Camp Meade, Maryland 1917

Ambrose strikes. Can’t go wrong with a headline like that. “..the rescue of the euro and the North European banking system in 2010, otherwise known by some cruel twist of language as the Greek bail-out.” And “..take your rotting pile of damp wood elsewhere Madame Lagarde.”

• IMF Meddling On Brexit Is Scandalous Skulduggery (AEP)

If the IMF and its co-conspirators in the Treasury wish to deter undecided voters from flirting with Brexit, they have certainly failed in my case. Having listened to their irritating lectures, I am more inclined to opt for defiance, for their mask of objectivity has fallen. There can no longer be any doubt that they are playing politics with the democratic self-determination of this country. The Fund gives the game away in point 8 of its Article IV conclusion on the UK economy. It states that “the cost of insuring against a UK sovereign default has doubled (albeit from a low level)”. Any normal person who does not follow the derivatives markets would interpret this as a grim warning from global investors. Yes, the price of credit default swaps on 5-year UK debt – the proxy we all use – has jumped from 17 to 37 since late last year.

But the IMF neglected to mention that it has risen from 15 to 33 in Switzerland, from 26 to 43 in France, and from 45 to 65 in Korea. The jump has almost nothing to do with Brexit, and the IMF knows this perfectly well. The French have an expression that will be familiar to the IMF’s Christine Lagarde: ils font feu de tout bois. Her own IMF mentor and long-time chief economist, Olivier Blanchard, told me last month that there was no risk whatsoever of a sovereign bond crisis, or a Gilts strike, or a sudden stop of any kind. “Will financing be more difficult after Brexit? Will investors see the British government as more risky? I don’t think so,” he said. Professor Blanchard, who recently stepped down from the Fund and is free to speak his mind, says there may be a price to pay for Brexit but it is impossible to calculate.

“The cost of exiting will not be seamless, and the uncertainty will last for a very long time afterwards. Firms deciding whether to locate a plant in the UK or in the Continent will wait. Investment will drop,” he said. But he also said weaker pound would cushion the effects of falling investment to some degree. So bare this in mind when you comb through today’s Article IV statement with its delicious mix of precision and selective vagueness on the alleged damage of Brexit. The hit ranges from 1.5pc to 9.5pc of GDP. Note the decimal points. The range depends on whether it is “a la Switzerland, a la Norway, or a la WTO,” said Madame Lagarde. Perhaps it is churlish to point out that the IMF completely missed the onset of the global financial crisis, and was blindsided when the US fell into recession in November 2007. The Fund’s staff were still predicting sunlit uplands as far as the eye could see, even when the blackest of black storms was upon them.

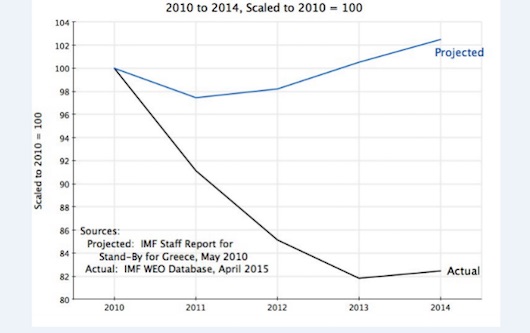

The IMF misjudged the fiscal multiplier horribly in Greece

Its forecasts for Greece were wrong every single year following the rescue of the euro and the North European banking system in 2010, otherwise known by some cruel twist of language as the Greek bail-out. They originally said the Greek economy would contract by 2.6pc in 2010 and then recover briskly. What actually happened – as predicted at the time by the Indian member of the IMF board – was the most spectacular collapse of a developed economy in the post-war era. Output ultimately fell by 26pc from peak to trough. To its credit, the IMF later admitted that it had horribly misjudged the fiscal multiplier. Indeed. I don’t wish the denigrate the Fund. It remains a superb institution. I use its research all the time in my work. But on this occasion it has been misused for political purposes.

Maybe they can pay people to dig a big hole to throw the produced steel in.?!

• The Zombies Return: Steel Firms In China Come Back From The Dead (SCMP)

The grey smoke pouring once again into the sky above a rusty steel plant in a town in northern China is seen as a blessing by people who live nearby. One of the plant’s six blast furnaces was put back into operation earlier this month, breathing new life into Dongzhen in Shanxi province. The plant, formally known as Haixin Iron and Steel, was closed two years ago as demand for the metal plunged in China. Steel companies with little hope of turning a profit are among the enterprises known as “zombie firms” in China, many operating in ailing heavy industries that the central government has pledged to cut back as it attempts to create a modern, high-tech and innovation driven economy. Millions of jobs are due to be axed in the steel and coal sectors in the coming years.

But the plant at Dongzhen has been given a lifeline. It has been renamed and taken over by new owners amid signs of a rise in steel prices, plus massive support from the local government. And there is evidence that increasing numbers of other steel plants are also reopening in China, despite the government’s pledges that the industry must be cut back. Local people in Dongzhen, at least, now dare to believe there may still be hope for their beleaguered industry. Restaurants have reopened, new food stalls set up, and even watermelon vendors are driving their carts and trucks nearby to serve the thousands of workers coming in and out of the compound. Uniformed workers in red and blue helmets flow through the foundry gate, heavy trucks and cars blow their horns and there is a renewed sense of dynamism in this dusty town.

The fate of the Dongzhen steel plant highlights the dilemma facing many local government across the country: the need for massive economic reforms, weighed against the suffering created by massive job losses and the fear of social unrest. President Xi Jinping has said cutting overcapacity in ailing industries such as steel is an essential part of the government’s “supply-side” economic reforms. An unidentified “authoritative figure” was also quoted in a prominent article in the Communist Party mouthpiece the People’s Daily on Monday renewing calls to terminate “zombie companies”. Haixin, however, is not the only “zombie” steel firming coming back from the dead. As China pumped unprecedented amounts of credit to boost growth in the first quarter, many steel plants are back on stream to take advantage of a rise in steel prices.

Daily steel output on the mainland in March rebounded to a nine-month high and output in April could be even higher, according to analysts, although the steel price rally has started to fizzle away this month. “It’s difficult to take Chinese pledges to address surplus capacity seriously,” said Christopher Balding, an associate professor of economics at Peking University HSBC Business School. “There is a recent track record of talking about the problem and not taking the steps required to solve it: like a dieter who wants to lose weight and still eats chocolate chip cookies.”

Fighting for a share of a collapsing market.

• Europe Launches Probe Into Claims China Is Subsidising Steel Producers (Tel.)

A new front has opened up in the “steel war” between China and Europe after Brussels launched an investigation into whether the Beijing government is subsidising its steel producers. The European Commission said it was starting a probe into a complaint that China is subsiding its producers of hot rolled flat steel – one of the most widely used forms of the alloy. The Commission has already imposed tariffs on some forms of steel being exported into Europe after earlier investigations determined they were being “dumped” – sold at below cost – by Chinese plants, as they get rid of excess production in the wake of a drop in domestic demand. However, the new investigation could tackle the problem at source, by looking into claims China is subsidising its largely state-owned steel industry, damaging European rivals.

If it finds subsidisation is taking place, further duties could be imposed on Chinese imports in an attempt to level the playing field. The announcement comes less than 24 hours after the European Parliament voted with an overwhelming majority against China being given the coveted Market Economy Status. The move follows a complaint from Eurofer, the European steel association, and a spokesman said the group “welcomed the move into unfair subsidisation originating in China”. “Hot rolled flat steel is the bread and butter of the industry, going into everything from cans to cars and by far the most commonly used form of steel,” the spokesman added. “The European steel industry suffers damage from unfair trading practices originating in China.”

The European steel industry is in crisis at the moment as it battles the flood of cheap steel from China, and struggles against tougher environmental controls and higher prices, which are particularly punishing in the UK. More than 5,000 jobs have been lost in Britain’s steel industry in the past year as plants have struggled to compete. In April Tata launched the sale of its loss-making British steel operations based around the massive Port Talbot plant. Gareth Stace, director of trade body UK Steel, said the widening of investigations from dumping into subsidies was a progression of the campaign to fight unfair trade. “This is a welcome and much-needed investigation into Chinese Government subsidies which will run in parallel to its ongoing investigation into dumping of steel into the EU. The significant unfair trading practices carried out by China has been a major cause of the worst steel crisis in over a generation here in the UK.”

“China’s complaint to the WTO was filed just days after Washington lodged a similar complaint against China..”

• China Complains To WTO That US Fails To Implement Tariff Ruling (R.)

In another sign of escalating trade tensions between China and the United States, Beijing told the World Trade Organization on Friday that Washington was failing to implement a WTO ruling against punitive U.S. tariffs on a range of Chinese goods. China’s Ministry of Commerce (MOFCOM) said it had requested consultations with the United States over the issue, and anti-subsidy duties on products including solar panels, wind towers and steel pipe used in the oil industry. China’s complaint to the WTO was filed just days after Washington lodged a similar complaint against China, accusing it of unfairly continuing punitive duties on U.S. exports of broiler chicken products in violation of WTO rules.

“By disregarding the WTO rules and rulings, the United States has severely impaired the integrity of WTO rules and the interests of Chinese industries,” MOFCOM said in a statement distributed by the Chinese embassy in Washington. The case was first brought before the WTO by China in 2012 against U.S. duties on 15 diverse product categories that also include thermal paper, steel sinks and tow-behind lawn grooming equipment. In December 2014, the WTO’s Appellate Body ruled in favor of Chinese claims that the products subject to duties had not benefited from subsidies from “public bodies” favoring particular manufacturers.

The deadline for implementation of the rulings and recommendations of the WTO Dispute Settlement Body, set through binding arbitration, expired on April 1, according to WTO records. A U.S. Trade Representative spokesman said the United States had been “working diligently to comply with the recommendations” and to fully conform with its WTO obligations. He added that the U.S. response to China’s request for consultations would come “in due course.”

Dollar-denominated debt is the sword of Damocles.

• China Inc. Misses Best Shot to Repay $430 Billion as Yuan Drops (BBG)

The best time for China Inc. to repay its dollar debt may be coming to an end. The greenback is rallying after its worst quarter since 2010, threatening to drive up costs for companies seeking to either repay U.S. currency borrowings or hedge exposure. The yuan declined 1% since March 31, following a 2% rally between February and March. Royal Bank of Canada and Credit Suisse see more depreciation. “If corporates haven’t taken advantage of this period of yuan gains, they really only have themselves to blame,” said Sue Trinh, Hong Kong-based head of Asian foreign-exchange strategy at RBC. “The government won’t hold down the exchange rate forever.”

RBC estimates Chinese companies’ outstanding dollar borrowings have now been trimmed to $430 billion, while Daiwa Capital Markets says as much as $3 trillion was borrowed to plow into the higher-yielding yuan, including by individuals and foreign companies. A rush to repay risks accelerating capital outflows and yuan weakness amid China’s slowest economic growth in 25 years. The yuan’s renewed depreciation is a challenge for companies that took advantage of the currency’s gains in the four years through 2013 to borrow dollars offshore, profiting from both an appreciating exchange rate and higher interest rates at home. The one-way bets began to unravel as the currency dropped 2.4% in 2014 and 4.5% last year.

The yuan sank 2.6% in August last year after a shock devaluation, and then rose for the next two months as the People’s Bank of China intervened in the market to support the exchange rate. The authority reiterated in its latest monetary policy implementation report released last week that it wants to keep the currency stable. “The recent yuan stability was artificial and likely helped by consistent verbal intervention from the PBOC that there is no depreciation pressure,” said Koon How Heng at Credit Suisse in Singapore. “However, in the background, there is growing concern of increasing debt issues. We are watching growing incidences of coupon defaults.”

Pretty damning. But it will continue short term. And a few years down the road, infrastructure will start falling apart.

• S&P 500 Companies Plan $600 Billion Buybacks In Losing Strategy (CNBC)

Companies are planning to devote billions to buying back their own stock this year, even though the strategy seems to be losing its bite. Statements accompanying first-quarter earnings indicate corporations are preparing to buy a total of $600 billion in their own shares, according to Goldman Sachs calculations. That comes after a year in which S&P 500 buybacks amounted to $572.2 billion, which itself was a 3,3% increase from 2014 and part of a trend that has seen repurchases amount to more than $2.7 trillion since 2010, data from S&P Dow Jones Indices show. Buybacks slowed in the first part of the year, with TrimTabs reporting a 35% decline over 2015. However, that’s not likely to last as companies struggle to find the best way to spend cash. S&P 500 companies have nearly $1.5 trillion in cash on their balance sheets.

“The main thing that determines that is whether they see their markets pop or not,” said Jim Paulsen, chief market strategist at Wells Capital Management. “One of the things we really haven’t had in this recovery is getting all the economic boats moving north at the same time.” With the lack of sustained economic growth, companies have turned to buybacks and dividends to pick up the slack. However, the effectiveness of returning cash directly to shareholders doesn’t have the same pop it once had. Where buybacks had helped fuel the S&P 500’s meteoric rise and the second longest bull market in history, the market has been volatile but flat over the past year or so. Moreover, companies that have been the biggest movers in buybacks have underperformed significantly.

The PowerShares BuyBack Achievers Portfolio exchange-traded fund tracks companies that have bought back at least 5% of their shares over the past 12 months. The ETF is down about 0.7% in 2016 and off 8.4% over the past year. The fund’s biggest holdings include McDonald’s, Boeing, Qualcomm, Lowes and Mondelez. A big name missing from the top holdings is Apple, which has buyback plans totaling $175 billion for a stock that is down 13.2% year to date and 27.5% over the past year. Yet the buyback and dividend trend continues as companies remain reluctant to hire and invest in equipment and as the deal climate cools after a blistering 2015. Mergers and acquisitions activity plunged 25% in the first quarter, with much of the steam taken out by the collapse of multiple big-ticket deals, the most recent being the $6 billion Staples-Office Depot marriage.

“..once the hedges roll off you can’t support that debt.”

• US Energy Bankruptcy Wave Surges Despite Recovering Oil Prices (R.)

The wave of U.S. oil and gas bankruptcies surged past 60 this week, an ominous sign that the recovery of crude prices to near $50 a barrel is too little, too late for small companies that are running out of money. On Friday, Exco Resources, a Dallas-based company with a star-studded board, said it will evaluate alternatives, including a restructuring in or out of court. Its shares fell 35% to 62 cents each. Exco’s notice capped off one of the heaviest weeks of bankruptcy filings since crude prices nosedived from more than $100 a barrel in mid-2014. Prices have bounced back to $46 a barrel from February lows in the mid-$20s, but the futures market shows investors do not expect U.S. benchmark crude to rise above $50 for more than a year.

That will not help smaller producers built for far higher prices. These companies have largely exhausted funding alternatives after issuing more equity and debt, tapping second-lien loans and shedding assets over the last two years to stay afloat as banks trimmed credit lines. Some companies are in more acute distress, faced with the expiration of derivative contracts that had allowed them to sell oil above market prices. “Everybody was able to hold on for a while,” said Gary Evans, former CEO of Magnum Hunter Resources, which emerged from bankruptcy protection this week. “But once the hedges roll off you can’t support that debt.”

Bankruptcy filers this week included Linn Energy and Penn Virginia. Struggling SandRidge, a former high flyer once led by legendary wildcatter Tom Ward, said it would not be able to file quarterly results on time. The number of U.S. energy bankruptcies is closing in on the staggering 68 filings seen during the depths of the telecommunications sector bust of 2002 and 2003, according to Reuters data, the law firm Haynes & Boone and bankruptcydata.com.

I would normally shudder at the very thought of anyone quoting Larry Summers or god forbid Jeff Rubin, but this is a topic that warrants attention.

• The Other Fire: Fort McMurray’s Slow Burn (Tyee)

At the end of the day the $10-billion wildfire that consumed 2400 homes and buildings in Fort McMurray may be the least of the region’s problems. Although the chaotic evacuation of 80,000 people through walls of flame will likely haunt its brave participants for years, a slow global economic burn has already taken a nasty toll on the region’s workers. That fire began last year when global oil prices crashed by 40% and evaporated billions of investment capital in the tarsands. As the project’s most hight cost producers started to bleed cash, corporations laid off 40,000 engineers, labourers, cleaners, welders, mechanics and trades people with little fanfare and even less thanks. Many of these human “stranded assets” endured home foreclosures and lineups at the food bank.

Worker flights to Red Deer and Kelowna got cancelled and traffic at the city’s new airport declined by 16%. Unemployment in Canada’s so-called economic engine soared to nearly nine%. Despite the high cost of the oil price crash, most residents of Fort McMurray, along with Canada’s politicians, think that oil prices will rebound and things will turn around sooner or later. They’ve seen it all before, they say. But a number of economic trends and analyses suggest that bitumen’s glory days may be over. What resembles a string of bad luck may actually be the unfortunate consequence of rapidly developing a high risk and volatile resource with no real safety net. The first undeniable factor is weakening demand for oil, the engine of global economic growth. China’s economy, the world’s largest oil importer, is faltering as its industrial revolution peaks and fades.

Europe, Japan and the United States are also using less oil, and their economies are stagnating too. The global economy has become so stuck in neutral that famous financial power brokers such as Larry Summers now write depressing articles entitled “The Age of Secular Stagnation,” in Foreign Affairs no less. In such a world, little if any bitumen will be needed in the international market place. In fact economists now trace about 50% of the oil price collapse to evaporating demand. But there are many other potent signs and they have already covered the economic landscape with smoke. Murray Edwards, the billionaire tycoon behind Canadian Natural Resources, one of the largest bitumen extractors, has decamped from Alberta to London, England. Edwards and company slashed $2.4-billion from CNRL’s budget in 2015. Since the oil price crash, by some accounts, Murray’s company has lost 50% of its market value.

“..the large bonuses paid to banks’ CEOs as they led their firms to ruin and the economy to the brink of collapse are hard to reconcile with the belief that individuals’ pay has anything to do with their social contributions.”

• The New Era Of Monopoly Is Here (Stiglitz)

For 200 years, there have been two schools of thought about what determines the distribution of income – and how the economy functions. One, emanating from Adam Smith and 19th-century liberal economists, focuses on competitive markets. The other, cognisant of how Smith’s brand of liberalism leads to rapid concentration of wealth and income, takes as its starting point unfettered markets’ tendency toward monopoly. It is important to understand both, because our views about government policies and existing inequalities are shaped by which of the two schools of thought one believes provides a better description of reality. For the 19th-century liberals and their latter-day acolytes, because markets are competitive, individuals’ returns are related to their social contributions – their “marginal product”, in the language of economists.

Capitalists are rewarded for saving rather than consuming – for their abstinence, in the words of Nassau Senior, one of my predecessors in the Drummond Professorship of Political Economy at Oxford. Differences in income were then related to their ownership of “assets” – human and financial capital. Scholars of inequality thus focused on the determinants of the distribution of assets, including how they are passed on across generations. The second school of thought takes as its starting point “power”, including the ability to exercise monopoly control or, in labour markets, to assert authority over workers. Scholars in this area have focused on what gives rise to power, how it is maintained and strengthened, and other features that may prevent markets from being competitive. Work on exploitation arising from asymmetries of information is an important example.

In the west in the post-second world war era, the liberal school of thought has dominated. Yet, as inequality has widened and concerns about it have grown, the competitive school, viewing individual returns in terms of marginal product, has become increasingly unable to explain how the economy works. So, today, the second school of thought is ascendant. After all, the large bonuses paid to banks’ CEOs as they led their firms to ruin and the economy to the brink of collapse are hard to reconcile with the belief that individuals’ pay has anything to do with their social contributions. Of course, historically, the oppression of large groups – slaves, women, and minorities of various types – are obvious instances where inequalities are the result of power relationships, not marginal returns.

“The ECB’s requirement for an “investment-grade” rating turns out to be an elastic condition; something you tell the Germans to put them off until the next meeting.”

• Vicious Feedback Loops in New York Art and European Equities (Dizard)

The remarkable swing in sentiment, from depression to relief, and, in some cases, euphoria, around the New York art auctions this past week was one of the most astonishing examples of herd mentality I have seen. Back in 1990, we would buy a paper from the newsboy that would describe a decline in the Japanese stock market that had taken place the previous year. Weeks later, bids for Renoirs would dry up, and there would be talk about a correction in the art market. These days, we are all in short-cycle businesses. But I am trying to take the long-term view here, one that might hold up until the US elections in November. So in that spirit of philosophical detachment, I would say it is time to buy euro-denominated high-yield bonds before the other bidders come in next month in response to the ECB’s corporate bond-buying programme.

I understand that most of the quantitative analysis done on art and securities markets tells us that equity prices “cause” art prices to rise or fall, but it seems to me that the present volatility and vicious feedback loops in both markets are being caused by a more general instability. The weak equity markets at the beginning of this year, and the decline in art prices that had set in by early 2015, apparently led collectors to hold off on consigning contemporary works of art to the spring auctions in New York. Then when the Christie’s evening contemporary sale on Tuesday night worked out better than many expected, with 87% of the lots sold, there was suddenly a shortage of works on public offer. This led to more frantic bidding for contemporary art in that market’s equivalent of junk or high yield, the day sales. All within a couple of days.

The same risk-averse sentiment earlier this year led euro-area junk-rated companies to hold off on selling new bond issues. According to Richard Briggs, credit strategist at CreditSights, a fixed income research provider, euro high-yield debt issuance declined to just €12.7bn in the year to date up to May 9, compared with €47.9bn in the same period in 2015. So euro-based investors are even more starved for yield than New York collectors were for contemporary art. Not everyone agrees with me about the relative value of European junk bonds. As Matt King at Citi Research says: “A lot of investors prefer, or have preferred, US high yield. Optically, the yields are higher. Most of that, though, is about duration and credit quality, and you should adjust for those. The US has more CCC credits [the bottom of the non-defaulting junk pile], and when you take that into account, all the US HY advantage disappears.”

[..] The ECB’s bond-buying programme could have an outsized effect. It is targeted specifically at non-financial corporate bonds. The ECB has indicated it will buy €3bn-€5bn of corporate bonds each month, which is about the same rate of non-financial bond purchases as euro-area financial institutions have maintained since 2012. The ECB’s requirement for an “investment-grade” rating turns out to be an elastic condition; something you tell the Germans to put them off until the next meeting. If just one rating agency, including the Canadian DBRS, will give a corporate bond an investment-grade stamp, the ECB will be open to buying it. Mr King calculates that one little tweak will make about 4% of the European junk-bond market eligible for purchase. In a relatively illiquid €310bn market, every little bit helps.

Intriguing by Matthew Klein. To be continued.

• What If Greece Got Massive Debt Relief But No One Admitted It? – Part 1 (FT)

In 2012, the “official sector” lenders realised they needed to do something different. Over the course of the year they made new loans at low interest rates, lowered interest rates on existing loans, gave the Greek government much more time to repay existing loans, remitted profits from the ECB’s holdings of Greek government bonds back to the Greek government, and forced private lenders to accept getting repaid less than originally owed, among other things. The net effect was to sharply reduce the present value of the Greek government’s debt burden. According IMF data, the Greek government spent about €15 billion, or 7.3% of GDP, on debt interest payments in 2011. For perspective, the Italian government was spending 4.4% and the Portuguese government was spending 3.8%.

By 2013, the Greek economy had shrunk by 13%, in nominal euro terms, yet the sovereign debt interest burden was now 4.0% of GDP, against 4.5% for Italy and 4.2% for Portugal. Put another way, the debt modifications in 2012 cut the amount spent by the Greek government on interest payments by more than half. Subsequent debt modifications and the general decline in euro area interest rates have cut the amount the Greek government spends on interest payments by another 12.6%. Interest expense was 3.6% of Greek GDP in 2015, compared to 4.0% in Italy and 4.1% in Portugal. So why didn’t the 2012 modifications end the crisis? My colleague Martin Sandbu puts it well:

“The problem is the chill caused by the uncertainty the debt overhang causes: will the debt service cost at some point increase (perhaps to crippling levels), and will there be another refinancing crisis whenever a large portion of debt is set to mature? It is this uncertainty that must be erased for investment to pick up.”

In other words, investors don’t care about the decline in the interest burden nearly as much as they worry, reasonably, about the headline debt figures. This makes it impossible for the Greek government to fund itself in the markets at reasonable rates, leaving it dependent on the whims of “official sector” creditors to make its small interest payments and roll over its large debts. This is why it matters whether Kazarian is right about the accounting treatment of Greek sovereign obligations. There are plenty of weak economies in the euro area with miserable productivity growth, terrible demographics, and lots of debt. Greece isn’t that different except insofar as it’s excluded from ECB bond-buying and insofar as the markets and ratings companies treat it as a pariah.

So if the Greek government’s actual debt number were far lower than what’s commonly reported, investors would have little reason to charge it more than they demand from Portugal. And that would have big implications for an economy wracked for years by uncertainty about debt default, sky-high capital costs, and outside demands for “structural reform” and budget surpluses. In part 2, we’ll look at why exactly Kazarian thinks the Greek government’s net debt is only 39% of GDP, rather than 177%, as well as some potential objections. In part 3, we’ll imagine what sorts of budget surpluses would have been required to make the Greek government compliant with Maastricht criteria for debt levels by 2020 under different assumptions of the impact of the 2012 modifications, in comparison to what “official sector” creditors actually demanded.

The US is falling apart in many places.

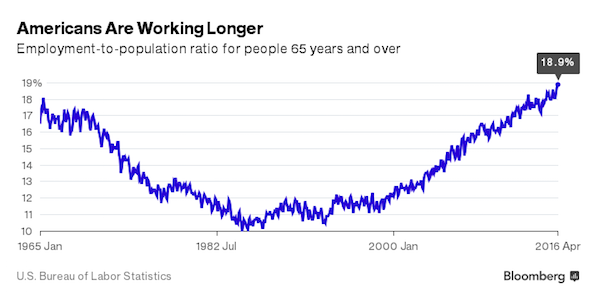

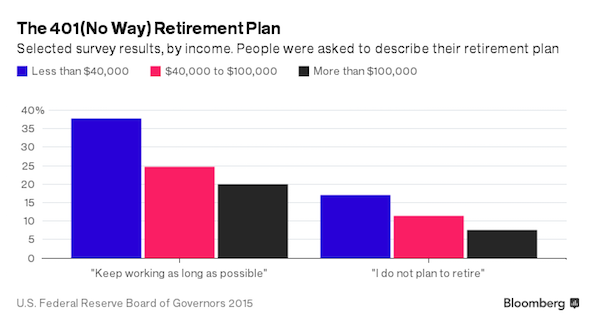

• “I’ll Never Retire”: Americans Break Record for Working Past 65 (BBG)

Almost 20% of Americans 65 and older are now working, according to the latest data from the U.S. Bureau of Labor Statistics. That’s the most older people with a job since the early 1960s, before the U.S. enacted Medicare. Because of the huge baby boom generation that is just now hitting retirement age, the U.S. has the largest number of older workers ever. When asked to describe their plans for retirement, 27% of Americans said they will “keep working as long as possible,” a 2015 Federal Reserve study found. Another 12% said they don’t plan to retire at all. Why are more people putting off retirement? Three in five retirees surveyed by the Transamerica Center for Retirement Studies said making money or earning benefits was at least one reason they had retired later than they planned to.

Almost half said financial problems were their main reason for working past 65. The financial crisis, and the tech bust before it, devastated many baby boomers’ retirement savings. That’s if they had any to begin with. Today, 60% of U.S. households have no money in a 401(k) or similar retirement account, and the benefits of 401(k)s are skewed toward the wealthiest Americans, a recent report by the Government Accountability Office found. The waning of traditional, defined-benefit pensions could also be delaying retirement, even for wealthier Americans. Instead of getting a monthly check, many retirees end up with a pot of 401(k) assets they’re not sure how they should be spending. The ups and downs of the market can heighten their anxiety and keep them going into the office.

The sadness is hard to describe.

• Retiree To Fly 80 South African Rhinos To Australia (G.)

A retired South African sales executive who emigrated to Australia 30 years ago is hatching a daring plan to airlift 80 rhinos to his adopted country in an attempt to save the species from poachers. Flying each animal on the 11,000-kilometre journey will cost about $A60,500, but Ray Dearlove believes the expense and risk is essential as poaching deaths have soared in recent years. The rhinos will be relocated to a safari park in Australia, which is being kept secret for security reasons, where they will become a “seed bank” to breed future generations. “Our grand plan is to move 80 over a four-year period. We think that will provide the nucleus of a good breeding herd,” Dearlove said while visiting South Africa to organise for the first batch to be flown out.

The Australian Rhino Project, which the 68-year-old founded in 2013, hopes to take six rhinos to their new home before the end of the year. Funding – from private and corporate sources – is nearly in place, and the first rhinos have been selected from animals kept on private reserves in South Africa. “We have got to get this first one right because it’s a big task, it’s expensive, it’s complex,” Dearlove said. When they are settled successfully in Australia, “then we hopefully will go up in gear,” he added. [..] Poachers slaughtered 1,338 rhinos across Africa last year – the highest level since the poaching crisis exploded in 2008, according to the International Union for Conservation of Nature (IUCN). The IUCN, which rates white rhinos as “near threatened” as a species, says that booming demand for horn and the involvement of international criminal syndicates has fuelled the explosion in poaching since 2007.

A German point of view.

• Merkel’s Deal with Turkey in Danger of Collapse (Spiegel)

On Thursday, Turkish President Recep Tayyip Erdogan was standing on a stage in Ankara raging against the European Union. “Since when are you controlling Turkey?” he demanded. “Who gave you the order?” He then accused Brussels of dividing his country. “Do you think we don’t know that?” It sounded as though he was laying the groundwork for a break with Europe. Erdogan’s fit of rage is only the most recent escalation in the conflict over German Chancellor Angela Merkel’s refugee deal with Turkey. Thus far, officials in Berlin have been dismissing the Turkish president’s tirades as mere theater. “Erdogan is following the Seehofer playbook,” says one Chancellery official, a reference to the outspoken governor of Bavaria who has been extremely critical of Merkel’s refugee policies.

But things aren’t looking good for the deal, which the chancellor has declared as the only proper way to solve the refugee crisis. Indeed, Merkel’s greatest foreign policy project is on the verge of collapsing. The chancellor still hopes that Erdogan will stick to the refugee deal. A key element of that deal is visa-free travel to the EU for Turkish citizens, and Merkel believes that Erdogan’s popularity would take a hit if that didn’t come to pass. That’s why she believes that Erdogan will come around in the end. But she could be mistaken. After all, no one aside from the German chancellor appears to have much interest in the agreement anymore. Erdogan certainly doesn’t: He does not want to make any concessions on his country’s expansive anti-terror laws, the reform of which is one of a long list of conditions Turkey must meet before the EU will grant visa freedoms.

The Europeans at large, wary of selling out their values to the autocrat in Ankara, are also deeply skeptical. And in Germany, Merkel’s junior coalition partners, the center-left Social Democrats (SPD), have seized on the deal as a way to finally score some much needed political points against the powerful chancellor. Even within Merkel’s own conservatives, many are seeing the troubles the deal is facing as an opportunity to break with the chancellor’s disliked refugee policies.

Brussels and Berlin would make a deal with Hitler if it suited them.

• EU to Work with African Despot to Keep Refugees Out (Spiegel)

The ambassadors of the 28 European Union member states had agreed to secrecy. “Under no circumstances” should the public learn what was said at the talks that took place on March 23rd, the European Commission warned during the meeting of the Permanent Representatives Committee. A staff member of EU High Representative for Foreign Affairs Federica Mogherini even warned that Europe’s reputation could be at stake. Under the heading “TOP 37: Country fiches,” the leading diplomats that day discussed a plan that the EU member states had agreed to: They would work together with dictatorships around the Horn of Africa in order to stop the refugee flows to Europe – under Germany’s leadership.

When it comes to taking action to counter the root causes of flight in the region, Angela Merkel has said, “I strongly believe that we must improve peoples’ living conditions.” The EU’s new action plan for the Horn of Africa provides the first concrete outlines: For three years, €40 million is to be paid out to eight African countries from the Emergency Trust Fund, including Sudan. Minutes from the March 23 meetings and additional classified documents obtained by SPIEGEL and German public TV station ARD show that the focus of the project is border protection. To that end, equipment is to be provided to the countries in question. The International Criminal Court in The Hague has issued an arrest warrant against Sudanese President Omar al-Bashir on charges relating to his alleged role in genocide and crimes against humanity in the Darfur conflict.

Amnesty International also claims that the Sudanese secret service has tortured members of the opposition. And the United States accuses the country of providing financial support to terrorists. Nevertheless, documents relating to the project indicate that Europe want to send cameras, scanners and servers for registering refugees to the Sudanese regime in addition to training their border police and assisting with the construction of two camps with detention rooms for migrants. The German Ministry for Economic Cooperation and Development has confirmed that action plan is binding, although no concrete decisions have yet been made regarding its implementation. The German development agency GIZ is expected to coordinate the project.

The organization, which is a government enterprise, has experience working with authoritarian countries. In Saudi Arabia, for example, German federal police are providing their Saudi colleagues with training in German high-tech border installations. The money for the training comes not directly from the federal budget but rather from GIZ. When it comes to questions of finance, the organization has become a vehicle the government can use to be less transparent, a government official confirms.

Home › Forums › Debt Rattle May 14 2016