Jack Delano Brakeman H.B. Van Santford on the AT&SF line from Summit to San Bernardino 1943

Very interesting. I’ve said it a thousand times: everyone should let sink in what Steve has to say. It’s curious to see that people like Max agree with everything Steve says -as far as they can understand him-, but disagree with him on gold.

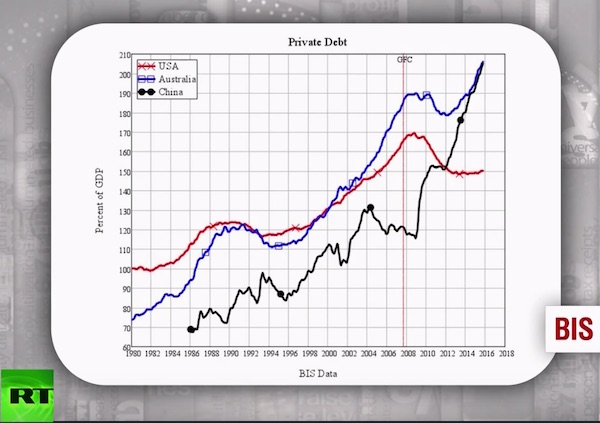

• Steve Keen on Debt, Trump and Gold (RT)

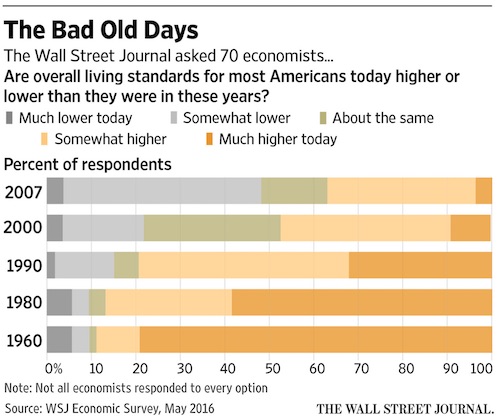

No, really, this is a serious WSJ article. Economists claim they know better then you about your own situation, and the paper gives them the space to utter their blubber. “You’re not really hungry, you’re just imagining that, and your hospital bill is not REALLY higher than it was 40 years ago, and in student debt was this high in 1970 too, don’t you remember?!”

• Economists Disagree With Voters Who See US Worse Off Today Than in 1960s (WSJ)

When was America at its best? Put the question to voters and many will point as far back as the 1960s. Put the question to economists and they identify a much more recent peak in U.S. living standards. Forecasters in The Wall Street Journal’s monthly survey of business, academic and financial economists were asked to rate whether U.S. living standards were higher today or at various points in the past. Around 80% say those standards are higher today than during the 1990s or earlier. The 2016 presidential campaign has exposed worries among many voters about a U.S. in decline. The sentiment played a particular role in boosting the candidacy of businessman Donald Trump, with a campaign slogan pledging to “Make America Great Again.”

While many economists view the U.S. as not fully recovered from the recession that began in 2007 or the previous recession in 2001, that still leaves a 40-year disconnect compared to voters who see the U.S. in a half-century of decline. The Pew Research Center recently polled voters on the question “Compared with 50 years ago, life for people like you in America is better or worse?” A plurality of 46% said things were worse now. Only 34% said life today is better than in the 1960s. A Morning Consult poll asked voters whether the 1960s or 1980s were better than today. In that survey, 31% said the ‘60s were better and 37% said the 1980s were better. By contrast, 88% of economists said the U.S. is better today than in 1960 and 87% see today as better than 1980.

“Between technology and health advances, today is much better than in 1960,” said Amy Crews Cutts, chief economist at Equifax. By many of the measures economists are inclined to look at, it is not a close call. In 1960, the life expectancy of the average American was a full decade shorter than it is today, according to the Centers for Disease Control and Prevention. The median personal income, after adjusting for inflation, is 55% higher today than in 1960, according to the Census Bureau. These measures of overall well-being continued to rise throughout the 1980s and 1990s. Why do so many voters put such little stock in the past 50 years? Economists point to a few culprits.

First, wages or available jobs have deteriorated for some demographic groups, particularly men without a high-school diploma and men who worked in manufacturing (two groups with some overlap). Second, we have just lived through the “first decade where the average worker lost ground,” said Joel Naroff, chief economist of Naroff Economic Advisers. Overall incomes declined during the two most recent recessions, but not enough to set people back to a 1960s standard of living. About 53% of respondents in the Journal’s survey said the U.S. today is “about the same” or “worse” than it was in 2000. About 63% said the same about 2007. The survey of 70 economists was conducted from May 6 to May 10, though not every economist answered every question.

And these are ‘official’ numbers, which for a reason that escapes me we‘re still clinging on to. So I ‘adapted’ the title.

• China: “It Appears That All The Engines Suddenly Lost Momentum” (R.)

China’s investment, factory output and retail sales all grew more slowly than expected in April, adding to doubts about whether the world’s second-largest economy is stabilizing. Growth in factory output cooled to 6% in April, the National Bureau of Statistics (NBS) said on Saturday, disappointing analysts who expected it to rise 6.5% on an annual basis after an increase of 6.8% the prior month. China’s fixed-asset investment growth eased to 10.5% year-on-year in the January-April period, missing market expectations of 10.9%, and down from the first quarter’s 10.7%.

Fixed investment by private firms continued to slow, indicating private businesses remain skeptical of economic prospects. Investment by private firms rose 5.2% year-on-year in January-April, down from 5.7% growth in the first quarter. “It appears that all the engines suddenly lost momentum, and growth outlook has turned soft as well,” Zhou Hao, economist at Commerzbank in Singapore, said in a research note. “At the end of the day, we have acknowledge that China is still struggling.”

The PBoC’s bizarro explanation:“..the figures don’t include new local government bond issuance to refinance debt previously issued by local government financing vehicles.” As if to say: don’t worry, we’re still borrowing like crazy, only now half of it is to refi what we couldn’t pay back.

• Chinese Banks’ New Loans Plunge By More Than Half In April (R.)

China’s central bank said it has not changed its “prudent” monetary policy stance despite a disappointing release of April data showing banks had cut back sharply on new loans. Banks made 555.6 billion yuan ($85.21 billion) in net new yuan loans in April, much lower than expected and less than half the 1.37 trillion yuan seen in March, data showed on Friday. The People’s Bank of China (PBOC), in a question and answer posted on its website on Saturday, attributed the slide to seasonal and technical factors, including the fact that the figures don’t include new local government bond issuance to refinance debt previously issued by local government financing vehicles.

“If this is factored in, new loans in April were more than 900 billion yuan,” the PBOC said, in answer to a question as to whether the figures indicated a decline in the real economy. That number would match analysts previous forecasts for April. However, the bank also pointed to a decline in corporate bond financing, which came in over 500 billion less than March – while still up slightly from the same period last year, and noted that banks remain cautious given increased focus on asset quality control. “On the whole, current financial support to the real economy is still strong,” it said. “Prudent monetary policy has not changed.”

Curious attempt to make deeply troubling problems look like great opportunities instead. Nobody wants to buy these assets and everyone knows they MUST sell, which is why Shell try to sell as much as $40 billion of it now, and in the way they do (IPO?!). And that would “..let Shell benefit from a sustained oil price recovery?!”

• Shell Eyes $40 Billion Non-Core Asset Spin-Off To Cut Its Huge Debt Pile (Tel.)

Oil giant Royal Dutch Shell is eyeing a possible $40bn spin-off of non-core assets around the globe as it grapples with a $70bn debt pile following a takeover of BG Group earlier this year. Chief financial officer Simon Henry told analysts last week that a float of Shell’s non-core assets is “very much on the agenda”. The comments were made after the Anglo-Dutch multinational announced its intention to sell off assets totalling $30bn over the next three years in an attempt to protect its dividend, after the merger with BG left it with a stretched balance sheet. Analysts at Exane BNP Paribas are now concerned that despite its attempts to offload assets, “a dry market for asset sales leaves Shell exposed”.

Reducing Shell’s debt burden is “critical for shares to perform”, said Aneek Haq, of Exane BNP Paribas, but failure to do so may force management to “bite the bullet” and make a radical move, such as an initial public offering of the parts of Shell’s empire it wants to offload. Henry said: “There are no prima facie reasons why we would not look at such a monetisation route, if that was the best way to create value.” However, given the foundering oil price, he said it was “not obvious in today’s market” where such value would be. Unlike a divestment, an IPO of the company’s mature assets, which has been dubbed “Baby Shell” would let Shell benefit from a sustained oil price recovery. Mr Haq also believes such a move would refocus management on core assets and reduce net debt by more than $50bn over four years.

The non-core upstream assets, from markets such as the UK, Norway, New Zealand, Italy and Nigeria, are cash-generative, averaging at $4bn a year free cash flow, and adding additional assets from Kazakstan could “prove attractive for shareholders”, said Haq. Although a $40bn listing would be cumbersome, it is not unfamiliar territory. In 2014, Shell raised $920m by spinning off a pipeline of US assets, Shell Midstream Partners. Given its previous form, Henry said: “It should be clear that not only are we open to innovation, [but also] we are able to deliver such complicated deals and execute over a period of time.”

These downgrades are expensive.

• Moody’s Downgrades Saudi Arabia, Bahrain, Oman (AP)

Saudi Arabia’s credit rating has been downgraded by Moody’s because of the long and deep slump in oil prices. Moody’s Investors Service said it also downgraded Gulf oil producers Bahrain and Oman. It left ratings unchanged for other Gulf states including Kuwait and Qatar. Saudi Arabia is the world’s largest oil exporter. Moody’s cut the country’s long-term issuer rating one notch to A1 from Aa3 after a review that began in March. Crude prices fell from more than $100 in mid-2014 to under $30 a barrel in February, although they have recovered into the mid-$40s. Benchmark international crude settled on Friday at $47.83 a barrel.

“A combination of lower growth, higher debt levels and smaller domestic and external buffers leave the Kingdom less well positioned to weather future shocks,” Moody’s said in a note. Moody’s lowered Oman to Baa1 from A3 and Bahrain to Ba2 from Ba1. The ratings agency did not downgrade Kuwait, Qatar, the United Arab Emirates or Abu Dhabi, but it assigned a negative outlook to each. Oil prices slumped because of production that grew faster than demand. Surging production from shale operators in the US contributed to the glut. So did OPEC, which decided in November 2014, several months after prices began falling, to continue pumping rather than give up market share.

Germany’s Constitutional Court has been asked for opinions on the ECB a dozen times now, but not much has come of it.

• German Professors And Entrepreneurs File Complaint Against ECB Policy (R.)

A group of professors and entrepreneurs in Germany filed a complaint against the ECB’s monetary policy this week at the country’s top court, the Welt am Sonntag newspaper said. A complaint would open a new chapter in a long-running legal battle between the ECB and groups within the euro zone’s biggest economy who want to curb the bank’s power. A challenge to an emergency plan the ECB made at the height of the euro zone crisis is also back at Germany’s Constitutional Court after being rejected by Europe’s top court in June. The German court will make a final ruling this year. There has been widespread criticism in Germany of the ECB’s monetary policy in recent weeks, with politicians complaining that low interest rates are hitting the retirement provisions of ordinary Germans and could boost the right wing.

Welt am Sonntag said the issue in the latest complaint filed at the Constitutional Court was whether the ECB had overstepped its mandate by extensively buying government bonds and with its plan to start buying corporate bonds. The newspaper said the professors and entrepreneurs thought the ECB was starting programs that contained incalculable risks for the German central bank’s balance sheet, and hence for German taxpayers – under the pretence of reaching its inflation target of just under 2% in the medium term. “The ECB’s current policy is neither necessary nor appropriate to directly revive the economy in the euro zone by increasing the inflation rate to around 2% in terms of consumer prices,” Markus Kerber, a lawyer and professor of public finance who initiated the complaint, was quoted as saying.

Kerber said the ECB was losing sight of the principle of the “proportionality” of its measures, according to Welt am Sonntag. In March, the ECB unveiled a large stimulus package that included cutting its deposit rate deeper into negative territory, expanding it asset buying program and offering free loans to the corporate sector to stimulate growth. German central bank governor Jens Weidmann, who sits on the ECB’s Governing Council, said on Wednesday the ECB’s expansionary monetary policy stance was “justified for now” while Bundesbank board member Andreas Dombret also said the ECB’s policy was justified by a subdued growth outlook in the euro zone.

“They may have finally gone too far. A backlash is brewing, threatening not just their current bets, but their various tax benefits too. One senior House Republican aide who’s worked closely with the hedge funds says that members of Congress have seen enough. “I think on the Fannie stuff, they’ve hurt themselves,” he said. “We’re like, fuck em. If they’re not your friends, they’re your enemies.”

• The Vultures’ Vultures: New Hedge-Fund Strategy Corrupts Washington (HuffPo)

Take Robert Shapiro. A Harvard-trained political economist, Shapiro is the head of a consulting firm called Sonecon. That business card doesn’t do it for you? He’s got a few more in his wallet: Senior fellow at the Georgetown University School of Business. Adviser to the International Monetary Fund. Director of the Globalization Initiative at NDN, a progressive think tank. Shapiro, a Democrat, has advised presidents and presidential candidates, and has held powerful government posts. It stands to reason, then, that when he has thoughts on public policy, he can find an outlet ready to publish them. Recently, he’s had ideas on how the government can address the debt crisis in Puerto Rico and how it can end the conservatorship of Fannie Mae and Freddie Mac by moving them into the private market.

Before that, he had a take on how to deal with Argentina’s debt crisis. For all three, he produced academic-looking papers, complete with footnotes and charts. All three situations have one thing in common: If they were resolved the way Shapiro suggested, a variety of bets placed by a select group of the most politically powerful hedge funds would pay off in a huge way. In the case of Argentina, they mostly have. Fights over how to resolve the other two issues are still raging in Washington. For this article, we called Shapiro to ask on whose behalf he has been waging these intellectual battles. His answer was surprising in its honesty: He’s working with DCI Group, a political dark arts master known to be advocating on behalf of a group of powerful hedge funds that are changing how Washington works.

Shapiro, it turns out, is but one foot soldier in the hedge fund infantry. A review of public documents, tax filings and interviews with people involved finds that in each of the three campaigns, hedge funds have enlisted the same set of lobbyists, political operatives, dark money groups and think-tank experts spanning the political spectrum. No single document or set of disclosures ties all of these groups together. They don’t put out joint press releases, parade themselves around Washington as part of a coalition, or chat together on conference calls. Finding the players in this game, instead, is more a process of deduction. For a group of firms and experts to be working for vulture funds on the issue of Argentine debt is normal Washington practice. (Vulture’s meaning here isn’t pejorative: it refers to an investment strategy that feeds off of assets the market has left for dead.)

For the exact same people and groups to be working on the next big issue that these funds care about — the Puerto Rican debt crisis — could be a coincidence. But now, the hedge funds are focused on a third issue — government-sponsored enterprise reform, which refers to the effort to establish new housing finance policy in the wake of the federal takeover of lenders Fannie Mae and Freddie Mac. And it’s the same political firms and the same independent experts that are once again weighing in — coincidentally, all on the side of the hedge funds. Maybe it’s all coincidence, but let’s run the traps either way.

Make basic human needs part of speculative financial markets and mayhem is inevitable. Some things do not belong in a casino. When will we learn? When we run out of water and food?

• Farmland Values Fall Sharply in Parts of the Midwest (WSJ)

Real farmland values in parts of the Midwest fell at their fastest clip in almost 30 years during the first quarter, according to a regional Federal Reserve report on Thursday. Falling crop prices have weighed on land values from Kansas to Indiana over the past two years as farm income declined and investors who had piled into the asset at the start of the decade retrenched. Three regional Federal Reserve banks all reported year-over-year declines in farmland values in their districts and said the drops would continue, though their forecasts were based on surveys taken before the recent rally in corn and soybean prices.

The St. Louis Fed region that includes parts of the U.S. agricultural heartland in Illinois, Indiana and Missouri reported the steepest decline, with the average price of “quality” farmland falling 6.4% in the quarter, the biggest decline since its survey began in 2012. The Chicago Fed said prices for similar land in its district fell 4% from a year ago, the seventh successive quarterly decline. Adjusted for inflation, prices in an area that includes parts of Illinois, Indiana, Iowa, Michigan and Wisconsin fell 5%, the biggest quarterly drop since 1987. Declines in the Kansas City Fed’s district, which includes Kansas and Nebraska, were less pronounced, but the bank said prices for nonirrigated cropland fell 4% in the quarter.

Though some agricultural markets have rallied in recent weeks, prices for corn and wheat are still more than 50% lower than their 2012 peak, and the U.S. Department of Agriculture has projected that net U.S. farm income will fall this year to the lowest level in more than a decade. Commodity prices have declined as farmers in the U.S. and elsewhere harvested bumper crops, adding to already generous stockpiles. U.S. farmers have also been hit by the strength of the dollar, which has stymied demand to export their crops. The drop in land values has been accompanied by deteriorating credit conditions, with more loans taken out to cover farm operations even as repayment rates fell on existing debt.

Wow: “Boris Johnson is trusted to tell the truth about Europe by twice as many voters as trust David Cameron..” I can’t imagine anyone trusting Boris, so what does that say about trust in Cameron?

• Cameron’s Anti-Brexit ‘Remain’ Campaign Has A Major Trust Issue (Ind.)

Boris Johnson is trusted to tell the truth about Europe by twice as many voters as trust David Cameron, according to a ComRes poll for The Independent. By a two-to-one margin, 45% to 21%, voters say that Mr Johnson is “more likely to tell the truth about the EU” than Mr Cameron. By a smaller margin, 39% to 24%, campaigners for Leave generally are considered “more likely to tell the truth” than campaigners for Remain.

The Referendum Campaigns

• Following key speeches this week, Britons are more than twice as likely to say Boris Johnson would tell the truth about the EU than David Cameron (45% v 21%).

• Conservative voters also say Boris Johnson is more likely to tell the truth about the EU than the Prime Minister (42% v 27%).

• Similarly, Britons tend to say the campaigners for leaving the EU are more likely to tell the truth than the remain campaigners (39% v 24%), although a significant minority say they don’t know (38%).The EU Referendum

• The British public remain divided over whether they would be personally better off if Britain left the EU or remained part of it (29% v 33%). Around two in five (38%) say they don’t know how the referendum outcome would personally affect them.

• There has been a rise in the proportion of Britons saying national security would be better if Britain left the EU – 42% say it would be stronger if Britain left, compared to 38% who say it would be stronger if Britain remained. This represents an increase of 7 points from March in favour of leaving (35% in March 2016).

• However, attitudes towards immigration are clear; British adults are more than twice as likely to say the government could control Britain’s borders better if it left the EU (57% v 27% if Britain remains).

Presenting it this way makes it look like the money is lost. Presenting it as an investment would be a lot fairer.

• German Government Plans To Spend €93.6 Billion On Refugees By End 2020 (R.)

Germany’s government expects to spend around €93.6 billion by the end of 2020 on costs related to the refugee crisis, a magazine said on Saturday, citing a draft from the federal finance ministry for negotiations with the country’s 16 states. The figure is likely to stoke concerns, particularly among growing anti-immigration movements, on the impact of new arrivals on Europe’s largest economy which took in more than a million people last year, many from Syria and other war zones. The numbers arriving have fallen this year, helped by a deal between the EU and Turkey that was designed to give Turks visa-free travel to Europe in return for stemming the flow of migrants.

German weekly news magazine Der Spiegel said the finance ministry’s calculations included the costs for accommodating and integrating refugees as well as tackling the root causes for people fleeing from crisis-stricken regions. Officials based their estimates on 600,000 migrants arriving this year, 400,000 next year and 300,000 in each of the following years, the report said, adding that they expected 55% of recognized refugees to have a job after five years. A spokesman for the finance ministry declined to comment on the figures but pointed to ongoing talks between the government and states, saying they would meet again on May 31 to discuss how to divide up the costs between them.

The report said that €25.7 billion would be needed for jobless payments, rent subsidies and other benefits for recognized asylum applicants by the end of 2020. Another €5.7 billion would be needed for language courses and €4.6 billion would be required for measures to help migrants get jobs, it added. The annual cost of dealing with the refugee crisis would hit €20.4 billion in 2020, up from around €16.1 billion this year, the report said.

Home › Forums › Debt Rattle May 15 2016