DPC New Orleans milk cart1903

It was terminal when it began.

• Abenomics Is In Poor Health After Nikkei Slide, And It May Be Terminal (G.)

Not long ago, Shinzo Abe was being heralded for the early success of his grand design to bring Japan out of a deflationary spiral that had haunted the world’s third-biggest economy for two decades. Soon after Abe became prime minister in December 2012, the first two of the three tenets of his ‘Abenomics’ programme – monetary easing and fiscal stimulus – were having the desired effect. In the first year of the programme, the Nikkei index jumped nearly 60%, and the strong yen, the scourge of the country’s exporters, finally ceded ground to the US dollar. And in April 2013 came the appointment of Haruhiko Kuroda, a Bank of Japan governor who shared Abe’s zeal for deflation busting through ever looser monetary policy.

But by Friday, at the end of a dismal week for the Nikkei share index, market volatility caused by renewed fears over the health of the global economy has left Abe’s prescription for economic recovery in jeopardy. While, as some suggest, it is too early to read the last rites for Abenomics, few would disagree that its symptoms are in danger of becoming terminal. There is damning evidence for that claim; enough, in fact, for Abe to reportedly summon key economic advisers on Friday to discuss a way out of the impasse. Japanese shares registered their biggest weekly drop for more than seven years after shedding 4.8% for the Nikkei s lowest close since October 2014. That took the index below the 15,000 level investors regard as a psychological watershed, and erased all the gains made since the Bank of Japan made the shock decision in October 2014 to inject 80tn yen into the economy.

To compound the problem, another pillar of Abenomics – a weak yen – is also crumbling, with the Japanese currency rising to its strongest level for more than a year on Friday. The intention was for a weak yen to push up corporate earnings and help generate inflation by raising import prices; instead, companies are now cutting earnings forecasts as speculation mounts that Japan will again intervene to rein in the yen’s surge. In recent weeks, slumping oil costs and soft consumer spending – the driving force behind 60% of Japan’s economic activity – have brought inflation to a halt. Official data released last month showed that Japan’s inflation rate came in at 0.5% in 2015, way below the Bank of Japan’s 2% target, as the government struggled to convince cautious firms to usher in big wage rises to stir spending and drive up prices.

In response, the Bank of Japan extended the deadline for achieving its 2% inflation target to the first half of the fiscal year 2017, from its previous estimate of the second half of fiscal 2016. In fairness, Abe is partly the victim of factors beyond his control, namely China’s slowdown, weak overseas demand and plunging oil prices. The problem for Abe and Kuroda is that they are quickly running out of options: witness how the market boost from last week’s surprise decision to adopt negative interest rates ended after a couple of days with barely a whimper. By the time Japan hosts G7 leaders this summer, Abe could be forced to concede defeat in his principal aim of dragging Japan out of deflation and boosting growth.

But higher share prices and a weaker yen were only part of the scheme. He has barely started to address the structural reforms comprising the “third arrow” of Abenomics: a shrinking and ageing workforce and the urgent need to boost the role of women in the economy. Next year, he is expected to introduce a highly controversial increase in the consumption tax – a move that will help Japan tackle its public debt and pay for rising health and social security costs, but which could also dampen consumer spending, the driving force behind 60% of the economy. He may be inclined to disagree after a month of upheaval that also saw the resignation of his economics minister, but Abe’s troubles may be only just beginning.

When you lose the currency war.

• Yen’s Best Two-Week Run Since 1998 Just the Start (BBG)

When the going gets tough, foreign-exchange traders turn to the yen. Japan’s currency may extend its biggest two-week rally since 1998 as investors continue to seek out refuge assets amid market turmoil, according Citigroup Inc. State Street Global Advisors Inc., which oversees about $2.4 trillion, says it’s buying yen and selling dollars as the tumult gripping financial markets bolsters the Japanese currency’s appeal. “We’re not counting on the market mood shifting any time soon,” said Steven Englander at Citigroup. Citigroup, world’s biggest foreign-exchange trader according to Euromoney magazine, expects haven currencies including the yen, euro and Swiss franc to appreciate in the near term, even though it said investors are being overly pessimistic about the prospects for economic growth in the U.S. and monetary stimulus elsewhere.

The yen has defied predictions to weaken this year while its biggest counterpart, the dollar, has upended forecasts for gains. Currency traders are questioning the idea that the U.S. economy is strong enough for the Federal Reserve to raise interest rates while central bankers in Tokyo and Frankfurt consider adding to stimulus. Japan’s currency rose 3.2% this week to 113.25 per dollar, adding to last week’s 3.7% gain. Its strength contrasts with a median forecast for the currency to drop to 123 against the dollar by the end of the year. Global equities fell into a bear market this week, and commodities declined, amid growing signs that central-bank policy tools were losing their stimulative effects. Fed Chair Janet Yellen signaled financial-market volatility may delay rate increases as the central bank assesses the impact of recent turmoil on domestic growth.

“In 2009, the ETF enjoyed average daily volume of just 10,000 to 20,000 shares. By 2012, about 200,000 shares were being traded each day. The DXJ rallied tremendously in the next half a year, and by mid-2013 was seeing about 7 million to 8 million shares trade daily..”

• The World’s Hottest Trade Has Suddenly Turned Ice-Cold (CNBC)

An international trade that once looked like a no-brainer has turned into a major headache. The WisdomTree Japan Hedged Equity Fund (DXJ), which combines a long position on Japanese stocks with a short position on the Japanese yen, sounds like a niche product. But as that trade played out beautifully over the past few years, with Japanese stocks soaring as the yen tanked, the ETF has become downright mainstream. In 2009, the ETF enjoyed average daily volume of just 10,000 to 20,000 shares. By 2012, about 200,000 shares were being traded each day. The DXJ rallied tremendously in the next half a year, and by mid-2013 was seeing about 7 million to 8 million shares trade daily, a pace it has maintained up to the present.

The product plays into a popular macro thesis: Expansive policies from the Bank of Japan should help Japanese stocks and hurt the yen. This trend indeed played out powerfully for a time, leading the DXJ to nearly double from November 2012 to June 2015. But the good times didn’t last. In the eight months after hitting that June peak, the ETF lost nearly all of its gain, falling back to its lowest level in more than three years. This as both legs of the trade failed, with Japanese stocks sliding and the yen strengthening amid a global sell-off in risk assets. What may make this especially frustrating is that Japanese monetary authorities haven’t exactly given up on their plan to send the yen lower in order to foster long-dormant inflation and to boost exports.

To the contrary, the BOJ has introduced a negative interest rate policy — which utterly failed in halting the yen’s rise. In fact, the currency is enjoying its best week in years.

Omen.

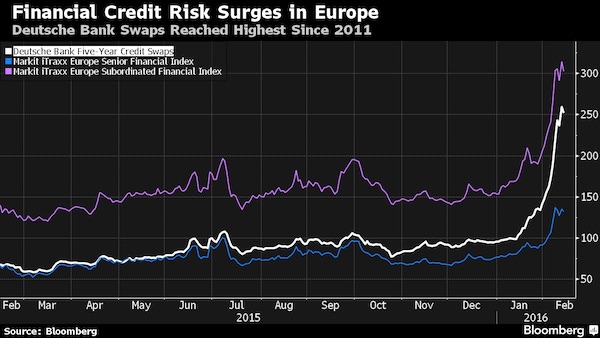

• Credit Default Swaps Are Back As Investors Look For Panic Button (BBG)

As markets plunge globally, investors are seeking refuge in an all-but-forgotten place. Trading volumes in the credit-default swaps market — where banks and fund managers go to hedge against losses on corporate and government debt — have surged. Transactions tied to individual entities doubled in the four weeks ended Feb. 5 to a daily average of $12 billion, according to a JPMorgan analysis of trade repository data. The volume of contracts on benchmark indexes in the market increased two-fold during that period to an average of $87 billion a day. The growth could represent a shift. The credit derivatives market has contracted for almost a decade, after loose monetary policies triggered a big rally in assets including corporate bonds, which made investors less eager to protect against the worst.

Regulators have also urged banks to curb their risk taking, reducing the appetite for at least some dealers to trade the instruments. Now, stock markets are selling off and junk bond prices are plunging, increasing investor demand for protection. “The surge we’ve seen in trading is likely to stay with us for the foreseeable future,” said Geraud Charpin at BlueBay Asset Management, which has traded more credit-default swaps on individual credits in the past three months. “The credit cycle has turned, so there’s more appetite to go short and buy protection.” Risk measures fell on Friday after soaring this week to the highest levels since at least 2012 in the U.S., and 2013 in Europe. The cost of insuring Deutsche Bank’s subordinated debt dropped from a record after the German lender said it planned to buy back about $5.4 billion of bonds to allay investor concerns about its finances. The bank’s shares have lost about a third of their value this year.

The EU just gets crazier by the day. But currency in circulation is way up.

• ‘Austrians Need Constitutional Right to Pay in Cash’ (BBG)

Austrians should have the constitutional right to use cash to protect their privacy, Deputy Economy Minister Harald Mahrer said, as the EU considers curbing the use of banknotes and coins. “We don’t want someone to be able to track digitally what we buy, eat and drink, what books we read and what movies we watch,” Mahrer said on Austrian public radio station Oe1. “We will fight everywhere against rules” including caps on cash purchases, he said. EU finance ministers vowed at a meeting in Brussels on Friday to crack down on “illicit cash movements.” They urged the European Commission to “explore the need for appropriate restrictions on cash payments exceeding certain thresholds and to engage with the ECB to consider appropriate measures regarding high denomination notes, in particular the €500 note.” Ministers told the commission to report on its findings by May 1.

“..orders for new vessels dropped 40% in 2015 [..] The demolition rate for unwanted vessels jumped 15%.”

• The Shipping Industry Is Suffering From China’s Trade Slowdown (BBG)

When business slows and owners of ships and offshore oil rigs need a place to store their unneeded vessels, Saravanan Krishna suddenly becomes one of the industry’s most popular executives. Krishna is the operation director of International Shipcare, a Malaysian company that mothballs ships and rigs, and these days he’s busy taking calls from beleaguered operators with excess capacity. There are 102 vessels laid up at the company’s berths off the Malaysian island of Labuan, more than double the number a year ago. More are on the way. “There’s a huge demand,” he says. “People are calling us not to lay up one ship but 15 or 20.” Shipbuilders, container lines, and port operators feasted on China’s rise and the global resources boom.

Now they’re among the biggest victims of the country’s slowdown and the worldwide decline in demand for oil rigs and other gear amid the oil price plunge. China’s exports fell 1.8% in 2015, while its imports tumbled 13.2%. The Baltic Dry Index, which measures the cost of shipping coal, iron ore, grain, and other non-oil commodities, has fallen 76% since August and is now at a record low. Shipping rates for Asia-originated routes have dropped, too, and traffic at some of the region’s major ports is falling. In Singapore, the world’s second-largest port, container traffic fell 8.7% in 2015, the first decline in six years. Volumes at the port of Hong Kong, the fourth-busiest, slid 9.5% last year. Beyond Asia, the giant port of Rotterdam in the Netherlands recorded a dip in containerized traffic for the year. Globally, orders for new vessels dropped 40% in 2015, to $69 billion, according to Clarksons Research. The demolition rate for unwanted vessels jumped 15%.

Just a few years ago, as the global economy improved and oil prices rose, many companies ordered more fuel-efficient ships. There were more than 1,200 orders for bulk carriers that transport iron ore, coal, and grain in 2013, compared with just 250 last year, according to Clarksons. Many of the ships ordered are now in operation, says Tim Huxley, chief executive officer of Wah Kwong Maritime Transport Holdings, a Hong Kong-based owner of bulk carriers and tankers. “You have a massive oversupply,” he says. The damage is especially severe in China, the world’s leading producer of ships. New orders for Chinese shipbuilders fell by nearly half last year, according to the Ministry of Industry and Information Technology. In December, Zhoushan Wuzhou Ship Repairing & Building became the first state-owned shipbuilder to go bankrupt in a decade.

Beijing wants monopoly on sentiment.

• China Central Bank: Speculators Should Not Dominate Sentiment (Reuters)

Speculators should not be allowed to dominate market sentiment regarding China’s foreign exchange reserves and it was quite normal for reserves to fall as well as rise, central bank governor Zhou Xiaochuan was quoted as saying on Saturday. China’s foreign reserves fell for a third straight month in January, as the central bank dumped dollars to defend the yuan and prevent an increase in capital outflows. In an interview carried in the Chinese financial magazine Caixin, Zhou said yuan exchange reform would help the market be more flexible in dealing with speculative forces. There was a need to distinguish capital outflows from capital flight, and tight capital controls would not be effective for China, he said. China has not fully liberalized its capital account.

Zhou added that there was no basis for the yuan to keep depreciating, and China would keep the yuan basically stable versus a basket of currencies while allowing greater volatility against the U.S. dollar. The government also needed to prevent systemic risks in the economy, and prevent “cross infection” between the stock, debt and currency markets, he said. The comments come after China reported economic growth of 6.9% for 2015, its weakest in 25 years, while depreciation pressure on the yuan adds to the case for the central bank to take more economic stimulus measures over the near-term. A slew of economic indicators has sent mixed signals to markets at the start of 2016 over the health of China’s economy. Activity in the services sector expanded at its fastest pace in six months in January, a private survey showed on Feb. 3, while manufacturing activity fell to the lowest since August 2012.

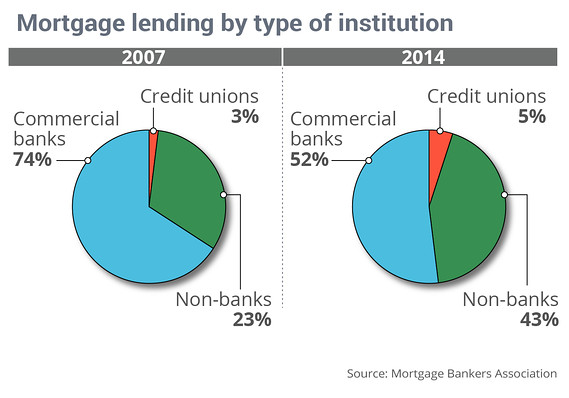

“..the four largest commercial banks will “downsize or exit entirely from the business of originating and servicing residential mortgages.”

• America’s Big Banks Are Fleeing The Mortgage Market (MW)

When it comes to residential mortgages, big banks are waving the white flag. Banks originated 74% of all mortgages in 2007, but their share fell to 52% in 2014, the most recent data available from the Mortgage Bankers Association. And it could go even lower. But even at these levels, the big bank backtrack is reshaping a lending landscape that’s already undergone seismic shifts since the housing bubble burst. While there’s widespread agreement that banks should have been reined in — and perhaps punished — after playing a major role in the housing bubble that helped tank the economy, the past few years have been tough for banks’ mortgage businesses. They now face a regulatory environment so strict that many are afraid to lend, even to customers with the most pristine credit.

They’re still paying up for misdeeds done during the bubble. There’s essentially no private bond market to whom to sell mortgages. And fighting those battles on behalf of their least-profitable divisions means residential lending just isn’t worth it for many banks. “We can’t make money in the business,” BankUnited CEO John Kanas said when he announced a mortgage retreat on a January earnings call. “We realized that this was the lowest-margin, most volatile business we had and we decided that we should exit.” Of the top 10 originators in 2015, banks lent 28.6% of all mortgages, according to data from Inside Mortgage Finance. That’s about half their share in 2012, when banks among the top 10 originators accounted for 54.4% of all mortgages.

For many analysts, that step is only natural. “The fact is that the cost of capital and compliance has convinced many bankers that making home loans to American families is not worth the risk,” said Chris Whalen, a long-time bank analyst now with Kroll Bond Rating Agency, in a speech early in February. Whalen expects the four largest commercial banks will “downsize or exit entirely from the business of originating and servicing residential mortgages.”

Boomers. They’re supposed to be the richest Americans. “..the aggregate debt of the average Baby Boomer has soared 169% since 2003..”

• Large Increase in Debts Held by Americans Over Age 50 (WSJ)

Americans in their 50s, 60s and 70s are carrying unprecedented amounts of debt, a shift that reflects both the aging of the baby boomer generation and their greater likelihood of retaining mortgage, auto and student debt at much later ages than previous generations. The average 65-year-old borrower has 47% more mortgage debt and 29% more auto debt than 65-year-olds had in 2003, according to data from the Federal Reserve Bank of New York released Friday. The result: U.S. household debt is vastly different than it was before the financial crisis, when many younger households had taken on large debts they could no longer afford when the bottom fell out of the economy.

The shift represents a “reallocation of debt from young [people], with historically weak repayment, to retirement- aged consumers, with historically strong repayment,” according to New York Fed economist Meta Brown in a presentation of the findings. Older borrowers have historically been less likely to default on loans and have typically been successful at shrinking their debt balances. But greater borrowing among this age group could become alarming if evidence mounted that large numbers of people were entering retirement with debts they couldn’t manage. So far, that doesn’t appear to be the case. Most of the households with debt also have higher credit scores and more assets than in the past.

“Retirement-aged consumers’ repayment has shown little sign of developing weakness as their balances have grown,” according to Ms. Brown. The data were released in conjunction with the New York Fed’s quarterly report on household debt, that aggregates millions of credit reports from the credit-rating agency Equifax. The report was launched in 2010 to track the changing debt behaviors of U.S. households after the financial crisis. For the last two years, household debts have been slowly rising, although they remain well below where they were in 2008. That trend continued in the final quarter of 2015, with overall household indebtedness rising by $51 billion to $ 12.1 trillion.

Timber!

• The Eurozone Crisis Is Back On The Boil (Guardian)

Greece is back in recession. Italy is barely growing. Portugal expanded but only at half the expected rate. The message could hardly be clearer: the next phase of the eurozone crisis is about to begin. On the face of it, the performance of the eurozone economy in the final three months of 2015 looks solid if unspectacular, with growth as measured by GDP up by 0.3%. But scratch beneath the surface and the picture looks far less rosy. The beneficial impacts of the European Central Bank’s quantitative easing programme have started to wear off, as has the effect of the big drop in oil prices in the second half of 2014. The eurozone peaked in the second quarter of 2015 and the trend was starting to weaken even before the recent turbulence on the financial markets.

Three individual countries bear closer examination. The first is Germany, for which growth of 0.3% in the fourth quarter of 2015 and 1.4% for the year as a whole is as good as it gets. Exports – the mainstay of the German economy – are going to face a much more challenging international climate in 2016, particularly with the euro strengthening on the foreign exchanges. Finland is noteworthy, not just because it is officially back in recession after two successive quarters of negative growth and still has a smaller economy than it did when the financial crisis erupted in 2008, but because its performance is worse than that of Denmark and Sweden, two Scandinavian EU members not in the single currency.

But by far the most worrying country is Greece, where a crumbling economy and the attempts to impose even more draconian austerity is leading, unsurprisingly, to violent protests on the streets. A contraction in growth makes it even harder for Greece to achieve the already ridiculously ambitious deficit and debt reduction targets set for it by its creditors, and on past form that will lead sooner or later (sooner in this case) to a fresh financial crisis and the imposition of further austerity measures. After six months out of the headlines, Greece is coming back to the boil. The danger is that other weak countries on the eurozone’s periphery – most notably Italy and Portugal – suffer from contagion effects.

He’s trying so hard to boost Deutsche confidence it’ll backfire. People are going to say: ‘let’s see what you got’.

• Schäuble Says Portugal Debt Woes Trump ‘Strong’ Deutsche Bank (BBG)

The volatile Portuguese bond market is more alarming than plunging confidence in Deutsche Bank AG, Europe’s largest lender, according to German Finance Minister Wolfgang Schaeuble. Even as a global rout in stocks has driven down European bank shares by 27% this year, Schaeuble warned on Friday after a meeting of EU finance ministers in Brussels that Portugal doesn’t have enough “resilience.” “Portugal must do everything to counter uncertainty in financial markets,” he said. The German finance minister’s comments come after the yield on Portugal’s 10-year bond fluctuated in a range of 143 basis points this week, the largest five-day swing since July 2013. Prime Minister Antonio Costa, who was sworn in at the end of November, has rolled back reform measures introduced during the nation’s bailout program that ended in 2014.

Deutsche Bank, which issued a statement Friday reassuring investors it has enough reserves to service debt obligations, “has sufficient capital and is well positioned,” Schaeuble said. In an effort to allay anxieties, the Frankfurt-based lender announced plans to buy back about $5.4 billion of bonds in euros and dollars Friday. The move comes after the cost of insuring its senior debt via credit-default swaps rose to the highest since 2011. Deutsche Bank isn’t alone as confidence in banks’ abilities to return profits in a low interest rate environment is waning. Global banks including Citigroup, Bank of America, Credit Suisse and Deutsche Bank have all plunged more than 32%. European finance ministers, when asked about the negative sentiment around European banks, remained upbeat, citing confidence in the safeguards put in place after Lehman Brothers went under in 2008. “We have taken precautions to make banks more resilient after the lessons from the financial and banking crisis,” Schaeuble said.

The chain is as strong as…

• European Banks Are In The Eye Of A New Financial Storm (Economist)

If the start of the year has been desperate for the world’s stockmarkets, it has been downright disastrous for shares in banks. Financial stocks are down by 19% in America. The declines have been even steeper elsewhere. Japanese banks’ shares have plunged by 36% since January 1st; Italian banks’ by 31% and Greek banks’ by a horrifying 60%. The fall in the overall European banking index of 24% has brought it close to the lows it plumbed in the summer of 2012, when the euro zone seemed on the verge of disintegration until Mario Draghi, the president of the ECB, promised to do “whatever it takes” to save it. The distress in Europe encompasses big banks as well as smaller ones. It has affected behemoths within the euro area such as Société Générale and Deutsche Bank – both of which saw their shares fall by 10% in hours this week – as well as giants outside it such as Barclays (based in Britain) and Credit Suisse (Switzerland).

The apparent frailty of European banks is especially disappointing given the efforts made in recent years to make them more robust, both through capital-raising and tougher regulation. Euro-zone banks issued over €250 billion ($280 billion) of new equity between 2007, when the global financial crisis began, and 2014, when the ECB took charge of supervising them. Before taking on the job, it combed through the books of 130 of the euro zone’s most important banks and found only modest shortfalls in capital. Some of the recent weakness in European banking shares arises from wider worries about the world economy that have also driven down financial stocks elsewhere. A slowdown in global growth is one threat. Another is that the negative interest rates being pursued by central banks to try to prod more life into economies will further sap banks’ profits.

A retreat in Japanese bank shares turned into a rout following such a decision in late January. Investors in European banks fret not just about lacklustre growth but also a possible move deeper into negative territory by the ECB in March. On February 11th Sweden’s central bank cut its benchmark rate from -0.35% to -0.5%, prompting shares in Swedish banks to tumble. But the malaise of European banking stocks has deeper roots. The fundamental problem is both that there are too many banks in Europe and that many are not profitable enough because they have clung to flawed business models. European investment banks lack the deep domestic capital markets that give their American competitors an edge. Deutsche, for instance, has only just resolved to hack back its investment bank in the face of a less hospitable regulatory environment following the financial crisis.

What to say?

• 150,000 Penguins Die After Giant Iceberg Renders Colony Landlocked (Guardian)

An estimated 150,000 Adelie penguins living in Antarctica have died after an iceberg the size of Rome became grounded near their colony, forcing them to trek 60km to the sea for food. The penguins of Cape Denison in Commonwealth Bay used to live close to a large body of open water. However, in 2010 a colossal iceberg measuring 2900sq km became trapped in the bay, rendering the colony effectively landlocked.Penguins seeking food must now waddle 60km to the coast to fish. Over the years, the arduous journey has had a devastating effect on the size of the colony. Since 2011 the colony of 160,000 penguins has shrunk to just 10,000, according to research carried out by the Climate Change Research Centre at Australia’s University of New South Wales. Scientists predict the colony will be gone in 20 years unless the sea ice breaks up or the giant iceberg, dubbed B09B, is dislodged.

Penguins have been recorded in the area for more than 100 years. But the outlook for the penguins remaining at Cape Denison is dire. “The arrival of iceberg B09B in Commonwealth Bay, East Antarctica, and subsequent fast ice expansion has dramatically increased the distance Adélie penguins breeding at Cape Denison must travel in search of food,” said the researchers in an article in Antarctic Science. “The Cape Denison population could be extirpated within 20 years unless B09B relocates or the now perennial fast ice within the bay breaks out” “This has provided a natural experiment to investigate the impact of iceberg stranding events and sea ice expansion along the East Antarctic coast.” In contrast, a colony located just 8km from the coast of Commonwealth Bay is thriving, the researchers said. The iceberg had apparently been floating close to the coast for 20 years before crashing into a glacier and becoming stuck.

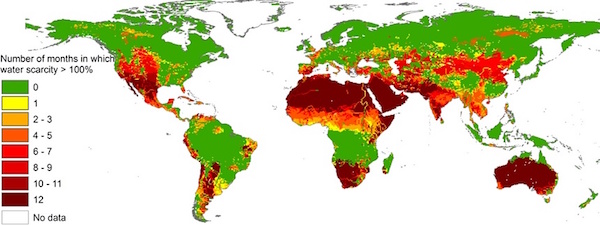

The next trigger for mass migrations.

• Four Billion People Face Severe Water Scarcity (Guardian)

At least two-thirds of the global population, over 4 billion people, live with severe water scarcity for at least one month every year, according to a major new analysis. The revelation shows water shortages, one of the most dangerous challenges the world faces, is far worse previously than thought. The new research also reveals that 500m people live in places where water consumption is double the amount replenished by rain for the entire year, leaving them extremely vulnerable as underground aquifers run down. Many of those living with fragile water resources are in India and China, but other regions highlighted are the central and western US, Australia and even the city of London. These water problems are set to worsen, according to the researchers, as population growth and increasing water use – particularly through eating meat – continues to rise.

In January, water crises were rated as one of three greatest risks of harm to people and economies in the next decade by the World Economic Forum, alongside climate change and mass migration. In places, such as Syria, the three risks come together: a recent study found that climate change made the severe 2007-2010 drought much more likely and the drought led to mass migration of farming families into cities. “If you look at environmental problems, [water scarcity] is certainly the top problem,” said Prof Arjen Hoekstra, at the University of Twente in the Netherlands and who led the new research. “One place where it is very, very acute is in Yemen.” Yemen could run out of water within a few years, but many other places are living on borrowed time as aquifers are continuously depleted, including Pakistan, Iran, Mexico, and Saudi Arabia. Hoekstra also highlights the Murray-Darling basin in Australia and the midwest of the US. “There you have the huge Ogallala acquifer, which is being depleted.”

He said even rich cities like London in the UK were living unsustainably: “You don’t have the water in the surrounding area to sustain the water flows” to London in the long term. The new study, published in the journal Science Advances on Friday, is the first to examine global water scarcity on a monthly basis and at a resolution of 31 miles or less. It analysed data from 1996-2005 and found severe water scarcity – defined as water use being more than twice the amount being replenished – affected 4 billion people for at least one month a year. “The results imply the global water situation is much worse than suggested by previous studies, which estimated such scarcity impacts between 1.7 billion and 3.1 billion people,” the researchers concluded. The new work also showed 1.8 billion people suffer severe water scarcity for at least half of every year.

Making deals with Turkey while blaming Greece is just plain wrong on many different levels.

• Merkel Turns to ‘Coalition of Willing’ to Tackle Refugee Crisis (BBG)

German Chancellor Angela Merkel is turning to a subgroup of European Union members to tackle the region’s refugee crisis as the bloc as a whole bickers over how to handle the biggest influx of migrants into Europe since World War II. Merkel plans to meet again with a “coalition of the willing” in Brussels ahead of an EU summit in the city next week. Turkish Prime Minister Ahmet Davutoglu will attend the talks, which have taken place at previous EU gatherings. Turkey is the main country from which migrants enter the EU. “This doesn’t have to do with a permanent distribution mechanism but rather a group of countries that are willing to consider” taking refugees once the illegal trafficking has been stopped, Merkel said Friday at a Berlin press conference with her Polish counterpart Beata Szydlo.

“We will then report quite transparently to all 28 member states where things stand.” Merkel traveled earlier this week to Turkey to discuss the crisis with Davutoglu. Merkel said on Monday the only way to end the flood of illegal migration across the Aegean Sea from Turkey into Greece was to replace it with a legal avenue. That would involve the EU resettling allotments of mostly Syrian refugees directly from Turkey in return for Turkey halting the flow of migrants, she said. The chancellor has thus far failed to secure a wider EU deal to share in housing and caring for those who have already reached the bloc.

Germany, which took in more than 1 million refugees last year, has pushed to implement a quota system to distribute migrants among EU members – something that a number of the bloc’s states, in particular in the east, argue should only be done on a voluntary basis. “For Poland, a permanent mechanism of relocating migrants is currently not acceptable,” Szydlo said at the press conference with Merkel. “I think we will continue talking about this. But I want to stress that Poland wants to actively participate in solving the migrant crisis because it’s very important for the EU as a whole.”

They’re too thick to see that this means the end of the union.

• EU Is Poised To Restrict Passport-Free Travel (AP)

EU countries are poised to restrict passport-free travel by invoking an emergency rule to keep some border controls for two more years because of the migration crisis and Greece’s troubles in controlling its border, according to EU documents seen by AP. The switch would reverse a decades-old trend of expanding passport-free travel in Europe. Since 1995, people have been able to cross borders among Schengen Area member countries without document checks. Each of the current 26 countries in the Schengen Area is allowed to unilaterally put up border controls for a maximum of six months, but that time limit can be extended for up to two years if a member is found to be failing to protect its borders.

The documents show that EU policy makers are preparing to make unprecedented use of an emergency provision by declaring that Greece is failing to sufficiently protect it border. Some 2,000 people are still arriving daily on Greek islands in smugglers’ boats from Turkey, most of them keen to move deeper into Europe to wealthier countries like Germany and Sweden. A European official showed the documents to the AP on condition of anonymity because the documents are confidential. Greek government officials declined to comment on the content of documents not made public. In Brussels on Friday, EU nations acknowledged that the overall functioning of Schengen “is at serious risk” and said Greece must make further efforts to address “serious deficiencies” within the next three months.

European inspectors visited Greek border sites in November and gave Athens until early May to upgrade the border management on its islands. Two draft assessments forwarded to the Greek government in early January indicated Athens was making progress, although they noted “important shortcomings” in handling migrant flows. But with asylum-seekers still coming at a pace ten times that of January 2015, European countries are reluctant to dismantle their emergency border controls. And if they keep them in place without authorization, EU officials fear the entire concept of the open-travel zone could be brought down. A summary written by an official in the EU’s Dutch presidency for a meeting of EU justice and home affairs ministers last month showed they decided that declaring Greece to have failed in its upgrade was “the only way” for Europe to extend the time for border checks.

“..more than in the first four months of 2015..”

• 80,000 Refugees Arrive In Europe In First Six Weeks Of 2016 (UNHCR)

Despite rough seas and harsh winter weather, more than 80,000 refugees and migrants arrived in Europe by boat during the first six weeks of 2016, more than in the first four months of 2015, the UN Refugee Agency, UNHCR, announced today. In addition it said more than 400 people had lost their lives trying to cross the Mediterranean. However, despite the dangers over 2,000 people a day continue to risk their lives and the lives of their children attempting to reach Europe. Comparable figures for 2015 show such numbers only began arriving in July. “The majority of those arriving in January 2016, nearly 58%, were women and children; one in three people arriving to Greece were children as compared to just 1 in 10 in September 2015,” UNHCR’s Chief spokesperson Melissa Fleming told a press briefing in Geneva.

Fleming added that over 91% of those arriving in Greece come from the world’s top ten refugee producing countries, including Syria, Afghanistan and Iraq. “Winter weather and rough seas have not deterred those desperate enough to make the journey, resulting in near daily shipwrecks,” she added. When surveyed upon arrival, most of them cite they had to leave their homeland due to conflict. More than 56% of January arrivals to Greece were from Syria. However, UNHCR stressed that solutions to Europe’s situation were not only eminently possible, but had already been agreed by States and now urgently needed to be implemented. Stabilization is essential and something for which there is also strong public demand.

“Within the context of the necessary reduction of dangerous sea arrivals, safe access to seek asylum, including through resettlement and humanitarian admission, is a fundamental human right that must be protected and respected,” Fleming added. She said that regular pathways to Europe and elsewhere were important for allowing refugees to reach safety without putting their lives in the hands of smugglers and making dangerous sea crossings. “Avenues, such as enhanced resettlement and humanitarian admission, family reunification, private sponsorship, and humanitarian and refugee student/work visas, should be established to ensure that movements are manageable, controlled and coordinated for countries receiving these refugees,” Fleming added.

Vincent Cochetel, UNHCR’s Director Bureau for Europe, added that faced with this situation, UNHCR hoped that EU Member States would implement at a faster pace all EU-wide measures agreed upon in 2015, including the implementation of hotspots and the relocation process for 160,000 people already in Greece and Italy and the EU-Turkey Joint-Action Plan. “If Europe wants to avoid the mess of 2015, it must take action. There is no plan B,” he also told the briefing.

Home › Forums › Debt Rattle February 13 2016