. This is up from $2 trillion in 2000. The emerging market share – mostly Asian – has doubled to $4.5 trillion since the Lehman crisis, including camouflaged lending through banks registered in London, Zurich or the Cayman Islands. The result is that the world credit system is acutely sensitive to any shift by the Fed. “Changes in the short-term policy rate are promptly reflected in the cost of $5 trillion in US dollar bank loans,” said the BIS.

Markets are already pricing in such a change. The Fed’s so-called “dot plot” – the gauge of future thinking by Fed members – hints at three rate rises this year, kicking off in June. The BIS paper’s ominous implications are already visible as the dollar rises at a parabolic rate, smashing the Brazilian real, the Turkish lira, the South African rand and the Malaysian Ringitt, and driving the euro to a 12-year low of $1.06.

The dollar index (DXY) has soared 24pc since July, and 40pc since mid-2011. This is a bigger and steeper rise than the dollar rally in the mid-1990s – also caused by a US recovery at a time of European weakness, and by Fed tightening – which set off the East Asian crisis and Russia’s default in 1998. Emerging market governments learned the bitter lesson of that shock. They no longer borrow in dollars. Companies have more than made up for them.

“The world is on a dollar standard, not a euro or a yen standard, and that is why it matters so much what the Fed does,” said Stephen Jen, a former IMF official now at SLJ Macro Partners. He says the latest spasms of stress in emerging markets are more serious than the “taper tantrum” in May 2013, when the Fed first talked of phasing out quantitative easing. “Capital flows into these countries have continued to accelerate over recent quarters. This is mostly fickle money. The result is that there is now even more dry wood in the pile to serve as fuel,” he said. Mr Jen said Asian and Latin American companies are frantically trying to hedge their dollar debts on the derivatives markets, which drives the dollar even higher and feeds a vicious circle. “This is how avalanches start,” he said.

Companies are hanging on by their fingertips across the world. Brazilian airline Gol was sitting pretty four years ago when the real was the strongest currency in the world. Three quarters of its debt is in dollars. This has now turned into a ghastly currency mismatch as the real goes into free-fall, losing half its value. Interest payments on Gol’s debts have doubled, relative to its income stream in Brazil. The loans must be repaid or rolled over in a far less benign world, if possible at all.

You would not think it possible that an Asian sovereign wealth fund could run into trouble too, but Malaysia’s 1MDM state fund came close to default earlier this year after borrowing too heavily to buy energy projects and speculate on land. Its bonds are currently trading at junk level. It became a piggy bank for the political elites and now faces a corruption probe, a recurring pattern in the BRICS and mini-BRICS as the liquidity tide recedes and exposes the underlying rot.

BIS data show that the dollar debts of Chinese companies have jumped fivefold to $1.1 trillion since 2008, and are almost certainly higher if disguised sources are included. Among the flow is a $900bn “carry trade” – mostly through Hong Kong – that amounts to a huge collective bet on a falling dollar. Woe betide them if China starts to drive down the yuan to keep growth alive.

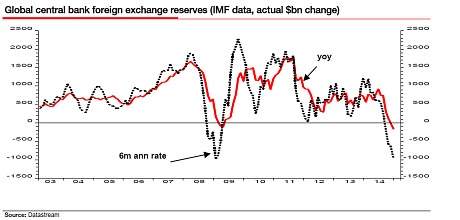

Manoj Pradhan, from Morgan Stanley, said emerging markets were able to weather the dollar spike in 2014 because the world’s deflation scare was still holding down the cost of global funding. These costs are now rising. Even Singapore’s three-month Sibor used for benchmark lending is ratcheting up fast. The added twist is that central banks in the developing world have stopped buying foreign bonds, after boosting their reserves from $1 trillion to $11 trillion since 2000.

The Institute of International Finance (IIF) calculates that the oil slump has slashed petrodollar flows by $375bn a year. Crude exporters will switch from being net buyers of $123bn of foreign bonds and assets in 2013, to net sellers of $90bn this year. Russia sold $13bn in February alone. China has also changed sides, becoming a seller late last year as capital flight quickened. Liquidation of reserves automatically entails monetary tightening within these countries, unless offsetting action is taken. China still has the latitude to do this. Russia is not so lucky, and nor is Brazil. If they cut rates, they risk a further currency slide.

In short, Janet Yellen will go down into history as the person responsible for what may be the biggest economic crash ever, or at least delivering the final punch of the way into it, a crash that will make the rich banks even much richer. And there is not one iota of coincidence in there. Yellen works for those banks. The Fed only ever held investors’ hands because that worked out well for Wall Street. And now that’s over. Y’all are on the same side of the same trade, and there’s no profit for Wall Street that way.

Home › Forums › From Yellen Put To Yellen Massacre