Unknown Dutch Gap, Virginia. Bomb-proof quarters of Major Strong 1864

The world drowns in cynicism.

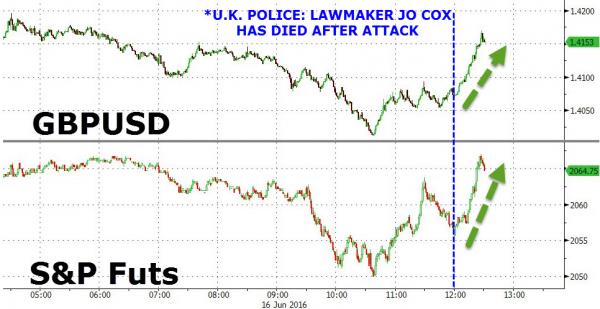

• Stocks, Sterling Surge After British MP’s Death (ZH)

The devastating news that British MP Jo Cox has died following the shooting incident earlier today by a mentally unstable man…

“U.K. Labour Party lawmaker Jo Cox died after being attacked as she met constituents in her electoral district in West Yorkshire in the north of England. Campaigning ahead of next week’s referendum on Britain’s membership of the European Union was suspended for the rest of Thursday by both sides after the attack, which happened just before 1 p.m. Jo was attacked by a man who inflicted serious and, sadly, ultimately fatal injuries,” West Yorkshire Police Temporary Chief Constable Dee Collins said in a televised press conference in Wakefield.

…has sparked a bullish buying binge in stocks as Sterling rallies on the market’s “hope” that the Brexit vote will be delayed. This evening’s major speech at Mansion House by Bank of England Governor Carney has been cancelled due to her death…

Bank of England says Governor Mark Carney will no longer deliver planned speech in London. BOE cites “dreadful attack today on Jo Cox MP” Governor will attend event and deliver a “short speech reflecting on today’s events”

No further comment. Perhaps complete silence would be the most appropriate answer, but all we’ll hear all day and then some is comments and opinions. Spin doctors and conspiracies work overtime.

• ’I’d Risk Life And Limb For My Babies’: Jo Cox (G.)

Labour MP Jo Cox, who died on Thursday after being attacked in her constituency of Batley and Spen in West Yorkshire by an armed man, makes a speech in parliament about the need for the UK to help child migrants stranded unaccompanied in Europe. The speech was part of a debate on the issue which took place in April 2016.

Unaffordability. Known to pop many a bubble.

• There’s A New Kind Of Housing Crisis in America (MW)

America has a housing crisis, and most Americans want policy action to address it. That’s the conclusion of an annual survey released Thursday by the MacArthur Foundation. The “crisis” is no longer defined by the layers of distress left behind after the subprime bubble burst, but about access to stable, affordable housing. A vast majority of respondents – 81% – said housing affordability is a problem, and one-third said they or someone they know has been evicted, foreclosed on, or lost their housing in the past five years. Over half the respondents, 53%, said they’d had to make sacrifices over the past three years to be able to pay their mortgage or rent. Yet most respondents believe the housing problem is solvable, and want policymakers to address it.

Nearly two-thirds of survey respondents from both parties say housing hasn’t received enough attention in the 2016 campaign. Most people supported a range of proposed policies to support affordable housing, both rentals and purchase. But people increasingly believe that owning a home is a “an excellent long-term investment.” Some 60% agreed with that statement, up from 56% a year ago and 50% in 2014. Access to stable, affordable housing – whether to rent or buy – is “about more than shelter,” the MacArthur Foundation noted in a release. “It is at the core of strong, vibrant, and healthy families and communities.”

“If 2006 was a known bubble with housing prices at “X”, affordability never better, easy availability of credit, unemployment in the 4%’s, total workforce at record highs, and growing wages, then what do you call today with house prices at X+ 5% to 20%, worse affordability and credit, higher unemployment, weakening total workforce, and shrinking wages? Whatever you call it, it’s a greater thing than “X”.

• US Housing Bubble 2.0: Shadow Demand vs Shelter-Buyer Fundamentals (Hanson)

[..] if everybody always had to purchase owner-occupied properties using the same down payment amount and a market rate, fixed-rate mortgage then house prices would always reflect the employment, income, and macro-economic conditions of the surrounding area. But, when ‘Shadow Demand’ cohorts enter the market using cheap and easy credit and liquidity prices can detach from local-area economics, especially if the Shadow Demand continues to gain market share. Heck, in the greater Phoenix region, over 50% of all households can’t afford the going rate on a two-bedroom apartment, yet house prices are some of the strongest in the nation. Obviously, this isn’t due to strong end-user, shelter-buyer fundamentals.

As Shadow Demand continues to gain share over end-user buyers, they settle for lower respective returns on their housing investments and prices continue to rise. Then, when appraisers use properties purchased by Shadow buyers — for unconventional purposes with cheap and easy credit and liquidity — as comparable sales, all property values rise. Sure, there are end-user, shelter-buyers who will be able to chase the market all the way up. But, the larger the bubble blows the more the end-user, shelter-buyer demand will get crowded out and/or turn into increased supply as they liquidate. We are seeing this happen all over the nation.

In Bubble 1.0, Shadow Demand continued to gain market share until it blew up. And we know that beginning in 2011 the four pillars of unorthodox, Shadow Demand — beginning with the distressed market — controlled housing demand and still does. The implosion of the mortgage securitization market in 2007 didn’t crash housing. Rather, when the Shadow Demand – reliant on cheap and easy credit and liquidity largely driven by securitization — left the market, housing “reset to end-user, shelter-buyer fundamentals”. In other words, the pendulum swung back to the fundamental, end-user, shelter-buyer with 20% down and a market-rate 30-year fixed mortgage, which was 30% lower. Again, this isn’t a housing crash per se, rather a demand-shift and a reset, or reattachment, to real fundamentals.

Bottom line: History will repeat because the drivers are identical. Bubble 2.0 will end with house prices once again “resetting to end-user fundamentals”, or to what the end-user shelter buyer can afford with a typical down payment and 30-year fixed rate mortgage. And it doesn’t have to be an MBS market blowing up to cause house prices to reattach to end-user fundamentals. It could be anything that swings this pendulum from being driven by Shadow Demand, which is where we are today.

Erosion.

• America’s Dying Shopping Malls Have Billions in Debt Coming Due (BBG)

Suburban Detroit’s Lakeside Mall, with mid-range stores such as Sears, Bath & Body Works and Kay Jewelers, is one of the hundreds of retail centers across the U.S. being buffeted by the rise of e-commerce. After a $144 million loan on the property came due this month, owner General Growth Properties Inc. didn’t make the payment. The default by the second-biggest U.S. mall owner may be a harbinger of trouble nationwide as a wave of debt from the last decade’s borrowing binge comes due for shopping centers. About $47.5 billion of loans backed by retail properties are set to mature over the next 18 months, data from BofAML show. That’s coinciding with a tighter market for commercial-mortgage backed securities, where many such properties are financed.

For some mall owners, negotiating loan extensions or refinancing may be difficult. Lenders are tightening their purse strings as unease surrounding the future of shopping centers grows, with bleak earnings forecasts from retailers including Macy’s and Nordstrom, and bankruptcy filings by chains such as Aeropostale and Sports Authority. Older malls in small cities and towns are being hit hardest, squeezed by competition from both the Internet and newer, glitzier malls that draw wealthy shoppers. “For many years, people thought the retail business in the U.S. was a bit overbuilt,” said Tad Philipp at Moody’s. “The advent of online shopping is kind of accelerating the separation of winners and losers.” Landlords that can’t refinance debt may either walk away from the property or negotiate for an extension of the due date. It can be hard to save a failing mall, leading to high losses for lenders on soured loans, Philipp said.

“.. (low) interest rates are the mothers milk of speculation..”

• Sell The Stocks, Sell The Bonds, Get Out Of The Casino: Stockman (Fox)

“..central banks in their infinite wisdom have made the cost of money so cheap that it has created an environment that forces a complete misallocation of capital in the market ..”

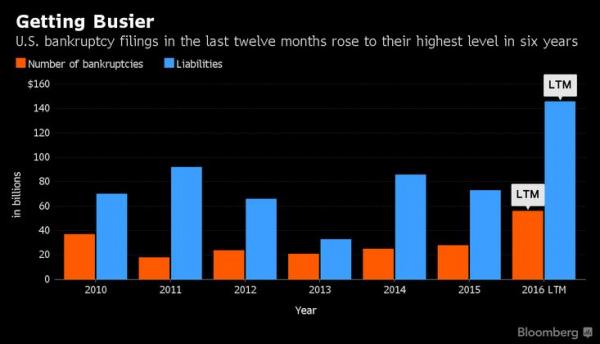

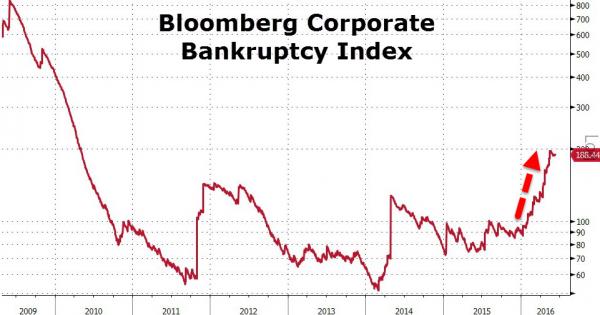

• Default Cycle: ‘It’s Only A Matter Of Time Before Many Of Them Blow Up’ (ZH)

It’s been a tough year for traders and bankers alike, as layoffs have gripped firms due to difficult trading environments and an overall sluggish economy. However, there is one area that is starting to actually pick up. As the number of bankruptcies begin to increase, firms are expanding their turnaround teams in order to handle all of the work headed their way – bankers with experience in turnarounds and restructuring are now in high demand. “Firms are hungry for experienced restructuring professionals, who are increasingly in short supply. You need to reach deep into your Rolodex to find people you know who are capable, and you need to move fast.” said Richard Shinder, hired by Piper Jaffray in March to help build out its restructuring team.

Both the number of bankruptcies and the amount of liabilities associated with them have picked up significantly, as Bloomberg points out. With the amount of companies in distress, firms such as Lazard, Guggenheim, Perella Weinberg and Alix are all hiring in anticipation of even more bankruptcies. “Cycles come and go, but when a wave hits, you want to make sure you are in the right seat with the right group of people. We are putting the band back together.” said Ronen Bojmel, who is helping to build the restructuring team at Guggenheim. Moody’s is forecasting high default rates in sectors that are largely expected given commodity prices, such as Metals & Mining and Oil & Gas, however trouble looks to be spilling over into other sectors such as Construction, Media, Durable Consumer Goods, and even Retail.

As we have discussed for quite some time, central banks in their infinite wisdom have made the cost of money so cheap that it has created an environment that forces a complete misallocation of capital in the market as the search for yield continues down every rabbit hole it can find. This will (and already is) inevitably catch up to the economy in the form of defaults and bankruptcies. “The wave is already here. Many risky debt deals have been done as people chased yield, and it’s a matter of time before many of them blow up.” said Tim Coleman, head of PJT Partners.

Local governments = shadow banks. Would like to see someone dig into who owns them.

• China’s Debt Is 250% of GDP And ‘Could Be Fatal’, Says Government Expert (G.)

China’s total debt was more than double its GDP in 2015, a government economist has said, warning that debt linkages between the state and industry could be “fatal” for the world’s second largest economy. The country’s debt has ballooned to almost 250% of GDP thanks to Beijing’s repeated use of cheap credit to stimulate slowing growth, unleashing a massive, debt-fuelled spending binge. While the stimulus may help the country post better growth numbers in the near term, analysts say the rebound might be short-lived. China’s borrowings hit 168.48 trillion yuan ($25.6 trillion) at the end of last year, equivalent to 249% of economic output, Li Yang, a senior researcher with the leading government think-tank the China Academy of Social Sciences (CASS), has told reporters.

But the huge number, which includes government, corporate and household borrowings, was lower than some non-government estimates. The consulting firm McKinsey Group said earlier this year that the country’s total debt had quadrupled since 2007 and was likely as high as $28 trillion by mid-2014. The debt-to-GDP ratio is not the highest in the world. The US has a ratio of 331%, for example, much of which is accounted for by federal debt. But part of the concern about China’s massive debt binge is that the most worrying risks lie in the non-financial corporate sector, where the debt-to-GDP ratio was estimated at 156%. This sector includes the liabilities of local government financing vehicles, Li said.

Interesting observation.

• The Fed Has Brought Back ‘Taxation Without Representation’ (Black)

In February 1768, a revolutionary article entitled “No taxation without representation” was published London Magazine. The article was a re-print of an impassioned speech made by Lord Camden arguing in parliament against Britain’s oppressive tax policies in the American colonies. Britain had been milking the colonists like medieval serfs. And the idea of ‘no taxation without representation’ was revolutionary, of course, because it became a rallying cry for the American Revolution. The idea was simple: colonists had no elected officials representing their interests in the British government, therefore they were being taxed without their consent. To the colonists, this was tantamount to robbery.

Thomas Jefferson even included “imposing taxes without our consent” on the long list of grievances claimed against Great Britain in the Declaration of Independence. It was enough of a reason to go to war. These days we’re taught in our government-controlled schools that taxation without representation is a thing of the past, because, of course, we can vote for (or against) the politicians who create tax policy.

But this is a complete charade. Here’s an example: Just yesterday, the Federal Reserve announced that it would keep interest rates at 0.25%. Now, this is all part of a ridiculous monetary system in which unelected Fed officials raise and lower rates to induce people to adjust their spending habits. If they want us little people to spend more money, they cut rates. If they want us to spend less, they raise rates. It’s incredibly offensive when you think about it– the entire financial system is underpinned by a belief that a committee of bureaucrats knows better than us about what we should be doing with our own money.

It’s too late to even try bridging the gaps.

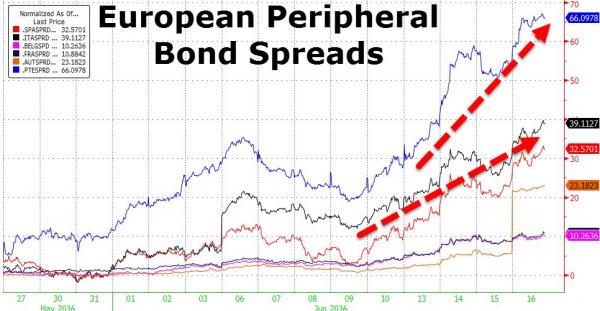

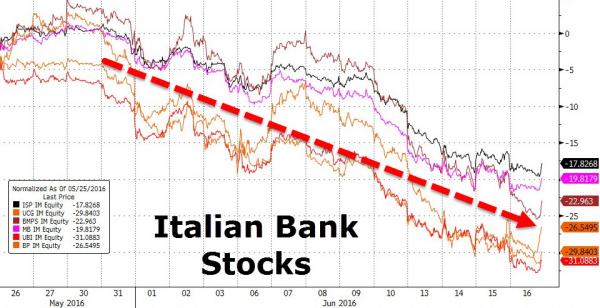

• Forget Brexit, It’s Italy’s Turn (Stelter)

If the Germans really want to avoid a Brexit or the exit of other countries from the Eurozone, they will have to change their policies. Unfortunately, German politicians and economists prefer to criticize the other countries instead of doing their homework. They oppose spending more money at home, they oppose a debt restructuring, they oppose debt monetization by the ECB, they oppose exits from the eurozone. In doing so, they increase the pressure in the system as Europe remains locked in recession. Irrespective of how the British vote next week, the problems of Europe keep on growing. It is only a question of when, not if, a euroskeptic party gets into power in one of the largest EU economies, promising to solve all problems by exiting the Euro and the EU.

I continue to see Italy as the prime candidate for such a move. The country suffers under a recession which has by now lasted longer than the recession of the 1930s. It still has not managed to get back to 2008 GDP levels. Unemployment is high, government debt is out of control. Closing the competitive gap to Germany by lowering wages by 30% is a ridiculous idea and an impossible task. The alternative is to leave the eurozone. Italy could then devalue the new lira and regain competitiveness overnight. An Italian uscita (exit) – or “Uscitaly” in the latest clever term of art – is the true risk for the eurozone. And it would be too late when Der Spiegel comes up with a new cover: “Mon dio, Italia. Si prega di non uscire!”

This is the EU Britain must vote for or against. This is what it does. It turns member states into third world nations. Greece had a great health care system. But nobody can afford it anymore.

• Austerity Kills! Greeks’ Health Deteriorating, Life Expectancy Shrinks (KTG)

The economic crisis and the strict austerity bound to the loan agreement kill. They kill Greeks. The Bank of Greece may not write it in such a melodramatic way on its Monetary Policy Report 2015-2016. However, the conclusions in the chapter about “Reforms in health, economic crisis and impact on the health of population” are shocking and confirm what we have been hearing and reading around from relatives and friends in the last years: that the physical and mental health of Greeks has been deteriorating – partly due to economic insecurity, high unemployment, job insecurity, income decrease and constant exposure to stress. Partly also due to economic problems that have patients cut their treatment, partly due to the incredible cuts and shortages in the public health system. The Report notes that “while it takes longer to record the exact effect, trends show a deterioration of the health of Greeks in the years of loan agreements and austerity cuts.”

The BoG states:

• Suicides increased. “The risk of suicidal behavior increases when there are so-called primary risk factors (psychiatric-medical conditions), while the secondary factors (economic situation) and tertiary factors (age, gender) affects the risk of suicide, but only if primary risk factors pre-exist.

• Infant mortality increased by nearly 50%, mainly due to increase of deaths of infants younger than one year, and the decline of births by 22,1%. Infant mortality increase: 2.65% in 2008 and 3.75% in 2014

• Increase of parts of population with mental illness, especially with depression. Increase: 3.,3% in 2008 to 6.8% in 2009, to 8.2% in 2011 and to 12.3% in 2013. In 2014, a 4.7% of the population above 15 years old declared it suffered form depression – that was 2.6% in 2009.

• Chronic diseases increased by approximately 24%.The BoG notes that “the large cuts in public expenditure have not been accompanied by changes and improvement of the health system in order to limit the consequences for the weakest citizens and vulnerable groups of the society.” [..] Citing OECD data of 2013, the BoG underlines that 79% of the population in Greece was not covered with insurance and therefore without medical and medicine due to long-term unemployment, while self-employed could not afford to pay their social contributions.

[..] One of the neighborhood pharmacists has been telling me on and off about the dramatic number of patients who cannot afford the self-participation in prescription medicine. Many of his clients cut their treatment into half – like 1 tablet for cholesterol not daily but every other day basis – and that some have given up the whole treatment. “For some people the choice is: either have treatment or food.” And this has been going on since 2012, when then Greek Health Minister adopted the German model of “self-participation in prescription medicine, laboratory tests” and cut some primary health services but forgot to adopt also that aspect of the German model that provides that patients would not spend more than 2% of their income for medical services and medication.

4 million years ago is well before anything closely resembling man appeared. That makes this so dangerous for us. It creates an environment that we did not evolve in. As more and more of what was there when we did evolve will also disappear.

• Antarctic CO2 Hits 400ppm For First Time In 4 Million Years (G.)

We’re officially living in a new world. Carbon dioxide has been steadily rising since the start of the Industrial Revolution, setting a new high year after year. There’s a notable new entry to the record books. The last station on Earth without a 400 parts per million (ppm) reading has reached it. A little 400 ppm history. Three years ago, the world’s gold standard carbon dioxide observatory passed the symbolic threshold of 400 ppm. Other observing stations have steadily reached that threshold as carbon dioxide spreads across the planet’s atmosphere at various points since then. Collectively, the world passed the threshold for a month last year.

In the remote reaches of Antarctica, the South Pole Observatory carbon dioxide observing station cleared 400 ppm on May 23, according to an announcement from the National Oceanic and Atmospheric Administration on Wednesday. That’s the first time it’s passed that level in 4 million years (no, that’s not a typo). There’s a lag in how carbon dioxide moves around the atmosphere. Most carbon pollution originates in the northern hemisphere because that’s where most of the world’s population lives. That’s in part why carbon dioxide in the atmosphere hit the 400 ppm milestone earlier in the northern reaches of the world.

But the most remote continent on earth has caught up with its more populated counterparts. “The increase of carbon dioxide is everywhere, even as far away as you can get from civilization,” Pieter Tans, a carbon-monitoring scientist at the Environmental Science Research Laboratory, said. “If you emit carbon dioxide in New York, some fraction of it will be in the South Pole next year.”

Home › Forums › Debt Rattle June 17 2016