Pablo Picasso Nude, Green Leaves and Bust 1932

Nothing has value anymore.

• Global Shares Rise To Record New Highs (R.)

Upbeat data helped send world shares to a fourth all-time high in less than a month on Thursday as Wall Street edged higher in anticipation of solid earnings, while crude oil gained on evidence of stronger demand in China. Stocks were buoyed in Asia and elsewhere a day after Federal Reserve Chair Janet Yellen signaled a rise in interest rates would be less aggressive than some investors had expected. Sentiment was boosted after China reported upbeat data on exports and imports for June, the latest sign that the global growth is picking up a bit. That offset reports of higher production by key members of OPEC in a report by the International Energy Agency (IEA), lifting oil prices.

The data pushed Asian shares up more than 1% and lifted MSCI’s 47-country gauge of global equity markets to a fresh record high with a gain of 0.29%. “Yesterday’s move was in response to Yellen comments that should inflation remain below the 2% target rate, the central bank will be less aggressive in their tightening program,” said Sam Stovall, chief investment strategist at CFRA Research. “Today, the market is saying that’s old news and let’s focus on the matter at hand, which is earnings that will be coming out in earnest this week,” Stovall said. U.S. shares rose in anticipation second-quarter earnings will grow 7.8% for S&P 500 companies, according to Thomson Reuters data.

Don’t worry, everybody is.

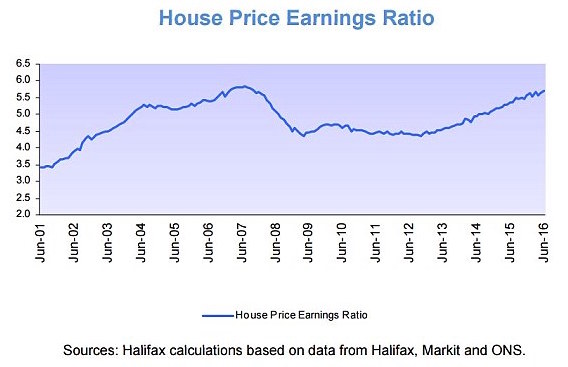

• Britain In Worse Shape To Withstand A Recession Than In 2007 (G.)

Britain’s public finances are in worse shape to withstand a recession than they were on the eve of the 2007 financial crash a decade ago and face the twin threat of a fresh downturn and Brexit, the Treasury’s independent forecaster has warned. The Office for Budget Responsibility – the UK’s fiscal watchdog – said another recession was inevitable at some point and that Theresa May’s failure to win a parliamentary majority in last month’s election left the public finances more vulnerable to being blown off course than they were in 2007. In its first in-depth analysis of the fiscal risks facing Britain, the OBR said its main message was clear: “Governments should expect nasty fiscal surprises from time to time – because policy can only reduce risks, not eliminate them – and plan accordingly.

“And they have to do so in the context of ongoing pressures that are likely to weigh on receipts and drive up spending and a variety of risks that governments choose to expose themselves to for policy reasons. This is true for any government, but this one also has to manage the uncertainties posed by Brexit, which could influence the likelihood or impact of other risks.” The OBR said the size of the UK’s Brexit divorce bill – currently a matter of dispute between London and Brussels – would have little impact on the public finances. But it noted that even a small fall in Britain’s underlying growth rate after departure from the EU would lead to a big increase in the country’s debt burden.

If a knock to trade with the rest of Europe caused productivity to slip by just 0.1 percentage points over the next 50 years, tax receipts would be £36bn lower. With spending growth left unchanged, the debt-to-GDP ratio would end up around 50 percentage points higher, the OBR added. The campaign group Open Britain said the OBR’s report showed “a hard Brexit poses a real threat to our economy. People voted for £350m a week for the NHS, not a £36bn black hole in the public finances that could mean severe cuts to the NHS”.

Has Australia been warned yet?

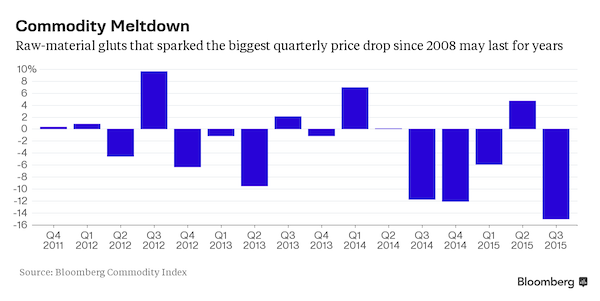

• IMF Warns Canada On Housing, Trade, Rate Hikes (R.)

The IMF said on Thursday that while Canada’s economy has regained momentum, housing imbalances have increased and uncertainty surrounding trade negotiations with the United States could hurt the recovery. The report, written before the central bank raised interest rates by a quarter of a percentage point on Wednesday to 0.75%, also said the Bank of Canada’s current monetary policy stance is appropriate, and it cautioned against tightening. “While the output gap has started to close, monetary policy should stay accommodative until signs of durable growth and higher inflation emerge,” it said, adding that rate hikes should be “approached cautiously.” Cheng Hoon Lim, IMF mission chief for Canada, later clarified that even with Wednesday’s rate hike, monetary policy remains “appropriately accommodative.”

“The Bank of Canada’s increase of the policy rate reflects encouraging economic data over the past few months. We welcome the good news on the economy,” Lim said in an emailed statement. “Given the considerable uncertainty around the growth and inflation outlook, the Bank should continue to take a cautious approach in further adjusting the monetary policy stance,” she added. In a statement following its annual policy review with Canada, the IMF cautioned that risks to Canada’s outlook are significant – particularly the danger of a sharp correction in the housing market, a further decline in oil prices, or U.S. protectionism. It said financial stability risks could emerge if the housing correction is accompanied by a recession, but said stress tests have shown Canadian banks could withstand a “significant loss” on their uninsured residential mortgage portfolio, in part because of high capital position.

House prices in Toronto and Vancouver have more than doubled since 2009 and the boom has fueled record household debt, a vulnerability that has also been noted by the Bank of Canada. “The main risk on the domestic side is a sharp correction in the housing market that impairs bank balance sheets, triggers negative feedback loops in the economy, and increases contingent claims on the government,” the Fund said. The Fund also warned U.S. protectionism could hurt Canada, laying out a scenario for higher tariffs that could come with the renegotiation of NAFTA. If the United States raises the average tariff on imports from Canada by 2.1 percentage points and there is no retaliation from Canada, there would be a short-term impact on real GDP of about 0.4%.

Bankers have no more use for borders than birds do.

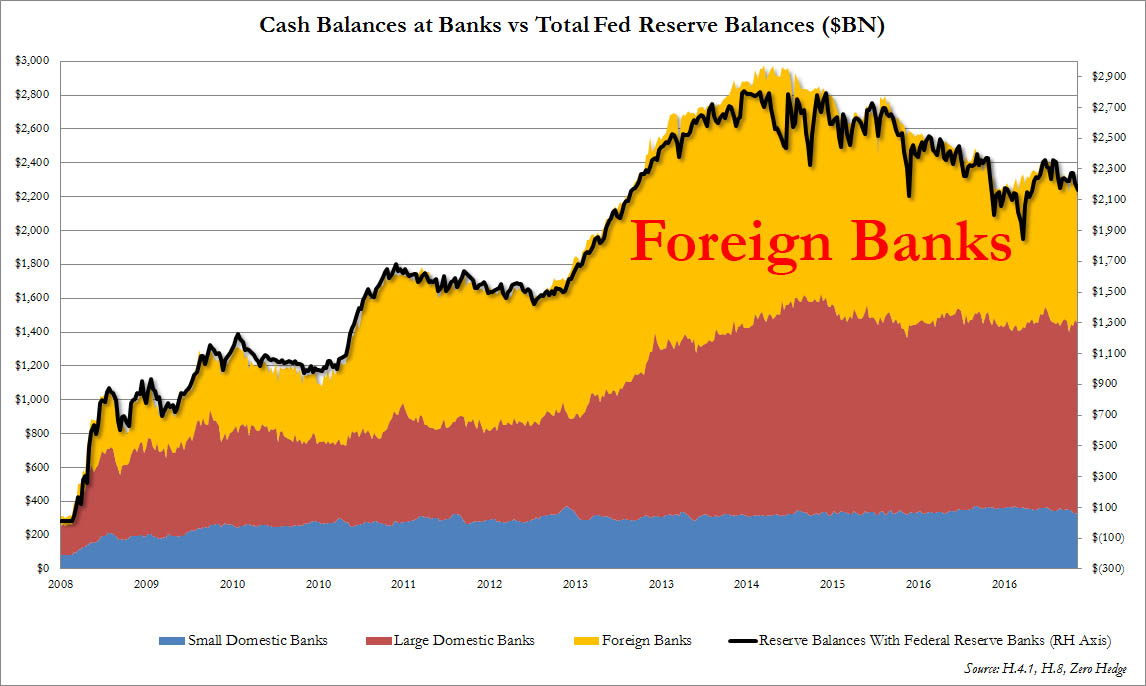

• 40% Of The Fed’s Interest On Excess Reserves Is Paid To Foreign Banks (ZH)

Recall that as we showed first all the way back in 2011, the total cash on the books of commercial banks with operations in the US tracks the Fed’s excess reserves almost dollar for dollar. More importantly, the number is broken down by small and large domestic banks, as well as international banks. It is the last number that is of biggest interest, because now that Congress is finally scrutinizing the $4.5 trillion elephant in the room, i.e., the Fed’s balance sheet, it may be interested to know that approximately 40%, or $838 billion as of the latest weekly data, in reserves parked at the Fed belongs to foreign banks.

While we will reserve judgment, and merely point out that of the $100 or so billion in dividends and buybacks announced by US banks after the latest stress test a substantial amount comes directly courtesy of the Fed – cash that ultimately ends up in shareholders’ pockets – we will note that the interest the Fed pays to foreign banks operating in the US who have parked reserves at the Fed, amounts to $10.4 billion annualized as of this moment. This is a subsidy from the Fed, supposedly an institution that exists for the benefit of the US population, going directly and without any frictions to foreign banks, who – just like in the US – then proceed to dividend and buybacks these funds, “returning” them to their own shareholders, most of whom are foreign individuals.

While the number appears modest, it is poised to grow substantially as the Fed Funds rate is expected to keep growing, ultimately hitting 3.0% according to the Fed. Indicatively, assuming excess reserves remain unchanged for the next 2-3 years and rates rise to 3.0%, that would imply a total annual subsidy to commercial banks amounting to $65 billion, of which $25 billion would go to foreign banks every year. We wonder if this is the main reason why the Fed is so desperate to trim its balance sheet as it hikes rates, as sooner or later, someone in Congress will figure this out.

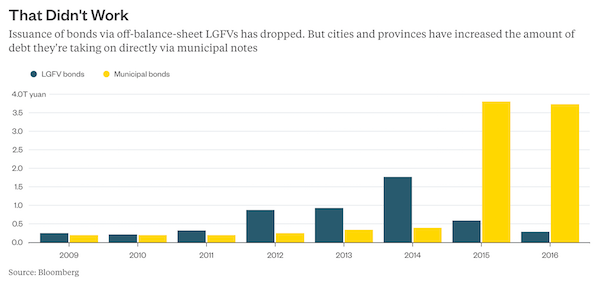

Unintended consequences? One of many?

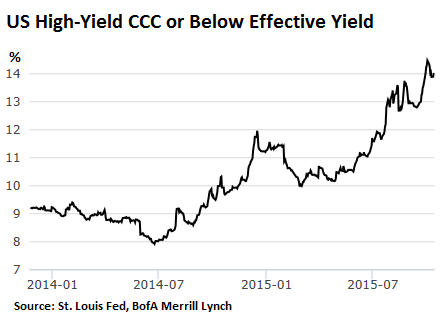

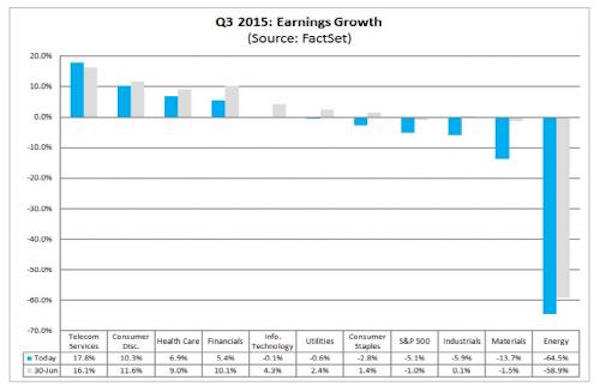

• Will Corporate Bonds Cross Over? (DDMB)

Unbeknownst to unassuming corporate bond holders, they too will soon be forced into the slow lane. For the moment, the vast majority fancy themselves that equally exasperating driver who won’t get out of the fast lane, determined to bully their way to their damned destination. As for the perils of tailgating, they’re for the other guy, the less agile driver with rubbery reflexes. That’s all good and well and has been for many years. Bond market fender benders are nearly nonexistent. The question is: Will central bankers worldwide turn placid parkways into highways to hell as they ‘remove accommodation,’ to borrow from their gently genteel jargon? That’s certainly one way to interpret Federal Reserve Chair Janet Yellen’s latest promise to shrink the balance sheet ‘appreciably.’

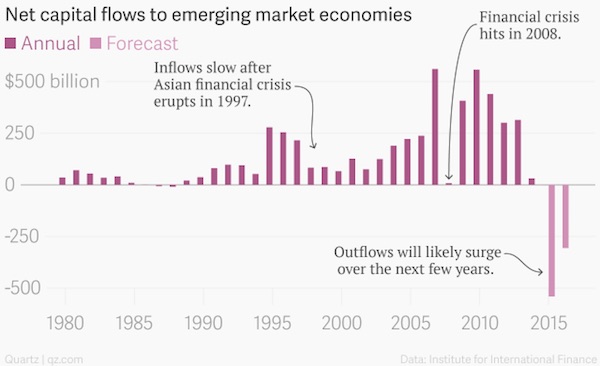

Care for a translation? How easily does “Aggressive Quantitative Tightening” roll off the tongue? Perhaps you’ve just bitten yours instead. Enter the International Monetary Fund (IMF), The Institute of International Finance (IIF), The Bank of International Settlements (BIS), and by the way, the Emerging Markets complex including and especially China. As a former central banker, it is with embarrassing ease yours truly can bandy about fantastic figures. No surprise that nary an eyebrow was raised at the latest figures out of the IIF that aggregate global debt is closing in on $220 trillion, as touched on last week. Consider that to be the broad backdrop. Now, narrow in on the IMF’s concerns that financial stability could be rocked by a rumble in US corporate debt markets.

Using firms’ capacity to service their debts from current earnings as a simple and elegant yard stick, the report warned that one in ten firms are failing outright. The last two years of levering up have exacted rapid damage: earnings have fallen to less than six times interest expense, this during an era of unprecedented low interest rates. And as record non-financial debt as a percentage of GDP quickly approaches 50%, the share of income required to service this mountain is at a seven-year high. Should financial conditions tighten (the report was published in April prior to the Fed’s June rate hike), one-in-five firms are likely to default, which rises to 22% if rates continue to rise.

“..The Russian system would not be compatible with other NATO defense systems, but also wouldn’t be subject to the same constraints imposed by the alliance, which prevents Turkey from deploying such systems on the Armenian border, Aegean coast or Greek border..”

• Turkey Chooses Russia Over NATO for Missile Defense (BBG)

Turkey has agreed to pay $2.5 billion to acquire Russia’s most advanced missile defense system, a senior Turkish official said, in a deal that signals a turn away from the NATO military alliance that has anchored Turkey to the West for more than six decades. The preliminary agreement sees Turkey receiving two S-400 missile batteries from Russia within the next year, and then producing another two inside Turkey, according to the Turkish official, who asked not to be named because of the sensitivity of the matter. A spokesman for Russia’s arms-export company Rosoboronexport OJSC said he couldn’t immediately comment on details of a deal with Turkey. Turkey has reached the point of an agreement on a missile defense system before, only to scupper the deal later amid protests and condemnation from NATO.

Under pressure from the U.S., Turkey gave up an earlier plan to buy a similar missile-defense system from a state-run Chinese company, which had been sanctioned by the U.S. for alleged missile sales to Iran. Turkey has been in NATO since the early years of the Cold War, playing a key role as a frontline state bordering the Soviet Union. But ties with fellow members have been strained in recent years, with Turkish President Recep Tayyip Erdogan pursuing a more assertive and independent foreign policy as conflict engulfed neighboring Iraq and Syria. Tensions with the U.S. mounted over U.S. support for Kurdish militants in Syria that Turkey considers terrorists, and the relationship with the European Union soured as the bloc pushed back against what it sees as Turkey’s increasingly autocratic turn.

Last month, Germany decided to withdraw from the main NATO base in Turkey, Incirlik, after Turkey refused to allow German lawmakers to visit troops there. The missile deal with Russia “is a clear sign that Turkey is disappointed in the U.S. and Europe,” said Konstantin Makienko, an analyst at the Center for Analysis of Strategies and Technologies, a Moscow think-tank. “But until the advance is paid and the assembly begins, we can’t be sure of anything.” The Russian system would not be compatible with other NATO defense systems, but also wouldn’t be subject to the same constraints imposed by the alliance, which prevents Turkey from deploying such systems on the Armenian border, Aegean coast or Greek border, the official said. The Russian deal would allow Turkey to deploy the missile defense systems anywhere in the country, the official said.

[..] The official said the systems delivered to Turkey would not have a friend-or-foe identification system, which means they could be deployed against any threat without restriction.

That must have been one hell of a conspiracy.

• 100,000 and Counting: No Letup in Turkey Coup Purges a Year On (BBG)

The scale of Turkey’s crackdown on alleged government opponents following last year’s attempted coup was confirmed by a top official, as the nation prepares to mark the anniversary of the failed putsch amid deepening concern over the rule of law. Authorities have fired 103,824 state employees and suspended 33,483 more since the July 15 bid to seize power by a section of the military, Deputy Prime Minister Numan Kurtulmus said in an interview. The purge of suspected followers of U.S.-based cleric Fethullah Gulen, accused by the government of orchestrating the coup attempt, is necessary to ensure national security, he said. ustice Ministry data showed 50,546 suspected members of Gulen’s organization were in prison on July 3, and that arrest warrants had been issued for 8,000 others. The preacher denies involvement in the takeover attempt.

“There might be crypto members of Feto who walk on the snow without leaving tracks,” Kurtulmus said, using an abbreviation of Gulen’s first name that officials have adopted since the defeated military power grab to refer to his movement. “Related agencies are carefully conducting their work against this possibility.” Just this week, Erdogan rebuffed criticism over the detention of a group of international rights activists, including the director of Amnesty International Turkey, as they held a workshop on an island off Istanbul. “They gathered as if they were holding a meeting to continue July 15,” the president said. Amnesty criticized Turkey on Tuesday after the detentions were extended by seven days. “It is truly absurd that they are under investigation for membership of an armed terrorist organization,” Amnesty Europe Director John Dalhuisen said in an email. “For them to be entering a second week in police cells is a shocking indictment of the ruthless treatment of those who attempt to stand up for human rights in Turkey.”

Dirty deeds.

• Philip Morris’ Anti-Anti-Smoking Campaign (R.)

A group of cigarette company executives stood in the lobby of a drab convention center near New Delhi last November. They were waiting for credentials to enter the World Health Organization’s global tobacco treaty conference, one designed to curb smoking and combat the influence of the cigarette industry. Treaty officials didn’t want them there. But still, among those lined up hoping to get in were executives from Japan Tobacco International and British American Tobacco Plc. There was a big name missing from the group: Philip Morris International Inc. A Philip Morris representative later told Reuters its employees didn’t turn up because the company knew it wasn’t welcome. In fact, executives from the largest publicly traded tobacco firm had flown in from around the world to New Delhi for the anti-tobacco meeting.

Unknown to treaty organizers, they were staying at a hotel an hour from the convention center, working from an operations room there. Philip Morris International would soon be holding secret meetings with delegates from the government of Vietnam and other treaty members. The object of these clandestine activities: the WHO’s Framework Convention on Tobacco Control, or FCTC, a treaty aimed at reducing smoking globally. Reuters has found that Philip Morris International is running a secretive campaign to block or weaken treaty provisions that save millions of lives by curbing tobacco use. [..] Confidential company documents and interviews with current and former Philip Morris employees reveal an offensive that stretches from the Americas to Africa to Asia, from hardscrabble tobacco fields to the halls of political power, in what may be one of the broadest corporate lobbying efforts in existence.

It needs growth, and there ain’t none.

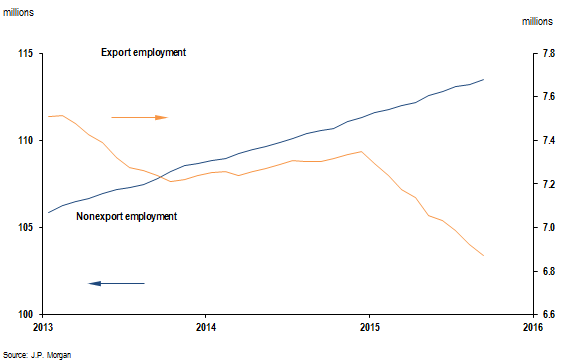

• Globalisation: The Rise And Fall Of An Idea That Swept The World (G.)

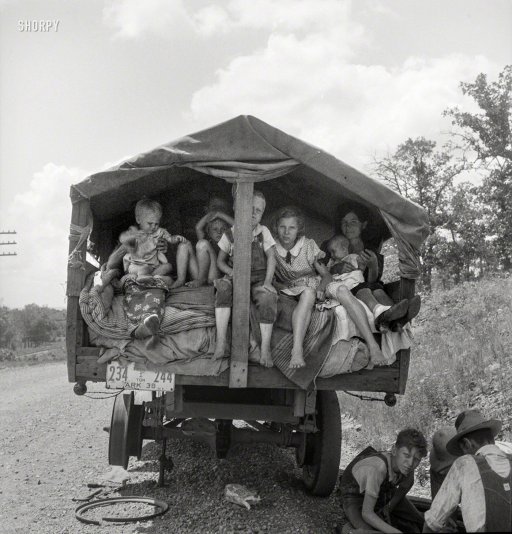

It was only a few decades ago that globalisation was held by many, even by some critics, to be an inevitable, unstoppable force. “Rejecting globalisation,” the American journalist George Packer has written, “was like rejecting the sunrise.” Globalisation could take place in services, capital and ideas, making it a notoriously imprecise term; but what it meant most often was making it cheaper to trade across borders – something that seemed to many at the time to be an unquestionable good. In practice, this often meant that industry would move from rich countries, where labour was expensive, to poor countries, where labour was cheaper. People in the rich countries would either have to accept lower wages to compete, or lose their jobs. But no matter what, the goods they formerly produced would now be imported, and be even cheaper.

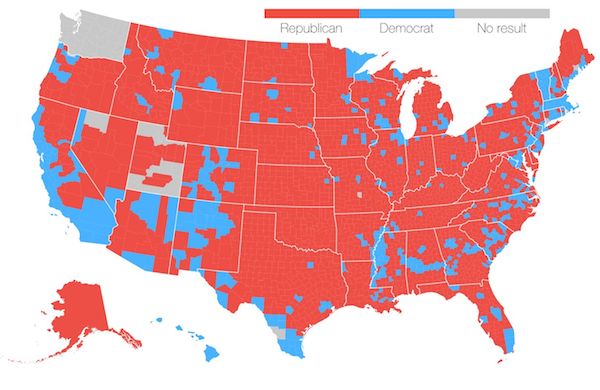

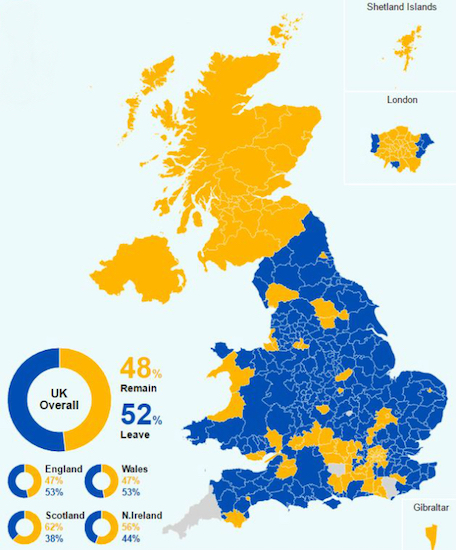

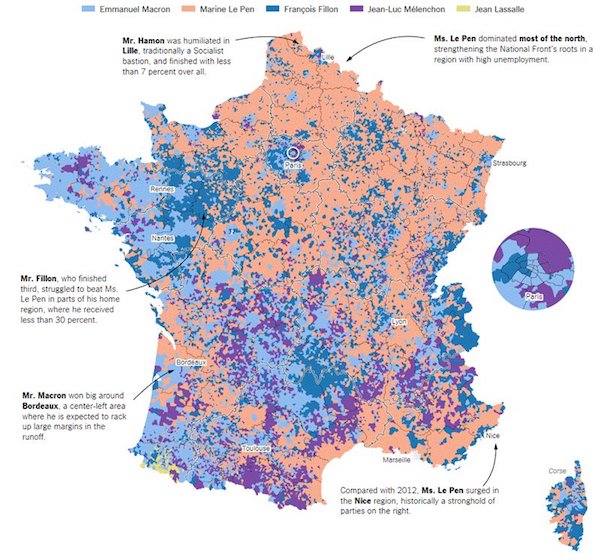

And the unemployed could get new, higher-skilled jobs (if they got the requisite training). Mainstream economists and politicians upheld the consensus about the merits of globalisation, with little concern that there might be political consequences. Back then, economists could calmly chalk up anti-globalisation sentiment to a marginal group of delusional protesters, or disgruntled stragglers still toiling uselessly in “sunset industries”. These days, as sizable constituencies have voted in country after country for anti-free-trade policies, or candidates that promise to limit them, the old self-assurance is gone. Millions have rejected, with uncertain results, the punishing logic that globalisation could not be stopped. The backlash has swelled a wave of soul-searching among economists, one that had already begun to roll ashore with the financial crisis. How did they fail to foresee the repercussions?

The world should not allow the Fukushima secrecy any longer.

• Tepco: Decision Already Been Made To Release Radioactive Tritium Into Sea (JT)

Radioactive tritium, said to pose little risk to human health, will be released from the crippled Fukushima No. 1 nuclear power complex into the sea, according to a top official of the plant operator. “The decision has already been made,” Takashi Kawamura, chairman of Tokyo Electric Power Company, said in a recent interview with media outlets, referring to the discharge of tritium, which remains in filtered water even after highly toxic radioactive materials are removed from water used to cool the damaged reactors at the plant. At other nuclear power plants, tritium-containing water has routinely been released into the sea after it is diluted. But the move by Tepco has prompted worries among local fishermen about the potential ramifications for their livelihood as public perceptions about fish and other marine products caught off Fukushima could worsen.

They are the first public remarks by the utility’s management on the matter, as Tepco continues its cleanup of toxic water and tanks containing it continue to fill the premises of the plant, where three reactors suffered meltdowns after tsunami flooded the complex in March 2011 following a massive earthquake. Kawamura’s comments came at a time when a government panel is still debating how to deal with tritium-containing water at the Fukushima plant, including whether to dump it into sea. Saying its next move is contingent on the panel’s decision, Kawamura indicated in the interview that Tepco will wait for a decision by the government before it actually starts releasing the water into sea. “We cannot keep going if we do not have the support of the state” as well as Fukushima Prefecture and other stakeholders, he said.

The EU is one big success story.

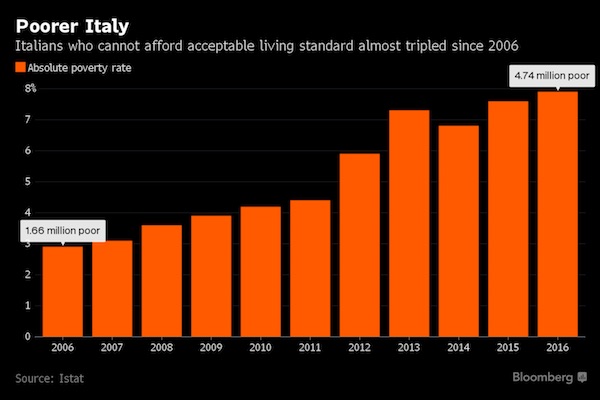

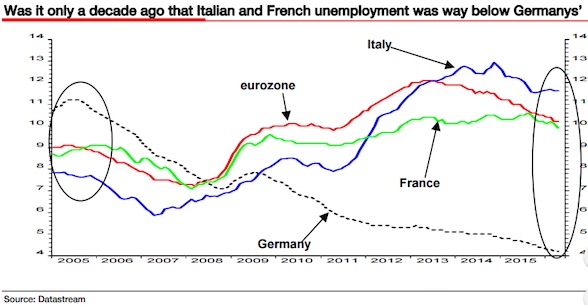

• Italy’s Poor Almost Triple in a Decade Amid Economic Slumps

Italians living below the level of absolute poverty almost tripled over the last decade as the country went through a double-dip, record-long recession. The absolute poor, or those unable to purchase a basket of necessary goods and services, reached 4.7 million last year, up from almost 1.7 million in 2006, national statistics agency Istat said Thursday. That is 7.9% of the population, with many of them concentrated in the nation’s southern regions. As Italy went through its deepest, and then its longest, recession since World War II between 2008 and 2013, more than a quarter of the nation’s industrial production was wiped out. Over the same period unemployment also rose, with the rate rising to as high as 13% in 2014 from a low of 5.7% in 2007. Joblessness was at 11.3% at last check in May.

For decades, Italy has grappled with a low fertility rate – just 1.35 children per woman compared with a 1.58 average across the 28-nation EU as of 2015, the last year for which comparable data are available. “The poverty report shows how it is pointless to wonder why there are fewer newborn in Italy,” said Gigi De Palo, head of Italy’s Forum of Family Associations. “Making a child means becoming poor, it seems like in Italy children are not seen as a common good.” The number of absolute poor rose last year in the younger-age classes, reaching 10% in the group of those between 18 and 34 years old. It fell among seniors to 3.8% in the age group of 65 and older, the Istat report also showed.

Earlier this year, the Rome-based parliament approved a new anti-poverty tool called inclusion income that is replacing existing income-support measures. It will benefit 400,000 households, for a total of 1.7 million people, Il Sole 24 Ore daily reported, citing parliamentary documents. The program will be funded with resources of around €2 billion ($2.3 billion) this year which should rise to nearly €2.2 billion in 2018, Sole also said