Christopher Helin Flint auto, Ghirardelli Square, San Francisco 1924

Big risk for Xi. He must be desperate.

• China To Lay Off 5 To 6 Million Workers (Reuters)

China aims to lay off 5-6 million state workers over the next two to three years as part of efforts to curb industrial overcapacity and pollution, two reliable sources said, Beijing’s boldest retrenchment program in almost two decades. China’s leadership, obsessed with maintaining stability and making sure redundancies do not lead to unrest, will spend nearly 150 billion yuan ($23 billion) to cover layoffs in just the coal and steel sectors in the next 2-3 years. The overall figure is likely to rise as closures spread to other industries and even more funding will be required to handle the debt left behind by “zombie” state firms. The term refers to companies that have shut down some of their operations but keep staff on their rolls since local governments are worried about the social and economic impact of bankruptcies and unemployment.

Shutting down “zombie firms” has been identified as one of the government’s priorities this year, with China’s Premier Li Keqiang promising in December that they would soon “go under the knife”.. The government plans to lay off five million workers in industries suffering from a supply glut, one source with ties to the leadership said. A second source with leadership ties put the number of layoffs at six million. Both sources requested anonymity because they were not authorized to speak to media about the politically sensitive subject for fear of sparking social unrest. The ministry of industry did not immediately respond when asked for comment on the reports. The hugely inefficient state sector employed around 37 million people in 2013 and accounts for about 40% of the country’s industrial output and nearly half of its bank lending.

It is China’s most significant nationwide retrenchment since the restructuring of state-owned enterprises from 1998 to 2003 led to around 28 million redundancies and cost the central government about 73.1 billion yuan ($11.2 billion) in resettlement funds. [..] China aims to cut capacity gluts in as many as seven sectors, including cement, glassmaking and shipbuilding, but the oversupplied solar power industry is likely to be spared any large-scale restructuring because it still has growth potential, the first source said. The government has already drawn up plans to cut as much as 150 million tonnes of crude steel capacity and 500 million tonnes of surplus coal production in the next three to five years. It has earmarked 100 billion yuan in central government funds to deal directly with the layoffs from steel and coal over the next two years, vice-industry minister Feng Fei said last week.

The Ministry of Finance said in January it would also collect 46 billion yuan from surcharges on coal-fired power over the coming three years in order to resettle workers. In addition, an assortment of local government matching funds will also be made available. However, the funds currently being offered will do little to resolve the problems of debts held by zombie firms, which could overwhelm local banks if they are not handled correctly. “They have proposed this dedicated fund only to pay the workers, but there is no money for the bad debts, and if the bad debts are too big the banks will have problems and there will be panic,” said Xu Zhongbo, head of Beijing Metal Consulting, who advises Chinese steel mills.

Nothing they could ever do. Deflation must and will have its day.

• Deflation Defeats Impotent Central Banks (A. Gary Shilling)

Central banks are deadly fearful of deflation. That’s why the Federal Reserve, the European Central Bank, the Bank of Canada, the Bank of Japan and Sweden’s Riksbank, among others, have 2% inflation targets. They don’t love rising prices, but they worry about the consequences of a general decline in consumer prices, so they want a firebreak. Unfortunately, they seem powerless to meet their targets in the current economic environment. The guardians of monetary policy are riveted by Japan, where consumer prices have declined in 48 of the last 83 quarters. This pattern of deflation long ago convinced Japanese buyers to hold off purchases in anticipation of lower prices. But the result is excess inventories and too much productive capacity, which force prices even lower.

That confirms expectations, resulting in yet more buyer restraint. The result of this deflationary spiral has been a miserable economy with an average growth in real GDP of just 0.8% at annual rates since the beginning of 1994. Central banks also fret that in a deflationary environment, debt burdens remain fixed in nominal terms, but the ability to service them drops along with falling nominal incomes and waning corporate cash flows. So bankruptcies leap, while borrowing, consumer spending and capital investment all weaken.

As I argued on Monday, deflation remains a clear and present danger. Worryingly, the remedies central bankers are using aren’t working. First, in reaction to the financial crisis, they knocked their short-term reference rates down to essentially zero, and bailed out their stricken banks and other financial institutions. That may have forestalled financial collapse but it did little to stimulate borrowing, spending, capital investment and economic activity. Creditworthy borrowers already had ample liquidity and few attractive spending and investment outlets; slashing borrowing costs to record lows stimulated asset prices such as equities, with little economic benefit.

Furthermore, banks were too scared to lend. And as they resisted attempts to break them up and eliminate the too-big-to-fail problem, regulators bereaved them of profitable activities such as proprietary trading and building and selling complex derivatives. That forced them back toward less lucrative traditional spread lending – borrowing short-term money cheaply and lending it for longer at a profit – just as the shrinking gap between short- and long-term funds made that business even less attractive. With the amount of capital banks are obliged to set aside against their trading activities also leaping, they’re now regulated to such an extent that many of them probably wish they had been broken up.

And Beijing claims Kyle Bass is wrong?

Chinese bankers often pride themselves on having studied in the U.S. or the U.K and true to form, they’re bringing home a lot of the intricate financing that helped people overseas get loans for homes, cars and education. But these financiers are taking creative structures one step further.On Monday, Bloomberg News reported that China will allow domestic banks to issue as much as 50 billion yuan ($7.6 billion) of asset-backed securities that would be paid back using the proceeds from nonperforming loans. (Yes, you read that correctly.) The structure they’re employing is similar to the method that was used to repackage subprime mortgages in the U.S. ahead of the global financial crisis. But when bankers in America were bundling those low-doc mortgages into AAA-rated bonds, they still expected most of the loans would be repaid.

In this case, the debt has already gone bad. Considering hardly any Chinese asset-backed securities have ever received a less than AA score from a local rating company to date, chances are these ones will be awarded the same grade. Of course, investors buying these bonds should be aware they’re backed with debt that’s already soured, regardless of its credit score. Yet, the move is worrying because it’s the latest in a string of revivals in China of dangerous structures that were common in the West before being all but abandoned after 2008. Many of the instruments are helping banks disguise or unload their exposure to troubled companies in the same way issuance of asset-backed securities helped U.S. and British lenders mask their exposure to souring home payments as loans became delinquent.

Ironically, China had pretty much banned asset-backed securities until 2013 because of what happened during the credit crisis. Since authorities began allowing them again, they’ve spread like wildfire. Official data indicate that 593 billion yuan of ABS were sold last year, 79% more than in 2014. Less comprehensive Chinabond data show some 678 billion yuan being issued over the past two years. The first quota of 50 billion yuan is just a test. If there’s enough demand you can bet there will be plenty more of these repackaged bad-loan bonds floating around China in coming years. The amount of debt classed as nonperforming at Chinese commercial banks jumped 51% from a year earlier to 1.27 trillion yuan as of Dec. 31, the highest since June 2006, data from the China Banking Regulatory Commission showed last month.

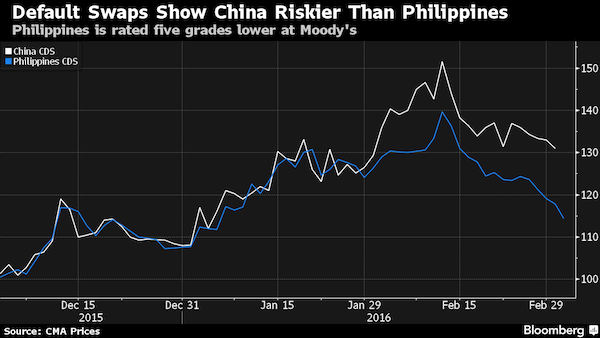

CDS look very ugly.

• China Credit Outlook Cut to Negative by Moody’s (BBG)

China’s credit-rating outlook was lowered to negative from stable at Moody’s Investors Service, which highlighted the country’s surging debt burden and questioned the government’s ability to enact reforms just days before leaders gather to approve a five-year road map for the economy. The government’s financial strength may come under pressure if it takes on liabilities from troubled state-owned companies, while capital outflows have limited policy makers’ scope to stimulate the weakest economy in a quarter century, the ratings company said in a statement on Wednesday. State intervention in equity and foreign-exchange markets has heightened uncertainty about the leadership’s commitment to reform, Moody’s said.

While markets shrugged off the outlook cut on Wednesday, it highlights concern among global investors that the ruling Communist Party will struggle to overhaul Asia’s largest economy at a time when capital is flowing out of the country and debt levels have climbed to an unprecedented 247% of GDP. Chinese leaders will begin nearly two weeks of policy meetings on Saturday to map out how to tackle the nation’s economic challenges and meet the government’s goal of doubling per-capita income by 2020. “The government’s ability to absorb shocks has diminished and we want to signal this in the negative outlook,” Marie Diron, a senior vice president at Moody’s, said in an interview on Bloomberg Television. Authorities “have stepped backward in their reform steps and so that is creating some uncertainty.”

Growth market. Next up: scrapyards.

• China’s Secret Weapon: Used Car Salesmen (FT)

You have probably read, in the Financial Times and elsewhere, that China is the world’s largest car market. It is not. It is the world’s largest new car market, with sales of 21.1m units last year compared with 17.4m in the US. When used cars are included, the US auto market swells to more than 40m units, against less than 30m total passenger car sales in China. In value terms, the gap between the two markets is even larger. In 2014, the overall value of US car sales was almost $1.2tn, more than twice as large as China’s $470bn. This is not surprising, considering that two-thirds of cars on Chinese roads are less than five years old and 80% of all buyers are first-time drivers. The latter fact explains why crossing an intersection in China can be a harrowing experience for pedestrians.

Put another way, an industry that most Americans, Europeans and Japanese have grown up with and now take for granted does not yet even exist in China. Dismiss a shady character as a “used car salesman” and most Chinese people will not understand the reference. As Chinese leaders gather at their annual parliamentary session later this week, it is worth bearing in mind that they are doing so in a country where one cannot very easily buy a used car. That fact should reassure Chinese politicians and multinational executives worried about the pace of growth in the world’s second-largest economy, which will be a topic of much discussion at the National People’s Congress.

Government officials insist that the rising “new economy” will balance out the declining “old economy”, allowing the country to grow at an average rate of 6.5% through 2020. The creation of entirely new industries will further support growth. The inevitable rise of what will soon be the world’s largest used car market is one such example. While its emergence will initially cannibalise some new car sales — primarily those of cheap domestic brands — the potential for growth is huge. In most developed auto markets, there are at least two used car sales for every one new car sale. In China the ratio is inverted, with roughly three new car transactions for every used car sold.

Just a signal of panic.

• China Reserve Ratio Cut ‘No Signal Of Impending Large-Scale Stimulus’ (Reuters)

China’s move to cut banks’ reserve requirement ratio (RRR) indicates a slight easing bias in China’s “prudent” monetary policy, but that is by no means a signal of any coming large-scale stimulus, the official Xinhua news agency said in a commentary late on Tuesday. The Xinhua commentary follows rising market expectations that China could implement a version of the massive stimulus it adopted during the global financial crisis, launching in late 2008 a 4 trillion yuan ($610 billion)stimulus package to boost the economy. The news agency said strong stimulus was not needed because China still had monetary policy tools available and China’s economy was growing at a reasonable rate, with no signs of chaos or crisis in the global economy. Xinhua stated that because China would stick to its prudent monetary policy, there would be no changes in the way the government adjusted liquidity, which would be kept at a reasonable and flexible level, it said.

That meant China’s lending and total social financing would grow at a steady and reasonable rate, Xinhua noted. Xinhua’s view was echoed by state-owned People’s Daily, which reported on Wednesday, citing economists, that the RRR cut was not stimulus, but only reflected increasing policy flexibility aimed at supporting economic development. Late on Monday, the People’s Bank of China announced a cut in the amount of cash that banks must hold as reserves – the reserve ratio requirement (RRR) – by 50 basis points. It frees up an estimated $100 billion in cash for new lending. Hong Hao at BOCOM International said the RRR cut was largely liquidity neutral, because the move was intended to offset the decline in China’s foreign currency reserves and to accommodate more than 1 trillion yuan of open market operations facilities due this week.

So they can’t go broke, right?!

• Debts Rise At China’s Big Steel Mills, Consumption Falls (Reuters)

China’s major steel mills added to their debt pile in 2015 while consumption of steel products fell for the first time in two decades, a senior official said on Wednesday, adding to the industry’s difficulties as it tries to tackle a crippling glut. The debt ratio of major steel mills rose 1.6 %age points to 70.1% from a year ago, taking the big mills’ debt to 3.27 trillion yuan ($499 billion), Li Xinchuang, the vice secretary general of the China Iron & Steel Association (CISA), told a conference. At the same time, steel product consumption in China fell 5.4% to 664 million tonnes in 2015 from a year ago, the first drop since 1996, said Li, who is also head of the China Metallurgical Industry Planning and Research Institute.

China is trying to rein in its bloated steel sector, and aims to cut crude steel capacity by 100 million to 150 million tonnes within the next five years, as well as ban new steel projects and eliminate so-called “zombie” mills. However, slower demand and rising debt will put further pressure on the industry, with prices already at multi-year lows. China’s major steel mills produced a combined 601 million tonnes of steel last year, accounting for nearly three-quarters of the country’s total output, Li said. CISA earlier said the country’s total annual crude steel capacity now stands at 1.2 billion tonnes. Total production reached 803.8 million tonnes last year, down 2.3%, the first drop since 1981. The drive to cut industrial capacity will force China to lay off probably 1.8 million workers from coal and steel sectors, and the central government will allocate 100 billion yuan to deal with job losses and tackle debt.

“..Australian LNG production is expected to grow 50% in the five years through to 2020..”

• Natural Gas Prices Plunge To 17-Year Lows (CNBC)

Natural gas prices have crashed to 17-year-lows in the past week, underscoring burgeoning supply in the global market just as U.S. exports its first ever shale gas cargo. On Monday, natural gas prices on the New York Mercantile Exchange settled 4.5% lower to their lowest level since 1999 after U.S. weather forecasts signaled warmer weather in the weeks ahead, curbing demand for natural gas used for heating. The decline brought February losses in natural gas to 26%. Prices recovered on Tuesday but the outlook remains depressed. Japan, the world’s largest importer of natural gas, is restarting its nuclear reactors six years after the 2011 Fukushima disaster, with three out of 43 nuclear reactors brought back online since August and more expected to come.

Japan is likely to bring back more reactors online, which will make the country less dependent on LNG for electricity generation. In January, shipments of LNG into Japan fell the most in more than six years, according to Bloomberg calculations. This does not bode well for Australia, which has pumped more than $160 billion in LNG investments just before the commodities rout that has taken oil prices down 70% since the summer of 2014. Australian LNG production is expected to grow 50% in the five years through to 2020 even as certain producers cut capital expenditures and reduce spending on upstream activities, said Fitch Group unit BMI Research in a note last week.

“..people will be filling up their “swimming pools” with it this year.”

• Europe’s Biggest Oil Hub Fills as Ship Queue at Seven-Year High (BBG)

The queue of ships waiting outside Europe’s biggest port and oil-trading hub of Rotterdam has grown to the longest in seven years as a global supply glut fills storage capacity. As many as 50 oil tankers, twice as many as normal, are waiting outside Rotterdam because storage sites are almost full, the port’s spokesman Tie Schellekens said by phone on Tuesday. “This is a clear sign of the oversupply filling up storage to the brim,” Gerrit Zambo, an oil trader at Bayerische Landesbank in Munich, said by phone. “People are preferring to store oil rather than cut production. These are bearish signs.” The world is so awash with oil that BP CEO Bob Dudley said last month people will be filling up their “swimming pools” with it this year.

Traders are taking advantage of a market contango, where forward prices are higher than current prices, by buying oil cheap, storing it and selling the commodity later. As onshore storage fills up, companies could start stockpiling at sea in a repeat of a strategy last seen in 2008 and 2009. Crude oil in storage tanks in Rotterdam stood at 51.3 million barrels on Feb. 19, the highest for the time of year in data starting in 2013, according to Genscape, which monitors inventories. Royal Vopak NV, the world’s largest oil-storage company, last week reported a fourth-quarter occupancy rate of 96% at its 11 terminals in the Netherlands compared with 85% a year earlier. The situation in Rotterdam mirrors that in the biggest U.S. storage hub of Cushing in Oklahoma, where stockpiles are at a record high.

“In Cushing and probably Rotterdam storage is filling up very quickly,” said Giovanni Staunovo at UBS in Zurich, Switzerland. “In China, given high oil imports, there are too many ships and the infrastructure seems not be able to handle that.” Saudi Arabia, the world’s biggest oil exporter, said last month it won’t cut production to ease global oversupply, while Iran has pledged to increase output after sanctions were lifted in January. Still, oil climbed on Tuesday from the highest close in more than seven weeks on speculation that monetary stimulus in China could help revive flagging economic growth in the world’s second-biggest fuel consumer.

It will bankrupt them first.

• UAE Says Oil Collapse Will Force All Producers to Cap Volumes (BBG)

The oil-price collapse will compel all producers to freeze output and no early OPEC meeting can take place without such a move, the United Arab Emirates’ energy minister said. “This is the reality,” Suhail Al Mazrouei said Tuesday in Abu Dhabi. “Current prices will force everyone to freeze production; stubbornness doesn’t make sense.” Saudi Arabia – the world’s largest crude exporter – Russia, Venezuela and Qatar have proposed that producers cap production at January levels to bolster prices that have tumbled almost 70% in two years. OPEC member Iran, which is ramping up output following the removal of sanctions in January, has said the plan is “ridiculous” and saddles it with “unrealistic demands.”

Venezuela is among members of the Organization of Petroleum Exporting Countries to call for a meeting of oil producers this month, while Saudi Arabian Oil Minister Ali al-Naimi has said he hopes for such a gathering. The group’s next scheduled meeting is in June. Mazrouei said he hasn’t received an invitation for an early meeting and a summit won’t be necessary if producers don’t agree in advance to freeze output. That runs counter to Iran’s plans to increase volumes by 1 million barrels a day this year. “The idea of bringing a lot of production in a short period is not practical,” Mazrouei said.

Laws of nature.

• Negative Rates … Negative Outcomes (Corrigan)

There has been much head-scratching of late as to why, with interest rates lower than they have been since the Universe first exploded out of the Void, businesses are not undertaking any where near as much investment as that hoped for beforehand by the academic cabal whose ‘effective demand’ and ‘transmission channel’ fixations have helped drive rates to today’s mind-boggling levels. This is obviously a complex topic in which there are many different factors at work – not the least of which is that the prevalence of overly-low interest rates for much of the recent past has meant that all too much of such investment as is now desired has not only already been done, but done in what has turned out to be so misguided a fashion, that there is less appetite – as well as fewer means, in many cases – to undertake much more of it today.

If the cure for higher prices – as the saying in commodity markets goes – is higher prices, then the cause of lower rates is almost certainly lower rates! Be that as it may, on a more fundamental level, it might also be possible to tease out at least one aspect of the answer to the conundrum with the aid of a little straightforward logic, as we shall now attempt to do here. In theory, positive interest rates reflect the primal truth that goods fit for our enjoyment today are worth more to their potential consumer than those same goods which are only available tomorrow. Moreover, since producer goods are otherwise inedible, unwearable, uninhabitable, etc., in their present form, they only derive their value in respect of their quality of being innate consumer goods-to-be.

Hence, the means of producing the day’s goods for some future date are always to be discounted back using that same ratio (which is none other than the natural rate) as the one which prevails between consumables-now and consumables-then. Doing so gives us a positive IRR (or, if you prefer, assuring that NPV>0) for the process. Here it goes without saying that since the natural rate is inherently unobservable, the market interest rate will be used in its place – an unavoidable substitution which demands that this latter quantity be subject to as few falsifications as possible (a vexed topic suitable for a forthcoming, much deeper treatment).

Oh, wait, Drumpfocalypse.

• Trumpocalypse Now (Guardian)

There will be those in the Republican and conservative establishment who will try to spin the Super Tuesday results. Some among the GOP chattering classes will tell you that Trump didn’t get the knock-out punch he wanted – that there is still a chance to restore order. Don’t believe it. The numbers make it clear that, for the Republican party, it’s Trumpocalypse Now. While Ted Cruz won his home state of Texas as well as Oklahoma, and Rubio ran him close in Virginia and actually managed to win Minnesota, Trump dominated elsewhere. His success extended from Massachusetts to Georgia to Alabama to Tennessee to Oklahoma. He won in Ted Cruz’s south, and he won in the north-east, where a more establishment-friendly candidate like Marco Rubio was supposed to prevail.

Trump is winning with men and women, moderates and conservatives, with the young and the old. Trump is winning despite a weekend of unforced errors – after failing to repudiate former Klu Klux Klan Grand Wizard David Duke. Trump is winning even after taking political napalm from Marco Rubio since last week’s debate – with Rubio ridiculing his rival on the trail for days. Trump is winning despite the fact that the Republican speaker of the House and majority whip in the Senate both criticized him this week. He is winning in spite of the fact that almost every big name Republican officer-holder and mega-donor is lined up behind his opponents. The race is not technically over. While Trump will win the lion’s share of delegates tonight, both Cruz and Rubio will pick up delegates and spend the next couple of weeks trying to convince voters and donors that they can stop the frontrunner – that they have a path to the nomination.

Whether or not either of these men can really achieve that at this point – and I remain highly skeptical, despite Cruz’s two-state win – the day of reckoning for the Republican party has arrived. Whatever happens, what neither Cruz nor Rubio nor anyone else can do is to stop the forces that Trump’s candidacy has unleashed. It’s no longer possible to say the Republican party is a conservative party. You can’t even say the Republican party’s base is conservative. It appears that a new, populist-nationalist wing has wrested control of the of the GOP away from its familiar constituency. This is no longer the party of William F Buckley and Jack Kemp. It’s now the party of Pat Buchanan and Ross Perot.

“I never imagined that we would ever again in an industrialised country have a depression deeper than the United States experienced in the 1930s and that’s what’s happened in Greece.”

• Euro Depression Is ‘Deliberate’ EU Choice, Says Mervyn King (Telegraph)

Europe’s deep economic malaise is the result of “deliberate” policy choices made by EU elites, according to the former governor of the Bank of England. Lord Mervyn King continued his scathing assault on Europe’s economic and monetary union, having predicted the beleaguered currency zone will need to be dismantled to free its weakest members from unremitting austerity and record levels of unemployment. Speaking at the launch of his new book, Lord King said he could never have envisaged an economic collapse of the depths of the 1930s returning to Europe’s shores in the modern age. But the fate of Greece since 2009 – which has suffered a contraction eclipsing the US depression in the inter-war years – was an “appalling” example of economic policy failure, he told an audience at the London School of Economics.

“In the euro area, the countries in the periphery have nothing at all to offset austerity. They are simply being asked to cut total spending without any form of demand to compensate. I think that is a serious problem. “I never imagined that we would ever again in an industrialised country have a depression deeper than the United States experienced in the 1930s and that’s what’s happened in Greece. “It is appalling and it has happened almost as a deliberate act of policy which makes it even worse”. Lord King – who spent a decade fighting the worst financial crisis in history at the Bank of England – has said the weakest eurozone members face little choice but to return to their national currencies as “the only way to plot a route back to economic growth and full employment”.

“The long-term benefits outweigh the short-term costs,” he writes in The End of Alchemy. The former Bank governor has said popular disillusion with EU economic policies are likely to lead to disintegration of the single currency rather than a move towards “completing” monetary union. Two of the eurozone’s debtor nations – Ireland and Spain – are currently locked in electoral stalemate after their pro-bail-out governments failed to win the backing of voters. But the European Commission has defended itself against claims that punishing austerity measures have made incumbent European regimes unelectable, arguing that Brussels’ economic policy represents a “virtuous triangle” of austerity, structural reforms and investment.

Nobody cares about the laws they signed up for.

• Why Austria’s Asylum Cap Is So Controversial (Economist)

Europe is divided on how to handle the largest number of refugees since the second world war. Still, Austria’s move to cap asylum claims at 80 per day at its southern border and limit the daily number of people travelling through Austria to seek asylum in Germany to 3,200 has sparked outrage. After Austria, which lies on the migrant route from the Balkans into Germany, announced its plan, Dimitris Avramopoulos, European Commissioner for migration, home affairs and citizenship, wrote to Austria’s interior minister to protest. The move, he said, was “plainly incompatible” with EU law. The minister replied, on television: “they have their legal adviser and I have legal advisers.” The Geneva Convention and the EU Charter of Fundamental Rights clearly state that asylum is a right.

Human-rights activists argue that a cap runs counter to the spirit of these texts; lawyers know that, as fundamental as they are, rights are never absolute. But Austria would seem to be flouting some EU directives. One (which was voted for by Austria) says that asylum applications must be officially registered (that is, given a number) no more than ten days after they have been lodged; a daily limit would seem to make following that difficult. Last year, around 700,000 migrants entered Austria and around 90,000 applied for asylum. According to another rule, refugees are supposed to apply for asylum in the first “safe country” they are in, rather than moving on to another. EU rules have been woefully stretched by Europe’s immigration crisis already of course. In 2011, European judges criticised Greece for failing to register asylum applications at the border.

All applications, they said, were being made on one day a week at one police station in Athens. More recently, the European Commission criticised Greece for not being able to control its border and letting people hike up north. In 2011, Italy issued thousands of temporary residency permits, which allow immigrants to travel around Europe, to Tunisians who had arrived on its shores. In response, France closed its border with Italy. No action was taken. Mr Avramopoulos is adamant that Austria’s measures are unlawful, but it is not clear what he intends to do about it. The European Commission’s legal services are building up their case but judges might never hear it. Further angry exchanges seem more likely than legal action. Meanwhile, Austria’s move has led to border slowdowns for migrants across the Balkans. EU leaders have announced they will hold a summit in early March with Turkey to attempt to seek fresh solutions to the crisis.

Never mind. Schengen’s long dead.

• EU Nations Urged To Lift Border Checks To Save Passport-Free Zone (Guardian)

European Union countries are being urged to lift internal border controls before the end of the year, to save the “crowning achievement” of the passport-free travel zone from total collapse, according to a draft report by the European commission. Walls, fences and border checks have returned across Europe as the EU struggles to cope with the biggest inflow of refugees since the end of the second world war. Since September 2015, eight countries in the 26-nation passport-free Schengen zone have re-instated border checks. These controls “place into question the proper functioning of the Schengen area of free movement”, according to the draft report seen by the Guardian, which will be published on Friday. “It is now time for member states to pull together in the common interest to safeguard one of the union’s crowning achievements.”

Separately, the European commissioner for humanitarian aid is expected to announce on Wednesday that €700m (£544m) will be spent over three years in helping refugees in the western Balkans. Much of the money is destined for Greece, as EU leaders scramble to help Athens deal with its own crisis. 24,000 refugees are in need of permanent shelter and 2,000 people are arriving on Greek shores each day. EC president Donald Tusk has described helping Greece as “a test of our Europeanness”. The passport-free travel zone, which stretches from Iceland to Greece but does not include the UK or Ireland, has been under unprecedented pressure; its collapse could unravel decades of European integration. The commission wants member states to lift border controls “as quickly as possible” and with “a clear target date of November 2016”. But Brussels also wants tighter control of the EU’s external border and will repeat warnings that Greece could be kicked out of Schengen if it fails to improve border management by May.

[..] Greece is under growing pressure to hand over management of its borders to the EU, as it struggles to cope with the numbers. According to this latest plan, EU authorities will carry out an inspection of Greece’s borders in mid April to determine whether controls are adequate, with a final decision on Greece’s place in Schengen to be taken in May. The EU executive also reaffirms its intention to overhaul rules governing asylum claims. Under the current rules, known as the Dublin system, asylum seekers have to lodge their claim in the first country they enter. The Dublin regime was effectively finished last year when the chancellor, Angela Merkel, opened Germany’s borders to any Syrian who wanted to claim asylum there, regardless of where they arrived in the EU. In mid-March the commission will set out a list of options for reforming EU asylum policy. The favoured idea is a permanent system of relocation, where refugees are shared out around the union, depending on the wealth and size of a country.

Second hand citizens.

• Rights Groups Accuse France Of Brutality In Calais Eviction (AP)

More than a dozen humanitarian organizations on Tuesday accused authorities of brutally evicting migrants from their makeshift dwellings in a sprawling camp in northern France, as fiery protests of the demolition continued. Thousands of migrants fleeing war and misery in their homelands use the port city of Calais as a springboard to try to get to Britain on the other side of the English Channel. However, authorities are moving to cut short that dream by closing a large swath of the slum camp in the port city of Calais. In the stinging accusation at the close of the second day of a state-ordered mass eviction and demolition operation, the organizations charged that authorities have failed to respect their promise of a humane and progressive operation based on persuading migrants to vacate their tents and tarp-covered homes.

“Refugees, under threats and disinformation, were given one hour to 10 minutes to leave their homes,” a statement said. Police pulled out some who refused, making arrests in certain cases, while others were not allowed to gather their belongings or identity papers, the statement charged. Migrants and pro-migrant activists protested against the eviction Tuesday, some climbing onto shanty rooftops to briefly stall the tear-down, and others by starting a night fire. Tents and tarp-covered lean-tos were also set afire on Monday and earlier Tuesday. The protesting organizations alleged that police aimed flash-balls at the roof protesters, then clubbed them and made some arrests. Tear gas, water cannons and other tactics have been used excessively, the statement charged.

Organizations respected for their humanitarian work with migrants, such as Auberge des Migrants (Migrants’ Shelter), GISTI and Secours Catholique were among the 14 who signed the list of charges. The mass evictions from the southern sector of the camp were announced Feb. 12 with promises by Interior Minister Bernard Cazeneuve that there would be no brutality. However, the Monday start of operations came as a surprise. The regional prefecture in charge of the demolition says the hundreds of police present are needed to protect workers in the tear-down and state employees advising migrants of their options. France’s government has offered to relocate uprooted migrants into heated containers nearby or to centers around France where they can decide whether to apply for asylum. Officials have blamed activists from the group No Borders for the ongoing unrest. But many migrants resist French offers of help, afraid of hurting their chances of reaching Britain.

Officials say the evictions concern 800-1,000 migrants, but organizations working in the camp say the real number is more than 3,000.

Crazy they even have to ask.

• Greece Seeks EU Aid For 100,000 Refugees (AFP)

Greece has asked the EU for €480 million ($534 million) in emergency funds to help shelter 100,000 refugees, the government said Tuesday, warning that the migrant influx threatened to overwhelm its crisis-hit resources. “Greece has submitted an emergency plan to the European Commission .. corresponding to around 100,000 refugees,” government spokeswoman Olga Gerovassili told reporters. “We cannot bear the strain of all the refugees coming here… these are temporary measures, there needs to be a permanent solution on where the refugees will be relocated,” she added. “Greece has made it clear that it will use every diplomatic means available to find the best possible solution,” Gerovassili said.

With Austria and Balkan states capping the numbers of migrants entering their soil, there has been a swift build-up along the Greek border with Former Yugoslav Republic of Macedonia (FYROM). Athens had previously warned that it could be stuck with up to 70,000 people trapped on its territory. Gerovassili said there were 25,000 migrants and refugees currently in the country and that FYROM was only allowing “a few dozen” through every day. Over 7,000 people – many of them stranded in near the Idomeni border crossing for days – spent a freezing night and awoke under wet canvas among sodden wheat fields.

Home › Forums › Debt Rattle March 2 2016