Unknown Dutch Gap, Virginia. Picket station of Colored troops 1864

Just as I wrote on election day in America is The Poisoned Chalice.

• Financial Conditions Are Rigged Against Donald Trump (BBG)

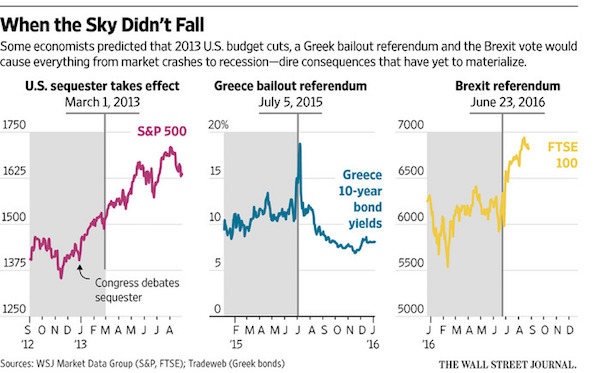

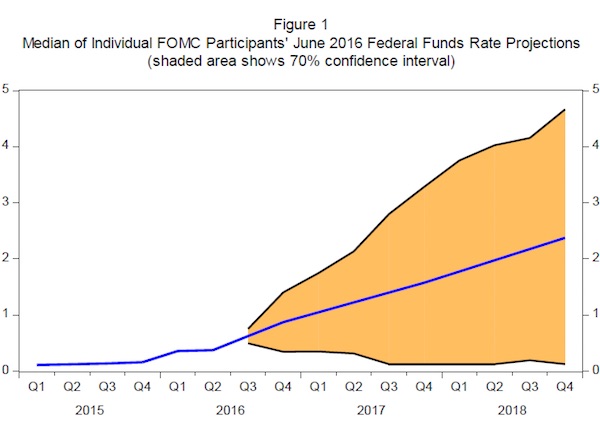

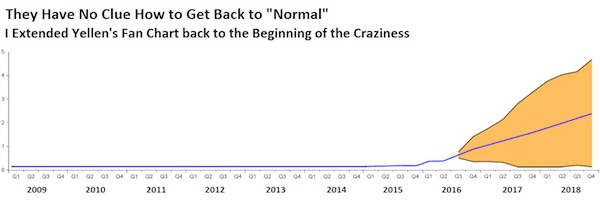

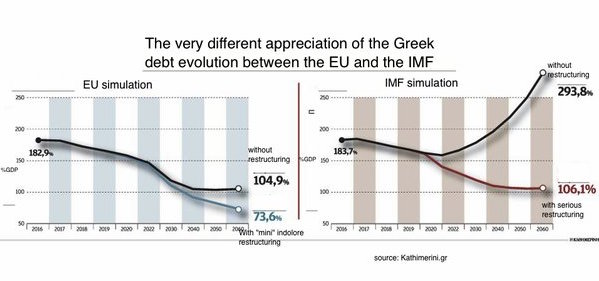

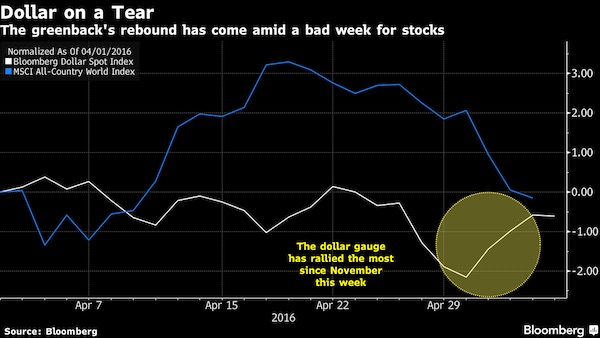

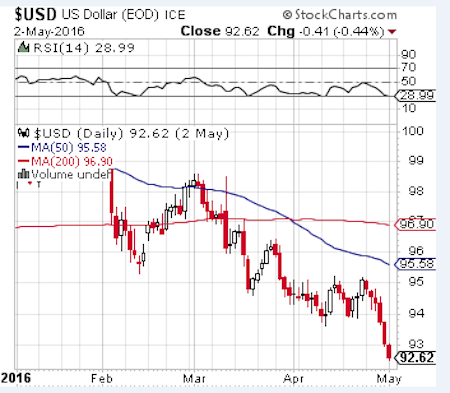

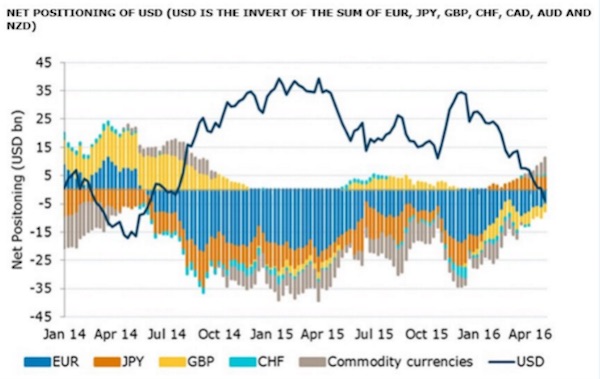

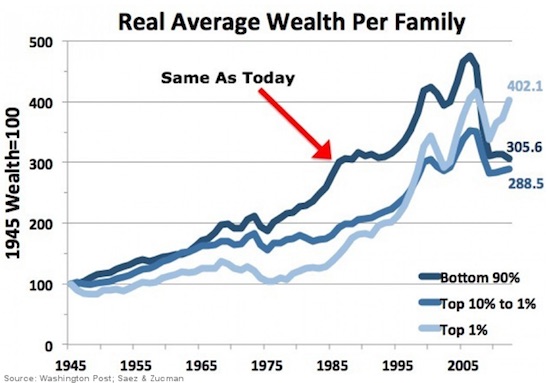

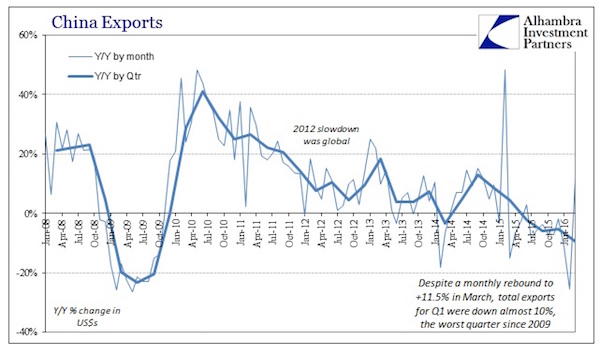

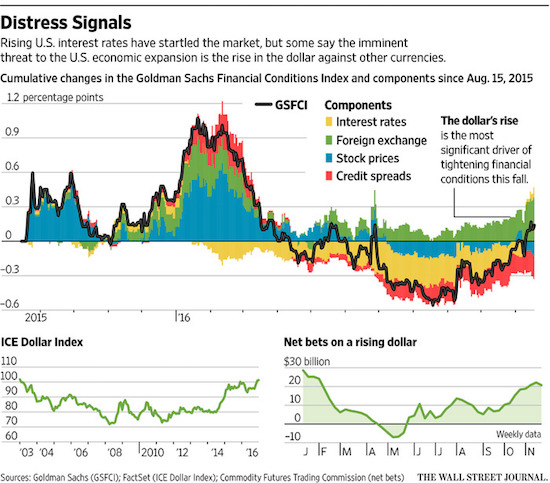

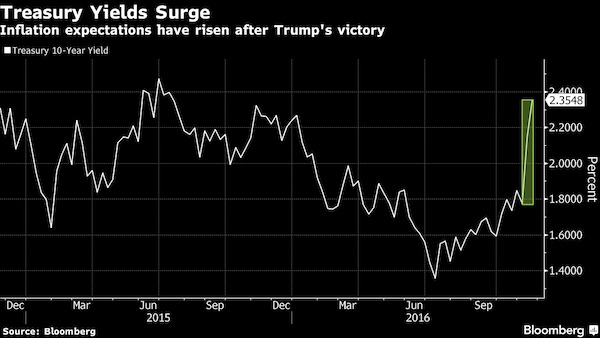

The reaction in financial markets to Trump’s election victory – much like the win itself – has defied conventional wisdom, with U.S. equities surging following a sharp drop as the results came in. But if you’re an occasional real estate developer — a self-professed “low interest rate guy” who wants to fix America’s trade deficit while bringing factories back from overseas – it might seem as though markets have been rigged against you. The U.S. dollar spot index (DXY) touched levels not seen since the Clinton administration on Friday morning, and the yield on the 10-year U.S. Treasury has increased by more than 50 basis points since Nov. 9.

This rise in the greenback and borrowing costs for the U.S. constitutes a tightening of financial conditions — a potential obstacle to U.S. growth, as servicing new debt has become more expensive and goods produced domestically are now less attractive to foreigners. Earlier this week, the Goldman Sachs Financial Conditions Index rose above 100 to hit levels not seen since March, when the financial backdrop was trending in a more accommodative direction following the market turmoil that started 2016. The index tracks changes in interest rates, credit spreads, equity prices, and the value of the U.S. dollar: a rise indicates that financial conditions have tightened. “A stronger USD implies lower domestic inflation and higher real rates, a headwind to U.S. growth,” writes Neil Dutta at Renaissance Macro Research.

In her testimony before Congress on Thursday, Federal Reserve Chair Janet Yellen highlighted this rise in the U.S. dollar as well as interest rates since the election — but not the gains in the stock market. This may serve as an implicit nod at what’s reflected in many financial conditions indexes: There’s a certain degree of asymmetry at play, with the rise in the greenback and U.S. Treasury yields far outweighing the tightening of credit spreads and rise in stock values. That asymmetry perhaps speaks to an unintentional and counterintuitive overlap between how the president-elect and the Federal Reserve interpret how changes in financial conditions affect real economic activity.

“What is very negative is that in every country in Europe, the largest owner of that country’s sovereign bonds are that country’s banks..”

• Big Short’s Steve Eisman: ‘Europe is Screwed’ (G)

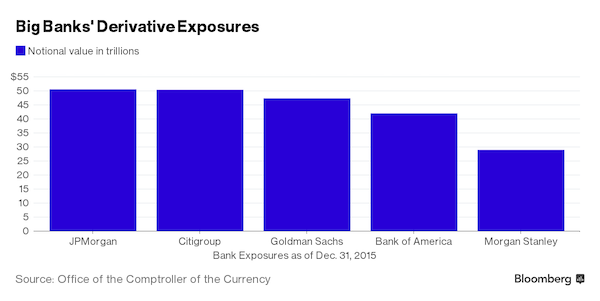

In the Oscar-winning The Big Short, Steve Carell plays the angry Wall Street outsider who predicts (and hugely profits from) the great financial crash of 2007-08. [..] In real life he is Steve Eisman, he is still on Wall Street, and he is still shorting stocks he thinks are going to plummet. And while he’s tight-lipped about which ones (unless you have $1m to spare for him to manage) it is evident he has one major target in mind: continental Europe’s banks – and Italy’s are probably the worst. Why Italy? Because, he says, the banks there are stuffed with “non-performing loans” (NPLs). That’s jargon for loans handed out to companies and households where the borrower has fallen behind with repayments, or is barely paying at all. But the Italian banks have not written off these loans as duds, he says.

Instead, billions upon billions are still on the books, written down as worth about 45% to 50% of their original value. The big problem, says Eisman, is that they are not worth anywhere near that much. In The Big Short, Eisman’s staff head to Florida to speak to the owners of newly built homes bundled up in “mortgage-backed securities” rated as AAA by the investment banks. What they find are strippers with loans against multiple homes but almost no income, the mortgages arranged by sharp-suited brokers who know they won’t be repaid, and don’t care. Visiting the housing estates that these triple-A mortgages are secured against, they find foreclosures and dereliction. In a mix of moral outrage at the banks – and investing acumen – Eisman and his colleagues bought as many “swaps” as possible to profit from the inevitable collapse of the mortgage-backed securities, making a $1bn profit along the way.

This time around, Eisman is not padding around the plains of Lombardy because he says the evidence is in plain sight. When financiers look to buy the NPLs off the Italian banks, they value the loans at what they are really worth – in other words, how many of the holders are really able to repay, and how much money will be recovered. What they find is that the NPLs should be valued at just 20% of their original price. Trouble is, if the Italian banks recognise their loans at their true value, it wipes out their capital, and they go bust overnight. “Europe is screwed. You guys are still screwed,” says Eisman. “In the Italian system, the banks say they are worth 45-50 cents in the dollar. But the bid price is 20 cents. If they were to mark them down, they would be insolvent.”

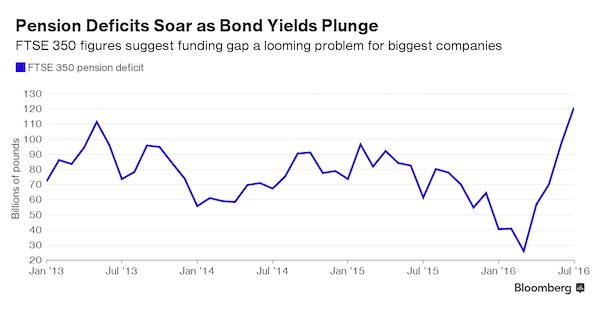

[..] Trump’s victory has sent the bond markets into disarray, with the yield on government bonds rising steeply. While this sounds good for savers – interest rates could rise – it is bad news for the holders of government bonds, which fall in value when the yield rises. Eisman sees that as another woe for Europe’s banks, who hold vast amounts of “sovereign bonds”. “What is very negative is that in every country in Europe, the largest owner of that country’s sovereign bonds are that country’s banks,” he says. As the bonds decline in value, then the capital base of the banks deteriorates.

The usual victims.

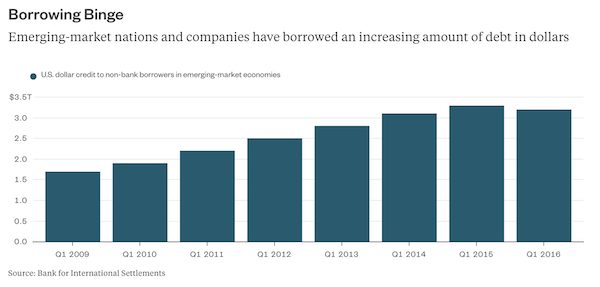

• Emerging Markets Borrowers Owe $3.2 Trillion In -Rising- Dollar Debt (BBG)

[..] Companies in these more-vulnerable economies have $340 billion of debt coming due through 2018, and they are going to have a hard time paying all that back if investors keep withdrawing their cash. [..] After the election of Donald Trump as the next U.S. president, many expect his infrastructure spending programs and trade policies to lead to higher consumer prices in the world’s biggest economy. Bonds tend to do poorly when inflation accelerates, especially because such an environment would prompt the Fed to raise benchmark interest rates faster than many expect. That would bad for all types of debt but particularly for notes in emerging markets. That’s because investors will migrate back to higher-rated bonds in developed economies instead of those in less-proven nations.

Also, more U.S. growth typically means a stronger dollar, which is a significant problem for emerging-market nonbank borrowers, which have accumulated more than $3 trillion in dollar-denominated debt, according to BIS data. The higher the dollar rises, the more expensive it becomes to pay back the debt. And already this week, the currency has surged because of the sudden prospect of tighter Fed policies and faster U.S. growth. The sheer scale of leverage in the economy, including “the large increase of emerging-market debt, much of it denominated in dollars,” is one of the biggest risks in the financial system right now, Adair Turner, former U.K. Financial Services Authority chairman, said in a Bloomberg Television interview Friday. All that money is owed to somebody, and a failure to pay it back will cause big ripple effects.

if the US doesn’t manipulate its currency lower soon, it’s going to lose export markets.

• Dollar’s Rapid Gain Triggers Angst in Emerging Markets (WSJ)

The dollar extended its powerful rally, spurring central banks in developing countries to take steps to stabilize their own currencies and threatening to create headwinds for the long-running U.S. expansion. The US currency moved closer to parity with the euro after rising for the 10th straight day, the dollar’s longest winning streak against the euro since the European currency’s inception in 1999. The dollar also moved higher against the yen, which fell to its weakest levels against the U.S. currency since May 30. The gains are even greater against many emerging-market currencies, prompting central banks in a number of countries to intervene to slow the slide. The Mexican peso has fallen 11% against the dollar to record lows since the election, while the Brazilian real has tumbled 6.3%.

The currency’s gains make foreign goods and travel cheaper for U.S. consumers and could give a boost to exports from Japan and Europe. But they also are reigniting fears that the dollar’s strength could slow U.S. corporate profit growth and intensify capital flight from the developing world, which would complicate the prospects for economic growth. “The strong dollar is destabilizing for markets, for foreign assets, for emerging-market nations that pay back their debt in dollars,” said Jonathan Lewis, chief investment officer Fiera Capital. “That’s pretty significant.” The dollar’s gains have been driven by bets that fiscal spending and tax cuts proposed by President-elect Donald Trump will spur U.S. economic growth, as well as by the rising probability that the Federal Reserve will raise interest rates next month.

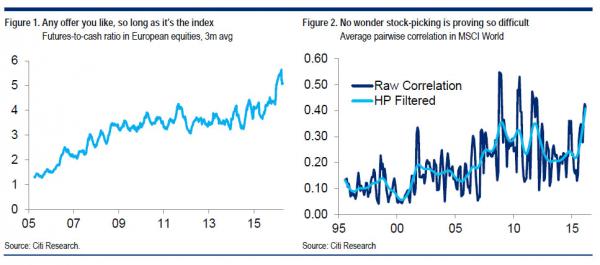

Too much is moving in the same direction. Sheep don’t make for healthy markets.

• Global Bonds Post Biggest Two-Week Loss in 26 Years (BBG)

Bonds around the world had their steepest two-week loss in at least 26 years as President-elect Donald Trump sends inflation expectations surging. The Bloomberg Barclays Global Aggregate Index has fallen 4% since Nov. 4. It’s the biggest two-week rout in data going back to 1990. Federal Reserve Chair Janet Yellen contributed to the decline by saying Thursday an interest-rate hike could come “relatively soon.” “We’ve seen a sharp and swift move since the election, which is pricing in the potential future policies of Trump,” said Sean Simko at SEI Investments in Oaks, Pennsylvania. “The big question is to what extent these policies are going to be implemented, and how quickly are they going to be implemented.”

Treasury 10-year note yields climbed five basis points, or 0.05 percentage point, to 2.35% as of 5 p.m. in New York, reaching the highest since November 2015, according to Bloomberg Bond Trader data. The 2% security due in November 2026 closed at 96 27/32. “Trump is a game changer,” Park Sung-jin at Mirae Asset Securities. “I was bearish, but the current level is more than I expected.” The selloff has gone fast enough that it’ll probably pause before yields press higher in 2017, Park said. Yellen, addressing U.S. lawmakers Thursday, signaled the U.S. central bank is close to lifting interest rates as the economy continues to create jobs at a healthy clip and inflation inches higher.

The president-elect’s pledges include tax cuts and spending $500 billion or more over a decade on infrastructure, a combination that’s seen as spurring quicker growth and price gains in the world’s biggest economy. Trump has also blamed China and Mexico for American job losses and threatened punitive tariffs on imports, a move that may spur inflation. The difference between yields on U.S. 10-year notes and similar-maturity Treasury Inflation Protected Securities, a gauge of trader expectations for consumer prices over the life of the debt, rose to as much as 1.97 percentage points this week, the highest since April 2015.

It’s not just global markets being hit, the US ‘homeowner’ will also pay the price.

• Bond Carnage hits Mortgage Rates. But This Time, it’s Real (WS)

The carnage in bonds has consequences. The average interest rate of the a conforming 30-year fixed mortgage as of Friday was quoted at 4.125% for top credit scores. That’s up about 0.5 percentage point from just before the election, according to Mortgage News Daily. It put the month “on a short list of 4 worst months in more than a decade.” One of the other three months on that short list occurred at the end of 2010 and two “back to back amid the 2013 Taper Tantrum,” when the Fed let it slip that it might taper QE Infinity out of existence. Investors were not amused. From the day after the election through November 16, they yanked $8.2 billion out of bond funds, the largest weekly outflow since Taper-Tantrum June.

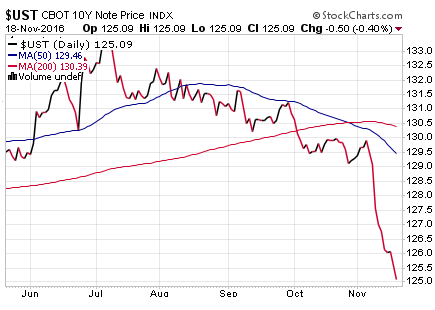

The 10-year Treasury yield today jumped to 2.36% in late trading the highest since December 2015, up 66 basis point since the election, and up one full percentage point since July! The 10-year yield is at a critical juncture. In terms of reality, the first thing that might happen is a rate increase by the Fed in December, after a year of flip-flopping. A slew of post-election pronouncements by Fed heads – including Yellen’s “relatively soon” – have pushed the odds of a rate hike to 98%. [..] I still think that pullback in yields is going to happen any day now. As I said, nothing goes to heck in a straight line. In terms of dollars and cents, this move has wiped out a lot of wealth. Bond prices fall when yields rise. This chart shows the CBOT Price Index for the 10-year note. It’s down 5.6% since July:

The 30-year Treasury bond went through a similar drubbing. The yield spiked to 3.01%. The mid-week pullback was a little more pronounced. Since the election, the yield has spiked by 44 basis points and since early July by 91 basis points (via StockCharts.com). Folks who have this “risk free” bond in their portfolios: note that in terms of dollars and cents, the CBOT Price Index for the 30-year bond has plunged 13.8% since early July!

This will now be scaring Abe and Kuroda.

• US Dollar Sees Steepest 2-Week Gain Against Yen Since January 1988 (R.)

The dollar rose to its highest level since April 2003 against a basket of currencies on Friday, marking its biggest two-week increase since March 2015 as traders piled bets on a massive dose of fiscal stimulus under a Trump U.S. presidency. Also stoking the dollar rally were growing expectations the Fed would raise interest rates next month on signs of rising inflation and improved economic growth. The greenback has climbed 7.3% against the yen in two weeks, its steepest such gain since January 1988 and its second-strongest performance in the era of floating exchange rates. The dollar has been on a tear following Donald Trump’s Nov. 8 victory over Hillary Clinton, tracking surging U.S. Treasury yields amid concerns government borrowing to fund possible stimulus programs could stoke inflation.

Traders have seized on the tax cuts, deregulation and infrastructure spending that Trump campaigned on as negatives for bonds and positives for the dollar. “It has caused a wave of dollar buying across the board,” said Richard Scalone, co-head of foreign exchange at TJM Brokerage in Chicago. To be sure, it remained unclear how many, if any, of the policy proposals would materialize. Trump’s stance on immigration and trade, if they become law, could hurt the dollar, analysts said. “The dollar is the wild card,” said Richard Bernstein, CEO of Richard Bernstein Advisors. The dollar index, hit 101.48, its highest since early April 2003 before paring gains to 101.25, up 0.4% on the day.

Yeah, like that’s in your power… “’Interest rates may have risen in the U.S., but that doesn’t mean that we have to automatically allow Japanese interest rates to increase in tandem’, Mr. Kuroda said.”

• Bank of Japan Surprises With Plan to Buy Unlimited JGBs at Fixed Rates (WSJ)

The Bank of Japan on Thursday offered to buy an unlimited amount of Japanese government bonds at fixed rates for the first time since the introduction of a new policy framework—a sign of its concerns over recent rises in yields. The move is the first clear sign from the central bank that it intends to take action to keep a lid on rising yields, and took market participants by surprise. “I thought there was still a lot more room left” before the BOJ took action, said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management. The BOJ’s move followed a sharp rise in government bond yields globally, sparked by expectations that the presidency of Donald Trump would lift inflation and growth.

Japanese government bond yields have risen as well, but not as sharply. The 10-year yield rose to its highest level since March on Wednesday. Yields on two-year and five-year Japanese government bonds fell Thursday after the BOJ’s announcement. The 10-year yield also briefly fell to 0.010% after hitting as high as 0.025% earlier in the morning. Speaking in parliament, Bank of Japan Gov. Haruhiko Kuroda said he wouldn’t allow market pressure from abroad to dictate the course of Japanese government bond yields, highlighting his resolve to hold interest rates down. “Interest rates may have risen in the U.S., but that doesn’t mean that we have to automatically allow Japanese interest rates to increase in tandem,” Mr. Kuroda said.

And the winner is … plastic.

• US Banks Close Rupee Exchanges After Large Bills Ruled Illegal (BBG)

Aruna Desai has a problem with the thousands of Indian rupees she has with her in the U.S. – she can’t find a bank to exchange her funds and couldn’t give the money away if she tried. Since Indian PM Narendra Modi removed 500- and 1,000-rupee notes from circulation, currency exchange providers in the U.S. have been unable to take the outlawed bills. Some of the country’s biggest banks, including JPMorgan and Citigroup work with vendors to provide rupees to clients and those vendors have made the bills unavailable, spokesmen for the banks said. Wells Fargo also said it can’t supply rupees at this time, while Bank of America said it has never accepted the currency for exchange. “If you have a euro, you can go to a bank and exchange it,” Desai, 76, of Cliffside Park, New Jersey, said. “For an Indian rupee, I don’t think there’s any bank that does that here.”

Five-hundred rupee ($7.34) and 1,000-rupee notes ceased to be legal tender Nov. 9, Modi said last week in a surprise announcement, sweeping away 86% of the total currency in circulation. The move has been seen as an attempt to fulfill his election promise of curbing tax evasion and recovering illegal income, locally known as black money, stashed overseas. The notes will have to be deposited in banks by the end of December, Modi said. “For our clients, it’s very hard,” Nandita Chandra, head of Great Indian Travel’s New York office, said in a telephone interview while visiting New Delhi. “A lot of people are affected and we don’t have a culture that is credit-card friendly, it’s a cash-based economy.”

Mastercard, the second-largest payment network, heralded the move as one that will reduce crime and drive growth in the Indian economy. Modi’s “bold action and leadership is a critical step in positioning India to be a leader in the global cashless and digital economy movement,” Porush Singh, the firm’s president for South Asia, said in a statement. “Mastercard is committed to working with the government to provide the cashless solutions that combat corruption and create growth, and inclusion for all members of society.”

Will Washington fall apart without the lobbyists who keep it standing up?

• Lobbyists Leave Trump Transition Team After New Ethics Rule (Pol.)

At least three lobbyists have left President-elect Donald Trump’s presidential transition operation after the team imposed a new ethics policy that would have required them to drop all their clients. CGCN’s Michael Catanzaro, who was responsible for energy independence; Michael Torrey, who was running the handoff at the Department of Agriculture; and Michael McKenna of MWR Strategies, who was focused on the Energy Department, are no longer part of the transition, POLITICO has learned. Lobbyists who piled into the transition when it was being run by New Jersey Gov. Chris Christie were caught off-guard Wednesday by a new ethics policy requiring them to terminate their clients.

“Throughout my time assisting the transition effort, I have adhered closely to the code of ethical conduct and confidentiality agreement that was provided to me,” Torrey said in a statement. “When asked recently to terminate lobbying registration for clients whom I serve in order to continue my role with the transition, I respectfully resigned from my role.” Torrey represents the American Beverage Association, Dean Foods and pizza franchise Little Caesars. Before founding Michael Torrey & Associates in 2005, he was Agriculture Secretary Ann Veneman’s deputy chief of staff, advised Kansas Sen. Bob Dole and worked at the Commodity Futures Trading Commission. Catanzaro lobbies for the American Fuel and Petrochemical Manufacturers, a refining group, as well as Hess, Encana, Noble Energy and Devon Energy.

Let’s see how many will be left come January 20.

• The Rise Of The ‘Un-Lobbyist’ (Mother Jones)

On Wednesday, Donald Trump’s transition team announced one phase of the president-elect’s plan to “drain the swamp” of corruption—a prohibition on registered lobbyists serving in his administration and a five-year lobbying ban for Trump officials who return to the private sector. Trump’s plan effectively doubles down on a policy that the Obama administration already has in place—one that many good government groups and lobbyists alike believe may have created a new problem: un-lobbyists—that is, influence-peddlers who avoid registering as lobbyists to skirt the administration’s rules.

Obama, like Trump, campaigned on a platform of aggressively rooting out the influence of lobbyists. After taking office, he put in place several major good-government initiatives, including a ban on lobbyists serving in his administration and a two-year cooling-off period before ex-administration officials could register to lobby. Once Obama’s lobbying rules took effect, there was a sharp decline in the number of registered lobbyists. Industry insiders and watchdog groups that track the influence game noted that the decrease was not due to lobbyists hanging up their spurs as hired guns for corporations and special interests. Rather it appeared that lobbyists were finding creative ways to avoid officially registering as such. There was no less influence-peddling going on, but now there was less disclosure of the lobbying that was taking place.

The problem lies with the definition of who is a lobbyist. The federal government requires anyone who spends more than 20% of their time on behalf of a client while making “lobbying contacts”—an elaborate and specifically defined type of contact with certain types of federal officials—to register as a lobbyist and file quarterly paperwork disclosing their clients and the bills or agencies he or she sought to sway. But by avoiding too many official “lobbying contacts” and limiting how much income that kind of work accounts for, lobbyists can shed the scarlet L, describing themselves as government affairs consultants or experts in advocacy and public policy.

All governments will use all new technology to encroach ever more on all people’s lives.

• UK Approves ‘Most Extreme Surveillance In History Of Western Democracy’ (AFP)

The British parliament this week gave the green light to new bulk surveillance powers for police and intelligence services that critics have denounced as the most far-reaching of any western democracy. The Investigatory Powers Bill would, among other measures, require websites to keep customers’ browsing history for up to a year and allow law enforcement agencies to access them to help with investigations. Edward Snowden, the former US National Security Agency contractor turned whistleblower, said the powers “went further than many autocracies”. “The UK has just legalised the most extreme surveillance in the history of western democracy,” he tweeted.

The bill, the first major update of British surveillance laws for 15 years, was passed by the House of Lords and now only needs rubber-stamping by Queen Elizabeth II. Prime Minister Theresa May introduced the bill in March when she was still interior minister, describing it as “world-leading” legislation intended to reflect the change in online communications. It gives legal footing to existing but murky powers such as the hacking of computers and mobile phones, while introducing new safeguards such as the need for a judge to authorise interception warrants. But critics have dubbed it the “snooper’s charter” and say that, in authorising the blanket retention and access by authorities of records of emails, calls, texts and web activity, it breaches fundamental rights of privacy.

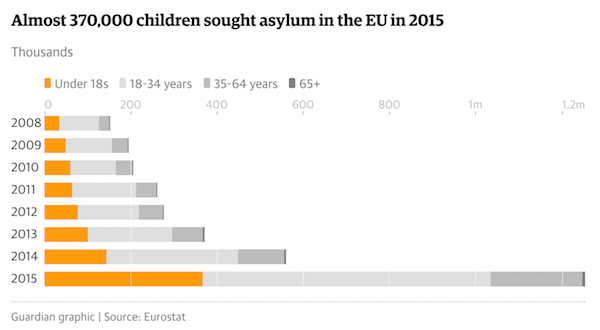

The EU needs to act to stop this. But instead it still hardly resettles refugees at all, and won’t even allow for the refugees to be hosted in mainland Greece. Ugliness guaranteed. Couldn’t have been more effective if they planned it.

• Far-Right Group Attacks Refugee Camp On Greek Island Of Chios (G.)

Dozens of people have been driven out of a refugee camp on the Greek island of Chios after two successive nights of attacks by a far-right group. At least two people were wounded after attackers threw Molotov cocktails and rocks as big as boulders from elevated areas surrounding the Souda camp, activists said. Three tents were burned down and three others were hit by rocks. A 42-year-old Syrian man was assaulted, while a Nigerian boy was hit by a rock. Fearing a third attack on Friday night, about 100 former occupants refused to re-enter the camp, instead taking shelter in a nearby car park. “We do not have any kind of protection,” Mostafa al-Khatib, a Syrian refugee, told the Guardian. “No one cares about us.” Gabrielle Tan, an aid worker with Action From Switzerland, a grassroots organisation working on Chios, said those sheltering in the car park included families with babies and toddlers.

“They’d rather sleep outside in the cold than go back inside,” said Tan. The mayor of Chios said the attackers were thought to be affiliated with Greece’s main far-right party, Golden Dawn. “Of course Golden Dawn supporters are suspected to have participated,” Manolis Vournous told the Guardian. Activists and camp occupants said the rocks appeared to have been thrown with the intention of killing people. Tan said: “These rocks were probably the size of a shoebox, weighing approximately 15kg. Some of them I can’t even lift.” There were conflicting reports about who started the clashes on Wednesday. According to Vournous, the unrest began after Algerians and Moroccans stole alcohol and fireworks from a shop, frightening local residents. But some activists claimed the events escalated after a planned assault by Golden Dawn.