Arnold Genthe Manhattan 1932

It’s exceedingly safe to assume that the main reason the Kiev government agreed to a ceasefire on Friday was that the Ukraine army was losing on just about all fronts. Which they blame on Russian troops and weaponry being involved in increasing numbers, but there’s still to this day no proof for that.

The ‘rebels’ suspect that Kiev will use the ceasefire only to regroup, send in more men and guns, and fortify its positions. Moreover, the same ‘rebels’, who in the western press are increasingly awarded the “pro-Russian” label, even though they have no intention of joining Russia, have accused Kiev of having already violated the ceasefire within hours of it being announced.

Does anyone truly believe the US/EU/NATO coalition, which has spent billions on their Ukraine regime change project, are going to leave it at this? That they’re willing to admit defeat and will now retreat to their original positions, minus East Ukraine? If so, please have a look at the Brooklyn Bridge I have up for sale on Ebay. It has an absolutely lovely weathered look, literally tons of patina, and a history to die for.

I still haven’t seen one single western journalist take an in-depth look at the role of Victoria Nuland, Geoffrey Pyatt and their EU accomplices. Nobody seems interested in what these people have done over the past years that led up to Yanukovych’ ouster in February, and the subsequent civil war Kiev unleashed upon its own people. Not one single western journalist. And it’s not as if there’s no story there.

Meanwhile, the demonization of Vladimir Putin by those same journalists continues unabated. I saw something pass by just now about a Ukrainian priest claiming Putin is obsessed by Satan, no less. That’s the sort of thing that is duly reported in the west. Not Victoria Nuland.

And western politicians too play the same grossly over the top game like they were born for it. US officials have announced they will ‘degrade’ Islamist State (Obama) and chase them into Hell where they belong (Joe Biden). That’s the kind of language that ‘earns’ them applause.

As if there’s nothing wrong with using the images of an American being decapitated for hollow political gain. As if honor has nothing to do with it. In the exact same way that using 298 deaths on flight MH17 didn’t keep anyone from assigning blame, in graphical terms and without any evidence. I guess this is welcome to the age of communication. The more there is, the more is hidden. Perhaps there comes a point where communication equates to propaganda, where information can’t help turning into spin.

But so, yes, I don’t see the west giving up on Ukraine anytime soon. But I don’t see either the Donbass people, or those who support them, doing so either. And the more bases and attack and defense systems, and rapid deployment troops, NATO positions ever close to Russia’s borders, the more Moscow will feel obliged to counter-act.

It’s a stupid way to deal with things when you have two heavily militarized forces opposite each other. But it’s what we see develop as we’re watching. And it looks as if the media war in the west has been won by the west, to the extent that nothing that can be said from here on in will ever be able to wipe the completely invented anti-Putin allegations from our cumulative unconsciousness.

Even if Tuesday’s preliminary MH17 report by the Dutch Safety Board, for which reportedly so many detectives were engaged that no other crimes were solved at all the past two months or so, points not to Putin or Donbass rebels as the guilty party or parties, the allegations against them will still be left in everyone’s unconscience.

Not that I think there’s much chance of that; My guess is the preliminary report will leave so many questions open that there’ll be plenty room to keep the suspicions against Russia and the Donbass alive. The full report won’t be concluded until next summer, so the artificially induced bad taste can simmer and fester for another year.

But I’m still curious to see the report. As I am to see the Russian Union of Engineers’ report which we will present here at the Automatic Earth shortly.

To get back to why I started writing this, I don’t see a truce or ceasefire holding for long. The ‘rebels’ have a lot of reasons to keep fighting: first off, there were winning, and second, they were on their way to establish a land bridge to the Crimea, which would lift their isolation.

And as I said, I don’t see the west give up on their expansionist project. They can now make all of their people believe it was Putin who violated the 1997 NATO-Russia Founding Act (not that anyone has any idea what that is), that NATO is right to expand eastward, even if it’s obvious that Russia can only respond by countering that expansion with force.

The west will find a reason to blame the other side, rebels or imagined Russians, for violating the ceasefire, and use it to increase its military power. Americans and Europeans alike have so far taken all the ‘news’ they were served hook line and sinker, and why should that change? In other words, US/EU/NATO are free to do whatever they want, as long as they can spin a somewhat credible anti-Putin line in their media. And just about any line is credible by now.

But the ceasefire will truly stop when conditions are laid upon the table. Kiev will never ever again rule over the Donbass, the sole region to make Ukraine an economically viable entity. The gory and bloody attempts over the past 6 months to subdue the east Ukraine population have failed, and there won’t be a second chance.

What’s left of the Donbass after the shelling by its own official government will not agree to be governed by that same government. Ukraine as we draw it on the map today has ceased to exist. But that doesn’t mean the west won’t be willing to give it another try.

No matter how awry this goes, the likes of Obama and Barroso and Juncker still think they’ll win because they have bigger dicks a.k.a. guns. And the guys behind the curtains are laughing out loud. They have the ‘bigger’ view.

• US Jobs Bombshell Raises Questions Of New Weakness (CNBC)

August’s nonfarm payrolls growth of just 142,000 raises concerns that the economy is healing unevenly, but economists say the stunningly weak jobs report could be just a temporary setback in a stronger trend. The soft employment data, however, is also questionable enough to add fuel to the debate about labor slack when the Fed meets later in the month, though economists don’t see any change in Fed policy. The total August payrolls growth is the first below 200,000 in seven months, and included revisions that cut a combined 28,000 jobs from June and July. The jobless rate fell to 6.1 from 6.2 but it accompanied a drop in labor force participation to 62.8% from 62.9%. “I think it’s just a clunker. I wouldn’t put too much emphasis on it. It is disturbing .We had six months of 200,000 and now we have a clunker,” said John Canally, market strategist and economist at LPL Financial. Canally said August payroll data have been below expectations 17 of the last 18 years.

• The ECB Is Blowing Smoke In Our Eyes (AEP)

Mario Draghi has played a weak hand with skill, as always. He is a superb actor. Yet the package of measures unveiled by the ECB yesterday is pitifully small and mostly window dressing, an effort to buy time with a mix of vague gestures and outright gimmicks, a substitute for decisive action “This is a classic ECB play of the kind we have seen so many times over the last three years,” said Andrew Roberts, credit chief at RBS. “There is huge smoke and mirrors at the time of the announcement, but when you go through the figures 24 hours later you realise it is nothing like what you thought.” The delirious reaction of market traders is interesting, but essentially just noise. What the ECB did will not move the macroeconomic dial by one iota. As Christian Schulz from Berenberg Bank puts it, the latest rate cuts are a screen to “paper over divisions”. The ECB could not secure German political consent for genuine reflation, so it put on a pantomime instead.

The new measures add little to what was already on the table in June. Some are marginally helpful, some trivial, with a shocking lack of detail about the one point that really matters The ECB has had years to plan asset purchases (QE Lite), yet Mr Draghi dodged all questions about the scale. You might conclude that there is still no real agreement on the course of action. Little wonder since Germany’s member of the ECB board – Sabine Lautenschlaeger – said only two months ago that QE is unthinkable except in an “emergency”, and no such emergency exists By default, the ECB is making the same mistake as the Bank of Japan in its dog days, trying to buy time with half measures, hoping that global recovery will lift Europe off the reefs without anything being done. They may get away with this, but there is a very high risk that Europe will instead remain trapped in mass unemployment, with ever rising debt ratios. [..]

If the brilliant Mr Draghi were running a real central bank, he would simply carry out old-fashion open-market operations – with an eight hundred year history – and keep buying assets on whatever scale is needed to meet the ECB’s 2pc inflation target. Instead he running a zoo. He is forced by abominable circumstances to blow smoke in our eyes. He is good at it though.

• East Ukraine Calm After Ceasefire, But Residents Doubt It Will Last (Reuters)

A ceasefire between Ukrainian forces and pro-Russian separatists in eastern Ukraine appeared to be holding on Friday evening, despite some initial shelling in the rebel stronghold of Donetsk. However, many residents and combatants were skeptical that the ceasefire could last long or turn into a basis for a durable peace settlement after six months of conflict. The two sides remain far apart on the future of the region. The ceasefire was approved by envoys from Ukraine, the separatist leadership, Russia and Europe’s OSCE security watchdog meeting in Minsk as part of a peace road map that also includes an exchange of prisoners and the creation of a humanitarian corridor for refugees and aid. Minutes after the ceasefire began at 1500 GMT, three blasts were heard north of Donetsk, followed by scattered mortar and artillery fire, but this later fell quiet.

Fighting had raged for much of the day in two flashpoints in eastern Ukraine – near the strategic port of Mariupol on the Sea of Azov and further north in Donetsk, mostly around the city’s airport which remains in government hands. Kiev says its forces have been trying to repel a big offensive by the rebels to take Mariupol, whose port is crucial to Ukraine’s steel exports. It stands about halfway between Russia and the Russian-annexed Crimean Peninsula. Ukrainian commanders denied separatist claims that separatist forces had entered Mariupol on Friday.

• Kiev Forces Continue Shelling Despite Ceasefire: Donetsk Militia (RIA)

Ukrainian special forces continued shelling towns and militia positions in the Donetsk region late Friday despite the ceasefire established hours before, the militia forces of the self-proclaimed Donetsk People’s Republic (DPR) said Saturday. “The people’s militia’s subdivisions in Horlivka and Makiivka fell under mortar shelling in the Donetsk direction at 20 hours 15 minutes [17:15 GMT],” said in the DPR headquarters. Some 1.5 hours later, the Ukrainian forces attacked the city of Yasynuvata, and at 10:30 p.m. (19:30 GMT), the positions of the militia forces’ at the Donetsk airport, according to militia. “Along the whole contact line with the enemy, [militia forces] adhered to the commander’s order not to fire back,” the DPR representatives said.

• Russia ‘Will React’ If EU Implements New Sanctions (Reuters)

Russia’s Foreign Ministry vowed on Saturday to react if the European Union implements new sanctions against Moscow over its role in the Ukraine crisis. The EU announced the additional measures late on Friday but said they could be suspended if Moscow withdraws its troops from Ukraine and observes a newly agreed ceasefire in eastern Ukraine. The new sanctions include adding a further 24 people to a list of people barred from entry to the 28-nation bloc and whose assets are frozen. They are due to be implemented on Monday. “If they (new sanctions) are implemented of course there will be a reaction from our side,” the ministry said in a statement.

• Russia Lashes Out Over NATO Spearhead Force In Eastern Europe (RT)

Moscow has accused NATO of using the Ukrainian crisis as a “pretext” to “push its military presence closer to Russia’s borders,” and says that plans for a new rapid response force will sabotage the peace process in eastern Ukraine. “The [expansion] plans have been harbored by NATO for a long time, and recent events have served as a pretext to put them into action,” said a statement published on the Russian Foreign Ministry’s website, following the wrapping up of the NATO summit in Wales. “Together with the rhetoric at the summit, and the planned military exercises before the end of the year, this will increase tension, destabilization the nascent peace process, and further widen the division in Ukraine,” the ministry’s statement said.

“The above is also testament to NATO’s unconditional support for the extremists and neo-fascists in Kiev, including the Right Sector political movement,” it stressed. During the two-day summit, the 28 NATO member states instituted the creation of a rapid response unit numbering at least 4,000. It could be deployed in Eastern Europe – where it will be based – in less than 48 hours. The primary stated reason for the initiative is “Russia’s aggression against Ukraine.” Russia’s NATO envoy, Aleksandr Grushko, also denounced NATO’s policy, suggesting that the alliance was engaged in “Cold War thinking,” and risked undermining the landmark 1997 treaty in which Moscow and Brussels officially proclaimed that they were no longer “adversaries.”

In a TV interview, Grushko said that NATO was “flexing its muscles,” and pointed out that an increased presence of NATO vessels in the Baltic and Black Sea would destroy the recently built-up level of trust in what were once the potential flashpoints in the standoff. Grushko also called the planned NATO-Ukraine exercises a “provocation” because “foreign troops will appear in a country that is fighting its own people.” “NATO must play no role in the Ukrainian conflict,” the official told Rossiya-24 network. He also accused the US of “trying to unload the financial burden of maintaining NATO onto its allies.”

Word.

• ‘The People On Wall Street Aren’t Seeing What Really Goes On In America’ (ZH)

Today’s jobs data was almost 5 standard deviations below Wall Street’s best-and-brightest’s estimate and has already been dismissed by many as an ‘anomaly’ or ‘unbelievable’. Despite the fact that the National Retail Foundation noted over 17,000 layoffs in August “calling into question how much momentum the economy really has,” one member of the public was able to #NailTheNumber on CNBC’s great payroll-guessing game. Ronnie Squires explains to a silenced CNBC anchor the real state of America…

Apologies for audio quality…

The uncomfortable truth…

“I do a lot of traveling around the country and there’s still a lot of folks who say ‘there’s no jobs out there’.

I watch [CNBC] every day and I just don’t see it.

I don’t know if the people on Wall Street are not really getting out and seeing what’s really going on [in America].

When you go to small towns, like I do, and talk to people – people don’t have much confidence in the numbers you hear.“

Central banks print money to keep the S&P 500 at record levels.

• What’s The Point Of Hiding It Any Longer? (Zero Hedge)

Compare and contrast.

From the Chicago Mercantile Exchange 2012 10-K:

Customer Base: Our customer base includes professional traders, financial institutions, institutional and individual investors, major corporations, manufacturers, producers and governments.

And from the Chicago Mercantile Exchange 2013 10-K:

Customer Base: Our customer base includes professional traders, financial institutions, institutional and individual investors, major corporations, manufacturers, producers, governments and central banks.

And there you have it At this point why even pretend there is a “market”? The “market”, and by “market” we mean stocks – it has long been known that central banks actively trade bonds, FX and commodities – is whatever central banks say it is. Finally, if central banks are going to be rigging the market as they now conclusively are on a daily basis, perhaps they can disclose ahead of the trading day start to everyone, and not just the primary dealers, what the closing S&P 500 price for any given day is.

And they still all think tomorrow’s going to be better.

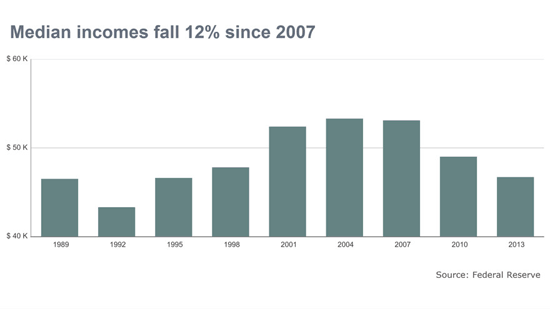

• The American Family Makes $200 More A Year Than It Did In 1989 (MarketWatch)

As of a year ago, typical U.S. households still hadn’t recovered all of the wealth they lost in the Great Recession of 2008-09, according to the latest Survey of Consumer Finances released by the Federal Reserve on Thursday. Median net worth fell 2% (inflation-adjusted) between 2010 and 2013 to $81,200 per family, down about 40% from the $135,400 they had in 2007, just before home prices and stock prices plunged, the Fed reported. (The median means that half of families had more wealth, and half had less. Net worth is the value of all assets minus the value of all liabilities or debts.) The Survey of Consumer Finances is considered one of the most comprehensive studies on income, wealth and debt. Unfortunately, it’s only produced every third year, and it’s published about 18 months after the survey. A lot can change in that 18 months, including a 14% increase in home prices and a 30% gain in the stock market.

If the typical family thinks the Great Recession never ended, here’s a good explanation: Median incomes have dropped about 12% in real terms since 2007, just before the recession began. In inflation-adjusted terms, the typical family makes only about $200 more a year than it did in 1989. There was some steady progress in median incomes from 1992 to 2004, but that’s all been wiped away. Some groups have done better than others: Incomes of the top 10% have risen about 18% in real terms since 1989. But those in the 60th to 80th%ile — the once-prosperous middle class — have seen their incomes rise just 4% in 24 years.

Oh, sweet recovery.

• Millions Struggle To Get Enough To Eat Despite Jobs Returning (NPR)

The number of U.S. families that struggled to get enough to eat last year was essentially unchanged from the year before, according to the U.S. Department of Agriculture’s latest report on “food security.” The agency says that about 17.5 million families — or 1 in 7 — were food insecure last year. That means that at some point during the year, the household had trouble feeding all of its members. In 2012, the number was 17.6 million. The number of households experiencing what the government calls “very low food security” — which means people actually miss meals or cut back their intake because they don’t have enough money for food — was also essentially unchanged last year at 6.8 million households. Anti-hunger groups say the fact that so many families are still struggling to put enough food on the table, even as the economy improves, is a sign that more needs to be done to help them out.

“These startling numbers prove there has been no true economic recovery for tens of millions of struggling U.S. families,” Joel Berg, executive director of the New York City Coalition Against Hunger, said in a statement. “It is clearer than ever that we need a massive new government jobs program, a significant increase in the minimum wage and a robust increase in the federal nutrition safety net program.” USDA sociologist Alisha Coleman-Jensen, an author of the report, says the numbers have not declined as much as one might expect with a drop in unemployment, because higher food prices and inflation last year offset the benefits of a brighter job market. She notes that over a two-year period, the drop in the%age of struggling families was statistically significant — from 14.9% in 2011 to 14.3% last year. Still, the level of food insecurity remains much higher than it was before the recession. In 2007, about 11% of households struggled to get enough to eat.

“Student loans issued from 2007 to 2012 are on target to produce $66 billion in profit for the United States government.”

• Elizabeth Warren: The Market Is Broken (CNN)

Senator Elizabeth Warren says she picked up a lot of her feistiness from reading Nancy Drew novels as a kid. Today she believes the most important mystery to solve is how to get the American economy working for someone other than billionaires. It’s a message she’s been taking all over the country, and she isn’t afraid to call banks, credit card companies and some employers cheats and tricksters. “The biggest financial institutions figured out they could make a lot of money by cheating people on mortgages, credit cards and payday loans,” she told a packed auditorium at the Graduate Center of the City University of New York, where she spoke alongside New York Times columnist Paul Krugman. The Democrat from Massachusetts even said the market is broken in many regards. “This is about getting markets to work for real people,” she said. The biggest applause of the night was on three issues that come up frequently in Warren’s speeches.

1) Financial regulation: Warren was the driving force behind the creation of the Consumer Financial Protection Bureau after the 2008 financial crisis. The agency has returned billions of dollars to Americans who were wronged. “Traffic works better with traffic lights,” she explained. In her eyes, a true capitalist system would have transparency so consumers could make informed choices. But in a world of “mice type” with pages and pages of fine print that no one reads or understands, the market breaks down.

2) Reducing student loans: Last summer Warren made headlines for arguing that student loans should have the same interest rates that banks get when they borrow money from the Federal Reserve. This year she’s pushing to allow people to re-finance their student loans at the historically low rates currently in place. As she likes to remind people, “Student loans issued from 2007 to 2012 are on target to produce $66 billion in profit for the United States government.”

3) Raising the minimum wage: “No one should work full time and still live in poverty,” Warren said. She uses her own family story to illustrate how critical it is for workers to make a living wage. Her father had a heart attack when she was 12, and her mother had to go back to work in retail at Sears to support the family.

And, let’s guess, 2/3 of them don’t make enough money?!

• Freelance Nation: One-Third Of US Workers Are Freelancers (Yahoo)

When the Labor Department releases its latest jobs report on Friday, it will likely show that the economy added about 200,000 jobs in August and the unemployment rate remained near 6.2%. What it won’t show is the extent to which many workers are no longer on payroll but self-employed as freelancers. The Freelancers Union, a national organization, released a survey today showing that 53 million Americans, or 34% of the country’s workforce, are freelancers. The trend started “decades ago, then accelerated,” says Sara Horowitz, the group’s founder and executive director. “Freelancing is everywhere.” She calls it a “new normal.”

Some say the freelance trend is not the worker’s friend and is a result of layoffs, forcing many to find work any way they can. But Horowitz says freelance work is “meaningful independence” — a “new way” of work that people like because “they can really organize their time [and] have flexibility.” Freelancing gives people a sense of control over their work lives, Horowitz tells Yahoo Finance in the video above. “Workers are saying ‘if I’m not going to have an employer that’s going to have loyalty to me and if I don’t have expenses that are so high, I can actually start to control my life by working freelance in these different ways,'” says Horowitz. It’s particularly popular among millennials, according to the survey which found that 38% of them are freelancing.

Yeah, right, not enough credit=debt is being created…

• When The Next Housing Bust Hits, Blame The Bankers (MarketWatch)

The U.S. economic recovery is being endangered by a slowing housing market, as prospective homeowners with lower incomes and credit scores are finding it nearly impossible to get a mortgage. Six years after the collapse of home prices, the mortgage-lending industry is going through an upheaval. Wells Fargo has the largest share of the mortgage market, but CEO John Stumpf in an interview with the Financial Times last week said his company would be unwilling to lend to lower-income borrowers and those with relatively low credit scores. That is, unless regulators made it more difficult for investors to force banks to repurchase securitized loans. “If you guys want to stick with this program of ‘putting back’ any time, any way, whatever, that’s fine, we’re just not going to make those loans and there’s going to be a whole bunch of Americans that are underserved in the mortgage market,” Stumpf said.

He was referring to loan-repurchase demands by Fannie Mae, Freddie Mac and private investors. J.P. Morgan CEO James Dimon, during a July conference call, said the bank’s volume of loans insured by the Federal Housing Administration was “way down,” and that the bank had “lost a tremendous sum of money on the FHA,” which had disputed roughly a third of all insurance claims. “We want to help the consumers there, but we can’t do it at great risk to J.P. Morgan, so until they come up with some kind of safe harbors or something, we’re going to be very, very cautious in that line of business,” Dimon said. Even Federal Reserve Chairwoman Janet Yellen said in June: “It is difficult for any homeowner who doesn’t have pristine credit these days to get a mortgage,” which was one of the causes of the limp housing recovery.

Big report by Glenn Greenwald.

• The US Government’s Secret Plans To Spy For American Corporations (Greenwald)

Throughout the last year, the U.S. government has repeatedly insisted that it does not engage in economic and industrial espionage, in an effort to distinguish its own spying from China’s infiltrations of Google, Nortel, and other corporate targets. So critical is this denial to the U.S. government that last August, an NSA spokesperson emailed The Washington Post to say (emphasis in original): “The department does ***not*** engage in economic espionage in any domain, including cyber.” After that categorical statement to the Post, the NSA was caught spying on plainly financial targets such as the Brazilian oil giant Petrobras; economic summits; international credit card and banking systems; the EU antitrust commissioner investigating Google, Microsoft, and Intel; and the International Monetary Fund and World Bank. In response, the U.S. modified its denial to acknowledge that it does engage in economic spying, but unlike China, the spying is never done to benefit American corporations.

Director of National Intelligence James Clapper, for instance, responded to the Petrobras revelations by claiming: “It is not a secret that the Intelligence Community collects information about economic and financial matters…. What we do not do, as we have said many times, is use our foreign intelligence capabilities to steal the trade secrets of foreign companies on behalf of—or give intelligence we collect to—U.S. companies to enhance their international competitiveness or increase their bottom line.”

But a secret 2009 report issued by Clapper’s own office explicitly contemplates doing exactly that. The document, the 2009 Quadrennial Intelligence Community Review—provided by NSA whistleblower Edward Snowden—is a fascinating window into the mindset of America’s spies as they identify future threats to the U.S. and lay out the actions the U.S. intelligence community should take in response. It anticipates a series of potential scenarios the U.S. may face in 2025, from a “China/Russia/India/Iran centered bloc [that] challenges U.S. supremacy” to a world in which “identity-based groups supplant nation-states,” and games out how the U.S. intelligence community should operate in those alternative futures—the idea being to assess “the most challenging issues [the U.S.] could face beyond the standard planning cycle.”

One of the principal threats raised in the report is a scenario “in which the United States’ technological and innovative edge slips”— in particular, “that the technological capacity of foreign multinational corporations could outstrip that of U.S. corporations.” Such a development, the report says “could put the United States at a growing—and potentially permanent—disadvantage in crucial areas such as energy, nanotechnology, medicine, and information technology.” How could U.S. intelligence agencies solve that problem? The report recommends “a multi-pronged, systematic effort to gather open source and proprietary information through overt means, clandestine penetration (through physical and cyber means), and counterintelligence” (emphasis added). In particular, the DNI’s report envisions “cyber operations” to penetrate “covert centers of innovation” such as R&D facilities.

The fight that keeps on taking.

• Argentina Senate Passes Debt Swap Plan In Defiance Of US Courts (Reuters)

Argentina’s Senate on Thursday passed a bill aimed at circumventing U.S. court decisions regarding its defaulted debt by changing payment jurisdiction, sending the proposal to the lower house Chamber of Deputies for final approval. The chamber, like the Senate, is controlled by government allies who are expected to vote the bill into law. Debate in the lower chamber is set to start next week. The Senate vote approving the measure was 39 to 27. President Cristina Fernandez wants to resume servicing sovereign bonds that were restructured after Argentina’s previous default in 2002. Her government missed a coupon payment on its restructured bonds in July, thrusting the South American country into default.

The proposed law, which says that foreign debt can be paid through intermediaries outside the United States, is Fernandez’s attempt at getting back on a paying basis by putting government debt out of reach of U.S. courts that have jurisdiction over some of the original bond contracts. The bill would replace Bank of New York Mellon with state-controlled bank Banco Nacion as the trustee for bond payments. It would also allow holders of restructured bonds governed by foreign law to swap them for paper governed by Argentine law. Both moves would be in violation of U.S. court orders. [..] “Sometimes there are court decisions that cannot be followed,” said Miguel Angel Pichetto, head of the government’s Frente para la Victoria coalition in the Senate. “To pay the vulture funds would be very dangerous.” The bill is expected to become law before Sept. 30, when the next payment on Argentina’s restructured bonds is due.

• Italy Economy In ‘Acute Emergency’: Ex-PM Monti (CNBC)

Italy is still embroiled in a financial crisis—but one that is insufficiently severe to convince the public that reforms are urgently needed, the country’s former prime minister told CNBC on Friday. “The acute emergency that we now have in the real economy, and in the employment situation, is there. It bites deeply into society,” Mario Monti, the economist who led an Italian technocrat government between 2011 and 2013, told CNBC from the annual economic Ambrosetti Forum in Italy. “But of course, it is not so visible as an emergency that brings the whole of public opinion to rally around a tough political project to introduce the structural reforms that are needed to slowly go out of that crisis.”

The Italian economy is seen shrinking again this year, after contracting 0.2% in the second-quarter. Unemployment remains above both the euro zone and the Europe-wide average, hitting 12.6% in July. The country needs to create 2.5 million new jobs to meet the European Union target of 75% employment by 2020, according to Ambrosetti economists. Despite this, both Monti and his successor Matteo Renzi have struggled to free up Italy’s high restrictive labor market. Firms currently lack flexibility in hiring and firing and are inhibited by the practice of nationwide collective bargaining.

Limits to Growth has always been right. Other than in little details, but it was never about details.

• Limits to Growth Was Right. New Models Show We’re Nearing Collapse (Guardian)

The 1972 book Limits to Growth, which predicted our civilisation would probably collapse some time this century, has been criticised as doomsday fantasy since it was published. Back in 2002, self-styled environmental expert Bjorn Lomborg consigned it to the “dustbin of history”. It doesn’t belong there. Research from the University of Melbourne has found the book’s forecasts are accurate, 40 years on. If we continue to track in line with the book’s scenario, expect the early stages of global collapse to start appearing soon. Limits to Growth was commissioned by a think tank called the Club of Rome. Researchers working out of the Massachusetts Institute of Technology, including husband-and-wife team Donella and Dennis Meadows, built a computer model to track the world’s economy and environment. Called World3, this computer model was cutting edge. The task was very ambitious. The team tracked industrialisation, population, food, use of resources, and pollution.

They modelled data up to 1970, then developed a range of scenarios out to 2100, depending on whether humanity took serious action on environmental and resource issues. If that didn’t happen, the model predicted “overshoot and collapse” – in the economy, environment and population – before 2070. This was called the “business-as-usual” scenario. The book’s central point, much criticised since, is that “the earth is finite” and the quest for unlimited growth in population, material goods etc would eventually lead to a crash. So were they right? We decided to check in with those scenarios after 40 years. Dr Graham Turner gathered data from the UN (its department of economic and social affairs, Unesco, the food and agriculture organisation, and the UN statistics yearbook). He also checked in with the US national oceanic and atmospheric administration, the BP statistical review, and elsewhere. That data was plotted alongside the Limits to Growth scenarios.

Not going to happen. They don’t have anywhere near enough control.

• UN Aims To Stop Ebola Transmission In Six To Nine Months (Reuters)

The United Nations plans to set up an Ebola crisis center to coordinate the response to the deadly virus and to strive to halt its spread in West African countries in six to nine months, U.N. Secretary-General Ban Ki-moon announced on Friday. Ban called on the international community to provide $600 million needed for supplies in West Africa, where more than 3,500 confirmed or probable cases of the hemorrhagic fever have been reported and more than 1,900 people have died since March. “The number of cases is rising exponentially. The disease is spreading far faster than the response. People are increasingly frustrated that it is not being controlled,” Ban told reporters.

“The goal is to stop Ebola transmission in affected countries within six to nine months, and to prevent the international spread of the virus,” he said. “This can be done only if the urgent and necessary mobilization is done both in the affected countries and by the international community.” Countries affected by the epidemic include Guinea, Liberia, Nigeria, Senegal and Sierra Leone. An outbreak in the Democratic Republic of Congo is unrelated to and independent of the West African epidemic, the World Health Organization has said. It is the worst outbreak since the virus was discovered in 1976 near the Ebola River in what is now Democratic Republic of Congo. The WHO has said casualty figures may be up to four times higher than reported, and that up to 20,000 people may be affected before the outbreak ends.

Home › Forums › Debt Rattle Sep 6 2014: ‘We’ Don’t Want The Ceasefire To Hold