Paul Cézanne The Card Players 1895

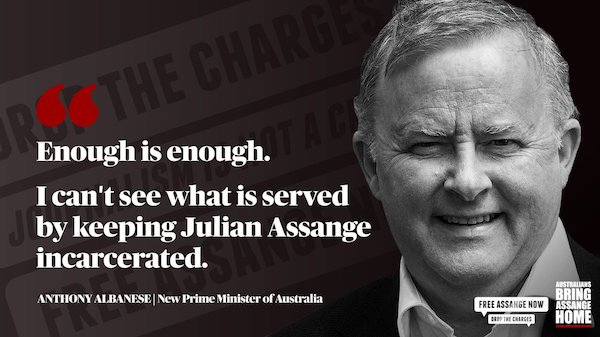

Levy

This is such an extraordinary speech. I only ask of my followers to watch this. Then I leave you alonepic.twitter.com/rZLQKD2BMX

— Bruno Maçães (@MacaesBruno) November 6, 2023

Nurse

An American nurse who just got out of Gaza details the unimaginable conditions under Israel’s bombs and the heroism from her Palestinian colleagues whose families are being exterminated. An absolute must watch pic.twitter.com/r4kMOnsI4r

— Dan Cohen (@dancohen3000) November 7, 2023

Norman Finkelstein RESPONDS to Bernie Sanders statement OPPOSING GAZA CEASEFIRE

“[W]e see not just a growing Israeli fascism but racism akin to Nazism in its early stages.”

• Israel’s Final Solution for the Palestinians (Chris Hedges)

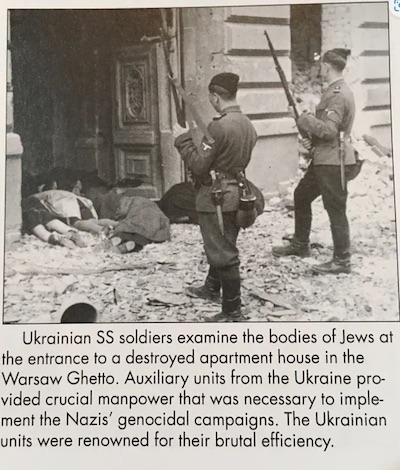

I covered the birth of Jewish fascism in Israel. I reported on the extremist Meir Kahane, who was barred from running for office and whose Kach Party was outlawed in 1994 and declared a terrorist organization by Israel and the United States. I attended political rallies held by Benjamin Netanyahu, who received lavish funding from rightwing Americans, when he ran against Yitzhak Rabin, who was negotiating a peace settlement with the Palestinians. Netanyahu’s supporters chanted “Death to Rabin.” They burned an effigy of Rabin dressed in a Nazi uniform. Netanyahu marched in front of a mock funeral for Rabin. Prime Minister Rabin was assassinated on Nov. 4, 1995 by a Jewish fanatic. Rabin’s widow, Lehea, blamed Netanyahu and his supporters for her husband’s murder.

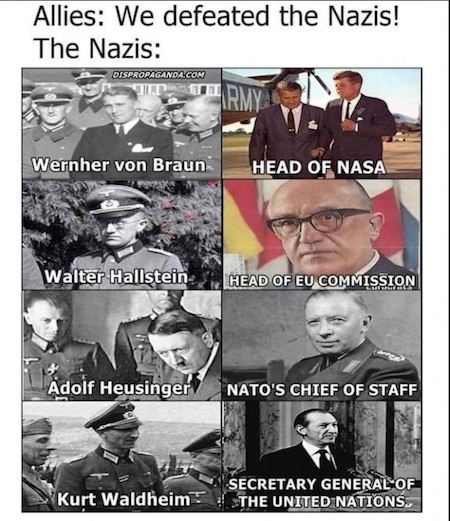

Netanyahu, who first became prime minister in 1996, has spent his political career nurturing Jewish extremists, including Avigdor Lieberman, Gideon Sa’ar, Naftali Bennett, and Ayelet Shaked. His father, Benzion — who worked as an assistant to the Zionist pioneer Vladimir Jabotinsky, who Benito Mussolini referred to as “a good fascist” — was a leader in the Herut Party that called on the Jewish state to seize all the land of historic Palestine. Many of those who formed the Herut Party carried out terrorist attacks during the 1948 war that established the state of Israel. Albert Einstein, Hannah Arendt, Sidney Hook and other Jewish intellectuals, described the Herut Party in a statement published in The New York Times as a “political party closely akin in its organization, methods, political philosophy and social appeal to Nazi and Fascist parties.”

There has always been a strain of Jewish fascism within the Zionist project. Now it has taken control of the Israeli state. “The left is no longer capable of overcoming the toxic ultra-nationalism that has evolved here,” Zeev Sternhell, a Holocaust survivor and Israel’s foremost authority on fascism, warned in 2018, “the kind whose European strain almost wiped out a majority of the Jewish people.” Sternhell added, “[W]e see not just a growing Israeli fascism but racism akin to Nazism in its early stages.” The decision to obliterate Gaza has long been the dream of Israel’s crypto-fascists, heirs of Kahane’s movement. These Jewish extremists, which make up the ruling coaltion government, are orchestrating the genocide in Gaza, where hundreds of Palestinians are dying daily. They champion the iconography and language of their homegrown fascism.

Jewish identity and Jewish nationalism are the Zionist versions of blood and soil. Jewish supremacy is sanctified by God, as is the slaughter of the Palestinians, who Netanyahu compared to the Biblical Ammonites, massacred by the Israelites. Enemies — usually Muslims — slated for extinction are subhuman who embody evil. Violence and the threat of violence are the only forms of communication those outside the magical circle of Jewish nationalism understand. Millions of Muslims and Christians, including those with Israeli citizenship, are to be purged. A leaked 10-page document from the Israeli Ministry of Intelligence dated Oct. 13, 2023 recommends the forcible and permanent transfer of the Gaza Strip’s 2.3 million Palestinian residents to Egypt’s Sinai Peninsula.

It is a grave mistake not to take the blood curdling calls for the wholesale eradication and ethnic cleansing of the Palestinians seriously. This rhetoric is not hyperbolic. It is a literal prescription. Netanyahu in a tweet, later removed, described the battle with Hamas as a “struggle between the children of light and the children of darkness, between humanity and the law of the jungle.”

Kucinich is a longtime anti-war voice.

• ‘We’re a War Machine as a Nation’ (Hedges/Kucinich)

Israel’s ongoing massacre in Gaza has stirred worldwide calls for a ceasefire to stop the genocide unfolding. The United States has been no exception, which countless demonstrators taking to the streets in recent weeks. That hasn’t stopped the US government from backing Israel’s horrific campaign in Gaza to the hilt. The White House has refused to heed calls for a ceasefire and even deployed two aircraft carriers to the Mediterranean—not to defend Palestinians, but to dissuade regional powers from joining the fray to defend Palestine. As the possibility of a regional war looms with the entry of Yemen into the conflict, many wonder how the US might respond to such a scenario. Former US Congressperson Dennis Kucinich joins The Chris Hedges Report for a discussion on the US war machine—what it is, how it works, and how it might respond should the war in Palestine spiral into a wider conflagration.

“..the revolutionary spark lighting a transformation in the Middle Eastern and the Global South’s consciousness..”

• The Great Schism – Will It Be Quietly Ignored? (Alastair Crooke)

Dominique De Villepin, former Prime Minister of France, who famously led France’s opposition to the Iraq war, recently described the term ‘Occidentalism’ (currently the prevalent sentiment in much of Europe) as being the notion that “the West, which for five centuries managed the world’s affairs, will be able to quietly continue to do so”. He continues: “There is this idea that, faced with what is currently happening in the Middle East, we must continue the fight even more, towards what might resemble a religious or a civilizational war”. “That is to say, to isolate ourselves even more on the international stage”. “They’ve gone “all in” on a certain moral and ethical framework of the world, and faced with a situation where the West’s moral fabric has been openly exposed and refuted, they find it extremely difficult—and perhaps fatally impossible—to withdraw”.

It is ditto for an Israel (which is umbilically linked to the West): Were Israel to imagine that its former Arab allies might look the other way, whilst the Jewish state attempts to annihilate resistance in Gaza,- and then expect these allies to help police and pay for a Gaza security apparatus to rule there, they would be guilty of wishfull thinking. And, if either Washington or Israel assume this ‘after-Gaza’ plan can unfold in the same moment that militant settlers on the other side of the terrain build their settlement kingdom with the express goal of founding Israel on the Land of Israel (thus expunging Palestine altogether), that notion too would constitute a fantasy, both strategically and morally incoherent. It won’t work. Israel will not be able to generate either the Palestinian partners, nor the global allies, it needs to co-operate in such a scheme. The situation in the Middle East has radically transformed. Whereas Palestine was about national liberation, today Palestine is the symbol of a wider civilisational re-awakening – the ‘end to centuries of Regional humiliation’.

Equally, whilst Zionism in Israel was largely a secular political project (Greater Israel), today it has become messianic and prophetic. The point here is that we continue to think about the Gaza issue in the ‘old way’ – through the prism of secular material rationalism. This leads to conclusions such as ‘Hamas objectively is weaker than Israel’s IDF’, and therefore rationally the latter must prevail as being the stronger party. In this way of thinking, though, there is only ‘one single reality’ with only the descriptions and interpretations of this ‘reality’ differing. Yet there is demonstrably more than ‘one reality’ as collectively, we progress from one consciousness to another. In one consciousness, for example, ‘Hamas is destined to fail’, and the discussion turns to US and Israeli notions of ‘what follows in Gaza’.

In another state of consciousness however – one becoming ever more prevalent in the region – the ‘reality’ is that any ‘rationally’ negotiated compromise between two clashing eschatological structures is impossible. The more so should the conflict escalate horizontally – overflowing the boundaries of Gaza. Other ‘fronts’ likely might open, as Gaza is seen – whether or not Hamas is crushed – as the revolutionary spark lighting a transformation in the Middle Eastern and the Global South’s consciousness (note the list of Global South states now cutting diplomatic ties with Israel). The West however, has opted to back itself in a silo of its own making – as defined by its demand for a singularity of messaging that all of Europe ‘stand with Israel’; refusing any ceasefire; and saying ‘no limit’ to Israeli action (subject to law).

“.. Americans and Europeans are getting no help from their governments or media in understanding that Putin is doing his best to save them from a world war..”

• Will the Hamas-Israel Conflict Spin Out of Control? (Paul Craig Roberts)

According to Iran’s PressTV, the Iranian defense minister announced that the US “will be hit hard” it Israel’s war on Gaza does not halt. It is unclear why the defense minister’s target is the US and not Israel. By US he probably means US bases in Syria and Iraq. Add this puzzle to the growing collection. For example, if Iran and Hezbollah are behind Hamas’ October 7 attack, why wasn’t Hamas provided with air defense capability against what everyone had to know would be massive Israeli bombing of Gaza? Why did Russia provide Syria with the S-300 air defense system and prevent Syria from using it against Israeli and US aircraft that attack Syrian territory? I explained that the October 7 attack on Israel has the Biden regime’s neoconservatives and Netanyahu’s fingers all over it.

It is not only Palestine that is Netanhayu’s goal, but also Greater Israel which runs according to Zionists from the Nile to the Euphrates. The intent is to draw into the conflict Iran and Syria so that the neoconservatives can reopen the wars in the Middle East against Hezbollah’s suppliers. Without weapons and money from Iran and Syria, Hezbollah would not be able to prevent Israel’s occupation of southern Lebanon. I doubt that Biden understands this. Most likely the neoconservatives in the government told him that having a strong US military presence on the scene would keep things from getting out of hand. Many Americans think that the president knows everything and is in control, but the fact is that he only knows what his officials tell him, and the neoconservatives have their own agenda.

That the intent is to widen the conflict is supported by the enormous quantities of weapons, troops and air power that the US is assembling in the area. This concentration supplemented with German and French troops, according to media reports, go far beyond what is needed to subdue Hamas. The official explanation for this concentration of Western military resources is to protect Israel from Hezbollah and Iran. Adding to the collection of puzzles, if Israel is so vulnerable from attacking Gaza, why would Israel risk it. It makes no sense to risk defeat for the sake of revenge. Israel must have known in advance that US forces would instantly be on the scene. How did Israel know that if October 7 was a surprise?

Putin and it seems Biden have realized that if Iran and Hezbollah are enticed into the conflict a wider regional conflict will emerge that could result in World War III. Putin has been restraining the Muslims and Biden has tried to restrain Netanyahu. If Putin succeeds, the neoconservatives and Netanyahu will likely initiate a false flag attack on Israel and blame Hezbollah, and the neoconservatives who run the Biden regime will use the false flag attack to widen the war. Certainly Americans and Europeans are getting no help from their governments or media in understanding that Putin is doing his best to save them from a world war. Instead, hate continues to pour out against Putin.

And why not…

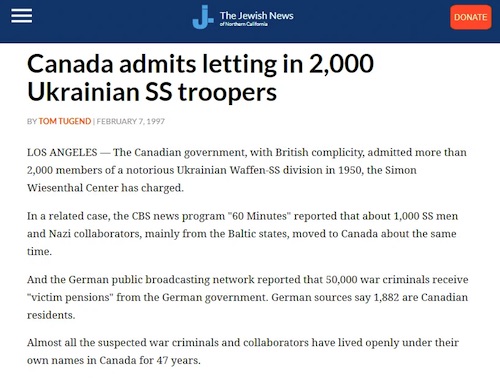

• Israel Wants To Dump Palestinian Refugees On Canada (Marsden)

Israel’s Intelligence Ministry has come up with a creative solution for dealing with those displaced by the Gaza conflict, of which there are an estimated 1.4 million and counting: Go west — all the way to Canada. As Gaza residents were being directed by Israel to clear out and move towards the southern border with Egypt – while the IDF pelted the northern part of the enclave, where most Hamas forces are reportedly concentrated, with missiles – one of the big questions some of us asked was where over 2 million Palestinians would possibly go. Thanks to a leaked Israeli government document, dated October 13 and published by Israeli news site Sicha Mekomit, there’s now some insight into what at least some Israeli government officials have been floating. This paper, which Israeli Prime Minister Benjamin Netanyahu’s office says presents “initial thoughts” that won’t be considered until the war is over, envisions the refugees heading to Egypt first.

But, because Egypt has previously refused to absorb Gaza residents, it may ultimately just end up being used as a staging ground for their mass relocation to other countries. The proposal is for Egypt, Turkey, Saudi Arabia, and the United Arab Emirates to at least provide financial support for this mass displacement, if not offer to take in some refugees themselves, either in the short or long term. But the real kicker is that one particular Western country – way over on the other side of the world from the conflict – is singled out for its “lenient” immigration policy, making it a place where Israeli officials figure the displaced Palestinians could feasibly be resettled. And that country is Canada. Because despite its strict points-based immigration system that selects for potential newcomers based on their skills and education, Canada still clearly has a reputation for being a refugee welcome mat – even though today’s reality is a far cry from this perception.

Not that our big-mouthed Canadian officials have helped. “To those fleeing persecution, terror & war, Canadians will welcome you, regardless of your faith. Diversity is our strength #WelcomeToCanada,” Prime Minister Justin Trudeau tweeted in January 2017, in reaction to then-US President Donald Trump’s executive order banning refugees from a list of Muslim countries. But it wasn’t long before Trudeau had to send out members of his own administration to explain to these same migrant communities that his tweets were a bit more obtuse than official policy. Nor does the image of Canada as a freeloader’s paradise jibe with real life upon arrival in the country. By 2019, Canada had welcomed nearly 60,000 Syrian refugees amid the US-backed regime change war against President Bashar Assad.

Images abound of Canadian Prime Minister Justin Trudeau handing out winter jackets to arriving families at Toronto’s Pearson airport. “You’re safe at home now,” Trudeau told them. That was back in 2015. Just four years later, some provinces had ditched all aid for immigration and refugee programs and just 24% of male and 8% of female refugees from Syria had found employment, according to government data.

“.. the ultimate result being the loss or weakening of statehood in these countries..”

• Lavrov: West Pushing Middle East Towards Major War (Sp.)

Western politicians are provoking a major conflict in the Middle East, said Russian Foreign Minister Sergey Lavrov during a marathon event at the Znanie Society within the framework of the Russia International Exhibition-Forum. Russia’s foreign minister has asserted that Western nations are actively steering Middle Eastern countries toward a potential large-scale conflict. Lavrov pointed out that historically, such “Anglo-Saxon strategies” have precipitated waves of terrorism and forced the migration of countless refugees. “Right now, we are witnessing how the Anglo-Saxons are literally pushing the Middle East to the brink of a major war,” he said. The consequences of this Western approach are evident in Ukraine, Iraq, Libya, and Syria, with the ultimate result being the loss or weakening of statehood in these countries, the top diplomat emphasized.

“Other consequences include a surge in terrorism and extremism, shattered human destinies, broken families and the massive influx of refugees,” Lavrov noted in his speech at the “Znanie” (lit. “Knowledge”) Society event. The methods used by the United States and its allies are sowing chaos in various regions of the world, fueling conflicts between countries and peoples, exacerbating inter-religious and inter-ethnic tensions. The West has grown accustomed to solving its own problems at the expense of others and exploiting other people’s resources and, contrary to global processes, hopes to rule the world by interfering in the internal affairs of states, Lavrov concluded.

In a recent flare-up, the Palestinian-Israeli conflict reignited on October 7 after a major rocket attack on Israel from Gaza. Subsequently, Hamas infiltrated the southern border areas, attacking military and civilian targets in Israel and taking hostages. In response, Israel launched Operation Swords of Iron in the Gaza Strip, taking control of border settlements, conducting airstrikes, including on civilian targets, and imposing a complete blockade, cutting off supplies of essential goods. Moscow has called on both sides to cease hostilities. Earlier, Russian President Vladimir Putin said the Middle East crisis can only be resolved on the basis of the United Nations Security Council’s “two-state” formula, which calls for an independent Palestinian state within the 1967 borders with its capital in East Jerusalem.

“..anyone waving a Palestinian or Hamas flag “shouldn’t continue living on the face of the earth.”

• ‘Nuke Gaza’ Comment From Israeli Minister Raises Eyebrows In Moscow (Cradle)

Russian foreign ministry spokeswoman Maria Zakharova on 7 November said that recent remarks by Israeli Minister of Heritage Amihai Eliyahu, in which he said dropping a nuclear bomb in the Gaza Strip is “a possibility,” raised a multitude of questions. “It raised a great number of questions. Question number one: Does this mean we are hearing an official statement acknowledging [Israel’s] possession of nuclear weapons? Accordingly, the next set of questions that everyone has is: Where are the international organizations, including the IAEA [International Atomic Energy Agency]; where are the inspectors?” Zakharova said during a televised interview. Estimates of Israel’s nuclear stockpile range between 80 and 400 warheads, which can be delivered via aircraft, submarine-launched cruise missiles, and the Jericho series of intermediate to intercontinental-range ballistic missiles.

Its first deliverable nuclear weapon is thought to have been completed in late 1966 or early 1967, making it the sixth country in the world to have developed them. Israel has never openly tested its nuclear weapons nor signed the Nuclear Non-Proliferation Treaty (NPT), making it the world’s only unacknowledged atomic power. The country has also never been subjected to an inspection from the UN nuclear watchdog. Asked in an interview with Radio Kol Berama last week whether an atomic bomb should be dropped on Gaza, Israeli minister Eliyahu answered: “This is one of the possibilities.” Eliyahu, from the Jewish supremacist Religious Zionist party, stated further that “there is no such thing as uninvolved civilians in Gaza” and that, therefore, no humanitarian aid should be allowed into the besieged enclave.

He also expressed his support for depopulating Gaza and reconquering it to reestablish Jewish settlements there. Regarding the Palestinian population, he said: “They can go to Ireland or deserts; the monsters in Gaza should find a solution by themselves.” Eliyahu added that anyone waving a Palestinian or Hamas flag “shouldn’t continue living on the face of the earth.” In response, Israeli Prime Minister Benjamin Netanyahu suspended Eliyahu from participating in cabinet meetings and dismissed his statement, calling it “not based in reality.” Russia’s UN envoy has previously stated that, as an occupying state, Israel has “no right” to self-defense.

Which is why the US is destabilizing it.

• Stable Eurasia Important To Multipolar World – Putin (RT)

Russia and Kazakhstan have a true strategic partnership and are working together to advance a more just and multi-faceted world order, President Vladimir Putin said in an interview on Tuesday. Putin spoke with the outlet Kazakhstanskaya Pravda, ahead of the planned visit to Astana later this week for talks with his Kazakh counterpart Kassym-Jomart Tokayev. “Development of a new and fairer world order based on the primacy of international law has been a prevailing trend,” Putin told the outlet. “Russia believes that establishment of a common peaceful, stable and prosperous Eurasian space is an integral part of this process.” He noted that Russia and Kazakhstan share the world’s longest land border – almost 7,600 kilometers – and that some 6,000 Russian companies have invested around $17 billion in the Central Asian neighbor.

The two countries’ partnership is “forward-looking, extensive and multifaceted, time-tested and developing in an upward direction,” the Russian president said. In addition to oil and natural gas exploration, Russia and Kazakhstan are also collaborating on uranium mining and nuclear power projects. Astana is currently considering the construction of an atomic power plant on Kazakh territory and should it decide to proceed, Russia’s state corporation Rosatom stands ready to develop it using “the most advanced technologies,” Putin noted. The Russian leader specifically addressed Kazakhstan’s presidency over the Shanghai Cooperation Organization (SCO). At the organization’s summit in July, Tokayev had introduced the Initiative on World Unity for Just Peace and Harmony.

“The SCO attracts with its focus on creation and multifaceted cooperation, mutual consideration of interests, equality, openness, and respect for cultural and civilizational diversity,” Putin said, which makes it superior to Western-promoted initiatives with but a handful of handpicked participants. He described cooperation within the SCO as “one of the key pillars for strategic relations of friendship and alliance” between Russia and Kazakhstan. “As for economic stability, the Eurasian Economic Union no doubt has a crucial role to play in this area,” Putin added. The Kremlin has confirmed that Putin will travel to Kazakhstan on Thursday, adding that his agenda will include talks with Tokayev, signing a number of agreements, and attending the 19th Russia-Kazakhstan Interregional Cooperation Forum.

Lost cause.

• US Senate Blocks Aid For Israel Over Ukraine (RT)

Senate Democrats on Tuesday blocked a House bill that would have provided emergency aid to Israel without funding to Ukraine, demanding the Republicans agree to President Joe Biden’s $106 bundle request instead. The White House proposal has sought to combine the aid for Ukraine, Israel, Taiwan and migration policy – presented as “border security” – in order to overcome opposition by some Republicans to continued funding of Kiev. The Republican-majority House of Representatives, however, passed a $14 billion standalone package for Israel last week, to be offset by cuts to the Internal Revenue Service (IRS). “Time is of the essence and it’s imperative that the Senate not delay delivering this crucial aid to Israel another day,” Senator Roger Marshall of Kansas said on Tuesday, urging the Democrats to agree to the House bill.

“Our allies in Ukraine can no more afford a delay than our allies in Israel,” replied Patty Murray of Washington, chair of the Senate Appropriations Committee. Biden has already said he would veto the House bill were it somehow to be approved in the Senate, where Democrats control 51 out of the 100 seats. Unlike the simple-majority rules of the House, a bill requires 60 votes to pass in the Senate, meaning at least nine Republicans would need to cross the aisle. According to the Pentagon, the US has sent Ukraine over $44 billion in military aid since February 2022, including weapons, equipment and ammunition. The US has insisted this does not make it a party to the conflict with Russia, however. American taxpayers have also coughed up around $4 billion in humanitarian aid and almost $27 billion in “economic assistance,”including paying the salaries of Ukrainian government employees.

A secret deal with the White House to fund Ukraine cost the former House Speaker Kevin McCarthy his job in early October, leading to a three-week deadlock in the lower house of Congress. The new speaker, Louisiana Republican Mike Johnson, has voted against continued funding of Kiev and expressed support for single-item bills. The Ukraine Security Assistance Initiative (USAI), which the Pentagon has used to buy new equipment for Kiev from the US military industry, ran out earlier this week, according to the White House. Defense Secretary Lloyd Austin has told the Senate that Ukraine would lose the conflict with Russia without continued US assistance. Senate Democrats are reportedly working on their own funding proposal and hope to introduce it later this week, according to Reuters.

Erdogan gets serious.

• Türkiye Warns US About ‘Tarnished Reputation’ – Media (RT)

Türkiye has told the US that its stance on the Israel-Hamas conflict has both tarnished its reputation and put the entire world community in a tough spot, Hurriyet reported on Tuesday. According to the Turkish daily, Ankara conveyed that message during a meeting between Foreign Minister Hakan Fidan and Secretary of State Antony Blinken on Monday, which concerned the current crisis in the Middle East. The sit-down came amid heightened tensions between Türkiye and Israel, Washington’s key ally in the region, with President Recep Tayyip Erdogan recently accusing the Jewish state of “war crimes” in Gaza and denouncing its ground assault as “an open, vicious massacre.” Israel maintains that it has no intention of harming the civilian population in the Palestinian enclave, stressing that its main objective is to defeat Hamas, which launched a surprise attack on the country on October 7.

Hurriyet claimed that Fidan and his delegation “clearly explained” to Blinken what was happening in Gaza, and that the US vow to stand by Israel while refusing to call for a ceasefire, was “putting everyone in trouble.” “You are also putting your own image in trouble because you are seen as the patron of the crimes committed by Israel,” the delegation reportedly said. Following the meeting, the two sides did not issue a joint statement or hold a joint press conference. Speaking to reporters, however, Blinken said that he had a very “productive” conversation with Fidan, including about the need to “significantly expand humanitarian assistance” to Gaza and avoid escalating the conflict.

His remarks came after US President Joe Biden called for a humanitarian “pause” in hostilities. Israeli Prime Minister Benjamin Netanyahu later signaled that his government was open to “little pauses” in the fighting. After Hamas attacked Israel last month, the latter responded with air and missile strikes on Gaza while announcing a “complete siege” of the enclave. To date, the fighting has claimed the lives of more than 10,000 Palestinians, and more than 1,400 Israelis. Meanwhile, Politico reported on Monday that a group of low- and mid-level US diplomats had urged the Biden administration to condemn Israel’s bombing of civilians and demand a ceasefire. They reportedly argued that failure to do so “contributes to regional public perceptions that the United States is a biased and dishonest actor.”

“pro-Russian conspiracy narratives..”

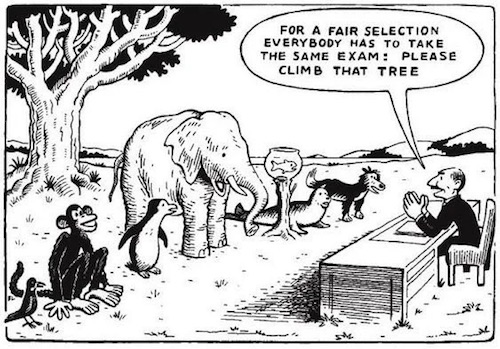

• Europe ‘Powerless Against Kremlin Propaganda’ – Media (RT)

Despite the EU’s best efforts to sanction and ban Russian news outlets, Europeans can still read RT and Sputnik, and “pro-Russian conspiracy narratives” are becoming more popular, the editor-in-chief of Luxembourg’s Tageblatt complained in a recent op-ed. Less than a week after Russian troops entered Ukraine last year, the European Commission announced sanctions on RT and Sputnik, suspending their TV broadcasting licenses and blocking both websites for readers across the EU. Just as 11 rounds of sanctions failed to crater the Russian economy, the crackdown on RT and Sputnik “promised a lot and delivered little,” Tageblatt editor-in-chief Tobias Senzig wrote in an editorial on Monday.

“With just a few tricks – a simple change in the network settings of your computer is enough – you can easily access the RT and Sputnik websites,” he griped, referring to the fact that RT remains accessible to readers using a VPN, the Tor browser, or the Psiphon censorship-bypass tool. Although Senzig argued that free access to information is one of the “grassroots democratic principles that the internet rightly upholds,”he called the EU’s sanctions “long overdue.” RT and Sputnik are not “public broadcasters,” he claimed, but “pure offshoots of the Kremlin’s propaganda department.”

“Not only are they trying to represent the ‘Moscow view’ to the rest of the world, but they are also aggressively interfering in intra-European affairs,” he elaborated.“Our democracies are portrayed as broken and dysfunctional, and Moscow’s antagonists are constantly being attacked: Social Democrats, Greens, ‘do-gooders’, Brussels, Ukraine.” Moscow argues that the Western media outlets are working in lockstep with Western governments against Russia. These outlets “receive instructions and manuals from their special services, they get leaks of information – which are mostly, very often, specially and professionally prepared falsehoods – and do this round the clock,” Kremlin spokesman Dmitry Peskov said in August.

Russia has set out to compete with them “very gingerly, but quite successfully,” he added. RT is “laughing up its sleeve,”Senzig declared, noting that according to a study published by German think tank Cemas last November, “approval ratings for pro-Russian conspiracy narratives surrounding the Ukraine war have increased ‘significantly’ among the overall German population since April 2022.” “In other words,” he explained, “more people in Germany believed Putin’s lies after the attack than before the war.” Senzig is not the first pundit or official to decry the apparent power of RT. The commander of United States Southern Command Gen. Laura Richardson, complained last month that the US is losing the “conflict in the information domain” to RT, Sputnik, and TeleSUR in Latin America.

Malone ventures away from vaccines.

• PsyWar & Washington DC’s Bureaucracy (Robert Malone)

In many ways the modern American Administrative and Deep State, with its “public-private partnerships”, has come to resemble the 17th through 19th century British monarchy, with an entrenched bureaucracy (the permanent administrative state) functionally managed by a largely hereditary elite, surrounded by the concentric status rings of courtiers which comprise the Deep State (in the current embodiment). Within the growing hereditary ruling American oligarchy there is some degree of turnover and palace intrigue, as the fortunes of some wane while others rise. As with the rise of the British bourgeoisie and mixing of gentry with financially successful upper middle castes, this often reflects broader financial and technological trends within the overall geo-political and geo-economic context in which a globalized oligarchy competes.

The obvious irony being that this type of system was precisely what the American Revolution was intended to overturn, and precisely what the US Constitution was written to prevent. And above all of this, we have now added a transcendently powerful new capability to the Leviathan of old. The rise of the CIA and its “Mockingbird/Mighty Wurlitzer” infiltration of both media and academia, the FBI and its politically weaponized COINTELPRO-type surveillance, infiltration and disruption capabilities, the DoD and its PsyOps/PsyWar capabilities designed for offshore conflicts but turned against domestic citizenry to support executive branch-defined “crisis” management, and the explosive growth of a new censorship-industrial complex has yielded a “Leviathan” with reality-bending information control capabilities the likes of which the historic British monarchy could only dream of. Propaganda has come a long way from the days of Edward Bernays’ seminal 1928 book by the same name.

The Washington DC-based Administrative/Deep State has emerged as a separate entity unto itself, with its own culture, purpose, privileges and prerogatives. A key characteristic of this separate cultural phenomenon and mindset- often geographically referred to as the “inside the beltway” set (referring to the I 495 freeway loop encircling DC and environs)- is a focus on self-preservation and personal advancement, rather than on achieving a mission, producing a deliverable, or serving the needs of outside-the-beltway flyover state serfdom. Imperial DC beltway denizens form an incestuous culture, much like any historic imperial court. Passive-aggressive “slow walking” of initiatives has been refined to a fine art. Sexual favors are routinely exchanged to seal short-term alliances, both within agencies and between contractors and “Govies”.

Nuances of administrative regulations are weaponized to enable petty counterproductive one-upmanship. “Beltway Bandit” corporations, lobbyists (registered and unregistered) and “think tanks” cultivate, collect and support Deep State “swamp monsters” when the political wing they are allied with is out of power for a period, anticipating that these courtiers will be rotated back in with the next political shift or Executive branch “change” in leadership. And all are tied together in a revolving maypole dance. Together, they collectively weave a Uniparty in which the commonalities of shared commitment to advancing the interests of the Administrative/Deep State court are far more important and lasting than any inconvenient superficial narrative about serving the interests of the general electorate and citizenry. In this beltway culture, actually solving national problems takes a back bench to the pageantry and Machiavellian machinations of the elite courtiers and their allies.

Letitia

This brutal 1-minute takedown of New York AG Letitia James is disqualifying.

Look at the hatred she has for Trump, men, and white people. Is this really an impartial good-faith actor?

The entire case should be thrown out.

— End Wokeness (@EndWokeness) November 7, 2023

Grok is Elon’s new AI toy.

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.