Wyland Stanley Indian guides and Nash auto at Covelo stables., Mendocino County CA 1925

“..the story of fast Chinese growth—a story that has soothed investors and corporate managers around the world since the 1980s—is looking increasingly tough to square with the evidence. ..”

• Last 30 Years Of Global Economic History Are About To Go Out The Window (Quartz)

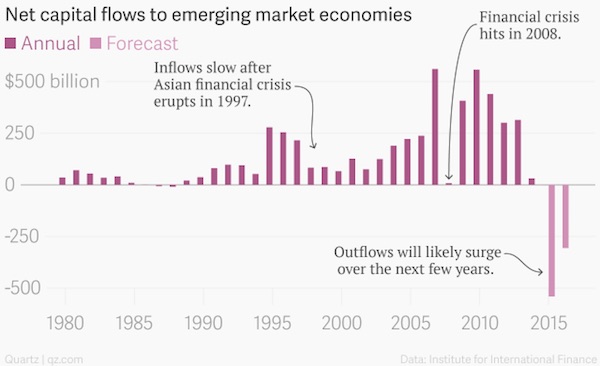

Over the last 30 years, a near constant flow of cash has inundated China and other emerging markets. It has lifted those economies, pulled hundreds of millions of people out of poverty, and dictated corporate expansion plans worldwide. That wave is now ebbing. This year will see the first net outflow of capital from emerging markets in 27 years, according to the Institute of International Finance, a trade group representing international bankers. The group expects more than $500 billion worth of cash previously invested in things like Chinese factories, Brazilian government bonds, and Nigerian stocks to cascade out of such markets this year. What’s going on? In a word: China. In a profound change of narrative for both the global economy and markets that are closely tied to it, the story of fast Chinese growth—a story that has soothed investors and corporate managers around the world since the 1980s—is looking increasingly tough to square with the evidence.

And it’s even tougher to imagine anything else like China—a billion new consumers joining the global economy—emerging any time soon. Of course, the slowdown in China isn’t confined to China. Over the last 30 years, countries worldwide have built their economies to service the needs of the People’s Republic. Brazil would be a case in point. The South American giant has done a brisk business digging up and selling China the iron needed to feed booming steel mills. (Brazil is the world’s second largest iron ore exporter, behind Australia.) But Chinese steel mills aren’t roaring like they used to. Crude steel production fell 2% during the first eight months of the year, a decline unprecedented in data going back roughly 20 years. As Chinese steel plants cooled, iron ore prices fell sharply. At roughly $55 a tonne, iron ore prices are down 60% from where they were at the end of 2013. And as prices for iron plummeted, so did revenues of big iron-ore exporters such as Brazil.

“..In no state is a living wage less than $14.26 per hour..”

• Nowhere in US Can A Single Adult Live On Less Than $14/Hr In 40-Hour Week (DK)

You read that right. Alliance for a Just Society just released a report. In it they looked at living expenses in every state, for singles as well as families. This is an attempt to figure out what a reasonable living wage would be. What’s a “living wage”? The study’s definition includes the ability to pay for luxuries items like housing, child care, utilities and savings. The conclusions, while known anecdotally by virtually every American (sans conservatives), are still chilling: Though $15 per hour is significantly higher than any minimum wage in the country, it is not a living wage in most states. A living wage was calculated for all 50 states and for Washington DC In 35 states and in Washington DC, a living wage for a single adult is more than $15 per hour. In no state is a living wage less than $14.26 per hour.

In fact, nationally, the living wage for a single adult is $16.87 per hour ($35,087 annually) – the weighted average of single adult living wages for all 50 states and Washington, D.C. Some of the people who have it the hardest? Childcare workers. In 2014, 582,970 people worked as child care providers at a median wage of $9.48 per hour. Let’s put it into perspective. According to the study, in order to get by on minimum wage as it is in each state right now, you would have to work an almost 111 hour week in Hawaii. You’d be better off in Virginia, where for $7.25 it would only take a touch over 103 hours a week to get by. IF YOU ARE SINGLE. If you’re a real lazybones or don’t like a little hard work, you can move to Washington or South Dakota where you only have to work for about 67 and half hours a week to get by.

Ominous.

• US Manufacturing Falls for a Second Month (Bloomberg)

Factory output fell in September for a second month as high inventories and lukewarm demand from overseas customers kept American producers bogged down. The 0.1% drop at manufacturers, which make up 75% of all production, followed a revised 0.4% decrease the prior month, a Federal Reserve report showed Friday. Total industrial production, which also includes mines and utilities, dropped 0.2%. A surge in the dollar since mid-2014 has made U.S. products more expensive in foreign markets at the same time the oil industry cuts back and companies contend with bloated stockpiles. Manufacturing’s woes are only partially being cushioned by steady purchases of automobiles that have led consumer spending in underpinning the economy.

“Manufacturing continues to be kind of soft,” said Joshua Shapiro at Maria Fiorini Ramirez in New York. “It’s a combination of weak foreign demand and inventories getting rebalanced. I’d expect another few months of flat-to-down manufacturing output.” Utility output climbed 1.3% for a second month as warmer September weather boosted demand for air conditioning. Mining production, which includes oil drilling, slumped 2%, the most in four months. Oil and gas well drilling decreased 4%. [..] manufacturing accounts for about 12% of the economy. The previous month’s reading was revised from a 0.5% drop.

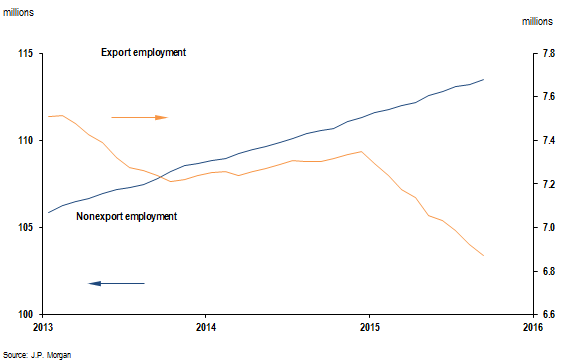

“The drag from job losses in export industries will linger on for some time at least.” Considering export-oriented jobs are among the better paying ones, that’s a pretty sobering forecast.”

• US Export Industries Are Losing 50,000 Jobs A Month (Bloomberg)

Employment is taking a dive in industries that sell a lot of U.S.-made goods abroad, and things could get worse before they get better. The double whammy to exports from the stronger dollar and cooling overseas markets was bound to hit employment in the world’s largest economy. JPMorgan has put numbers to the damage. Export-oriented industries have been losing about 50,000 jobs a month for most of this year, after adding 9,000 a month on average in 2014, according to JPMorgan economist Jesse Edgerton. Recent manufacturing surveys hint the impact could worsen, and the employment erosion may extend into the first half of 2016, he predicts. In effect, that would mean private payrolls growth takes a step down to around 150,000 a month, from the booming 250,000-plus average of 2014.

“Employment is declining in industries exposed to exports, and we haven’t seen any sign the decline is slowing down,” Edgerton said. “The drag from job losses in export industries will linger on for some time at least.” Considering export-oriented jobs are among the better paying ones, that’s a pretty sobering forecast. U.S. jobs supported by goods exports, for example, pay as much as 18% more than the national average, according to government estimates. At a time of increased concern that growth is losing momentum, a strong labor market backed by jobs that pay well is key to sustaining consumer spending, the biggest part of the economy. Edgerton has pieced out the hit to employment, which isn’t easy to gauge from the Labor Department’s monthly payrolls report.

He developed a way to measure the share of each industry’s output that is exported, both directly and indirectly through sales to other industries that cater to overseas demand. Using that, he worked out how payrolls are faring in those businesses compared with counterparts that focus on the U.S. market. Trends in the top four industries with the largest export share — transportation equipment excluding motor vehicles; machinery; computer and electronic products; and primary metals — offer another reason for concern, Edgerton said. Payrolls have been slowing for decades in capital-intensive manufacturing businesses that dominate exports. So there’s little reason to expect export jobs will see a return to positive territory.

“..companies’ ability to pay these interest expenses, as measured by the interest coverage ratio, dropped to the lowest level since 2009. Companies also have to refinance that debt when it comes due.”

• Wrath of Financial Engineering: It’s Now Eating into Earnings (WolfStreet)

Companies with investment-grade credit ratings – the cream-of-the-crop “high-grade” corporate borrowers – have gorged on borrowed money at super-low interest rates over the past few years, as monetary policies put investors into trance. And interest on that mountain of debt, which grew another 4% in the second quarter, is now eating their earnings like never before. These companies – according to JPMorgan analysts cited by Bloomberg – have incurred $119 billion in interest expense over the 12 months through the second quarter. The most ever. With impeccable timing: for S&P 500 companies, revenues have been in a recession all year, and the last thing companies need now is higher expenses.

Risks are piling up too: according to Bloomberg, companies’ ability to pay these interest expenses, as measured by the interest coverage ratio, dropped to the lowest level since 2009. Companies also have to refinance that debt when it comes due. If they can’t, they’ll end up going through what their beaten-down brethren in the energy and mining sectors are undergoing right now: reshuffling assets and debts, some of it in bankruptcy court. But high-grade borrowers can always borrow – as long as they remain “high-grade.” And for years, they were on the gravy train riding toward ever lower interest rates: they could replace old higher-interest debt with new lower-interest debt. But now the bonanza is ending. Bloomberg:

As recently as 2012, companies were refinancing at interest rates that were 0.83 percentage point cheaper than the rates on the debt they were replacing, JPMorgan analysts said. That gap narrowed to 0.26 percentage point last year, even without a rise in interest rates, because the average coupon on newly issued debt increased. Companies saved a mere 0.21 percentage point in the second quarter on refinancings as investors demanded average yields of 3.12% to own high-grade corporate debt – about half a percentage point more than the post-crisis low in May 2013.

That was in the second quarter. Since then, conditions have worsened. Moody’s Aaa Corporate Bond Yield index, which tracks the highest-rated borrowers, was at 3.29% in early February. In July last year, it was even lower for a few moments. So refinancing old debt at these super-low interest rates was a deal. But last week, the index was over 4%. It currently sits at 3.93%. And the benefits of refinancing at ever lower yields are disappearing fast. What’s left is a record amount of debt, generating a record amount of interest expense, even at these still very low yields. “Increasingly alarming” is what Goldman’s credit strategists led by Lotfi Karoui called this deterioration of corporate balance sheets. And it will get worse as yields edge up and as corporate revenues and earnings sink deeper into the mire of the slowing global economy.

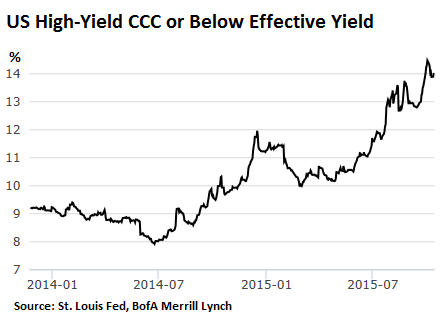

But these are the cream of the credit crop. At the other end of the spectrum – which the JPMorgan analysts (probably holding their nose) did not address – are the junk-rated masses of over-indebted corporate America. For deep-junk CCC-rated borrowers, replacing old debt with new debt has suddenly gotten to be much more expensive or even impossible, as yields have shot up from the low last June of around 8% to around 14% these days. Yields have risen not because of the Fed’s policies – ZIRP is still in place – but because investors are coming out of their trance and are opening their eyes and are finally demanding higher returns to take on these risks. Even high-grade borrowers are feeling the long-dormant urge by investors to be once again compensated for risk, at least a tiny bit.

More financial engineering to come:

• Megamergers Will Depend on Huge Amounts of Debt (Barron’s)

History doesn’t repeat, but it often rhymes, as Mark Twain may (or may not) have said. And one of those repetitions is the preponderance of megamergers and acquisitions late in economic expansions and bull markets, which are the results of confidence brimming over in C-suites and the sense that opportunities are endless. And so the announcement of not one but two megadeals—privately held Dell mating with data-storage outfit EMC, and Anheuser-BuschInBev linking up with fellow brewer SABMiller —provoked a spate of commentary that they represented some fin-de-cycle phenomenon. As usual, these nuptials are expected to produce that most desired benefit of such unions: often-elusive synergies. That’s mainly a euphemism for cost-cutting, largely through reduced head counts, rather than the rare phenomenon of one plus one adding up to three, something seen mainly in the consultant community, not the real world.

But what really drives deals isn’t so much what’s happening with companies’ stocks as with the credit markets. And the Dell-EMC and AB InBev-SABMiller nuptials, if approved by regulators, will be made possible by nearly $120 billion from the corporate bond and loan markets. The brewers’ $106 billion merger reportedly would involve some $70 billion of borrowing, including about $55 billion in bonds and the rest in loans. The $67 billion Dell-EMC deal, meanwhile, would be funded by $49.5 billion in debt, along with new common equity and cash in the coffers. If either of those financing plans come to fruition, they would eclipse the record set by Verizon, which issued $49 billion in bonds to fund its acquisition of Vodafone’s minority stake in Verizon Wireless. The question is whether there is any limit to what Carl Sagan would describe as the billions and billions that the credit markets can conjure. The answer may determine how long the deal making can continue.

The amount of overindebted overinvestment across China based on false expectations of growth will prove to be staggering and often deadly.

• China’s Exporters Downcast As Orders Slow, Costs Rise (Reuters)

Around two-thirds of exporters at China’s largest trade fair expect the slowdown in their markets to persist for at least six months, a Reuters poll has found, with the country expected to announce its weakest economic growth in decades early next week. Many economists expect data released on Monday to show China’s third quarter GDP dipped below 7%, the slowest rate since the global financial crisis. A weak showing could possibly prompt Beijing to take more steps to stimulate the economy. In the vast, booth-filled halls of the biannual Canton Fair on the banks of the Pearl River in Guangzhou this week, a poll of 103 mostly small to medium sized Chinese manufacturers found they expected orders to rise an average of 1.83% this year, though production costs were expected to rise 5.6% in the coming 12 months.

“I feel great pressure right now,” said Kelvin Qiu, the manager of a factory making heaters and radiators based in northeastern China. “I have around 40% less customers than before and the fair is quieter,” he said, comparing activity with the previous Canton fair in April. The Canton fair draws tens of thousands of Chinese exporters and foreign buyers into one gargantuan venue, and has long been regarded as barometer for an economy that has been the world’s biggest exporter since 2009. The poll’s results reflect a gathering pessimism in the export sector, a major driver of the world’s second largest economy. A similar Reuters survey in April had been more bullish, as it showed expectations that orders would rise 3.1%. Exports, however, fell 5.5% in August and 3.7% in September, reflecting anaemic global demand for China-made goods.

36% of exporters polled saying they expected a fresh wave of factory closures. 36% also said they expected an export rebound within 6 months, though 32% said the export slowdown would persist for over one year given continued weakness in core markets like Europe and the United States. Since the previous Canton Fair in April, China’s stock market crash and surprise currency depreciation have clouded the economic outlook, with Beijing taking a series of desperate measures – including interest rate cuts and ramped up fiscal spending – to galvanize growth. Its efforts have had limited success so far. China’s dominance as an exporter has been undermined by its previously strengthening currency, soaring labor costs, and a strategic shift by the authorities away from an excessive reliance on exports to domestic consumption.

Beijing in a bind.

• PBOC Data Suggest Capital Outflows Stayed Strong in September (Bloomberg)

Chinese financial institutions including the central bank sold a record amount of foreign exchange in September, a sign capital outflows were more severe last month than was previously thought. The offshore yuan fell to a two-week low. A gauge of their foreign-currency assets declined by the equivalent of 761.3 billion yuan ($120 billion), exceeding an August drop of 723.8 billion yuan, People’s Bank of China data showed Friday. China devalued its currency on Aug. 11 and concerns about further depreciation and slowing economic growth, coupled with the prospect of a U.S. interest-rate increase, are spurring outflows of funds.

“This shows although outflows probably did slow in September from August, they didn’t slow as much as previously expected,” said Chen Xingdong, chief China economist at BNP Paribas in Beijing. “If you look at commercial banks and the central bank as a unit, in August the central bank took more of the outflows and in September commercial banks took more.” Previous data showed the decline in the central bank’s foreign reserves moderated last month, giving rise to speculation that pressure for the yuan to weaken had eased from August. The holdings declined by $43.3 billion to $3.51 trillion, after sliding a record $93.9 billion the previous month, as the PBOC sold dollars to support China’s exchange rate.

This sounds like a death sentence: “..debt will increase to 254% of GDP in 2015, up from 248% last year.” 46% of GDP was investment, not production.

• Good News Is Bad News for China (Bloomberg)

On Monday, the Chinese government will once again try to convince the world its troubled economy is not that bad off after all. Third-quarter GDP data will be released, and whether the growth rate beats or misses consensus estimates, it’s likely to be touted by the government as proof of the economy’s continued resilience. No doubt that’ll help further calm investors, whose worst fears about China have ebbed recently. Overly bearish perceptions of China’s economy have become “thoroughly divorced from facts on the ground” proclaims the latest China Beige Book study. In a survey conducted in October by Bank of America-Merrill Lynch, only 39% of fund managers queried considered China the biggest “tail risk,” down significantly from 54% a month earlier.

Those investors shouldn’t get too comfortable. The panic that roiled global stock and currency markets over the summer may well have been overblown. But the real risks to China’s economic well-being are long-term, and they haven’t diminished. In fact, the strong growth rates could be setting the stage for a harder landing later. Even the regime agrees that China’s economy is seriously flawed. Excess capacity is rampant in steel, cement and other industries. Debt has risen to astronomical levels. The growth model China used during its hyper-charged decades — unleashing productivity by tossing its 1.3 billion poor workers into the global supply chain – has lost steam as costs rise and the workforce ages.

How well is China tackling these problems? Not very. Debt continues to rise even as growth slows. IHS Global Insight estimates debt will increase to 254% of GDP in 2015, up from 248% last year. In all-too-many sick industries, zombie companies are being kept afloat by creditors and the government. Deeper free-market reform is needed to spur entrepreneurship and innovation and better allocate financial resources to the most efficient companies. Yet despite much talk from President Xi Jinping and his Communist Party comrades, progress has been glacial. The government’s new plan to improve the performance of bloated state enterprises is underwhelming.

Authorities have done little to make the banking sector more commercially oriented or to open the economy to greater foreign competition or capital flows. The government’s heavy-handed intervention to quell a mid-summer stock market swoon was rightly seen a step backwards. Above all, the economy needs to “rebalance” away from its unhealthy reliance on investment – which according to Goldman Sachs’ Ha Jiming, totaled 46% of GDP last year, more than during Mao’s disastrous Great Leap Forward.

Bad data.

• Eurozone Inflation Confirmed At -0.1% In September (Reuters)

Annual inflation in the euro zone turned negative in September due to sharply lower energy prices, the EU’s statistics office confirmed on Friday, maintaining pressure on the ECB to increase its asset purchases to boost prices. Eurostat said consumer prices in the 19 countries sharing the euro fell by 0.1% in the year to September, dipping below zero for the first time since March, and confirming its earlier estimate. Compared to the previous month, prices were 0.2% higher in September. Eurostat said milk, cheese and eggs were cheaper, while heating oil and motor fuel stripped almost a full percentage point from the annual rate. Restaurants and cafes, vegetables and tobacco had the biggest upward impact.

Excluding the most volatile components of unprocessed food and energy – what the ECB calls core inflation – prices were 0.8% up year-on-year, slightly down from the previous reading of 0.9%. Month-on-month, they rose 0.4%. Long term inflation expectations have dropped to their lowest since February, before the ECB’s asset purchases started, as China’s economic slowdown, the commodity rout and paltry euro zone lending growth reinforce pessimistic predictions. Under its money-printing quantitative easing scheme, the ECB is buying government bonds and other assets to pump around €1 trillion into the economy, aiming to lift inflation towards its target rate of just under 2%.

Race to the bottom.

• Party Time Is Over For Norway’s Oil Capital – And The Country (Reuters)

In Norway’s oil capital Stavanger, house prices are falling, unemployment is rising and orders of champagne and sushi sprinkled with gold are down – a taste of things to come for the rest of the country as slumping crude prices hit the economy. The oil-producing nation used to be the exception in Europe. At the height of the financial crisis in 2009, unemployment reached just 2.7%; when other nations have had to cut welfare spending, Oslo could rely on its $856-billion sovereign wealth fund to plug any budget deficit. But now it is joining the rest of Europe in its economic slump as oil prices have halved. GDP growth is expected to stagnate at 1.2% in 2015 and 2016. And the government expects to make its first ever net withdrawal from the fund next year as state oil revenues decline with crude prices.

“It is a new era for the Norwegian economy. We are no longer in a league of our own,” Governor Oeystein Olsen said when the central bank unexpectedly cut rates to 0.75% on Sept. 24 to support a slowing economy. Business conditions for companies in Stavanger and the surrounding region got even worse in the third quarter and the weaker sentiment is spreading to firms outside the energy industry, a survey said in September. Demand is lower and profitability is down, it said. Boosting competitiveness has been the mantra of the right-wing minority government of Prime Minister Erna Solberg, which is proposing to cut corporate tax to boost firms’ international competitiveness. Norway as an exception was most on show in Stavanger, the country’s fourth-largest city, with its compact center of white wooden houses and oil industry ships anchored in the harbor. It enjoyed the good times more than anywhere else.

“Citizens of resource-rich countries tended to be less literate, live 4.5 years less and have higher rates of malnutrition among women and children than other African states..”

• Africa’s Poor Grow By 100 Million Since 1990: World Bank (Reuters)

The number of Africans trapped in poverty has surged by around 100 million over the past quarter century, the World Bank said on Friday, despite years of economic growth and multi-million dollar aid programs. The report’s figures, described as “staggering” by the bank’s Africa head Makhtar Diop, showed widespread malnutrition, and rising violence against civilians, particularly in central regions and the Horn of Africa. “It is projected that the world’s extreme poor will be increasingly concentrated in Africa,” Diop added in a foreword. A surge in population meant the proportion of Africans in poverty had actually fallen since 1990, but the actual numbers were up. In a major study of households taking stock of African economies and societies after two decades of relatively strong growth, the Bank said 388 million – 43% of the sub-Saharan region’s 900 million people – lived on less than $1.90 a day.

In 1990, at the start of the study period, the ratio was 56%, or 284 million. The findings present a mixed bag for countries that, on average, enjoyed economic growth of 4.5% over the last two decades, dubbed the era of ‘Africa Rising’ in contrast to the post-independence stagnation, war and decay that typified the 1970s and 1980s. A child born in Africa now is likely to live more than six years longer than one born in 1995, the study found, while adult literacy rates over the same period have risen 4 percentage points. However, the Bank defined Africa’s social achievements as “low in all domains” – for instance, tolerance of domestic violence in Africa is twice as high as other developing regions – and noted that the rates of improvement were leveling off.

“Despite the increase in school enrolment, today more than two out of five adults are unable to read or write,” the report said. “Nearly 2 in 5 children are malnourished and 1 in 8 women is underweight,” it continued. “At the other end of the spectrum, obesity is emerging as a new health concern.” Perhaps most disturbingly, the study presented more evidence of the ‘resource curse’ that afflicts states endowed with plentiful reserves of hydrocarbons or minerals, often the source of internal or external conflict, or corruption and government ineptitude. Citizens of resource-rich countries tended to be less literate, live 4.5 years less and have higher rates of malnutrition among women and children than other African states, the study found.

Weaker emerging markets will be hit hardest.

• Stress Building in Kenyan Credit Markets Spells Doom for Growth (Bloomberg)

Doubts are growing about Kenya’s ability to keep economic growth on the boil as it battles a plunging stock market, surging debt costs and a weaker currency. Kenyan shilling bonds have lost more money this month than the local securities of 31 emerging markets, while equities in East Africa’s largest economy dropped the most out of 93 global indexes. Efforts to stabilize the shilling have sucked liquidity out of foreign exchange and money markets, spurring a scurry for cash that is driving short-term borrowing costs higher just as the central bank takes over the management of two lenders. An economic expansion that outstripped peers in sub-Saharan Africa since 2011 is slowing as attacks by Islamist militants decimate Kenya’s tourism industry and a drought cuts exports of tea, the two largest sources of foreign exchange.

As President Uhuru Kenyatta’s administration ramps up spending on transport and energy projects to keep fueling growth, budget and current-account deficits are swelling and interest rates are rising. “It’s not looking like there will be an inflexion point for the better any time soon,” Bryan Carter at Acadian Asset Management, who cut all his Kenya bond holdings earlier this year, said by phone from Boston. “The currency looks overvalued.” Yields on short-term Treasury bills have surged above longer-dated bonds, an anomaly known as an inverted yield curve that signals investors are more concerned about near-term repayment risks than economic prospects further out. Rates on 91-day T-bills jumped to 21.4% at an auction on Oct. 8, a record high. That compares with yields of 14.6% on 21 billion shillings ($204 million) of bonds maturing in March 2025.

The inverted curve is “indicative of short-term funding stress in the economy, which is typically followed by a slowdown of credit growth and cyclical economic growth,” Chris Becker at Investec in Johannesburg, said in a note. The World Bank cut its estimate for 2015 growth in Kenya to 5.4% on Thursday, compared with a December forecast of 6%, saying volatility in foreign-exchange markets and the subsequent monetary policy response will curb output. Kenya’s shilling has weakened 12% against the dollar this year amid a rout in emerging-market currencies. The central bank’s Monetary Policy Committee countered by raising the benchmark rate 300 basis points to 11.5%. Investors have been unnerved by the seizure of two small banks in as many months. Regulators placed Imperial Bank under administration on Tuesday, the same day the closely held lender was due to start trading bonds on the Nairobi Securities Exchange.

Great historical perspective.

• Ancient Rome and Today’s Migrant Crisis (WSJ)

When ancient Romans looked back to their origins, they told two very different stories, but each had a similar message. One founder of the Roman race was Aeneas, a refugee from the losing side in the Trojan War, who endured storm and shipwreck around the Mediterranean before landing in Italy to establish his new home. The other was Romulus who, in order to find citizens for the little settlement he was building on the banks of the Tiber, declared it an “asylum” and welcomed any runaways and criminals who wanted to join. It was a remarkable story even in antiquity. Some of Rome’s enemies were known to have observed sharply that you could never trust men descended from a band of ruffians.

In the past 500 years, politicians in the West have often returned to ancient Rome and ancient Greece in search of models for their own decisions and policies (or, more often, for self-serving justifications). On questions of citizenship, they have found two wildly conflicting examples. The stories told by the democracy of ancient Athens were typical of the Greek cities. When they looked back to their origins, they imagined that the first Athenians sprang directly out of the soil of Athens itself. The difference was significant. The Athenians rigidly restricted the rights of citizenship, eventually insisting that people should have both a citizen father and a citizen mother to qualify. Ancient democracy came at a price: It was only possible to share political power equally if you severely limited those who were to be allowed to be equals and to join the democratic club.

That is a price that many European democracies are now wondering whether they must pay too. Rome was never a democracy in the Athenian sense. The Roman Empire, brutal as it could often be, was founded on very different principles of incorporation and of the free movement of people. Over the first thousand years of its history, from the eighth century B.C., it gradually shared the rights and protection of full Roman citizenship with the people that it had conquered, turning one-time enemies into Romans. That process culminated in 212 A.D., when the emperor Caracalla made every free inhabitant of the empire a citizen—perhaps 30 million people at once, the single biggest grant of citizenship in the history of the world.

When the Romans looked back to their beginnings, they saw themselves as a city of asylum seekers. John F. Kennedy, in his “Ich bin ein Berliner” speech in the middle of the Cold War, praised ideas of Roman citizenship as an inspiration for Western liberty. “Two thousand years ago,” he said, “the proudest boast was ‘civis Romanus sum’”: that is, “I am a Roman citizen.” He was referring to the freedoms guaranteed by citizen status, particularly rights of legal protection and, in the Roman context, immunity from particularly degrading forms of punishment, including crucifixion.

And a great future perspective.

• Immigrants To Account For 88% Of US Population Increase In Next 50 Years (Pew)

Fifty years after passage of the landmark law that rewrote U.S. immigration policy, nearly 59 million immigrants have arrived in the United States, pushing the country’s foreign-born share to a near record 14%. For the past half-century, these modern-era immigrants and their descendants have accounted for just over half the nation’s population growth and have reshaped its racial and ethnic composition. Looking ahead, new Pew Research Center U.S. population projections show that if current demographic trends continue, future immigrants and their descendants will be an even bigger source of population growth.

Between 2015 and 2065, they are projected to account for 88% of the U.S. population increase, or 103 million people, as the nation grows to 441 million. These are some key findings of a new Pew Research analysis of U.S. Census Bureau data and new Pew Research U.S. population projections through 2065, which provide a 100-year look at immigration’s impact on population growth and on racial and ethnic change. In addition, this report uses newly released Pew Research survey data to examine U.S. public attitudes toward immigration, and it employs census data to analyze changes in the characteristics of recently arrived immigrants and paint a statistical portrait of the historical and 2013 foreign-born populations.

More footage of razor wire and news of drowning children. Europe is completely lost.

• Hungary Seals Border With Croatia to Stem Flow of Refugees (Bloomberg)

Hungary will seal its border with Croatia from midnight on Friday, expanding one of the European Union’s toughest set of measures to stem the influx of refugees, Foreign Minister Peter Szijjarto said in Budapest. “This is the second-best option,” Szijjarto told reporters. “The best option, setting up an EU force to defend Greece’s external borders, was rejected in Brussels yesterday.” An EU summit on Thursday failed to reach a final agreement on recruiting Turkey to help control the flow of refugees as Russia’s bombing campaign in Syria threatens to push more people to seek safety. The bloc’s leaders also made little progress on how to redesign the system of distributing immigrants, forming an EU border-guard corps or on ensuring arrivals are properly processed.

Hungary has extended an existing barbed-wire fence on its border with Serbia to cover its frontier with Croatia. Prime Minister Viktor Orban warned this week that his government would complete the barrier if EU leaders fail to agree on closing the Greek border, the main entry point for Syrian and other Middle Eastern refugees into the 28-nation bloc. Croatia will now help transport migrants to its border with Slovenia, in agreement with its northwestern neighbor, Croatian Deputy Prime Minister Vesna Pusic told state TV late Friday. From Slovenia refugees are likely to travel to Austria and on to Germany. “Slovenia will not close its border unless Germany closes its border, in which case Croatia will be forced to do the same,” Pusic said. “We will discuss with Slovenia the number of people we can bring to them.”

More than 180,000 migrants have entered Croatia from Serbia since they started arriving in mid-September, according to police data. Most of them have since left the country to Hungary, while a minority entered Slovenia as they seek to reach western European countries. Several eastern European countries are trying to avoid hosting migrants and are against mandatory quotas for the distribution of refugees within the EU. More than 380,000 asylum seekers have crossed into Hungary from the western Balkans this year and the number may reach 700,000 by the end of 2015, government spokesman Zoltan Kovacs told reporters in Budapest on Friday. From Saturday, refugees won’t be able to enter Hungary from Croatia except at designated border crossings.

“..on an average day around 5,000 people make the crossing..” That’s 150,000 a month. 1.8 million a year. Just one border crossing.

• Remote Greek Village Becomes Doorway To Europe (Omaira Gill)

Idomeni is a small village sitting within comfortable walking distance of Greece’s border with Macedonia. The 2011 census put its population at just 154 inhabitants. The locals themselves tell you there is nothing remarkable about the place, except for the stream of refugees flocking to this outpost to cross into Macedonia. Yiannis Panagiotopoulos, an Athenian taxi driver recently ferried a newly arrived group of Syrians from Athens to Idomeni. “They were so well dressed. I asked for €1,000 expecting them to protest, and they immediately paid me in cash. The were Coptic Christians and said Saudi Arabia is giving each non-Muslim $2,000 and a smartphone to leave because they want Syria for Muslims only.” Everyone wants to get to Idomeni, and if you can’t afford a taxi, there are plenty of unofficial buses that’ll take you there for €35.

The buses are more or less an illegal operation. Certain cafes near Victoria Square sell the tickets for cash, no receipts, and the trip that should take five and a half hours ends up taking nine because of various meandering detours to avoid rumored police checkpoints. Along the way, service stations have bumped up their prices to cash in on this unexpected windfall. At one, hot meals carry a starting price of eight euros, an extortionate amount for crisis-era Greece. Sitting in the front of one such coach, crammed to the last seat as children sleep on coats laid in the aisle, was 34-year-old Yahyah Abbas from Aleppo in Syria. Before the war, he used to work in a cosmetics distribution company. Now, he said, there is nothing in Syria, “only the devil.” “Syria was the best country in the world. It was ruined by terrorists. I love Bashar al Assad, he is the best. But I cannot live in my country because of terrorists.”

[..] After months of chaos and violent scenes at the border this summer the operation at the border has now fallen into an efficient routine that works “most of the time,” Greek authorities say. The border with Macedonia opens every 15 minutes to accept a group of 50-80 people. When the buses finally arrive at Idomeni, they offload passengers at a rate relevant to the pace of the crossings. Greek police issue each bus load with a number for their group which represents the order in which they will cross. They estimate that on an average day around 5,000 people make the crossing. Volunteers meet the groups straight off the bus and direct them to food, water, toiletries, clothes and medical attention. Then, they wait in huge white UNHCR tents until their turn comes.

“They announce they’ll take in 30,000 to 40,000 refugees and then they are nominated for the Nobel for that. We are hosting two and a half million refugees but nobody cares..”

• Turkey Pours Cold Water On Migrant Plan, Ridicules EU (AFP)

The EUs much-hyped deal with Turkey to stem the flow of migrants looked shaky on Friday after Ankara said Brussels had offered too little money and mocked Europe’s efforts to tackle the refugee crisis. Just hours after the EU announced the accord with great fanfare at a leaders’ summit, Ankara said the plan to cope with a crisis that has seen some 600,000 mostly Syrian migrants enter the EU this year was just a draft. Cracks in the deal emerged as Bulgaria’s president apologised after an Afghan refugee was shot dead crossing the border from Turkey. In the latest in a series of jabs at Europe over the crisis, Turkish President Recep Tayyip Erdogan ridiculed the bloc’s efforts to help Syrian refugees and challenged it to take Ankaras bid for EU membership more seriously.

“They announce they’ll take in 30,000 to 40,000 refugees and then they are nominated for the Nobel for that. We are hosting two and a half million refugees but nobody cares,” said Erdogan. Turkish Foreign Minister Feridun Sinirlioglu then slammed an offer of financial help made by top European Commission officials during a visit on Wednesday, saying his country needed at least €3 billion in the first year of the deal. “There is a financial package proposed by the EU and we told them it is unacceptable,” Sinirlioglu told reporters, adding that the action plan is “not final” and merely “a draft on which we are working.” Under the tentative agreement, Turkey had agreed to tackle people smugglers, cooperate with EU border authorities and put a brake on refugees fleeing the Syrian conflict from crossing by sea to Europe.

In exchange, European leaders agreed to speed up easing visa restrictions on Turkish citizens travelling to Europe and give Ankara more funds to tackle the problem, although it did not specify how much. As he announced the agreement on Thursday night, European Council President Donald Tusk had hailed the pact as a “major step forward” but warned that it “only makes sense if it effectively contains the flow of refugees.” European officials said they were still waiting for concrete steps from Turkey and said that the €3 billion demanded by Ankara would be a problem for the EUs 28 member states. Even as the summit was underway, the volatile situation on the EUs frontier with Turkey exploded into violence with the fatal Bulgarian border shooting, which the UN refugee agency said was the first of its kind.

The victim was among a group of 54 migrants spotted by a patrol near the southeastern town of Sredets close to the Turkish border and was wounded by a ricochet after border guards fired warning shots into the air, officials said. The migrants were not armed but they did not obey a police order to stop and put up resistance, they said. Bulgarian president Rosen Plevneliev said he “deeply regrets” the shooting but said it showed the need for “rapid common European measures to tackle the roots of the crisis.” The death adds to the toll of over 3,000 migrants who have died while trying to get to Europe this year, most of them drowning in the Mediterranean while trying to sail across in rubber dinghies or flimsy boats.

Home › Forums › Debt Rattle October 17 2015