Harris&Ewing Kron Prinz Wilhelm, German ship, interned in US in tow 1916

The Panama Papers are a huge issue, with many names being named and more suggested. We’re more or less promised revelations about US angles soon, which are absent. But what does the Guardian open with today? A photo of Vladimir Putin, who’s NOT in the papers, but is linked to a violinist he knows, who is. Poroshenko is named, the Iceland PM is, the Saudi king, Cameron’s dad, Xi Jinping, and many others. But the Guardian opens with Putin. There goes the last bit of credibility. Western media propaganda has gone beyond shameless.

• Panama Papers “100 Times Bigger Than Wikileaks” (Fusion)

One April morning in 2014, Jurgen Mossack, the tall, German-born co-founder of the prominent Panama City law firm Mossack Fonseca, shot off an agitated email with the subject line “Serious Matter URGENT” to three top members of his staff. There was trouble brewing in the British Virgin Islands, a “secrecy jurisdiction” whose white-sand beaches and blue Caribbean waters conceal a barely-regulated haven for people who wish to create shell corporations. Many of those people employ Mossack Fonseca to perform precisely this service. “Swindled investors call the office constantly. We need to resign from this company immediately,” Mossack wrote. “At any moment, the police arrive, and we end up in the newspapers.”

As a “registered agent,” Mossack Fonseca provides the paperwork, signatures, and mailing addresses that breathe life into shell companies established in tax havens around the world – holding companies that often create nothing and sell nothing, but shelter assets with maximum concealment and a minimum of fuss. Jurgen wanted to pull the plug on representing one such firm that was raising red flags. For weeks, investors in an entity called Swiss Group Corporation had been contacting Mossack Fonseca, wondering why their annuity payments had suddenly stopped, why they had received only vague emails, whether they had been a victim of a fraud. “Swiss Group Corp. has shown no transparency in their processes,” one woman wrote from Colombia on March 31, 2014, “and now, I am worried about the investment I made 5 years ago, which is my only means of living.”

Mossack instructed his underlings to “Please do what you have to do,” – and then, he added: “Use the telephone!” Weeks after Jurgen issued his stern orders, queries continued to pour in from investors – including one woman who identified herself as a U.S. citizen, and others from Colombia and Bolivia. They were still groping in the dark, searching for shreds of information in the same black hole of offshore finance that routinely stumps tax authorities, law enforcement officials, and asset-tracers across the globe. By one estimate – based on data from the World Bank, IMF, UN, and central banks of 139 countries – between $21 and $32 trillion is hiding in tax havens, more than the United States’ national debt. That study didn’t even attempt to count money from fraud, drug trafficking and other criminal transactions whose perpetrators gravitate toward the same secret hideouts.

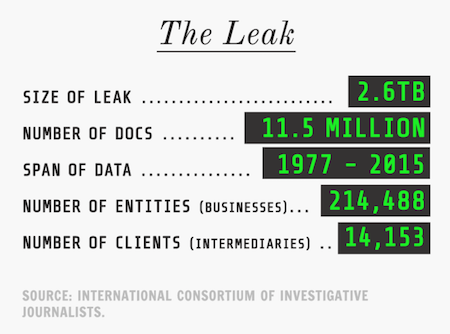

Mossack and his business partner Ramon Fonseca, a powerful political leader and best-selling author in Panama, are captains in an offshore industry that has had a major impact on the world’s finances since the 1970s. As their business has grown to encompass more than 500 employees and collaborators, they’ve expanded into jurisdictions around the world – including parts of the United States. But a new trove of secret information is shining unprecedented light on this dark corner of the global economy. Fusion analyzed an archive containing 11.5 million internal documents from Mossack Fonseca’s files, including corporate records, financial filings, emails, and more, extending from the firm’s inception in 1977 to December 2015.

The documents were obtained by the German newspaper Süddeutsche Zeitung and shared with Fusion and over 100 other media outlets by the International Consortium of Investigative Journalists (ICIJ) as part of the Panama Papers investigation. The massive leak is estimated to be 100 times bigger than Wikileaks. It’s believed to be the largest global investigation in history.

The world’s biggest ‘offshore industry’ is in the US these days. Delaware. Nevada. South Dakota.

• Corporate Media Gatekeepers Protect Western 1% From Panama Leak (Murray)

Whoever leaked the Mossack Fonseca papers appears motivated by a genuine desire to expose the system that enables the ultra wealthy to hide their massive stashes, often corruptly obtained and all involved in tax avoidance. These Panamanian lawyers hide the wealth of a significant proportion of the 1%, and the massive leak of their documents ought to be a wonderful thing. Unfortunately the leaker has made the dreadful mistake of turning to the western corporate media to publicise the results. In consequence the first major story, published today by the Guardian, is all about Vladimir Putin and a cellist on the fiddle. As it happens I believe the story and have no doubt Putin is bent. But why focus on Russia? Russian wealth is only a tiny minority of the money hidden away with the aid of Mossack Fonseca.

In fact, it soon becomes obvious that the selective reporting is going to stink. The Suddeutsche Zeitung, which received the leak, gives a detailed explanation of the methodology the corporate media used to search the files. The main search they have done is for names associated with breaking UN sanctions regimes. The Guardian reports this too and helpfully lists those countries as Zimbabwe, North Korea, Russia and Syria. The filtering of this Mossack Fonseca information by the corporate media follows a direct western governmental agenda. There is no mention at all of use of Mossack Fonseca by massive western corporations or western billionaires – the main customers. And the Guardian is quick to reassure that “much of the leaked material will remain private.”

What do you expect? The leak is being managed by the grandly but laughably named “International Consortium of Investigative Journalists”, which is funded and organised entirely by the USA’s Center for Public Integrity. Their funders include Ford Foundation, Carnegie Endowment, Rockefeller Family Fund, W K Kellogg Foundation, Open Society Foundation (Soros) among many others. Do not expect a genuine expose of western capitalism. The dirty secrets of western corporations will remain unpublished. Expect hits at Russia, Iran and Syria and some tiny “balancing” western country like Iceland. A superannuated UK peer or two will be sacrificed – someone already with dementia. The corporate media – the Guardian and BBC in the UK – have exclusive access to the database which you and I cannot see.

They are protecting themselves from even seeing western corporations’ sensitive information by only looking at those documents which are brought up by specific searches such as UN sanctions busters. Never forget the Guardian smashed its copies of the Snowden files on the instruction of MI6. What if they did Mossack Fonseca database searches on the owners of all the corporate media and their companies, and all the editors and senior corporate media journalists? What if they did Mossack Fonseca searches on all the most senior people at the BBC?

What if they did Mossack Fonseca searches on every donor to the Center for Public Integrity and their companies? What if they did Mossack Fonseca searches on every listed company in the western stock exchanges, and on every western millionaire they could trace? That would be much more interesting. I know Russia and China are corrupt, you don’t have to tell me that. What if you look at things that we might, here in the west, be able to rise up and do something about? And what if you corporate lapdogs let the people see the actual data?

Hmmm.. We wonder how deep the impact will be..

• ‘Panama Papers’ Leak Spells Danger For Tax Havens, World Leaders (CNBC)

A huge leak of documents that implicate government heads in the setting up of “shell” companies to harbor billions of dollars is set to cause upheaval on offshore hubs and shake up global political governance. A team of journalists from around the world published what they called the “Panama Papers” on Sunday—more than 11.5 million encrypted internal documents from Mossack Fonseca, a Panamanian law firm. An anonymous source began supplying the documents— dated from the 1970s to 2016—to German newspaper Süddeutsche Zeitung (SZ) a year ago. SZ assembled a group of media organizations, including the International Consortium of Investigative Journalists (ICIJ), The Guardian, the BBC and Le Monde, to analyze the data, before simultaneously releasing their findings.

Calling the leak “the biggest that journalists had ever worked with,” SZ said the documents revealed numerous shadowy financial transactions via offshore companies created by Mossack Fonseca. The law firm, who has more than 40 offices worldwide, specialized in the sale of anonymous offshore companies, known as shell firms. According to SZ’s findings, 12 current and former heads of state, 200 other politicians, as well as members of various Mafia organizations, plus football stars, 350 major banks, and hundreds of thousands of regular citizens were among Mossack Fonseca’s clients. It is important to note that owning an offshore company is not illegal in itself, but SZ alleged that concealing the identities of the true company owners was the law firm’s primary aim in the bulk of cases.

While people often legitimately move funds to countries outside their national boundaries to access more relaxed financial regulations, offshore companies are also commonly associated with tax evasion as well as serious illicit activities such as money laundering. Argentine President Mauricio Macri, Iceland’s Prime Minister Sigmundur David Gunnlaugsson, Saudi Arabia’s King Salman, U.A.E President Sheikh Khalifa and Ukrainian President Petro Poroshenko are among those named in the documents as having set up shell companies, according to SZ. Relatives and associates of other leaders, including Russia’s Vladimir Putin, China’s Xi Jinping, Syria’s Bashar Assad and Britain’s David Cameron, were also identified by the team of reporters that examined the documents. Other prominent Asian officials named in the reports included Anuraj Kerjiwal, the former head of Indian political party Lok Sattam, as well as Cambodia’s Minister of Justice.

Okay, this doofus is gone. What a dork.

• Iceland PM Faces No Confidence Vote After Panama Papers Disclosure (BBG)

Icelandic Prime Minister Sigmundur D. Gunnlaugsson faces a no confidence vote in parliament amid revelations he and his wife had an investment account in the British Virgin Islands created with the aid of the Panama-based law firm at the center of a global tax evasion leak. The opposition has called for a vote against the government as parliament begins its session at 3 p.m. local time. Protests are scheduled in Reykjavik starting two hours later. Gunnlaugsson, who took office in 2013, finds himself in the middle of a political storm after it was revealed in a leak uncovered by the International Consortium of Investigative Journalists, or ICIJ, that he and his wife had an offshore account to manage an inheritance. His wife, Anna Sigurlaug Palsdottir, previously revealed the account in a Facebook posting in March after the premier was questioned about the money.

According to the ICIJ report, Pálsdóttir says she has always paid all her taxes owed on the Wintris account, which was confirmed by her tax firm, KPMG. ICIJ cited a leak covering documents spanning leaders and businesses across the globe from 1977 to 2015 from Panama-based law firm Mossack Fonseca, a top creator of shell companies that has branches in Hong Kong, Miami, Zurich and more than 35 other places around the world. “As has been explained publicly, in establishing this company, the Prime Minister and his wife have adhered to Icelandic law, including declaring all assets, securities and income in Icelandic tax returns since 2008,” a Gunnlaugsson spokesman said in a statement to the ICIJ. The premier was one of 12 current and former world leaders to have offshore holdings revealed in the leak that has come to be called the Panama Papers. Offshore holdings can be legal, though documents show some banks, law firms failed to follow requirements to check their clients are not involved in crimes.

“..the candy magnate was more concerned about his own welfare than his country’s – going so far as to arguably violate the law twice, misrepresent information and deprive his country of badly needed tax dollars during a time of war.”

• Panama Papers Reveal Ukraine President Poroshenko’s Voter Betrayal (OCCRP)

When Ukrainian President Petro Poroshenko ran for the top office in 2014, he promised voters he would sell Roshen, Ukraine’s largest candy business, so he could devote his full attention to running the country. “If I get elected, I will wipe the slate clean and sell the Roshen concern. As President of Ukraine I plan and commit to focus exclusively on welfare of the nation,” Poroshenko told the German newspaper Bild less than two months before the election. Instead, actions by his financial advisers and Poroshenko himself, who is worth an estimated $858 million, make it appear that the candy magnate was more concerned about his own welfare than his country’s – going so far as to arguably violate the law twice, misrepresent information and deprive his country of badly needed tax dollars during a time of war.

Poroshenko did this by setting up an offshore holding company to move his business to the British Virgin Islands (BVI), a notorious offshore jurisdiction often used to hide ownership and evade taxes. His financial advisers say it was done through BVI to make Roshen more attractive to potential international buyers, but it also means Poroshenko may save millions of dollars in Ukrainian taxes. In one of several ironic twists in this story, the news about the president’s offshore comes as the Ukrainian government is actively fighting the use of offshores, which one organization says are costing Ukraine $11.6 billion a year in lost revenues.

Details about the Roshen deal can be found in the Panama Papers, documents obtained from a Panama-based offshore services provider called Mossack Fonseca. The documents were received by the German newspaper Süddeutsche Zeitung and shared by the International Consortium of Investigative Journalists (ICIJ) with the Organized Crime and Corruption Reporting Project (OCCRP). And in a more painful irony, the Panama Papers reveal that Poroshenko was apparently scrambling to protect his substantial financial assets in the BVI at a time when the conflict between Russia and Ukraine had reached its fiercest.

Dutch anti-Putin propaganda is as strong as any, but people still don’t like supporting Ukraine’s corrupt system. As now represented by Poroshenko.

• In Brexit Warm Up, Dutch To Vote on EU Treaty With Ukraine (Reuters)

Dutch voters will decide on Wednesday whether to support a European treaty deepening ties with Ukraine in a referendum that will test sentiment toward Brussels ahead of Britain’s June Brexit vote and could also bring a boost for Russia. The broad political, trade and defense treaty is already provisionally in place but has to be ratified by all 28 European Union member states for every part of it to have full legal force. The Netherlands is the only country that has not done so. While a “no” vote in the non-binding referendum would not force the Dutch government to veto the treaty on an EU level the fragile coalition, which holds the rotating EU presidency, might find it hard to ignore with less than a year to general elections.

[..] An EU decision to push on with the treaty despite a “no vote”, whether the government respects it or not, could be damaging for the EU and highlight EU problems ahead of the British vote. “If politicians ignore the Dutch no then it will be an even stronger signal than what the British have already received that there is no way to correct the European political class and that they should vote to leave,” said Thierry Baudet, a “no” campaigner and one of the architects of the referendum that was triggered when activists gathered thousands of signatures of support.

Many Dutch feel they are being asked to choose between two unattractive options: EU expansion plans dreamed up by unaccountable bureaucrats in Brussels or helping Russian Putin who they blame for the MH17 plane disaster which killed almost 200 Dutch citizens in July 2014. A poll by Maurice De Hond on Sunday forecast that 66% of people certain to vote, would back ‘No’ with only 25% in favor, with turnout likely to be decisive in shaping the final result. Pollsters TNS Nipo have forecast turnout of 32%, just above the 30% threshold that is needed for the referendum to be valid.

The hastily gathered ‘expert’ comments are so lame Trump doesn’t even need to comment.

• Trump’s Prediction Of ‘Massive Recession’ Puzzles Economists (Reuters)

Donald Trump’s prediction that the U.S. economy was on the verge of a “very massive recession” hit a wall of skepticism on Sunday from economists who questioned the Republican presidential front-runner’s calculations. In an interview with the Washington Post published on Saturday, the billionaire businessman said a combination of high unemployment and an overvalued stock market had set the stage for another economic slump. He put real unemployment above 20%. “We’re not heading for a recession, massive or minor, and the unemployment rate is not 20%,” said Harm Bandholz, chief U.S. economist at UniCredit Research in New York. The official unemployment rate has declined to 5% from a peak of 10% in October 2009, according to government statistics.

But a different, broader measure of unemployment that includes people who want to work but have given up searching and those working part-time because they cannot find full-time employment is at 9.8%. Coming off a difficult week of campaigning, in which he acknowledged he struggled to articulate his position on abortion among other missteps, Trump’s comments to the Post might be some of his most bearish on the economy and financial markets. “I think we’re sitting on an economic bubble. A financial bubble,” he said. Some economists agree the stock market is in a period of overvaluation but do not see that as foretelling a cataclysmic economic downturn originating in the United States.

“Nobody can predict what the stock market is going to do,” said Rajeev Dhawan, director of the Economic Forecasting Center at Georgia State University. “I cannot predict a stock market crash, so I cannot predict a recession. I don’t see any of the reasons for a recession going forward unless there is a huge problem with the market or there is some catastrophic world event which is beyond the scope of economics.” Sung Won Sohn, an economics professor at California State University Channel Islands in Camarillo, put the probability of an imminent recession at less than 10%. “If it happens, it would be because of what is happening overseas, especially in China and Europe,” he said.

Negative rates are perverse.

• BOJ Negative Rates Destroy Interbank Loan Market as Freeze Deepens (BBG)

The freeze in Tokyo’s market for overnight loans looks set to extend into a third month as the Bank of Japan’s negative rate policy makes it harder for brokers to price and process transactions. Two months after the BOJ said it would start charging interest on some lenders’ reserves, the outstanding balance in the interbank call market tumbled to a record low 2.97 trillion yen ($27 billion) on March 31, according to Tanshi Kyokai data going back to 1988. While the brokers association and the Japan Securities Depository Center said two weeks ago they had upgraded systems to settle transactions at sub-zero yields, traders say more than technical issues are preventing a revival.

“Among central banks, the BOJ is the one that destroys functioning markets the most,” said Izuru Kato, the president of Totan Research in Tokyo. “Companies will slash staff and scale back operations where activity is grinding to a halt, exposing markets to spikes in rates when the time comes for normalization.” The disruption to Japan’s ground zero for bank funding coincides with a collapse in bond-market trading over the past year, even as the BOJ’s hoarding of notes has left it nowhere near achieving its 2% inflation target three years after Haruhiko Kuroda became governor. When questioned by a lawmaker in parliament last month, Kuroda agreed that it would be theoretically possible to lower rates to minus 0.5%, from the current minus 0.1%.

It’s high time to have this talk.

• An Inconvenient Truth About Free Trade (BBG)

It’s easy to scoff at the anti-free-trade rhetoric emanating from the U.S. presidential campaign trail. Donald Trump keeps yelling about China, Mexico, and Japan. Bernie Sanders won’t stop shouting about greedy multinational corporations. Hillary Clinton, Ted Cruz, and John Kasich are awkwardly leaning in the same direction. If you’re a typical pro-trade business executive, you’re tempted to ask: Were these people throwing Frisbees on the quad during Econ 101? A recent article in the National Review expressed disdain by blaming a swath of America for its own problems, attributing Trump’s success to a “white American underclass” that’s “in thrall to a vicious, selfish culture whose main products are misery and used heroin needles.” Wait. Trump and Sanders may be clumsy and overly dramatic, and their solutions may be misbegotten, but they’re on to something real.

New research confirms what a lot of ordinary people have been saying all along, which is that free trade, while good overall, harms workers who are exposed to low-wage competition from abroad. Ignoring this damage—or pretending that it’s being cured through “redistribution” of gains—undermines the credibility of free traders and makes it harder to win trade liberalization deals. “Economists, for whatever odd reason, tend to close ranks when they talk about trade in public” for fear of giving ammunition to protectionists, says Dani Rodrik, an economist at Harvard’s Kennedy School of Government. “There’s a sense that it will feed the barbarians.” The theory of comparative advantage that’s taught to college freshmen is impossibly clean: It’s all about specialization. England trades its cloth for Portugal’s wine.

Even if Portugal is slightly better at producing cloth than England is, it should focus on what it’s best at, winemaking. Portuguese who lose their jobs making cloth will readily find new ones making wine. Efficiency improves. Everyone wins. Life is more complicated. For example: In times of slack global demand, countries grab more than their fair share of the available work by boosting exports and limiting imports. Perpetual trade deficits leave one country deep in hock to another, threatening its sovereignty. Financial bubbles form when deficit countries are overwhelmed by hot money inflows. Countries restrict trade for strategic reasons, such as to nurture an infant industry, to punish a rival, or to guarantee a domestic source for sensitive military hardware and software.

Nation-states may not appear in intro econ, but they call the shots in the real world. Even setting aside geopolitics, trade creates losers as well as winners. Back in 1941, economists Wolfgang Stolper and Paul Samuelson pointed out that unskilled workers in a high-wage country would suffer losses if that country opened up to imports from a low-wage nation. (The prestigious American Economic Review rejected the paper, calling it a complete sell-out to protectionists.) American support for free trade was strong for most of the 20th century. The Stolper-Samuelson theorem was of mainly theoretical interest because most U.S. trade was with other developed nations. Besides, economic textbooks assured students that losers from trade could be compensated with a portion of society’s gains.

“At the end of the 1990s, imports accounted for 40% of UK demand for basic metals; import penetration is now at 90%.”

• Britain’s Free Market Economy Isn’t Working (G.)

Last week should have been a good one for George Osborne. The first day of April marked the day when the ”national living wage” came into force. The idea was championed by the chancellor in his 2015 summer budget when he said it was time to “give Britain a pay rise”. Unfortunately for the chancellor, the 50p an hour increase in the pay floor for workers over 25 was completely overshadowed by the existential threat to the steel industry posed by Tata’s decision to sell its UK plants. Instead of being acclaimed by a grateful nation, Osborne found his handling of the economy under fire. The fact that official figures showed that Britain has the highest current account deficit since modern records began in 1948 did not help. At one level, all seems well with the economy. Growth was revised up for the fourth quarter of 2015 to 0.6% and is running at an annual rate of just over 2% – close to its long-term average and higher than in Germany, France or Italy.

Two of three key sectors of the economy are struggling, though. Industrial production and construction have yet to recover the ground lost in the recession of 2008-09, leaving the economy dependent on services, which accounts for three-quarters of national output. Digging beneath the surface glitter shows just how unbalanced and unsustainable the economy has become. Growth is far too biased towards consumer spending. Borrowing is going up and imports are being sucked in. An enormous current account deficit and a collapse in the household saving ratio are usually consistent with the economy in the last stages of a wild boom rather than one trundling along at 2%. A little extra digging provides the explanation, with some alarming structural flaws quickly emerging.

Here are two pieces of evidence. The first, relevant to the debate about the future of the steel industry, comes from an investigation by the left of centre thinktank, the IPPR, into the state of Britain’s foundation industries. Foundation industries supply the basic goods – such as metal and chemicals – used by other industries. They have been having a tough time of it across the developed world, but the decline has been especially pronounced in the UK. Since 2000, the share of GDP accounted for by foundation industries has fallen by 21% across the rich nations that belong to the OECD but by 43% in Britain. At the end of the 1990s, imports accounted for 40% of UK demand for basic metals; import penetration is now at 90%. Clearly, this trend will become even more marked if the Tata steel plants close.

The second piece of evidence comes from a joint piece of research from the innovation foundation Nesta and the National Institute for Economic and Social Research being published on Monday. This found that productivity weaknesses are common across the sectors of the UK economy, but particularly marked among newly formed companies. Fledgling firms tend to be less efficient on average, but the report said that in the years since the recession performance had been unusually poor among startups. Since the economy emerged from recession, the growth of highly productive companies has been curbed and there has also been a slowdown in the number of under-performing businesses contracting in size. This helps explain why Britain has an 18% productivity gap with the other members of the G7 group of industrial nations.

Now we’re talking.

• UK Housing Policy ‘Tantamount To Social Cleansing’ (Ind.)

Charities and politicians are demanding urgent changes to housing policy across Britain and warning that thousands of homeless children’s lives may be at risk because they are disappearing from support services after being rehoused. The calls come after an investigation by The Independent uncovered cases of homeless children dying from neglect and abuse after families were moved out of their local authority boundaries. Other evidence in the report suggested that the transfer of homeless families to other parts of the country could have resulted in suicides and miscarriages.

Councils are shunting homeless families out of their local areas on an unprecedented scale to save money on accommodation, as the legacy of the housing crisis and the the Government’s cuts to welfare are felt, but they are frequently neglecting to share records with each other, meaning thousands of vulnerable women and children are completely off the radar of support services. Figures obtained exclusively by The Independent show that at least 64,704 homeless families were moved out by London boroughs between July 2011 and June 2015, with more recent data yet to be collated. The Independent’s research suggests at least one third of families are moved without information being shared with the receiving council, though it is not known how high that figure could potentially be.

Councils are legally obliged to send notification under Section 208 of the Housing Act 1996. Housing and children’s charities are now calling for an urgent review of the practice. Barnardo’s chief executive Javed Khan told The Independent: “Children’s lives can be put at risk if homeless families fall off the radar of authorities.” “[Councils must] share information more effectively to stop that happening”. Shelter’s chief executive Campbell Robb said that out-of-area moves are “far too common and can have a disastrous effect on health and wellbeing” but that one problem is the Government not giving councils “realistic budgets to find accommodation locally”.

“We should follow the other Marx — Groucho — and apply the rule that no-one who actually wants the top job should get it.” As I’ve said many times, our ‘democratic’ structures self-select for the very last people you should want to hold the jobs.

• There Has To Be A Better Way (Steve Keen)

One of the disadvantages of growing up is finding in your old age that people you never took seriously in your youth are now running your country. In my personal case, I’m speaking about Tony Abbott and Malcolm Turnbull – but if I’d gone to University at the same time and place as Kevin Rudd, I’m sure I’d be speaking about him too. I knew Abbott and Turnbull in their Sydney University days: they were both active student politicians, while I was one of the leaders of the student revolt against the economics curriculum there. Abbott and Turnbull both tried to play a role in this “political economy” dispute – and their approach then mirrors their styles today. One believed he knew the word of God, while the other believed he was God. Abbott tried to defeat what he described, in his peculiar nasal drawl, as “the Maarxists” behind the protests.

He went beyond speaking against us at meetings and voting against us on the Students Representative Council to, shall we say, robust attempts to stop us putting up posters in the dead of night. He failed. He lost the votes in public forums and on the SRC. The posters went up, and most of them stayed up – my favourite stayed for years, because we cleaned it into the tarnished copper cladding of the library stack. Turnbull tried to reach a negotiated settlement between the warring sides: a majority of the students and (a substantial segment of the staff) on one side, and the professors Hogan and Simkin and Vice-Chancellor Williams on the other. He failed too. At a meeting where I was one of two invited student speakers, the economics faculty voted, against the professors’ wishes, for an inquiry into the Department of Economics.

The inquiry recommended, against the Vice Chancellor’s wishes, that the department should be split in two. This occurred in 1975 with the formation of the Department of Political Economy, which still exists today. So Turnbull and Abbott were bit players in that drama, but of course their eyes were set on a bigger role: that of becoming prime minister of Australia, as they both have now done. We knew those ambitions back in the 1970s too, and we laughed. It turned out to be no laughing matter so far as their ambitions went, but for the country itself, their success — and that of Rudd before them, and frankly many others — was a crying shame. Their one qualification for the top job was the unshakable belief that they deserved it. That self-belief, and the drive that went with it, carried them all — Rudd included — to the top.

This time it’s Portugal. Worse than Greece. Political distortions engendered by Draghi.

• Rescuing Europe’s Worst Government Bonds May Take More Than ECB (BBG)

It’s gone from bad to the worst for investors in Portuguese bonds. While government debt in the euro region posted the biggest quarterly returns since the ECB started its quantitative easing program a year ago, holders of Portuguese securities were left nursing a loss. Political wrangling to form a government and then a shift in budget policy have been dragging down the market more than in Spain, which is still without an elected government, or even Greece, a byword for crisis. Portuguese bonds lost 1.3% in the three months through March 31, compared with an average gain of 3.3% in the euro area, according to Bloomberg World Bond Indexes. Greece managed to eek out a 0.4% return.

“The situation in Portuguese bonds has been compromised by the election result and the instability that came after,” said Gianluca Ziglio at Sunrise Brokers in London. “That creates uncertainty with potential impact on the rating.” While Portugal’s bonds have also benefited from the ECB’s expansion of its asset-purchase program by €20 billion a month starting April, they have had a torrid year as investors avoided what they consider the riskiest assets. The issue is that Portugal’s prospects just look gloomier compared with neighboring Spain, even without their respective political battles. Portugal’s economy is forecast to grow 1.5% this year compared with 2.7% in Spain and 4.7% in Ireland.

Another country that had to resort to a bailout at the height of the sovereign debt crisis, Ireland last week sold a bond that matures in a century at 2.35%. Portugal has to pay about 3% just to borrow for a decade. Portugal is rated below investment grade, or junk, by Fitch Ratings, Moody’s Investors Service and Standard & Poor’s. It’s only the grading by DBRS Ltd., which is scheduled to next review its position on April 29, that gives the country enough creditworthiness to qualify for purchases under the ECB’s QE program.

Yeah, why not?! Let’s do it all over again.

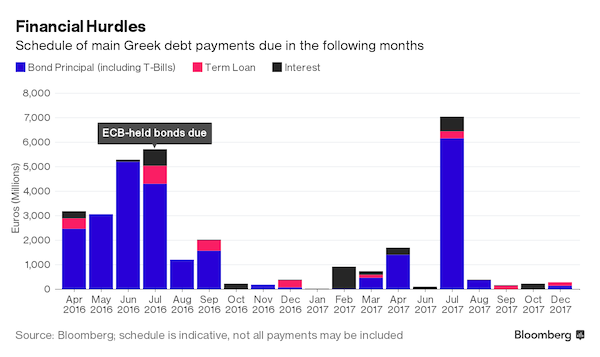

• Greece’s Euro Future May Be Back in Play as Rescue Talks Drag On (BBG)

Greece could again face the threat of being pushed into default and out of the euro area if its current bailout review drags on into June and July, according to European officials monitoring the slow progress of Prime Minister Alexis Tsipras’s negotiations with creditors. Greece still hasn’t cut a deal on pensions, tax administration or its fiscal gap, and other issues like non-performing loans and a proposed privatization fund continue to slow the talks, said European officials. The IMF presents another obstacle, they said. The IMF, for its part, disagrees with the euro area on how Greece needs to cut its budget. With Germany insisting that the fund will eventually have to get on board for the bailout to proceed, officials from the IMF are trying to find ways to pressure Chancellor Angela Merkel to give Greece debt relief, according to a transcript of a purported conversation published by WikiLeaks April 2.

The euro area’s most-indebted member was almost forced out of the currency union last July before national leaders agreed to a third bailout package after all-night talks in Brussels. Merkel helped break the logjam then, warning it would be reckless and sow chaos to let Greece slip away from the currency union. While European officials have talked up the prospects for the review in public recently, all sides have harbored doubts from the get-go about whether Greece could meet the strict budget goals at the heart of last year’s rescue. Those concerns have increased as Tsipras’s Syriza party has lost allies and the European Commission and the ECB have faced stepped up demands from IMF negotiators.

“My odds for another Greek crisis this summer are relatively high,” said Carsten Brzeski, chief economist at ING Diba in Frankfurt. “Given the extremely slow pace of the implementations, the review, Syriza’s loss of popularity in opinion polls and still little appetite for debt relief, the next crisis is already in the making. It’s only a matter of time before it happens.”

The entire south is the weakest link.

• Italy, Not UK is European Union’s Weakest Link (Reuters)

The drama of the European Union can’t yet be called a tragedy, but it’s shaping up that way. What started out as the salvation of a continent from the horrors of the first half of its 20th century is now — after decades of optimistic growth lofty proclamations — toiling miserably merely to exist. Dramatic tragedy is the collapse of high status and ambition: The EU grasped after greatness, achieved much – and is now perilously close to losing all. The most obvious challenges from within come, first, from the always semi-detached British, who may well leave after a referendum in June. Informed opinion, which had been comfortably sure that fear or inertia would ensure continued membership, is now alarmed that threats of mass immigration, terrorism and increased economic turbulence mean out is winning over in.

But smaller nations are pesky too. Hungary is in what seems a frozen posture of enmity to the liberal ideals and practices of the Union it clamoured to join. To only a slightly lesser degree, so is Poland, seen since its 2004 accession to the Union as the most successful of the post-communist entrants. Greece still trembles on the brink of a new collapse: the governing leftist Syriza party must pass several dozen laws which will deepen austerity as a prelude to what is promised to be growth next year. It may balk. Yet a still larger, and hidden, challenge comes from the state that was one of the founding six nations and has consistently been most enthusiastic for ever-closer union. That state is Italy, a world soft power for its art and culture, both historic and present, its flair in design, its cuisine, its beauty. Italy is perhaps the weakest point in the European construction — for obvious reasons, and a deeper one.

One of the obvious reasons is its public debt: at over $2 trillion, it is second only to Greece in these dismal stakes. Another is the weakness of the Italian banks, which are burdened with bad debt of some $350 billion. It can be managed, say the financial authorities, as long as growth continues to increase: at present, however, it’s slowing. Prime Minister Matteo Renzi, a man of constant public optimism, seems to have passed on his upbeat view to the people of his nation, but not to the statistics. A Reuters analysis in January noted that Renzi’s sunniness “appears to have got through to most Italians, but this does not solve the chronically weak productivity and economic bottlenecks that have crimped its growth for two decades.” To set the seal on gloom, the analysis quotes the Deutsche Bank economist Marco Stringa as saying that “Every year (Italy) grows below the euro zone average, and if you are always below the average you have a problem.”

Lagrade reacts to Tsipras’ inquiries about the Wikileaks reveal with venom.

• IMF Chief Says Greece Plan ‘Good Distance Away’ (AFP)

IMF chief Christine Lagarde on Sunday told Greek Prime Minister Alexis Tsipras that “we are still a good distance away” in negotiations for a new deal for hard-up Athens. Her strongly worded letter to the prime minister, made public by the IMF, comes amid tense ties between Athens and the IMF after WikiLeaks said the lender sought a crisis “event” to push the indebted nation into concluding talks over its reforms. “My view of the ongoing negotiations is that we are still a good distance away from having a coherent program that I can present to our Executive Board,” Lagarde wrote, in unusually forceful terms, after Tsipras wrote to her in the wake of the WikiLeaks allegations.

“I have on many occasions stressed that we can only support a program that is credible and based on realistic assumptions, and that delivers on its objective of setting Greece on a path of robust growth while gradually restoring debt sustainability.” The Greek government on Saturday reacted strongly to the WikiLeaks report, saying it wanted the IMF to clarify its position. Lagarde rebuffed any suggestions the IMF was pushing for crisis in Greece. “The IMF conducts its negotiations in good faith, not by way of threats, and we do not communicate through leaks,” IMF managing director Lagarde said in her letter, adding that she was releasing the details of the text “to further enhance the transparency of our dialogue.” “I also look forward to any personal conversation with you on how to take the discussions forward,” she added.

In July, Greece accepted a three-year, €86 billion EU bailout that saved it from crashing out of the eurozone. But the bailout came with strict conditions such as fresh tax cuts and pay cuts. The IMF worked with the EU on two previous bailouts for Greece since 2010 but the Washington-based lender said it would not participate in the third rescue plan without credible reforms and an EU agreement to ease Greece’s debt burden. Athens is under pressure to address the large number of non-performing loans burdening Greek banks and to push forward with a pension and tax overhaul resisted by farmers and white-collar staff. Tsipras has accused the IMF of employing “stalling tactics” and “arbitrary” estimates to delay a reforms review crucial to unlock further bailout cash.

Mission chiefs from Greece’s international lenders — the EU, IMF, European Central Bank and European rescue fund — are due to resume an audit of the reforms on Monday. “I agree with you that successful negotiations are built on mutual trust, and this weekend’s incident has made me concerned as to whether we can indeed achieve progress in a climate of extreme sensitivity to statements of either side,” Lagarde wrote. “On reflection, however, I have decided to allow our team to return to Athens to continue the discussions,” she added, stressing that “it is critical that your authorities ensure an environment that respects the privacy of their internal discussions and take all necessary steps to guarantee their personal safety.”

Just one of many things that show that.

• Sordid Wrangling Between IMF and EU Shows Greek Democracy Is Dead (E.)

Financiers from the IMF are prepared to force millions of Greeks into abject poverty to secure a petty political victory over Brussels, according to a leaked conversation between top officials. The sordid wrangling shows just how dead Greece’s supposed democracy is, with Prime Minister Alexis Tsipras now powerless to defend his people from its puppet paymasters in Berlin and Washington, where the IMF is based. The international lender even wanted to use Britain’s EU referendum as an excuse to drive the struggling country to the wall so that it could get its own way. Greek politicians have reacted with fury to the revelations, and have demanded immediate answers from IMF boss Christine Lagarde. In a response today she astonishingly asked Greece’s former finance minister to “respect the privacy” of her staff, but also denied that the organisation would use his country’s insolvency as a bargaining chip.

But in truth they have no power to change the situation, with their country now entirely reliant on international bailouts to stay afloat. The shocking plot has been revealed in a leaked transcript of a meeting between two top IMF officials released by the whistle blowing website Wikileaks. The conversation, on 19 March, purportedly involves Poul Thomsen, head of the IMF’s Europe department, and Delia Velculescu, leader of the IMF team in Greece, who are the senior officials in charge of Greece’s debt crisis. They are apparently discussing how to get the EU – and Angela Merkel in particular – to come around to their way of thinking over a restructuring of Greek debt. The IMF says it will only sign up to a deal which involves debt relief for the stricken nation, a position Germany emphatically rejects.

The two parties are due to meet next week to discuss the next financial instalment for Greece, which will need fresh funding in the summer to avert a costly default. During the conversation it is apparently suggested that the international lender should be prepared to bring about an “event” – in other words a financial crisis bringing Greece to the point of collapse – to force the issue to a head. In the leaked transcript Mr Thomsen is quoted as complaining about the pace of talks on reforms Greece has agreed to carry out in exchange for the bailout. He asks: “What is going to bring it all to a decision point? “In the past there has been only one time when the decision has been made and then that was when they were about to run out of money seriously and to default.” Ms Velculescu later agrees, saying: “We need an event, but I don’t know what that will be”.

European democracy is dead. So is its reputation, its decency, its humanity. It will take a hundred years or more to get it back.

• EU Begins Refugee Push-Back, Defying Human Rights Outcry (WaPo)

The European Union on Monday began sending back across the sea hundreds of people who, only days ago, had braved the crossing to Greece aboard flimsy rubber rafts in search of a new life. Just after dawn on Lesbos, several bus-loads of men were led aboard two ferries under heavy police and military guard. The ferries, flying Turkish flags, steamed out of the port and turned east toward the Turkish coast. More than 100 migrants were believed to have been aboard. The deportations are the first of thousands expected under the E.U.’s plan to end the continent’s refugee crisis by shifting the burden onto neighboring Turkey. Human rights groups have condemned the strategy as a violation of basic rights.

But European officials forged ahead with a plan to send several boatloads of people on Monday across the Aegean Sea from the Greek islands of Lesbos and Chios — two popular landing spots for refugee rafts — to Turkey. More deportations are expected to follow later in the week. A spokeswoman for Frontex, the E.U. border control agency that will carry out the deportations, said on Sunday it had organized ferries to transport the migrants and that 200 personnel would be on Lesbos to oversee the operation, including to serve as escorts. “It needs to be done right with respect to human dignity,” said Ewa Moncure, the spokeswoman. But human rights advocates insisted that the plan was fundamentally flawed and represented an abandonment of European responsibility to help those seeking escape from the conflicts flaring on Europe’s doorstep. Amnesty International has called it “a historic blow to human rights.”

Home › Forums › Debt Rattle April 4 2016