Jack Delano “Untitled” 1940

“..it’s a terrible time right now” to invest in the stock market..”

• Trump Predicts A ‘Very Massive Recession’ (WaPo)

Donald Trump said in an interview that economic conditions are so perilous that the country is headed for a “very massive recession” and that “it’s a terrible time right now” to invest in the stock market, embracing a distinctly gloomy view of the economy that counters mainstream economic forecasts. The New York billionaire dismissed concern that his comments – which are exceedingly unusual, if not unprecedented, for a major party front-runner – could potentially affect financial markets. “I know the Wall Street people probably better than anybody knows them,” said Trump, who has misfired on such predictions in the past. “I don’t need them.”

Trump’s go-it-alone instincts were a consistent refrain – “I’m the Lone Ranger,” he said at one point – during a 96-minute interview Thursday in which he talked candidly about his aggressive style of campaigning and offered new details about what he would do as president. The real estate mogul, top aides and his son Don Jr. gathered over lunch at a makeshift conference table set amid construction debris at Trump’s soon-to-be-finished hotel five blocks from the White House. Just before, he had met there with his foreign-policy advisers and just after he visited officials at the Republican National Committee – signs that, in spite of his Trump-knows-best manner, the political novice is making efforts to build a more well-rounded bid.

Over the course of the discussion, the candidate made clear that he would govern in the same nontraditional way that he has campaigned, tossing aside decades of American policy and custom in favor of a new, Trumpian approach to the world. In his first 100 days, Trump said, he would cut taxes, “renegotiate trade deals and renegotiate military deals,” including altering the U.S. role in NATO. He insisted that he would be able to get rid of the nation’s more than $19 trillion national debt “over a period of eight years.” Most economists would consider this impossible because it could require taking more than $2 trillion a year out of the annual $4 trillion budget to pay off holders of the debt.

Creating crisis.

• IMF Plots New “Credit Event” For Greece (Mason)

The IMF has been caught, red handed, plotting to stage a “credit event” that forces Greece to the edge of bankruptcy, using the pretext of the Brexit referendum. No, this is not the plot of the next Bond movie. It is the transcript of a teleconference between the IMF’s chief negotiator, Poul Thomsen and Delia Velculescu, head of the IMF mission to Greece. Released by Wikileaks, the discussion took place in Athens just before the IMF walked out of talks aimed at giving Greece the green light for the next stage of its bailout. The situation is: the IMF does not believe the numbers being used by both Greece and Europe to do the next stage of the deal.

It does not want to take part in the bailout. Meanwhile the EU cannot do the deal without the IMF because the German parliament won’t allow it. As they bicker about the numbers, Thomsen and Velculescu are heard mulling whether to suppress the IMF’s next report on whether Greek debt is sustainable. That’s important because the IMF will only sign up to a deal that involves debt relief, and the Germans will not.

Then Thomsen drops the bombshell:

THOMSEN: What is going to bring it all to a decision point? In the past there has been only one time when the decision has been made and then that was when they were about to run out of money seriously and to default. Right?

VELCULESCU: Right!

THOMSEN: And possibly this is what is going to happen again. In that case, it drags on until July, and clearly the Europeans are not going to have any discussions for a month before the Brexits and so, at some stage they will want to take a break and then they want to start again after the European referendum.

Velculescu says they should try and do something in April. Thomsen replies:

THOMSEN: But that is not an event. That is not going to cause them to… That discussion can go on for a long time. And they are just leading them down the road… why are they leading them down the road? Because they are not close to the event, whatever it is.

VELCULESCU: I agree that we need an event, but I don’t know what that will be.So let me decode. An “event” is a financial crisis bringing Greece close to default. Just like last year, when the banks closed, millions of people faced economic and psychological catastrophe. Only this time, the IMF wants to inflict that catastrophe on a nation holding tens of thousands of refugees and tasked with one of the most complex and legally dubious international border policing missions in modern history. The Greek government is furious: “we are not going to let the IMF play with fire,” a source told me. But the issue is out of Greek hands. In the end, as Thomsen hints in the transcript, only the European Commission and above all the German government can decide to honour the terms of the deal it did to bail Greece out last July. The transcript, though received with fury and incredulity in Greece, will drop like a bombshell into the Commission and the ECB. It is they who are holding €300bn+ of Greek debt. It is the whole of Europe, in other words, that the IMF is conspiring to hit with the shock doctrine.

But won’t get any.

• Greece Wants IMF Explanations Over Wikileaks Report (AFP)

Greece on Saturday demanded “explanations” from the IMF after Wikileaks said the lender sought a crisis “event” to push the indebted nation into concluding talks over its reforms. IMF officials, in an internal discussion, allegedly voiced exasperation with Greece on its slow pace of reform, complaining Athens only moved decisively when faced with the peril of default, the website said. An “event” was thus needed to drive the threat of default and get the Greeks to act, one official purportedly says. The “event” is not described in the transcript placed on the Wikileaks website on Saturday. The official, assessing the state of the talks and the political calendar, predicts the EU will stop discussions “for a month” before Britain’s EU referendum on June 23.

The Greek government reacted strongly to the report, saying it wanted the IMF to clarify its position. “The Greek government is demanding explanations from the IMF over whether seeking to create default conditions in Greece, shortly ahead of the referendum in Britain, is the fund’s official position,” spokeswoman Olga Gerovassili said in a statement. The transcript purports to be that of a teleconference that took place on March 19. Those taking part were Iva Petrova and Delia Velculescu, who have been representing the IMF in the negotiations with Greece, and Poul Thomsen, director of the Fund’s European Department.

In it, Thomsen allegedly voices exasperation with the slow pace of talks on Greek reforms between Greece and its international lenders. “In the past there has been only one time when the decision has been made and then that was when (the Greeks) were about to run out of money seriously and to default,” he reportedly says. “I agree that we need an event, but I don’t know what that will be,” Velculescu allegedly replies later in the conversation.

Hubris.

• IMF Weighing Exit From Greek Bailout (FT)

The IMF is considering forcing Germany’s leadership to quickly grant wide-ranging debt relief for Greece or allow the Fund to exit Athens’ bailout programme after six years, according to a transcript of an internal IMF teleconference published by WikiLeaks. The teleconference, between the head of the IMF’s European operations and its top Greek bailout monitor, is the clearest sign to date that the Fund wants to leave Greece’s €86 billion ($97 billion) rescue to the European Union alone and wash its hands of a programme that has led to a torrent of criticism. During the call, which occurred just two weeks ago, Poul Thomsen, head of the IMF’s European bureau, notes that Berlin is under intense political pressure because of the refugee crisis and suggests confronting Angela Merkel, the German chancellor, to either agree to debt relief or allow the IMF to exit.

German officials have repeatedly said they could not participate in Greece’s bailout without the IMF on board, and senior members of the Bundestag have warned Ms Merkel they would reject new eurozone loans to Greece if only EU authorities were monitoring the programme. “Look, you Ms Merkel, you face a question, you have to think about what is more costly: to go ahead without the IMF? Would the Bundestag say, ‘The IMF is not on board’?” the transcript quotes Mr Thomsen as saying to his staff. “Or [does Ms Merkel] pick the debt relief that we think that Greece needs in order to keep us on board? Right? That is really the issue.” The IMF said it would not comment on “supposed reports of internal discussions.” But it noted that it has long pushed for “a credible set of reforms matched by debt relief from [Greece’s] European partners.”

One official involved in the talks said it accurately reflected Mr Thomsen’s private and publicly-stated views, albeit in “more direct and colourful language.” Many of the points raised by Mr Thomsen in the call have been made publicly on his IMF blog. Greek officials, however, reacted angrily to the revelation, arguing it was evidence the IMF was “blackmailing” Germany on the debt relief issue. “We will not allow anyone to play with fire and blackmail Greece or Germany or Europe,” said a senior Greek official. Alexis Tsipras, the Greek prime minister, was meeting with his cabinet on Saturday to decide how to respond and was expected to talk to Christine Lagarde, the IMF managing director, later in the day.The IMF teleconference came just days after Wolfgang Schäuble, the powerful German finance minister, publicly said he was opposed to Greek debt relief — despite the fact eurozone leaders agreed to restructuring last July at a high-drama EU summit that agreed to a third bailout programme.

Yada yada.

• Lenders Eye Start Of Greek Debt Relief Talks At Mid-April IMF Meetings (R.)

Euro zone finance ministers are likely to start discussing debt relief for Greece on the sidelines of the IMF’s spring meetings in mid-April, if there is a deal by then with Athens on a reform package, euro zone officials said. Representatives of Greece’s official lenders are to resume talks with the Greek government from Monday on how to tackle non-performing loans in the banking system and pension and income tax reforms. Negotiations on these reforms have been dragging on for months because they are politically very difficult for the left-wing government of Alexis Tsipras, elected on promises to end austerity. Yet these measures are crucial for Greece to reach a sizeable primary surplus in 2018, when lenders hope it will be able to manage its own finances and borrow from the market at sustainable rates.

Without an agreement on the measures, Athens cannot get the next tranche of loans from the euro zone bailout fund. It needs the money to pay back $4 billion to the IMF and the ECB in July. An agreement is also a crucial condition for any debt relief talks to start and a deal on debt relief is also a condition for the IMF to participate in the bailout program for Greece. “If the Greeks want to …have a disbursement well before July, there needs to be agreement on policies by around mid-April – and on 12 April everybody goes to Washington, so best before that,” one senior euro zone official said.

“Only then can one start discussing debt issues in earnest, and that will take some time. And then at the end everything has to come together simultaneously,” the official said. “For now everybody is working towards this – but the decisive factor is if the Greeks can pull their act together politically, there is no technically difficult issue anywhere,” the official said. Many euro zone finance ministers will participate in the spring meetings of the IMF in Washington on April 15-17, including all the biggest euro zone members, as well as top representatives of all the key euro zone institutions.

Down for the count.

• As China Turns to Consumers, Australia Confronts End of Iron Age (BBG)

Just as China’s industrialization helped reshape Australia’s economy, the Asian giant’s pivot toward consumer-led growth is challenging Down Under anew. Chinese demand for food and energy will only partly offset slowing growth in iron ore exports that funneled cash throughout Australia for more than a decade, according to the Reserve Bank of Australia. That means the nation must find new growth drivers at a time a housing boom falters and a resurgent currency compound difficulties posed by the slowdown in Australia’s biggest trading partner. Central bank Governor Glenn Stevens acknowledged last week it’s impossible to know how China’s transition will unfold given nothing on the scale has been tried before, signaling elevated risks ahead for the developed world’s most China-dependent economy.

Minutes from its March 1 board meeting – where interest rates were kept at a record low 2% – showed a bigger chunk of policy makers’ time was spent discussing China. “The Australian economy at the moment is being buoyed by the confidence that comes from extraordinarily low interest rates driving up asset prices,” said Andrew Charlton, director of consultancy AlphaBeta in Sydney and one-time adviser to former Prime Minister Kevin Rudd. The subsequent housing boom and wealth creation “have been temporary policy stimulus holding up what will be a long-term negative impact of the changing Chinese economy on Australia.” The stakes are high for Australia, with China accounting for about a third of its trade and earning the mineral-rich country about 5% of its GDP.

Furthermore, resources will still comprise a larger share of Australia’s commodity exports to China than food in the coming two decades, the RBA’s chief China specialist Ivan Roberts said in a research paper released March 18. The pressures aren’t restricted to Asia. China’s steel production could be materially cut by a European Union move to consider tougher steel-import tariffs amid concern that Chinese producers pose a threat to their continental counterparts, Fitch Ratings warned on March 24. That would inevitably flow onto Australia’s iron ore industry, where prices have already slumped about 75% in the last five years. While iron ore rebounded 23% in the first quarter to as high as $63.74, McKinsey & Co. predicts the steel making ingredient will snap back to between $45 and $50 this year as evidence of any real improvement in demand is scant.

Trade war is inevitable.

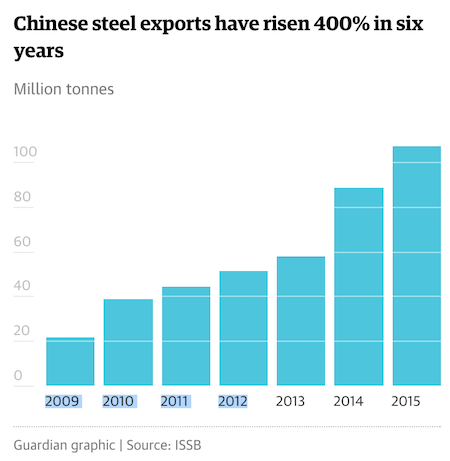

• China’s Zeal For Steel Casts Long Shadows At Home And Abroad (G.)

Until recently steel was a Chinese success story. Its steel industry kicked off in 1894 with a small victory against its historic rival, Japan, after the opening of the Hangyang Iron Works in Hubei province. Though it opened two years before Japan’s first steel plant, the factory was privatised in 1908 and was eventually bought by the Japanese. The first world war stimulated demand, and after a postwar decline in production, further Chinese steel plants saw the industry take off. When Mao Zedong took power in 1949 and the People’s Republic of China was established, self-sufficiency rather than global industry domination was the driving force in a diplomatically isolated country. Steel production expanded through the 1950s as Soviet-influenced heavy industrialisation kicked in.

Annual output was 158,000 tonnes when Mao took over; by 1976, the year before his death and the final year of the decade-long Cultural Revolution, it was 20.5 million tonnes. But in the 1980s, China imported more and more steel as it struggled to meet domestic demand. As the country’s economic clout grew, the government set a target of increasing crude steel production to 60 million tonnes by the end of 1990 and 80 million by 1995. Early signs of the recent, disastrous, overproduction were apparent as these targets were surpassed. In 1996, China overtook Japan to become the world’s biggest steel producer, churning out more than 101 million tonnes that year. The 2008 global recession failed to put the brakes on. While much of the developed world was mired in crisis, China boasted a 9% GDP growth rate in 2009.

Steel production was still rocketing, with output of 683 million tonnes in 2011. After 2014, China’s economic growth slowed, and so did domestic demand. China responded by increasing steel exports, which led to accusations of dumping. In 2015 exports increased by 20% to 107 million tonnes. Prices were slashed as Chinese steel companies battled to survive. The dumping cast a shadow over the UK steel industry, and has also meant shutdowns and layoffs at Chinese plants. Last month, before it became clear that 40,000 jobs were at risk in the UK, the Chinese government announced that 500,000 steel workers were to lose their jobs. All this is the result of China’s first annual steel industry contraction in a quarter of a century, announced last January. The government is aiming to cut steel production by 150 million tonnes by 2020.

Ayn Rand.

• The Dogmas Destroying UK Steel Also Inhibit Future Economic Growth (G.)

The elimination of Britain’s steel industry in a matter of weeks – the reality of Tata’s statement that it wants to close its UK operations – is, by any standards, shocking. There will be efforts to save something from the ruins, but the financial and trading truths are brutal. This has not happened, however, in a day, or even over the past few years. Rather the plight of British steel making is the culmination of 40 years of refusal to organise economic, financial and industrial policy to support the generation of value. This is done in the laissez-faire belief – contested even in economic theory – that any such attempt is self-defeating. Business secretary Sajid Javid personifies this view. In fact, he is surely the most ideologically driven and least practical politician to hold this key post since the war. The most generous interpretation is that this is creative destruction at work.

Steel was an integral element of an industrial economy now giving way to a new knowledge-based capitalism where know-how is more important than brawn. It is tragic for those whose livelihoods and skills are now redundant, but it was no less tragic for ostlers, sailmakers and coal miners in their day. The trouble is that Britain is very good at destruction, much less good at the creative part. Nor is it clear that steel’s days are over: its usage in a range of key functions – from transport to construction – remains fundamental and is growing. Rather, the economic behemoth China has monumentally over-invested in steel, for which there is too little domestic demand, and is now flooding world markets. Britain, with a systemically overvalued exchange rate, porous market, high energy costs and ideological refusal to join others in the EU to deter imports dumped below cost with higher tariffs, is uniquely exposed to the threat.

Now up to 40,000 workers directly and indirectly connected to steel production are about to lose their livelihoods. Beneath the specifics of the steel industry lie more deep-seated problems. The day after Tata’s announcement, the Office of National Statistics (ONS) disclosed that the country’s balance of payments deficit in the last quarter of 2015 climbed to a record 7% of GDP. Britain’s international accounts are more in the red than those of any other developed country. Imports of goods and services, which have steadily outstripped exports for decades, are now to be given an extra impetus by the closure of UK steel capacity. What’s more, the same weaknesses that plague the old also inhibit the growth of the new.

After the interventionism of the 1930s – or even the 1950s and 1960s – Britain could boast dozens of substantial companies representing industries as disparate as pharmaceuticals, chemicals, aerospace and electronics. Not so in 2016. Only two high-tech companies are represented in the FTSE 100 – ARM and Sage. Another 20 years of the laissez-faire framework Javid cherishes – he is a devotee of the wild philosopher of hyper-libertarianism Ayn Rand – and the economy will be eviscerated, with a current account deficit so large it cannot be conventionally financed. The consequences – on living standards, employment, inflation, interest rates and house prices – will be severe.

Not in doubt, but non-existent.

• Russian Oil Output Rises to Record as Production Freeze in Doubt (BBG)

Russia’s oil output set a post-Soviet high in March as the success of a proposed crude production freeze between OPEC members and other major producers appeared to be in doubt. Russian production of crude and a light oil called condensate climbed 2.1% in March from a year earlier to 10.912 million barrels a day, according to the Energy Ministry’s CDU-TEK unit. That narrowly beat the previous high of 10.910 million barrels in January. With most OPEC members, Russia and some others outside the group scheduled to meet in Doha this month to discuss an accord on capping output, Saudi Arabia’s Mohammed bin Salman signaled in an interview with Bloomberg that if any country raises output, the kingdom will also boost sales.

Prices on Friday sank more than 4% after the comments. Iran previously said it plans to boost production after the lifting of sanctions following a deal to curb its nuclear program. Saudi Arabia, Russia, Venezuela and Qatar in February first proposed an accord to cap oil output to reduce a worldwide surplus and boost prices. Brent prices in London have gained nearly 40% from the 12-year low reached in January. Russian oil exports rose 10% to 5.59 million barrels a day, according to the Energy Ministry data.

It was always blind to presume otherwise.

• Cheap Oil ‘Too Much Of A Good Thing’ For US Economy: Goldman (CNBC)

The U.S.’s embarrassment of oil riches may not have been that beneficial after all. Those are the findings of a recent Goldman Sachs report, in which the bank explained that the net effects of cheaper crude on growth have been “negative so far,” given the impact on oil producers who are now finding it hard to churn out more black gold while maintaining needed levels of capital expenditures. Although Goldman acknowledged a lift to consumer spending, the summary constituted an admission that the virtues of the boom that sent U.S. oil production skyrocketing, leaving world markets awash in inexpensive crude, may not have delivered the economic boost many observers had anticipated at its outset.

“While cheap oil has … become ‘too much of a good thing’ for growth, the employment impact of lower oil prices is likely still positive, reflecting the modest effect on employment of the capital-intensive energy sector,” Goldman wrote. Last year, the U.S. produced nearly 10 million barrels per day — the largest amount in decades and second only to Saudi Arabia. As a consequence of the massive buildup of supply that flooded world markets, oil prices slumped by more than half, placing intense pressure on domestic energy producers. In the research note released on Saturday, Goldman estimated that the level at which U.S. producers would need to breakeven is somewhere within a range of $45 to $80. On Friday, crude closed below $40 per barrel. Given current levels of crude, the crumbling of capital expenditures is a net drag on economic growth, Goldman notes.

It added that oil would need to climb back to $70 at least to give energy capital spending a second wind. “Adding up, we conclude that the net effect of cheap oil on growth has probably been negative so far, with the capex collapse outweighing the consumption boost,” analysts wrote. “But going forward, the net effect is likely to be neutral at worst under our $30 scenario, but would be moderately positive if oil prices rebound to $50 or $70, reflecting the outsized impact of price changes in this crucial range on energy capex and production,” it added. With that as a backdrop, energy companies are feeling the pinch of lower crude prices. Last year, ratings agency Standard & Poor’s warned that 50% of energy company bonds were now considered “distressed” and were at risk of default. In total, S&P estimates that $180 billion worth of debt falls in that category. Meanwhile, at least 50 different oil and gas companies have filed for bankruptcy since last year.

The deal will throw back Europe by decades in the eyes of the world.

• Fears Grow Over Refugee Safety With EU Returns Plan Set To Take Effect (Ind.)

Fears are growing that Greece will be unable to manage the task of sending back refugees to Turkey under the European Union’s controversial migrant transfer deal which is due to be enforced from Monday. Humanitarian aid groups have warned that the deal will be impossible for overwhelmed Greek and EU officials to implement. While a top UN official has said that the deal to send Syrian refugees back to Turkey en masse could be illegal, as Ankara is pushing them back over the border into the war zone. “Collective deportations without having regard to the individual rights of those who claim to be refugees are illegal,” Peter Sutherland, the UN Secretary General’s special representative for international migration and development told the BBC.

“Secondly, their rights have to be absolutely protected where they are deported to, in other words Turkey. There has to be adequate assurances they can’t be sent back from Turkey to Syria.” There has also been opposition to the move from within both Greece and Turkey. In the coastal Turkish town of Dikili, hundreds demonstrated on Saturday against the prospect of hosting people expelled from the nearby Greek islands, especially Chios and Lesbos. A plan to build a reception centre for returned migrants and refugees in Dikili is unpopular with locals. “We definitely don’t want a refugee camp in Dikili,” said the town’s mayor, Mustafa Tosun, according to the Associated Press. Demonstrators expressed concern over the impact the EU deal could have on the economy, tourism and security in their town.

It’s illegal on many fronts.

• EU-Turkey Refugee Plan Could Be Illegal, Says UN Official (G.)

The European Union’s plan to send refugees fleeing Syria’s civil war back to Turkey en masse could be illegal, a top UN official has warned, amid concerns that Greece lacks the infrastructure needed for the deal to take effect on Monday. Peter Sutherland, the UN secretary general’s special representative for international migration and development, said that deporting migrants and refugees without first considering their asylum applications would break international law. And, in light of claims by an NGO that Turkey had been pushing Syrians back over the border to their home country, he warned that none could be deported from Europe without guarantees that their rights would be protected. Sutherland spoke as Greece prepares to begin deporting migrants and refugees on Monday. Greek immigration officials have already warned they need more staff to implement the plan.

Asked during an interview on BBC Radio 4’s Today programme whether Europe’s scheme could be illegal, Sutherland replied: “Absolutely, and there are two fundamental reasons for this. “First of all, collective deportations without having regard to the individual rights of those who claim to be refugees are illegal. Now, we don’t know what is going to happen next week, but if there is any question of collective deportations without individuals being given the right to claim asylum that is illegal. “Secondly, their rights have to be absolutely protected where they are deported to, in other words Turkey. There has to be adequate assurances they can’t be sent back from Turkey to Syria, for example if they are Syrian refugees, or Afghanistan or wherever.”

European and Turkish leaders are set to implement a deal on Monday that will result in almost all asylum seekers being deported back to Turkey. In exchange for each person sent back, the EU has agreed to accept a refugee who has not tried to enter Europe illegally. But the success of the deal rests on both Greece’s ability to process thousands of people in a short space of time, and Turkey’s ability to prove itself a safe country for refugees. In theory, only those refugees who fail to claim asylum in Greece – usually because they are seeking to settle elsewhere in the EU – or whose claims are rejected will be deported. However, the most senior Greek asylum official, Maria Stavropoulou, on Friday told the Guardian she would need a 20-fold increase in personnel to handle expected claims.

However, unrest has already erupted among refugees and migrants in Greece who are anticipating the beginning of the deal. On the Greek island of Chios, hundreds of people ripped down a razor wire fence that had kept them imprisoned in a camp and fled. One told the BBC: “Deportation is a big mistake because we have risked a lot to come here especially during our crossing from Turkey to Greece. We were smuggled here from Turkey. We cannot go back. “We will repeat our trip again and again if need be because we are running away in order to save our lives.” Meanwhile, Amnesty International alleged that unaccompanied children were among hundreds of Syrians illegally expelled from Turkey since January. John Dalhuisen, Amnesty’s Europe and central Asia director, said: “In their desperation to seal their borders, EU leaders have wilfully ignored the simplest of facts: Turkey is not a safe country for Syrian refugees and is getting less safe by the day.”

This will not go well.

• Greece On Brink Of Chaos As Refugees Riot Over Forced Return To Turkey (G.)

The Greek government is bracing itself for violence ahead of the European Union implementing a landmark deal that, from Monday, will see Syrian refugees and migrants being deported back to Turkey en masse. Rioting and rebellion by thousands of entrapped refugees across Greece has triggered mounting fears in Athens over the practicality of enforcing an agreement already marred by growing concerns over its legality. Islands have become flashpoints, with as many as 800 people breaking out of a detention centre on Chios on Friday. “We are expecting violence. People in despair tend to be violent,” the leftist-led government’s migration spokesman, Giorgos Kyritsis, told the Observer. “The whole philosophy of the deal is to deter human trafficking [into Europe] from the Turkish coast, but it is going to be difficult and we are trying to use a soft approach. These are people have fled war. They are not criminals.”

Barely 24 hours ahead of the pact coming into force, it emerged that Frontex, the EU border agency, had not dispatched the appropriate personnel to oversee the operation. Eight Frontex boats will transport men, women and children, who are detained on Greek islands and have been selected for deportation, back across the Aegean following fast-track asylum hearings. But of the 2,300 officials the EU has promised to send Greece only 200 have so far arrived, Kyritsis admitted. “We are still waiting for the legal experts and translators they said they would send,” he added. “Even Frontex personnel haven’t got here yet.” Humanitarian aid also earmarked for Greece had similarly been held up, with the result that the bankrupt country was managing the crisis – and continued refugee flows – on very limited funds from the state budget.

On Saturday overstretched resources were evident in the chaos on Chios where detainees, fearing imminent deportation, had not only run amok, breaking through razorwire enclosing a holding centre on the island, but in despair had marched on the town’s port. In the stampede three refugees were stabbed as riot police tried to control the crowds with stun guns and teargas. The camp, a former recycling factory, had been ransacked, with cabins and even fingerprint equipment smashed. “This is what happens when you have 30 policemen guarding 1,600 refugees determined to get out,” said Benjamin Julian, an Icelandic volunteer speaking from the island. “I witnessed it all and I know that all the time they were chanting ‘freedom, freedom, freedom’ and ‘no Torkia, no Torkia’. That is what they want and are determined to get.”

In the mayhem that had ensued, panic-stricken local authorities had been forced to divert the daily ferry connecting the island with the mainland for fear it would be stormed. Similar outbreaks of violence had also occurred in Piraeus, Athens’ port city, where eight young men had been taken to hospital after riots erupted between rival ethnic groups on Wednesday. With tensions on the rise in Lesbos, the Aegean island that has borne the brunt of the flows, and in Idomeni on the Greek-Macedonia frontier where around 11,000 have massed since the border’s closure, NGOs warned of a timebomb in the making. Hopes of numbers decreasing following the announcement of the EU-Turkey deal have been dispelled by a renewed surge in arrivals with the onset of spring.

But who cares?

• 129 Unaccompanied Children Missing Since Calais Camp Demolition (Ind.)

More than a hundred unaccompanied children have gone missing since the southern section of the Calais “Jungle” was demolished last month. According to a census by Help Refugees UK, 129 unaccompanied minors from the camp have gone unaccounted for. The census found that since the demolition took place in March, 4,946 refugees are still living there, including 1,400 in the shipping containers set up by the French government. The refugee charity said it was “very concerned” at the findings. It wrote in a Facebook post: “This is simply not acceptable. We call on the French authorities to put systems in place immediately to register and safeguard the remaining 294 lone children in the camp.”

“No alternative accommodation was provided for unaccompanied minors during the evictions, no assessment was made by the French authorities of their needs and no systems put in place to monitor them or provide safeguarding. There is no official registration system for children in place In Calais or Dunkirk.” Help Refugees UK added it had shared this information with the UK children’s commissioner Anne Longfield and her French counterpart Genevieve Avenard. According to the EU police agency Europol, more than 10,000 unaccompanied child refugees have disappeared in Europe in the last two years. Aid workers are concerned at the deteriorating safety conditions and told The Independent teenage boys are being raped in the camp.

Libby Freeman, founder of grassroots campaign Calais Action, told The Independent the findings were “shocking”. Ms Freeman said: “Nobody knows where these vulnerable children have ended up. “Since the closure [and relocation] of the Women’s and Children’s centre, they have been uprooted. With so many children missing, it’s difficult not to think the worst. It’s more than irresponsible. “And many of the minors have a legal right to join their family in the UK. The government should stop [delaying] the law.”

Home › Forums › Debt Rattle April 3 2016