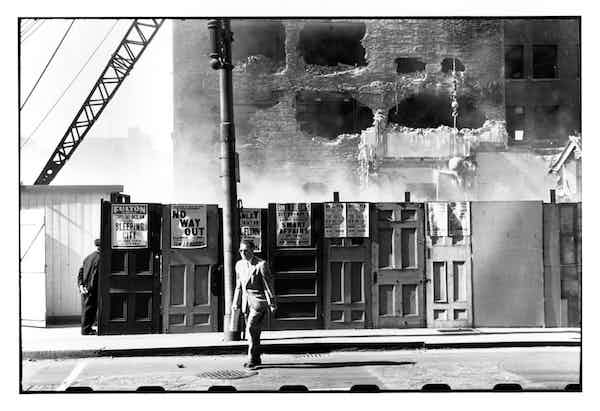

Jack Delano Long stairway in mill district of Pittsburgh, Pennsylvania 1941

People’s Daily: “Chinese health authorities announced Sunday that 1,975 confirmed cases of pneumonia caused by the novel coronavirus (2019-nCoV), including 324 in critical conditions and 56 deaths, had been reported in the country by the end of Saturday.”

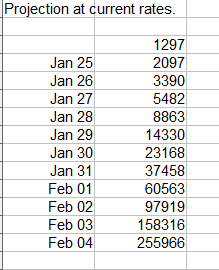

We’re nicely in line with the Fibonacci sequence, with Hubei infections rising from 1,400 to 2,000. 3,300 tomorrow? Note that “official” updates are provided once a day, apparently first thing in the morning. Curious that deaths the previous day rose from 26 to 41, and today to 56, i.e. by 15 in both cases. The updates are heavily controlled.

Incubation time is now estimated as up to 2 weeks, so think back at least those 14 days and think back to how safety measures were back then. Questions also arise about the origin of the virus. A dead bat, a bioweapon lab, or both? Many animals are now -officially- off the menu.

Fibonacci

• Chinese Virus Deaths Rise To 56, 2,000 Infected & More Cases Abroad (RT)

The death toll from the 2019-nCoV coronavirus outbreak in China has reached 56, with hundreds of new infections detected nationwide, despite all containment efforts. A handful of news cases have also been reported outside China. The first death was reported in Shanghai, and another one in Henan Province, while 13 more people died in Hubei Province – the epicenter of the outbreak – where nearly 130 people were reportedly in serious or critical condition as of Sunday morning. In addition to hundreds of known and confirmed cases, some 7,000 people there remain under increased medical supervision due to their potentially dangerous “close contacts.”

Meanwhile, the number of those who have beaten the virus and were discharged from hospitals has increased to at least 85, according to authorities. = China is facing a “grave situation” as the new coronavirus is “accelerating its spread,” President Xi Jinping warned earlier. He added, however, that given the immense efforts to contain the outbreak, China “will definitely be able to win the battle.” Around 450 Chinese military medics, many with experience in combating SARS or Ebola, were deployed in the region to help the overworked and exhausted hospital staff, who had been on around-the-clock shifts in recent weeks. Meanwhile, local authorities are rushing to construct a new 1,000-bed facility specifically to treat victims of the deadly virus.

Chinese authorities have also imposed strict travel restrictions in the outbreak epicenter of Wuhan, as well as nearly 20 cities in Hubei Province, with nearly 50 million people virtually quarantined in the middle of the holiday season. With many mass public events canceled, additional limitations have been imposed on intercity bus routes starting Sunday. Medical staff have been tasked with checking travelers’ temperatures for any signs of fever – the most apparent symptom of coronavirus, which is followed by a dry cough and leads to shortness of breath.

R0 rate appears to have been lowered to 2.5, from 3.8. Don’t get all happy.

• Coronavirus Contagion Rate Makes It Hard To Control (R.)

Each person infected with coronavirus is passing the disease on to between two and three other people on average at current transmission rates, according to two separate scientific analyses of the epidemic. Whether the outbreak will continue to spread at this rate depends on the effectiveness of control measures, the scientists who conducted the studies said. But to be able to contain the epidemic and turn the tide of infections, control measures would have to halt transmission in at least 60% of cases. The death toll from the coronavirus outbreak jumped to 41 on Saturday, with more than 1,400 people infected worldwide – the vast majority in China.

“It is unclear at the current time whether this outbreak can be contained within China,” said Neil Ferguson, an infectious disease specialist at Imperial College London who co-led one of the studies. Ferguson’s team suggest as many as 4,000 people in Wuhan were already infected by Jan. 18 and that on average each case was infecting two or three others. A second study by researchers at Britain’s Lancaster University also calculated the contagion rate at 2.5 new people on average being infected by each person already infected. “Should the epidemic continue unabated in Wuhan, we predict (it) will be substantially larger by Feb. 4,” the scientists wrote. “Should the epidemic continue unabated in Wuhan, we predict (it) will be substantially larger by Feb. 4,” the scientists wrote.

They estimated that the central Chinese city of Wuhan where the outbreak began in December will alone have around 190,000 cases of infection by Feb. 4., and that “infection will be established in other Chinese cities, and importations to other countries will be more frequent.”

This kind of uncertainty doesn’t help.

• No Link With Seafood Market In First Case Of China Coronavirus (SCMP)

The first person known to have been infected by the Wuhan coronavirus had never visited the city’s seafood market – regarded as the epicentre of the outbreak – according to Chinese researchers, who also called for extra precautions against airborne transmission of the disease between humans. The researchers, seven of whom work at Wuhan’s Jinyintan hospital, designated for patients with the illness, revealed on Friday in The Lancet medical journal that symptoms of the new disease were first reported on December 1 – much earlier than the Wuhan government’s initial announcement on December 31 of 27 cases of the pneumonia-like infection.

According to the report, the first patient had no exposure to the Huanan seafood market which was shut down on January 1 over fears – later confirmed – that the new virus was linked to its trade in wild animals. The researchers added that none of the patient’s family had developed fever or any respiratory symptoms. There was also no epidemiological link between the first patient and the later cases, they found. The researchers analysed data from 41 patients with confirmed infections who had showed an onset of symptoms up to January 2. Six of those patients died, putting the fatality rate of the group at 15 per cent. The researchers noted that clinical presentations of the patients greatly resembled severe acute respiratory syndrome.

The first patient to die from the new coronavirus had continuous exposure to the market before he was admitted to hospital with a seven-day history of fever, cough and breathing difficulties, according to their report. Five days after the onset of symptoms, his wife, a 53-year-old woman with no known history of exposure to the market, also presented with pneumonia and was hospitalised in the isolation ward, they said. The absence of a link to the seafood market is one of the indicators for human-to-human transmission of the virus and the researchers identified another 13 patients who also had no direct exposure to the market.

Lots of background. Viruses are potent weapons.

• China Stole Coronavirus From Canada And Weaponized It (GGI)

Last year a mysterious shipment was caught smuggling Coronavirus from Canada. It was traced to Chinese agents working at a Canadian lab. Subsequent investigation by GreatGameIndia linked the agents to Chinese Biological Warfare Program from where the virus is suspected to have leaked causing the Wuhan Coronavirus outbreak. On June 13, 2012 a 60-year-old Saudi man was admitted to a private hospital in Jeddah, Saudi Arabia, with a 7-day history of fever, cough, expectoration, and shortness of breath. He had no history of cardiopulmonary or renal disease, was receiving no long-term medications, and did not smoke. Egyptian virologist Dr. Ali Mohamed Zaki isolated and identified a previously unknown coronavirus from his lungs.

After routine diagnostics failed to identify the causative agent, Zaki contacted Ron Fouchier, a leading virologist at the Erasmus Medical Center (EMC) in Rotterdam, the Netherlands, for advice. Fouchier sequenced the virus from a sample sent by Zaki. Fouchier used a broad-spectrum “pan-coronavirus” real-time polymerase chain reaction (RT-PCR) method to test for distinguishing features of a number of known coronaviruses known to infect humans. This Coronavirus sample was acquired by Scientific Director Dr. Frank Plummer of Canada’s National Microbiology Laboratory (NML) in Winnipeg directly from Fouchier, who received it from Zaki. This virus was reportedly stolen from the Canadian lab by Chinese agents.

Coronavirus arrived at Canada’s NML Winnipeg facility on May 4, 2013 from the Dutch lab. The Canadian lab grew up stocks of the virus and used it to assess diagnostic tests being used in Canada. Winnipeg scientists worked to see which animal species can be infected with the new virus. Research was done in conjunction with the Canadian Food Inspection Agency’s national lab, the National Centre for Foreign Animal Diseases which is housed in the same complex as the National Microbiology Laboratory.

In March 2019, in mysterious event a shipment of exceptionally virulent viruses from Canada’s NML ended up in China. The event caused a major scandal with Bio-warfare experts questioning why Canada was sending lethal viruses to China. Scientists from NML said the highly lethal viruses were a potential bio-weapon. Following investigation, the incident was traced to Chinese agents working at NML. Four months later in July 2019, a group of Chinese virologists were forcibly dispatched from the Canadian National Microbiology Laboratory (NML). The NML is Canada’s only level-4 facility and one of only a few in North America equipped to handle the world’s deadliest diseases, including Ebola, SARS, Coronavirus, etc.

Elections in 9-10 months.

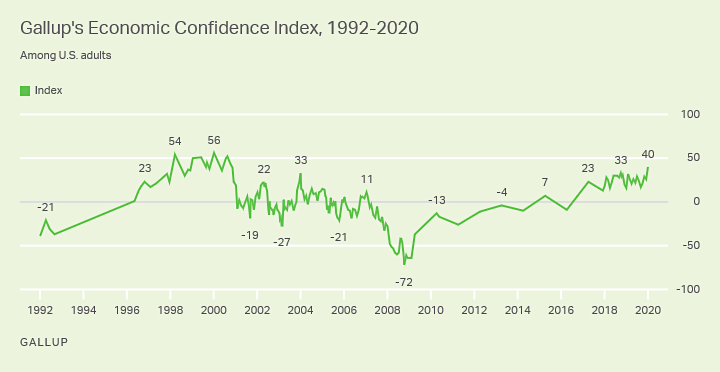

• US Economic Confidence at Highest Point Since 2000 (Gallup)

Americans’ confidence in the U.S. economy is higher than at any point in about two decades. The latest figure from Gallup’s Economic Confidence Index is +40, the highest reading recorded since +44 in October 2000. Americans’ buoyant confidence in the economy in Gallup’s latest poll, conducted Jan. 2-15, likely reflects the U.S. unemployment rate’s continued stay at a 50-year low. Meanwhile, the Dow Jones Industrial Average continues to reach record highs — and flirts with reaching the 30,000 marker. Gallup’s Economic Confidence Index is the average of two components: Americans’ ratings of current economic conditions and their views on whether the economy is getting better or getting worse.

The index has a theoretical maximum of +100, achieved if all Americans believe the economy is excellent or good and getting better. The theoretical minimum is -100, if all Americans say the economy is poor and getting worse. The current conditions component score of +54 is the result of 62% of Americans saying the economy is “excellent” or “good” and 8% describing it as “poor.” Meanwhile, the economic outlook component score of +26 is the result of 59% saying the economy is “getting better” and 33% saying it is “getting worse.” Gallup’s tracking of economic confidence over the past 28 years has recorded index readings at or above the +40 mark in just nine other measurements, all between 1998 and 2000 — with the highest level recorded in January 2000, at +56, after a then-record high for the Dow. The latest reading of +40 is the only time the index has reached that level since 2000.

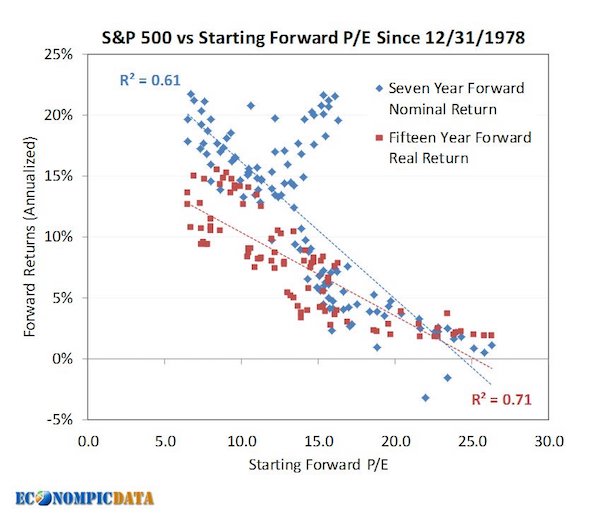

Nothing I haven’t already said 1000 times.

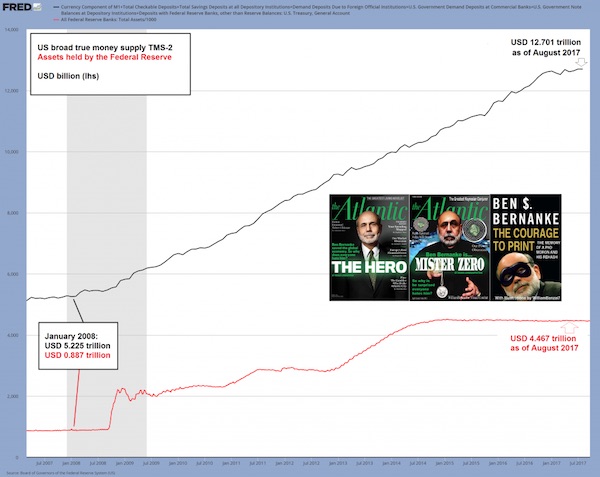

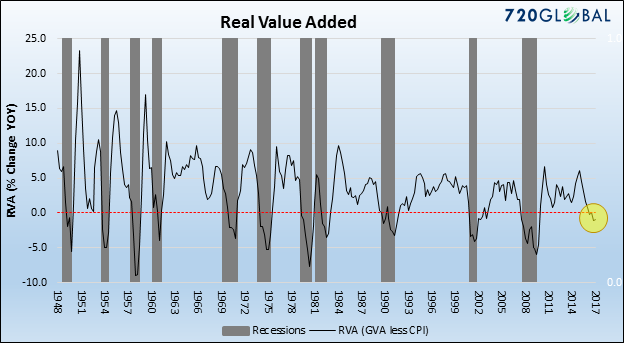

• Stock Market A ‘Ponzi Scheme’ That Eventually Must Collapse – Guggenheim (RT)

The rallying markets aren’t as good as they seem, says Guggenheim Partners chief Scott Minerd. He likened inflation of asset prices caused by loose money policies of central banks to a ponzi scheme that eventually must collapse. “We will reach a tipping point when investors will awake to the rising tide of defaults and downgrades,” Minerd wrote in a letter from the World Economic Forum meeting. “The timing is hard to predict, but this reminds me a lot of the lead-up to the 2001 and 2002 recession.” He cited rising defaults despite a rally in riskier assets, and reiterated a warning that BBB-rated bonds risk further downgrades.

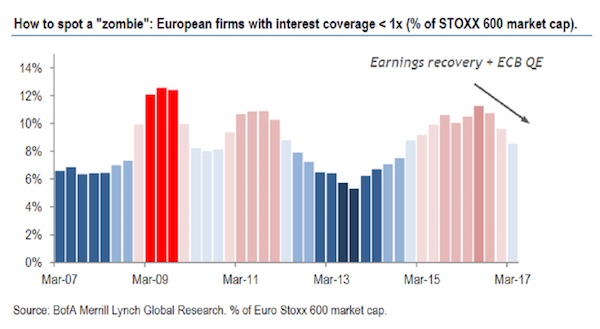

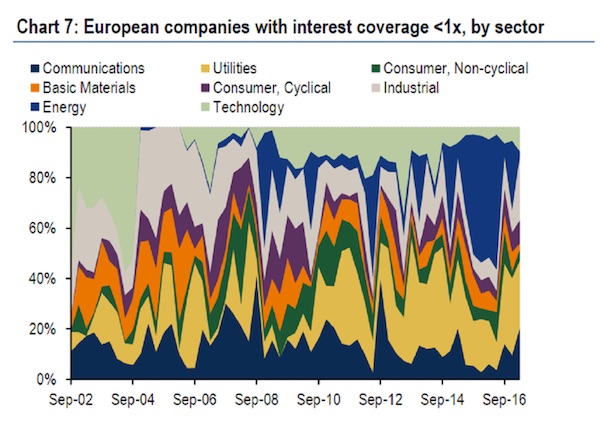

The chief executive said that the type of debt is at a greater risk of deterioration than it was in 2007. Guggenheim Partners, which operates in the global investment and advisory space, manages more than $275 billion in assets as of September last year. The company’s fixed-income chief Anne Walsh told Yahoo Finance that 15 percent of the US economy is already in recession. According to her, the Federal Reserve’s efforts to pump liquidity into markets has created “zombie companies” that may see an outflow of capital as the utility of that money continues to diminish. The longer that this market runs, the harder the fall will be when it ends, she said.

Don’t attack a jury.

• Neither Side Is Really Trying To Win This Trump Impeachment Trial (Turley)

It is the one unbreakable rule in litigation. You can insult the defendant or the opposing attorney and, on occasion, you might even insult the judge. But the one thing you can never do is insult the jury. That is only if you want to win a jury verdict, and that may be why both legal teams in the impeachment trial of President Trump seem more eager to get the goats of Senate jurors rather than their votes. Both sides seem to be striving for the constitutional equivalent of a hung jury, not enough votes for either a bipartisan acquittal or conviction, simply the status quo. What is different is that you usually do not actually hang the jury in a hung jury strategy.

The most riveting example this week was the argument of House Judiciary Committee Chairman Jerrold Nadler, who stood in the well of the Senate and appeared to accuse Republican senators of a conspiracy to “cover up” the wrongdoing of the president. It was a moment that produced an audible gasp from the room, along with a note from Senator Susan Collins complaining to Chief Justice John Roberts, who then promptly declared that “those addressing the Senate should remember where they are.” The aspersions from Nadler alienated at least two of the four Republican senators that House impeachment managers are struggling to win over in their fight to call witnesses.

In addition to Collins, Senator Lisa Murkowski was irate and denounced the comments by Nadler as soon as she walked off the floor. Murkowski later expressed skepticism about helping House managers to call witnesses they did not seek to compel during their own investigations. That is what happens when a prosecutor incorporates the jury into the list of accomplices in an ongoing conspiracy during trial. House manager Adam Schiff produced further gasps when he repeated reports that the senators were warned that if they vote against Trump their heads “will be on a pike.” Collins and Murkowski were among those angrily responding to the “unnecessary” remarks. Other senators have had their own awkward moments.

The House managers played a clip of Senator Lindsay Graham from the Clinton impeachment trial declaring, “What is a high crime? It does not even have to be a crime. It is just when you start using your office and you are acting in a way that hurts people, you have committed a high crime.” That statement of a hurtful standard for impeachment was meant to embarrass Graham. It certainly worked. For its part, the White House could not get enough of old clips of Senator Charles Schumer promising to vote for acquittal before the Clinton trial was even scheduled. Schumer also opposed any witnesses or a full trial in the Clinton impeachment.

He’s the face after all. They get bonus points for limiting it to 2 hours. And they seemed to do well.

• Trump Defense Team Signals Focus On Schiff (Hill)

At several points during their opening argument, President Trump’s defense team trained their fire on Rep. Adam Schiff (D-Calif.), removing any doubt about their intent to make the House manager’s credibility an issue at the impeachment trial. Addressing the Senate on Saturday, Trump’s lawyers accused Schiff of repeatedly stretching the truth and creating false impressions amid his pursuit to take down the president. “Chairman Schiff has made so much of the House’s case about the credibility of interpretations that the House managers want to place on — not hard evidence — but on inferences,” said Patrick Philbin, deputy counsel to Trump.

“It is very relevant to know whether assessments of evidence he’s presented in the past are accurate,” Philbin said of Schiff. “And we would submit they have not been, and that that is relevant for your consideration.” The defense team portrayed Schiff as having first launched his overreaching efforts against Trump during former special counsel Robert Mueller’s investigation and continuing through Trump’s impeachment trial. The attacks on Schiff were perhaps unsurprising, as the House Intelligence Committee chairman has emerged as the lead prosecutor among House managers pressing the case against Trump in the Senate.

In fact, Schiff anticipated the offensive and delivered a warning to senators last night that spelled out specific attacks he expected to be lodged against him, some of which materialized Saturday. “I think the second thing you’ll hear from the president’s team is, attack the managers. Those managers are just awful. They’re terrible people,” Schiff said. “Especially that Schiff guy. He’s the worst. He’s the worst.” [..] Trump’s team today called into question whether Schiff can be trusted as an honest broker. At one point, Trump’s defense team played video of Schiff on NBC’s “Meet the Press,” saying that he had seen “evidence that is not circumstantial” that the Trump campaign had colluded in Russia’s 2016 election interference.

Trump’s lawyers contrasted Schiff’s claim with Mueller’s conclusion that his nearly two-year probe had established no coordination between the Trump campaign and Moscow. The defense team also accused Schiff and his staff of coaching the whistleblower, who raised a red flag over Trump’s July 25 phone call with the Ukrainian president that set in motion the impeachment. They paired the allegation with a clip of Schiff asserting on national television that “we have not spoken directly with the whistleblower,” a claim which fact-checkers found was false.

The war party.

• Adam Schiff Is a Dangerous Warmonger (Jacobin)

Assuring us that he is aware, actually, of what century this is, Schiff said in 2015, “Now, we’re not seeing the same bipolar world we had between communism and capitalism.” (Phew!) He then added, “But we are seeing a new bipolar world, I think, where you have democracy versus authoritarianism.” Schiff has not viewed this as a mere contest of ideas: he constantly advocated for Obama to impose tougher sanctions on Russia and give more weapons to Ukraine.

Although delicately opposed to violence in some contexts — he’s a vegan! — this isn’t the only war Schiff has championed. He supported the Afghanistan, Iraq, and Libya wars, greater US intervention in Syria, as well as the Saudi war with Yemen (although he has, in the past year, turned against the latter adventure, seeming to draw the line at sawing up journalists with bonesaws — he is a moderate after all, plus very popular with the media), and he has voted for nearly every possible increase in the defense budget.

As Jacobin’s own Branko Marcetic observed two years ago, Schiff’s bellicosity is extensively funded by arms manufacturers and military contractors. A Ukrainian arms dealer named Igor Pasternak held a $2,500 per head fundraiser for Schiff in 2013, as the late Justin Raimondo reported in a terrific analysis on Antiwar.com in 2017, at a time when Ukraine was desperately trying to counter the Obama administration’s disinterest in funding its war with Russia. Despite that disinterest, the State Department approved some very profitable dealings for Pasternak in Ukraine after that fundraiser.

And that’s only one example. In the current cycle, donations from the war industry have continued to flood his coffers. Many come from employees of firms with extensive Department of Defense contracts, including Radiance Technologies and Raytheon. PACs representing the defense industry also make a robust showing among Schiff’s contributors, according to data on Open Secrets.org; companies funneling money to Schiff — sorry, contributing to those PACs — include Lockheed Martin, Northrop Grumman, Raytheon, Radiance, and others, including L3Harris Technologies (which got in big trouble with the State Department in September and had to pay $13 million in penalties for illegal arms dealing).

Why is everyone still talking about Biden? He’s out.

• Joe Biden Lied About His Record On Social Security (IC)

Over the past few weeks, former Vice President Joe Biden has been making an effort to recast his record on Social Security as one of a champion who defended the program from assaults, rather than one who consistently argued that it ought to be cut. The value of such a revision is clear: Austerity is no longer a politically viable platform for Democrats to take in the primary. His defense of his record has included multiple television interviews, public comments, and even an ad attacking Sen. Bernie Sanders for “dishonest smears” challenging him on Social Security. In the ad, Biden makes a sweeping claim: “I’ve been fighting to protect — and expand — Social Security for my whole career. Any suggestion otherwise is just flat-out wrong.”

At Vice’s Black and Brown Forum in Iowa this week, when pressed on his proposal to freeze Social Security payments by moderator Antonia Hylton, he simply lied: “I didn’t propose a freeze.” In fact, Biden has argued for cuts or freezes to Social Security throughout much of his career. Earlier in January, The Intercept wrote about several instances in which Biden advocated for cutting Social Security over the course of his career. Biden, when he acknowledges his past support for cuts, portrays the advocacy as deep in the past. But a close inspection finds reams of more recent evidence of Biden’s support for cuts — including in Biden’s recent recounting of a conversation he had with China’s president, Xi Jinping, and in his choice of Bruce Reed, a longtime deficit hawk, as a senior policy adviser in his current presidential campaign.

Reed, a longtime Biden aide, played a central role in advocating cuts to the New Deal-era program as a co-founder of the Democratic Leadership Council, as the top staffer for a controversial commission dedicated to slashing the deficit, and then as Biden’s chief of staff during the Obama administration. In Washington, D.C., he would be the last high-level staffer a campaign would bring aboard if it was genuinely intent on expanding, not cutting, Social Security.

This past week, Biden steadily ratcheted up his revision of his record. At Vice News’s Brown and Black Forum in Iowa on Monday, he was pressed on Social Security. “Do you think though that it’s fair for voters to question your commitment to Social Security when in the past you proposed a freeze to it?” he was asked by Vice moderator Hylton. “No, I didn’t propose a freeze,” he said. “You did,” she corrected. On Tuesday, he released an ad attacking Sanders for what he called “dishonest smears.” The hit prompted a response from Sanders, who posted a short ad showing Biden boasting of his willingness to cut Social Security on the Senate floor. The Sanders ad has been viewed some 4 million times, to Biden’s less than a million.

Does he even know?

• VP Pence Appears To Suggest Americans, Nor Russians, Liberated Auschwitz (RT)

US Vice President Mike Pence’s speech on the Holocaust left the impression it was American soldiers who liberated Auschwitz, erased the Soviet Union’s well-documented act, and even used the solemn occasion to lash out at Iran. Speaking at the World Holocaust Forum in Israel on Thursday, Pence said that it was “soldiers” who opened the gates of Auschwitz on January 27, 1945. Which soldiers? Pence does not say, whether accidentally or on purpose. Pence’s omission became much more glaring a few moments later, when he honored the memory of “all the Allied forces, including more than two million American soldiers, who left hearth and home, suffered appalling casualties, and freed a continent from the grip of tyranny.”

Listening to Pence’s speech, one might be tempted to conclude that it was these American soldiers who liberated Auschwitz, or bore the brunt of the burden of liberating Europe from the Nazis. Yet if we want to talk about truly “appalling casualties,” how about the nearly 27 million soldiers and civilians of the Soviet Union who perished in that war? What about the Red Army’s 322nd Rifle Division, under General Pyotr Ivanovich Zubov, that actually kicked in the doors of Auschwitz, only to be ‘erased’ from memory by an American vice-president 75 years later? One word – “Soviet” before “soldiers” – would have sufficed to give credit where it’s due. There is nothing wrong with being an American patriot, but this sort of dissembling is at best ignorance, and at worst outright stolen valor, both entirely unbecoming of a statesman.

Pence ended his speech by praising the US alliance with Israel and urging the world to “stand strong against the Islamic Republic of Iran” as “the one government in the world that denies the Holocaust as a matter of state policy and threatens to wipe Israel off the map.” Meanwhile, at the same event, Russian President Vladimir Putin denounced the use of the Holocaust in present-day political disputes and proposed a summit of the five permanent UN Security Council members – representing the nations principally responsible for defeating Hitler and establishing the post-war world order – to address the challenges of the world today and “demonstrate our common commitment to the spirit of allied relations, historical memory and the lofty ideals and values for which our predecessors, our grandfathers and fathers fought shoulder to shoulder.”

https://twitter.com/i/status/1221188593290366976

Include the Automatic Earth in your 2020 charity list. Support us on Paypal and Patreon.