Henri Matisse Still Life with Apples on Pink Cloth 1925

— Elon Musk (@elonmusk) March 23, 2025

Modi -highly recommend-

Such a powerful interview of PM Modi. It gives you amazing insights into how President Trump is viewed by world leaders. pic.twitter.com/BNnLkvjzEh

— Michelle Maxwell (@MichelleMaxwell) March 23, 2025

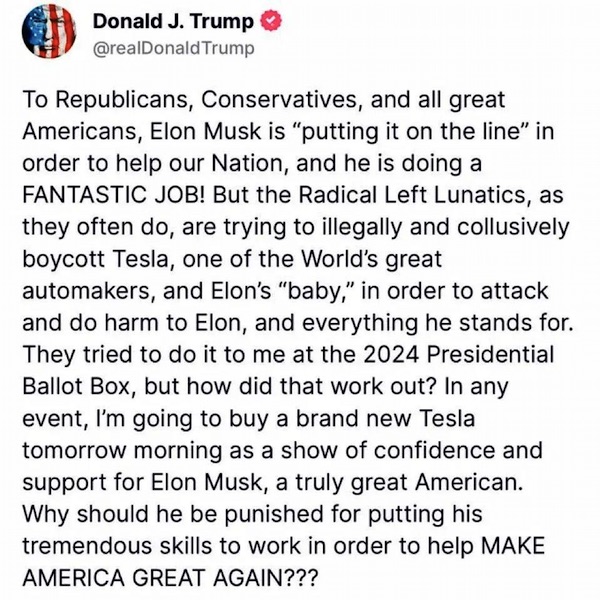

Elon

https://twitter.com/Girlpatriot1974/status/1903543762783277072

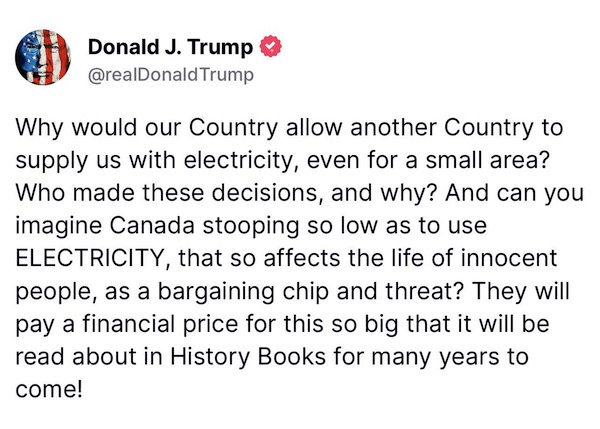

Lutnick

Reporter: Investors are on edge over the possibility of a recession after the Atlanta Fed predicted a 2.4% contraction this quarter

Lutnick: What? Say that again? 2.4% contraction?! Right here right now — that is ridiculous.

Reporter: Have you spoken to the Atlanta Fed… pic.twitter.com/zfINRTjI6z

— unusual_whales (@unusual_whales) March 22, 2025

Rescission

Sen. Rand Paul Says He Pitched to Elon Musk a Plan to Claw Back $500 Billion in Federal Spending

“It's called rescission. I did mention this to @elonmusk. He seemed enthusiastic. It can be done. No Democrats will cut one penny from any spending anywhere. But can we get all the… pic.twitter.com/GU7AmWvvW6

— Chief Nerd (@TheChiefNerd) March 23, 2025

“He dragged us into court on a Saturday without any notice. And then he’s continuing these hearings. He’s trying to ask us about national security information, which he is absolutely not entitled to.”

• Pam Bondi Destroys Judge Boasberg for Meddling in Immigration Policy (Margolis)

U.S. Attorney General Pam Bondi unleashed a scathing attack on U.S. District Court Judge James Boasberg during a Sunday morning interview on Fox News, accusing him of overstepping his authority and attempting to control U.S. foreign policy from the bench. “This is an out-of-control judge, a federal judge trying to control our entire foreign policy, and he cannot do it,” Bondi told host Maria Bartiromo. “He dragged us into court on a Saturday without any notice. And then he’s continuing these hearings. He’s trying to ask us about national security information, which he is absolutely not entitled to.” The case revolves around the Obama-appointed judge’s attempt to block the Trump administration’s deportation of illegal alien Tren de Aragua gang members, an effort Bondi made clear would not stand.

“We are appealing. We will be in court Monday. Again. We will win. We will prevail,” she stated, showing no hesitation in taking the fight back to court. Boasberg previously ordered a deportation flight for these illegal alien gang members to turn around back to the United States; however, since the ruling was made while the plane was over international waters, he had no jurisdiction, and the deportations continued as planned. According to New York Post columnist Miranda Devine, Boasberg has been “demanding DOJ lawyers provide minute details of the flights—potentially to hold members of the administration in contempt and serve as the basis for a future impeachment of Trump.” Bondi highlighted the administration’s success in swiftly deporting dangerous criminals, arguing that their efforts are already making the country safer.

“There are 261 reasons why Americans are safer today. And that’s because those people are now in an El Salvador prison,” she explained. “We are going to follow the law and we are going to protect Americans.” Slamming the left’s failed border policies, Bondi noted the overwhelming public dissatisfaction with the Biden administration’s handling of immigration, which led to President Trump’s decisive victory in 2024. “There’s a reason why Biden’s approval rating was plummeting because of the border. There is a reason why the current Democrats’ approval rating is at 29%,” she said. She made it clear that the Trump administration’s approach is rooted in basic public safety—something the American people overwhelmingly support. “People want to be safe. This is President Trump’s agenda to keep Americans safe,” she said. “It’s basic public safety. Get these people out of our country as fast as we can.”

Bondi also rejected the left’s attempts to blur the distinction between legal immigration and illegal entry by dangerous criminals. “They’re not immigrants. They’re illegal aliens who are committing the most violent crimes you can imagine on Americans—murder, rapes,” she said. “Ask the parents of all of these young women who have been violently strangled, raped, and murdered.” The Biden administration’s lax immigration policies fueled a surge in crime, making border security a top issue in the 2024 election. Under Trump, Bondi emphasized, those days are over. “We are going to continue to make America safe again because that’s President Trump’s agenda,” she declared.

Despite judicial activism from the left, Bondi reaffirmed the administration’s commitment to upholding immigration laws, deporting violent criminals, and keeping Americans safe. “We are going to follow the law, and we are going to protect Americans,” she reiterated. With the Trump administration refusing to back down and the American people firmly behind stronger border enforcement, it’s clear that Bondi and the White House will not allow activist judges like Boasberg to undermine national security.

1000%

pic.twitter.com/2SQHsWDjMT— Elon Musk (@elonmusk) March 23, 2025

.@AGPamBondi on Judge Boasberg: "This is an out-of-control judge… trying to control our entire foreign policy, and he cannot do it… There are 261 reasons why Americans are safer today, and that's because those people are now in an El Salvador prison… we are going to follow… pic.twitter.com/yWj5pBvxvD

— Rapid Response 47 (@RapidResponse47) March 23, 2025

Schlichter gets it exactly right. Roberts wants things to go “as they should”. Where a court case slowly winds its way up the chain. But there is no time left for that. Moreover, he and the SCOTUS judges also know that Schumer boasts he has 235 judges in his pocket. If they don’t deal with this, soon, Trump will simply ignore them like he ignored Boasberg. Basically, is foreign policy set by the administration or by a dictrict judge?

• The Agony of John Roberts (Kurt Schlichter)

Pity poor John Roberts. No, he’s not corrupt or compromised. He is simply a man who has found himself at a pivotal time and place in a position of great responsibility for which he is utterly unsuited. He’s not a dumb man. He is, in fact, a very smart man – Hugh Hewitt knew him personally in the Reagan administration and testifies to that. I have no doubt it’s true. I know many smart people who have similar flaws. As objectively intelligent as John Roberts is, he is unwise, and he is endangering the institution he wants to preserve because he does not understand human nature or the times he finds himself in. Frankly, I’ll take wisdom over raw intellect any day of the week.

If he had the capacity to lead that he so manifestly lacks, John Roberts could save his institution with decisive and bold action. But that’s not who he is. Understand what John Roberts wants. He is an institutionalist who has always wanted to protect the judiciary branch. He wants it to be a fully co-equal branch that is respected by all. But the very actions he has chosen to take – or not to take – in response to the current crisis of out-of-control subordinate courts are guaranteeing that it will fall. Article III of our Constitution provides for the judicial branch, but it does not expressly provide the judiciary with any powers other than those it earns in the eyes of the other two branches. It cannot self-enforce its decrees.

Article I creates the Congress, and the legislative branch has both the power of the purse and the power to impeach to check the judiciary. Article II establishes the presidency, but the Constitution does not specify its checks and balances over the court. That power is implied, and the implied power is for the executive – who runs the machinery of the federal government, including the cogs and gears that carry guns – to simply say “No” to an out-of-control judiciary. This implied power of defiance is as much a check and balance as any enumerated one, and without it, you would have an unchecked judiciary with hundreds of district court judges presuming to micromanage the legitimate actions of the executive branch. You know, kind of like what’s happening now.

Judge Roberts’s problem is that he wants to return to something like regular order in the judiciary. What we have is highly irregular order. You non-lawyers need to understand that all these temporary restraining orders and injunctions and so forth are insane. This is not how law is done, either procedurally or substantively. I did litigation for 30 years, including in federal courts (up to arguing in front of the Ninth Circuit), and never saw anything remotely like these antics. So, realize that this is abnormal. Abnormal times call for abnormal responses, but that’s not how John Roberts or his ilk work. Remember, he’s a Bushie, the kind of soft Republican who sees his job less as fixing our broken government than managing its gentlemanly decline. We’ve largely booted them out of elective office, but Roberts has his seat for life. His advocation is protecting his institution. He wants the judiciary to be held in respect and obeyed, but he doesn’t want to do the hard, stern work of disciplining his underlings that makes that possible.

John Roberts wants the normal appellate procedures to apply. He’s hoping that if he shuts his eyes and pretends that everything is normal, he’ll open them and it will all be normal again. This was the main takeaway from his unbelievably tone-deaf response to Trump’s, Musk’s, and others’ frustration-driven talk about impeachment. Now, Roberts was right in theory about what he said, but what we’re facing is not theory but practice. Put aside the practical reality that we’re not going to be able to impeach anybody, and don’t fall for the Internet amateur ambulance chasers who think there’s one neat trick where we can somehow get rid of judges by a majority vote because of “bad behavior.” That is a reason to get rid of them, not a means. The means is impeachment, and that takes 67 senators. That’s never going to happen so we should stop talking about it. They would wear a failed impeachment like Tim Walz would have worn his war medals if he had shown up to earn any. Haven’t we learned not to engage in failure theater?

In normal times, the response to a judge over one dumb decision is the appellate process. But these are not normal times. These are not one dumb decision. These are dozens of dumb decisions. And the answer here is not the appellate process because the appellate process is long, drawn out, and deliberate. The goal of this campaign is to use that delay to effectively strip Donald Trump of the ability to govern. To that end, they have sought to wrap him up in a web of orders and injunctions that will prevent him from doing the things he was elected to do. If it was one case or ten cases, you could wait months and months for the appellate process to grind through. Eventually, Trump administration will win most of these cases through the appellate process because they’re procedurally and substantively ridiculous.

But the purpose of these judicial antics is not to fulfill the letter of the law, but to create friction that improperly prevents political actions that the executive has the right to take. In other words, Donald Trump may live in the White House, but he can’t actually be President, thereby disenfranchising the people who elected him. So, we have a system that is not being used normally and that is not being used for a normal purpose. But Chief Justice Roberts, in his lack of wisdom, refuses to see that abnormal actions sometimes require abnormal responses. As I have said before, he will never be able to normal the abnormal back to normality. He thinks he can force normality back onto the judiciary by simply pretending the abnormality doesn’t exist and that everything is hunky-dory. He can’t. He must force normality back on the judiciary by addressing the abnormality directly.

That means he has to take abnormal actions in response. Procedurally, he needs to lead the charge to stop the imposition and use of these bizarre nationwide orders and injunctions by giving the circuit courts of appeal clear guidance to end this nonsense. Substantively, he needs to direct the circuit courts to issue stays on district court orders that far exceed the scope of the judiciary’s proper powers. And if the circuit courts of appeal refuse to do that, then the Supreme Court needs to issue the orders to enforce its will, even if that means issuing dozens and dozens of orders. The Supreme Court only takes 50 or so cases a year. With over 100 lawsuits against the Trump administration as part of this lawfare campaign, that workload no longer works.

What John Roberts is risking by refusing to put an end to these abuses is the Trump administration putting an end to these abuses by exercising its implied power under the Constitution to check an out-of-control judiciary. If an order issues and no one enforces it, is it really an order?

“Accountability is especially important when misconduct by lawyers and law firms threatens our national security, homeland security, public safety, or election integrity.”

• Trump Goes Nuclear Against Activist Lawyers Undermining His Presidency (Margolis)

The radical Left’s latest scheme to derail President Trump’s America First agenda has reached a fever pitch, with over 100 frivolous lawsuits filed against his administration since January. But Trump isn’t taking their lawfare lying down. In a bold move that should have Democrats and their army of activist attorneys panicking, Trump directed Attorney General Pam Bondi to investigate anti-Trump lawyers and law firms attempting to hamstring his presidency through baseless litigation. The timing couldn’t be more critical, with an unprecedented 15 injunctions slapped against presidential actions just last month—far more than Obama or Biden ever faced. The Left’s desperation is palpable. After losing the Oval Office, the House, and the Senate in November, they’re resorting to their favorite tactic: shopping for activist judges to block crucial executive actions.

We’ve seen this circus play out with injunctions against Trump’s birthright citizenship executive order and his use of wartime powers to deport Venezuelan gang members terrorizing American communities. “Lawyers and law firms that engage in actions that violate the laws of the United States or rules governing attorney conduct must be efficiently and effectively held accountable,” Trump declared in a memorandum released Saturday. “Accountability is especially important when misconduct by lawyers and law firms threatens our national security, homeland security, public safety, or election integrity.” Trump also named names. Recent examples of grossly unethical misconduct are far too common. For instance, in 2016, Marc Elias, founder and chair of Elias Law Group LLP, was deeply involved in the creation of a false “dossier” by a foreign national designed to provide a fraudulent basis for Federal law enforcement to investigate a Presidential candidate in order to alter the outcome of the Presidential election. Elias also intentionally sought to conceal the role of his client — failed Presidential candidate Hillary Clinton — in the dossier.

Many immigration lawyers, including those from major law firms, are undermining Trump’s power to enforce our nation’s immigration laws. The memorandum notes that these activist lawyers actively coach clients to lie or hide their past to manipulate the asylum process, bypass national security measures, and deceive immigration authorities. The federal government faces a heavy burden in combating this widespread fraud, which not only erodes the rule of law but also fuels mass illegal immigration—leading to tragic crimes against innocent Americans and straining taxpayer-funded resources meant for citizens. Now, Attorney General Bondi has been specifically tasked with recommending additional countermeasures against these frivolous lawsuits, which the administration correctly views as a violation of separation of powers.

“I further direct the Attorney General and the Secretary of Homeland Security to prioritize enforcement of their respective regulations governing attorney conduct and discipline,” Trump wrote. “I further direct the Attorney General to take all appropriate action to refer for disciplinary action any attorney whose conduct in Federal court or before any component of the Federal Government appears to violate professional conduct rules, including rules governing meritorious claims and contentions, and particularly in cases that implicate national security, homeland security, public safety, or election integrity.”

Trump also directed the attorney general to hold law firms accountable for ethical misconduct, including making senior partners responsible for junior attorneys’ unethical actions when appropriate. If an attorney or firm engaged in litigation against the federal government is found to warrant sanctions or disciplinary action, the attorney general must recommend further steps to the president, such as revoking security clearances or terminating federal contracts. Additionally, the attorney general is ordered to review attorney conduct in cases against the government over the past eight years and, if misconduct is found—such as frivolous lawsuits or fraud—to propose further action, including contract termination or other penalties. It’s about time someone stood up to these legal mercenaries who abuse our court system.

Good talker – and thinker.

• “The Most Intuitive Man Who Ever Lived” (CTH)

Commerce Secretary Howard Lutnick appears for an extensive discussion with the All In podcast. Secretary Lutnick has been a 30-year friend of President Trump and is currently one of the most critical members of the MAGAnomic team who are executing Trump’s agenda to Make America Great Again. Secretary Lutnick outlines the background of what makes President Trump so effective in his position, and within the discussion Lutnick notes at the core of Donald Trump is “the most intuitive person he has ever known.” This is a casual discussion about President Trump and how Lutnick came into the administration.

“The government rules by martial law, has failed in its key policies, is reportedly highly corrupt, and lacks public support.”

• Zelensky Regime Likely to Collapse Soon – Jeffrey Sachs (Sp.)

The government of the Ukraine’s Volodymyr Zelensky will probably be replaced soon as it does not have enough public support and is corrupt, renowned American economist and Columbia University professor Jeffrey Sachs told RIA Novosti. “The Zelenskyy government will likely be out of power sometime soon. The government rules by martial law, has failed in its key policies, is reportedly highly corrupt, and lacks public support. These conditions suggest the likelihood of political change,” Sachs said when asked how did he view the future of Zelensky. The professor noted that his viewpoint was “strongly against regime-change operations” and that the UN doctrine of non-intervention in internal affairs should prevail.

Earlier in March, media reported that senior allies of US President Donald Trump have held talks with possible opponents of Volodymyr Zelensky to assess whether Ukraine could hold a quick presidential election. In February, Trump criticized Zelensky for his unwillingness to hold elections, called him a “dictator,” and also suggested that the Ukrainian leader wanted to keep the “gravy train” going amid the grinding conflict with Russia. Trump also said that Zelensky talked the US into spending $350 billion “to go into a war that couldn’t be won.” Zelensky’s presidential term expired on May 20, 2024. The presidential election in Ukraine was canceled due to martial law and general mobilization

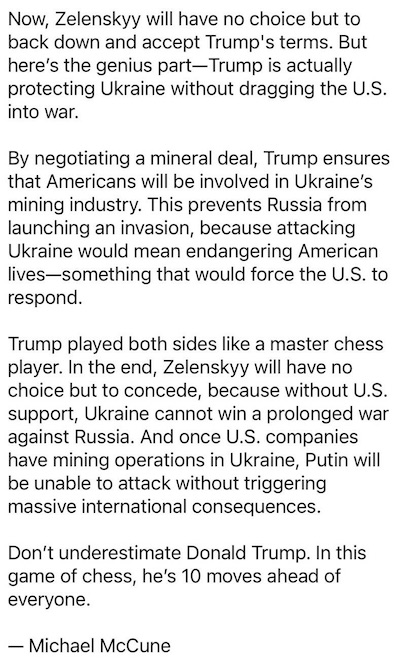

4 weeks.

• US Sets Easter Target For Ukraine Ceasefire Deal (RT)

Washington is still hoping to broker a ceasefire in the Ukraine conflict by Easter, Bloomberg wrote on Sunday, citing sources. US President Donald Trump has vowed to bring a swift end to the hostilities in Ukraine, and has moved to restart diplomatic relations with Russia, which were frozen during the term of his predecessor, Joe Biden. Russian and US delegations are set to meet in Riyadh on Monday for the second round of high-level talks since the apparent thaw. Following Tuesday’s phone conversation between Trump and Russian President Vladimir Putin, Moscow agreed to a mutual temporary halt on strikes against energy infrastructure, which it says Kiev immediately violated.

The White House aims to have Russia and Ukraine agree to a full ceasefire by Easter Sunday – April 20 – but realizes that the timeline could be delayed due to significant differences between the sides, Bloomberg wrote, citing anonymous sources familiar with the discussions. Prior to talks with Trump’s special envoy, Steve Witkoff, in Moscow last week, Putin stated that while he is open to a 30-day ceasefire, all military supplies to Kiev as well as the Ukrainian draft campaign need to stop to avoid strengthening Ukraine during the pause. Washington, which briefly stopped intelligence sharing and military aid to Kiev earlier this month, has not agreed to any of the demands, US officials told Bloomberg. According to the newspaper’s US sources, Trump wants any potential deal to be acceptable to Kiev, and isn’t prepared to concede too much.

Despite agreeing to the terms of the US-brokered partial truce, Ukraine struck an oil depot in southern Russia the day after the agreement, and blew up a gas metering station in Russia’s Kursk Region on Friday. The violations show that Ukraine’s Vladimir Zelensky is not trustworthy, Kremlin spokesman Dmitry Peskov said in an interview on Sunday. “The Kiev regime’s words and Zelensky’s word are not worth much,” he said. Ukrainian claims that Russia shelled its own gas metering station in Sudzha are “absurd,” he added. Earlier this week, Putin stressed that Russia needs to hear a concrete plan on how a full ceasefire would be enforced and regulated before Moscow agrees.

“I don’t think there’s anybody in the world that [is] going to stop [Putin], except me, and I think I’m going to be able to stop him..”

• Trump Hails ‘Rational’ Putin Conversations (RT)

US President Donald Trump has praised his work relationship with his Russian counterpart Vladimir Putin, describing their conversations as “very rational” and reiterating a desire to end the Ukraine conflict. In an interview aboard Air Force One with the outlet OutKick on Saturday, Trump reflected on his history with Putin and the Ukraine conflict, describing himself as the only person capable of “stopping” the Russian leader. “I don’t think there’s anybody in the world that [is] going to stop [Putin], except me, and I think I’m going to be able to stop him”, he said. “We’ve had some very rational discussions, and I just want to see the people stop getting killed.”

He warned that failure to mediate the conflict could lead to World War III, but noted that “it’s somewhat under control.” “I have a good relationship with President Putin and, actually, a good relationship with President Zelensky too. It’d be a great thing to be able to stop it. And I will say this, nobody else would have been able to.” After his inauguration, Trump actively sought to restore relations with Russia, which were at an all-time low, and to mediate a settlement of the Ukraine conflict. The Russian and US leaders have held at least two phone calls on the matter, while delegations from the two countries have held several rounds of direct talks. During the last phone conversation on Tuesday, which lasted two and a half hours, Putin and Trump discussed the US president’s idea of a 30-day ceasefire.

Putin generally spoke favorably of the initiative but mentioned several major obstacles, including the need to establish a monitoring mechanism and prevent forced mobilization and rearmament in Ukraine during the ceasefire. At the same time, Putin supported the idea of Moscow and Kiev halting strikes on each other’s energy infrastructure facilities for 30 days. Following the talks, Steve Witkoff, Trump’s special envoy to the Middle East, suggested that a complete ceasefire in the conflict could be implemented within “a couple of weeks.” He later noted that Kiev had seemingly agreed to stay out of NATO – one of Moscow’s key demands – adding that the key item on the agenda was now the fate of Crimea and the four other former Ukrainian territories that voted to become part of Russia.

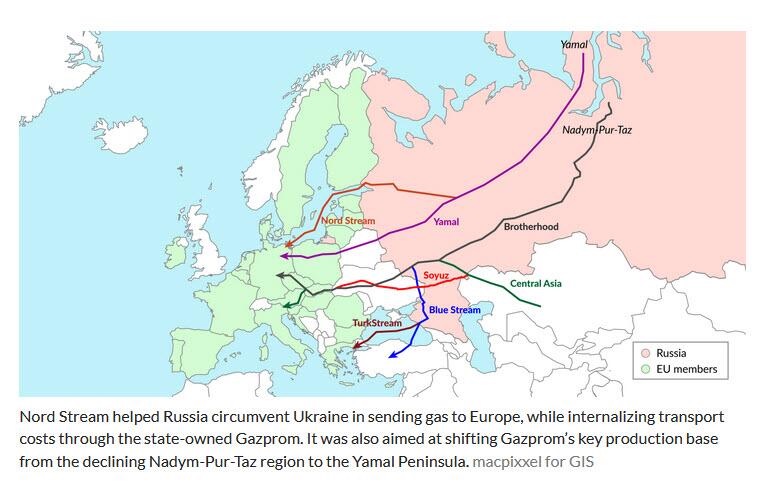

The Black Sea becomes more important.

• Waltz Reveals Topics Of Russia-US Talks in Riyadh (RT)

A Black Sea maritime truce will be one of the top issues on the agenda of the upcoming US-Russia meeting in Riyadh, US National Security Adviser Mike Waltz told CBS on Sunday. If reached, the ceasefire deal would allow both Moscow and Kiev to “move grain, fuel, and start conducting trade” in the sea again, according to the official.Waltz hailed the US-mediated peace efforts, saying: “we’re closer to peace than we ever have been.” His comments come ahead of a new round of negotiations between Russian and US officials scheduled for Monday.

He described the upcoming event as “proximity talks.” Apart from the Black Sea ceasefire, the sides are also expected to explore options for a wider truce, according to the national security adviser. “We’ll talk the line of control… details of verification mechanisms, peace keeping, you know, freezing the lines where they are.” The issue of a “broader and permanent peace” and “security guarantees” for Kiev will also be on the table, Waltz added. On Wednesday, Waltz said he had a phone call with Russian President Vladimir Putin’s foreign policy aide, Yury Ushakov, in which they discussed the details of the upcoming meeting.

Ushakov confirmed that “a conversation did take place,” and said the meeting, which is scheduled to take place in the Saudi capital, Riyadh, will focus on the “safety of navigation in the Black Sea.” The issue of a maritime ceasefire was raised by US President Donald Trump during a phone call with Putin on Tuesday. The Russian president supported the idea and agreed to initiate talks on the details of a potential arrangement.

Includes a great story about human trust,

• Trump Is The First Leader Who Is Looking To Rebuild Trust With Putin (Proud)

Western politicians and journalists constantly tell us that President Putin cannot be trusted, and that, under no circumstances should anyone strike a deal with him. But in response to that rhetorical question, I always ask, ‘do you think that he trusts us?’ Trust is a two way thing and it must be built on small gestures and mutual respect. And it is so much more complicated building trust with people of different cultures, languages and worldviews etc. Right back in 2014, a colleague and friend in the Russian Presidential Administration told me that it would take at least a decade to rebuild the trust lost over the Maidan and Yanukovych’s ouster. It will take much longer now, after three years of devastating war. Zelensky, European politicians and the mainstream media scream at us constantly that Putin can’t be trusted. They claim, with no basis in evidence, that Putin has broken 25 (pick any number that you like) ceasefires in Ukraine since 2014.

Yet I wonder when we’ve really trusted Putin to stick to a deal and trusted in ourselves to hold to our end of the bargain? One thing’s for sure; everyone in the Russian state apparatus would say that western leaders have broken every promise that they made in the past, including on NATO expansion, and have acted in shockingly bad faith in other ways, including in orchestrating a coup in Kyiv and in setting up the Minsk 2 agreement to fail. The problem with refusing to talk to President Putin since the war started, and minimising all diplomatic contact with Russia since 2014, is that you reduce opportunities to rebuild trust to almost nought. How do you trust someone you dislike and then refuse ever to talk to again? It’s like schoolkids falling out epically, with 6000 nuclear missiles thrown into the mix. You focus obsessively on owning the media narrative of ‘I’m right and you’re wrong’, as if you are a ten year old using X for the first time in the playground.

You tell all your closest friends and family members about how awful the other person is, and they nod and say, ‘oh, I know’ like Sybil Fawlty. I don’t believe for a minute that Russia can’t ever be trusted or that decision makers in the west are purer than the driven snow. Trust is about making a deal and sticking to it. I often recall taking my family on holiday to Dubai to escape the Moscow winter in early 2015. With the kids still very young, we loaded up the minibus taxi with luggage, pushchairs and car seats etc. and made our way to Sheremetyevo through the morning snow. At the airport, I discovered that I only had a 5000 rouble note for the 2500 rouble fare and the driver, having unloaded our stuff, was clearly in a hurry to get back in his warm cab and drive home. He took one look at the crisp note and said he didn’t have change.

I had absolutely no intention of dashing into the terminal, finding somewhere to break the note, while navigating very young kids, luggage trolleys and a diminutive wife whose saintly patience would only stretch so far. So I looked at the cab driver and he looked at me, wondering how we’d break the deadlock. I could have tried not to pay, but that would have caused an argument and, in any case, that’s not the sort of move I’d ever pull anyway. I could have asked him to check whether, in fact, he did have change, being that he was a taxi driver. But then he may well have been offended, because he’d clearly told me that he didn’t have change, and why shouldn’t I believe him? In the end, I decided that, as it was before 7 in the morning, he probably didn’t have change, and that, as it was minus ten degrees outside on the frosty kerbside, I’d have to trust him. So I said, ‘look, take the 5000 rouble note. Our flight gets back on this date at this time, and if you can come and pick us up and we’ll be even.’

He nodded, shook my hand without much of a smile and disappeared. I had his phone number, but there was practically nothing I could have done had he simply disappeared and left us stranded at the airport upon our return two weeks later. So it was with a certain trepidation that we passed through the diplomatic lane at passport control and I wondered whether he’d be in arrivals. As it happens, he was, just as we’d agreed. I smiled at him, he offered a smile back, we loaded up the minibus, clicked the kids into their car seats, and headed back into the centre of Moscow. Trust is a two-way exchange. Now and then, you have to take a chance on trusting someone, when your instincts raise questions.

Zelensky clearly doesn’t trust Putin, but he also has no interest in peace, from my observation. When he made it illegal to talk to Putin or any Russian official, he was, in my opinion, investing in a continuance of the war, hoping the west would back him come what may. And despite the rapid shift in U.S. policy over the past two months, many decision makers in Europe still do want to back Zelensky come what may, which is a worrying thing.

But peace in Ukraine will only be possible once the grown-ups start talking again. Maybe that’s the difference that Donald Trump is bringing to the war; taking small steps through initial deals towards bridging the vast gulf in trust between Russia and the west and, eventually, ending the death and destruction.In one month, Donald Trump has spoken to Vladimir Putin for four hours, which is probably four times more time that Biden spent in engagement in the preceding four years. There are stark parallels with Reagan and Gorbachev in the Eighties, breaking down barriers to focus on the longer-term good. Right now, Trump and Putin are the only grown ups in the conversation. Let’s hope the small steps towards trust they are taking right now, develop into something lasting. The world needs it. Though I remain sceptical that European leaders are ready to follow Trump’s lead.

“Peskov also noted that the meeting between the two presidents must be carefully prepared and requires difficult technical negotiations first. “On Monday, our negotiators will travel to Riyadh to begin this difficult process,” Peskov said.”

• Putin and Trump Could Have Other Contacts Alongside With Official Ones (TASS)

Kremlin Spokesman Dmitry Peskov did not rule out that Russian and US Presidents Vladimir Putin and Donald Trump could have other contacts in recent months in addition to those officially announced. “We are informing you about the conversations that we know about, but we cannot rule out everything else,” Peskov said in an interview with VGTRK journalist Pavel Zarubin. The journalist noted that if you listen to Trump’s statements, you can conclude that there were more contacts between the presidents than was officially announced. Talking to the journalist Peskov also noted that the meeting between the two presidents must be carefully prepared and requires difficult technical negotiations first. “On Monday, our negotiators will travel to Riyadh to begin this difficult process,” Peskov said.

“This rampant militarist policy of Europe – there is no other way to describe it – is hard to comprehend..”

• Europe’s Policy On Ukraine Conflict ‘Paradoxical’ – Kremlin (RT)

The approach taken by European powers to the Ukraine conflict makes no sense because instead of seeking peace they have decided to engage in reckless militarization, Kremlin spokesman Dmitry Peskov has said. In an interview with Russia 1 TV journalist Pavel Zarubin on Sunday, Peskov also remarked that rather than addressing the root causes of the conflict, European powers “are talking about placing NATO contingents on Ukrainian territory”. “This rampant militarist policy of Europe – there is no other way to describe it – is hard to comprehend,” he added.

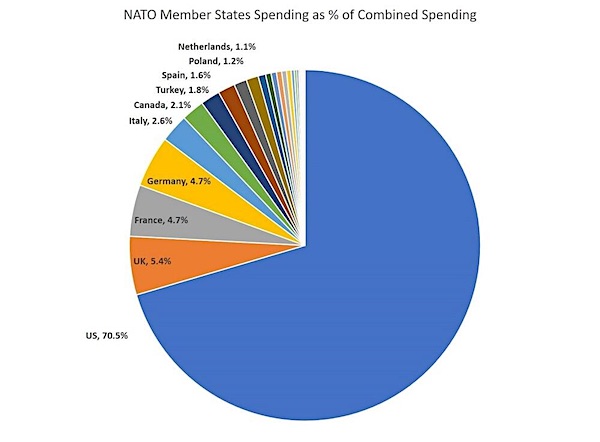

At the same time, the Kremlin spokesman acknowledged that the EU has found itself in a tight spot after the return to the White House of US President Donald Trump, who has repeatedly demanded that the bloc pay more for its own defense. “There’s a new sheriff in town… So they are forced to leave their comfort zone — and they’re doing it in an aggressive, militarist way. We hear [French President Emmanuel] Macron talking about a nuclear umbrella for Europe, and that also sounds very dangerous.”

Peskov’s comments come after the UK and France said they are open to sending Western peacekeepers to Ukraine once a ceasefire is reached. Moscow has rejected the idea, saying it does not matter under what disguise NATO troops arrive in the neighboring country. Earlier this month, Macron also signaled that France would discuss the possibility of using its nuclear arsenal to protect its allies in Europe, and urged the EU to ramp up military spending while labelling Russia a “threat.” Russian President Vladimir Putin has repeatedly dismissed speculation that Moscow could attack NATO as “nonsense,” arguing it has no interest whatsoever in doing so.

All based on the narrative that Putin plans to overrun Europe. For which there is zero evidence.

• EU Afraid Trump Will Cut Off Weapons Support – WaPo (RT)

Officials from EU member states are worried that the Trump administration could stop supporting US-made weapons systems used by its NATO allies in Europe, the Washington Post reported on Sunday, citing people familiar with the matter. The US has provided nearly two-thirds of Europe’s arms imports in recent years. Many of the systems are maintained and operated by American personnel. Equipment containing US components could also face restrictions if support is withdrawn. According to the Post, officials are afraid that reliance on American missile defense, surveillance aircraft, drones, and fighter jets could become a major vulnerability, given President Donald Trump’s strained relations with the EU. Some are reportedly concerned that US-made platforms could be rendered inoperable if access to parts, software, or data is blocked.

“It’s not as if President Trump could just push a button and all aircraft would fall from the sky,” an EU official told the Post. “But there is an issue of dependency,” particularly in intelligence and communications, the official added. Several member states are reviewing their arsenals to assess how exposed they would be in the event of a support cutoff. French President Emmanuel Macron recently urged the bloc to stop buying American weapons, arguing that European rearmament is pointless if member states remain dependent on US suppliers. German Chancellor-designate Friedrich Merz proposed extending France’s nuclear deterrent to cover its EU neighbors, a move that Macron said could be discussed.

Rasmus Jarlov, the chair of Denmark’s defense committee, said he regrets that Copenhagen purchased US-made F-35 fighter planes. He called them “a security risk that we cannot run,” and warned that the US could deactivate the systems if Denmark refuses its demands, such as handing over Greenland. Portugal has scrapped plans to purchase F-35s, citing the current “geopolitical context.” UK Prime Minister Keir Starmer has backed the push for military autonomy, saying Trump “may have a point” about Europe needing to spend more on its own defense.

There is a lot of blood thirst in Europe.

• The Führer of Germany – Friedrich Merz – In A War And Spending Frenzy (Hanseler)

After more than 80 years, Germany once again has a Führer who is in no way inferior to the old one in terms of mendacity and megalomania while spending sums that are unimaginable for most people. We do the math while our optimism withers.

Peter HanselerIntroduction

Yesterday I read the following lines on the Internet – unfortunately without an author’s reference: This has never happened before: a man who has not even been elected chancellor yet negotiates the biggest borrowing in the history of the Federal Republic of Germany with parties that lost the election, in a Bundestag that has long since been dissolved. If you had described Friedrich Merz’s current behavior to a German 10 years ago, you would have been declared insane and put in a clinic without raising a fuss. Friedrich Merz, who refuses to form a coalition with the AFD because he accuses them of right-wing extremism, is preparing Germany for war against Russia. The AFD wants peace with Russia, Russia seeks peace, the Americans want peace and Merz opposes all those who seek peace. This week the Handelsblatt reported that up to 1.7 trillion could be spent. This article will prove that this plan is madness, simply by putting this astronomical figure into perspective for regular people.How much is a trillion seconds? I maintain that very few people are able to categorize the size of this number. Let’s give it a try: How much time elapses in one million seconds? – Correct, 11.57 days. How much time elapses in a trillion seconds? – You will be wrong if you say a few years. It is exactly 31,709 years. That is indeed a long time ago. The earth was populated by sabre-toothed tigers and woolly mammoths, the last ice age took place. Rome was only founded a good 28,000 years afterwards. I assume that all readers are somewhat overwhelmed that a trillion is as much as it is. 1.7 trillion in money. Germany’s current debt at federal level. As at June 30, Germany’s federal debt amounted to 1.621 trillion – or 1,621 billion euros. This corresponds to a national debt to GDP ratio of 62.4%.

1.7 trillion is a hundred times more than all DAX companies together earned in 2023. Friedrich Merz will double this debt. This would lead to a debt ratio of 125% – which would put the country in the neighborhood of Greece (158%). The additional interest burden for the 1.7 trillion euros will amount to 47.6 billion euros per year if the current interest rate of the 10-year German government bond of 2.8% is used for the calculation. The cumulative profit of Volkswagen, Mercedes-Benz and BMW amounted to 29.2 billion euros in 2024. The German automotive giants would therefore not even be able to pay the interest on this madness if they were to send all their profits to Berlin. In 2024, Germany collected income taxes amounting to 181.95 billion euros at federal level. This means that for nearly 10 years, 100% of total income taxes would have to be spent on the repayment of 1,700 billion euros.

Conclusion Without even mentioning that Friedrich Merz’s actions are more than legally questionable, it is already clear from the figure of 1.7 trillion euros that he has lost his mind. This debt bonanza will drive the former world export champion and the former jewel of industry to the wall financially. For many years, the German political elite has been railing against Russia, the country to which it owed the cheap energy that allowed Germany to become the industrial jewel of the world in the first place. Russia forgave the Germans, who had 27 million Russians on their conscience; the Russians have not forgotten these atrocities, but the Germans, or rather the German leadership, have, because what the German people think, choose or want is once again a thing of the past in Germania. Germany then turned imperiously against China, the current industrial jewel that, unlike the Germans, has not slept through the major trends.

Last but not least, the German leadership is salivating against the US, the colonial master of the Germans, which has made a political U-turn and is now seeking peace with Russia. It is therefore by no means inappropriate to describe Friedrich Merz’s behavior as megalomania. Ms. Baerbock, who made Germany a laughing stock on the international stage during her time as foreign minister, is cuddling up to the new Syrian government, which is made up of terrorists. For about two weeks now, civilians have been slaughtered in Syria, women and children have had their heads cut off, obviously a necessity on the road to democracy. Ms. Baerbock seems to agree with this. Incidentally, I do not recommend our readers to watch videos of these goings-on, thousands of which are posted on social media; they are nightmares that will deprive you of sleep.

Ms. Baerbock is transferring 300 million euros to these very gentlemen. Ms. Baerbock, who will soon no longer have a job, seems to have special talents. She is to become the new President of the UN General Assembly. As a geopolitical analyst, you should always remain an optimist at heart, otherwise you will burn out completely. However, I find it increasingly difficult to carry a spark of hope for Germany: legally, geopolitically, in terms of freedom and emotionally.

“There is one way to achieve this: if we get Europe to support the president of the United States in his peace efforts, instead of embarking on war adventures, and then there will be peace.”

• Hungary’s Orban Continues Blocking EU’s ‘Pro-War’ Stance On Ukraine (ZH)

Hungary continued this past week being a lone EU voice blocking the European Union’s collective efforts to ramp up more financial and military aid to Ukraine, at a moment Prime Minister Viktor Orbán has a powerful backer in Washington – the Trump administration. Hungary in a Thursday European Council summit vote refused to endorse a statement reaffirming the bloc’s commitment to Ukraine’s sovereignty and territorial integrity. The Orbán government slammed the ‘pro-war’ stance of the EU, despite 26 out of 27 EU nations signing off on it. While the statement had only largely symbolic significance, saying Europe backs the “continued and unwavering support for Ukraine’s independence, sovereignty and territorial integrity” – Orban described that this only prolongs the war and brings the conflict no closer to peaceful resolution.

“Once again, they wanted to adopt a common position in which we want to give Ukraine even more money and even more weapons, and we are committed to the war,” the Hungarian leader explained after the veto. “Over the past three years, Hungarian families have lost around 2.5 million forints (approximately €6,268) per household as a result of the war. I must stop this, and we must not allow Hungarian families to continue to pay the economic consequences,” Orbán stated. He urged European capitals to get in Trump’s corner, who is seeking a diplomatic solution. But here’s how The Associated Press and other outlets characterized Hungary’s stubborn refusal to go along with Brussels:

“At the same time, Orbán is also emboldened by U.S. President Donald Trump, who is pushing for a ceasefire in Ukraine. Trump has blamed Ukraine for Russia’s unprovoked invasion, all while accusing Kyiv of unnecessarily prolonging the biggest land war in Europe since World War II.” Orban described further in an interview with regional media… “There is one way to achieve this: if we get Europe to support the president of the United States in his peace efforts, instead of embarking on war adventures, and then there will be peace. This debate took place, but we were unable to convince each other.” He continued, “I vetoed the common position, and therefore the European Union has no common position. What will be made public here today is nothing more than the private position of 26 member states, not the common position of the European Union, because without Hungary such a position cannot be accepted.”

“The president of Ukraine is confused about his role, he is behaving as if he were in the European Union and therefore could afford to take a sharper tone when he cannot do so. He is an applicant who wants to join the European Union, about which opinions are divided,” Orbán remarked. Parrel to all of this, NATO is seeking to ‘Trump-proof’ the alliance for the long-term, which reports of closed-door discussions on how to replace United States leadership in the alliance some five to ten years down the road, amid fears that Washington will retreat from leadership, and its majority financial and weapons support to NATO.

“Very few people know that there is a major political party in South Africa that is actively promoting white genocide,”

• Musk Slams South Africa Over ‘White Genocide’ (RT)

Elon Musk has once again lashed out at his country of birth, South Africa, over what he claimed was “active promotion” of “white genocide.” In a post on X on Sunday, the tech billionaire wrote that his Starlink satellite internet service cannot operate in the African country because he is “not black.”Musk’s remarks came amid tensions between Pretoria and Washington over a controversial land expropriation law signed in January that allows land seizures without compensation and aims to address longstanding disparities between black South Africans and the Afrikaner minority, who own nearly 75% of the country’s freehold farmland. US President Donald Trump condemned the law as an “egregious action” that unfairly targets white South Africans and signed an executive order directing federal agencies to cut aid to the country in a bid to pressure Pretoria to repeal the policy.

Musk, a close advisor to Trump who was born in Pretoria, has also been vocal in his criticism of the law. In his post on Sunday, he lashed out after sharing footage of a rally led by Julius Malema, head of the Economic Freedom Fighters (EFF) opposition party. The video showed demonstrators chanting an apartheid-era slogan Musk interpreted as calling for the killing of white South Africans. “A whole arena chanting about killing white people,” Musk wrote. “Where is the outrage? Why is there no coverage by the legacy media?” “Very few people know that there is a major political party in South Africa that is actively promoting white genocide,” Musk continued, apparently referring to the EFF. He then alleged for the second time in two weeks that Starlink had been refused a license to operate in the country “simply because I’m not black.”

The rally Musk referred to was held to commemorate the 1960 Sharpeville massacre, where police killed 69 black South African protesters during what is considered the first and most violent demonstration against apartheid in the country. The old chant – “Kill the Boer, kill the farmer” – has been a longstanding point of controversy in South Africa. Malema, whose party advocates for eliminating racial and economic disparities, has been known to sing it at rallies and considers it part of the country’s heritage, despite being found guilty of hate speech over it by the ruling African National Congress (ANC).

Despite criticism from Washington, Pretoria has maintained that its land policy is aimed at correcting historical injustice and does not discriminate against any racial group. South African officials have also called for dialogue with Washington to address what they say is “misinformation” about the new land policy. Foreign Ministry spokesman Clayson Monyela rejected Musk’s claim that Starlink was barred due to his race, saying the entire situation had “nothing to do” with skin color, and that the service could operate in South Africa provided it complied with local laws.

“Reagan was considered an outsider, and he was “dangerous” because the Republican establishment could lose its grip on the party to a populist whose basis was in the people and not in the organized interest groups.”

• My Time in the Reagan Administration (Paul Craig Roberts)

Paul Craig Roberts, who played a crucial role in enacting the tax cuts of the 1980s and in forging the political emergence of supply-side economics, reflects on his experience in Washington. He emphasizes that intra-party power struggles, not economics, are the main influence on policy. — Editor, The Independent Review. Paul Craig Roberts is chairman of the Institute for Political Economy. He had academic careers as senior research fellow, Hoover Institution, Stanford University, and William E. Simon Chair in Political Economy, Center for Strategic and International Studies, Georgetown University; journalism careers as associate editor and columnist for the Wall Street Journal and columnist for Business Week; government careers as a member of the U.S. congressional staff and as assistant secretary of the Treasury in the Reagan administration; and business careers as a director of industrial and financial companies.

*****

When I was an economics professor, I often wondered if what my faculty colleagues and I were teaching students about economic policy had any validity. I left Stanford University, went to Washington, D.C., and joined the congressional staff in order to experience how policy is made. In the House, I helped Rep. Jack Kemp introduce supply-side economics to his colleagues. I became chief economist of the House Budget Committee on the Republican side, and then staff associate for Senator Orrin Hatch on the Joint Economic Committee. My success in explaining to Congress that there was an alternative to Keynesian demand management, which had no solution for stagflation, led to President Reagan appointing me assistant secretary of the Treasury for economic policy.Having learned how policy is made (and unmade), I now had the assignment to implement a new one. The story of my experience is useful to economists. As one of my graduate professors, Ronald Coase, used to tell his class, “It would help economists to occasionally look outside the window of the box they keep themselves in.” The conflict between merit and redistribution that is characteristic of the American political system and the influence of established explanations are not the only problems confronting a policymaker, especially if he is introducing a new approach. As Niccolò Machiavelli wrote in The Prince, “There is nothing more difficult, more perilous or more uncertain of success than to take the lead in introducing a new order of things.”

One of the many problems a policymaker faces is that policies affect different interest groups in different ways. Some benefit, some don’t, and I don’t mean just in a material or economic way. Most of the things that influence economic policy have nothing to do with economics. They have to do with power. The party establishments that control the parties intend to stay in control. The organized interest groups that control the party establishments intend to continue in control. Few Americans understand that the main political fight is not between the two parties but within the administration of the party in power. Within the parties the fight is over who controls the party. When the fight is between the establishment and a populist rival like Ronald Reagan or Donald Trump, it can get very nasty.

During the first year of the Reagan administration, much of the battle was between President Reagan and his Treasury allies (primarily me and Secretary Don Regan) on one side and Reagan’s chief of staff, Jim Baker, chairman of the Council of Economic Advisers, Murray Weidenbaum, and Office of Management and Budget (OMB) director David Stockman on the other. The fight within the Reagan administration had its origin in Reagan taking the Republican nomination for president away from the establishment’s candidate, George H. W. Bush, former CIA director. Reagan was considered an outsider, and he was “dangerous” because the Republican establishment could lose its grip on the party to a populist whose basis was in the people and not in the organized interest groups.

Reagan was advised that he must take the defeated George H. W. Bush Republican establishment into his administration or suffer the fate of Barry Goldwater, who rejected Nelson Rockefeller after he defeated him in the Republican presidential nomination. Consequently, the Republican establishment helped the Democrats defeat Goldwater, the Republican populist candidate. Nancy Reagan judged by appearances, and Bush’s man, Jim Baker, a polished dresser, presented to Nancy a better image than Reagan’s laidback California crew to be standing by her husband. Baker was appointed chief of staff. So, from the start Reagan and his supporters in the administration were handicapped by an establishment operative being chief of staff of the Reagan Revolution. Only Reagan had offered a solution to the problem of “stagflation.” It was called supply-side economics. Lacking a solution to offer during the campaign for the nomination, Bush termed Reagan’s policy “voodoo economics.” This, of course, played into the hands of the Democrat opposition and the liberal media determined to undermine President Reagan as a Grade B movie actor who believed in fairy tales about tax cuts paying for themselves.

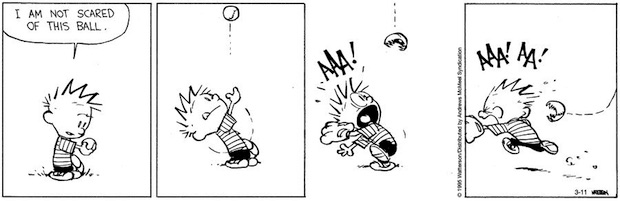

Self harm

Tucker Carlson does not speak on behalf of America, but I have the impression that more and more Americans view the weakness and submissiveness of the Europeans with contempt pic.twitter.com/O2GMdgAInN

— Glenn Diesen (@Glenn_Diesen) March 23, 2025

Tucker Carlson destroys @piersmorgan’s idea of Freedom in the funniest way possible. pic.twitter.com/SNBckPHXy1

— BATMAN (@BATMAN_SPOTTED) March 23, 2025

Job loss

https://twitter.com/its_The_Dr/status/1903631330321052141

Hand

https://twitter.com/buitengebieden/status/1903821746605609121

Moose

Extremely polite moose bull gently reminds a tourist that wildlife should be respected pic.twitter.com/cyZ3tAcKhF

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 21, 2025

Plank

Mother Sloth plank sleeping with her baby sleeping on her belly. pic.twitter.com/rutPEOILOx

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 23, 2025

Dogsbabies

Dogs love babies pic.twitter.com/dGYdYTrKLZ

— Enezator (@Enezator) March 23, 2025

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.