John Vachon Auto of migrant fruit worker at gas station, Sturgeon Bay, Wisconsin Jul 1940

Let’s see, how do we close this year in a proper manner? I already wrote that 2014 for me has been The Year Propaganda Came Of Age. Likewise, looking forward, I said that The Biggest Economic Story Going Into 2015 Is Not Oil. Moreover, I talked about things that need to be done next year in Things To Do In 2015 When You’re Not Yet Dead.

So what else is left? I thought I’d make a list of narratives that painted the past year, and look at what’s real about them versus what we’re being told they are about. Nothing comprehensive about them, mind you, just train of thought.

Ukraine/Crimea/Putin

The Crimeans voted to join Russia: not an option. Everybody but the Crimeans and Russians declared the vote illegal. East Ukraine held a referendum: not an option. Everybody but the East Ukrainians and Russians declared the vote illegal. The ‘logic’ is the only people who can hold a legal referendum in East Ukraine are the very ones who send in their armies to kill them.

But the US/EU-led ouster of an elected president, and the replacement of his government with one led by a US handpicked PM, narrowly voted in by a parliament at the time replete with guns and at best shady elements, that’s democracy, AD 2014. Throw in a billionaire Willy Wonka who, true, did get elected as president, though the legal status of that election should be under scrutiny given that East Ukraine did not, could not, participate in electing its own leader.

One of the very first things Willy Wonkoshenko did was order his Swastika-toting storm troops to go and kill more East Ukrainians, whose ‘official’ president he had just become (and they did). This all happened under US/EU command (Ukraine itself couldn’t fund a brassband, let alone an army).

Which makes me think, that’s not that far removed from for instance imagining that Washington sends its army into Texas or West Virginia with a licence to kill. But who over there have stood up for East Ukraine? None that I’m aware of. Other than Ron Paul, a proud Texan himself. You guys could have really gotten under Obama’s skin on that, but you never did. What a missed chance, right wing America! Too far away? Too close? Here you got these people whose only goal it is not to be subdued by Washington, and who get shot to bits because of it, and you don’t recognize yourselves in that image?

The west didn’t leave Putin any other option than to assimilate Crimea – and he did it through elections! -; it was clear all along to all involved that Russia would never let go of its only warm water port. It had nothing to do at any point with anything close to a majority of Ukrainians wanting to be ‘free’, but with the west – NATO – wanting to encroach on Russia’s borders, despite specific agreements stemming from the early 1990s not to do that. Putin is not the aggressor in this narrative, we are.

EU

2014 was almost quiet in Europe, apart from the Ukraine narrative, compared to the last few years. Well, that’s not going to last. We’re going to have a Greek election January 25, and an epic three weeks of mud-slinging and fear-mongering prior to that date. It’ll be something to behold, at least from a safe distance. For the Greek people, it won’t feel like much fun.

The European Union consists of democracies – however flawed and corrupt they may be -, but it is not itself a democracy. And that increasingly reflects back – in a very negative way – on the original democracies that founded the doomed edifice in the first place. Everyone gets infected by the virus eventually.

The EU, and the eurozone, will fail and fall apart at some point. The longer it takes, the worse it will be for the people. The EU deserves to fail for the same reasons other supra-national organizations do, like NATO, World Bank, IMF etc.: they’re all inherently undemocratic. They have no reason to listen to what people want. The same can by now well be said for the US, by the way.

The reason these organizations will start to fail now is that economies have begun to fail. It’s as simple as that. I first quoted Yeats years ago on this, but it’s still as fitting as can be: The Centre Cannot Hold. Not when the economy falls to bits. All the smart boys will call it protectionism, in very derogatory tones, but that’s what happens when economies and empires fail: people must manage to take care of themselves in smaller units.

The good thing is, people are very good at that. The bad thing, is emperors and other power hungry ‘leaders’ don’t take kindly to being made redundant. But it has to be done regardless. So let Greece lead the way. It wouldn’t be the first time. Brussels has been nothing but disaster to southern Europe. The European Union is dead and must be dissolved, and its place be taken by a form of cooperation that doesn’t suffocate entire nations. There’s no simpler or clearer way of putting it.

OPEC and oil prices

I know where it’s coming from, but I still look with a childish kind of amazement at all the pundits who declare OPEC, and Saudi Arabia first, responsible for what happens to oil prices. If only OPEC would cut production … what? like they did 30-40 years ago?! It’s a different world, kiddos. Why not demand the US cut production, or Canada? The rationale behind that is energy independence and all that, isn’t it?

But the reality behind that, in turn, is that global oil demand is dropping much faster than producers anticipated, while supply – temporarily – outpaces expectations because of unconventional oil. But, you know, if you fill your media to the brim with false reports about US growth and China growth day after day, what can you expect? The recent sudden drop in oil prices was a long time coming, and only held back by the QE related global central bank money drops.

We’ve seen lipsticked pigs for years now, and we think they’re born that way. They’re not, But it’s still very blind to say OPEC caused the drop in prices. I found a nice take on this at RT, where they interview Margaret Bogenrief at ACM partners, who says:

I think what is most interesting, and you are seeing this really with a lot of countries throughout the Middle East, is the genie has kind of been let out of the bottle. I mean, in Saudi Arabia its oil prices, in other countries like Iraq it’s the dissolution of the previous government. I don’t know if there is a lot that Saudi Arabia can do in 2015 to really take care of its citizenry and to prevent the unrest that you see is growing there. If you look at its population, it’s predominantly male, young and unemployed.

And I don’t know if there is a lot that they can do to keep that under control. [..] I think social unrest in Saudi Arabia is going to be a significant issue in 2015 and beyond. What I think is most interesting is that if you look at the 2014 economic numbers, oil accounted for something like 89% of the country’s revenue. That’s a very singular economy. And if you look at this economic disparity combined with that so focused on that resource, you are going to see some significant issues in 2015 and beyond.

[..] the US has really worked under the Bush and Obama Administrations to increase domestic oil production. That has sent a signal to the world market that the US is really looking not to be as competitive as Saudi Arabia, but certainly to be involved and try to control that a little bit more. Secondly, it’s also just a demographic issue. Saudi Arabia is facing a demographic reality that it has not had to face for decades. The combination of those two things along with the US fracking and trying to get more involved in the energy sector, that’s really combining to costs and issues.

If you look at fracking, I actually think that fracking is not as significant when it comes to actual oil production. I think it’s a better message tool than it’s an actual production tool. What Saudi Arabia is realizing, you certainly saw it in the budget, is that suddenly it doesn’t have complete control over the pricing and manufacturing of oil. That’s really causing some issues. In the budget for 2015 oil was priced to be $80 a barrel. Honestly, that’s wishful thinking.

If you look at Saudi Arabia it’s going to impact Saudi Arabia far more than other Middle Eastern countries. I know Iran is facing some potential sanction issues in 2015; the US is debating whether or not to lift sanctions. That’s not necessarily energy related but I do think you are going to see some significant changes there too.

Not like it’s a brilliant take, but it’s much better than just about any I’ve seen. The Saudis don’t control the price of oil anymore, and they know it – ahead of anyone else, it seems – . They’ve been running budget deficits for a while, and they’ve just seen their revenues halved. And then some 10,000 dimwit western journalists write that they should cut production, while shale oil in the US must keep growing. And then today the Saudi King was hospitalized today as well?

The House of Fahd is not having an easy time of it. They’re all on quaaludes by now. And then Bloomberg reports about a maze in the export ban laws that allow for more US light crude exports. What a brilliant idea. Export into an overloaded market, and let your own actions behead your own industry.

North Korea

Yeah, that daft film that now allegedly stands for freedom, artistic or otherwise, and that Obama apparently had to lean into. Chances that North Korea was involved into hacking the Japanese firm that financed it and sort of released it are by now slim to none, no matter what the FBI said. This is what America stands for these days. A mere narrative. Next up: the rape and murder of Obama’s daughters, Prince George and Vladimir Putin. All very funny and artistically free.

The US dollar and global currencies, stocks and bonds

As we speak, the euro has passed the $1.21 barrier. When the new year starts, it will sink below that, unless crazy measures are taken by someone, anyone. And stock markets are not going to remain anywhere near their present highs with commodities falling the way they are; too much ‘money’ is being lost along the way. It’s known as debt deflation.

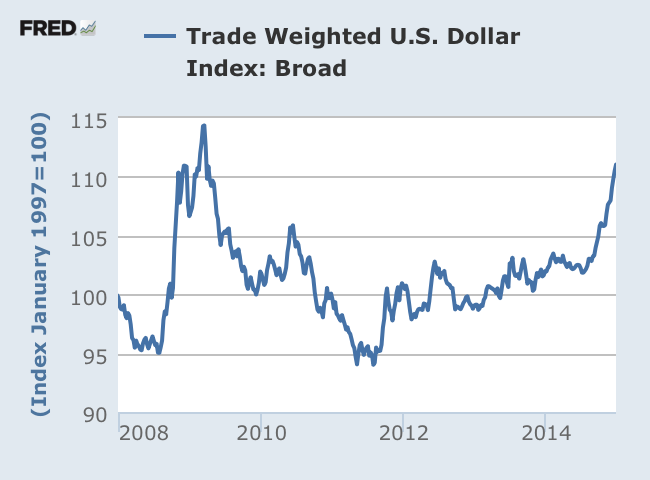

Yes, the greenback had a good run in 2014:

But there’s much more to come. And not because ‘investors like the US’ so much, or because the American economy actually grows at a 5% clip. The real reason is, as I explained in The Biggest Economic Story Going Into 2015 Is Not Oil, that emerging economies are being pulled through a wringer, and all the cheaply borrowed dollars they kept appearances up with are dripping right back into the mothership, i.e. the US.

How happy should this make us? Well, how happy should we be about poverty in Greece, Spain, Brazil and all these other nations to begin with? Do you feel it’s a good idea for us to get richer off of the backs and the misery of other people? If you say yes, it’s clean sailing for a while longer. If you don’t, what are you going to do about it?

If you live in a western country, no matter which one, that’s how your political candidates can promise to keep you rich for a bit. By making people elsewhere poorer, and by making your own children even worse off. There are no other ways left to keep up the facade we live in today. There’s no economic growth, there are no new energy sources, the only thing left to do is borrow from the future. And yeah, I know that seems to work up to the present.

But the price of oil should be a warning sign to you. If oil falls the way it does over a significant amount of time, and other commodities do too, it’s just a matter of time until stocks and bonds start bombing merrily along. And that’s even before the Fed raises its key rates, ‘guided’ by numbers like that 5% US GDP growth in Q3.

This is going to be a crazy year. We’ve said it many times before, but here you go again: volatility will reign the day, in ways we haven’t seen in many years. And the volatility will drive us downward. Not up. Nerves will guide decisions. And losses. Losses that will pressure economies, first of all Japan and Europe, into ever deeper deflationary territory. The central bank fairy tale will not last another 12 months. But the US dollar will be fine. Because it’ll be ‘nurtured’ by the demise of emerging markets.

What we, fortunate citizens of this earth, in the twilight of our civilization, should do in my humble view, is not to enrich ourselves as much as we can, but to ‘minimize the suffering of the herd’, as any shepherd should. I saw this Telegraph headline today, “Goodbye To One Of The Best Years In History”, and I thought, if that’s what you see when you look around, if you’re in Britain and you don’t see that fast and vast increase in poverty on your own doorstep, then what can I say? Hats off? Or heads off?

See ya in da New Year!

Home › Forums › The Year in 5 Narratives