G. G. Bain Asbury Park, Jersey Shore 1914 (just 35 years before Springsteen was born)

I was amazed and profoundly Bizarro puzzled watching this attempt at a solemn procession, designed to make it look like this was some time-honored tradition on the Hill (no such thing). I read somewhere they were going to present the articles in a wooden box, but I guess they couldn’t find any. Topped off with Pelosi having dozens of pens printed for the occasion. Entertainment for the echo chamber.

• House Delivers Articles Of Impeachment To Senate (ZH)

Update (1745ET): House Speaker Nancy Pelosi signed two articles of impeachment against Donald Trump on Wednesday shortly before they were delivered to the Senate, where the US president faces trial on charges of abuse of power and obstruction of Congress. “So sad, so tragic for our country, that the actions taken by the president to undermine our national security, to violate his oath of office and to jeopardize the security of our elections, has taken us to this place,” Pelosi said shortly before using several ceremonial pens to sign the articles. The articles were ceremonially walked through the US Capitol to the US Senate.

Trump’s impeachment trial will begin Tuesday, Senate Majority Leader Mitch McConnell said on the chamber’s floor. On Thursday, the House managers will present the impeachment articles to the full Senate at noon, and Chief Justice John Roberts will swear in the senators at 2 p.m., McConnell said. Then the Senate will notify the White House of the pending trial and summon Trump to answer the impeachment articles and send his lawyers, he said. “So the trial will commence in earnest on Tuesday,” McConnell said. The next step in the process will be a formal reading of the impeachment charges against Trump on the Senate floor by the seven House prosecutors Thursday morning.

Update: As expected, the House of Representatives officially voted Wednesday to send the articles of impeachment against President Donald Trump to the Senate and approved the House’s impeachment managers. The vote to send the articles of impeachment to the Senate and approve the impeachment managers was 228-193. Democratic Minnesota Rep. Collin Peterson was the only Democrat to vote nay, breaking with the rest of his party. House Republicans all voted together. [..] After waiting four weeks, House Speaker Nancy Pelosi announced that the House will finally transmit the two articles of impeachment against President Trump to the Senate, and that they have chosen seven impeachment managers to prosecute the case during the upcoming trial.

Nancy Pelosi’s souvenir pens served up on silver platters to sign the articles of impeachment…

“Anderson Cooper says CNN “obtained” the audio recorded by CNN microphones on the CNN debate stage..”

• Warren Told Sanders He Called Her A Liar On National TV (R.)

The mystery of what presidential rivals Elizabeth Warren and Bernie Sanders said to each other in a heated exchange after Tuesday night’s Democratic debate has been solved, with debate host CNN revealing that Warren accused Sanders of calling her a liar on national television. In an exchange caught on camera after the debate but unable to be heard by the television audience, Sanders responded to Warren that it was she who had called him a liar. Moments earlier Warren had refused to shake Sanders’ hand. The two U.S. senators and liberal standard bearers in the Democrats’ nominating contest to pick a candidate to take on Republican President Donald Trump in November had been locked in a dispute before and during the debate over an allegation by Warren that Sanders had told her in a private 2018 meeting that a woman could not be elected president.

Sanders disputed that claim before and during the debate but Warren insists it’s true. CNN said on Wednesday that its microphones had caught the post-debate exchange and released its contents. After failing to shake Sanders’ hands, Warren said: “I think you called me a liar on national TV.” “What?” Sanders replied. “I think you called me a liar on national TV,” Warren repeated. Sanders replied: “You know, let’s not do it right now. If you want to have that discussion, we’ll have that discussion.” Warren said: “Anytime.” Sanders said: “You called me a liar. You told me – all right, let’s not do it now.” Another Democratic candidate, billionaire Tom Steyer, who was standing behind the two, said: “I don’t want to get in the middle. I just want to say ‘hi’ to Bernie.”

CNN just aired the post-debate Sanders-Warren exchange. Both accuse the other of calling the other a liar. Warren intitiated. The fact that this was done on stage w/ camera & audio, and the fact that Warren’s camp started this whole thing, makes me wonder if they staged this too. pic.twitter.com/TRv5lunZJs

— Aaron Maté (@aaronjmate) January 16, 2020

Matt is much too kind to CNN: “Over a 24-hour period before, during, and after the debate, CNN bid farewell to what remained of its reputation as a nonpolitical actor via a remarkable stretch of factually dubious reporting, bent commentary, and heavy-handed messaging.”

• CNN’s Debate Performance Was Villainous and Shameful (Matt Taibbi)

CNN debate moderator Abby Phillip asked Bernie Sanders in the Tuesday debate in Des Moines: “CNN reported yesterday — and Senator Sanders, Senator Warren confirmed in a statement — that, in 2018, you told her you did not believe that a woman could win the election. Why did you say that?” Not “did you say that,” but “why did you say that?” Sanders denied it, then listed the many reasons the story makes no sense: He urged Warren herself to run in 2016, campaigned for a female candidate who won the popular vote by 3 million votes, and has been saying the opposite in public for decades. “There’s a video of me 30 years ago talking about how a woman could become president of the United States,” he said. Phillip asked him to clarify: He never said it? “That is correct,” Sanders said.

Phillip turned to Warren and deadpanned: “Senator Warren, what did you think when Senator Sanders told you a woman could not win the election?” That “when” was as transparent a media “fuck you” as we’ve seen in a presidential debate. It evoked memories of another infamous CNN ambush, when Bernard Shaw in 1988 crotch-kicked Mike Dukakis with a question about whether he’d favor the death penalty for someone who raped and murdered his wife, Kitty. This time, the whole network tossed the mud. Over a 24-hour period before, during, and after the debate, CNN bid farewell to what remained of its reputation as a nonpolitical actor via a remarkable stretch of factually dubious reporting, bent commentary, and heavy-handed messaging.

The cycle began with a “bombshell” exposé by CNN reporter MJ Lee. Released on the eve of the debate, Lee reported Warren’s claim that Sanders told her a woman couldn’t win in a December 2018 meeting. Lee treated the story as fact, using constructions such as, “Sanders responded that he did not think a woman could win,” and “the revelation that Sanders expressed skepticism that Warren could win.” Lee said “the conversation” opened a window into “the role of sexism and gender inequality in politics”: The conversation also illustrates the skepticism among not only American voters but also senior Democratic officials that the country is ready to elect a woman as president … Although Lee said she based the story on “the accounts of four people,” they were “two people Warren spoke with directly soon after the encounter,” and “two people familiar with the meeting.” There were only two people in the room, Sanders and Warren. Lee’s “four people” actually relied on just one source, Warren.

Cold feet? If the Dems get their witnesses and Trump does not, the 21st century equivalent of pitchforks can’t be far.

• Sen. Rand Paul Says GOP Will Shaft Trump (GP)

Senator Rand Paul warned his colleagues who plan to let the Democrats choose witnesses that they will lose their reelections. Senator Paul, who has seemingly been leading the charge to defend the president during this process, also explained that he would vote for Rep. Adam Schiff and Speaker Nancy Pelosi to have to testify, especially since Schiff has a staff member who is friends with the whistleblower — potentially making him a material witness. Additionally, Sen. Paul stated that he wants the impeachment process to be over as soon as possible, but that if the Democrats are allowed to call witnesses, President Trump must be afforded the same right.

When asked if any other Republicans have been supportive of Sen. Paul’s assertion that he wants to call in the whistleblower and Hunter Biden to testify, he asserted that there are a lot of people who do, but that they have been quiet. “There’s a lot of people who are quiet, so I’ve been kind of loud,” Sen. Paul said. “My goal in this is to be done with the impeachment as soon as possible, and probably the best way to do that is actually no witnesses — but, if we’re going to have witnesses we should have witnesses from both sides. In our interview, Sen. Paul warned that his Republican colleagues may be in trouble when they go up for re-election if they defy the president and allow Democrats to run amok, like they did in the House.

“What I keep trying to convince my colleagues, particularly the ones that might vote to allow the witnesses that the Democrats want to call, is that if they do that and they don’t vote to allow the president to bring his witnesses in, I think the Republican base and Trump supporters are going to be very very unhappy with them. I think it will have electoral consequences — which is sort of my way of saying that maybe they should reconsider having any witnesses at all,” Sen. Paul said. “My hope is some will reconsider and we will just be done with one vote.” [..] Sen. Paul explained that if there does end up being a vote for each individual witness, which could potentially be dozens, he believes that only the ones who are antagonistic to the president will get through.

This means that “Hunter Biden, Joe Biden and the whistleblower may not pass a majority vote.” He said that if this is how witnesses are decided, the senate will end up with a situation like the House did — a lopsided witness list that would be mostly people hostile to the president. When asked if he had any other specific witnesses in mind that he was looking to hear, besides Hunter Biden and the whistleblower, Sen. Paul said that “if they end up approving witnesses like Bolton, who I think are harmful, I will insist on a motion that says the president should get to call all witnesses that he or his team deem to be necessary to his defense.” “I don’t want to limit it, I’m not his lawyer, I don’t want to tell him who he has to call — I’m just going to say anyone. ‘Anyone’ includes people he has mentioned, like Hunter Biden and Joe Biden,” Sen. Paul said.

The meme is still not dead.

• Americans Beware! Russia Can Hack Your Brain (Bridge)

I suppose it is necessary, considering the bleak and humorless times we live in, to immediately start by acknowledging that the headline is meant as satire, what Webster defines as a form of “ridicule to expose and criticize people’s stupidity or vices, particularly in the context of contemporary politics and other topical issues.” In other words, nyet, the Kremlin does not have a hotline to the American brain that can trigger card-carrying Democrats to enter a catatonic trance on Election Day and vote against Joe Biden, or any of the other flawless Democratic gems for that matter. By this time, especially following the release of the Mueller Report, you would think that conspiracy theories involving Russia and American democracy would have subsided; instead they’ve only escalated as the U.S. enters the hot end of the 2020 presidential election campaign.

Courtesy of Bloomberg: “U.S. intelligence and law enforcement officials are assessing whether Russia is trying to undermine Joe Biden in its ongoing disinformation efforts with the former vice president still the front-runner in the race to challenge President Donald Trump, according to two officials familiar with the matter… Part of the inquiry is to determine whether Russia is trying to weaken Biden by promoting controversy over his past involvement in U.S. policy toward Ukraine while his son worked for an energy company there.” So how exactly does Russia, in a scene straight out of A Clockwork Orange, tap into the frontal lobe section of the U.S. electorate and cause them to lose all confidence in their political favorites?

“A signature trait of Russian President Vladimir Putin ‘is his ability to convince people of outright falsehoods,’ William Evanina, director of the National Counterintelligence and Security Center, said in a statement. ‘In America, [the Russians are] using social media and many other tools to inflame social divisions, promote conspiracy theories and sow distrust in our democracy and elections.’” Yes, somehow those dastardly Russians have outsmarted the brightest and best-paid political strategists in Washington, D.C. by brandishing what amounts to some really persuasive memes over social media, and for just rubles on the dollar. The techies at Wired went so far as to call this epic assault on the fragile American cranium, “meme warfare to divide America.”

Putin is not power hungry. He would love to be able to step back. But he fears for Russia, he fears the US neocons will take it as soon as he leaves.

• What Is Russia’s Putin Up To? (BBC)

It came out of nowhere. Even ministers in the Russian government apparently did not see their departure coming. Was it a case of a new working year in Moscow – out with the old and in with the new? But it was clear Vladimir Putin, 67, had change in mind. With four years to go before he leaves office, and 20 years already served, it was clear he was planning ahead. A new government, led by Mikhail Mishustin, a technocrat who turned Russia’s hated tax service into an efficient operation, and the end of a man who has worked hand in glove with Mr Putin since he became president. Dmitry Medvedev even filled in as president for four years, because under the constitution Mr Putin could not.

Mr Medvedev, the unpopular head of the United Russia party, is not going away, but his new role as deputy head of Russia’s security council is far more behind the scenes. “It’s a golden parachute. It means he is in reserve, as the security council is Putin’s closest inner circle – his own mini-government,” says Alexander Baunov of the Carnegie Moscow Center. Mr Putin is coming to the same point he reached after his second term, when Dmitry Medvedev deputised for him. But this time the president will not take a false backseat as prime minister. It now appears that Mr Putin’s fourth term as president will be his last. On the face of it, it means more powers for parliament – selecting the prime minister and approving the cabinet, for a start. But that won’t happen yet. Mr Putin has chosen Mr Medvedev’s successor and parliament will have to ratify him.

[..] One of the standout proposals is making the State Council a formal government agency enshrined in the constitution. At the moment it is an advisory body packed with 85 regional governors and other officials including political party leaders. It is so large that when it meets it fills a hall in the Kremlin. But Mr Putin clearly has designs on its future. One theory is that he could become a new, powerful leader of the State Council. “The very fact he’s started a discussion on the State Council is that he’s maybe trying to create another place where power resides, where he can step above the presidential post,” Mr Baunov suggests.

From the right.

• Bloomberg Is Wasting His Money Attacking Teflon Don (DC)

They say money can’t buy you love, but billionaire Michael Bloomberg is living proof that it can’t buy you common sense, either. Bloomberg has now spent $200 million on his campaign to defeat President Donald Trump — but that hasn’t put him on track to earn a single delegate. The long-shot Democratic presidential candidate announced that he is also shelling out roughly $10 million for a 60-second ad during the Super Bowl. His campaign previously announced that it would spend $100 million on an online ad campaign going after the president. But does anyone understand what Bloomberg plans to do for America? Has all that money passed on a clear political message?

Bloomberg remains fifth in the crowded Democratic field with only eight weeks to go until Super Tuesday. Internal data from one of his rivals suggested he is not polling above 10 percent in any of the four early voting states or the 15 that follow in March. The massive campaign spending coming from the former mayor is unheard of politically. No one is setting up a field operation that is even close to what Bloomberg is spending to influence American politics. “Mike Bloomberg is either going to be the nominee or the most important person supporting the Democratic nominee for president,” Kevin Sheekey, Bloomberg’s campaign manager, recently told NBC News. “He is dedicated to getting Trump out of the White House.”

Since his late entrance into the race in November, he has hired more than 800 staff members and is opening a dozen offices in Ohio, nine in Michigan, and 17 in Florida. His campaign has repeatedly said that their mission is to make sure Trump loses in 2020, whether Bloomberg wins the nomination or not. Apparently, like other Democrats and media bigwigs, Bloomberg hasn’t been paying attention for the past few years.

Ever since Donald Trump walked down the escalator in Trump Tower and announced he was running for president, he has been the target of a relentless attack by the media. A recent study found that 90 percent of all coverage he received in 2018 was negative. From the “Access Hollywood” tape to voting to impeach him, opponents of Trump have thrown everything they can at him to change public opinion, but nothing sticks. A Media Research Center analysis found that 93 percent of the coverage of the impeachment on ABC, CBS and NBC was negative. Evening news viewers of these networks heard 72 positive statements vs. 981 negative statements about the president since September 24.

The other day we saw how the US builds giant monopolies. This is why: they’re the only ones making money. That this is due to share buybacks, who cares as long as the press don’t ask questions?

• Over 40% Of Listed US Companies Don’t Make Money (ZH)

It’s absolutely stunning how the Fed/ECB/BoJ injected upwards of $1.1 trillion into global markets in the last quarter and cut rates 80 times in the past 12 months, which allowed money-losing companies to survive another day. The leader of all this insanity is Telsa, the biggest money-losing company on Wall Street, has soared 120% since the Fed launched ‘Not QE.’ Tesla investors are convinced that fundamentals are driving the stock higher, but that might not be the case, as central bank liquidity has been pouring into anything with a CUSIP. The company has lost money over the last 12 months, and to be fair, Elon Musk reported one quarter that turned a profit, but overall – Tesla is a blackhole. Its market capitalization is larger than Ford and General Motors put together. When you listen to Tesla investors, near-term profitability isn’t important because if it were, the stock would be much lower.

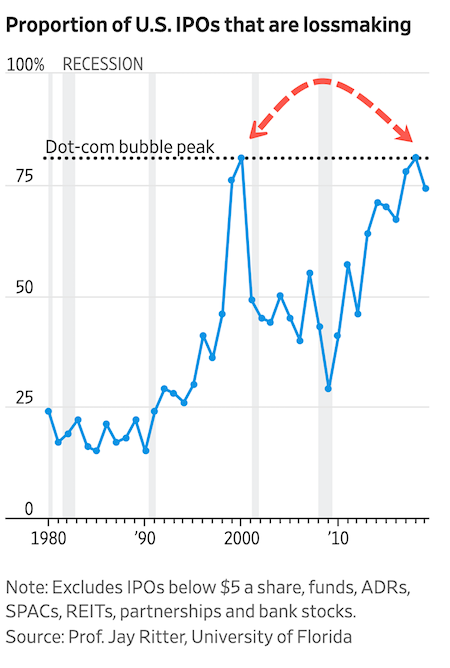

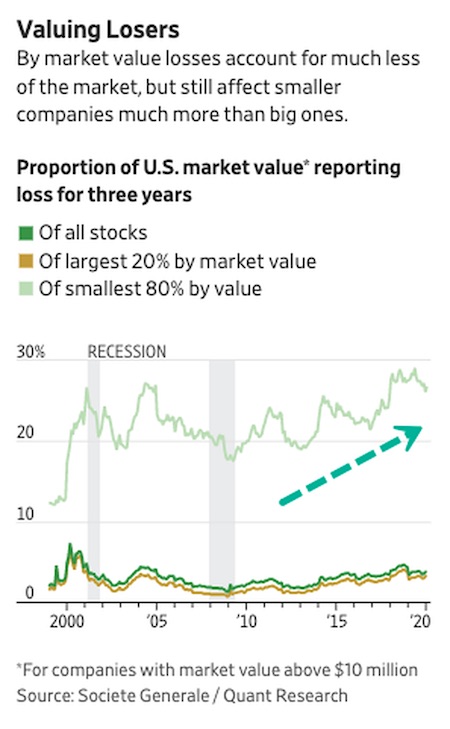

The Wall Street Journal notes that in the past 12 months, 40% of all US-listed companies were losing money, the highest level since the late 1990s – or a period also referred to as the Dot Com bubble. Jay Ritter, a finance professor at the University of Florida, provided The Journal with a chart that shows the percentage of money-losing IPOs hit 81% in 2018, the same level that was also seen in 2000. The Journal notes that 42% of health-care companies lost money, mostly because of speculative biotech. About 17% of technology companies also fail to turn a profit.

A more traditional company that has been losing money is GE. Its shares have plunged 60% in the last 42 months as a slowing economy, and insurmountable debts have forced a balance sheet recession that has doomed the company. Data from S&P Global Market Intelligence shows for small companies, losing money is part of the job. About 33% of the 100 biggest companies reported losses over the last 12 months.

Less transport. Good for the climate.

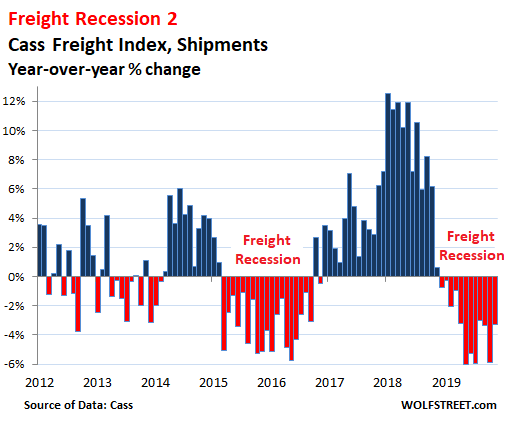

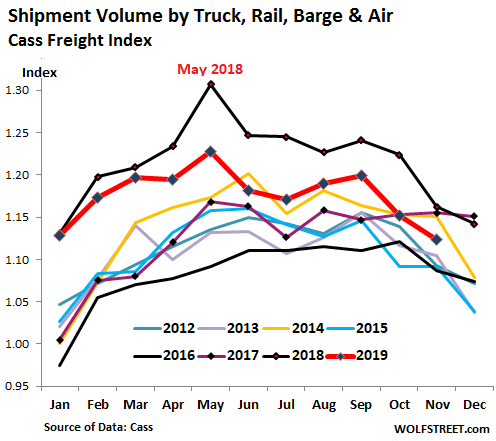

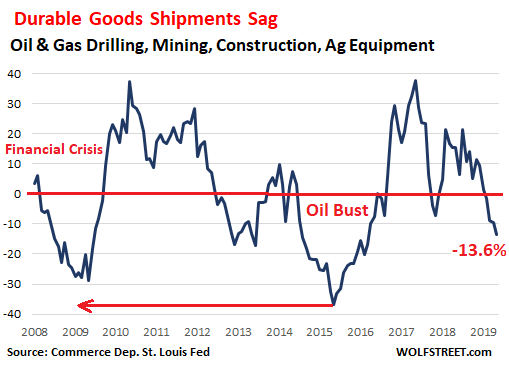

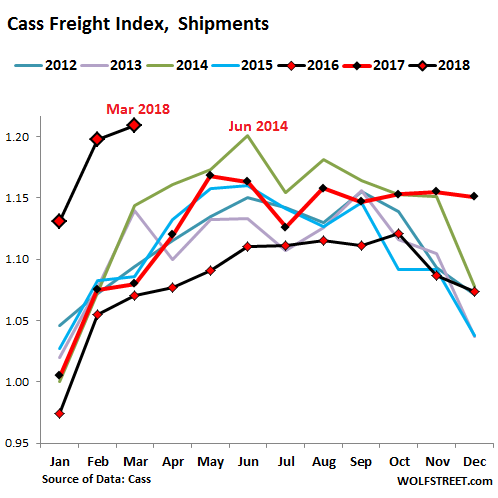

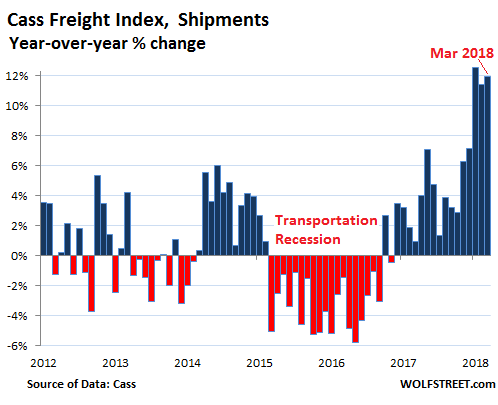

• US Freight Shipments Plunge at Fastest Rate since 2009, Hit 2011 Level (WS)

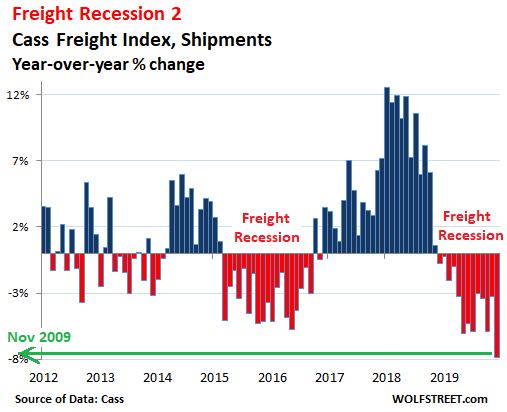

Shipment volume in the US by truck, rail, air, and barge plunged 7.9% in December 2019 compared to a year earlier, according to the Cass Freight Index for Shipments. It was the 13th month in a row of year-over-year declines, and the steepest year-over-year decline since November 2009, during the Financial Crisis. The Cass Freight Index tracks shipment volume of consumer goods and industrial products and supplies by all modes of transportation, but it does not track bulk commodities, such as grains. As always when things get ugly, the calendar gets blamed – Christmas fell on a Wednesday, as it does regularly.

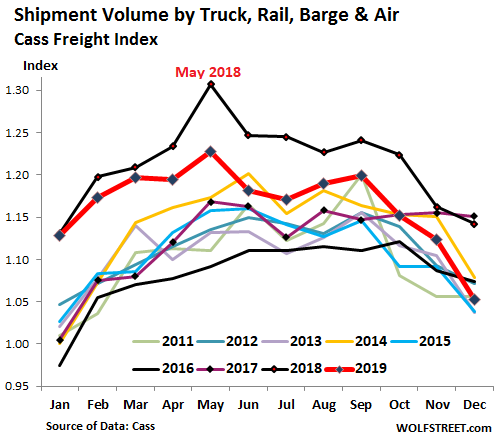

More realistically, December was also the month when Celadon Group, with about 3,000 drivers and about 2,700 tractors, filed for Chapter 11 bankruptcy and ceased operations — the largest truckload carrier ever to file for bankruptcy in US history. It rounded off a large wave of bankruptcies and shutdowns of trucking companies in 2019, most of them smaller ones, but also some regional carriers, and on December 9, Celadon. Rail traffic in December capped off a miserable year, with carloads down 9.2% year-over-year in December, and container and trailer loads (intermodal) down 9.6%, according to the Association of American Railroads. For the 52-week period, traffic of carloads and intermodal units fell 5%. The 7.9% year-over-year drop of the Cass Freight Index pushed it below a slew of prior Decembers, including December 2011. The top black line represents 2018, the fat red line 2019:

Will Australians ever wake up to their political reality?

• “It’s Unthinkable” Australia Sells Arms To Countries Accused Of War Crimes (G.)

Human rights groups say it is “unthinkable” that Australia has been secretly exporting arms to the war-ravaged Democratic Republic of Congo and other countries whose militaries have been consistently accused of war crimes and crimes against humanity. The Guardian revealed on Tuesday that the Australian government had approved the export of weapons to the Democratic Republic of Congo four times in 2018-19. It has also issued more than 80 weapons export permits to Sri Lanka, the United Arab Emirates and Saudi Arabia. The DRC has been gripped by successive waves of violence, rebellions, protests and political turmoil for decades. As recently as Friday, the United Nations warned ethnic killings and rape occurring in the DRC represented crimes against humanity.

Save the Children estimates more than five million people have been forced to flee their homes in the DRC alone, and says millions of children are “desperately in need of humanitarian assistance”. The chief executive of Save the Children Australia, Paul Ronalds, said the public would be shocked to learn their government was approving weapons sales in such an environment. “The fact we weren’t previously aware that Australia was exporting weapons to the DRC says it all really,” Ronalds told the Guardian. “It is unthinkable that Australian arms could potentially be fuelling these conflicts, and it’s kept a secret from the public.

“The public has a right to know where Australian-made arms are going, especially when taxpayers’ money is being used to market the industry to the world.” [..] Over the 2018-19 financial year, Australia issued 45 weapons export permits to the United Arab Emirates, 23 to Saudi Arabia, 14 to Sri Lanka and four to the Democratic Republic of Congo.

“Some as young as 11″. But of course that’s no reason to go talk to Ghislaine.

• Virgin Islands Alleges Epstein Used Private Island To Abuse And Traffic Girls (G.)

Disgraced financier Jeffrey Epstein continued to sexually abuse and traffic young women and girls to his private island as recently as 2018, with potentially hundreds of previously unknown victims, a new lawsuit alleges. The lawsuit, filed by the attorney general of the Virgin Islands, cites new evidence that Epstein used a computerized database to track women and girls – some as young as 11 – to Little Saint James island, a private estate Epstein purchased in 2016. According to the lawsuit, one girl attempted an escape by swimming, but was later found and had her passport confiscated. According to Wednesday’s complaint, Epstein and his alleged accomplices “trafficked, raped, sexually assaulted and held captive underage girls and young women” at his Virgin Islands properties.

In July last year, Epstein faced federal sex trafficking and conspiracy charges for allegedly exploiting dozens of women and girls in New York and Florida between 2002 and 2005. He had previously pleaded guilty in 2008 to a Florida state prostitution charge and completed a 13-month jail sentence. Epstein pleaded not guilty to the fresh charges. He died by suicide in a New York jail cell in August. According to Denise N George, attorney general for the US Virgin Islands, the suit aims to recoup damages from Epstein’s estate, estimated to be worth $577.7m. This suit marks the first against Epstein’s estate by the American territory or any government entity. George enlisted her office’s independent investigators and court documents from other cases to allege that Little Saint James was the epicenter of a decades-long sex trafficking scheme.

“Peirce is aiming to finalise the exhibits for submission to the prosecution by January 18. The government deadline for responding to those documents will be February 7.”

• Julian Assange at the Westminster Magistrates Court (OffG)

Another slot of judicial history, another notch to be added to the woeful record of legal proceedings being undertaken against Julian Assange. The ailing WikiLeaks founder was coping as well as he could, showing the resourcefulness of the desperate at his Monday hearing. At the Westminster Magistrates Court, Assange faced a 12-minute process, an ordinary affair in which he was asked to confirm his name, an ongoing ludicrous state of affairs, and seek clarification about an aspect of the proceedings. Of immediate concern to the lawyers, specifically seasoned human rights advocate Gareth Peirce, was the issue that prison officers at Belmarsh have been obstructing and preventing the legal team from spending sufficient time with their client, despite the availability of empty rooms.

“We have pushed Belmarsh in every way – it is a breach of a defendant’s rights.” Three substantial sets of documents and evidence required signing off by Assange before being submitted to the prosecution, a state of affairs distinctly impossible given the time constraints. A compounding problem was also cited by Peirce: the shift from moving the hearing a day forward resulted in a loss of time. “This slippage in the timetable is extremely worrying.” Whether this shows indifference to protocol or malice on the part of prosecuting authorities is hard to say, but either way, justice is being given a good flaying. The argument carried sufficient weight with District Judge Vanessa Baraitser to result in an adjournment till 2 pm in the afternoon, but this had more to do with logistics than any broader principle of conviction.

As Baraitser reasoned, 47 people were currently in custody at court; a mere eight rooms were available for interviewing, leaving an additional hour to the day. In her view, if Assange was sinned against, so was everybody else, given that others in custody should not be prevented from access to counsel. (This judge has a nose for justice, albeit using it selectively.) As things stand, Peirce is aiming to finalise the exhibits for submission to the prosecution by January 18. The government deadline for responding to those documents will be February 7. The case proceeding itself was adjourned till January 23, and Assange will have the choice, limited as it is, of having the hearing at the Westminster Magistrates Court or Belmarsh.

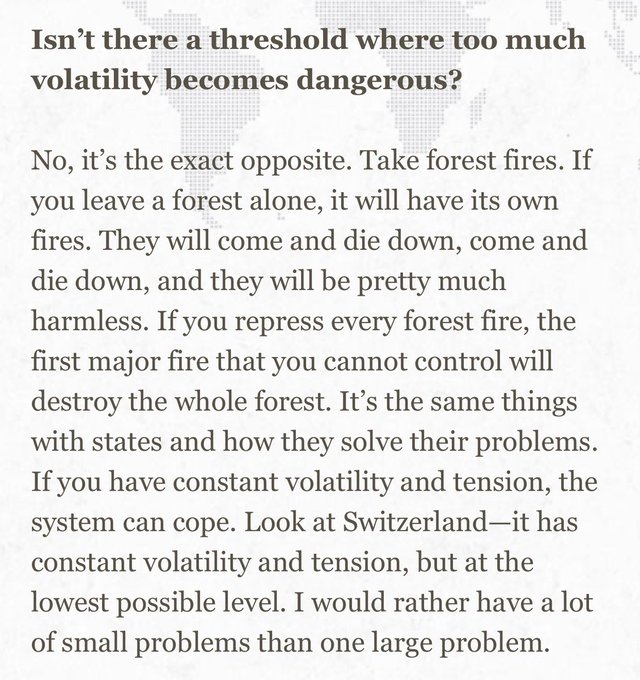

The Taleb approach to forest fires. Antifragility.

Include the Automatic Earth in your 2020 charity list. Support us on Paypal and Patreon.