Marc Chagall The Feast of the Tabernacles 1916

“Good people do things for other people. That’s it. The end”

Said it before: Borrell is EU’s No.1 warmonger, he needs to go.

Try this one: Putin has created the opportunity for peace. By making it much harder for Ukraine to shell its -formerly- own Russian speaking population.

• Russia Makes It ‘Impossible For War To End’ – Borrell (RT)

The accession of four former Ukrainian regions into Russia makes the conflict in Ukraine impossible to end, top EU diplomat Josep Borrell said on Saturday. Speaking to the Spanish RTVE channel, the bloc’s high representative for foreign affairs described the impending inclusion of the two Donbass Republics, and Zaporozhye and Kherson Regions, into the Russian Federation as an “annexation” and an act of “completely unjustified aggression.” “Putin makes it more difficult, even impossible, for the war to end,” Borrell said. The EU is committed to continuing its military support for Ukraine, the diplomat stressed. The bloc also intends to go ahead with another package of sanctions against Moscow “so that Russia would be isolated internationally,” he added.

Russia has consistently warned the West against “pumping up” Ukraine with weapons, saying that it would only prolong the conflict. Borrell’s claim that Russia’s “annexation” of new territories will further jeopardize a peaceful solution to the Ukraine crisis echoed earlier remarks by UN Secretary-General Antonio Guterres. Speaking on the eve of the accession ceremony for the former Ukrainian regions, Guterres condemned in very strong terms both their inclusion into Russia and the preceding referendums, and called on Russia “to step back from the brink.” In response, Moscow accused the secretary general of abusing his authority.

Putin, meanwhile, warned the Ukrainian authorities and their Western “handlers” that people living in the Donetsk and Lugansk People’s Republics, as well as in the regions of Kherson and Zaporozhye, have become Russian citizens “forever” because they made a choice “to be with their Motherland.” In his speech at the signing ceremony for the accession treaties, the president also accused the West of dreaming “to weaken and break up Russia,” of being “ready to cross every line to preserve the neo-colonial system,” and of overthrowing traditional values, which, in Putin’s opinion, amounts to “pure Satanism.” The Russian president did call on Kiev to “return to the negotiating table.” His Ukrainian counterpart, Vladimir Zelensky, however, said that his country was ready for dialogue with Russia, but “with another president.”

Read more …

“.. In the 80s they had another crisis they solved by “plundering our country”. Now they want to solve their problems by “breaking Russia”..

• The End of Western Hegemony is INEVITABLE – Putin (Konstantin Kisin)

This is a reproduction of my live Twitter summary/translation of Vladimir Putin’s speech: I wish every single person in the West would listen to Putin’s speech. Obviously, that won’t happen so let me summarise as a professional translator for 10+ years. He states, as he has done from the outset, what his intentions and complaints are in the plainest terms possible. Setting aside his brief comments on the recent “referendums”, he spends most of his speech discussing the West. His primary complaint isn’t NATO expansion, which gets only a cursory mention. The West is greedy and seeks to enslave and colonise other nations, like Russia. The West uses the power of finance and technology to enforce its will on other nations. To collect what he calls the “hegemon’s tax”.

To this end the West destabilises countries, creates terrorist enclaves and most of all seeks to deprive other countries of sovereignty. It is this “avarice” and desire to preserve its power that is the reason for the “hybrid war” the collective West is “waging on Russia”. They want us to be a “colony”. They do not want us to be free, they want Russians to be a mob of soulless slaves – direct quote. The rules-based order the West goes on about is “nonsense”. Who made these rules? Who agreed to them? Russia is an ancient country and civilization and we will not play by these “rigged” rules. The West has no moral authority to challenge the referendums because it has violated the borders of other countries. Western elites are “totalitarian, despotic and apartheidistic” – direct quote.

They are racist against Russia and other countries and nations. “Russophobia is racism”. They discriminate by calling themselves the “civilised world”. They colonised, started the global slave trade, genocided native Americans, pillaged India and Africa, forced China to buy opium through war. We, on the other hand, are proud that we “led” the anti-colonial movement that helped countries develop to reduce poverty and inequality. They are Russophobic (they hate us) because we didn’t allow our country to be pillaged by creating a strong CENTRALISED (emphasis his) state based on Christianity, Islam, Judaism and Buddhism. They have been trying to destabilise our country since the 17th century in the Times of Trouble. Eventually, they managed to “get their hands on our riches” at the end of the 20th century.

They called us friends and partners while pumping out trillions of dollars (his irony game is strong today). We remember this. We didn’t forget. The West claims to bring freedom and democracy to other countries but it’s the exact opposite of the truth. The unipolar world is anti-democratic by its very nature. It is a lie. They used nuclear weapons, creating a precedent. They flattened German cities without “any military need to do so”. There was no need for this except to scare us and the rest of the world. Korea, Vietnam. To this day they “occupy” Japan, South Korea and Germany and other countries while cynically calling them “allies”. The West has surveillance over the leaders of these nations who “swallow these insults like the slaves they are”. He then talks about bioweapon research (haven’t heard about them for a while) and human experiments “including in Ukraine”.

The US rules the world by the power of the fist. Any country which seeks to challenge Western hegemony becomes an enemy. Their neocolonialism is cloaked in lies like “containment” of Russia, China and Iran. The concept of truth has been destroyed with fakes and extreme propaganda (irony game still strong). You cannot feed your people with printed dollars and social media. You need food and energy. But Western elites have no desire to find a solution to the food and energy crises *they* (emphasis his) created. They solved the problems at the start of 20c with WW1 and the US established dominance of the world via the dollar as a result of WW2. In the 80s they had another crisis they solved by “plundering our country”. Now they want to solve their problems by “breaking Russia”.

Read more …

“It’s obvious to everyone who benefits from it,” Putin explained. “Those who benefit are the ones who have done it.”

• Nord Stream Explosions Are A ‘Tremendous Opportunity’ – US (RT)

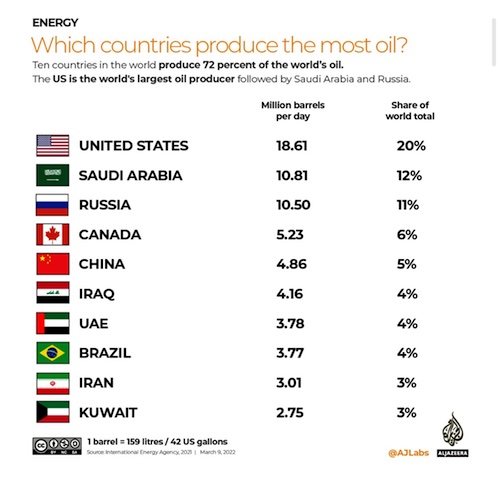

The US views the sabotage of the Nord Stream gas pipelines as a “tremendous opportunity” to wean the continent off of Russian energy, Secretary of State Antony Blinken told reporters on Friday. With winter approaching, Blinken said that the US wants Europe to decrease its fuel use. Speaking to reporters in Washington, Blinken boasted that the US is now “the leading supplier of [liquefied natural gas] to Europe.” In addition to shipping its own fuel to Europe, Blinken said that the US is working with European leaders to find ways to “decrease demand” and “speed up the transition to renewables.” “It’s a tremendous opportunity to once and for all remove the dependence on Russian energy and thus to take away from [Russian President] Vladimir Putin the weaponization of energy as a means of advancing his imperial designs,”Blinken declared.

The US likely stands to gain the most from the destruction of the Nord Stream 1 and Nord Stream 2 gas pipelines, which were damaged by a series of explosions off the Danish island of Bornholm earlier this week. Washington has for years been trying to convince European leaders to swap Russian gas for its LNG, and the severity of the damage to the undersea conduits now means that Europe is “indefinitely deprived” of Russian gas via this route, Russian energy operator Gazprom stated on Friday. In a speech on Friday, President Vladimir Putin blamed the explosions on“the Anglo-Saxons,” a Russian colloquialism for the US-UK transatlantic alliance. “It’s obvious to everyone who benefits from it,” Putin explained. “Those who benefit are the ones who have done it.”

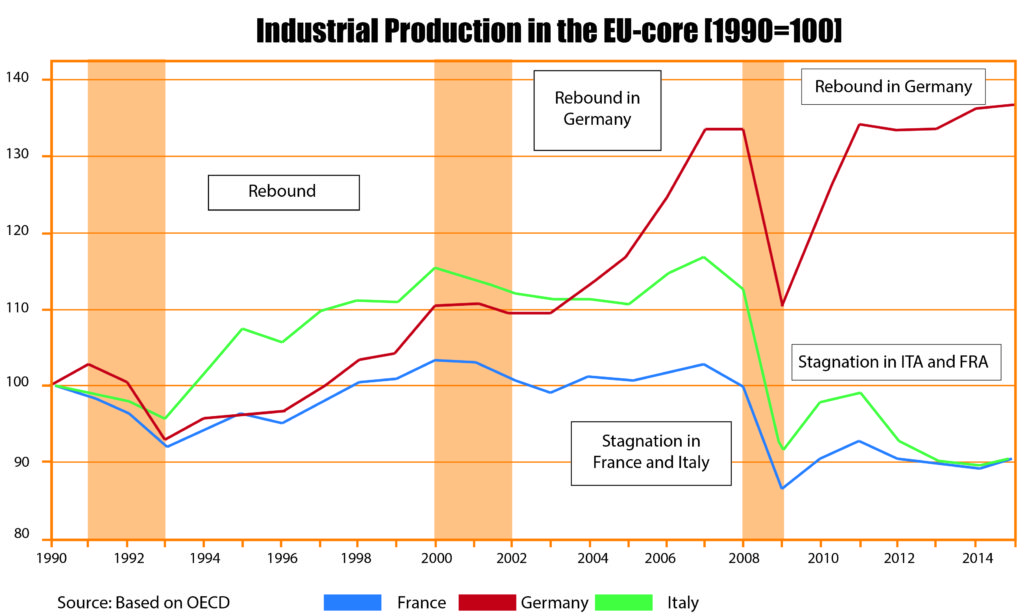

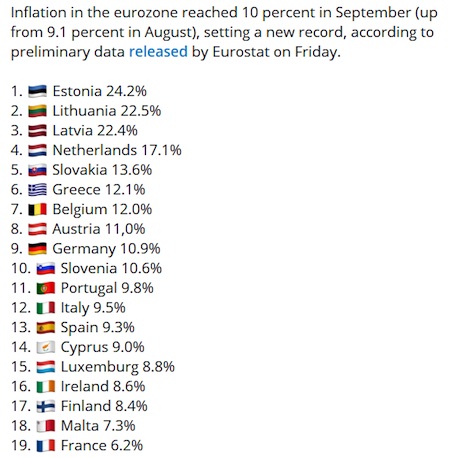

While the way is now open for the US to sell its more expensive LNG to Europe, the shortfall cannot be covered overnight. US exporters warned throughout the summer that they will not be able to ship enough gas to meet demand on the continent, and many of Europe’s import terminals are still under construction or in planning. Meanwhile, energy bills are skyrocketing across Europe. In Germany, which faces the prospect of rapid “deindustrialization,” protesters took to the streets to demand the re-opening of Nord Stream 2, just days before the explosions. Food shortages have been predicted in Germany and firewood is in hot demand across the continent as citizens struggle to heat their homes. “There’s a lot of hard work to do to make sure that countries and partners get through the winter,” Blinken said, suggesting, as EU leaders have also done, that Europe work to “reduce demand” for gas.

Blinken

Read more …

“..von der Leyen: [..] any “deliberate disruption of the European energy infrastructure is unacceptable and will lead to the strongest retaliation.”

Watch out US! Poland! Denmark! Sweden!

• Europe ‘Indefinitely Deprived’ Of Key Gas Supply Route – Gazprom (RT)

The damage to Russia’s Nord Stream 1 and 2 pipelines means Europe is indefinitely deprived of one of its key gas supply routes, Gazprom spokesman Sergey Kupriyanov said on Friday. “Essentially, Europe is indefinitely deprived of one of the key routes for obtaining a crucial energy resource. Russia and Gazprom spent a huge amount of energy and money to build and launch these pipelines because this is the shortest and safest, as we thought, way for Russian gas to reach European consumers. Now the pipelines are standing with puncture holes,” Kupriyanov said at a UN Security Council meeting. Technical data “allows [Gazprom] to say with certainty” that the sharp pressure drops were caused by physical damage, the spokesman stressed.

According to him, at the time of the incident, the pipelines were not transporting gas, but both were filled with the fuel and ready for service. There were about 800 million cubic meters of gas in the strings, which is equivalent to Denmark’s gas consumption for three months. “Gazprom has begun searching for possible solutions to get the Nord Stream system back up and running, but the timeline cannot yet be estimated… This is a very difficult technical task,” Kupriyanov said, noting that in order to assess the situation, Gazprom will have to start with a physical inspection of the damaged areas. The Danish authorities reported leaks on the pipelines on Monday after a local pipeline operator noted a loss of pressure on both the Nord Stream 1 and 2 pipelines earlier that day.

Danish and Swedish seismologists later spoke of a series of undersea explosions in the area. The Russian, American, and Swedish authorities said the leaks might have been the result of a deliberate attack. European Commission head Ursula von der Leyen said the incidents were the result of sabotage, warning that any “deliberate disruption of the European energy infrastructure is unacceptable and will lead to the strongest retaliation.” Russia called the incident a “terrorist attack” and summoned a UN Security Council meeting over it.

Read more …

“The US State Department declared that the idea the US was involved is “preposterous.”

• Who Profits From Pipeline Terror? (Escobar)

The notion that Russian intel would destroy Gazprom pipelines is beyond ludicrous. All they had to do was to turn off the valves. NS2 was not even operational, based on a political decision from Berlin. The gas flow in NS was hampered by western sanctions. Moreover, such an act would imply Moscow losing key strategic leverage over the EU. Diplomatic sources confirm that Berlin and Moscow were involved in a secret negotiation to solve both the NS and NS2 issues. So they had to be stopped – no holds barred. Geopolitically, the entity that had the motive to halt a deal holds anathema a possible alliance in the horizon between Germany, Russia, and China.

The Poles, moreover, are terrified that with Russia’s partial mobilization, and the new phase of the Special Military Operation (SMO) – soon to be transformed into a Counter-Terrorism Operation (CTO) – the Ukrainian battlefield will move westward. Ukrainian electric light and heating will most certainly be smashed. Millions of new refugees in western Ukraine will attempt to cross to Poland. At the same time there’s a sense of “victory” represented by the partial opening of the Baltic Pipe in northwest Poland – almost simultaneously with the sabotage. Talk about timing. Baltic Pipe will carry gas from Norway to Poland via Denmark. The maximum capacity is only 10 billion cubic meters, which happens to be ten times less than the volume supplied by NS and NS2. So Baltic Pipe may be enough for Poland, but carries no value for other EU customers.

Meanwhile, the fog of war gets thicker by the minute. It has already been documented that US helicopters were overflying the sabotage nodes only a few days ago; that a UK “research” vessel was loitering in Danish waters since mid-September; that NATO tweeted about the testing of “new unmanned systems at sea” on the same day of the sabotage. Not to mention that Der Spiegel published a startling report headlined “CIA warned German government against attacks on Baltic Sea pipelines,” possibly a clever play for plausible deniability. The Russian Foreign Ministry was sharp as a razor: “The incident took place in an area controlled by American intelligence.” The White House was forced to “clarify” that President Joe Biden – in a February video that has gone viral – did not promise to destroy NS2; he promised to “not allow” it to work. The US State Department declared that the idea the US was involved is “preposterous.”

Read more …

Netherlands banned “export and provision of pipes for Russia’s use”. And this is not deliberate?!

• Russian Gas Exports To EU Via TurkStream Plunge (RT)

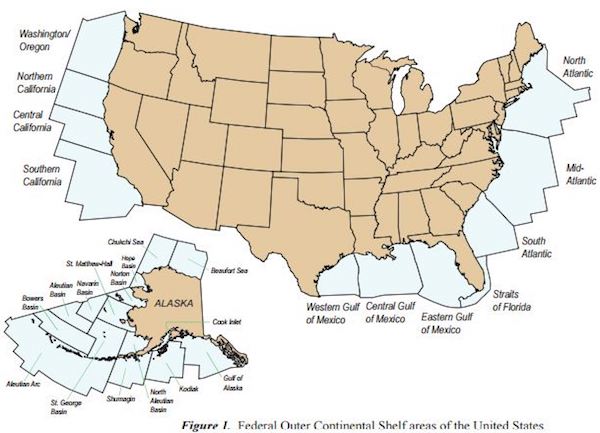

Russian gas flows to the EU via the TurkStream pipeline dropped by a quarter at the end of September compared to the end of August, the Russian newspaper Vedomosti reported on Saturday.According to the report, which cited data from the association of Europe’s transmission system operators, on September 29 about 32 million cubic meters of gas were supplied to the EU through the Strandzha 2-Malkoclar entry point on the Turkish-Bulgarian border. This is about 25% less than at the end of August, when the pipeline supplied about 43 million cubic meters of gas per day. On Thursday, the Russian-owned operator of the TurkStream pipeline,

South Stream Transport, said that the Netherlands had withdrawn its gas export license due to the latest EU sanctions package against Russia, which implies a ban on the export and provision of pipes for Russia’s use. Announcing their decision to revoke the license ahead of schedule, the Dutch authorities also referred to the ban on the supply of goods and provision of services, including technical assistance and maintenance of the pipeline in Russia’s exclusive economic zone and on its continental shelf. European gas futures spiked on the news of the license withdrawal, jumping 10% on Friday to $2,087 per thousand cubic meters, or €205.995 per megawatt hour.However, South Stream Transport later noted that the sanctions do not expressly impose restrictions on the transportation of gas via the pipeline. The company has already applied for a renewal of its export license.

Representatives of the operator said that the gas delivered to Europe via Turkish Stream supports the region’s energy security and that the pipeline is likely to be exempted from sanctions for this reason. TurkStream is a two-string pipeline with capacity of 31.5 billion cubic meters of gas per year. It carries Russian gas across the Black Sea to Türkiye and from there to countries of southern and southeastern Europe. With Nord Stream 1 currently out of operation due to this week’s leakage, TurkStream is the only remaining gas transmission system that bring gas to Europe besides the transit line running through Ukraine. Russian presidential spokesman Dmitry Peskov said on Friday that the TurkStream license withdrawal would not affect its operation and that gas supplies continue.

Read more …

“..the temperature when heating buildings will be reduced by one degree Celsius..”

• Russia Halts Gas Delivery To Italy (RT)

Russia’s Gazprom has informed Italian energy company Eni that it will not be able to supply gas to the country on Saturday, due to the “impossibility of transporting it” through Austria, the Italian company said in a statement. “Gazprom informed that it is not able to confirm the gas volumes requested for today, stating that it’s not possible to supply gas through Austria. Therefore, today’s Russian gas supplies to Eni through the Tarvisio entry point will be at zero,” the statement from Eni said, as cited by news agency RIA Novosti. Eni has said it will provide further information “in case supplies will be restored.” Gazprom has not yet specified the reason for its inability to supply gas through Austria. Grid operator Gas Connect Austria has not made any statements regarding the situation so far.

Italy receives Russian gas via the one remaining transit line through Ukraine. The gas flows to Italy after passing through Austria. Other European countries that receive Russian gas through Ukraine include Slovakia, Moldova, Romania, and the Czech Republic. Earlier, the website of the Ukrainian gas transit operator reported that the flow through Ukraine is expected to amount to around 41.6 million cubic meters on October 1. Since February, the share of Russian gas in Italian imports has fallen from 40% to roughly 18%, with the authorities saying they can cope with the shortfall expected in the winter by using alternative fuel sources. The country has adopted an energy-saving plan to reduce gas consumption. As part of this plan, the heating season will be cut by 15 days and the temperature when heating buildings will be reduced by one degree Celsius.

Read more …

AP doesn’t specify how much goes to Greece, but I would guess at least 1 billion cubic meters.

• Azerbaijan To Increase Gas Deliveries To Bulgaria, Via Greece (AP)

Azerbaijan’s president said Friday that his country is a reliable partner and will stick to an agreement to double gas exports to the European Union by 2027. Speaking to reporters in Bulgaria’s capital, President Ilhan Aliyev called a new gas interconnector with Greece “a historic achievement and an opportunity for Azeri gas to reach Europe in larger quantities.” Aliyev was in Sofia for the official launch Saturday of a new pipeline that will supply natural gas from Azerbaijan to Bulgaria, whose vital supply of Russian gas was cut off in April amid the fallout from Russia’s invasion of Ukraine. At the event on Saturday, he will join heads of state and governments from the region, as well as European Commission President Ursula von der Leyen.

The 182-kilometer pipeline is designed to run from the northeastern Greek city of Komotini to Stara Zagora in central Bulgaria. It is expected to start with an initial capacity of 3 billion cubic meters of gas a year, with the prospect of future expansion to 5 billion cubic meters. Bulgarian President Rumen Radev stressed the importance of the new gas link not only for Bulgaria, but for the continent. “It decisively changes the energy map of Europe,” he said. The desire for other sources of gas increased significantly after Moscow decided to turn its natural gas deliveries into a political weapon. In late April, Russia cut off gas supplies to Bulgaria after it refused Moscow’s demand to pay for the deliveries in rubles, Russia’s currency. Relations between the two former Soviet bloc allies have tanked in recent months, and last month Bulgaria ordered the expulsion of 70 Russian diplomats, triggering an angry response from Moscow.

Bulgaria, which has a contract for 1 billion cubic meters of Azeri gas, or one-third of the country’s annual needs, wants to increase the volume by between a half-billion to 1 billion cubic meters more per year following the suspension of Russian gas flows were suspended. Radev said he received a letter Thursday from gas system operators in Bulgaria, Romania, Hungary, and Slovakia that offered to transport gas from Azerbaijan using the integrated networks of their countries. He said Bulgaria could host a summit of the four countries to discuss possibilities for such gas transfers. The topic has become important after Russia said it would suspend some maintenance and repair work of a gas pipeline that supplies Turkey and countries like Serbia and Hungary.

Read more …

“TotalEnergies operates in over 130 countries spanning five continents..” US LNG? Qatar?

• Greek Gas Utility Clinches Winter LNG Deal (R.)

Greece’s biggest gas utility, DEPA Commercial, has clinched a deal with TotalEnergies for the supply of liquefied natural gas (LNG) over the winter months if needed, the Greek energy ministry said on Thursday. The deal stipulates that TotalEnergies will supply Greece with two LNG cargoes a month for five months until March 2023, the ministry said in a statement The total LNG that would be delivered for the five months would be 10 terrawatt hours (TWh), though Greece reserves the right not to purchase the gas but pay a cancellation fee. A deal price was not disclosed, but the ministry said Greece would buy the gas at a benchmark price rather than the highly TTF price.

“It’s a deal of key importance for the country’s energy supplies in the event gas flows from Russia are curbed or halted,” the statement said. Greece has been receiving Russian gas via the TurkStream pipeline, which also delivers to Hungary via Serbia. Athens has been working to reduce its reliance on Russian gas, ramping up LNG supplies and reopening some coal-fired power plants while also preparing to switch some gas-fired stations to diesel.

Read more …

“The problem is that its plans for how the Ukraine war and anti-Russian sanctions have worked out so far have been just the reverse of what was announced.”

• The Euro Without Germany (Michael Hudson)

On Tuesday, September 27 when news of the Nord Stream gas attacks became known, U.S. Secretary of State Antony Blinken shed crocodile tears and said that attacking Russian pipelines was “in no one’s interest.” But if that really were the case, no one would have attacked the gas lines. I have no doubt that U.S. strategists have a game plan for how to proceed from here, and to do so that indeed is in what the neocons claim to be in the U.S. interest – that of maintaining a unipolar neoliberalized and financialized global economy for as long as they can. They have long had a plan for countries that are unable to [service] their foreign debts. The IMF will lend them the money, conditional upon the debtor country raising the foreign exchange to repay the (increasingly expensive) dollar loans by privatizing what remains of their public domain, natural-resource patrimony and other assets, mainly to U.S. financial investors and their allies.

Will it work? Or will debtor countries band together and work out ways to restore the seemingly lost world of affordable oil and gas prices, fertilizer prices, grain and other food prices, and metals or raw materials supplied by Russia, China and their allied Eurasian neighbors? That is the next great worry for U.S. global strategists. It seems less easy to solve than was done by the sabotage of Nord Stream 1 and 2. But the solution seems to be the usual U.S. approach: something military in nature, new color revolutions. The aim is to gain the same power over Global South and Eurasian countries that American diplomacy wielded over Germany and other European countries via NATO.

Unless an institutional alternative is created to the IMF, World Bank, International Court, World Trade Organization and the numerous UN agencies now biased by U.S. diplomats and their proxies, the coming decades will see the U.S. economic strategy of financial and military dominance unfold as Washington has planned. The problem is that its plans for how the Ukraine war and anti-Russian sanctions have worked out so far have been just the reverse of what was announced. That may give some hope for the world’s future. The opposition and even contempt by U.S. diplomats to other countries acting in their own economic interest and social values is so strong that they are unwilling to think through just how these countries might develop their own alternative to the U.S. world plan. The question is thus how successfully these other countries may develop their alternative new economic order, and how they can protect themselves from the fate that Europe has just imposed upon itself for the next decade.

Read more …

“16,000 businesses may go bankrupt this year..” Imagine next year.

• Thousands Of German Stores On Brink Of Closure – Spiegel (RT)

Over 15,000 German stores are facing bankruptcy due to soaring energy costs, Der Spiegel reported on Friday, citing the German Retail Association (HDE). According to the report, the HDE wrote a letter to Vice-Chancellor and Economy Minister Robert Habeck in which it warned that the “exploding energy costs” are making it impossible for increasing numbers of retailers to make ends meet. The group called the situation “existentially threatening” and said that around 16,000 businesses may go bankrupt this year, while the “negative trend” is likely to continue through 2023. The group said the rise in energy costs, which have spiked by 147% on average since the beginning of the year, is preventing retailers from making a profit. The share of electricity costs in sales volumes for retailers has already reached almost 3% on average and many in the industry expect this figure to rise to as high as 5% in 2023.

According to HDE President Josef Sanktjohanser and Managing Director Stefan Genth, the returns generated in many retail sectors are already extremely low today. In the case of clothing, the operating profit as a percentage of sales is 2.1%, while in the case of shoes it is currently negative at -1.2%. Even in the food segment, it is only 2-4%. Such a state of affairs may put many companies “at a disadvantage,” the group warned. Given the sharp decline in the purchasing power of private households and record-high inflation, it will likely not be possible to shift the rising energy costs to consumers, the HDE states. Therefore, the group urged Berlin to intervene by temporarily limiting tariffs and cutting electricity taxes to a minimum.

Read more …

“Ukraine’s parliament formally abandoned neutrality later in 2014.”

• The Great Game In Ukraine Is Spinning Out Of Control (Jeffrey Sachs)

Under Clinton’s watch, NATO expanded to Poland, Hungary, and the Czech Republic in 1999. Five years later, under President George W. Bush, Jr. NATO expanded to seven more countries: the Baltic states (Estonia, Latvia, and Lithuania), the Black Sea (Bulgaria and Romania), the Balkans (Slovenia), and Slovakia. Under President Barack Obama, NATO expanded to Albania and Croatia in 2009, and under President Donald Trump, to Montenegro in 2019. Russia’s opposition to NATO enlargement intensified sharply in 1999 when NATO countries disregarded the UN and attacked Russia’s ally Serbia, and stiffened further in the 2000’s with the US wars of choice in Iraq, Syria, and Libya. At the Munich Security conference in 2007, President Putin declared that NATO enlargement represents a “serious provocation that reduces the level of mutual trust.”

Putin continued: “And we have the right to ask: against whom is this expansion intended? And what happened to the assurances [of no NATO enlargement] our western partners made after the dissolution of the Warsaw Pact? Where are those declarations today? No one even remembers them. But I will allow myself to remind this audience what was said. I would like to quote the speech of NATO General Secretary Mr. Woerner in Brussels on 17 May 1990. He said at the time that: ‘the fact that we are ready not to place a NATO army outside of German territory gives the Soviet Union a firm security guarantee.’ Where are these guarantees?” Also in 2007, with the NATO admission of two Black Sea countries, Bulgaria and Romania, the US established the Black Sea Area Task Group (originally the Task Force East).

Then in 2008, the US raised the US-Russia tensions still further by declaring that NATO would expand to the very heart of the Black Sea, by incorporating Ukraine and Georgia, threatening Russia’s naval access to the Black Sea, Mediterranean, and Middle East. With Ukraine’s and Georgia’s entry, Russia would be surrounded by five NATO countries in the Black Sea: Bulgaria, Georgia, Romania, Turkey, and Ukraine. Russia was initially protected from NATO enlargement to Ukraine by Ukraine’s pro-Russian president Viktor Yanukovych, who led the Ukrainian parliament to declare Ukraine’s neutrality in 2010. Yet in 2014, the US helped to overthrow Yanukovych and bring to power a staunchly anti-Russian government. The Ukraine War broke out at that point, with Russia quickly reclaiming Crimea and supporting pro-Russian separatists in the Donbas, the region of Eastern Ukraine with a relatively high proportion of Russian population. Ukraine’s parliament formally abandoned neutrality later in 2014.

Read more …

Churchill, Nobel Peace Prize, but embedded in the Bandera legacy. Yeah, makes a lot of sense…

• Zelensky’s Lies Can’t Hide Ukraine’s Bloody Role In The Holocaust (Dershowitz)

Volodymyr Zelensky has performed a truly great service on behalf of the Ukrainian people. Because of his Churchill-like determination to resist Russian aggression, I have proposed him for the Nobel Peace prize. But he has in the recent past mendaciously denied the role of Ukrainian people in the Holocaust. He has used that argument to forcefully claim that Israel owes Ukraine offensive weapons. Several days ago, he escalated his criticism, saying he shocked that Israel hasn’t capitulated to his demands. He has never apologized for the following statement he made this past March: “The Ukrainians made a choice 80 years ago, we saved Jews…” He is right the Ukrainian people made a choice 80 years ago, but it wasn’t to save Jews.

Almost without exception, Ukrainians either participated in the mass murder of Jews or said nothing as their Jewish neighbors were rounded up and slaughtered in places like Babi Yar. Many of those who pulled the trigger were themselves Ukrainian, recruited into the mobile killing squads by the Nazis. Vanishingly few saved Jews. The complicity of Ukrainians in these mass murders was greater than in most other countries. Hundreds of thousands of Ukrainian Jews were murdered. Nor was this the first time that the Ukrainian people made a similar choice. In 1648, Bogdan Chmielnicki led a pogrom that resulted in the deaths of tens of thousands of Jews, including babies, children, and mothers. That was a long time ago, but the statue of this genocidal murderer still stands in the center of Kyiv, and his picture still adorns the Ukrainian five-dollar bill. That is now! Ukraine has made a choice: to honor the memory of a mass murderer of Jews.

Between the Chmielnicki murders and the Holocaust, the Ukrainian people made many other choices: they conducted pogrom after pogrom against Jewish families. Antisemitism was rampant throughout the Ukraine. That is why so many Ukrainian Jews immigrated to the United States and elsewhere. In recent years, the situation in Ukraine has improved measurably. Though there are still a large number of antisemites in Ukraine—including in certain units of the armed forces—the remembrance of the Holocaust has caused many Ukrainians to abandon the traditional antisemitism that plagued the country. They even voted for Zelensky, who is a man of Jewish heritage.

Read more …

“..Plaintiff is asking the Special Master to order disclosure of the names of each attorney and Special Agent who was exposed to materials eventually provided to the Privilege Review Team.”

• FBI Agents Improperly Saw Privileged Trump Communications: Lawyers (ET)

The FBI team that seized documents from former President Donald Trump’s Florida resort improperly viewed communications between Trump and an attorney, violating attorney-client privilege for a third time, lawyers for Trump said in a new filing. The filter process set up by the government to try to prevent FBI agents from viewing privileged materials has already failed twice, the government has acknowledged. On Sept. 26, government officials informed Trump lawyers of a third failure, the lawyers said in a new filing lodged in a federal court in southern Florida. FBI agents viewed an email that they sent to the Privilege Review Team, a team that was supposed to filter out all potentially privileged materials before agents were able to view any.

The review team has characterized the email as non-privileged, but Trump disagrees. “Plaintiff believes the email falls squarely into the category of attorney-client privileged,” Trump lawyers told U.S. District Judge Raymond Dearie, a Reagan appointee who is serving as a special master in the case. Benjamin Hawk, the Department of Justice (DOJ) official in charge of the filter team, claimed during a recent hearing that the first two failures to separate potentially privileged materials were examples of the filter process working, but U.S. District Judge Aileen Cannon, the Trump appointee who inserted Dearie into the case, expressed doubt. The instances “indicate that, on more than one occasion, the Privilege Review Team’s initial screening failed to identify potentially privileged material,” she said.

FBI agents who viewed the potentially privileged materials may still be working on the case, according to a sealed filing described by Cannon. In the new filing, Trump’s lawyers said they want the names of all government officials who were exposed to the potentially privileged materials. “The unilaterally imposed filter team, which made no effort to contact Plaintiff’s counsel throughout its review process, has admitted to three breaches so far,” the lawyers said. “All this before review by the Special Master and the Plaintiff. By way of this filing, Plaintiff is asking the Special Master to order disclosure of the names of each attorney and Special Agent who was exposed to materials eventually provided to the Privilege Review Team.”

Read more …

Double-entry bookkeeping tells Steve that money is indeed destroyed. Just as Hyman Minsky and Augusto Graziani said.

• A Little Knowledge is a Dangerous Thing (Steve Keen)

I owe enormous intellectual debts to Hyman Minsky and Augusto Graziani. But at one point, my “little knowledge” led me to believe, falsely, that they had both made a huge mistake in claiming that repaying debt destroyed money: Graziani: As soon as firms repay their debt to the banks, the money initially created is destroyed. (Graziani 1989) Money is created as banks lend—mainly to business—and money is destroyed as borrowers fulfill their payment commitments to banks. (Minsky 1982) This couldn’t be right, I thought: surely once banks had created money, they wouldn’t let it be destroyed? I considered cash loans in particular—surely the cash wasn’t destroyed on receipt, but put back into the vault for relending?

This is why the model of money in my Debunking Economics (Keen 2011) is of a cash-lending bank, and not a modern electronic banking system, where loans are simultaneously matched by direct payments into deposit accounts. Then I developed Minsky, the monetary modelling software that I named in honour of Hyman Minsky. I came to really understand double-entry bookkeeping, and realised that Minsky and Graziani were correct, and I was wrong. These days, money is primarily the sum of private bank deposit accounts. When you show modern bank lending and bank debt repayment in a double-entry table, it’s obvious that the former creates money, and the latter destroys it.

This points to a general rule about money creation and destruction: leaving aside cash loans, and direct government payments of cash to the non-bank public, to create money, an operation must increase both the Assets and Liabilities (or short-term Equity) sides of the banking system’s ledger. Conversely, this means that operations that occur exclusively on either the Assets side or Liabilities & Equity side neither create nor destroy money. Having made this mistake myself, I came to realise that understanding double-entry bookkeeping is the “Holy Grail” to understanding money, and therefore that if someone makes claims about money that contradict double-entry bookkeeping (DEB for short), then they should be ignored, because they don’t know what they are talking about.

Read more …

“If someone submits their experience to VAERS they want and expect to have it investigated by the FDA. This includes autopsy reports..”

• FDA Withholds Autopsy Results on People Who Died After COVID-19 Vaccines (ET)

The U.S. Food and Drug Administration (FDA) is refusing to release the results of autopsies conducted on people who died after getting COVID-19 vaccines. The FDA says it is barred from releasing medical files, but a drug safety advocate says that it could release the autopsies with personal information redacted. The refusal was issued to The Epoch Times, which submitted a Freedom of Information Act for all autopsy reports obtained by the FDA concerning any deaths reported to the Vaccine Adverse Event Reporting System following COVID-19 vaccination. Reports are lodged with the system when a person experiences an adverse event, or a health issue, after receiving a vaccine. The FDA and other agencies are tasked with investigating the reports. Authorities request and review medical records to vet the reports, including autopsies.

The FDA declined to release any reports, even redacted copies. The FDA cited federal law, which enables agencies to withhold information if the agency “reasonably foresees that disclosure would harm an interest protected by an exemption,” with the exemption being “personnel and medical files and similar files the disclosure of which would constitute a clearly unwarranted invasion of personal privacy.” Federal regulations also bar the release of “personnel, medical and similar files the disclosure of which constitutes a clearly unwarranted invasion of personal privacy.” The Epoch Times has appealed the denial, in addition to the recent denial of results of data analysis of VAERS reports.

Kim Witczak, a drug safety advocate who advises the FDA as part of the Psychopharmacologic Drugs Advisory Committee, said that the reports could be released with personal information blacked out. “The personal information could easily be redacted without losing the potential learnings from [the] autopsy,” Witczak told The Epoch Times via email. People make the choice to submit autopsy results to the Vaccine Adverse Event Reporting System, Witczak noted. “If someone submits their experience to VAERS they want and expect to have it investigated by the FDA. This includes autopsy reports,” she said.

Read more …

“..most of them have battery backups that last around 30 minutes to run the mobile antennas. After that they go dark.”

• Next On Europe’s Doomsday List: Collapse Of Cell Phone Networks (ZH)

It’s not just heating that could be missing across Europe this winter: cell phones may be the next to go. That’s because if power cuts or energy rationing knocks out parts of the mobile networks across the region, mobile phones could go dark around Europe this winter according to the latest doomsday reporting from Reuters. While everyone knows by now that Europe’s chances of rationing and power shortages have exploded ever since Moscow suspended gas supplies, in France, the situation is even worse as several nuclear power plants are shutting down for maintenance. And the cherry on top: telecom industry officials told Reuters they fear a severe winter will put Europe’s telecoms infrastructure to the test, forcing companies and governments to try to mitigate the impact (i.e., more bailout demands).

The problem, as four telecoms executives put it, is that currently there are not enough back-up systems in many European countries to handle widespread power cuts, raising the prospect of mobile phone outages. Realizing that in just weeks Europe could be cell phone free, countries including France, Sweden and Germany, are scarmbling to ensure communications can continue even if power cuts end up exhausting back-up batteries installed on the thousands of cellular antennas spread across their territory. Alas, like with everything else in Europe, it’s too little, too late and Europe is facing a truly historic cell phone black out because while Europe has nearly half a million telecom towers, most of them have battery backups that last around 30 minutes to run the mobile antennas. After that they go dark.

One of the alternatives being discussed is pushing Europe back to communist era blackout regimes: In France, a plan put forward by electricity distributor Enedis, includes potential power cuts of up to two hours in a worst case scenario, two sources familiar with the matter said. The general black-outs would affect only parts of the country on a rotating basis. Essential services such as hospitals, police and government will not be impacted, the sources said. And now, it appears that cell phones are considered essential too: the French Federation of Telecoms (FFT), a lobby group representing Orange, Bouygues Telecomand Altice’s SFR, put the spotlight on Enedis for being unable to exempt antennas from the power cuts.

Enedis said it was able to isolate sections of the network to supply priority customers, such as hospitals, key industrial installations and the military and that it was up to local authorities to add telecoms operators infrastructure to the list of priority customers. “Maybe we’ll improve our knowledge on the matter by this winter, but it’s not easy to isolate a mobile antenna (from the rest of the network),” said a French finance ministry official with knowledge of the talks.

Read more …

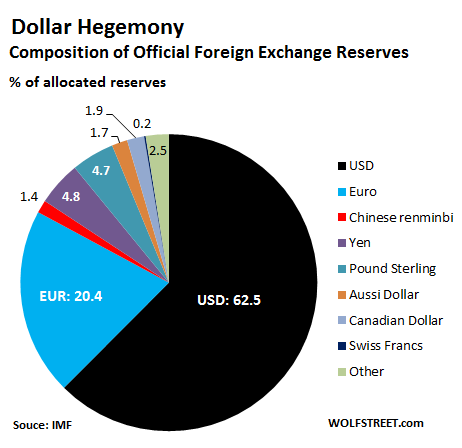

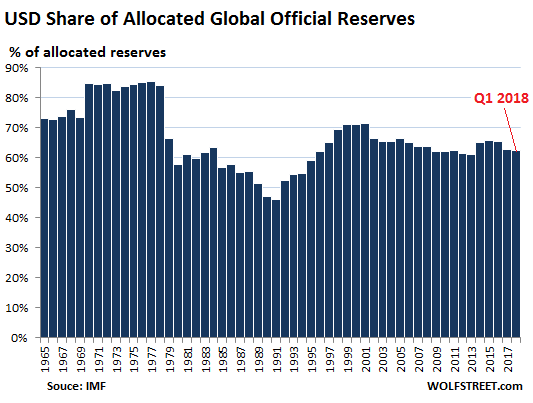

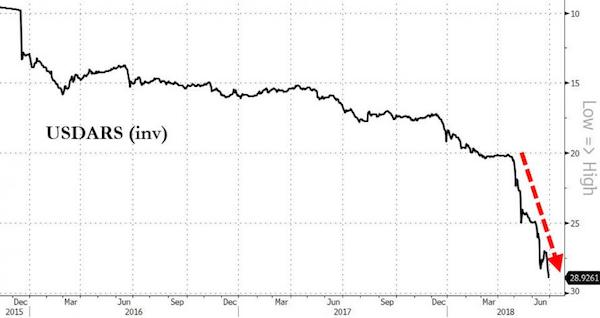

What Reuters claims here is that the banks are today pushed to not sell, but buy dollars -with yuan-, only to sell them tomorrow, to support the yuan?!

At the same time, China wants the yuan to play a big part in the new currency basket they want to replace the USD as reserve currency. Problem is, it’s too weak right now.

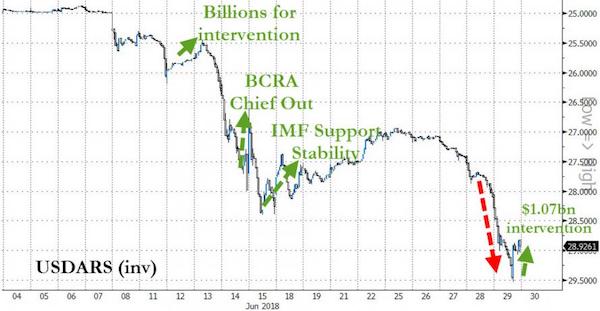

• China Tells State Banks To Sell Dollars, Buy Yuan (R.)

China’s central bank has asked major state-owned banks to be prepared to sell dollars for the local unit in offshore markets as it steps up efforts to stem the yuan’s descent, four sources with knowledge of the matter said. State banks were told to ask their offshore branches, including those based in Hong Kong, New York and London, to review their holdings of the offshore yuan and ensure U.S. dollar reserves are ready to be deployed, three of the sources, who declined to be identified, told Reuters. The simultaneous selling of dollars and buying of yuan could put a floor under the Chinese currency, which has lost more than 11% to the dollar so far this year and looks set for its biggest annual loss since 1994, when China unified its official and market rates.

The scale of this round of dollar selling to defend the weakening yuan will be rather big, one of the sources said. [..] While the yuan’s depreciation has been gradual and in line with the decline in major currencies against a dollar buoyed by aggressive Federal Reserve monetary tightening, its decline to the weaker side of 7-per-dollar has raised concerns about domestic sentiment and potential capital outflows. The offshore yuan moves in lock-step with the onshore unit, but its trading volumes account for about 70% of all yuan FX trades globally, dwarfing the volumes traded on the mainland. Chinese authorities have intervened in the past in the offshore yuan market to steer the yuan.

Sources said the intervention plan involved using state lenders’ dollar reserves primarily. But the total amount of dollar selling is yet to be determined as the yuan’s movements are largely dependent on dollar moves and the Fed’s tightening trajectory, the source said. China burnt through $1 trillion of its official FX reserves to prop up the currency after a one-off 2% devaluation in 2015 that roiled global financial markets. State banks, which usually act as the PBOC’s agents in offshore markets, are scrambling to procure more dollars in offshore markets, one of the sources said. The People’s Bank of China did not respond immediately when asked by Reuters about state banks stocking up on dollars.

Read more …

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.