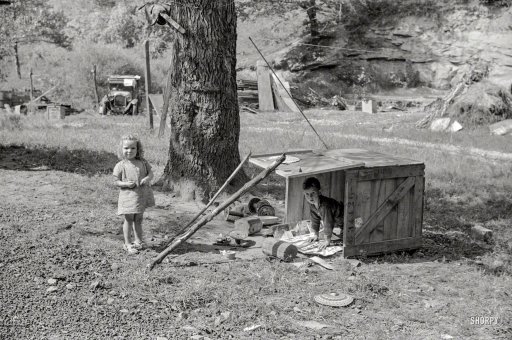

Marion Post Wolcott Works Progress Administration worker’s children, South Charleston, West Virginia Sep 1938

You can jot down Halloween 2014 in your calendar, and it’s unfortunately too tragic to make proper use of the irony involved, as the day Japan committed suicide. The sun is no longer rising. Not that the vital signs weren’t bad before, indeed it might not have survived regardless, but this lethal blow announced today is still quite the statement.

That financial markets interpret it as a reason to cheer and party and make lots of dough is yet one more proof of how shallow and single-minded the people operating in these markets are, lacking all insight in historical context, longer term consequences, wars and politics, and the human mind.

Because the ‘QE as morphine’ concept introduced today by the megalomaniac Shinzo Abe and his central bank raving mad puppets will change the world in ways that make financial gain less than even an afterthought, except perhaps for those of us who cannot see beyond today, or beyond the one single lonely dimension money is of any use in.

If and when a country resorts to having it central bank buy up – the equivalent of – all sovereign bonds it issues, the snake truly eats its tail, and not in a metaphorical sense. Japan eats it children, most of them as yet unborn, to keep its rapidly ageing population contented and in relative wealth, because the alternative would cost Tokyo’s financial-political power cabal their jobs and heads.

Japan’s problem is, and has been for many years, twofold: first, the Japanese people lost the spending power to keep the domestic real economy growing some 20 years ago and never got it back, and second, a whole slew of successive governments refused to restructure the debts in the financial sector, and instead put those debts on the public tally.

The negative growth announced today in US consumer spending should be a warning sign, as should similar numbers that have come from across Europe for a while now, a sign that we need to think about how to run our societies and economies without everlasting growth, and without the ever more failing and ever more costly policies aimed at constructing and maintaining that growth.

However, the worse the policies are for the real economy and the people who depend on it for survival, the more money the financial markets, and the banks, make. It truly is QE as morphine, and Japan has shown us today that morphine can alleviate pain, but it is also in the end the ultimate killer.

It may already be too late, but we can still make the effort to not fall into the same trap Japan has fallen in. Which in essence is simply trying to recreate a past world that is long gone, by applying measures that ‘wise men’ say are sure to bring back the past, and then more.

We must look at ourselves and wonder why we want more. And realize that if we don’t take that look, and we continue on our present path, we will all end up like Japan, guaranteeing that our quest for more will leave us with less, much less. We cannot build our world with credit, we need to work in order to build it. And we cannot borrow our way into growth, nor do we need to grow.

Halloween 2014. A day we could have learned something.

Home › Forums › Japan: QE As Morphine For A Terminal Patient