Jack Delano Engineer at AT&SF railroad yard, Clovis, NM 1943

“Despite attempts by governments across the bloc to rein in spending..”

• Europe’s Debt Mountain Just Got A Whole Lot Bigger (Telegraph)

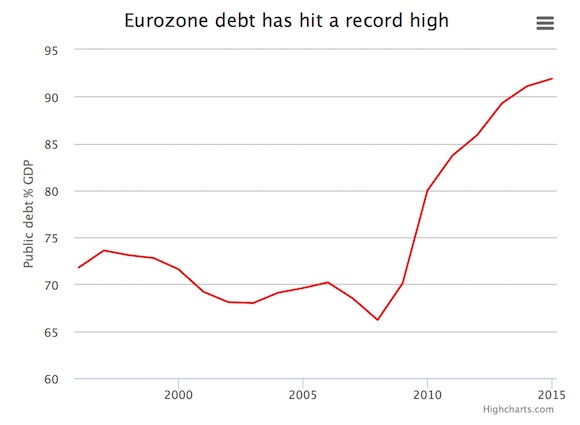

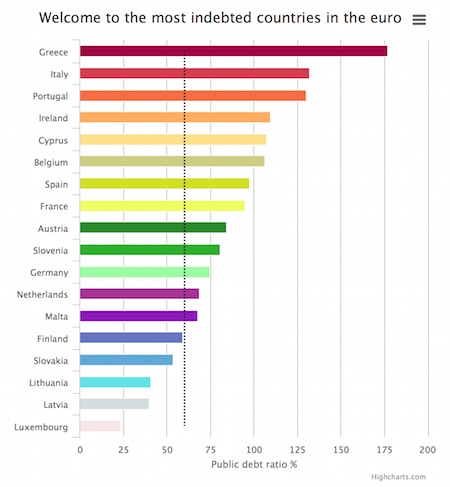

It’s official. The eurozone is drowning in debt. According to the latest figures from the bloc’s official statistical authority, government debt in the eurozone reached nearly 92pc of GDP last year – the highest level since the single currency was introduced in 1999. Unsurprisingly, debt-stricken Greece is the worst offender, with its public debt topping 177pc of national economic output. Italy is not far behind at 132pc of GDP, with bailed-out Cyprus at 107pc. The figures also show that only four of the eurozone’s 19 countries are below the Maastricht Treaty’s 60pc debt limit. Across Europe as a whole, 16 of out the 26 member states are officially in breach of the debt criteria.

Despite attempts by governments across the bloc to rein in spending, stagnant growth and insipid demand has seen debt ratios on the continent soar. Coupled with the ominous threat of deflation, the advanced world’s debt burden is now the foremost threat facing the global economy, according to the likes of the IMF. Total public and private debt levels have reached a record 275pc of GDP in rich countries, and 175pc in emerging markets. Both are up 30 points since the collapse of Lehman Brothers. But as the woes of Greece have shown, the prospect of mass debt write-offs is not on the cards. In the words of Margaret Atwood and beloved of the IMF: “And then the revenge that comes when they are not paid back.”

Part of the game.

• $5.3 Trillion Of Government Bonds Now Have Negative Yields (David Stockman)

The level of complacency in world financial markets is downright astounding – even stupid. Today there are two more signs of extreme mania – a brokerage firm calculation that there are now $5.3 trillion of government bonds trading at negative yields and the cross-over of eurolibor into the neither world of negative yields, as well. These deformations cannot be explained with reference to macroeconomic conditions – such as weak growth or a temporary spot of minimal CPI gains. Instead, they are the destructive work of central banks and a few hundred monetary mandarins who have literally usurped control of the entire world economy. And they have done it through a deft maneuver.

That is, by disabling the pricing system in financial markets entirely and displacing market forces with central command and control in the form of pegged money market rates, manipulated yield curves, invitations to speculators to front-run massive central bank bond buying programs and both implied and explicit promises that rising risk asset prices will be favored and facilitated at all hazards. All of this monetary mayhem is being done in the name of an astoundingly primitive Keynesian premise. Namely, that there is insufficient “aggregate demand” in the world and too little inflation in consumer goods and services as measured by the CPI and other consumption deflators; and that these insufficiencies can be magically remedied by ZIRP, massive government debt monetization and the rest of the easy money tool kit .

How? Why, by inducing businesses and households to borrow more and spend more when they are otherwise not inclined to spend income they don’t have; and to rid them of a reluctance to spend even what they can afford because the price of toilet paper, tonic water, TVs and trips to the mall may be going down tomorrow. Here’s the thing. Both of these alleged barriers to spending are postulates of Keynesian economic models, not conditions extant in the real world. Upwards of 85% of US households, for example, are not borrowing because they are already tapped out and trapped in “peak debt”. Even the borrowing rebound that has happened since the 2008 crisis has occurred for reasons that are irrelevant to the central bankers’ Keynesian predicate.

Restructuring.

• IMF Needs To Correct Its Big Greek Bailout Mistake (Ashoka Mody)

The Greek government’s mounting financial woes are leading it to contemplate the unthinkable: defaulting on a loan from the International Monetary Fund. Instead of demanding repayment and further austerity, the IMF should recognize its responsibility for the country’s predicament and forgive much of the debt. Greece’s onerous obligations to the IMF, the European Central Bank and European governments can be traced back to April 2010, when they made a fateful mistake. Instead of allowing Greece to default on its insurmountable debts to private creditors, they chose to lend it the money to pay in full. At the time, many called for immediately restructuring privately held debt, thus imposing losses on the banks and investors who had lent money to Greece.

Among them were several members of the IMF’s board and Karl Otto Pohl, a former president of the Bundesbank and a key architect of the euro. The IMF and European authorities responded that restructuring would cause global financial mayhem. As Pohl candidly noted, that was merely a cover for bailing out German and French banks, which had been among the largest enablers of Greek profligacy. Ultimately, the authorities’ approach merely replaced one problem with another: IMF and official European loans were used to repay private creditors. Thus, despite a belated restructuring in 2012, Greece’s obligations remain unbearable – only now they are owed almost entirely to official creditors. Five years after the crisis started, government debt has jumped from 130% of gross domestic product to almost 180%.

Meanwhile, a deep economic slump and deflation have severely impaired the government’s ability to repay. Almost everyone now agrees that pushing Greece to pay its private creditors was a bad idea. The required fiscal austerity was simply too great, causing the economy to collapse. The IMF acknowledged the error in a 2013 report on Greece. In a recent staff paper, the fund said that when a crisis threatens to spread, it should seek a collective global solution rather than forcing the distressed economy to bear the entire burden. The IMF’s chief economist, Olivier Blanchard, has warned that more austerity will crush growth. Oddly, the IMF’s proposed way forward for Greece remains unchanged: Borrow more money (this time from the European authorities) to repay one group of creditors (the IMF) and stay focused on austerity. [..]

Five years from now, the country’s economic and social stress could well be even more acute. The question will be: Why was more debt not forgiven earlier? No one is willing to confront that unpleasant arithmetic, and wishful thinking prevails. Having failed its first Greek test, the IMF risks doing so again. It remains trapped by the priorities of shareholders, including in recent years the U.K. and Germany. To reassert its independence and redeem its lost credibility, it should write off a big chunk of Greece’s debt and force its wealthy shareholders to bear the losses.

(Mody is a former IMF mission chief)

I like this: “Forgiveness is inevitable.”

• Mythology That Blocks Progress In Greece (Martin Wolf)

The Greek epic continues. It will not end well if the people involved do not recognise they are clinging on to myths. Here are six, each of which poses intellectual and emotional obstacles to reaching a solution.

A Greek exit would help the eurozone. “Will no one rid me of this turbulent priest?” This is the question Henry II is supposed to have asked about Archbishop Thomas Becket. Wolfgang Schäuble, Germany’s finance minister, must think much the same of his Greek partners. For the English king, however, the gratification of his wish was a disaster. A similar thing is likely to be true if Greece leaves. Yes, if Greece suffered a calamitous aftermath, populist campaigns elsewhere would be less effective. But euro membership would cease to be irrevocable. Each crisis could trigger destabilising speculation.

A Greek exit would help Greece. Many believe a weak new drachma offers a painless path to prosperity. But this is only likely to be true if the economy can easily expand its production of internationally competitive goods and services. Greece cannot. And the immediate consequences are likely to include exchange controls, defaults, a halt to foreign credit, and more political turbulence. Stable money counts for something, particularly in a mismanaged country. Ditching it carries a cost.

It is Greece’s fault. Nobody was forced to lend to Greece. Initially, private lenders were happy to lend to the Greek government on much the same terms as to the German government. Yet the nature of Greek politics, tellingly described in The 13th Labour of Hercules by Yannis Palaiologos , was no secret. Then, in 2010, it became clear the money would not be repaid. Rather than agree to the write-off that was needed, governments (and the IMF) decided to bail out the private creditors by refinancing Greece. Thus, began the game of “extend and pretend”. Stupid lenders lose money. That has always been the case. It is still the case today.

Greece has done nothing. Greece has undergone a huge adjustment of its fiscal and external positions. Between 2009 and 2014, the primary fiscal balance (before interest) tightened by 12% of gross domestic product, the structural fiscal deficit by 20% of GDP and the current account balance by 12% of GDP. Between the first quarter of 2008 and the last of 2013, real spending in the Greek economy fell by 35% and GDP by 27%, while unemployment peaked at 28% of the labour force. These are huge adjustments. Indeed, one of the tragedies of the impasse over the conditions for support is that the adjustment has happened. Greece does not need additional resources.

The Greeks will repay. This myth derives partly from the refusal to recognise sunk costs. The bad lending and the adjustment to the cessation of that lending both lie in the past. What is open is whether the Greeks will devote the next few decades to repaying a mountain of loans that should never have been made. What makes this far worse is that the debt burden has doubled, relative to GDP, despite a restructuring, since the crisis. Forgiveness is inevitable. Indeed, a report from the Centre for Economic Policy Research notes that excessive debt hangs over the entire eurozone, not just Greece.

Is it in Greece’s interest to wait that long?

• Why the Real Deadline for Greece Is July 20 (Bloomberg)

Greece probably has until late July to come to an agreement with its creditors. Possible delays in payments to the IMF shouldn’t prompt the European Central Bank to shut off vital liquidity to Greek banks. By contrast, a default on marketable debt, specifically the failure of the Greek government to pay €3.5 billion due to the ECB on July 20, would probably force the central bank’s hand. The Greek government and its creditors are still likely to reach a deal on a list of reforms before that crucial date. Greek banks are relying on liquidity from the ECB to avoid financial collapse. That support is currently provided by the Emergency Liquidity Assistance scheme from the monetary authorities in Frankfurt.

In the event of a sovereign default, the banks, which are large holders of Greek debt, would probably be ruled insolvent because the value of the assets on their balance sheets would fall sharply. Under the rules of the ELA, the ECB would be unlikely to be able to continue providing liquidity to lenders in the beleaguered country – users of the scheme must be solvent. Rolling over Treasury bills of about €11 billion between now and July 20 is unlikely to create a problem, as long as ECB liquidity remains available. The debt management office will probably be able to complete those operations because Greek banks have continued to be loyal buyers of those assets. A more pressing concern is a payment to the IMF. Greece must pay about €774 million on May 12.

Still, a failure to make that payment would be unlikely to cause the ECB to cut off liquidity to the country’s banks. Since the ability to pay depends on the ability to reach an agreement on reforms, that might be considered a matter of liquidity rather than solvency, allowing the ECB to keep funding Greek banks. In addition, the IMF wouldn’t even have to make a public announcement about the country being in arrears until three months have passed since the missed payment, though the country is immediately shut off from the Fund’s resources.

The IMF could still sign off on a “successful conclusion of the review” that would officially end Greece’s second bailout even if the country were in arrears. The four-month extension granted in February stipulates that this must be done by the end of June, though it’s a soft deadline. The “successful conclusion” would release the outstanding tranche of the current European Financial Stability Facility program – €1.8 billion – and the profits from the ECB’s Securities Markets Programme – €1.9 billion%. Those funds from Greece’s euro-area creditors, which sum to €3.7 billion, would be sufficient to repay the IMF about €3 billion that are due between now and July 13.

Yeah, but those just make Syriza new enemies.

• Greece Buys Six Weeks’ Space With Transfer of City Funds (Bloomberg)

Greek officials expect an order that local governments transfer funds to the central bank will keep the country afloat until the end of May as European policy makers turn up the heat on Prime Minister Alexis Tsipras. Municipalities’ reserves are estimated at about €1.5 billion, according to a person familiar with the matter, who spoke on condition of anonymity. Officials in Athens ruled out also seizing pension funds and the cash reserves of state companies because there wasn’t a need and the move would unnecessarily fuel anxiety, the person said. With bailout talks stalled, access to cash is becoming increasingly critical. Resistance at the ECB to further aiding the country’s stricken lenders is growing and the ECB is studying measures to rein in emergency funding for Greek banks.

“A bigger effort by the Greek side is needed so that we can close the topic in the interest of both sides,” European Commission President Jean-Claude Juncker said in Vienna. “The intensity of the talks has increased in the past 4-5 days but not to the extent that they are ripe enough to come to a quick conclusion.” Tsipras may meet with German Chancellor Angela Merkel on the sidelines of a European Union summit in Brussels on April 23, a Greek government official said Tuesday. Although a final accord is unlikely at a meeting of euro-area finance ministers in Latvia on Friday, another extraordinary meeting could be called at the end of April if needed.

“The sooner they come up with some kind of an agreement the better, but so far Europe has never missed the opportunity to miss an opportunity,” Standard Chartered Bank Global Chief Economist Marios Maratheftis said in a Bloomberg TV interview. Since Tsipras assumed office in January, Greece has been using up its cash reserves to meet its obligations. Greek lenders are mostly locked out of regular ECB cash tenders and instead have access to about €74 billion of emergency liquidity assistance from their own central bank – an amount that has been reviewed weekly by the ECB.

Right.

• Varoufakis Sees ‘Clear Convergence’ in Greek Creditor Talks (Bloomberg)

Greece and its creditors are narrowing their differences as officials on both sides recognize that the best chance for success is an accord that leaves them all a bit unsatisfied, Finance Minister Yanis Varoufakis said. “The convergence is absolutely clear, and the institutions are admitting that now,” Varoufakis told reporters in Athens late on Tuesday. Both sides “have invested a huge amount in achieving an agreement, and neither they nor we will let the opportunity slip to arrive at an agreement that’s clearly to the benefit of everyone.” Failure to do so would be “catastrophic,” he added. Greek Prime Minister Alexis Tsipras on Monday ordered local governments to move their funds to the central bank after failing to make sufficient progress in talks with European and IMF officials to release further bailout aid.

His government needs the cash for salaries, pensions and a payment to the IMF, and is running out of options to stay solvent. Municipalities’ reserves are estimated at about €1.5 billion, which will keep the country afloat until the end of May, according to a person familiar with the matter, who spoke on condition of anonymity. Greece is unlikely to meet the end-April target for it to submit a list of measures to revamp its economy, a European Union official said Tuesday. The euro area now views the end of June to be Greece’s main deadline to unlock aid payments, he added. While an April 24 meeting of euro area finance ministers in Latvia is probably too soon to seal an agreement, “an agreement will come,” Varoufakis said.

“The proposed pipeline, which has not been approved by the European Union..”

• Greece Hopes To Strike A Deal With Gazprom Soon (DW)

The Greek prime minister and Gazprom chief Alexei Miller held talks in Athens on Tuesday over a multibillion dollar gas pipeline project. Reports said both sides would work towards setting up a “road map” detailing the responsibilities the two parties would commit to in the coming months. Government sources said Athens hoped an agreement would be signed shortly. The proposed pipeline, which has not been approved by the European Union, could deliver Russian gas through Turkey and Greece to Europe. The visit by Miller came after Tsipras met Russian President Vladimir Putin in Moscow at the beginning of April and expressed his country’s interest in taking part in the so-called Turkish Stream gas pipeline project.

The pipeline is expected to transport Russian gas though Turkey and then in to Europe by 2017. Some observers, however, doubt the pipeline will be built on time, or even at all. “The pipeline is of big interest to our country and is among our priorities,” said Greek Energy Minister Panagiotis Lafazanis. “We are continuing talks with the Russian side and we hope to reach an agreement very soon,” he added, terming the talks as constructive. According to the Greek Kathimerini newspaper, Athens stands to earn several billion dollars in advance of the deal.

However, Lafazanis declined to comment when asked by reporters about any advance payments. Talking to reporters after meeting Tsipras, Gazprom’s Chief Executive Alexei Miller also did not make any reference to any advance payments to Greece from the pipeline. Greece is heavily dependent on Russian energy imports and is looking to negotiate a deal with Moscow for the reduction of the price of gas that it imports from Russia. Furthermore, Athens has indicated its interest in becoming a European hub for the natural gas pipeline project.

Nothing is safe anymore?

• China Sees First Bond Default by State Firm (Bloomberg)

A Chinese power-transformer maker became the country’s first state-owned company to default on an onshore bond, signaling the government’s willingness to let market forces decide an enterprise’s fate. Baoding Tianwei, the unit of central government-owned China South Industries Group Corp., said it will fail to pay 85.5 million yuan ($13.8 million) of bond interest due Tuesday. Kaisa Group Holdings Ltd. became the first Chinese developer to default on its U.S. currency debt Monday. Until now, only private-sector companies have defaulted in China’s domestic bond market even as state-owned enterprises have sold the vast majority of debt.

Tianwei’s default highlights a shifting attitude toward financial risk, underscored by Premier Li Keqiang’s pledge to open a cooling economy to market forces and strip power from the government. “It’s probably a start of more defaults in China,” said Qu Qing, a bond analyst at Huachuang Securities Co. in Beijing. “The economic slowdown has given a huge blow to some industries.” Baoding Tianwei’s 1.5 billion yuan of 5.7% April 2016 notes have dropped 7.1% since March 31 to 85.3% of par as of Monday, set for the sharpest monthly decline since they were issued in 2011.

The company will continue to raise payment funds via various means including asset disposal, according to today’s statement posted to Chinamoney.com.cn, the China Foreign Exchange Trade System website. The bonds’ rating is now B versus AA+ at issuance. “Our company suffered huge losses in 2014 and the debt to asset ratio surged quickly,” Baoding Tianwei said in today’s statement. “Our company has lost financing ability and suffered from a capital shortage. We can’t raise enough money to repay interest, despite all the efforts we have made.”

There’s irony in that headline somewhere.

• China Will Keep Growing Because It Has To (Bloomberg)

Can China’s economic policy makers maneuver their way out of this one? Let’s see: there’s a property bubble that’s beginning to deflate, a construction boom that’s now going in reverse and a financial system that’s riddled with bad debts. Oh, and the air is still really dirty. On the bright side, though, Cirque du Soleil and Segway are coming to China. With the success of the new Asian Infrastructure Investment Bank, the country has established itself as a global economic leader. And the Shanghai Composite Index has more than doubled during the past nine months. The outside world has a hard time fitting all this evidence together into a coherent picture. Is the stock boom a sign of hope, or a policy-driven bubble?

How about that bond default today by state-owned Baoding Tianwei – is it an indication of new financial maturity or the beginning of a great unraveling? Is the slowdown in construction, however scary for the world’s metal producers, a welcome signal that the economy is moving away from its dependence on exports and infrastructure to more sustainable consumer-driven growth? The common thread here is the Chinese government using every tool it has to keep its long growth run going. As the U.S. and the U.K. grew into industrial powers in the 19th century, they were tripped up every 10 to 20 years by financial crises and economic depressions. Measuring from December 1978, when the Chinese Communist Party “shifted its center of gravity from propagandizing class struggle and organizing political campaigns to economic construction,” China is now in its 37th straight year of economic expansion.

That quote is from a new biography of Deng Xiaoping by historians Alexander V. Pantsov and Steven I. Levine. I’ve just been reading the chapter about Deng’s 1977-78 battle with the charmingly named but otherwise not so great Whateverists, which set the course that China more or less still follows. In the months after founding father Mao Zedong’s death in September 1976, the Whateverist motto was:

We will resolutely defend whatever political decisions were taken by Chairman Mao; we will unwaveringly follow whatever directives were issued by Chairman Mao.

Mao’s handpicked successor, Hua Guofeng, defended these “two whatevers” even as he tried to tweak some of Mao’s decisions and directives. Deng, just rehabilitated after a year on the political outs, saw this as a disastrous approach to governing, given how often Mao had changed his mind and contradicted himself. He dug up an old Mao slogan to back himself up: “Seek truth from facts.” He then endorsed a polemic by several party intellectuals titled “Practice is the Sole Criterion of Truth” that pushed the two whatevers aside as the party’s guiding line.

I know, I know, Paulson and Sorkin…

• Hank Paulson Tells China to Be Wary (Sorkin)

About 340 pages into Henry M. Paulson’s new book on China, a sentence comes almost out of nowhere that stops readers in their tracks. “Frankly, it’s not a question of if, but when, China’s financial system,” he writes, “will face a reckoning and have to contend with a wave of credit losses and debt restructurings.” Mr. Paulson, the former Treasury secretary, knows a thing or two about financial crises, having been the lead firefighter during the 2008 financial collapse, the worst financial crisis since the Great Depression. Mr. Paulson also knows more about China, its politics and the players behind it than most Westerners, having been the former chief executive of Goldman Sachs and one of the first businessmen to seek to establish ties with China more than two decades ago, regularly making trips to the country and befriending top officials.

A crisis in China, even a small one, would be contagious, especially in the United States. Already, fears of a slowdown in China in recent months have led to jitters about the trajectory of the American economy. Mr. Paulson stresses that he’s not saying a crisis is inevitable, and he believes that one can be averted if officials make the right policy decisions. But Mr. Paulson’s anxieties about China have an unnerving similarity to the financial crisis in the United States, and his warnings demand attention. Like the United States crisis in 2008, Mr. Paulson worries that in China “the trigger would be a collapse in the real estate market,” and he declared in an interview that China is experiencing a real estate bubble. He noted that debt as a %age of GDP in China rose to 204% in June 2104 from 130% in 2008.

“Slowing economic growth and rapidly rising debt levels are rarely a happy combination, and China’s borrowing spree seems certain to lead to trouble,” he wrote. Mr. Paulson’s analysis in his book, “Dealing With China: An Insider Unmasks the New Economic Superpower,” are all the more remarkable because he has long been a bull on China and has deep friendships with its senior leaders, who could frown upon his straightforward comments. Mr. Paulson is hopeful that the book, an eye-opening account that praises China while acknowledging the challenges, will be published there and that the government won’t seek to press him to remove his critique. “I have just begun discussions with a Chinese publisher,” he said. “I will only authorize publication if it is published completely and accurately. I am unwavering on that.”

Or banks.

• Europe Should Protect People, Not Borders (Spiegel)

Workers at the Warsaw headquarters of Frontex, the European border protection agency, track every single irregular boat crossing and every vessel filled with refugees. Since December 2013, the authority has spent hundreds of millions of euros deploying drones and satellites to surveil the borders. The EU registers everything that happens near its borders. In contrast to the claims that are often made, they do not look away when refugees die. They are watching very closely. And what is happening here is not negligent behavior. They are deliberately killing refugees. People have been perishing as they sought to flee to Europe for years now. They drown in the Mediterranean, bleed to death on the border fences of the Spanish North African conclaves of Ceuta and Melilla or freeze to death in the mountains between Hungary and Ukraine.

But the European public still doesn’t appear to be entirely aware of the dimensions of this humanitarian catastrophe. We have become accomplices to one of the biggest crimes to take place in European postwar history. It’s possible that 20 years from now, courts or historians will be addressing this dark chapter. When that happens, it won’t just be politicians in Brussels, Berlin and Paris who come under pressure. We the people will also have to answer uncomfortable questions about what we did to try to stop this barbarism that was committed in all our names. The mass deaths of refugees at Europe’s external borders are no accidents — they are the direct result of European Union policies.

The German constitution and the European Charter of Fundamental Rights promise protection for people seeking flight from war or political persecution. But the EU member states have long been torpedoing this right. Those wishing to seek asylum in Europe must first reach European territory. But Europe’s policy of shielding itself off from refugees is making that next to impossible. The EU has erected meters-high fences at its periphery, soldiers have been ordered to the borders and war ships are dispatched in order to keep refugees from reaching Europe. For those seeking protection, regardless whether they come from Syria or Eritrea, there is no legal and safe way to get to Europe. Refugees are forced to travel into the EU as “illegal” immigrants, using dangerous and even fatal routes. Like the one across the Mediterranean.

A Darwinist situation has emerged on Europe’s external borders. The only people who stand a chance of applying for asylum in Europe are those with enough money to pay the human-traffickers, those who are tenacious enough to try over and over again to scale fences made of steel and barbed wire. The poor, sick, elderly, families or children are largely left to their fates. The European asylum system itself is perverting the right to asylum.

One dollar one vote.

• The Next Era of Campaign-Finance Craziness Is Already Underway (NY Times)

There may be no political adviser closer to Rand Paul than Jesse Benton. Benton was integral to Paul’s Senate run in 2010 and was a top strategist for both of Ron Paul’s Republican presidential campaigns. When a fellow Kentuckian, Senator Mitch McConnell, needed help with his re-election campaign last year, Rand Paul lent him Benton. Benton also happens to be married to Paul’s niece. So it would have been natural to expect Benton to move into Paul’s campaign headquarters as soon as he declared his candidacy for president. Not going to happen.

On April 6, the day before Paul made his formal announcement, National Journal reported that instead, Benton will be running America’s Liberty PAC, the principal Paul-supporting super PAC — the class of technically independent campaign organization that is free to spend as many millions of dollars as it can raise, without all those nettlesome regulations that limit donations to formal presidential campaigns to $5,400 a person. Then there is the longtime Jeb Bush adviser Mike Murphy. Murphy guided Bush through the rocky shallows of early-stage presidential politics and helped manage Bush’s successful push to lock down most of the Republican Party’s top donors for the 2016 race, effectively sidelining Mitt Romney and hobbling Chris Christie.

Not long ago, it would have been taken as a given that Murphy would join Bush’s formal campaign once it was announced — but people close to the campaign expect he will join Bush’s super PAC, Right to Rise, instead. And Gov. Scott Walker’s former campaign manager and chief of staff, Keith Gilkes, announced late last week that he would not be joining Walker’s formal campaign but rather Walker’s super PAC, Unintimidated PAC — this in spite of legal investigations into Walker’s aides’ interactions with outside conservative groups. All these moves point to the next stage in the great unraveling of the presidential campaign-finance system. And they make the few remaining prohibitions against coordination between these “independent” groups and campaigns look trifling, if not absurd.

Outside groups have played influential roles in presidential races for decades. Forerunners of the super PAC include groups like the National Security Political Action Committee, which produced the “Willie Horton” ads against Michael Dukakis in 1988, and the Swift Boat Veterans for Truth, which in 2004 brought false charges that John Kerry lied about his Vietnam War record. That same year, the Democratic-aligned groups America Coming Together and the Media Fund tried to help Kerry with get-out-the-vote operations and campaign ads attacking President George W. Bush.

Nobody stateside dares touch Warren.

• British Regulator Challenges US Over Scrutiny of Buffett’s Berkshire (FT)

British regulators have challenged their US peers over their apparent reluctance to subject Warren Buffett’s Berkshire Hathaway to tougher scrutiny as part of a worldwide push to make the financial system safer. The Bank of England has written to the US Treasury asking why Berkshire’s reinsurance operation — among the world’s most powerful — was left off a provisional list of “too big to fail” institutions drawn up by the Financial Stability Board. Regulators have already deemed nine primary insurance companies — including AIG of the US, Germany’s Allianz and UK-based Prudential — globally “systemically important”, a designation that could lead to higher capital requirements. But they have put off saying which reinsurers — groups such as Swiss Re, Munich Re and Berkshire, which provide insurance for insurers — should be included.

The failure to designate reinsurers has angered insurance companies, which argue reinsurers are more important to the financial system. In a separate move that underscores concern about the increased scrutiny brought by designation, MetLife has sued the US government to try to escape being deemed systemically important by Washington. Insurers deemed systemically important on a global level may need to hold more capital to cover unexpected losses and could face a requirement to draw up “living wills” to make them easier to wind down in a crisis. Yet regulators have yet to quantify the scale of the HLA requirements and the consequences of designation remain unclear. The Basel-based FSB was expected to make the reinsurance list public last year. But in November, following consultation with national authorities, it postponed the decision “pending further development of the methodology”.

“Tens of thousands of miles of pipeline go completely unregulated by federal officials..”

• ‘Pipelines Blow Up And People Die’ (Politico)

Oil and gas companies like to assure the public that pipelines are a safer way to ship their products than railroads or trucks. But government data makes clear there is hardly reason to celebrate. Last year, more than 700 pipeline failures killed 19 people, injured 97 and caused more than $300 million in damage. Two of the past five years have been the worst for combined pipeline-related deaths and injuries since 2000. To understand the failure revealed by these numbers, POLITICO talked to more than 15 former and current federal pipeline officials and advisers, as well as dozens of safety experts, engineers and state regulators. We reviewed more than a decade of government data on fatalities, injuries, property damage, incident locations, inspections, damages and penalties.

The picture that emerges is of an agency that lacks the manpower to inspect the nation’s 2.6 million miles of oil and gas lines, that grants the industry it regulates significant power to influence the rule-making process, and that has stubbornly failed to take a more aggressive regulatory role, even when ordered by Congress to do so. This is a particularly bad time for a front-line safety agency to take a backseat. The current boom in fossil fuel production has created intense pressure for massive new pipelines like Keystone XL. Many of the pipes already in the ground are more than half a century old. Tens of thousands of miles of pipeline go completely unregulated by federal officials, who have abandoned the increasingly high-pressure lines to the states.

“Stupid money”.

• Who Is Saudi Arabia Really Targeting In Its Price War? (Berman)

Saudi Arabia is not trying to crush U.S. shale plays. Its oil-price war is with the investment banks and the stupid money they directed to fund the plays. It is also with the zero-interest rate economic conditions that made this possible. Saudi Arabia intends to keep oil prices low for as long as possible. Its oil production increased to 10.3 million barrels per day in March 2015. That is 700,000 barrels per day more than in December 2014 and the highest level since the Joint Organizations Data Initiative began compiling production data in 2002. And Saudi Arabia’s rig count has never been higher. Market share is an important part of the motive but Saudi Minister of Petroleum and Mineral Resources Ali al-Naimi recently emphasized that “The challenge is to restore the supply-demand balance and reach price stability.”

Saudi Arabia’s need for market share and long-term demand is best met with a growing global economy and lower oil prices. That means ending the over-production from tight oil and other expensive plays (oil sands and ultra-deep water) and reviving global demand by keeping oil prices low for some extended period of time. Demand has been weak since the run-up in debt and oil prices that culminated in the Financial Collapse of 2008. Since 2008, the U.S. Federal Reserve Board and the central banks of other countries have further increased debt, devalued their currencies and kept interest rates at the lowest sustained levels ever.

These measures have not resulted in economic recovery and have helped produce the highest sustained oil prices in history. They also led to investments that are not particularly productive but promise higher yields that can [not] be found otherwise in a zero-interest rate world. The quest for yield led investment banks to direct capital to U.S. E&P companies to fund tight oil plays. Capital flowed in unprecedented volumes with no performance expectation other than payment of the coupon attached to that investment. This is stupid money. These capital providers are indifferent to the fundamentals of the companies they invest in or in the profitability of the plays. All that matters is yield. The financial performance of most companies involved in tight oil plays has been characterized by chronic negative cash flow and ever-increasing debt.

2 generals, one of each.

• How to Avert a Nuclear War (James E. Cartwright and Vladimir Dvorkin)

We find ourselves in an increasingly risky strategic environment. The Ukrainian crisis has threatened the stability of relations between Russia and the West, including the nuclear dimension — as became apparent last month when it was reported that Russian defense officials had advised President Vladimir V. Putin to consider placing Russia’s nuclear arsenal on alert during last year’s crisis in Crimea. Diplomatic efforts have done little to ease the new nuclear tension. This makes it all the more critical for Russia and the United States to talk, to relieve the pressures to “use or lose” nuclear forces during a crisis and minimize the risk of a mistaken launch. The fact is that we are still living with the nuclear-strike doctrine of the Cold War, which dictated three strategic options: first strike, launch on warning and post-attack retaliation.

There is no reason to believe that Russia and the United States have discarded these options, as long as the architecture of “mutually assured destruction” remains intact. For either side, the decision to launch on warning — in an attempt to fire one’s nuclear missiles before they are destroyed — would be made on the basis of information from early-warning satellites and ground radar. Given the 15- to 30-minute flight times of strategic missiles, a decision to launch after an alert of an apparent attack must be made in minutes. This is therefore the riskiest scenario, since provocations or malfunctions can trigger a global catastrophe. Since computer-based information systems have been in place, the likelihood of such errors has been minimized. But the emergence of cyberwarfare threats has increased the potential for false alerts in early-warning systems.

The possibility of an error cannot be ruled out. American officials have usually played down the launch-on-warning option. They have argued instead for the advantages of post-attack retaliation, which would allow more time to analyze the situation and make an intelligent decision. Neither the Soviet Union nor Russia ever stated explicitly that it would pursue a similar strategy, but an emphasis on mobile missile launchers and strategic submarines continues to imply a similar reliance on an ability to absorb an attack and carry out retaliatory strikes. Today, however, Russia’s early warning system is compromised. The last of the satellites that would have detected missile launches from American territory and submarines in the past stopped functioning last fall. This has raised questions about Russia’s very ability to carry out launch-on-warning attacks.

Fishy narrative. 2 questions: 1) if he’s so smart, how come he only made $40 million? 2) why let him continue for another 5 years if they were on to him even before the flash crash?

• UK Financial Trader Arrested Over 2010 Global Markets ‘Flash Crash’ (Guardian)

A financial trader who played the world’s futures markets from a small suburban house in Hounslow, west London, has been arrested and faces extradition to the US after supposedly making $40m (£27m) for his alleged role in the so-called “flash crash” of 2010. The US Department of Justice (DoJ) said on Tuesday that it was seeking the extradition of Navinder Singh Sarao, 37, who it claims “spoofed” financial markets using commercially available trading software to place $200m of false trades from his home in Hounslow. The US agency added that Sarao’s supposed manipulation contributed to the flash crash on 6 May 2010, when the Dow Jones industrial average plunged 600 points in five minutes and created havoc on Wall Street.

Sarao is expected to appear in custody at Westminster magistrates court on Wednesday. He is accused of duping the market into believing there were a lot more sellers than there really were and profiting from the market movement. He is said to have changed his orders more than 19,000 times before cancelling them. The episode, although not attributed to him, formed the backdrop for the Robert Harris novel The Fear Index. A DoJ spokesman would not speculate on how one person, using widely available commercial software, might have been able to crash the world’s financial markets. Nor would he comment on how an individual, who appears to live in a street populated by unremarkable three-bedroom semi-detached houses, seemed to make such huge rewards from his alleged scheme.

However, the US regulator, the Commodity Futures Trading Commission, said Sarao and his company had profited by more than $40m. The DoJ detailed a series of supposed coups, including episodes where Sarao is said to have made profits of more than $820,000 during a day’s trading. In an affidavit published by the DoJ in support of its complaint, FBI special agent Gregory LaBerta said Sarao was “a futures trader who operated from his residence in the United Kingdom and who primarily traded through his company, Nav Sarao Futures Limited.

“On numerous occasions between at least in or about April 2010 and in or about April 2014, Sarao spoofed the market and manipulated the intra-day price for … S&P 500 futures contracts on the Chicago Mercantile Exchange, including on or about 6 May 2010, when the US stock markets plunged dramatically in a matter of minutes in an event that came to be known as the ‘Flash Crash’.”

Hongcouver has been crazy for years.

• Metro Vancouver Is Swept Up In A Real Estate Frenzy (Vancouver Sun)

It is no exaggeration to use an F-word to describe Vancouver’s current real estate scene. As in, the market is in a Frenzy. Observers describe a perfect storm of forces coming together to create a tempestuous result: A 5.8-per-cent jobless rate in B.C., low interest rates, a devalued Canadian dollar attracting more foreign buyers, and panic over prices going even higher if buying is delayed. Even the particularly vicious winters of recent years in Eastern Canada may be having an impact. Meanwhile, the Bank of Canada warned last Wednesday about the risk of correction in three Canadian property markets — Vancouver, Toronto and Calgary. For the moment, few are heeding the caution.

A press release sent out last week by WestStone Properties, regarding its Evolve condominium project in Surrey, reported sales in a single day (April 11) of 300 condo units, worth $70 million. And get this — project completion is still three years into the future. The release described the purchasers’ enthusiasm: “Excited early buyers who stood in line for hours, grappled for position and swarmed the buying counter in a frenzy that hasn’t been seen in recent years.” Who was buying? Everyone. “Today’s buyers included first-time homeowners, parents purchasing for children and a large number of buyers from throughout Canada, the U.S. and overseas.” The Greater Vancouver Real Estate Board reported earlier this month, bidding wars are taking place with greater frequency.

And Royal Lepage last week cited a rush on Vancouver’s detached homes, resulting from a scarcity of product and high demand to live here. It seems that real estate enthusiasm is not limited to the Lower Mainland. The B.C. Real Estate Association has just reported: “B.C. home sales post the strongest March in eight years. … More homes traded hands last month than any March since 2007.” Property sales jumped 37.6% over March 2014 and sales dollar volume was up 57.1%. In Greater Vancouver, activity was even more robust, with year-over-year sales jumping 53.2%. Association chief economist Cameron Muir says: “Many board areas are now exhibiting sellers’ market conditions, with home prices advancing well above the overall rate of inflation.” The average sale price in March for all types of Vancouver-area housing was $891,000 — up from $801,000 12 months earlier.

Sounds like a book.

• Decisions: Life and Death on Wall Street, by Janet M. Tavakoli (Nomi Prins)

Janet Tavakoli is a born storyteller with an incredible tale to tell. In her captivating memoir, Decisions: Life and Death on Wall Street, she takes us on a brisk journey from the depravity of 1980s Wall Street to the ramifications of the systemic recklessness that crushed the global economy. Her compelling narrative sweeps through her warnings about the dangers of certain bank products in her path-breaking books, speeches before the Federal Reserve, and in talks with Jaime Dimon. She probes the moral complexity behind the lives, suicides and murders of international bankers mired in greed and inner conflict. Some of the people that touched her Wall Street career reflect broken elements of humanity. The burden of choosing money and power over values and humility translates to a loss for us all.

To truly understand the stakes of the global financial game, you must know its building blocks; the characters, testosterone, and egos, as well as the esoteric products designed to squeeze investors, manipulate rules, and favor power-players. You had to be there, and you had to be paying attention. Janet was. That’s what makes her memoir so scary. In Decisions, she breaks the hard stuff down with humor and requisite anger. As a side note, her international banking life eerily paralleled my own – from New York to London to New York to alerting the public about the risky nature of the political-financial complex. Her six chapters flow along various decisions, as the title suggests. In Chapter 1 “Decisions, Decisions”, Janet opens with an account of the laddish trading floor mentality of 1980s Wall Street.

In 1988, she was Head of Mortgage Backed Securities Marketing for Merrill Lynch. Those types of securities would be at the epicenter of the financial crisis thirty years later. Each morning she would broadcast a trade idea over the ‘squawk box.‘ Then came the stripper booked for a “final-on-the-job-stag party.” That incident, one repeated on many trading floors during those days, spurred Janet to squawk, not about mortgage spreads, but about decorum. Merrill ended trading floor nudity and her bosses ended her time in their department. Her bold stand would catapult her to “a front row seat during the biggest financial crisis in world history.” Reading Decisions, you’ll see why this latest financial crisis was decades in the making.

“Making a vegetable garden is a political statement”.

• The Food Production System is Criminal (Beppe Grillo’s blog)

Italian foodstuffs are subject to strict controls in order to guarantee the quality of the end product and the health of the consumer. Thanks to the strictness of these controls and the hard work of small Italian livestock and vegetable farmers and fishermen, the food in our Country is considered to be a source of excellence worldwide. One of the few things that we have left but that we will soon lose even that as soon as the TTIP is approved, a treaty that will allow cheap, low quality US products to find their way onto our tables.

As the crisis deepens, Italian consumers will lower their expectations and purchase chlorine flavoured chickens , beef and pork grown and nourished on hormones and fruit and vegetables with pesticides. Their health will undoubtedly suffer, farmers breeders and fishermen will close up shop and “Made in Italy” foods will become little more than a distant memory. We simply cannot allow this crime against our health! My friend Carlo Petrini, the founder of the Slow Food movement, explains how each and every one of us can sink this Criminal Foodstuff System by supporting our small Italian producers through their purchasing choices.

Blog – Slow Food is at the Expo with this slogan: “SAVE OUR BIODIVERSITY. SAVE THE PLANET. Can you explain to us why biodiversity is such an important asset?

Carlo Petrini – Biodiversity is the real driving force behind human understanding so we have to respect it. If we continue sticking to this foodstuff production model, with this criminal foodstuff system that destroys biodiversity by virtue of the fact that we must favour strong and more productive breeds and cultivars because we are only interested in the bottom line and never in Mother Earth or nature, all we will hand down to future generations is a far, far weaker genetic legacy.

Blog – Let’s talk about the TTIP: you have often mentioned your concern about the effect that this treaty will have on the European food industry. Why is there such a rush to get it approved very quickly? Who will profit from the TTIP? Who will the losers be? What will the long term effects be for Italy and for the consumer? And what about the planet’s equilibrium?

Carlo Petrini – I think that it is dishonest and improper to come up with these treaties in total and absolute secrecy and without involving the community at all. When things are done in secret it usually means that those involved are being dishonest! We must not allow these treaties to be introduced on the backs of millions of farmers, fishermen and food producers that are working all around the world and must be protected like now when they are facing this fetish called the free market, which is anything but free and often destroys the lives of these communities. Now, by virtue of the free market, I am allowed to bring in products made from meat that is not subject to the strict requirements that our breeders have to comply with and is full of chemicals, antibiotics, anabolic steroids and growth hormones, all of which are banned in Italy and in Europe but not banned in the United States.

It is unfair on our breeders because the law should be the same for everyone. We citizens can become co-producers because our choices can lead to certain agricultural choices. If I eat products that come from local small-scale farmers who don’t use pesticides, in other words who farm cleanly, then I’m helping that kind of farming along. If instead I buy and eat products produced by the multinationals, products that perhaps come from elsewhere in the world without any of the rules that our farmers have to adhere to, and perhaps obtained by means of slave labour, then equally I am helping that kind of farming.

Home › Forums › Debt Rattle April 22 2015