Edward S. Curtis Lucille, Dakota Sioux 1907

Read this excellent piece by Gareth Porter and you’ll never believe another single word about meddling. DHS made it all up, because it wanted to be the no. 1 cybersecurity unit in the US.

• Department of Homeland Security Lied About Russia Hacking US Voter Sites (CN)

The narrative of Russian intelligence attacking state and local election boards and threatening the integrity of U.S. elections has achieved near-universal acceptance by media and political elites. And now it has been accepted by the Trump administration’s intelligence chief, Dan Coats, as well. But the real story behind that narrative, recounted here for the first time, reveals that the Department of Homeland Security (DHS) created and nurtured an account that was grossly and deliberately deceptive. DHS compiled an intelligence report suggesting hackers linked to the Russian government could have targeted voter-related websites in many states and then leaked a sensational story of Russian attacks on those sites without the qualifications that would have revealed a different story.

When state election officials began asking questions, they discovered that the DHS claims were false and, in at least one case, laughable. The National Security Agency and special counsel Robert Mueller’s investigating team have also claimed evidence that Russian military intelligence was behind election infrastructure hacking, but on closer examination, those claims turn out to be speculative and misleading as well. Mueller’s indictment of 12 GRU military intelligence officers does not cite any violations of U.S. election laws though it claims Russia interfered with the 2016 election.

“With impeccable timing, there is a flood of new condos expected to be completed over the next two years..”

• Housing Bubble Pops in Sydney & Melbourne

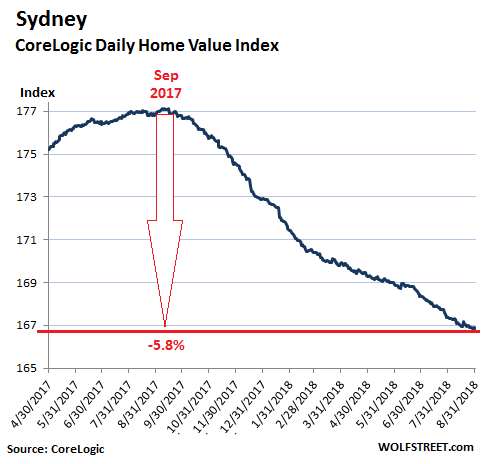

In Sydney, breeding ground for one of the world’s biggest housing bubbles, prices of single-family houses dropped 7.3% in August, compared to a year earlier. Prices of “units” — condos in US lingo — fell 2.2% year-over-year. Price declines were the sharpest at the high end, with prices down 8.1% in the most expensive quarter of home sales. Prices of all types of homes combined fell 5.6%, according to CoreLogic’s Daily Home Value Index. The index is down 5.8% from its peak last September:

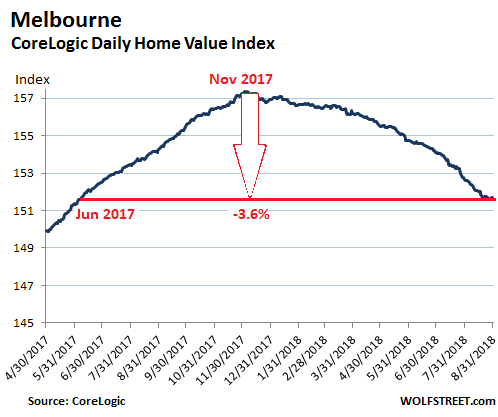

Melbourne, where the inflection point has been lagging a few months behind Sydney’s, is in the process of catching up. Over the three month-period, June-August, prices fell 2.0%, making Melbourne the weakest housing market among the capital cities. By segment, house prices fell 2.7% from a year ago while condo prices still inched up 1.5%. At the most expensive quarter of sales, prices fell 5.2% from a year ago. For all types of dwellings combined, prices declined 1.7% year-over-year, to the lowest level since early June 2017, according to CoreLogic. Prices are down 3.6% from their peak at the end of November 2017:

[..] With impeccable timing, there is a flood of new condos expected to be completed over the next two years, something avid crane-counters in Sydney and Melbourne have been swearing for a while. Here are some of these astounding numbers that CoreLogic estimates based on data it collected from the industry: Greater Sydney: In 2019: 31,500 new condos are scheduled to be completed. In 2020, another 45,500 condos are expected to be completed. This brings the two-year total of new condos to 77,000 units, which will increase the total stock of condos by 9.3%! Greater Melbourne: The oncoming flood of new condos is expected to reach 29,000 units in 2019 and nearly 50,000 units in 2020. Over the two years, this will increase the total stock of condos by nearly 79,000 units, or by 11.5%!

“Even property investors have been priced out of the market.”

• Sydney, Melbourne Have Zero Cashflow Positive Suburbs Left (News.com.au)

Even property investors have been priced out of the market. There are “currently no suburbs” in Sydney, Melbourne or Canberra where an investor can buy a detached house and expect it to be cashflow positive with a deposit of 20 per cent or less, according to an analysis by Propertyology. Releasing a list of the country’s “best capital city cash cow suburbs”, the research firm said buyers would have to travel to the Central Coast, 100km from the Sydney CBD, before finding an investment property with decent cashflow. Even then, a median-priced $490,000 house in Lake Munmorah — the least worst “Sydney” suburb identified in Propertyology’s list — will leave the investor $3093 out of pocket.

“Victoria paints a similar picture, with greater Melbourne’s best locations for cash flow investors within the municipality of Melton — 40km northwest of the CBD,” Propertyology head of research Simon Pressley said in a statement. It comes as CoreLogic figures showed national dwelling values fell for the 11th consecutive month in August, led by weakness in the two major capitals that comprise about 60 per cent of Australia’s housing market by value. Negatively geared properties — when the rental return is less than the interest payments and other costs — are “okay when you’re getting 10 per cent capital growth year in, year out”, said AMP Capital chief economist Dr Shane Oliver.

But investors now face falling house prices, rising interest rates, tighter lending conditions and the possibility of a future Labor government cracking down on negative gearing and capital gains tax breaks. “The equation gets more complicated,” Dr Oliver said.

Getting rich off of other people’s work.

• Europe’s News Agencies Blast Google, Facebook For ‘Plundering’ Content (AFP)

Europe’s biggest news agencies accused Google and Facebook of “plundering” news for free on Tuesday in a joint statement that called on the internet giants to share more of their revenues with the media. In a column signed by the CEOs of around 20 agencies including France’s Agence France-Presse, Britain’s Press Association and Germany’s Deutsche Presse-Agentur they called on the European Parliament to update copyright law in the EU to help address a “grotesque imbalance”. “The internet giants’ plundering of the news media’s content and of their advertising revenue poses a threat both to consumers and to democracy,” the column said.

European Parliament lawmakers are to set to debate a new copyright law this month that would force the internet giants to pay more for creative content used on their platforms such as news, music or movies. A first draft of the law was rejected in July and the plans have been firmly opposed by US tech firms, as well as advocates of internet freedom who fear that the regulations could lead to higher costs for consumers. “Can the titans of the internet compensate the media without asking people to pay for access to the internet, as they claim they would be forced to? The answer is clearly ‘yes’,” the column said. The joint statement from the agencies, which are major suppliers of news, photos and video, said Facebook reported revenues of $40 billion (34 billion euros) in 2017 and profits of $16 billion, while Google made $12.7 billion on sales of $110 billion.

Been here before. This time is wider and deeper.

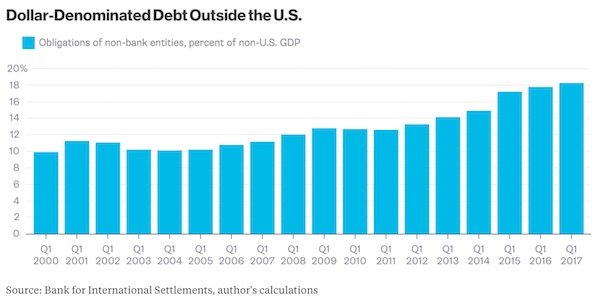

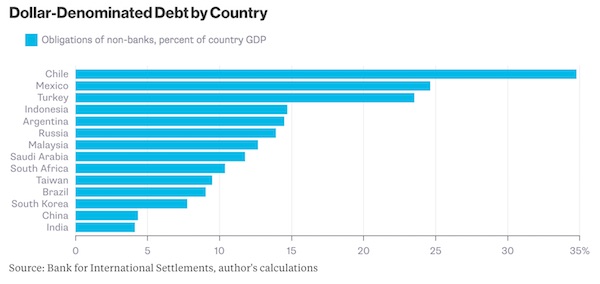

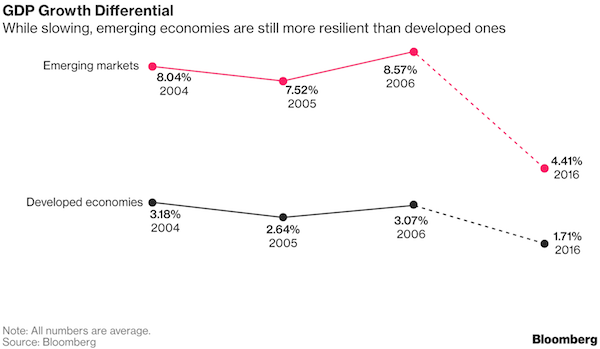

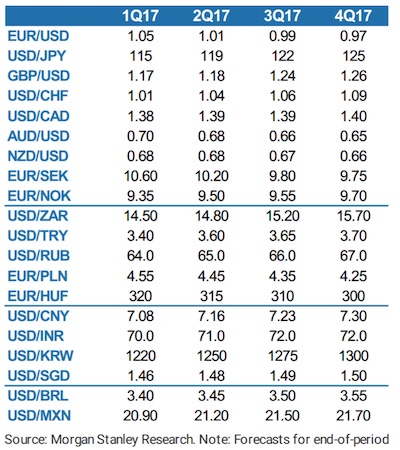

• The Emerging Market Crisis Is Back. And This Time It’s Serious (CNBC)

Markets have a very short attention span. Like babies, they move on quickly from one toy, or in this case an event, to another. For instance, markets seem to have moved on from the formation of the “Fragile Five,” a group of countries that suffered heavily when the U.S. Federal Reserve started to roll back its bond-buying program in 2013. Made up of Brazil, India, Indonesia, Turkey and South Africa, this group was marked by heavy currency depreciation, high current account deficits and political instability at home. The slump in commodity prices and fears of a Chinese slowdown kept the pressure on these economies. However, they have started to see a comeback; in India and Indonesia, for example, a change in government has led to political and economic reforms.

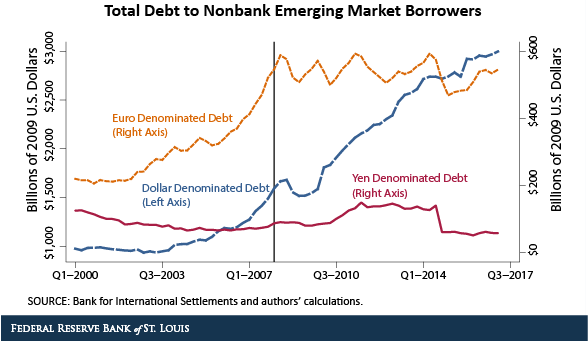

Investors started crowding this space and inflows into funds with exposure to these markets increased. But markets are feeling a sense of deja vu. Blame it on a stronger dollar, escalating tensions since President Donald Trump came to power, worries over a full-fledged trade war with China or rising interest rates in the U.S., this time around the crisis seems to have entered a new phase. The damage is far more widespread. The crisis has engulfed countries across the globe — from economies in South America, to Turkey, South Africa and some of the bigger economies in Asia, such as India and China. A number of these countries are seeing their currency fall to record levels, high inflation and unemployment, and in some cases, escalating tensions with the United States.

“..the rise of the rule of man begins to squeeze out the rule of law..”

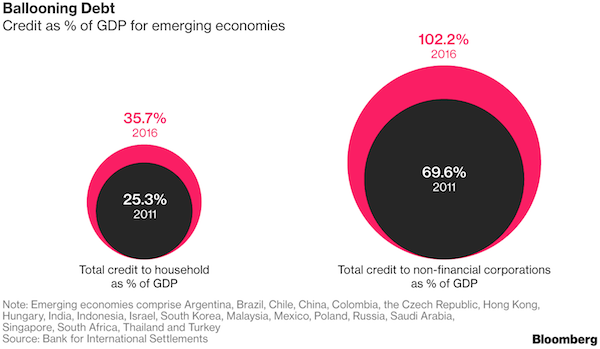

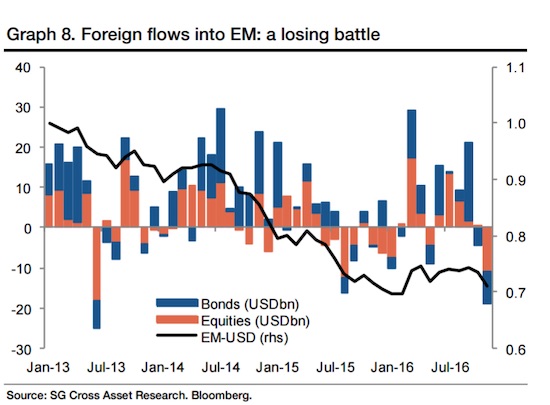

• Bringing Up The Bodies in Emerging Markets (Napier)

Investors brought up in the developed world take for granted the stability and continuation of the rule of law. They expect it to be as available and constant as air. Anyway, what role can a consideration of the rule of law play in trying to obtain index beating quarterly returns? It is this myopia and not the myopia associated with the short-term dumping of assets, because they are labelled ‘emerging markets’, that is particularly dangerous. The history of emerging markets is the history of populism, the real populism that subverts human rights and property rights. On the rise in emerging markets, this populism is resulting in a growing exodus of what are now very large sums, even in global terms, of local savings.

It is the shift in local savings, more so than foreign savings, that is pushing emerging market exchange rates to ever lower levels. It is not the flighty financial capital seeking slightly better interest rate differentials that departs in situations like this. It is the financial capital that funds development and growth that flees, as the rise of the rule of man begins to squeeze out the rule of law. The loss of such capital has profound long-term economic impacts. There is a key reason why the strong men are on the rise and the rule of law on the decline: the world is failing to inflate away its debts. Even before we invented paper money, there was a well recognized method of inflating away debts.

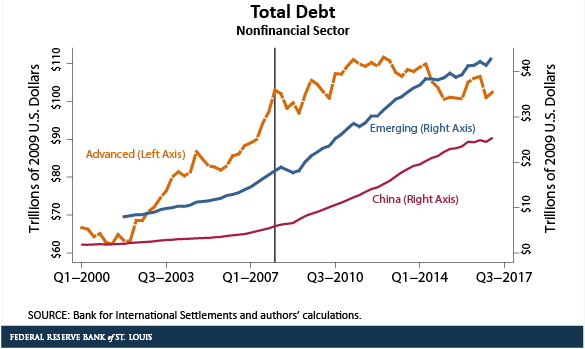

Perhaps most famously Henry VIII’s so-called great debasement (1544-1551) inflated away the excessive debts run up to fund wars with France and Scotland, as well as a bit of lavish spending by the king himself. Your analyst meets investors almost every day who believe that inflation is currently playing a similar role. However, such an assertion ignores the fact that the global non-financial debt to GDP ratio is now 244% up from what seemed a dangerous level of 210% of GDP as the global economy peaked in December 2007.

A nation that hasn’t moved in decades.

• Brexit Is The Wrong Diagnosis Of A Real Crisis (LSE)

The Leave campaign in 2016 had a lot in common with the 1979 Conservative election manifesto. Both evoked the threat of a bureaucratic super-state and something approaching a conspiracy of that state against the public. Both promised to rescue a Greater Britain from the conspiratorial political forces that were holding it back. Both campaigns were a misdiagnosis of the real crisis at hand. This time we face a crisis of ungovernability potentially far more severe than that of the 1970s; but its roots are less in Europe than in the failures of the homegrown neoliberal reforms of the British state.

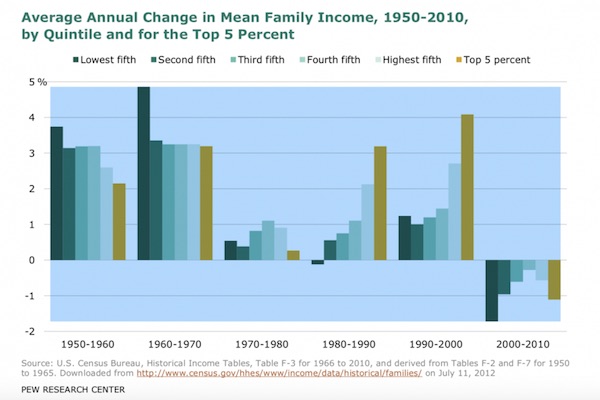

The last three decades of state reform in Western democracies have aggravated rather than resolved the social divisions that emerged with de-industrialisation. Over the last thirty years, liberal market economies in general and the UK in particular have transformed the character of their states through privatization and outsourcing, through the development of quasi markets in welfare, and the rejection of industrial policies. At the same time, permissive tax and regulatory regimes have encouraged large corporations to opt out of their former social obligations in the name of maximising shareholder value.

The ‘supply-side revolution’ of the last thirty years was driven by the dominant New Right diagnosis of the economic crises of the 1970s and based on the radical public choice economics aligned with the Chicago and Virginia schools. According to this diagnosis it was the state that was primarily responsible for the end of the post-war ‘golden age of growth’ because of its inhibition of the market. Thus, according to the New Right and later New Labour too, it wasn’t technological change, or de-industrialisation in the face of emerging markets, it wasn’t the Nixon shock, or the end of Bretton Woods, nor rising exchange rate instability, it wasn’t stagflation or the oil crises that had confronted the country with a need to re-evaluate its production regime. It was the state. And so it was the state, above all else, that had to be transformed.

But still there’s “A wave of African nations seeking to restructure their debt with China”. Care to explain?

• China Says It Is Helping Africa Develop, Not Accumulate Debt (R.)

China is helping Africa achieve development, not accumulate debt, a top Chinese official said on Tuesday, as the government pushes back against criticism it is loading the continent with an unsustainable burden during a major summit in Beijing. Chinese President Xi Jinping on Monday pledged funds of $60 billion to African nations at the opening of the Forum for China-Africa Cooperation, matching the size of the financing package offered at the last summit in Johannesburg in 2015. A wave of African nations seeking to restructure their debt with China has served as a reality check for Beijing’s relationship with the continent, though most countries still see Chinese lending as the best bet to develop their economies.

“If we take a closer look at these African countries that are heavily in debt, China is not their main creditor,” China’s special envoy for Africa, Xu Jinghu, told a news conference. “It’s senseless and baseless to shift the blame onto China for debt problems.” China would carefully choose projects that avoid causing debt problems when pushing forward with Xi’s pledges to Africa, she added. “When we cooperate with African countries we will conscientiously and fully carry out feasibility studies, to choose which projects can go ahead. These projects will take into account their development prospects so as to help African countries achieve sustainable development and avoid debt or financial problems.”

“The shale oil “miracle” was a stunt enabled by supernaturally low interest rates..”

• The Uncomfortable Hiatus (Kunstler)

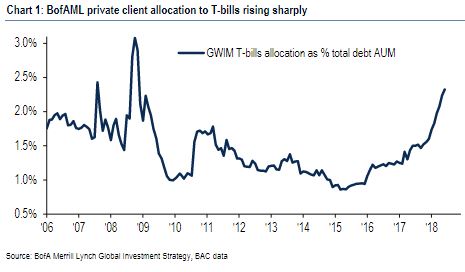

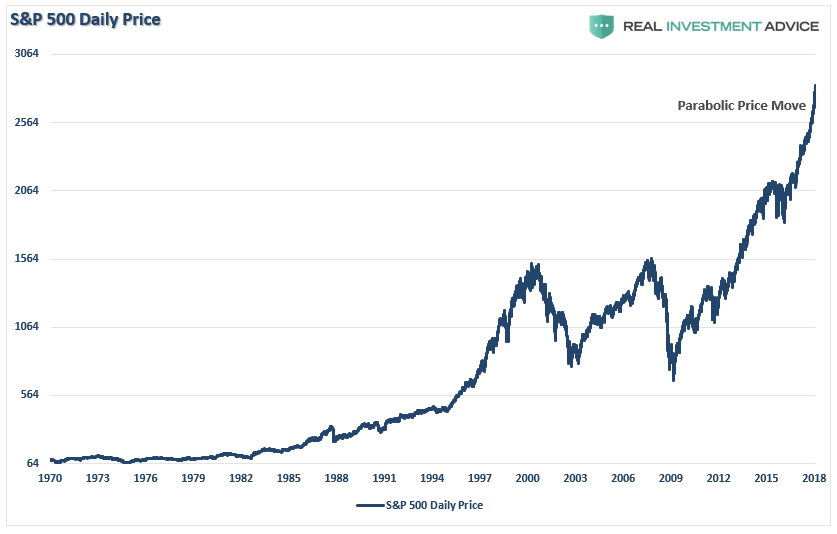

Energy: The shale oil “miracle” was a stunt enabled by supernaturally low interest rates, i.e. Federal Reserve policy. Even The New York Times said so yesterday (The Next Financial Crisis Lurks Underground). For all that, the shale oil producers still couldn’t make money at it. If interest rates go up, the industry will choke on the debt it has already accumulated and lose access to new loans. If the Fed reverses its current course — say, to rescue the stock and bond markets — then the shale oil industry has perhaps three more years before it collapses on a geological basis, maybe less. After that, we’re out of tricks. It will affect everything. The perceived solution is to run all our stuff on electricity, with the electricity produced by other means than fossil fuels, so-called alt energy.

This will only happen on the most limited basis and perhaps not at all. (And it is apart from the question of the decrepit electric grid itself.) What’s required is a political conversation about how we inhabit the landscape, how we do business, and what kind of business we do. The prospect of dismantling suburbia — or at least moving out of it — is evidently unthinkable. But it’s going to happen whether we make plans and policies, or we’re dragged kicking and screaming away from it. Corporate tyranny: The nation is groaning under despotic corporate rule. The fragility of these operations is moving toward criticality. As with shale oil, they depend largely on dishonest financial legerdemain. They are also threatened by the crack-up of globalism, and its 12,000-mile supply lines, now well underway. Get ready for business at a much smaller scale.

Hard as this sounds, it presents great opportunities for making Americans useful again, that is, giving them something to do, a meaningful place in society, and livelihoods. The implosion of national chain retail is already underway. Amazon is not the answer, because each Amazon sales item requires a separate truck trip to its destination, and that just doesn’t square with our energy predicament. We’ve got to rebuild main street economies and the layers of local and regional distribution that support them. That’s where many jobs and careers are.

In the most corrupt places on earth, Monsanto can do what it wants.

• Brazil Court Lifts Ban On Monsanto’s Glyphosate Weedkiller (AFP)

An appellate court on Monday lifted a court-ordered suspension of licenses in Brazil for products containing glyphosate, an industrial weedkiller in common use in Latin America’s agricultural powerhouse. Federal appeals court judge Kassio Marques ruled that “nothing justified” the suspension by a lower court, saying it had been abruptly imposed “without previous analysis of the grave impact it would have on the country’s economy and on production in general.” The suspension, which had been ordered August 3 by a federal judge in Brasilia, was supposed to go into effect on Monday until a “toxicological re-evaluation” of all products containing glyphosate could be completed by Brazil’s sanitary authority.

The ban also was to have extended to products containing the chemicals thiram and abamectin. Glyphosate is used in weedkillers like Roundup, made by Monsanto, whose parent company Bayer had urged that the ban be scrapped. Bayer hailed the suspension as “very good news for Brazilian farmers.” It comes just weeks after a jury in California ordered Monsanto to pay $289 million to a dying former school groundskeeper for failing to warn him of the risk that Roundup might cause cancer.